45Z’s first-year shock: SAF stumbles, RNG surges

New IRS and DOE rules made Section 45Z real in January 2025. The math and registration timing are pushing value from sustainable aviation fuel to renewable natural gas. See who wins, who loses, and how to plan through 2027.

The 2025 policy snap that reset the market

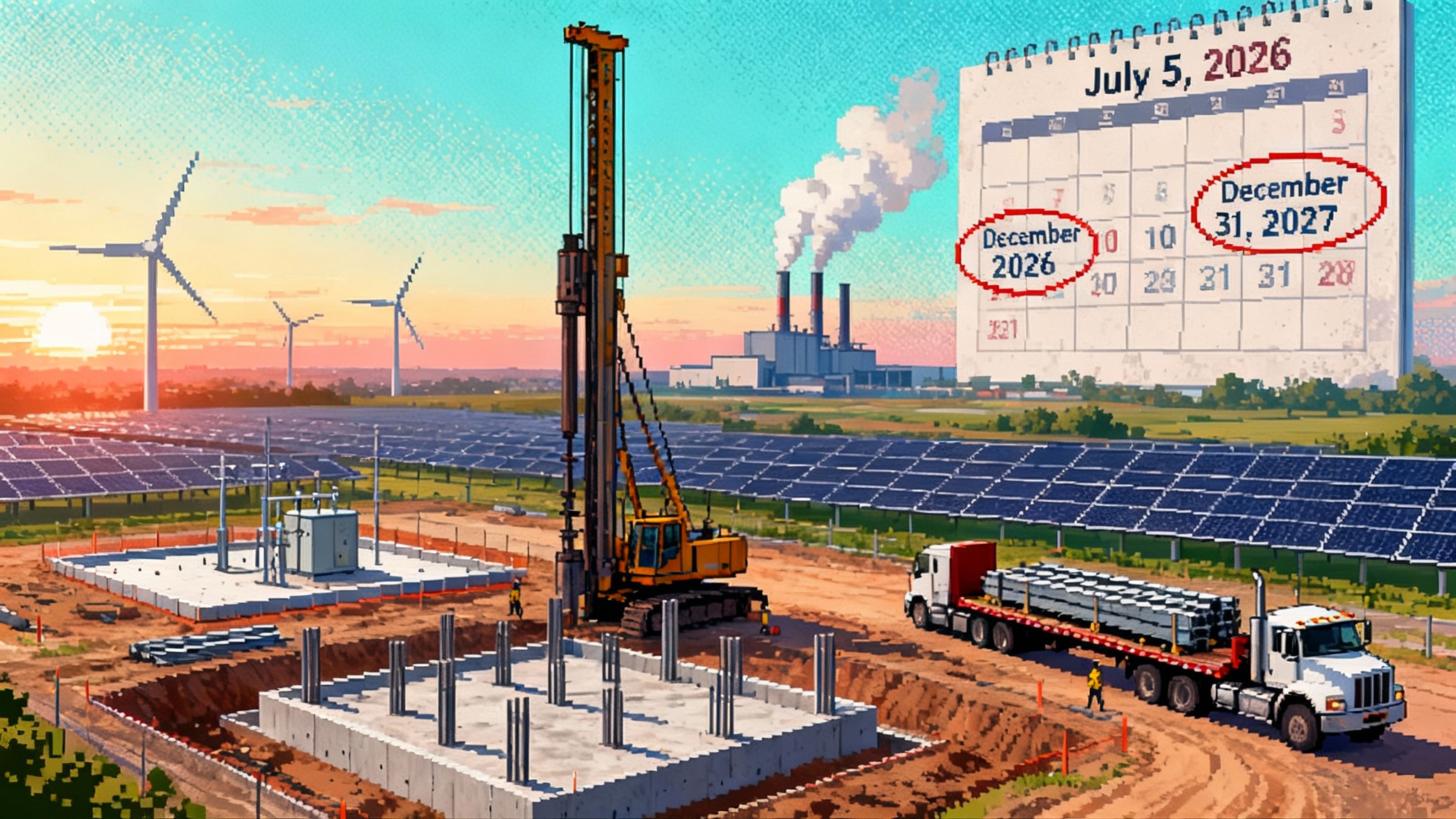

On January 10, 2025, Treasury and the IRS published their first comprehensive guidance for the Clean Fuel Production Credit under Section 45Z, setting out eligibility, emissions accounting, and registration mechanics that made the credit operational for fuel produced after December 31, 2024 and sold by December 31, 2027. The guidance clarified that the producer of the eligible fuel is the claimant, that fuels must be suitable for use in highway vehicles or aircraft, and that registration under Section 4101 at the time of production is mandatory. It also introduced the annual emissions rate table and confirmed the baseline of 50 kg CO2e per mmBTU for qualifying fuels, with the credit scaling from that baseline. Crucially, the emissions factor can exceed 1.0 when lifecycle emissions are negative. See the plain-language summary in Treasury’s January 10 guidance.

Five days later, on January 15, 2025, DOE released the 45ZCF-GREET model, a fit-for-purpose version of GREET to determine lifecycle emissions for 45Z, plus a user manual. This gave taxpayers a single, auditable model for non-SAF fuels and, for SAF, a choice between 45ZCF-GREET and approved ICAO methodologies. DOE’s release also signaled that 45ZCF-GREET supersedes R&D GREET for 45Z. See DOE releases 45ZCF-GREET model.

The same week, USDA issued an interim rule outlining technical guidelines for climate-smart practices to quantify feedstock carbon intensity at the farm level. That move prepared the ground for farm-specific carbon accounting to flow into future lifecycle determinations, a lever with major implications for corn ethanol and soy-based pathways as the rule is finalized.

Why early returns favor RNG over SAF

On paper, 45Z is technology neutral. In practice, the 2025 ruleset and math delivered a first-year shock: renewable natural gas, especially manure-based RNG, is outcompeting SAF for 45Z value.

Here is the math. The credit equals an applicable amount per gallon or gallon equivalent multiplied by an emissions factor. For non-SAF fuels, the applicable amount is 20 cents per gallon, or 1.00 dollars if prevailing wage and apprenticeship requirements are met. For SAF, the applicable amount is 35 cents per gallon, or 1.75 dollars with prevailing wage and apprenticeship. The emissions factor is (50 − CI) divided by 50, where CI is the lifecycle carbon intensity in kg CO2e per mmBTU. If CI is negative, the emissions factor is greater than 1.0.

