NECEC goes live: 1.2 GW hydro reshapes New England winter

New England enters a different kind of winter. As NECEC begins delivering firm Hydro-Québec power, ISO-NE should see fewer price spikes, lower gas burn and emissions, and shifting capacity and REC dynamics that reward resources that perform in the cold.

The winter New England has been waiting for

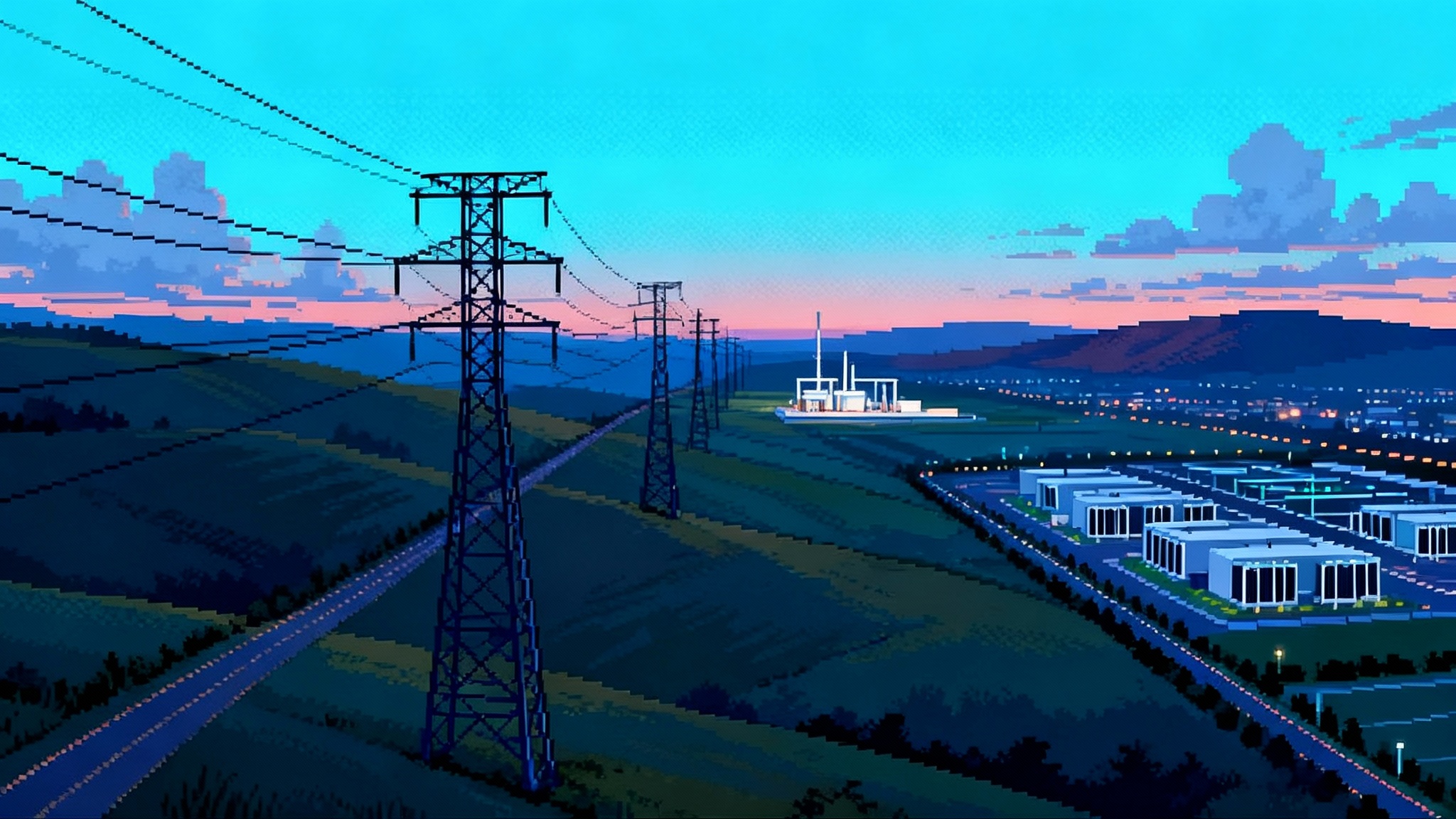

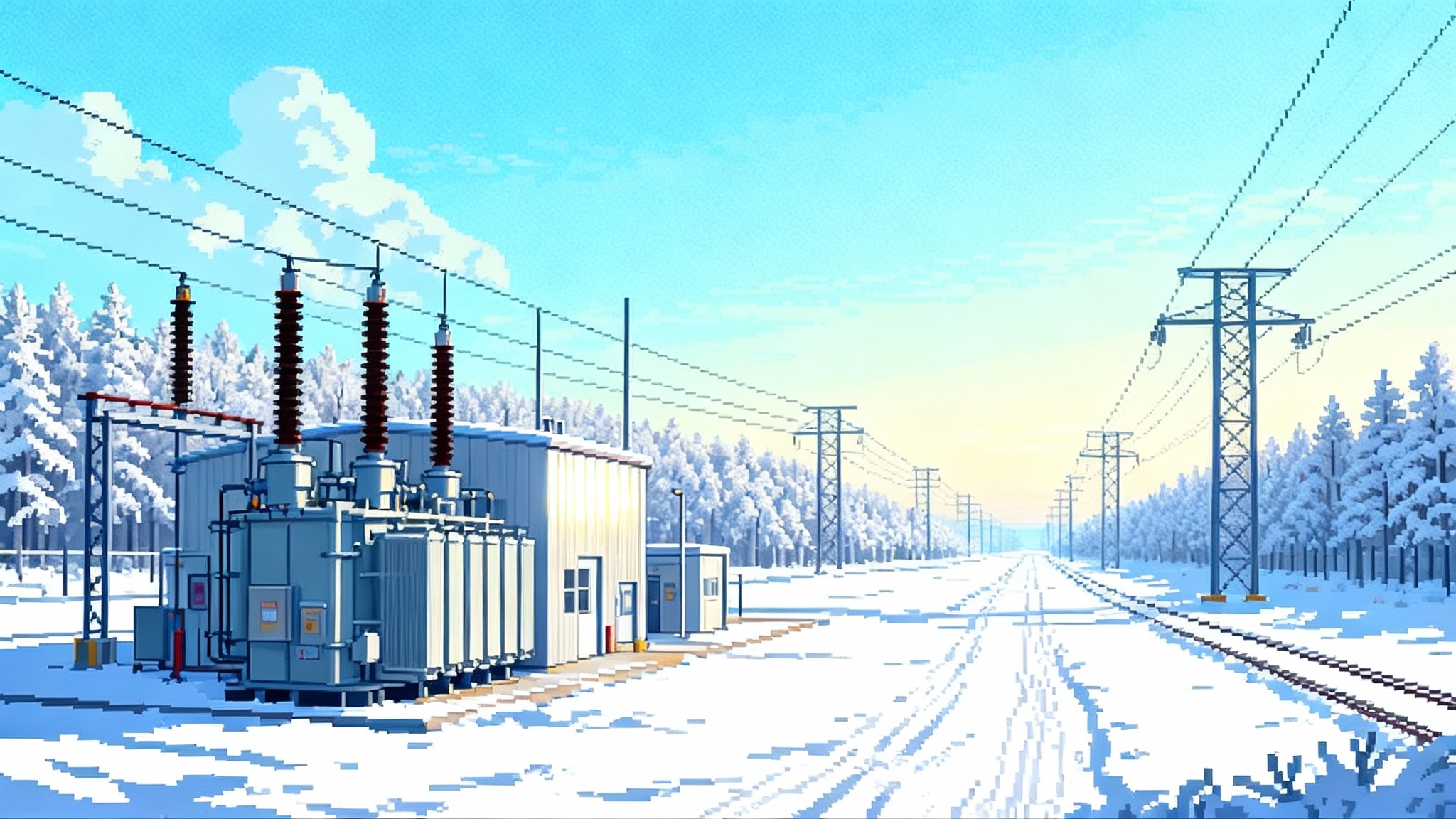

On the coldest mornings, New England’s power system leans hard on gas-fired plants just as heating demand peaks and pipeline capacity tightens. That is when wholesale prices can jump and emissions rise. This winter, that familiar story changes. The New England Clean Energy Connect, a 1.2 GW high-voltage direct current link from Hydro‑Québec into Maine, begins delivering firm hydroelectric power that can be scheduled into the morning ramp and sustained through prolonged cold snaps. With controllable flow and a dedicated interface, the project is built for exactly the moments when the region has historically struggled.

