After Methane Fee Repeal, Markets Rewrite the Rulebook on Gas

With Congress voiding EPA's methane fee and EPA removing it from the books, methane accountability is shifting to buyers, financiers, and states. EU import rules and satellite detection will reshape U.S. gas and LNG contracts, pricing, and market access in 2025-2027.

The fee is gone, the pressure is not

Congress used the Congressional Review Act in March 2025 to repeal EPA’s Waste Emissions Charge, and in May 2025 EPA removed the rule from the Code of Federal Regulations. That closed the chapter on a short lived federal methane price signal, as confirmed on the agency’s own page for the EPA Waste Emissions Charge. The policy vacuum does not make methane irrelevant. It shifts who enforces methane performance and how accountability shows up in contracts, access to markets, and the cost of capital.

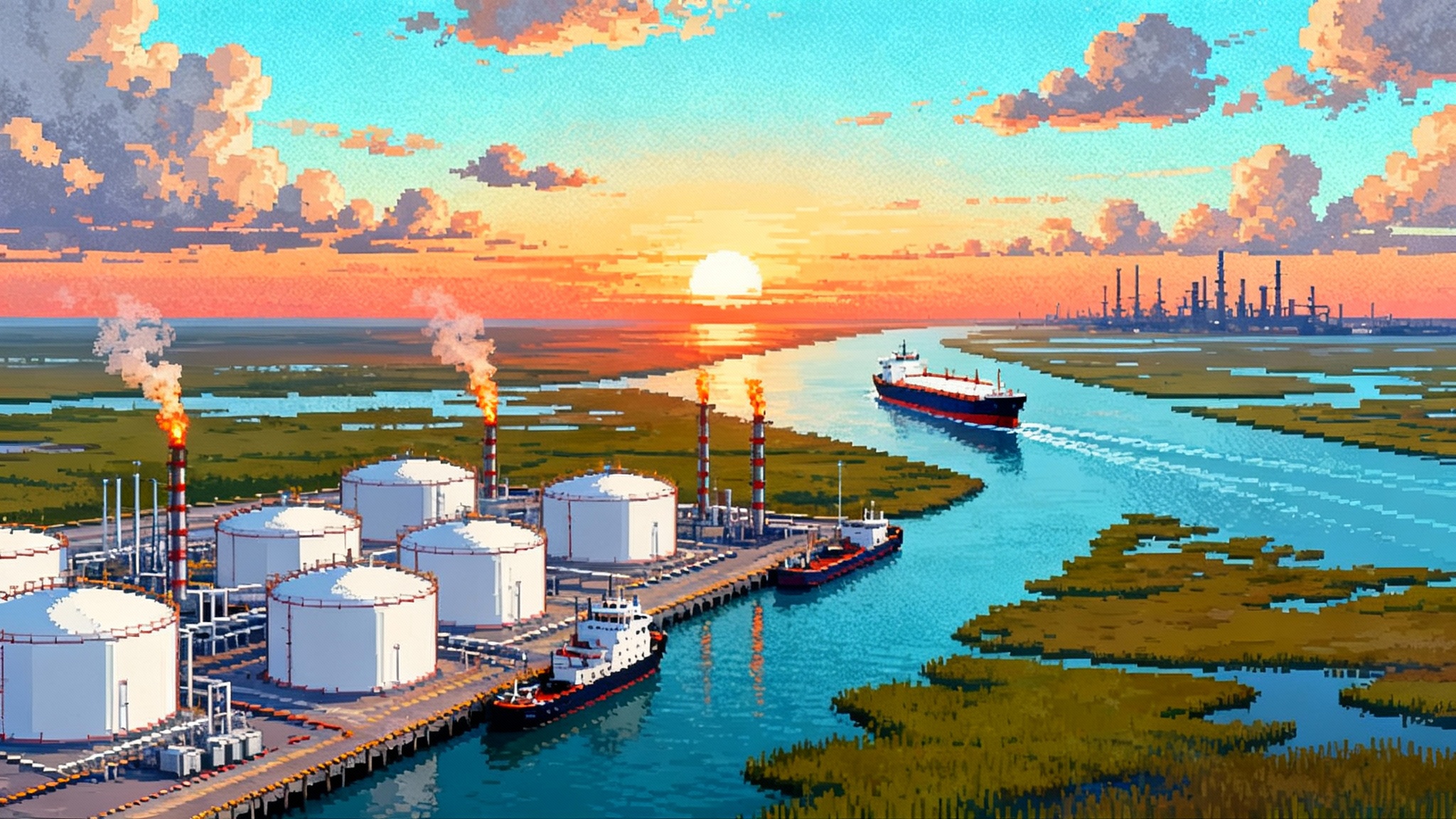

In the same year, Europe finished the architecture for the first border facing methane rules on fossil fuels. From 2027, importers must show that new contracts are backed by monitoring, reporting, and verification equivalent to EU standards, and by 2030 the EU plans to bind imports with maximum methane intensity limits. The European Commission outlines this structure in its summary of the new EU methane regulation.

