The 45Y/48E Crunch Resets U.S. Wind and Solar

Congress compressed the 45Y and 48E timelines and the IRS ended most of the 5 percent safe harbor. Here is what the July to September 2025 reset means for project finance, tax credit sales, supply chains, interconnection, M&A, and 2026 to 2027 build rates.

What changed between July and September 2025

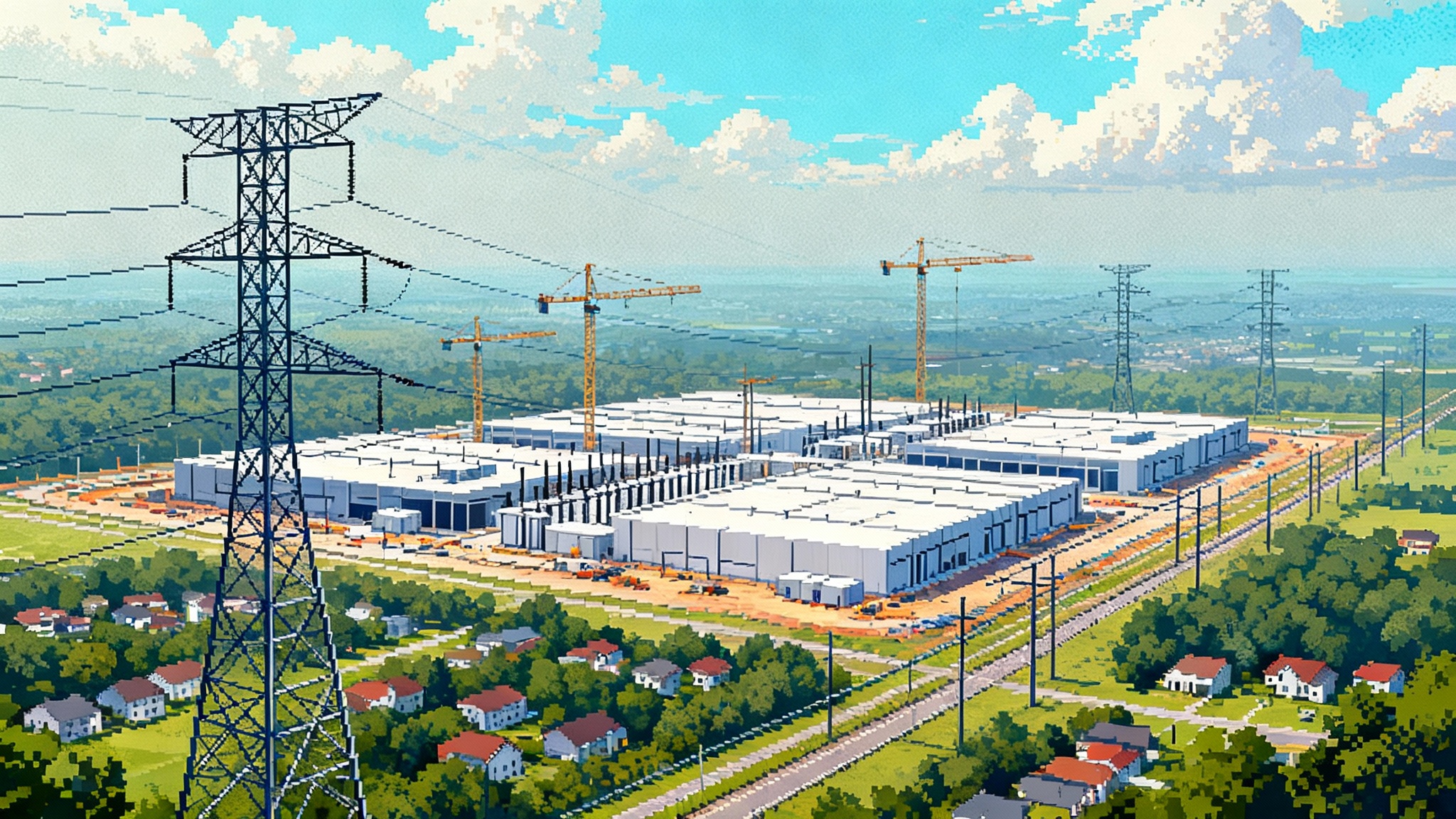

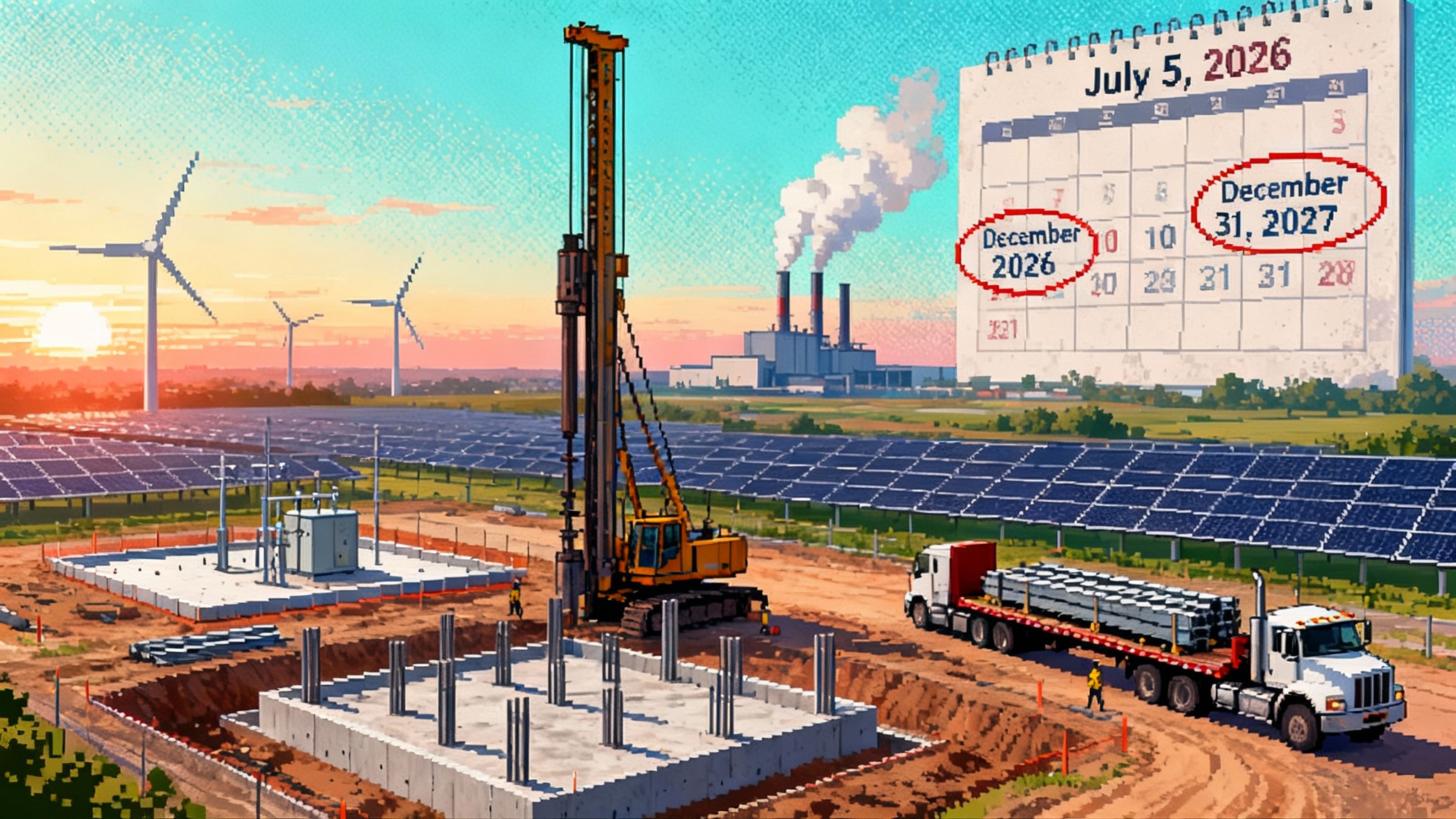

Two dates now anchor every wind and solar model. On July 4, 2025, Congress enacted the One Big Beautiful Bill Act as Public Law 119-21. For wind and solar, the law compresses eligibility under sections 45Y and 48E so that projects either begin construction by July 5, 2026 or are placed in service by December 31, 2027. You can read the governing statute in the Public Law 119-21 text.