Manure-derived RNG can post strongly negative lifecycle emissions because it avoids methane that would otherwise escape. With negative CI, the emissions factor surpasses 1.0, so qualified producers earn more than 1.00 dollars per gasoline-gallon equivalent at full wage and apprenticeship levels. That uplift is flowing into 2025 RNG offtake pricing and is a big reason RIN-plus-45Z-plus-state LCFS stacks are clearing at premium values. For broader gas-market context, see how markets rewrite the rulebook on gas.

By contrast, most SAF projects operating or near term rely on low-carbon lipid feedstocks like used cooking oil and tallow, or on alcohol-to-jet pathways that need very low CI ethanol. Under 2025 guidance, SAF claimants face stringent certification, narrower eligible coprocessing interpretations, and practical feedstock constraints. Even where a project hits a decent emissions factor, the per-gallon economics are frequently eclipsed by manure-RNG’s negative-CI leverage. Airlines are seeing it in price offers: post-guidance SAF quotes often require long-dated, inflation-indexed commitments that exceed what 45Z alone can carry.

Winners and losers across pathways

The policy specifics matter, so here is how 2025’s rules are repricing each major fuel slate.

-

Renewable natural gas

- What changed: A single designated model in 45ZCF-GREET, explicit allowance for emissions factors above 1.0 when lifecycle CI is negative, and clear producer-registration rules. Chain-of-custody and suitability rules still require attention, but they are navigable.

- Net effect in 2025: Strong winner. Manure-RNG leads on value, followed by selected landfill-RNG where CI is very low. Producers that locked in Section 4101 registration early are monetizing quickly via transfers, and many are repricing away from floating stacks to fixed-price 45Z adders given confidence in their CI.

-

Ethanol

- What changed: 45Z now pays for ethanol used as a transportation fuel in highway vehicles when CI is below 50 kg CO2e per mmBTU. The DOE model and USDA’s interim farm-level CI rule create a runway for producers who can document climate-smart practices, low-carbon process energy, and carbon capture and storage. The annual emissions table plus provisional emissions rate options give a path to recognize facility-specific improvements.