Together these shifts are rewriting incentives. The United States has no federal fee, yet buyers, project lenders, insurers, and state regulators are preparing to police methane through data rich performance clauses and market gates.

A vacuum in Washington meets a wall in Brussels

The repeal ended a simple, nationwide stick, a per ton charge applied to waste methane at high emitting oil and gas facilities. Europe is moving in the opposite direction. EU importers will bear the legal duty to prove that upstream producers outside the bloc follow EU like measurement and reporting. That puts the burden directly into the commercial chain between U.S. producers, midstream, and liquefaction projects that feed European buyers.

Concrete consequences:

- Contracted gas without credible measurement and third party verified reporting risks being marked as higher methane intensity, affecting eligibility for EU buyers in 2027 and pricing in 2028-2030.

- Sellers that cannot deliver data with the molecule could face volume deferrals, price discounts, or termination under new warranty and audit clauses already appearing in draft LNG and pipeline gas agreements.

- State level enforcement becomes the domestic backstop. Colorado, New Mexico, and others have built serious methane frameworks. In the absence of a federal fee, that patchwork becomes a differentiator when European counterparties diligence sourcing. See how state roles are shifting in our look at state power and FERC 1920-A.

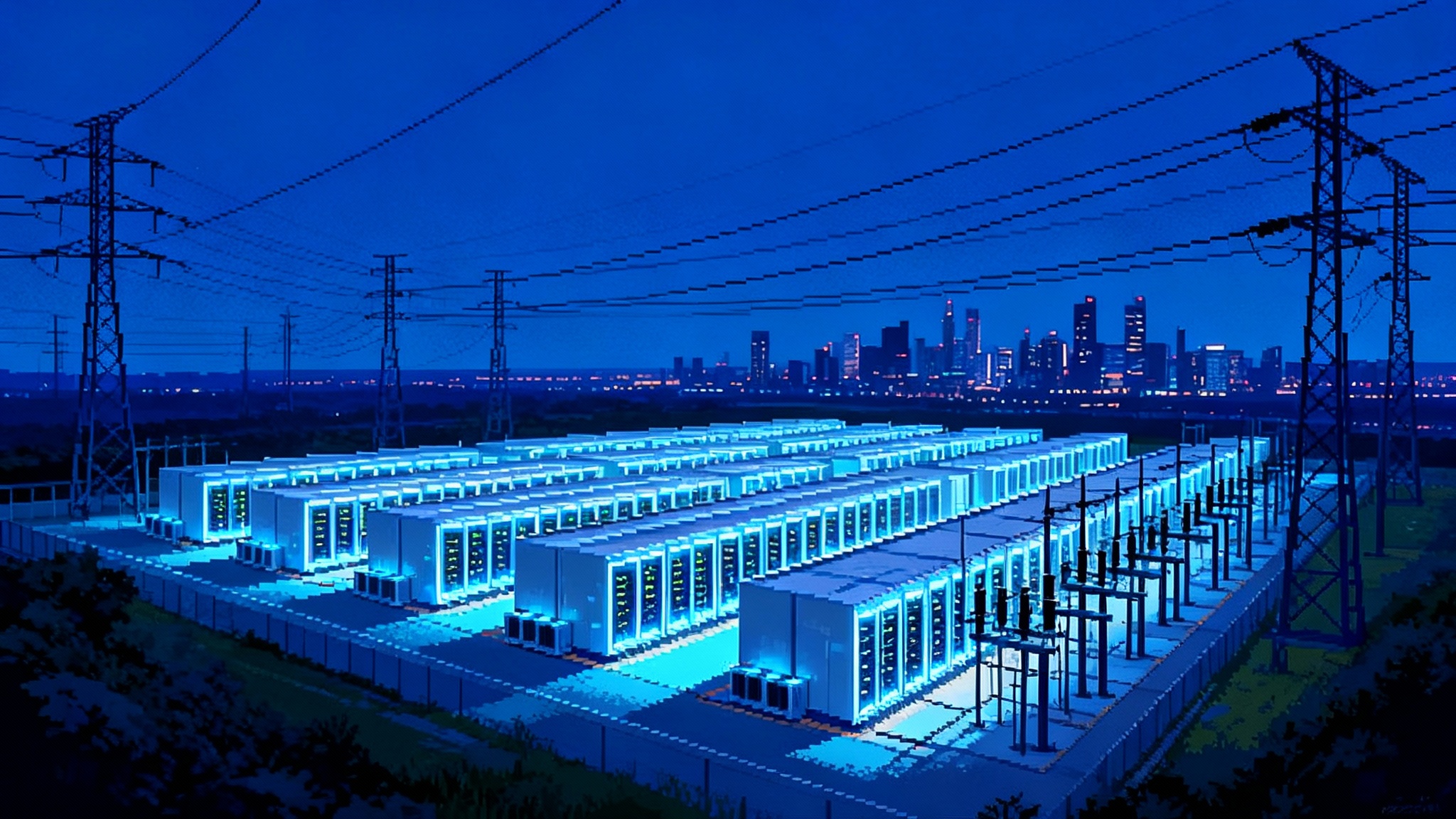

Satellites make methane visible and enforceable

Methane used to hide in spreadsheets of model estimates. That era is ending. Public and commercial satellites now detect and attribute plumes from basin scale down to individual facilities, and cadence is accelerating. Providers and national agencies are expanding coverage and shrinking revisit times. The EU regulation anticipates a global monitoring tool and a rapid alert mechanism for super emitting events. In practice, buyers and financiers can cross check operator reported data with independent observations, then write these checks into covenants or price adjustments.

The strategic point is not the novel technology, it is the cultural shift. Methane has become a data problem first, an engineering problem second. Companies that can instrument their emissions, reconcile site level and source level measurements, and respond at speed will convert scrutiny into commercial advantage.