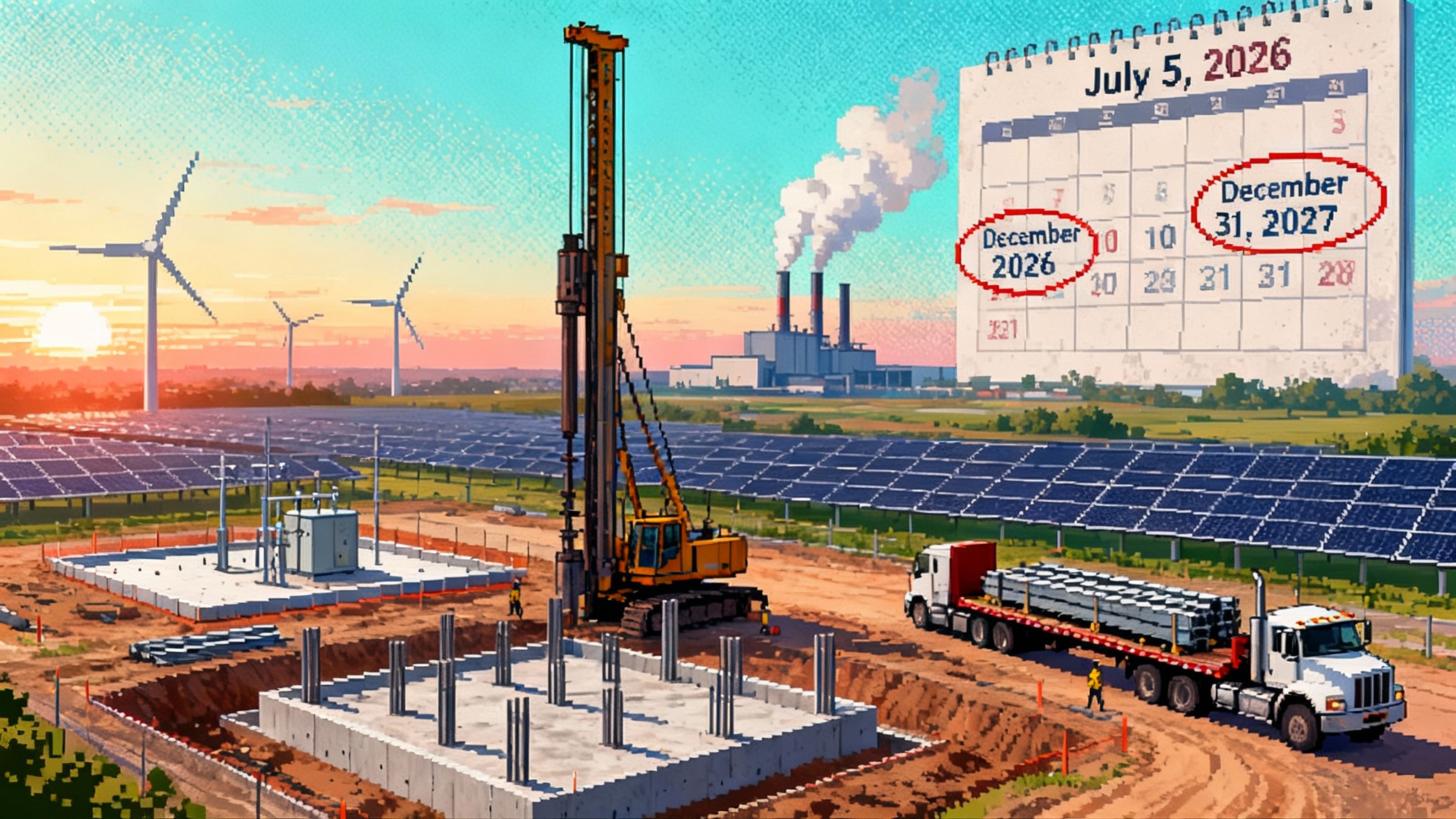

The long road to this moment ran through courtrooms, a statewide referendum, and construction pauses. Massachusetts regulators approved a settlement in January 2025 that cleared the way to finalize transmission service and affirmed a 20-year supply of Canadian hydro for the state’s utilities. The order also flagged a realistic in-service window in 2026, with commissioning and test energy potentially beginning beforehand. In other words, the first meaningful winter impact lands across the 2025–26 and 2026–27 heating seasons, with full commercial service expected to follow. See the Massachusetts DPU’s settlement approval for the official details and expected benefits, including estimated net customer savings and emissions reductions in DPU settlement approval January 2025.

What 1.2 GW means on a cold day

ISO‑NE’s winter peak typically sits in the high-teens to low-20s gigawatts. Dropping a controllable 1.2 GW into that stack is a material shift, especially during the morning and evening ramps. The hydropower behind NECEC is dispatchable within its operating limits, unlike variable wind or solar. That matters on still, subfreezing days when solar output fades early and wind can be fickle.

