U.S. LNG’s 2025 Reboot Meets Europe’s Russian Gas Pivot

DOE restarted LNG export approvals and eased commencement extensions, reviving Gulf Coast projects just as Europe moves to curb Russian LNG by 2027. Here is what it means for prices, ships, contracts, and risk.

The reset Washington just delivered

After a year of uncertainty, the U.S. Department of Energy resumed processing non‑FTA LNG export authorizations and clarified how it will handle commencement‑date extensions. The spring 2025 shift matters because it restores predictability to a queue of Gulf Coast proposals that had momentum, buyers, and engineering work but lacked the federal green light. The DOE’s own update confirms the restart and outlines how the agency will weigh climate, market need, and national interest while advancing pending applications, which reopens a critical gate for project finance and contracting. See the department’s announcement that it resumes LNG export authorizations.

Two practical changes flow from this turn:

- The backlog of authorizations can move again, which means developers with site control, EPC bids, and long lead equipment can align schedules with lenders and buyers.

- Greater flexibility on commencement‑date extensions reduces the risk that a project loses its authorization because construction ran long due to litigation, supply chain choke points, or financing gaps.

In plain terms, DOE’s reset puts time and sequencing back in the control of builders and offtakers. It does not remove environmental scrutiny or eliminate legal risk, but it lowers timing risk enough to get commercial workstreams going again.

Why the Gulf Coast pipeline is flowing again

The second wave of U.S. LNG has always been about execution. Feed gas availability, EPC deliverability, and take‑or‑pay contracts create a tightly coupled machine. When DOE approvals paused, that machine idled. The restart gives developers the confidence to lock in capital commitments and award procurement packages on a schedule that matches authorization milestones.

Projects with strong buyer rosters and partially completed pads can now accelerate toward final investment decisions. Brownfield expansions at existing terminals often move fastest because they leverage existing docks, tanks, and utility corridors. Greenfield sites that already cleared major federal reviews can also benefit from a predictable timeline for final export authorizations.

Commencement‑date flexibility is more than administrative housekeeping. Many LNG sales and purchase agreements tie offtaker obligations to a project reaching commercial operations within a defined window. If an authorization’s start date was at risk, lenders would demand bigger contingencies or refuse to size debt against those volumes. Easing the path to extensions keeps long‑dated SPAs bankable, which in turn supports higher leverage and lower cost of capital.

Europe’s pivot from Russian gas and the 2027 horizon

Europe’s security policy is pushing in the same direction. Since 2022 the EU has raced to cut exposure to Russian molecules and to redesign its gas market around diversification, efficiency, and storage. Moscow’s pipeline flows have collapsed, yet Russian LNG still arrives at some EU terminals, particularly via spot cargoes and transshipments. EU institutions have cracked down on this leakage. The Council adopted measures in 2024 that restrict Russian LNG transshipment through EU ports and signal a tightening stance on future imports, building on the broader REPowerEU objective to end reliance on Russian fossil fuels within this decade. See the Council’s action on restricting Russian LNG transshipment.

Several member states and European regulators are now aligning policy for a glide path that shrinks room for Russian LNG in EU portfolios by 2027. The lever will be a mix of sanctions compliance, infrastructure rules, methane intensity standards, and state‑backed procurement guidance from national buyers. The practical outcome is a reweighting of long‑term offtake toward U.S. and Qatari supply, with the Atlantic Basin advantage tilting many incremental European deals to Gulf Coast cargoes.

Contracting trends: FOB dominance with selective DES

The contract market is re‑sorting around risk choice.

- FOB still dominates new U.S. SPAs. Buyers take title at the terminal, manage shipping, and capture flexibility across destinations. Portfolio players and traders prefer FOB because they arbitrage between TTF, NBP, and occasionally Asia when Atlantic premiums soften.

- DES is gaining niche traction where a seller has a shipping arm or where a buyer wants price certainty to a specific regas. Some European utilities like DES for operational simplicity, but DES requires the seller to carry vessel and insurance risk, which raises the fixed fee and can complicate credit.

- Take‑or‑pay remains the backbone of bankable U.S. projects. Fixed liquefaction fees indexed to U.S. CPI plus Henry Hub passthrough give lenders a visible revenue stack. Merchant exposure is accepted at the margin but it lowers leverage and pushes sponsors to retain more equity.

- Hybrid pricing is spreading. Some SPAs blend a fixed fee with linkage to TTF rather than pure Henry Hub, allowing offtakers to neutralize basis risk in their target market. Others insert optionality into start dates or ramp profiles to match utility load and storage cycles.