What changes inside contracts in 2025-2027

Law firms, LNG counsel, and trading desks are already redlining term sheets. Expect these building blocks to become standard in upstream offtake, gas gathering and processing, and LNG sale and purchase agreements in 2025-2027:

- Measurement first LDAR obligations: Defined survey tiers, for example continuous monitoring on critical equipment, quarterly optical gas imaging, and scheduled aerial or satellite sweeps. Specify instrument types, calibration schedules, detection thresholds, and provide logs on request.

- Site and source reconciliation: Submit both inventory level estimates and measured source level data, then reconcile discrepancies beyond a tolerance band. This mirrors EU expectations and OGMP 2.0 logic that buyers will rely on.

- Super emitter response service levels: Time bound obligations, for example acknowledge within two hours, isolate within 24 hours, repair or secure within 72 hours, with exceptions for safety. Failure triggers fee per event, volume at risk, or the right to call a third party contractor at seller’s expense.

- Pneumatics and vents upgrade covenants: Schedules to swap high bleed pneumatics to low bleed or instrument air, add vapor recovery on storage, and eliminate routine venting. Milestones tie to price steps or eligibility for premium labels in the supply program.

- Verification and audit rights: Third party verification by accredited firms, audit access to raw sensor data, maintenance records, and satellite derived reports. Some buyers will reserve the right to nominate the verifier with cost sharing.

- Data sharing formats: Machine readable deliverables, often site level monthly files plus annual assurance statements. Expect references to APIs so buyers can ingest and score methane performance in portfolio risk models.

- Methane intensity warranties: A representation of methane intensity for delivered energy, with a dispute mechanism based on defined methodologies. Remedies range from price adjustments to replacement cargoes within a grace period.

- Carve outs and force majeure: Clauses that make clear that failure to maintain monitoring equipment or to meet LDAR schedules is not force majeure. Safety shutdowns remain protected, but data gaps must be explained and patched with conservative assumptions.

These details can look onerous, yet once embedded they reduce friction because they turn methane debates into operational checklists.