Then, on August 15, 2025, Treasury and the IRS issued Notice 2025-42. For wind and solar that have not already begun construction before September 2, 2025, the notice eliminates the 5 percent safe harbor except for solar facilities at or below 1.5 MW AC, and requires taxpayers to show significant physical work. A concise recap is in this Reuters summary of Notice.

Read those two sentences again and circle the dates. They define the next 30 months of U.S. wind and solar development.

What the end of the 5 percent safe harbor really means

For more than a decade, developers could lock eligibility with a 5 percent spend, often via module or turbine deposits and warehouse purchases. After September 2, 2025, that method is gone for most wind and solar. To qualify, you must:

- Perform physical work of a significant nature. Classic examples include site excavation, pile driving, foundation pours, substation foundations, and installation of trackers or towers. Preliminary activities like planning, permitting, interconnection studies, or securing finance do not count.

- Use off-site physical work only if it is custom, not inventory. Manufacturing that is unique to the project under a binding written contract can qualify. Commodity modules sitting in a supplier’s warehouse will not.

- Maintain continuity of construction or continuity of efforts. You still have a continuity requirement, but the outside dates in the statute override any comfort you might have taken from the four-year continuity safe harbor. If you need the credit for a project that will not be placed in service by December 31, 2027, then you must begin physical work by July 5, 2026 and keep moving.

- Remember the carve-out. Solar facilities at or below 1.5 MW AC can still use the 5 percent safe harbor after September 2, 2025.

