Governors vs. PJM: AI Data Centers Reshape the Grid

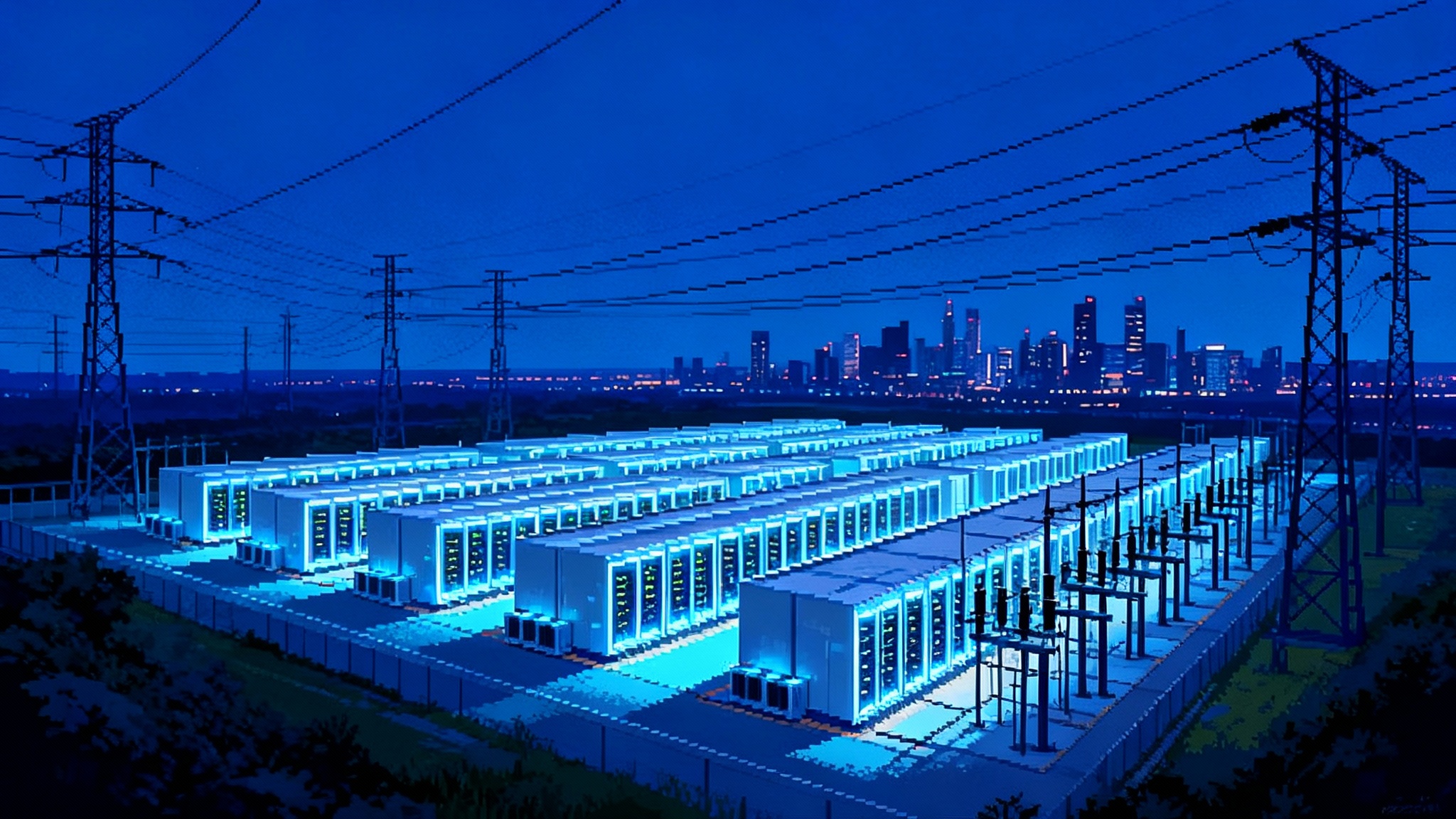

A coalition of PJM-state governors is moving to exert new influence over the nation’s largest grid as AI data centers turbocharge demand and push capacity prices higher. Here is what could change next for rules, rates, interconnection, and resources.

