FERC 1920-A, data centers, and a new grid playbook

States now have more say in who plans and pays for big wires. With PJM capacity prices spiking and data center demand soaring, here is what FERC 1920-A changes, where bottlenecks bite, and a 12‑month plan to put steel in the ground fast.

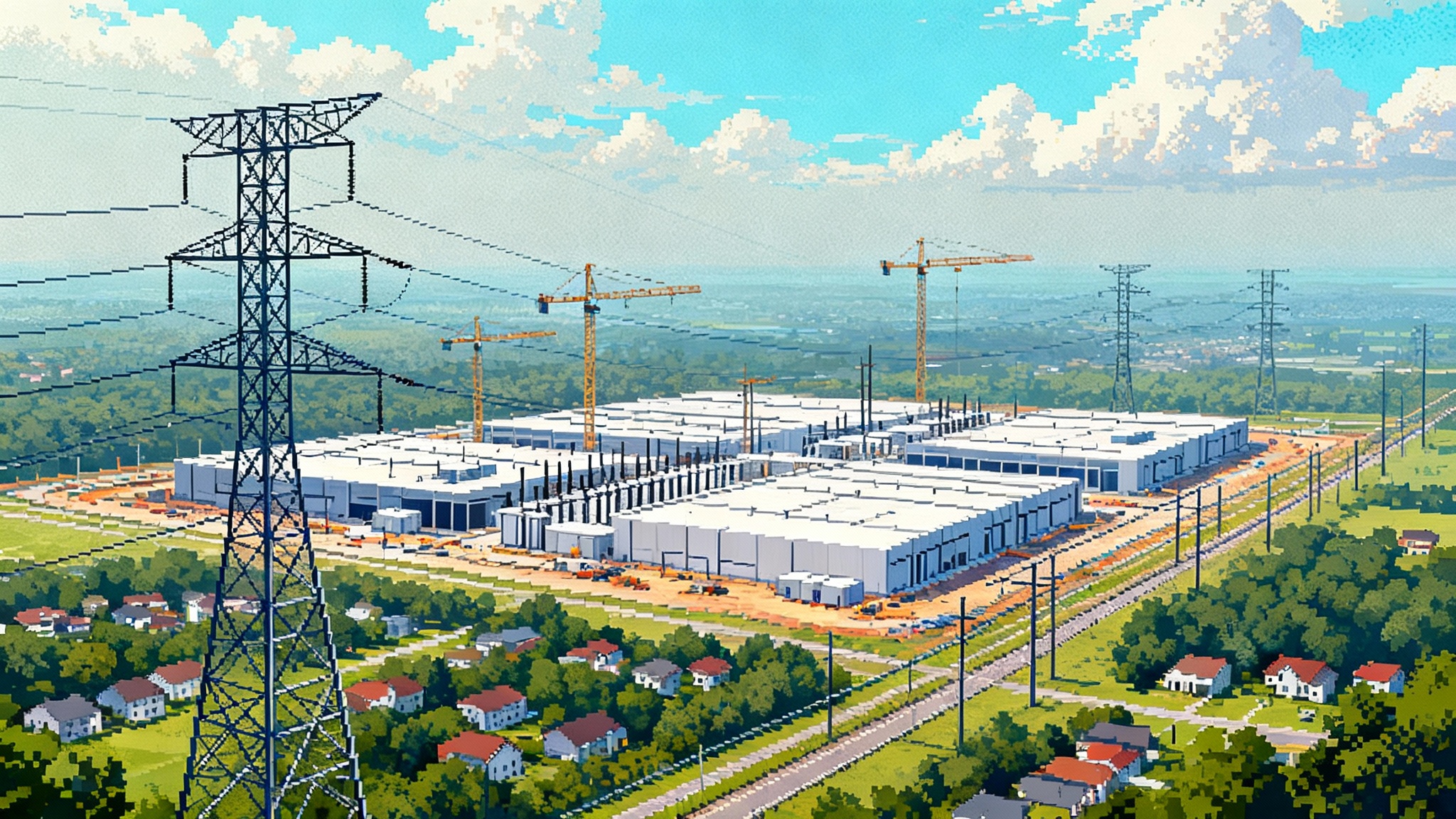

The grid is being rewritten by data centers and state power

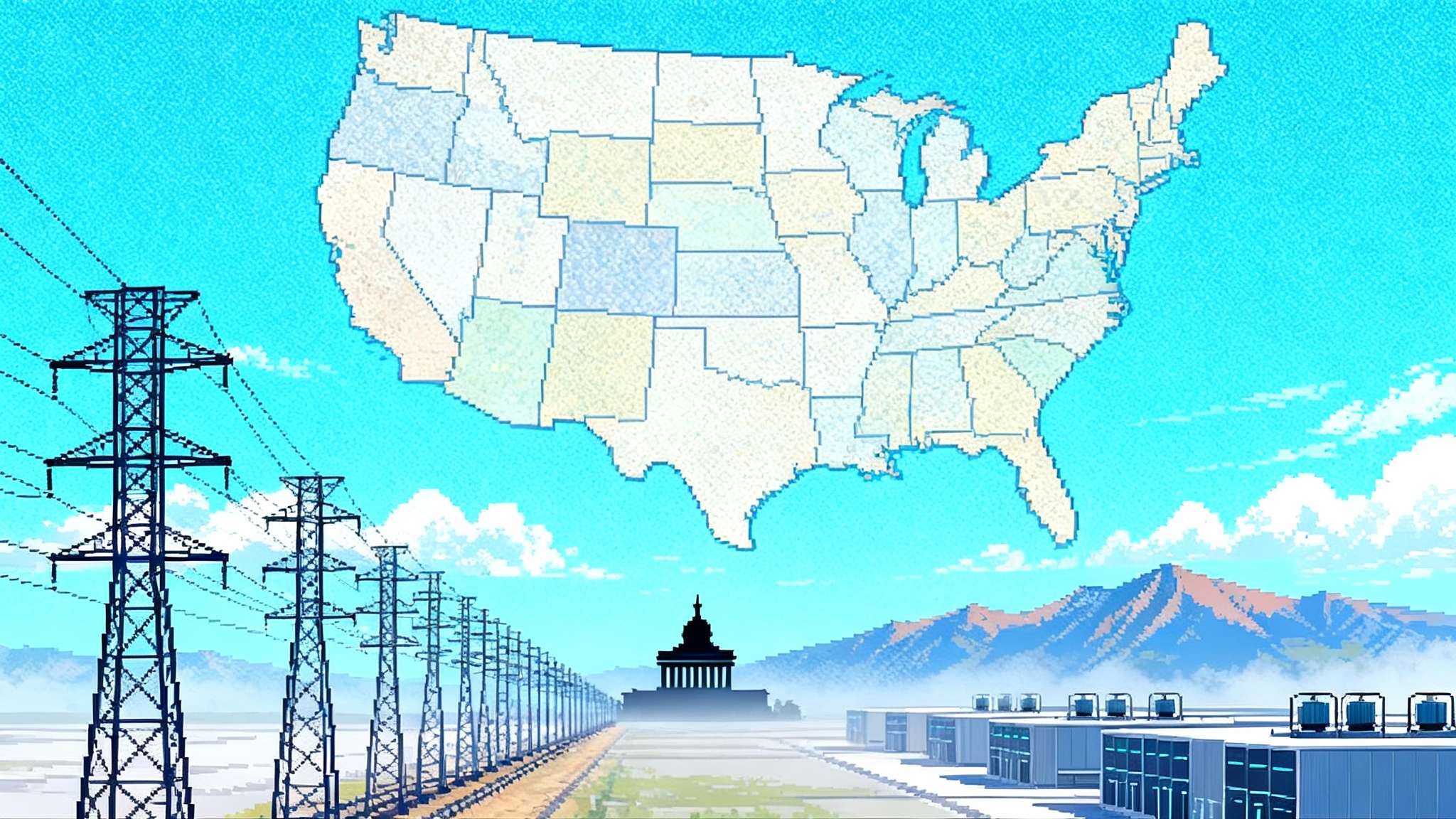

If you felt the ground shift under U.S. transmission policy this year, you are not imagining it. FERC’s rehearing and clarification order known as 1920-A arrived on November 21, 2024, and its state-centered changes are shaping 2025 as utilities, states, and regional grid operators translate the rule into near-term planning. The most important shift is simple: states now have a larger, formal role in long-term regional transmission planning, especially in scenario design and in deciding who pays. For a concise overview, see the FERC Order 1920-A presentation, and compare with our internal guide to transmission planning.