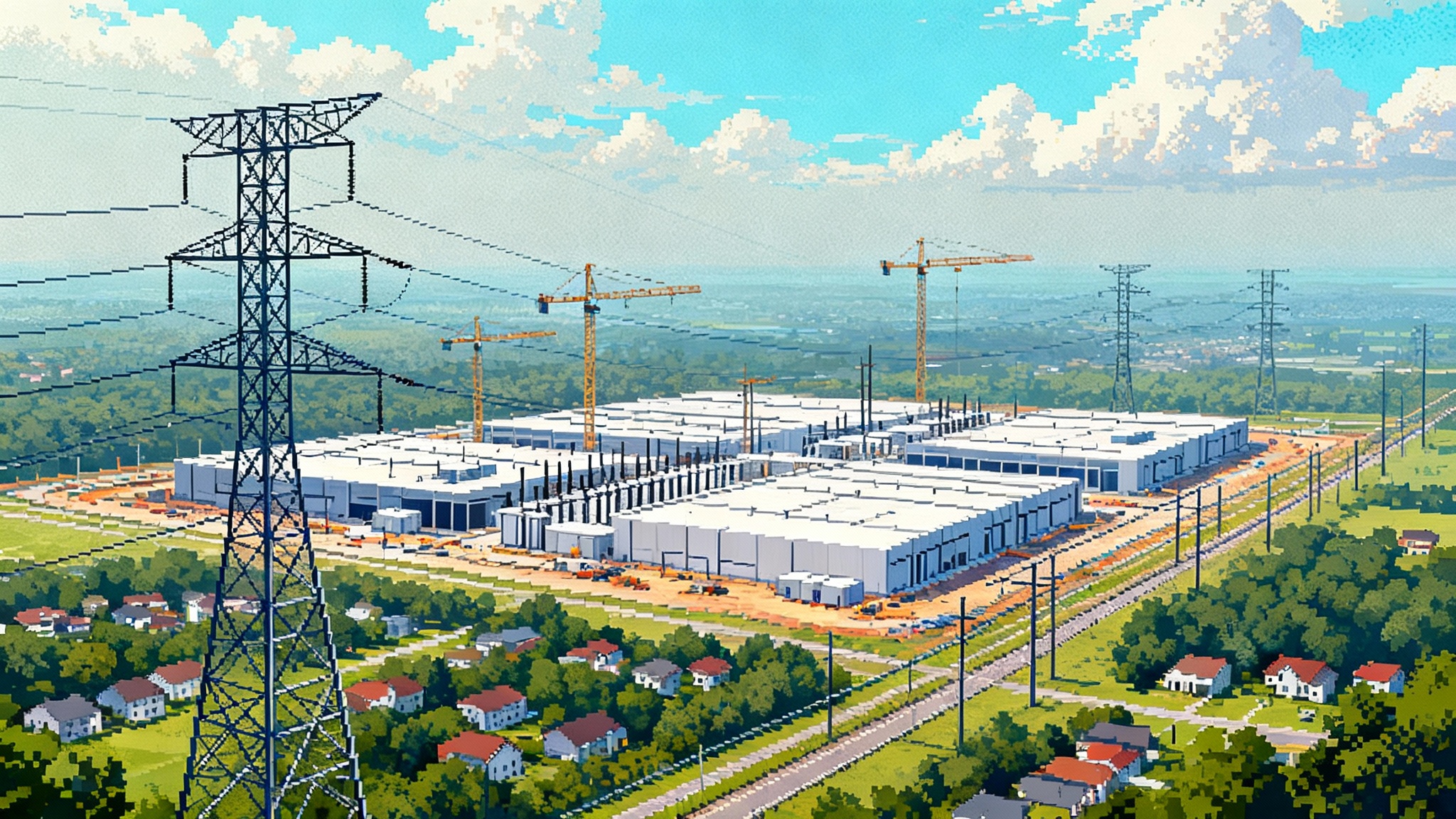

Exposure for Gulf Coast LNG feeding Europe

Gulf Coast liquefaction exports are the front line. European utilities and portfolio players will need MRV equivalence on new contracts starting in 2027. Several large U.S. projects sell into Atlantic Basin portfolios that swing between Europe and Asia. When European demand spikes, cargoes without compliant methane clauses or data packages could struggle to clear internal risk gates or fetch the best netbacks. For broader context on how LNG interacts with power markets, see our analysis of the LNG export wave and power.

Practical implications for U.S. LNG developers and tollers:

- Brownfield trains with diverse upstream supply will need a methane data program that can track and tag molecules by source, or at least allocate intensities by supplier and show continuous improvement.

- Marketers that aggregate third party gas into liquefaction feedgas will require methane representations from each shipper entering the header system, along with audit rights. Expect new annexes to master gas purchase agreements covering MRV obligations and remedies.

- Long lead buyers may insist on sustainability linked structures that embed methane KPIs into pricing or take or pay relief. Banks are comfortable underwriting to such frameworks if the underlying measurements are credible and verified.