What just happened and why it matters

A fresh political force has entered the most consequential electricity market in the United States. On September 22, 2025, reporting indicated that a group of governors across the PJM footprint plans to launch a PJM Governors’ Collaborative to gain more influence over how the nation’s largest grid is run, citing surging bills and a mismatch between exploding data center demand and new supply. Capacity payments, a key line item in customer bills, have climbed roughly tenfold over two auctions, and governors say current governance gives them too little say on solutions. The move places state executives squarely in the middle of PJM’s operating model, long steered by its board and voting members like transmission owners and generators. That balance may be about to change, as noted by Reuters on governors’ push.

The timing is no accident. The PJM region is home to the highest concentration of hyperscale data centers on earth, led by northern Virginia, with new projects spreading into Maryland, Pennsylvania, Ohio, and beyond. These facilities are large, power hungry, and impatient. They want multi-gigawatt connections on short timelines, combined with round-the-clock reliability and increasingly clean supply. The old cadence of interconnection queues and multi year resource development is colliding with AI buildouts measured in months. For primers on auction mechanics and siting dynamics, see our PJM capacity market guide and our interconnection reform explainer.

How a Governors’ Collaborative could reshape PJM

PJM is a rules machine. Small shifts in governance can redirect billions of dollars, alter what gets built, and determine who pays. A governors’ collective would not replace existing structures, but it could push for procedural levers that carry real consequences:

- Board selection and accountability: Expect a hard look at how PJM’s board is nominated and seated. Governors are likely to press for a formal advisory role in nominations, periodic performance reviews tied to planning accuracy, and clearer escalation channels when state priorities are ignored.

- Formal state advisory committee: PJM already interacts with state regulators through bodies like OPSI, but governors may want something closer to New England’s NESCOE model, with defined rights to initiate studies, request market rule filings, and trigger transparency reviews.

- Planning priorities and cost allocation: States may demand more weight in long term transmission and resource adequacy planning, including how benefits are defined and how costs flow. The political focus will be on investment that relieves data center driven congestion without socializing too much cost onto households.

- Data and transparency: There will be pressure for more granular load forecasting for large technology customers, clearer queue status dashboards, and publication of the assumptions that drive capacity accreditation and reserve margins.

If successful, the Collaborative would not write tariffs, yet it could shape the agenda PJM takes to its stakeholder process and the filings it makes at the Federal Energy Regulatory Commission. That indirect influence is often decisive.

The market rules most likely to change

Three buckets of rules are in the crosshairs.

-

Capacity market design. Rapid price swings in the Reliability Pricing Model have put a spotlight on auction parameters. Expect renewed debate over price caps, floors, demand curves, and how quickly the auction should reflect near term load surges. Governors will argue for dampers that reduce volatility for mass market customers, and for state informed adjustments that reflect real world siting and permitting conditions. For context, see our PJM capacity market guide.

-

Accreditation and performance. As the resource mix shifts, accreditation methods for wind, solar, storage, and hybrids will get more granular. States will push PJM to match accreditation to measured performance in critical hours, to reduce the risk that paper capacity fails during stress events. That could advantage fast starting gas peakers and long duration storage, and could reward demand response that proves measurable, dispatchable, and durable.

-

Load participation and special tariffs. The rules for large flexible loads will get a rework. Expect growing use of firm service obligations, minimum monthly charges tied to contracted capacity, and performance penalties if loads fail to follow dispatchable curtailment commitments. States will want those tools to reduce cross subsidies and to align data center behavior with system needs. Related design choices are outlined in our data center tariff playbook.

Ripple effects on rates and who pays

Rising capacity charges hit customer bills in a very visible way. The political instinct is to shield households and small businesses. That points to several practical shifts:

- Hyperscaler contribution rules: Expect more settlements that require data center customers to pay for a larger share of upgrades they trigger, or to post financial security for a minimum load profile over multi year horizons. This reduces stranded cost risk if a customer changes plans after network upgrades begin.

- Time varying tariffs and performance credits: Governors can pressure regulators and utilities to expand managed charging for fleets, pay for industrial load flexibility during peak hours, and offer performance credits that count toward capacity obligations.

- Securitization and bill smoothing: If big upgrades are unavoidable, states may lean on securitization tools to spread costs over time and reduce annual bill spikes, paired with protections for low income customers.