For Europe, the desire to displace Russian LNG on a timetable pushes buyers to secure volumes that begin mid‑decade and run into the 2040s, but with flexibility to roll down if gas demand declines. That means contracts with seasonal shaping, volume optionality, and robust diversion rights, all features that U.S. FOB deals are well suited to provide.

Gas price and basis risks to watch

LNG projects live at the intersection of Henry Hub, TTF, and JKM. Each carries its own story for 2025 through 2028.

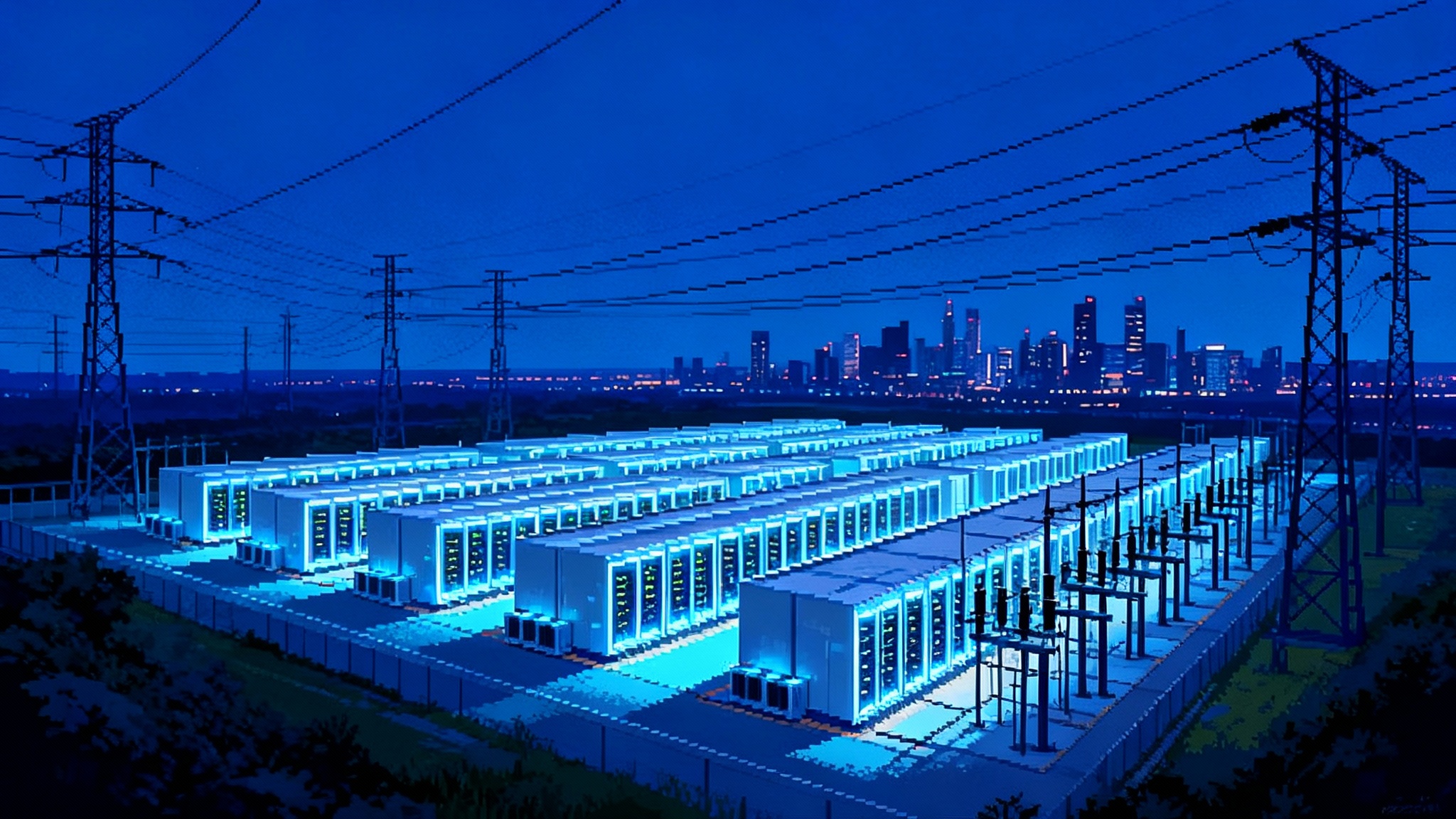

