AI’s power boom collides with America’s LNG export wave

Exploding AI data center demand is arriving just as a major wave of US and Qatari LNG supply hits global markets. The cross‑currents are rewriting policy from PJM to ERCOT, reshaping capacity prices, and guiding where new gas plants get built.

The collision everyone sees coming

America is living through two energy storylines that used to move in parallel but are now on a collision course. On one track, the AI and cloud rush is pulling forward a decade of electricity demand in just a few years, with data centers emerging as the biggest new loads on US grids. On the other, US LNG exporters are finishing a historic buildout that, together with Qatar and Canada, is poised to unleash the largest wave of new liquefied natural gas supply in years. The risk is simple to state and messy to solve: if global LNG swings into oversupply while domestic power demand pushes US gas‑fired generation and pipeline capacity to run harder, investors, utilities, and consumers could be whipsawed by volatility in both gas and power prices.

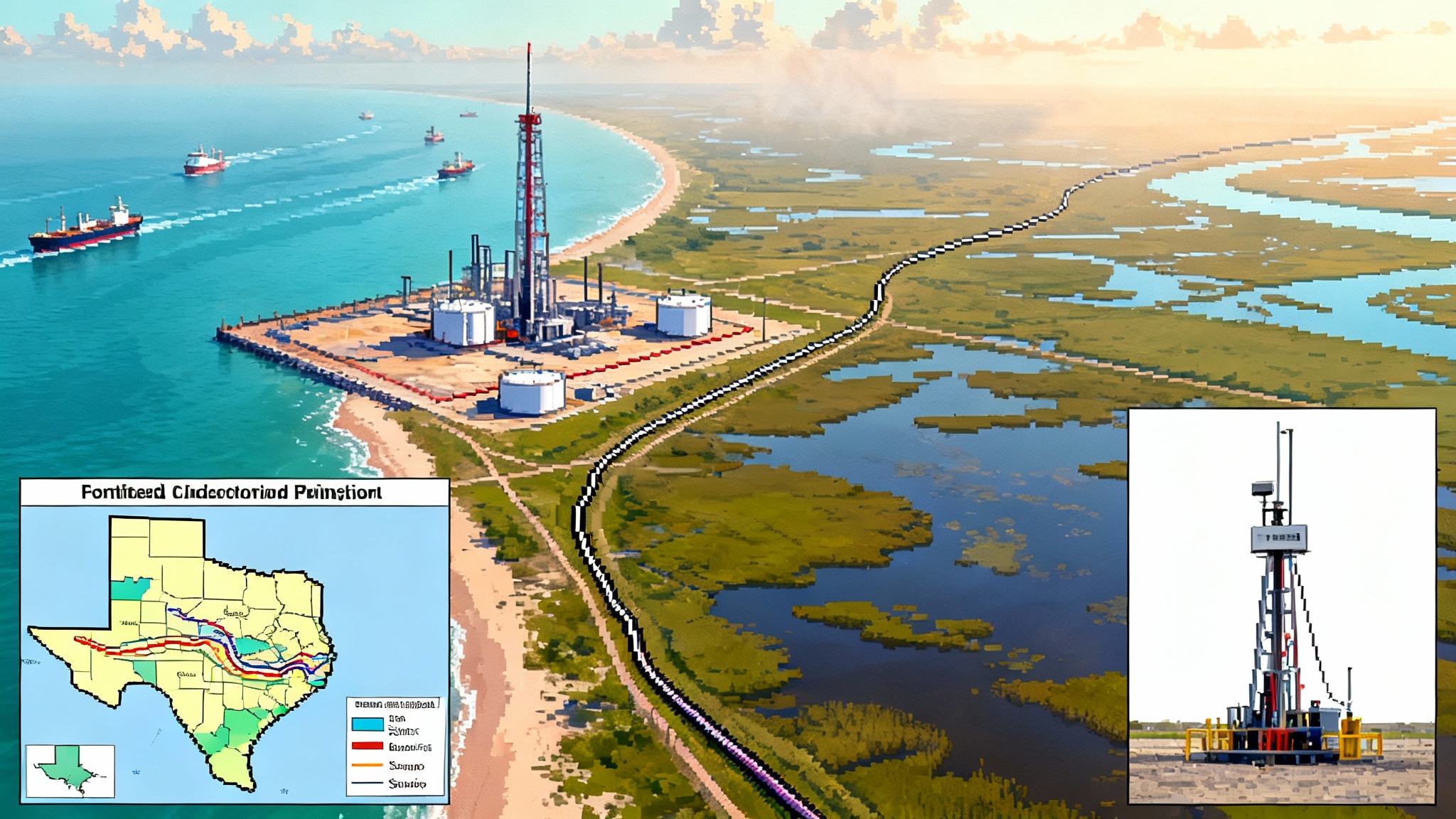

The International Energy Agency expects 2026 to bring the strongest increase in LNG supply since 2019, driven by US projects, Canada’s first cargoes, and the first phase of Qatar’s North Field East. That surge could loosen the global market and pressure seaborne prices, even as power‑hungry AI clusters in the US strain local grids and gas deliverability. For context, see the IEA outlook on LNG supply growth.