The political risk is that too much cost on new load will push projects to other regions. The equilibrium that emerges will vary by state, which introduces a new patchwork of customer terms inside a single regional market.

The interconnection chokepoint

Even with eager buyers, steel must still hit the ground. PJM’s queue reforms have moved from a serial to a cluster based approach, yet backlogs and network upgrade bottlenecks remain. Governors will aim for three accelerators:

- Prioritization for public interest projects: Expect proposals to elevate projects that directly relieve load pockets, or that enable large loads that sign up for firm obligations and local backup. This could take the form of a scoring rubric that influences study sequencing.

- Socialized upgrades with defined caps: If a transmission upgrade benefits many future projects, states may accept some socialization, but will likely insist on caps and on clawbacks if the expected future projects do not materialize.

- Standardized pre development: Governors can lean on utilities to map substation headroom, dynamic line ratings, and rights of way in a consistent public format. That helps developers site projects where interconnection costs are realistic and reduces speculative queue churn.

The practical goal is speed without chaos. Expect a blend of fast lanes for shovel ready projects and tighter screens against speculative queue entries. For more, see our interconnection reform explainer.

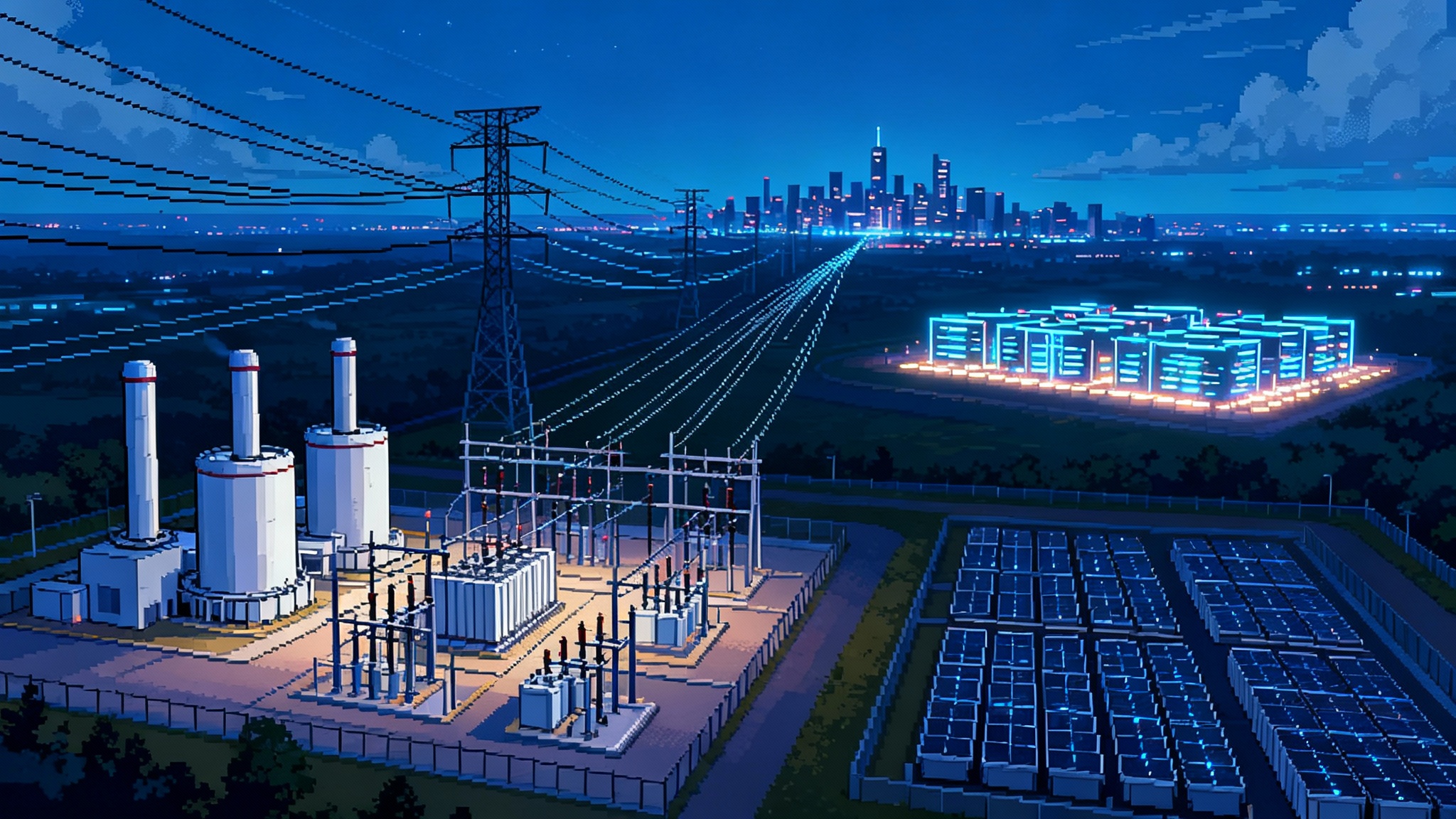

Why utilities are fast tracking new generation

When the lights must stay on, timelines rule. In PJM today, the only resources that can be permitted, financed, and built fast enough to match near term data center growth are gas peakers, reciprocating engines, battery storage, and certain uprates at existing plants. Utilities are moving to secure dispatchable megawatts they can count on in the next two to four summers.

- Gas peakers for shoulder and peak coverage: Simple cycle turbines can clear permitting faster than large combined cycle units, can be sited near existing substations, and can backstop variable renewables and storage. Several proposed projects in the region are explicitly tied to data center clusters that need firm capacity.

- Battery storage that follows load: Four hour batteries are already being paired with solar and with grid substations to shave peaks and capture price spreads. As accreditation methods evolve, storage will increasingly compete head to head with peakers for capacity value, especially in subregions where evening peaks dominate.

- Behind the meter and microgrids: Some data centers are pursuing on site generation for resilience, sometimes paired with grid services contracts. States may support this where it reduces substation stress, but will insist on interconnection standards and fair cost sharing.