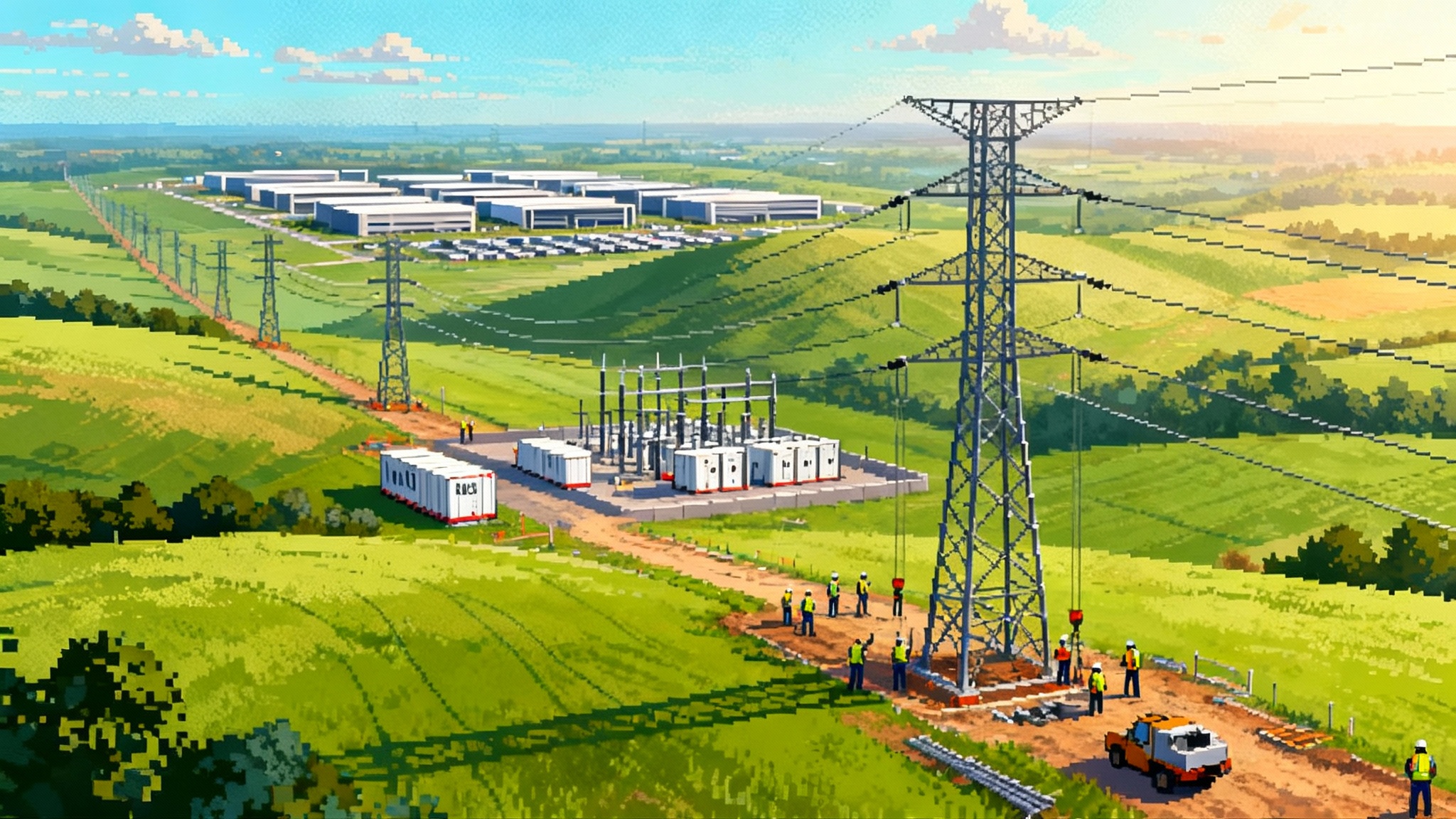

- Henry Hub upside risk. Feed gas demand will rise as new trains start, while power sector gas burn is supported by data center loads and coal retirements. For how AI‑driven load is reshaping power markets, see our take on AI data center demand. Permian associated gas growth helps, but pipeline takeaway from basins like the Permian and Haynesville can oscillate with drilling economics and weather. A tight storage trajectory or a hot summer can lift Hub above long‑run assumptions, pressuring netbacks for spot‑exposed cargoes.