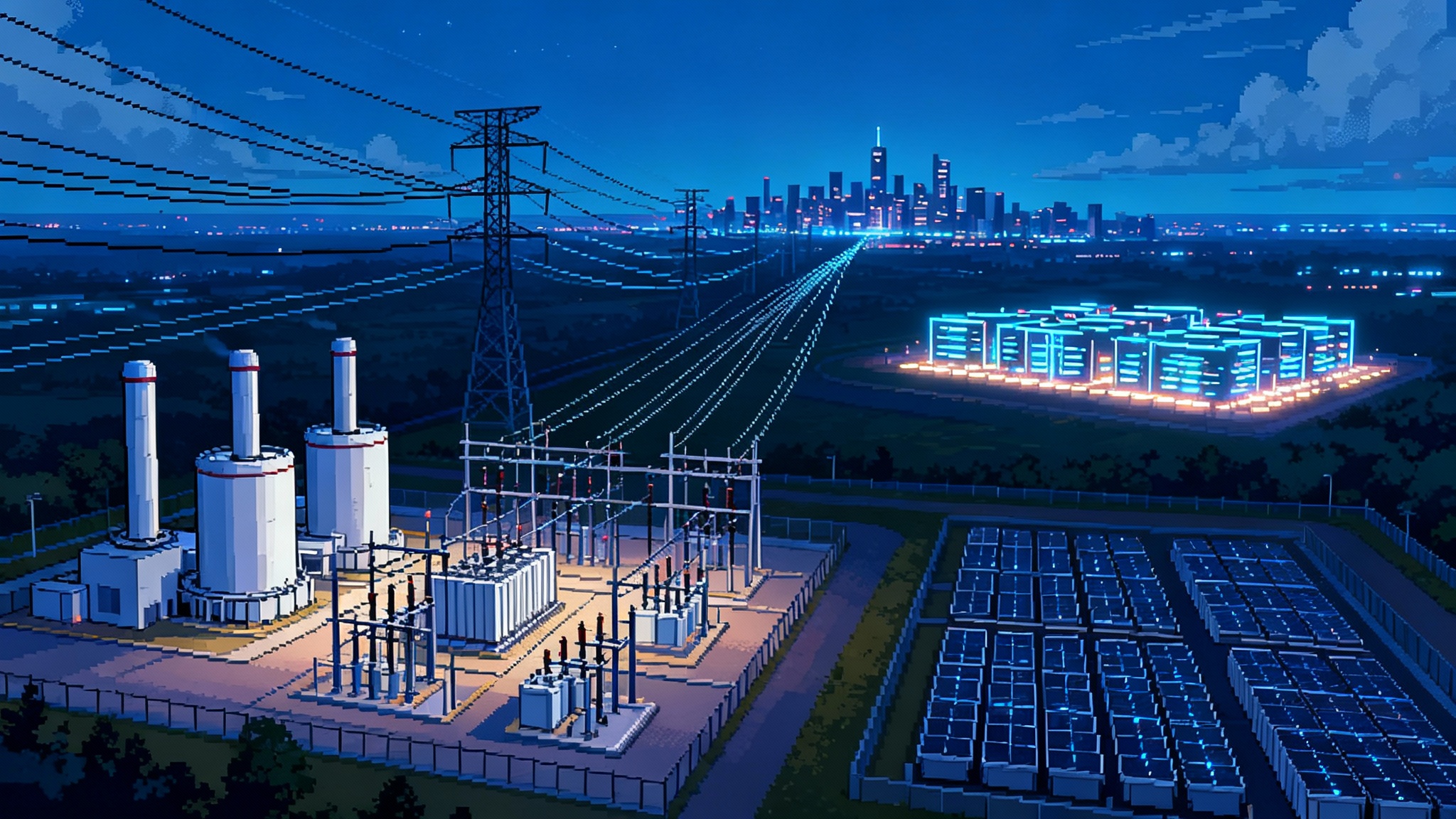

The macro math: swelling load meets shifting gas fundamentals

The electricity side flipped almost overnight. After a decade of flat demand, utilities now forecast multi‑year growth led by data centers, EV charging, electrified heating, and onshored manufacturing. Data centers are the standout. In Northern Virginia’s Data Center Alley, Dominion Energy reports tens of gigawatts of contracted demand and a pipeline of additional requests that would have seemed fanciful two years ago. PJM planners have mirrored this in load forecasts, warning that demand is rising faster than dispatchable replacement capacity can be built. For background on siting and interconnections, see our primer on AI data center grid impact.

On the gas side, US dry gas production set records in 2023 and 2024, then cooled as prices sank and producers throttled back. The Energy Information Administration expects average Henry Hub prices to run higher in 2025 and 2026 than in 2024 because demand from domestic consumption plus LNG exports grows faster than supply. Storage is ample today, but the trend line points to tighter balances if winter arrives cold or if power‑sector burns stay elevated through shoulder seasons to meet AI‑driven baseload.

Layer onto that a policy pivot. After a federal pause on new non‑FTA LNG export decisions in early 2024, the Department of Energy resumed processing applications in 2025, restarting the permitting pipeline just as big Gulf Coast trains ramp. By mid‑2026 the global LNG tape looks loose, while US local gas deliverability and power‑system adequacy look tight in fast‑growing load pockets.

Where policy is moving: exports, capacity markets, and fast‑track gas

