States Move to Rewire PJM as AI Load Swamps the Grid

Governors across the PJM region are forming a new collaborative to shape grid planning and market rules as AI data center demand drives up capacity prices and reliability risk. Here is what they want to change, how it could hit bills, and the milestones to watch next.

States seize the mic at PJM

The nation’s largest grid is getting a new kind of stakeholder. Today, governors from the PJM footprint announced a new PJM Governors’ Collaborative, seeking a stronger voice in how the Mid-Atlantic and Midwest bulk power system is planned, priced, and policed. The move follows months of rising bills, record capacity prices, and warnings that AI era data centers are outpacing the grid’s ability to keep up. The Collaborative, according to early signals, will push for deeper state input into decisions that shape both near-term reliability and long-term investment. That intent landed squarely in public view with the announcement of the new PJM Governors’ Collaborative.

This is not business as usual for PJM, which coordinates electricity for 13 states and the District of Columbia. For decades, PJM governance has centered on a board of managers and a stakeholder process dominated by utilities, transmission owners, generators, and marketers. States have had influence through their commissions and through FERC, but they have not acted as a bloc. That is changing, fast.

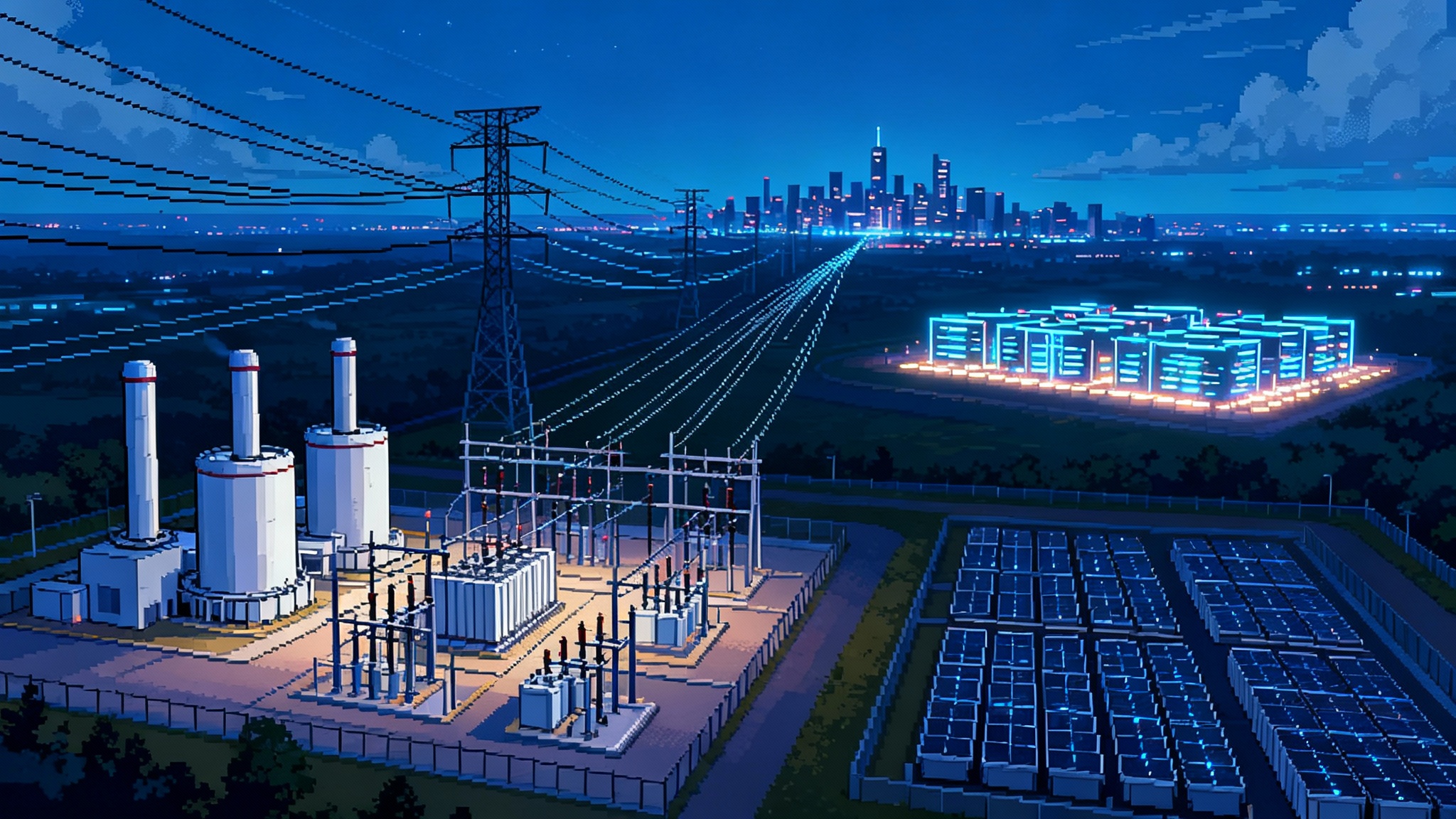

Why AI era load is breaking old planning molds

Data centers used to be another large customer class. The new wave is different. AI training clusters and inference farms draw power with high, persistent load factors, can add hundreds of megawatts at a time, and often cluster in a handful of counties near fiber, water, and favorable tax policy. Northern Virginia’s Data Center Alley, central Ohio, and parts of Pennsylvania and Maryland have seen a volume and speed of interconnection requests that were not imagined when PJM’s last decade of planning assumptions took shape.