This is not a repudiation of clean energy. It is a near term insurance policy. The extended play is more transmission, more storage duration, and longer lead projects like offshore wind and nuclear uprates. The governors’ pressure could accelerate those longer lead investments if it unlocks a planning path that regulators and utilities can trust.

FERC’s reliability and cyber push

While states push on governance, the federal referee is tightening the rulebook. FERC and NERC have spent the last two years hardening the grid against extreme weather and cyber threats, and they are not done. In September 2025 the Commission advanced reliability measures that include revised cold weather standards and a proposal to strengthen cybersecurity for low impact bulk system assets. The aim is to make sure that new loads and new resources do not outpace the grid’s ability to ride through stress. See FERC’s news page summarizing recent reliability and cyber actions.

This has three near term effects for PJM stakeholders:

- Compliance costs rise for more entities: Lower thresholds for cyber controls and new telemetry expectations will pull in facilities that once sat outside the tightest cyber perimeter. That includes some storage sites, distributed energy resources aggregations, and smaller transmission assets.

- Winter readiness becomes year round: Cold weather standards require investments that add cost but also add availability during shoulder seasons. Accreditation debates will account for this, since performance in stress events will be more measurable.

- Load forecasting scrutiny: Expect FERC to keep pressing RTOs and utilities to sharpen large load forecasting, with better visibility into data center pipelines, power purchase agreements, and the dependence of buildouts on substation upgrades.

What could change inside PJM’s rulebook

Policy makers have learned that changing one line in the PJM manual can ripple through investment. Watch for these specific levers in late 2025 and 2026:

- Capacity auction parameters: A package that tempers volatility, updates demand curves for faster load growth, and introduces circuit breakers tied to actual deliverability constraints.

- Deliverability and accreditation: Tighter links between deliverability studies and capacity credit, which could make some nameplate megawatts worth less in congested pockets while increasing the value of resources sited at targeted substations.

- Priority interconnection classes: New queue classes for projects that solve defined reliability problems or serve committed large loads that sign up for firm service and curtailment rights. Expect stricter penalties for projects that fail to meet milestones.

- Scarcity pricing and performance penalties: Adjustments that increase scarcity price signals and align penalty structures across capacity, energy, and ancillary services, meant to reward firm capability and fast response.