- Net effect in 2025: Conditional winner. Corn ethanol with verified low CI can earn meaningful 45Z value for on-road blends. Ethanol-to-jet remains viable but capital intensive. The swing factor is whether farm-level CI can be traced and validated at commercial scale.

-

Renewable diesel and biodiesel

- What changed: 45Z treats these as non-SAF fuels with credit value set by lifecycle CI. Treasury’s 2025 intent-to-propose language and definitions signal tighter treatment of coprocessing. Imported lipid feedstocks remain eligible under current law, but that is where Congressional proposals would bite.

- Net effect in 2025: Mixed. Facilities with domestic feedstocks and strong CI accounting are competitive. Projects relying on imported used cooking oil or palm-adjacent streams see headline risk on both eligibility and CI assumptions. Several producers are renegotiating supply to North American feedstocks to hedge legislative risk.

-

Sustainable aviation fuel

- What changed: SAF retains a higher applicable amount than non-SAF under current law, but claimants must secure third-party certification and use either 45ZCF-GREET or specified ICAO methods consistently across the lifecycle. Coprocessing interpretations are tighter, and feedstock availability is a binding constraint. Airlines still want book-and-claim simplicity, but the tax rules tie the credit to the producer, not the buyer.

- Net effect in 2025: Relative loser. Some pathways pencil, especially where ethanol-to-jet producers can show very low CI. Yet feedstock scarcity, certification costs, and capital timelines mean fewer gallons qualify at values that meet airlines’ budgeted abatement cost compared with the economics of RNG used to displace fossil gas in heavy-duty fleets.

Registration, modeling, and coprocessing are repricing contracts

The registration rule is a bright line. If your Section 4101 letter is dated after your production start, earlier 2025 output does not qualify. That reality led to a flurry of contract addenda in Q1 to shift start dates and pricing floors. It also divided the market between early registrants who could quote firm 45Z adders and late registrants who had to price with disclaimers or offer contingent true-ups.

Lifecycle accounting is moving markets. The release of 45ZCF-GREET as the designated model has shortened diligence and underwriting cycles. Buyers and credit insurers want either table-based emissions rates or well-documented model runs with auditable inputs. The result is a premium for projects that can prove CI with metered process energy and traceable feedstock data rather than literature defaults.

Refinery coprocessing economics have shifted too. Treasury’s 2025 guidance previewed a narrow reading for coprocessing eligibility, pointing to ASTM jet fuel specifications that only allow certain Fischer-Tropsch coprocessing to qualify as jet fuel and excluding other pathways that blend biogenic feed with fossil streams before distinct renewable molecules can be quantified. That is steering refiners toward stand-alone renewable diesel units or fully segregated biogenic runs rather than marginal coprocessing tweaks. The ripple effect: some planned coprocessing retrofits are being paused, and 45Z value is being back-allocated to projects that can meter biogenic throughput unambiguously.

The mid-2025 Hill proposals that could rewrite the rules again

By mid 2025, both chambers advanced proposals to extend and reshape 45Z beyond the current 2027 sunset. Although details differ, the outlines are clear enough to model. For a parallel look at tax-credit politics, see our take on the 45Y and 48E credit crunch.

-

Extension horizon

House and Senate drafts both extend 45Z into the early 2030s, with different end dates, to provide investment runway. -

Foreign-feedstock restrictions

The House package would make fuels ineligible if any non-North American feedstocks are used after a specified date. That is a direct hit to imported used cooking oil and some tallow streams that underpin renewable diesel and HEFA-SAF today.

The Senate framework would not ban such feedstocks outright but would haircut the credit in proportion to the foreign feedstock share. -

Indirect land-use change and negative emissions

Both chambers’ drafts remove indirect land-use change from lifecycle accounting for 45Z. That change is favorable to corn ethanol and soy-based diesel because it lowers calculated CI. The House draft would also limit negative emissions, with an explicit carve-out for animal manure pathways, which protects the RNG standout while capping the upside for other negative-CI fuels. -

Transferability and the SAF uplift

Differences remain on whether to keep transferability under Section 6418 past 2027 and whether to preserve the SAF uplift. Some House language would curtail transferability and reduce SAF’s relative premium, while Senate language has been more permissive. -

FEOC-style restrictions

Both packages contemplate foreign entity of concern style rules that would disallow credits if the producer is a specified foreign entity or becomes foreign influenced. That creates corporate-structure diligence requirements for fuel producers and investors.