Pricing and market access risks

Methane is unlikely to create a uniform, explicit price for U.S. gas soon. Instead, it will surface in differentials, eligibility screens, and reputational filters that shift who competes for European demand.

- Basis and quality premia: Gas with strong methane credentials can earn a small premium in bilateral deals when buyers face compliance or reputational constraints. Conversely, high uncertainty on methane data can require discounts, especially for prompt cargoes into Europe where compliance teams are strict.

- Portfolio optionality: Traders with a shelf of MRV compliant supply will capture optionality around European cold snaps or nuclear outages. Non compliant volumes will be diverted to less demanding markets or priced accordingly.

- Insurance and financing: Lenders and insurers are incorporating methane KPIs into covenants for midstream and LNG projects. Breaches can increase the cost of capital or restrict access to insurance for critical operations.

The key risk is not a single future fine from a regulator, it is the compounded cost of being the supplier that fails compliance reviews while competitors pass them.

The operator playbook for contract and data driven markets

A practical, investable plan fits on one page. It starts with measurement and closes with independent assurance.

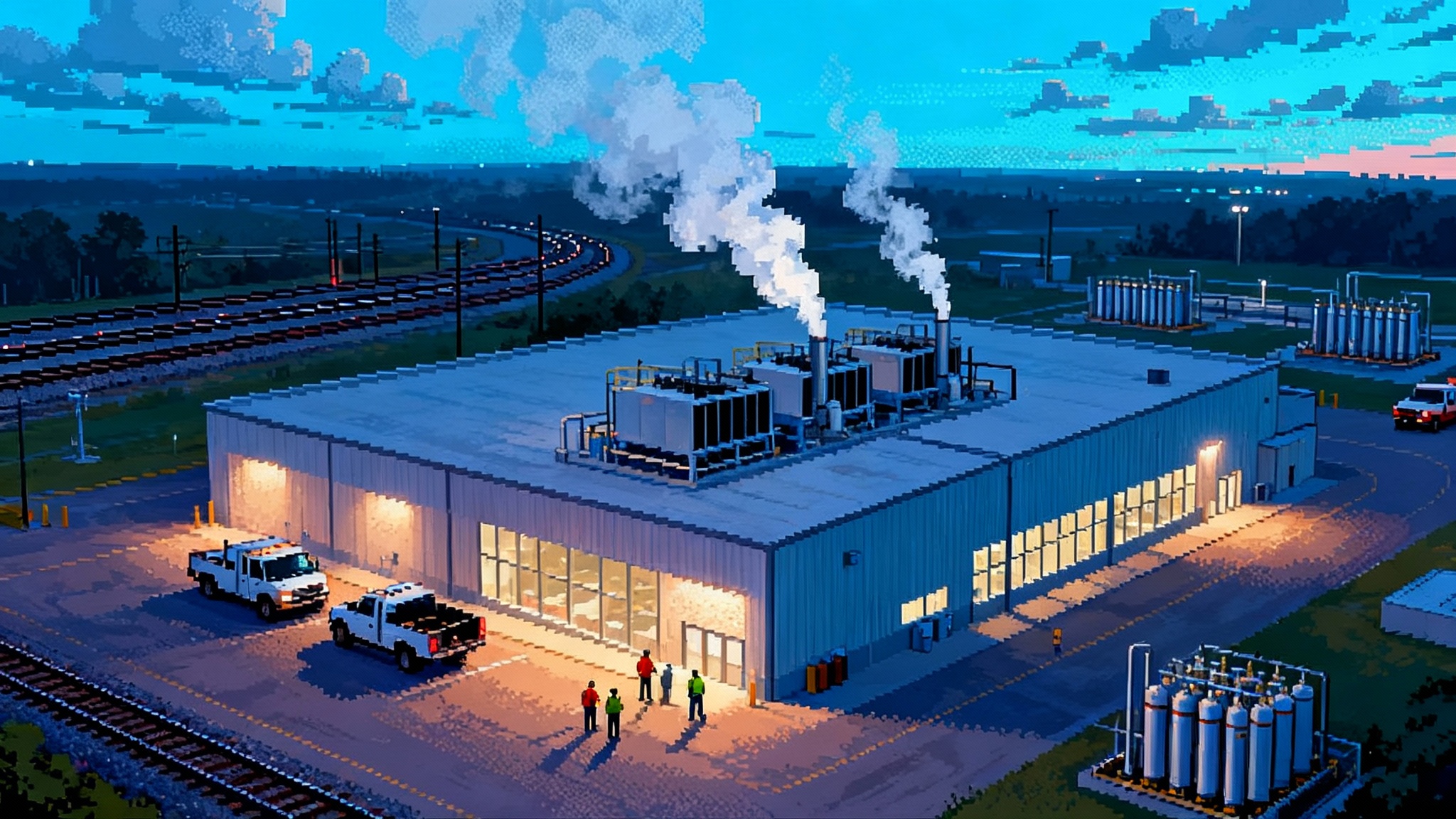

- Measure first

- Deploy continuous monitoring on high consequence equipment like compressors and dehydrators, then layer quarterly OGI and scheduled aerial surveys across pads and gathering lines.