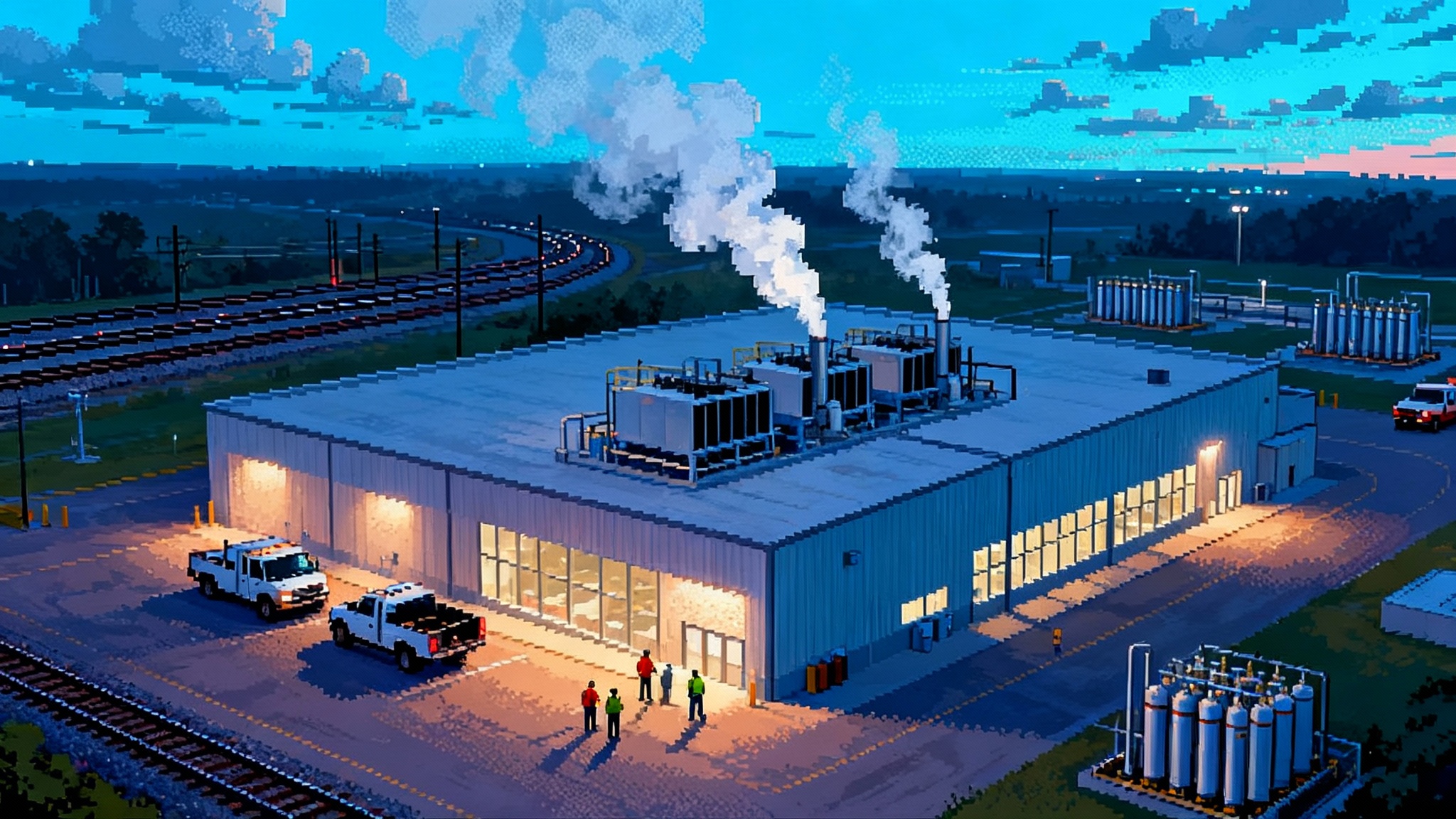

In practice, the industry is shifting from spreadsheet-based safe harboring to excavator-based safe harboring. That will change capital flows, procurement, the timing of interconnection work, and how deals get sold.

Immediate impacts on project finance and tax-credit monetization

- Transferability persists but the risk transfer point moves. Credit buyers will now price heavily for physical work evidence, not just invoices. Expect steeper holdbacks until an independent engineer confirms milestones like pile completion or substation energization. Representations and warranties will be tighter around the definition of begin construction, the classification of off-site manufacturing as non-inventory, and continuity.

- More credits will sell with insurance wrappers. With the 5 percent route gone for large wind and solar, underwriting will hinge on construction documentation, lien releases, and verified work logs. Expect the cost of tax insurance to creep up, but also expect it to unlock pricing for high-quality projects.

- ITC under 48E becomes the default for schedule-tight solar. Production risk over a shortened eligibility window makes the 45Y PTC less attractive unless you are confident of high capacity factors or accelerated CODs. Many sponsors will pivot to 48E for schedule certainty, especially where domestic content and energy community adders are attainable.

- Direct pay and elective pay remain limited for most sponsors. Transferability stays the main monetization tool for wind and solar developers without tax appetite. Buyers will triage hard, focusing on projects with permitted designs, bankable interconnection paths, and proof of physical work before July 5, 2026.

Supply chains now revolve around off-site physical work

If you cannot pour concrete this quarter, you will try to count off-site work. That creates a fast pivot in manufacturing orders:

- Order what counts. Custom foundations, pre-cast pads cut to site drawings, bespoke step-up transformers, substation steel and bus, tracker posts cut to your geotech specs, nacelle components tied to serial numbers, and collector system switchgear fabricated to stamped single-line drawings can all qualify as off-site physical work when contracted properly. The key is uniqueness to your project and clear allocation under a binding written contract.