Meanwhile, the market sent a loud signal. In September 2025, PJM’s capacity auction for the 2026 to 2027 delivery year cleared at the cap across the entire footprint, a move tied to surging data center load and supply that has not kept pace. That combination — stronger state leverage under 1920-A and PJM price spikes — is the near-term story for where transmission, right-sizing, and storage will move fastest in the next 12 months. For context, review PJM capacity market basics.

What 1920-A actually changed

1920-A largely kept the spine of Order 1920 intact, then added muscle where states asked for it. The upshots that matter for decisions you must make in the next year are:

- States as co-authors of scenarios. Transmission providers must incorporate state input on how long-term planning scenarios are built because those scenarios must reflect state laws and policies. States can also request additional optional scenarios beyond the minimum three required.

- A cleaner basis for scenarios. 1920-A clarified that identifying long-term needs should lean on economic and reliability drivers. Corporate commitments are no longer mandatory inputs in every required scenario, though states can ask planners to study them as optional cases.

- A stronger hand in cost allocation. Relevant State Entities can craft an ex ante cost allocation method or a state agreement process for long-lived facilities and have it placed on the record. If it meets cost-causation principles, FERC can adopt it. If states want more time to reach a deal, FERC can extend the engagement period by up to six months and adjust compliance deadlines.

- A more realistic first-cycle start. The first long-term regional planning cycle must begin within two years of initial compliance filings, rather than one, allowing alignment with existing study cycles and time to build state engagement.

The takeaway is not delay. It is alignment. In 2025 and 2026, the speed of new regional lines will depend less on how fast an RTO can run a study and more on how fast states can land a shared cost framework and a shared view of scenarios.

PJM’s September shock changed the near-term math

PJM’s most recent Base Residual Auction cleared at the cap of 329.17 dollars per megawatt-day for 2026 to 2027, part of a two-year leap from sub-30 levels to historic highs. Coverage linked the move to concentrated data center growth in northern Virginia and a supply stack that has not kept pace. Importantly, this time the entire footprint cleared at the cap, signaling a regional constraint and elevating the value of transmission that can move capacity and energy across seams. See the market context in Reuters analysis of the PJM auction.

How that intersects with 1920-A:

- Price signals identify pain points. Long-term scenarios should internalize these economic drivers, pointing toward upgrades on existing 500 kV backbones and cross-seam reinforcements.

- States can structure who pays. Expect coalitions of states inside PJM to move first on ex ante cost allocation for backbones and targeted cross-border upgrades.

- Large-load interconnections get more scrutiny. Developers should expect tighter conditions around local network upgrades and demand withdrawals if transmission does not keep pace.

NIETC can accelerate siting, but timing is key

DOE’s National Interest Electric Transmission Corridor process is in Phase 3 for several potential corridors, with draft designation reports expected in 2026. NIETC designations can unlock federal financing tools and may enable federal backstop siting under certain circumstances. For the next 12 months, that means:

- Do not depend on final NIETC designations in 2025. Plan pathways that do not require NIETC yet remain compatible with expected corridors. For background on process mechanics, see our explainer on how NIETC designations work.

- Engage early with DOE teams. Projects configured to fit likely geographies and community expectations will move faster once designations are final.

The 12-month playbook

The clock matters. Between now and next summer, winners will use 1920-A to lock in consensus on scenarios and cost allocation while pushing the fastest steel and silicon options.

For state energy offices and commissions

- Form a Relevant State Entities coalition on day one. Identify states that share a reliability and economics rationale for a backbone program. Pursue an ex ante cost allocation aligned with cost causation and regional benefits from congestion relief and capacity sharing.

- Decide the optional scenarios you want. If data center growth is likely, request a scenario that tests high load clustered near constrained 230 to 500 kV nodes, plus a contrasting scenario that relocates part of that load to areas with headroom. Stress test both against extreme weather and derates.

- Use the extended engagement period to reach real agreement. FERC will grant up to six months. Use it to secure legislative or budget support and align siting statutes for multistate projects.

- Pair transmission with siting reforms. Fast-track changes that allow right-sizing on replacement lines within existing rights of way, treat advanced conductors as like-for-like for environmental review, and enable storage-as-transmission where it is the least-cost reliability fix.

For utilities and transmission owners

- Build a right-sizing portfolio deliverable in 12 to 36 months. Inventory lines due for rebuild and target reconductoring with high-temperature low-sag or advanced composite core conductors. Expand substation equipment to match higher ampacity. These projects often stay within existing corridors and clear permitting faster.