Think through the price logic. In constrained hours, the marginal generator is often a gas unit exposed to volatile fuel prices and, at times, to LNG truck or tanker deliveries. If hydro imports displace one or more of those marginal gas units, the clearing price should fall toward the next least-cost offer. The effect is largest during scarcity conditions when gas prices spike or when system operators otherwise pull in oil-fired units to preserve gas for heating. NECEC’s contribution is not just energy volume but firmness at the hours that set the bill.

How firm hydro blunts winter price spikes

- Hydro‑Québec energy arrives as a scheduled, controllable DC injection. That allows operators to target the exact hours that drive day-ahead and real-time price peaks.

- By lowering the frequency and height of scarcity intervals, imports reduce the number of intervals that set high uplift and reserve prices. This helps downstream retail suppliers and municipal aggregations avoid risk premia that build into winter hedges.

- The benefit is regional, but its first stop is Maine, where the converter station injects into a part of the grid that often exports south. Because the line is controllable, operators can tune flows to reduce congestion through known bottlenecks and net-export interfaces.

A practical way to visualize the change: fewer hours where the marginal unit is an oil-fired peaker or a gas plant constrained by pipeline nominations. The hydro acts like a damper on the system’s most jittery hours.

Gas burn and emissions: less fuel, fewer tons

Hydro displaces thermal generation in the very hours when fuel constraints bite. That shows up in two places:

- Gas burn. During severe cold, generators compete with heating loads for pipeline capacity. Imports relieve that competition, reducing the need for high-heat-rate units and dual-fuel switching. Even a few hours per day of 1.2 GW displacement equates to meaningful daily reductions in gas demand.

- Emissions. Massachusetts regulators estimated roughly 2 million tons per year in avoided CO2 once deliveries hit steady state. The largest slices come from oil and older gas units that run most in winter stress conditions. Cutting those peaks also reduces local criteria pollutants at the times communities feel them most.

Will the weather still matter? Yes. Year-to-year hydrology in Québec can tighten or loosen energy budgets. But Hydro‑Québec manages a vast reservoir system that smooths dry stretches, and the NECEC contract was structured for firm delivery. That does not make the hydro limitless, but it makes it reliable enough to plan around in winter.

The capacity market subplot: accreditation is changing

Just as NECEC arrives, ISO‑NE is recasting how it credits capacity. The Capacity Auction Reforms project would move the Forward Capacity Market to seasonal, prompt auctions with updated Resource Capacity Accreditation, with a target start for the capacity period beginning June 1, 2028 after a FERC-approved delay of the 19th auction to 2026 to finish the redesign. The thrust is simple: credit resources for what they can actually deliver when risk is highest. See ISO-NE capacity auction reforms.

What that means for imports and for gas units:

- Imports with firm transmission and supply tend to accredit well in winter because their limitation is the contract, not fuel delivery in New England. Under a seasonal, risk-aware lens, that contribution becomes clearer.

- Gas plants with constrained winter fuel may receive lower winter accreditation than summer values unless they can demonstrate firm fuel arrangements or on-site energy. That nudges portfolios toward resources that can show up in cold snaps without scrambling for fuel.

- The combination of NECEC and accreditation reform could pull winter capacity prices down relative to a counterfactual with no firm imports and looser rules. Price direction still depends on retirements, offshore wind timing, and load growth, but the relative tilt favors resources that are strong in winter.

How NECEC participates is a commercial choice. In ISO‑NE, external resources can clear capacity as imports if they meet firm supply and transmission criteria. If the project elects to sell capacity for winter seasons under the new rules, it would likely earn stronger winter accreditation than many fuel-constrained units. If, instead, deliveries are focused on energy and clean credits, the capacity effect still materializes indirectly by lowering scarcity risk and reducing the need for short-notice winter support programs.

The REC and clean credit puzzle in Massachusetts and Maine

Massachusetts

- The 2016 Energy Diversity Act procurement known as 83D selected long-term clean energy deliveries from Hydro‑Québec coupled with NECEC.

- Those deliveries produce clean energy attributes that qualify under the Massachusetts Clean Energy Standard rather than flood the Class I RPS market. In practice, that means utilities retire Clean Energy Credits for CES compliance while preserving the separate supply and price dynamics in Class I, which is driven by new wind, solar, and eligible biomass.

- Result: NECEC stabilizes retail costs and helps the Commonwealth close its emissions gap without swamping Class I REC prices. Developers of new Class I resources still look to offshore wind solicitations, federal tax credits, and bilateral REC demand rather than worrying about a wave of large-hydro RECs crowding them out.

Maine

- Maine’s RPS has a Class I and IA structure that favors new, smaller renewables. Large hydro above 100 MW does not qualify for Class I or IA, and Maine recently added a separate clean standard pathway that grows later in the 2030s.