- Avoid inventory traps. Standard modules, commodity inverters, and generalized balance-of-system kits are unlikely to qualify as off-site physical work after September 2, 2025. If your 2026 plan depends on palletized inventory, assume it does not help you begin construction.

- Suppliers will ration shop time. Expect new physical-work priority queues in factories. Developers will pay premiums for dated production slots with project nameplates engraved, serial ranges allocated, and cancellation terms that preserve qualification.

- Documentation is as important as steel. You will need contracts that tie fabrication runs to your project, change-order protocols that do not break continuity, and milestone certificates that an engineer can verify. Treat recordkeeping as part of critical path.

Interconnection timelines and schedule triage

The eligibility compression forces hard choices in the queues:

- If your COD is achievable by December 31, 2027, push to build on that timeline and be prepared to evidence physical work quickly. Pull forward civil works and substation foundations ahead of final module or turbine deliveries.

- If COD will slide into 2028 or later, your only path to a credit is to begin construction by July 5, 2026. That shifts the near-term focus to activities you can control without final interconnection approval, such as access roads, grading, drainage, fence and laydown, pilings, and on-site substation foundations where local permits allow.

- Queue reform helps but will not save late projects. Several ISOs and utilities have accelerated cluster studies, yet many greenfield sites still face upgrade costs and schedule uncertainty that make a 2027 COD improbable. Sponsors should assume that interconnection delays are not a valid excuse for missing the statutory dates. For a broader view of reliability, supply chain, and operational risk, see our take on FERC’s September grid reboot and how it interacts with these timelines.

- Permitting and land control are king. Counties that allow early civil works before final equipment selection will become magnets. Sites with recorded easements and geotech complete will trade at premiums. The governance angle in the PJM footprint matters too; see States vs. PJM grid reckoning.

M&A: the new sorting mechanism for value

- Shovel-ready portfolios will clear at a premium. Buyers will pay up for sites with permits, interconnection agreements executed, geotech done, and construction packages ready to mobilize. The premium grows if there is verifiable off-site physical work underway or if on-site work can start within 90 days.

- Mid-stage greenfield will get repriced or stranded. Projects that relied on 5 percent spends and 2028 CODs must either step into physical work fast or accept steep discounts. Expect more seller financing, earn-outs tied to physical work milestones, and break-fee provisions if continuity falters.

- Bigger sponsors will buy time. Balance-sheet players can lock factory slots for qualifying off-site physical work and sequence their field crews to hit the July 5, 2026 marker across multiple sites. Smaller developers will partner or sell.

- Watch for carve-outs and re-papers. Co-located storage can be spun out to a separate 48E project if the solar misses its dates, preserving some value. Expect purchase agreements to anticipate that twist. For the demand and planning backdrop, map M&A timing against the FERC 1920-A grid playbook.

Tactical playbook: who can still win

- Distributed solar at or below 1.5 MW AC. The 5 percent safe harbor lives here. Community solar, school districts, municipal load aggregation, and C&I rooftops can still safe harbor equipment spend after September 2, 2025. Speed in permitting and interconnection will decide winners, but the path is clear.

- Shovel-ready utility-scale solar and wind. If you can get a dozer on site this year or early 2026, you can establish physical work. Prioritize foundations, piles, and substation civil work. Lock binding contracts for custom off-site fabrication with serial-number allocation and delivery windows inside 2026. Build a continuity plan that survives weather and supply shocks.

- Storage under 48E. Battery energy storage systems are not subject to the new wind and solar-specific limitation in the notice. Co-located storage can proceed as a separate 48E project if needed, and standalone storage remains eligible. Sponsors can still use 5 percent safe harbor logic for storage, but should document physical work anyway to de-risk monetization.