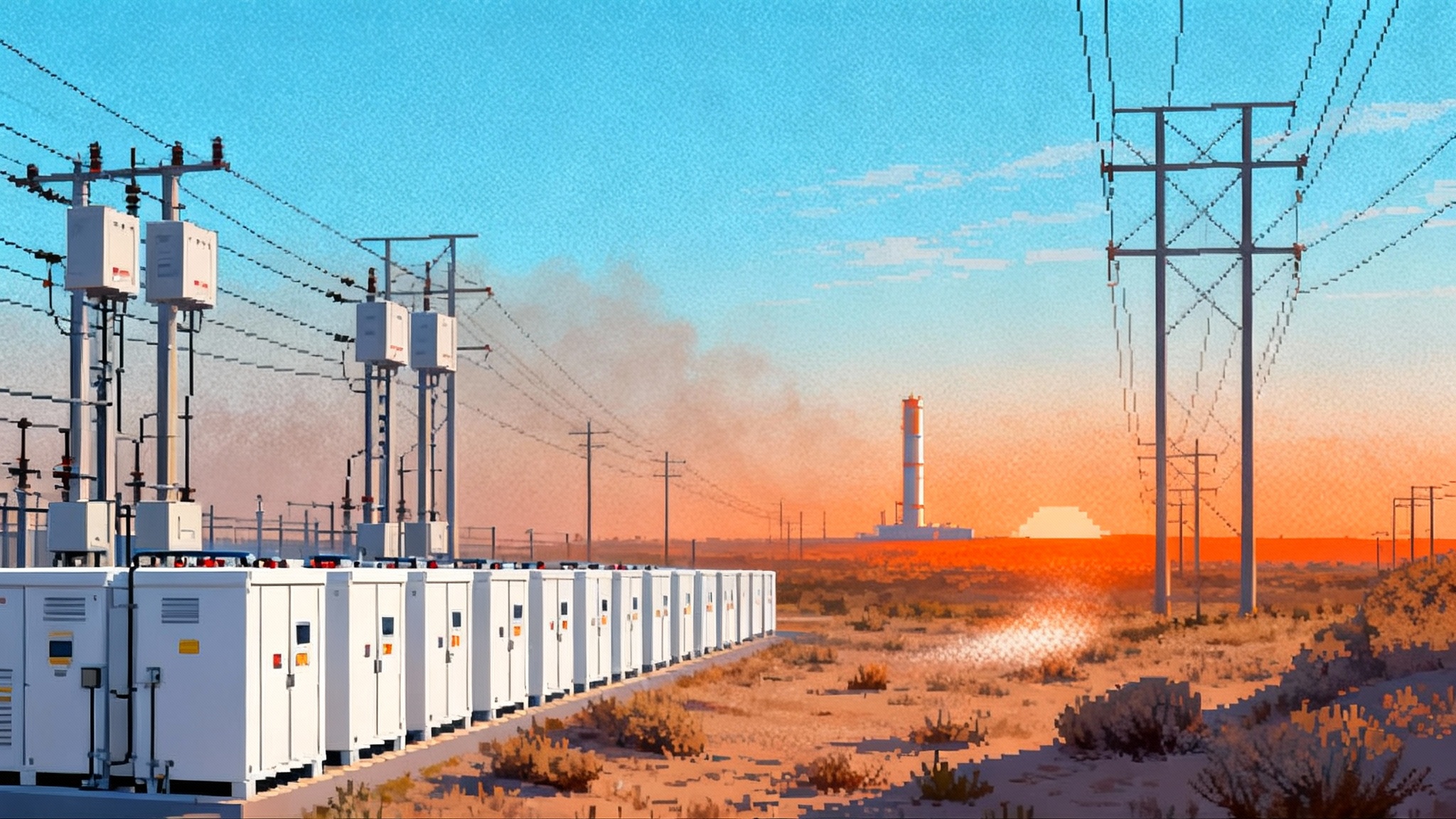

- Put storage to work as a transmission asset. Identify N-1 or N-1-1 corridors where 2 to 4 hour batteries at strategic substations would defer or reduce new lines. File them in long-term plans or as near-term reliability projects if local rules allow.

- Pre-stage long-lead items. Transformers and breakers face long procurement cycles. Submit orders now for known rebuilds and for storage interconnections that relieve bottlenecks.