-

LNG export approvals: The renewed processing of export permits signals that the federal government is likely to allow the next tranche of projects to move, subject to environmental and public‑interest reviews. Expect litigation around DOE’s analytical framework and state permits, but additional US capacity is still likely even if 2026 brings softer global prices.

-

Capacity markets: PJM’s last two Base Residual Auctions delivered a blunt message. Prices jumped from roughly 29 dollars per MW‑day for 2024 to 2025 to a record for 2025 to 2026, and then hit the FERC‑approved cap for 2026 to 2027. The 2026 to 2027 auction capped regionwide at 329.17 dollars per MW‑day, as reported in the APPA summary of PJM auction results. For mechanics and buyer impacts, see our PJM capacity market guide.

-

Fast‑track gas builds and hydrogen‑ready retrofits: Facing steep load growth and long interconnection queues, policymakers are carving new channels. Texas launched the Texas Energy Fund with low‑interest loans and completion bonuses to get new dispatchable megawatts online quickly, with the largest awards for plants connected by mid‑2026. Municipal and cooperative utilities are buying modern peakers that can start in minutes and are marketed as hydrogen‑ready to de‑risk emissions constraints later.

Case study: PJM’s new math on reliability and cost

Three things changed at once in PJM:

-

Demand: Load forecasts now bake in a structural step‑up from data centers and electrification. Winter peaks are rising faster too, closing the historical gap with summer peaks. That shifts the hour of highest risk and the kinds of resources that matter most.