Scenarios producers and airlines should plan for through 2027

Given the live legislative calendar, producers and airlines should run at least three scenarios and embed them in contracts now.

-

Status quo through 2027

RNG remains the credit-per-unit leader. Ethanol with documented farm-level CI reductions monetizes 45Z in highway markets and sets a foundation for future alcohol-to-jet. Renewable diesel and biodiesel proceed, but import-heavy feedstock strategies carry headline risk. SAF growth is paced by feedstock and certification bandwidth. Transferability continues to support broad monetization. -

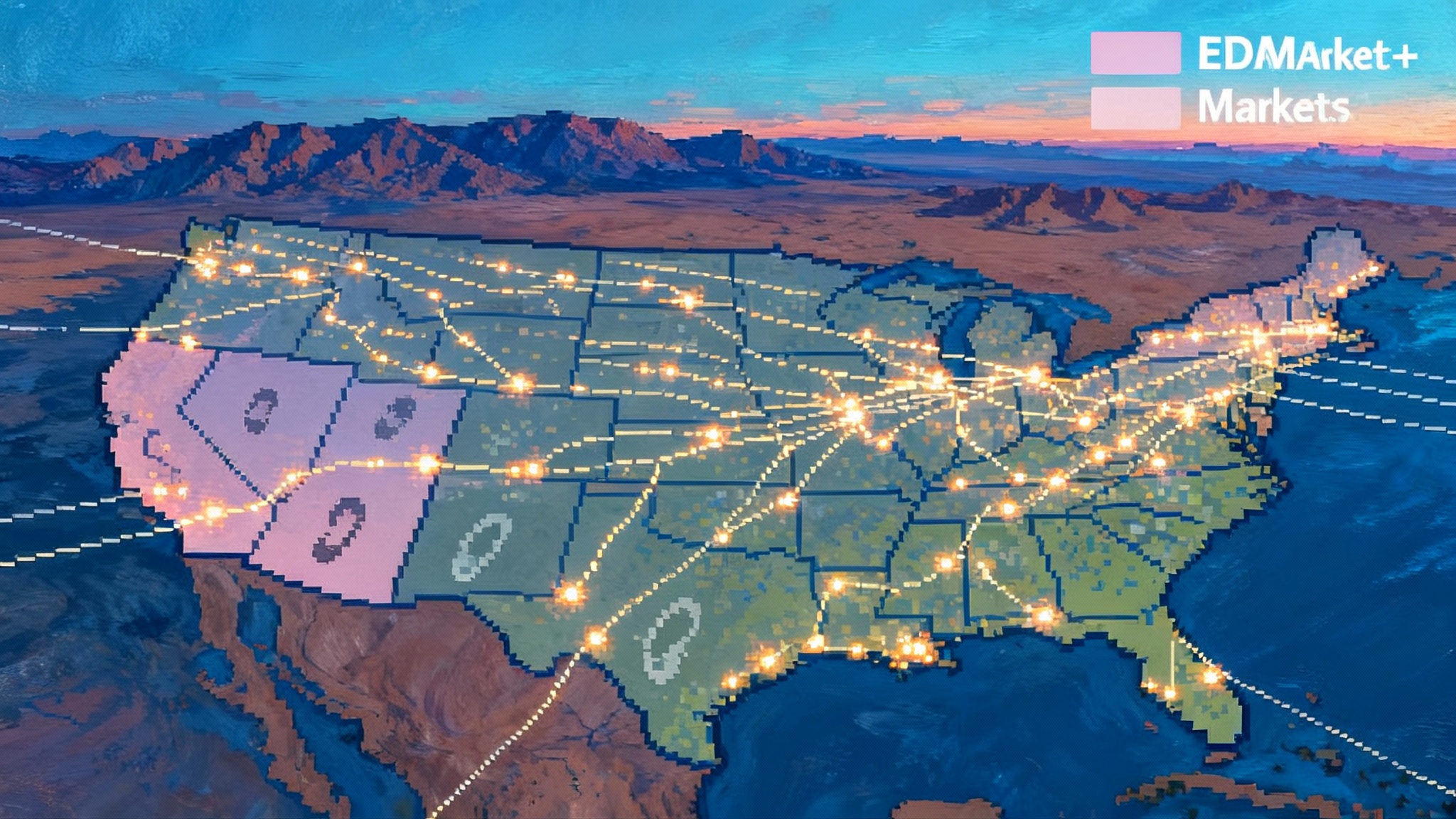

North America only feedstocks after 2025

Renewable diesel and HEFA-SAF projects must repaper supply to North American feedstocks. Expect a scramble for domestic used cooking oil and tallow, elevated feedstock basis, and a push toward cover crops and novel lipids. Ethanol and soy pathways gain relative share. Airlines should diversify decarbonization procurement, including more book-and-claim for RNG where allowed in their sustainability frameworks, while keeping SAF slots with flexible volume ramps. For cross-market reliability dependencies, see FERC’s September grid reboot. -

Proportional haircut on foreign feedstocks plus ILUC removal and a limit on negative CI

Importers take a haircut rather than a ban, but ethanol and soy win on ILUC removal. Manure-RNG keeps its super-credit status. Landfill-RNG may lose some upside if negative CI is capped. Producers should tighten CI measurement, avoid relying on literature defaults, and add change-in-law clauses tied to feedstock origin. Airlines should insert reopener clauses if the SAF uplift is reduced or transferability is curtailed.

A 2025 to 2027 playbook by sector

-

RNG developers

Move fast on Section 4101 registrations for any incremental facilities or pathways. Lock in metering and data capture that allows negative CI to be defended in audits. Use the current market window to sign multi-year offtakes with inflation guards and defined true-up mechanics if negative-emissions rules tighten. -

Ethanol producers

Stand up farm-level CI programs aligned with USDA’s interim guidelines. Shift process energy to low-carbon sources where possible and evaluate bolt-on carbon capture to push CI down. For ethanol-to-jet ambitions, model both a status-quo SAF uplift and a reduced uplift. Consider hedging with highway sales that monetize 45Z in 2025 to 2027 while SAF capacity and feedstock programs mature. -

Renewable diesel and biodiesel