- Information sharing and transparency: Requirements for standardized developer disclosures and for more frequent publication of queue conversion rates, interconnection cost ranges by zone, and upgrade lead times.

How the resource mix could tilt

- More gas in the near term: Peakers and reciprocating engines will fill peak and ramp needs while longer lead assets make their way through permitting and interconnection. States will impose emissions conditions and fuel assurance plans, and some utilities will pursue hydrogen capable equipment to preserve optionality.

- Storage continues to scale: Four hour batteries will expand rapidly, then a second wave of longer duration technologies will target evening peaks and multi day events. Capacity accreditation outcomes will guide which durations win first.

- Nuclear life extensions and uprates: Where uprates are economical and license renewals are straightforward, utilities will lean on existing nuclear to provide inertia and round-the-clock capacity that data centers value.

- Renewables with firming: Solar plus storage will target local peaks, while offshore wind in the mid Atlantic will remain a medium term play that depends on transmission corridors and stable pricing structures.

The governors’ entry increases the chance that transmission planning and cost allocation get more political attention, which is often what long duration, high capital projects need to move.

The rate picture, simplified

Customers will ask why bills are climbing and who is to blame. The short answer is that capacity prices and network upgrades are rising faster than retail tariffs can absorb. Governors can soften the blow by:

- Targeting cost responsibility: Reserve more of the cost for large new loads that trigger upgrades, via minimum bills, direct contributions, and performance backed curtailment contracts.

- Smoothing the path for customers: Use regulatory tools to spread costs over time, while enforcing strict accountability on project budgets and timelines.

- Protecting the most exposed: Target bill credits at low income customers and small businesses most exposed to short term spikes.

Sustained transparency on how each dollar of capacity and transmission spending improves reliability will be essential if public support is to hold.

Forward look: late 2025 to 2026

Here is a practical watchlist for the next four quarters:

- Governors’ Collaborative charter: Look for a written charter that spells out nomination input, planning triggers, and a timeline for the first set of asks to PJM’s board.

- PJM capacity market filing: Watch for a package that addresses volatility and accreditation, with a clear path to reflect large load growth sooner while preventing overcorrection.

- Queue reform 2.0: Expect proposals for priority classes and milestone enforcement, coupled with a public map of substation headroom and upgrade lead times that developers can trust.

- State data center tariffs: Several states are likely to adopt minimum monthly usage charges, firm service contracts, and curtailment programs tailored to hyperscalers. The biggest unknown is how uniform these become across the region.

- Gas procurement and storage build plans: Utilities will bring near term peaker and battery portfolios forward for approval, with more explicit ties to specific load nodes. Timelines and cost discipline will be closely scrutinized.

- FERC reliability and cyber rulemakings: Keep an eye on effective dates and compliance scopes. Developers should budget for cyber controls even for assets once considered low impact, and for telemetry requirements that enable dispatch.

- Transmission cost allocation debates: As multi state upgrades hit dockets, governors will seek formulas that align costs with beneficiaries. Compromises that include caps and backstops are likely.

If you are an investor, utility, or hyperscaler

- Investors: Favor developers that can site at pre qualified nodes with known headroom, that carry interconnection milestones, and that have flexible offtake structures. Peakers and batteries near data center clusters will see premium capacity values. Transmission enabling portfolios with clear cost recovery will command scarcity premiums.

- Utilities: Build optionality. Secure near term dispatchable capacity, invest in grid enhancing technologies that buy time, and use transparent hosting capacity maps to channel private capital to the right substations. Align resource plans with evolving accreditation and with state backed customer tariffs that reduce cross subsidies.

- Hyperscalers: Expect to carry more of the cost and more of the risk. Secure firm service with credible curtailment commitments, diversify with on site resilience where appropriate, and be prepared to co invest in grid upgrades that shorten timelines. A portfolio approach that blends PPAs, capacity contracts, and grid services will be a competitive advantage.

The headline is simple. Governors are stepping in because the economics of AI scale are colliding with the physics and governance of the grid. PJM’s rulebook will evolve, and that evolution will decide where power plants and wires get built, how fast data centers come online, and who pays for the ride. The Collaborative’s success will be measured by whether it can channel political urgency into market rules that keep the lights on without breaking the bill.