- Co-develop optional scenarios with states. Offer at least one state-requested scenario modeling high-load data center clusters with realistic diversity, backup profiles, and correlated weather risk. Translate findings into a shortlist of candidate projects with quantified benefits.

For data center developers and large-load customers

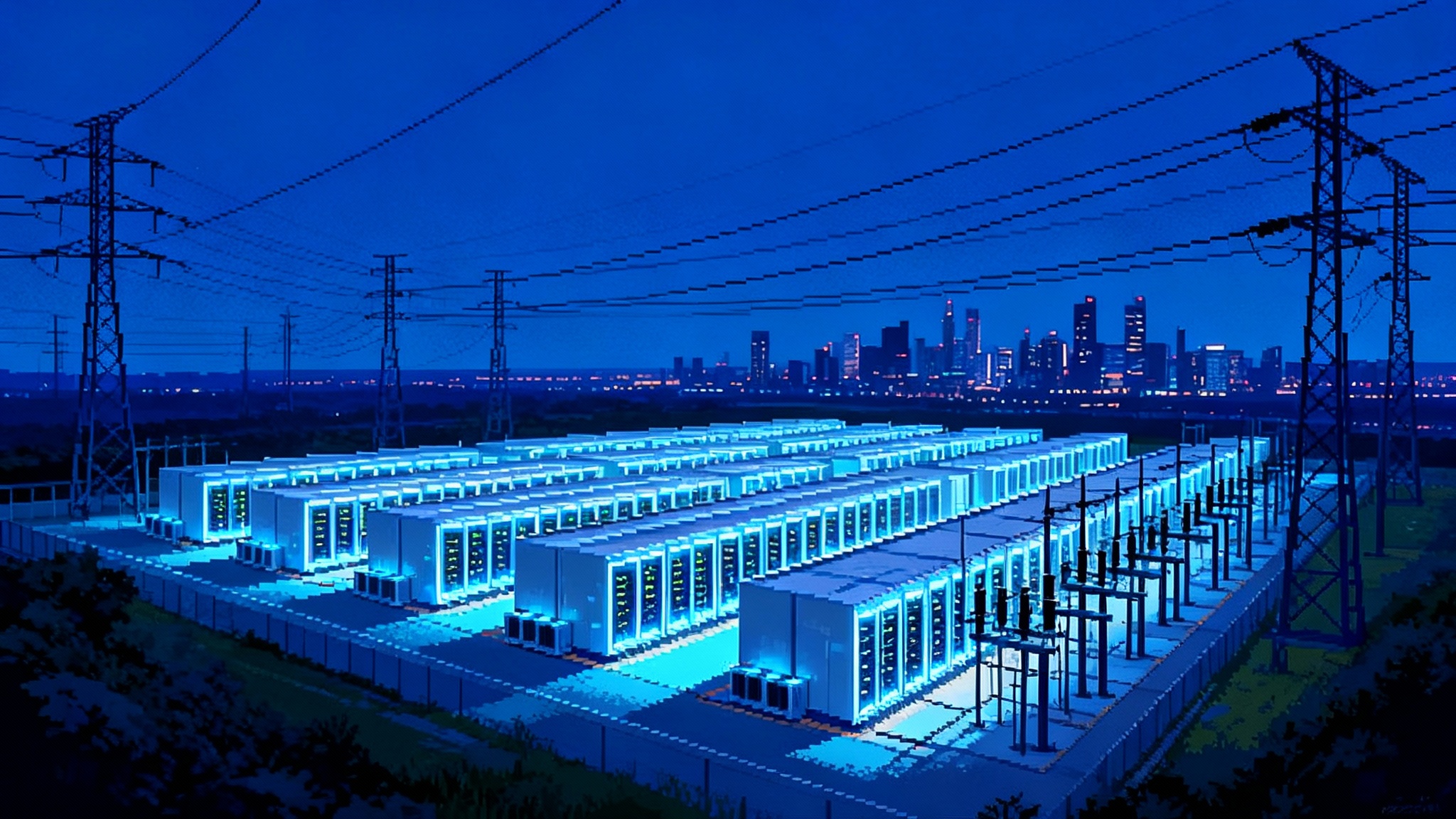

- Choose locations with headroom and an upgrade path. In PJM, that likely means outside the most constrained northern Virginia and central Maryland nodes. Look closely at western zones with better import capability, strong 345 kV backbones, and proximity to generation or storage.