Audit feedstock origin exposure and build North American supply options. Reassess any coprocessing projects that cannot cleanly segregate and quantify biogenic molecules. Structure supply agreements with origin warranties and credits-at-risk allocations tied to legislative changes on foreign feedstocks. -

SAF producers

Double down on certification readiness and on securing low-CI feedstocks with origin optionality. Prepare for capital stack pivots if transferability is curtailed in an extension. Offer airlines pricing ladders that assume different SAF uplift outcomes and include an indexed reopener if the model or table updates change CI mid contract. -

Airlines and large fuel buyers

Take a portfolio view. Combine a base level of SAF offtake for brand and trajectory with flexible, auditable RNG certificates that deliver near-term tons at lower cost. Insert change-in-law clauses tied to foreign-feedstock rules, ILUC treatment, and transferability. Require producers to reference 45ZCF-GREET runs or table values in attestations and to notify within defined windows of any model or certification changes.

What to watch each quarter

-

Treasury and IRS

Proposed regulations and updates to the emissions rate table and procedures for provisional emissions rates. Watch for refinements on coprocessing and on who can claim in more complex supply chains. -

DOE

Iterations to 45ZCF-GREET and updates to the user manual. Even small parameter changes can move credit values for borderline pathways. -

USDA

The transition from interim to final feedstock CI guidelines. The speed and specificity of farm-level CI measurement will decide whether corn ethanol and soy-based diesel move from conditional to clear winners. -

Congress

The conference dance between House and Senate packages on extension length, foreign-feedstock treatment, ILUC removal, negative-emissions limits, transferability, and the SAF uplift.

Bottom line

Section 45Z’s first real year picked a surprise early leader. The combination of registration gating, a dedicated GREET model, and an emissions formula that rewards negative CI has shifted the center of gravity from the skies to the farms and digesters that produce manure-RNG. Ethanol can climb the ladder with verifiable farm-level carbon intensity and process improvements. Renewable diesel and SAF remain in the game but face a decisive quarter ahead as Congress negotiates extensions and foreign-feedstock rules. The smartest players are baking scenario-based pricing, origin warranties, and model-update reopeners into every deal they sign between now and 2027.