Three dynamics are colliding:

- The load curve is not just peaking higher. It is getting fatter all day, with fewer off-peak valleys that used to make balancing simpler and cheaper.

- Large customers want very high uptime, which raises the bar for capacity and transmission planning. Many are also pursuing 24x7 clean energy matching, which strains both the supply stack and the rules that accredit clean resources for reliability.

- The queue of new resources is dominated by wind, solar, and batteries that rely on transmission capacity and careful siting. Queue backlogs and local deliverability limits slow the very resources that could relieve tightness.

Add to that a wave of retiring coal units, aging gas capacity in need of reinvestment, and a patchwork of pipeline constraints in several PJM zones. The region’s planning reserve assumptions have had to rise to keep loss of load risk within targets. That pushes more cost into capacity procurement even before a single new wire is strung. For a refresher on how those costs flow through, see our capacity market primer.

Where stress shows up: bills and reliability risk

The most visible symptom has been capacity prices. In 2024, PJM’s auction for the 2025 to 2026 delivery year cleared for most of the footprint around 270 dollars per megawatt day, up from under 30 dollars the prior year. In July 2025, the 2026 to 2027 auction cleared at the systemwide cap of 329.17 dollars per megawatt day across all modeled zones. PJM also reported that Baltimore Gas and Electric and Dominion had spiked even higher in the prior auction year. Those outcomes tracked rising peak load forecasts and a higher reserve margin. They also reset revenue expectations for generators and costs for load serving entities. PJM summarized the results and key drivers in its official notice of the 2026 to 2027 capacity auction results.

For customers, especially in states where retail competition passes wholesale costs through more directly, bill impacts have been sharp. For commissioners and governors, the political math is simple. When both data center developers and households are calling about reliability, and when rates are rising quickly, leaders want a seat at the table where the rules get written. For buyers planning new campuses, our data center energy strategy guide covers siting, contracts, and on-site resiliency.

Reliability questions are growing louder too. PJM has issued cautions about near-term adequacy in specific zones as demand rises and as generator retirements, fuel constraints, and transmission bottlenecks pinch options. Planning windows are now racing to add 765 kV backbones and east-west reinforcements, but large lines take years. Meanwhile, incremental fixes like reconductoring and dynamic line ratings can only do so much. Capacity performance penalties and accreditation rules for intermittent and storage resources remain a live debate, since they directly influence what clears and what gets built.

What the Governors’ Collaborative is likely to pursue

State leaders are not starting from scratch. They have watched models in other regions where state committees have more formal roles. Expect a focused agenda across three buckets: governance, market rules, and planning.

-

Governance reforms: States will likely seek formal recognition of a governors’ committee with advisory weight, plus a clearer pathway to nominate or vet board candidates and senior leadership. They may also push for a supermajority or fast-track process that elevates state consensus positions in stakeholder votes, particularly on consumer protection and reliability items.

-

Market rule priorities: Expect proposals to maintain a price cap in capacity auctions while PJM recalibrates reserve and accreditation methods to AI era conditions. States will press for storage and hybrid resources to receive fair, risk-adjusted accreditation that reflects actual performance during stress hours. They will also scrutinize penalty regimes to ensure they drive performance without deterring needed investment. Finally, watch for demand-side reforms that treat data centers as potential flexible load if paired with backup generation, storage, or compute shifting, with transparent rules for participation.

-

Planning and transparency: The Collaborative will target faster interconnection study timelines, clearer cost allocation for network upgrades, and more transparent local deliverability tests that can strand projects. Transmission planning is poised for a more expansive, multi-decade outlook that explicitly bakes in high data center growth and electrification, instead of leaning on incremental fixes. For context on methods and tradeoffs, see transmission planning basics.

Capacity market implications over the next 12 to 24 months

Two years of high clearing prices changed the incentives. Here is what to watch between now and the end of 2027:

-

Price formation guardrails: A systemwide cap at 329.17 dollars per megawatt day creates breathing room for buyers, but it can blunt the signal needed to draw new steel into the ground. States will test lower caps or narrower offer flexibility against reliability risks. The likely compromise is a cap that holds while PJM refines reserve and risk modeling to better reflect correlated winter and summer stress, gas deliverability risk, and the contribution of long-duration storage.