- Bring a transmission posture to the table. Under 1920-A, corporate commitments are not required inputs to core scenarios, but states can request optional cases. Collaborate with states to shape an optional scenario that reflects realistic demand, on-site backup, and willingness to fund site-specific network upgrades.

- Add flexible demand and on-site resources. Commit to demand management windows and install fast-start backup or battery systems that support the local grid during peak stress. In some regions, these can qualify for capacity revenues or non-wires credits.

- Consider co-siting with storage or firm generation. The PJM auction signals that firm capacity has value. A campus adjacent to a 100 to 300 MW battery or fast-start plant that can be dispatched into local constraints may face fewer costly upgrades.

Where projects can move fastest

- Rebuilds and reconductoring inside existing corridors. Expect 12 to 24 months from design to energization for many 115 to 230 kV rebuilds and 24 to 36 months for 345 to 500 kV work, subject to outage windows and supply chains.

- Right-sizing replacements at end of life. If a 230 kV line needs replacement, rebuild to higher capacity using advanced conductors and larger structures within the same right of way. Pair with substation expansions sized for the next 20 years.

- Substation-sited storage in constrained load pockets. One to three years from notice to proceed is realistic for 50 to 200 MW battery systems addressing voltage support and contingency overloads.

- State agreement processes that already exist. PJM’s state agreement model, used for offshore wind transmission, is a workable template for multistate reliability upgrades tied to new load. Adapt it for data center corridors and cross-seam reinforcements.

- NIETC-compatible long-haul routes. Final designations are unlikely before 2026, but developers aligning early with Phase 3 engagement and state corridors can save years later. Favor routes following highways, rail, or existing utility corridors to reduce conflict risk.

How to align state participation with regional needs

- Start from a shared reliability target. Define the common outcome needed by 2027 and 2030 in terms of loss-of-load expectation or reserve margin, then backcast the transmission and storage portfolio to hit it.

- Tie benefits to cost causation with plain math. Quantify congestion relief, reduced curtailment, loss-of-load risk reduction, and avoided local capacity investments. Allocate costs based on those measurable benefits. Keep the methodology simple enough to explain to ratepayers.

- Sequence projects to show value early. Lead with reconductoring and storage that can deliver relief inside two years, then follow with larger 345 to 500 kV builds whose benefits have been previewed by the early fixes.

- Keep optional scenarios truly optional. Use them to inform, not to stall. Where states disagree on long-term policy outcomes, bracket the range and prioritize projects that are robust across policies.

Prices and reliability through 2027

- Capacity prices. Given the 2026 to 2027 PJM outcome, the next auctions are likely to stay elevated unless there is a large, fast supply response or a demand shock. Storage additions will help, but most new firm generation will not arrive in time to fully reverse the trend by 2027.

- Energy prices. Expect volatility in constrained zones with higher congestion costs until rebuilds and right-sizing projects land. Cross-seam upgrades will take longer than 12 to 18 months, so near-term relief will come from storage that limits peak-hour congestion.

- Reliability. The near-term risk is tight margins during extreme weather, especially where large new loads concentrate on stressed networks. Right-sizing and storage can materially cut risk by 2027 if procurement starts now. Large new backbones will contribute later in the decade.

- Customer bills. Transmission investment adds to rates in the short run, but the PJM auction shows the cost of waiting. The least-cost path over the next two years is to deliver the highest benefit-to-cost projects first, typically reconductoring, targeted substation upgrades, and storage that avoids costly local capacity additions.

Bottom line

1920-A puts states in the driver’s seat for long-term transmission planning and cost allocation. PJM’s price spikes quantify the cost of delay. NIETC can accelerate siting, but not in time to rescue 2026 or 2027. The practical path over the next 12 months is clear: states should lock in simple, benefits-based cost allocation and request targeted optional scenarios that reflect real load risk; utilities should right-size and reconductor every feasible mile and deploy storage where it pencils first; data center developers should follow headroom and partner with states on optional scenarios while funding local upgrades and flexible demand. Do that and reliability improves by 2027, prices ease where congestion is worst, and bigger wires later in the decade have a smoother runway.

![Why Your UI Shows [object Object] and How to Fix It Fast](https://fvnmlvqcgqaarpyajaoh.supabase.co/storage/v1/object/public/images/1758580185084-c5pj4s.png)