- Hybrid strategies. In resource-rich markets, pair solar that meets the physical work test with storage that safe harbors by spend. Monetize the storage credit first if panel deliveries face tariff or supply uncertainty. Use storage revenue stacks to backstop tax equity sizing.

Who is most exposed

- Large wind projects with long lead interconnection and complex transmission upgrades. Physical work can be established on site, but crane availability, turbine deliveries, and interconnection timing make a 2027 COD tough, and off-site custom fabrication windows are tight.

- Greenfield utility solar that banked on warehouse safe harbor. If your qualification plan was module deposits and a 2028 COD, the risk just moved forward a year and into the dirt. Without early civil works or custom off-site fabrication, eligibility vanishes.

- Sponsors without construction muscle. The new rule rewards teams that can mobilize crews, pour concrete, and keep continuity through weather, labor, and supply events. Paper developers will struggle.

Scenarios for 2026 to 2027 build rates and pricing

- Sprint scenario. Developers accelerate. Factory slots get allocated to custom components, field crews mobilize, and a late-2026 wave of physical work locks eligibility. 2027 becomes a high-COD year for utility solar and some wind. Power purchase agreement prices drift up as buyers compete for the eligible cohort, but merchant prices stay moderate in markets adding new capacity on time.

- Squeeze scenario. Physical work starts on many projects by mid-2026, but supply and labor bottlenecks push CODs into 2028. Credits remain available because projects began on time, yet balance-sheet carry costs rise. PPA prices increase as buyers prefer projects with verified physical work. Capacity markets tighten in regions where CODs slip, lifting capacity prices and forward curves for 2027 to 2029.

- Stall scenario. Too many projects miss both the July 5, 2026 begin-construction test and the December 31, 2027 placed-in-service deadline. The 2027 COD cohort underdelivers, and 2028 to 2029 additions fall sharply for wind and solar. Regional power prices and RECs climb, especially in ISO zones with load growth and delayed transmission. M&A consolidates the pipeline into a smaller set of well-capitalized sponsors who can still extract value via 48E storage and non-wind, non-solar technologies that retain broader eligibility.

Actions to take in the next 90 to 180 days

- Build a physical-work checklist for each project. Map what you can do on site this quarter. Prioritize access roads, grading, drainage, foundations, and substation civil work. Sequence permits accordingly.

- Convert inventory-based plans to custom fabrication. Re-paper supplier agreements into binding contracts that specify project serial ranges, drawings, and delivery slots. Collect factory milestone certificates and photo logs.

- Reprice tax-credit sales with construction milestones. Add holdbacks tied to independent engineer verification of physical work. Consider wraps for the begin-construction representation and continuity risk.

- Triage the queue. Sort your pipeline into three bins: COD by 12-31-2027, begin by 7-5-2026, and miss. For the miss bin, evaluate storage carve-outs, technology swaps, or asset sales.

- Update PPAs and EPCs. Add schedule relief only where it preserves continuity. Align EPC milestone payments with physical work that matters for eligibility. Ensure your PPA accommodates a COD earlier than planned if crews and parts arrive.

- Strengthen owner’s engineering and recordkeeping. Treat documentation as a deliverable. If the credit depends on it, have an independent engineer sign it.

The bottom line

The era of spreadsheet safe harbors is over for large wind and solar. The window that opened on July 4, 2025 will not stay open long. If you can move dirt or turn steel by July 5, 2026, you preserve the option to place in service later. If you can reach COD by December 31, 2027, you can still claim under 45Y or 48E without the earlier milestone. Everyone else needs a plan B involving storage, smaller distributed solar, or a sale to someone who can build. The winners will be the sponsors who replace paper with proof on the ground, and who treat the next 18 months like a construction marathon rather than a procurement exercise.

![Why Your UI Shows [object Object] and How to Fix It Fast](https://fvnmlvqcgqaarpyajaoh.supabase.co/storage/v1/object/public/images/1758580185084-c5pj4s.png)