-

Accreditation shifts: Storage and hybrids will likely gain more nuanced accreditation tied to duration and historical performance during scarcity intervals. Wind and solar will see effective load carrying capability updates by season and hour. Gas will remain the backbone of accredited capacity, but with tougher expectations on fuel security and start performance.

-

Performance penalties and scarcity pricing: States will look for penalty regimes that curb gaming and ensure real availability during peak risk hours without triggering outsized volatility on consumer bills. Expect new scarcity constructs tied to more granular operating reserve curves and seasonal risk maps.

-

FRR and bilateral strategies: Some utilities and public power entities will consider Fixed Resource Requirement approaches to gain cost control and portfolio leverage, especially if they can contract new local resources faster than the market can. States may facilitate this with procurement guardrails and consumer protections.

Interconnection queues: from backlog to triage

The PJM queue will be a central battleground. Over the next 12 to 24 months, expect three changes:

-

Cluster study acceleration: PJM has already shifted to cluster-based study reforms. States will press for stricter site control, deposit schedules, and milestone gates to filter speculative projects. The aim is to clear late-stage projects that can start by mid decade.

-

Deliverability clarity: Developers need to know how many megawatts will actually be deliverable to load in zones with tight transmission. States will push for standard, transparent local deliverability area methodologies that reduce late surprises and allow projects to right-size interconnections.

-

Cost allocation and upgrades: The Collaborative will zero in on how network upgrade costs are assigned. Expect proposals for socializing certain high-value upgrades that unlock multiple projects, especially where data center clusters have created acute constraints. Look for pilot cost sharing around grid-enhancing technologies that buy time while big lines are built.

Transmission planning: from windows to backbones

Transmission is the long lever. The next two years are about locking in the backbone and speeding near-term fixes:

-

Big wires: PJM’s latest planning windows point to 765 kV reinforcements to move power west to east and into Virginia load pockets. The Collaborative will push for definitive schedules, procurement transparency, and construction risk buffers to keep milestones on track.

-

Grid-enhancing tech: Dynamic line ratings, advanced conductors, and topology optimization are lower-cost, near-term tools. States will press PJM and transmission owners to deploy them systematically, with clear measurement of capacity gains and timelines.

-

Cost allocation and siting: Expect hard conversations about who pays for multi-state lines that mainly serve fast-growing counties. The Collaborative gives governors a forum to hammer out principles on benefit measurement and cost sharing that can speed filings and reduce litigation risk.

What this means for key stakeholders

-

Utilities and load serving entities: Plan for another 12 to 24 months of elevated capacity costs in most zones, with some relief if the next auction clears below the cap. Hedging strategy will matter. Utilities with FRR options will evaluate bilateral capacity and tolling deals that lock in reliability with more cost certainty. Expect more emphasis on behind-the-meter resiliency for large commercial accounts to reduce coincident peaks.

-

Renewables and storage developers: Opportunity is real, but not one size fits all. In constrained zones, hybrid solar plus storage and standalone storage have the best shot at clearing and interconnecting if sited near substations with available deliverability. Accreditation rules will push developers toward 4 to 8 hour durations and toward controls that ensure performance in scarcity intervals. Projects that bundle reliability attributes and firm contracts for data centers will have an edge.

-

Gas generators and repowering projects: The capacity revenue stack is attractive again. New peaking and fast-start capacity can pencil, particularly at brownfield sites with existing interconnections. That said, fuel assurance and winter performance will be under a microscope. Developers should plan for dual fuel or storage hybridization where pipelines are tight, and for stricter testing and penalties.

-

Data center and large corporate buyers: Siting playbooks will shift. Expect more procurement that blends long-term physical supply, storage-backed shaping, and on-site backup that can participate in demand response without violating uptime commitments. Hourly matched clean energy strategies will need contracts that credit firming and transmission constraints honestly. Corporate buyers will also find themselves at the table with states on cost sharing for local upgrades where a campus drives a new substation or line.

-

Transmission owners: Governors’ attention means schedules and transparency will be scrutinized. Owners that can deliver credible timelines, standardized cost estimation, and early community engagement will find states more willing partners. Expect competitive transmission pressure to rise for multi-state projects.