-

Supply: Coal retirements continue, nuclear uprates help but are modest, and new‑build gas has lagged given construction, siting, and pipeline constraints. Renewables and batteries are surging in interconnection queues, but accreditation changes and winter performance requirements mean they do less to satisfy the last few percent of reserve margin under stressed conditions.

-

Risk modeling: Accreditation and demand modeling now reflect extreme‑weather performance and winter risk more faithfully. That narrows the gap between nameplate capability and reliable capacity, lifting the requirement for firm megawatts that can deliver at 7 a.m. on a polar morning.

For consumers, the near‑term effect is higher capacity charges in many PJM zones, with the steepest increases where data center growth is most concentrated and generation reserves are thinnest. For utilities, it strengthens the case for selective gas peakers, strategic transmission upgrades, and long‑duration storage pilots. For independent power producers, it supports uprates and life‑extension investments at existing gas and nuclear plants.

Case study: ERCOT’s sprint for firm megawatts

Texas runs a different playbook, but the pressures rhyme. ERCOT’s scenarios showed large prospective load from data centers and industrial growth. The grid operator has since adjusted projections to discount speculative requests, yet the direction is unchanged. Large loads are flocking to Texas for land, speed to interconnect, tax treatment, and proximity to renewables. For incentives and timelines, see the Texas Energy Fund explained.

Texas lawmakers and regulators responded with money and speed. The Texas Energy Fund offers low‑interest loans and sizable completion bonuses to get gas plants in the ground, with the richest incentive for units that interconnect by mid‑2026. Municipal utility deals to acquire modern peakers highlight a path many utilities may copy: buy young, flexible assets rather than wait years to build from scratch.

ERCOT continues to add batteries and solar at a world‑leading pace and has refined scarcity pricing and backstop tools after the 2021 crisis. Yet the AI wave is changing the nature of the peak. Instead of just late‑afternoon summer peaks, more load will run around the clock, flattening the diurnal curve and increasing the value of quick‑start gas and longer‑duration storage that can ride through wind or solar lulls.

LNG’s turn in the spotlight

The LNG storyline sounds good at first for gas‑fired power. If global LNG prices soften in 2026 on the back of new North American and Qatari supply, US producers could still see strong volumes through long‑term contracts, and domestic generators could benefit from looser global markets. The details complicate the picture:

- US feedgas demand will rise as new trains ramp, keeping baseline pipeline flows and Gulf Coast hub prices firm relative to 2024. Even if global prices ease, basins with takeaway constraints can see localized price spikes when power demand is high.

- LNG project margins compress in glutted markets, increasing sensitivity to delays, outages, and financing costs. Lowest‑cost suppliers are advantaged, and late‑stage projects face a higher bar for final investment decisions.

- Politically, if power prices jump again in 2026, export critics will revive the exports versus domestic affordability argument. DOE public‑interest tests and environmental reviews will be litigated project by project.

The result is a two‑front risk for investors: lower realized LNG prices in world markets just as domestic gas demand from the power sector and exports tightens US balances during stress periods.

What it means for consumers over the next 12 to 24 months

- Bill pressure where AI load clusters: In PJM and parts of the Southeast and Mid‑Atlantic, capacity and transmission charges are likely to be the main drivers of bill increases through mid‑2026. In Texas, pass‑through fuel and scarcity events remain the swing factor, but municipal and cooperative decisions to add gas capacity could stabilize local reliability.

- More calls for demand flexibility: Utilities will lean harder on interruptible tariffs for large loads, time‑varying rates, and behind‑the‑meter batteries. Expect pilot programs for grid‑synchronized load shaping and on‑site thermal storage at data centers.

- Reliability tradeoffs: Short‑term reliability will depend on whether quick‑turn gas projects and batteries arrive before the steepest load ramps. During extreme weather, conservation calls and emergency operations will remain part of the toolkit.