- Use controlled release tests to calibrate sensors and set facility specific detection limits. Tag each asset with a digital equipment list and maintenance history.

- Reconcile bottom up inventories with top down site level measurements at least annually. Where gaps remain, apply conservative estimates and document them openly.

- Fix recurring sources fast

- Replace or convert high bleed pneumatics systematically, aligning crew routes with maintenance windows. Track avoided methane as a recovered product stream to show cash value.

- Install vapor recovery on tanks and separators, and set automated alarms for pressure spikes that indicate leaks.

- Create playbooks for super emitter events with a clear chain of command and 24 by 7 coverage. Practice them like safety drills.

- Prove it to counterparties

- Hire an accredited verifier to review methods, raw data, and reconciliations. Ask for a findings log you can share with buyers and lenders.

- Publish a methane intensity figure for your operated assets, and show the trajectory over the next three years with planned projects and expected reductions.

- Align with a recognized reporting framework, for example OGMP 2.0, so your disclosures line up with EU equivalence expectations.

- Contract for accountability

- Offer audit rights and near real time data feeds to top tier buyers. Openness reduces disputes and accelerates offtake decisions.

- Embed service levels for leak response in your field service contracts so you can meet the SLAs in your sales agreements.

- Put a small price collar around methane intensity warranties to reduce the temptation to litigate minor deviations. Buyers prefer a simple make whole mechanism over a fight.

- Align the organization

- Give operations the budget to replace pneumatics and upgrade seals, then ask procurement to standardize parts that perform well in leak histories.

- Seat the environmental team next to commercial during SPA negotiations. The language they agree on will drive what data the field must collect.

- Equip IR and communications to explain methane performance simply. A clean story speeds diligence and lowers the risk premium investors demand. For how state actions can reshape markets, see states vs. PJM governance.

State regulators will matter more than ever

In the absence of a federal fee, states with clear leak detection rules, venting and flaring limits, and credible enforcement will become magnets for buyers confident that supply is lower risk for methane. The effect will be indirect but real. Producers in those states will find it easier to secure MRV clauses that pass European compliance checks and to command better terms with lenders who must underwrite future market access.

Milestones through 2027

- February 26-27, 2025: Congress passes a joint resolution under the Congressional Review Act to disapprove EPA’s WEC rule.

- March 14, 2025: The President signs the resolution, voiding the WEC. EPA signals the rule has no legal force and WEC filings are not required.

- May 12, 2025: EPA issues a final action removing WEC regulations from the Code of Federal Regulations.

- 2025: EU importer reporting begins under the new methane regulation, and the Commission starts work on a global methane monitoring tool and rapid alert mechanism.

- 2026: LNG and gas marketers increasingly add MRV and super emitter response clauses to new and renewed contracts in anticipation of EU buyer requirements.

- 2027: EU importers must ensure that new contracts for oil, gas, and LNG are subject to MRV measures equivalent to EU rules, with third party verification and site plus source reconciliation becoming standard.

Who is positioned to win

- Measurement led producers: Companies that can show reconciled measurements, quick repairs, and third party assurance will move to the front of the bid stack for premium buyers.

- LNG projects with traceable feedgas: Facilities that can allocate methane performance by supplier, and that impose MRV conditions at the header, will keep European doors open and extract optionality value.

- States with strong methane rules: Operators in those jurisdictions will enjoy smoother diligence with European counterparties and a lower cost of capital.

- Traders with compliant portfolios: Marketers who curate methane verified supply will monetize optionality when Europe pulls on the system.

The methane fee is gone. Methane accountability is not. In the next two years the market will embed it into contracts, diligence, and operations, and satellites will score the results in public. The best strategy is simple: measure first, fix fast, verify, and make the data part of the deal.

![Why Your UI Shows [object Object] and How to Fix It Fast](https://fvnmlvqcgqaarpyajaoh.supabase.co/storage/v1/object/public/images/1758580185084-c5pj4s.png)