The next 12 to 24 months: milestones to watch

-

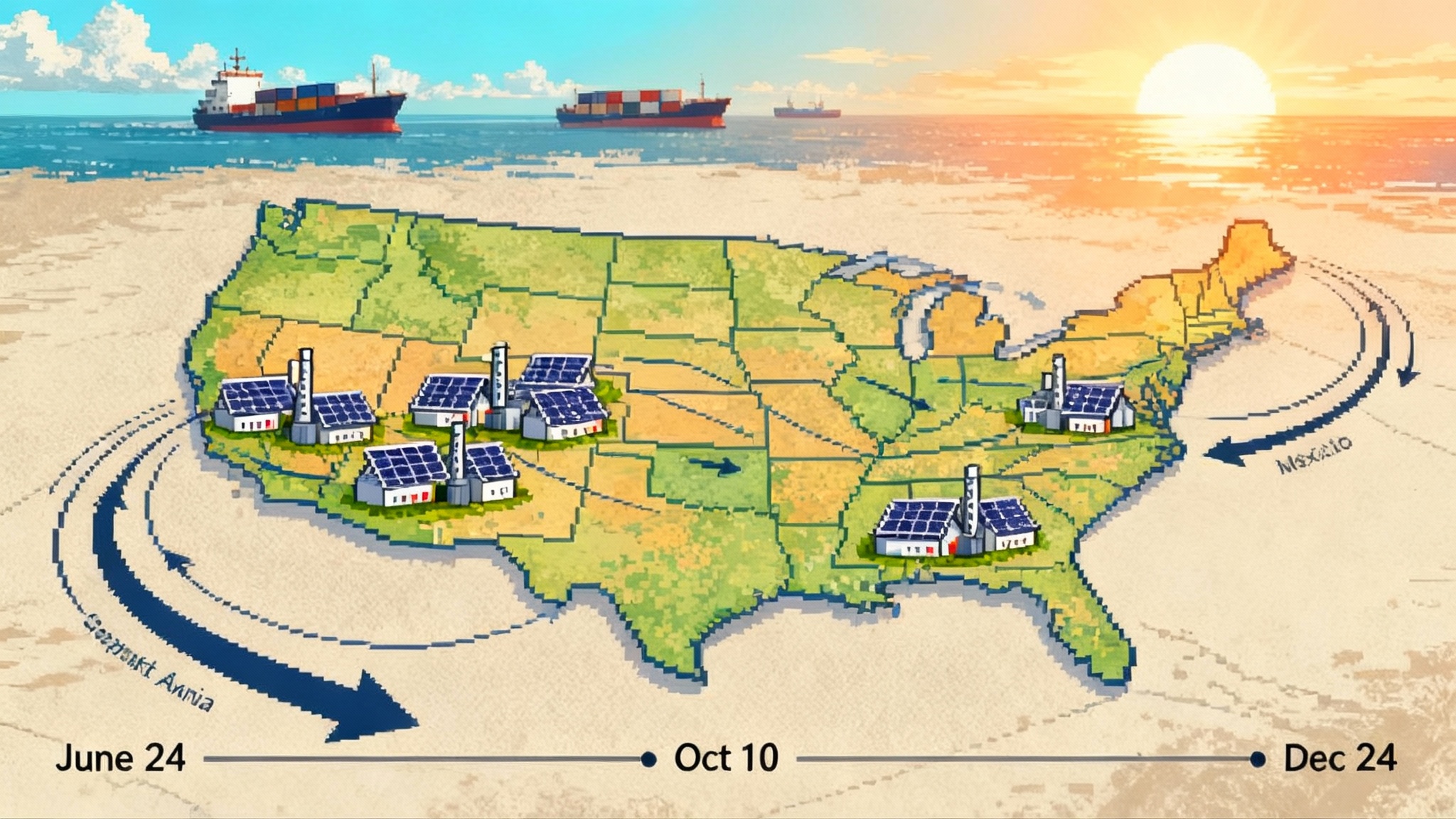

Fall 2025: The Governors’ Collaborative sets out a governance and market reform agenda. Expect a formal request for a standing state committee, a board nomination pathway, and a package of market proposals tied to capacity accreditation and performance.

-

Winter 2025 to spring 2026: PJM advances another round of interconnection cluster results. Look for a first tranche of shovel-ready storage and hybrid projects in constrained zones, as well as targeted network upgrades that unlock deliverability.

-

Mid 2026: The next capacity auction for the 2027 to 2028 delivery year will be the first test of whether reforms and new supply begin to bend prices. If peak forecasts continue to rise and large transmission projects are still on paper, caps may remain binding. If storage and repowered gas units clear in volume, prices could ease.

-

2026 to 2027: Transmission planning windows move from approval to execution. Early material orders, right of way progress, and standardized construction packages will determine whether critical backbones hit in-service dates before the end of the decade.

The takeaway

The PJM era that treated states as loosely aligned observers is closing. Governors are organizing to shape how the grid meets AI era demand while protecting customers. Capacity prices and reliability risks forced the issue. Over the next two years, watch governance and market rule changes that pull storage and hybrids into the reliability center, push transmission from plans to shovels, and align cost allocation with where growth is actually landing. The PJM Governors’ Collaborative puts states on the field, not in the stands. Whether prices ease and reliability improves will depend on how quickly this new team turns influence into steel, silicon, and firm megawatts.