What it means for utilities and grid operators

- Capex, but targeted: The best near‑term returns come from brownfield peakers at existing sites, substation expansions for large customers, and transmission that unlocks trapped generation. Long‑lead projects like offshore wind and new long‑haul pipelines remain strategic but will not solve 2025 and 2026 adequacy.

- Fuel strategy matters: Secure gas transport and storage rights sized to winter peaks, not just summer afternoons. Structured supply with price caps and optionality will be worth more than a few points of index savings.

- Hydrogen‑ready, but honest about timelines: Specifying turbines that can handle 5 to 20 percent blends gives optionality, but meaningful decarbonization at scale requires dedicated low‑carbon hydrogen supply and transport that are unlikely to arrive before late decade. Use the feature to de‑risk permitting, not to over‑promise near‑term emissions reductions.

- Data center compacts: New interconnection agreements will increasingly include cost‑sharing for network upgrades, minimum load factors, and participation in demand response. Some utilities are adding annexes that require on‑site backup or storage and curtailment during system emergencies.

What it means for investors

- Power producers and wires names: In PJM, owners of flexible gas fleets and nuclear plants look best positioned to capture high capacity payments and scarcity revenues. Transmission‑heavy utilities with constructive regulators can add rate base quickly to meet reliability needs.

- LNG value chain: Near‑term volume growth is solid, but 2026 pricing risk argues for disciplined exposure. Midstream names with contracted take‑or‑pay and low breakevens fare better than merchant‑exposed developers. Watch for offtakers pushing to reopen pricing if global benchmarks slump.

- Equipment and flexibility plays: OEMs selling aeroderivative turbines, utility‑scale batteries, and grid‑stabilizing software should benefit from the sprint for fast, flexible capacity. Demand‑response aggregators and behind‑the‑meter storage providers will find ready customers among data centers and industrials.

Scenarios to watch through mid‑2027

- Base case: Global LNG loosens in 2026 as new supply arrives. US gas prices trend above 2024 but remain moderate, with regional spikes during cold snaps. PJM capacity prices stay elevated into the 2027 to 2028 auction, pulling forward a wave of peakers, batteries, and transmission. ERCOT adds mid‑sized gas and a wall of batteries, and reliability improves, though conservation calls persist in extreme events.

- Bull case for consumers: Mild winters and steady renewable additions cut gas burns, while interconnection reforms accelerate new capacity. Global LNG oversupply deepens, keeping US gas cheap. Capacity prices stabilize and bills rise more slowly than feared.

- Stress case: A cold 2025 to 2026 winter and summer 2026 heat stretch gas and power systems simultaneously. LNG plant outages or pipeline constraints lift Gulf Coast hub prices. Capacity prices jump again, and emergency measures expand. Policy pressure to curb LNG approvals returns.

A pragmatic playbook

- For policymakers: Keep the export‑permit process credible and predictable while updating public‑interest tests to reflect today’s load realities. Fast‑track targeted gas peakers, long‑duration storage pilots, and transmission at existing substations near data center clusters. Accelerate interconnection reforms and winterization requirements.

- For utilities: Pursue least‑regrets capacity. Pair modern peakers with battery storage, and specify hydrogen‑capable hardware without banking on cheap clean hydrogen this decade. Lock in gas deliverability. Negotiate demand‑flex compacts with large loads. Stage transmission to serve known sites.

- For large loads and data centers: Bring skin in the game. Budget for network upgrades, build on‑site backup and thermal storage, and commit to grid services. Co‑locate with generation and storage where possible.

- For investors: Favor flexible capacity and grid enablers over long‑dated, merchant‑exposed bets. In LNG, prefer low‑cost, highly contracted projects and midstream with firm ship‑or‑pay. Watch PJM auction reforms, ERCOT’s Texas Energy Fund disbursements, and DOE’s export docket cadence.

The through‑line is discipline. AI is pulling power demand forward, and LNG is pulling gas supply outward. Markets and policy will reward the actors who add flexible, firm capacity where it is most scarce, secure fuel on prudent terms, and resist the temptation to overbuild into a soft global cycle. The next 12 to 24 months will test whether America can thread that needle.