- That means NECEC does not directly generate Class I or IA RECs for Maine suppliers. The price formation in Maine’s Class I and IA markets should continue to reflect in-state and regional wind, solar, and qualifying hydro and biomass supply, not Québec imports.

- Indirectly, lower wholesale energy prices can compress retail adders and risk premia, which affects how buyers value long-term REC strips. But the structural REC supply in Maine is not suddenly larger because NECEC flows.

Bottom line on attributes: in Massachusetts, the hydro deliveries are aimed squarely at CES compliance and customer savings. In Maine, the project is more about energy price relief, system reliability, and the economic package negotiated during siting.

Contract economics after delays and cost inflation

Years of litigation and a 2021 referendum added time and cost to the build. The January 2025 settlement approved by Massachusetts regulators addressed incremental transmission service costs tied to the delay while keeping the core 20-year clean energy supply on track. The state projected billions in net benefits over the contract term and modest monthly savings for typical residential customers once deliveries are underway. Importantly, the settlement insulated customers from legal fee recovery and kept the focus on getting firm, low-volatility energy into the region.

For Hydro‑Québec and the developer, the value proposition strengthens in winter when New England’s avoided cost is highest. For Massachusetts utilities and their customers, the gain is a portfolio hedge against gas price spikes that has become more valuable after three volatile winters. For competitive suppliers, the risk is that winter peaks become less lucrative. But that is the point: to turn extreme scarcity into routine, planned supply.

How the line changes winter operations on the ground

- Scheduling and ramping. HVDC controllability lets operators shape imports to the precise profile of the morning and evening ramps. That reduces the need to commit less efficient thermal units for long blocks just to cover a few peak hours.

- Congestion relief. The injection point in Maine sits upstream of interfaces that often bind southward. Directional control can help manage constraints and reduce uplift that otherwise shows up in load pockets.

- Reserves and reliability. By shaving the most stressed hours, imports cut the number of intervals in which operating reserves are tight, lowering the chance that scarcity pricing will cascade into real-time reserve and regulation penalties.

What to watch this winter

- Commissioning profile. Expect test flows that ramp up, then settle into targeted deliveries during the coldest weeks. Even partial daily imports can move prices in constrained hours.

- Gas pipeline constraints. Algonquin Citygate winter basis remains the weather lever. If basis widens, the value of imports rises. If basis stays narrow, hydro still earns its keep by reducing marginal oil burn and scarcity events.

- Oil use. One quick diagnostic: the count of hours in which oil units set price. If that tally drops, imports are doing their job.

- Forward curves. Winter 2026–27 forwards will assimilate a fuller year of NECEC deliveries and the approach of seasonal capacity accreditation. Watch how peak forwards and winter capacity prices evolve relative to the last three years.

Risks and limits

- Hydrology. Québec’s hydrologic year can run dry. Reservoir management dampens but does not eliminate that risk. The contract structure is designed to deliver firm energy, yet operators should still plan for occasional tight weeks.

- Transmission outages. Like any large asset, the HVDC link will have maintenance outages. The region should see enough benefit overall that occasional outages do not undo the winter hedge.

- Load growth and electrification. Heat pumps and EVs are climbing. Over time, 1.2 GW will feel smaller against winter peaks. Rising data center demand adds to the challenge, as covered in AI load reshapes power demand.

The bigger picture

NECEC is not a silver bullet. New England still needs offshore wind, batteries, responsive demand, and flexible thermal units that can run cleanly when called. Transmission planning debates are converging on similar themes across the country, including the FERC 1920-A transmission planning shift and lessons from the ERCOT 765 kV expansion. By delivering firm, predictable energy across deep winter, the line lowers price volatility, trims emissions, and rewards capacity resources that can actually perform in the cold. It also buys time for new resources to arrive under a market design that values winter reliability explicitly.

After years of controversy, the measure of success will be mundane: fewer price spikes, less oil burn, smaller emissions peaks, and a forward market that prices winter risk with more confidence and less drama. That is what 1.2 GW of controllable hydro is built to do.

Takeaways for market participants

- Load-serving entities in Massachusetts can lean on a steadier CES compliance path without counting on volatile Class I REC markets.

- Maine suppliers should not expect a flood of new Class I or IA REC supply, but they can plan for energy and risk cost relief in winter hedges.

- Generators with firm winter capability will likely fare better under accreditation reforms than those that cannot show up in the cold. Align portfolio strategy with seasonal accreditation.

- Watch commissioning data and winter margins in real time. The first winter’s operational lessons will inform offers into the new seasonal capacity construct and shape bilateral contracting for 2026–27.