- Gulf Coast basis risk. Waha and Katy spreads can swing with maintenance, hurricane impacts, and freeze‑offs. Developers that built in firm transport and multiple pipeline interconnects will outperform during stress events. Those relying on interruptible flows face curtailment risk that can ripple into liquefaction uptime.

- TTF volatility. Europe’s storage discipline tames summer prices but winter premium risk remains. Russian LNG attrition magnifies weather sensitivity. A cold Q4 combined with nuclear or hydro hiccups can lift TTF and widen the Atlantic premium. Conversely, a warm winter and high storage can flatten curves and test the economics of long ballast voyages to Asia.

- JKM competition. Qatar’s expansions and renewed Australian stability moderate Asia prices in benign weather. When JKM trades at a modest premium to TTF, Atlantic cargoes stay in Europe. If Asia pulls hard, U.S. FOB offtakers flex to the Pacific via Cape of Good Hope, raising ton‑mile demand and ship day rates.

For project sponsors, the hedge set is familiar but growing more sophisticated:

- Pre‑FID, lock in EPC and turbine pricing early to reduce capital cost variance.

- Post‑FID, use financial gas hedges at Henry Hub to protect fixed fee coverage. Layer basis hedges at key delivery points on the U.S. side and TTF on the European side.

- For offtakers, match contract indexation to your retail or generation exposure. A European utility with TTF‑linked revenue may prefer SPAs with partial TTF linkage rather than pure Hub plus fee.

Ships, canals, and the pace of physical delivery

Shipping is the quiet constraint that will shape 2026 through 2029.

- Carrier availability. The LNG newbuild orderbook is large but heavily booked by Qatari projects and portfolio majors. Early U.S. FIDs that reserved berths at Korean and Chinese yards will have an advantage. Late movers may face higher delivered costs or need to rely on shorter term charters at volatile rates.

- Voyage routing. For Europe, Gulf Coast cargoes enjoy short Atlantic legs with limited transit risks. For Asia, most U.S. volumes bypass the Panama Canal during drought constraints and sail around the Cape. That adds days and fuel burn, which buyers must account for when comparing U.S. FOB to DES alternatives from other suppliers.

- Weather and resilience. Hurricane season remains the biggest localized threat for Gulf terminals. Developers investing in higher seawalls, redundant power, and robust mooring will win uptime and credibility with lenders and insurers.

Shipping costs feed into the FOB versus DES balance. The scarcity of multi‑year charters at acceptable rates nudges some European buyers back to FOB so they can time the market and optimize fleets rather than paying a seller’s embedded premium in DES.

Environmental and legal headwinds that still matter

The DOE restart does not erase permitting and litigation risk. Key friction points remain and they can delay or alter project scope.

- NEPA scope and climate analysis. Courts continue to scrutinize whether federal reviews adequately quantify downstream greenhouse gas effects and consider reasonable alternatives. Expanded climate analysis raises documentation burdens and leaves room for procedural challenges.

- FERC rehearings and route conflicts. Pipeline laterals and expansions that feed LNG terminals can trigger rehearings and route adjustments, especially where landowner and habitat concerns collide with construction windows. For the broader transmission context, see our look at the FERC September grid reboot.

- Wetlands and coastal permitting. Army Corps Section 404 permits and state coastal zone approvals are still chokepoints. Small delays at these steps can cascade into missed construction weather windows and schedule creep.

- Methane performance. EPA’s methane rule and the Inflation Reduction Act’s methane fee raise the cost of high‑emitting upstream gas. European methane standards for imports will also push sellers to demonstrate credible measurement and verification across the U.S. supply chain. For market impacts, read our view on methane fee and contract risk.

- Local opposition and litigation costs. Community impacts around noise, traffic, and fishing grounds can spark suits that slow mobilization. The smartest developers budget legal spend and community benefits early and show continuous emissions monitoring rather than relying only on annual inventories.

None of these barriers is fatal to the second wave, but each can stretch timelines beyond what lenders underwrite. That is why DOE’s willingness to grant commencement‑date extensions on a reasoned basis is consequential. It preserves the commercial integrity of SPAs and keeps project finance structures intact when litigation clocks run longer than construction clocks.

Financing after the restart: what lenders will reward

Banks and export credit agencies want predictability of cash flows, schedule credibility, and counterparties with strong balance sheets.

- Contracted volume ratio. The higher the ratio of long‑term take‑or‑pay SPAs with creditworthy buyers, the higher the leverage and the lower the margin. Merchant volumes can create upside but at the cost of tighter covenants.

- Counterparty mix. A blend of European utilities, Asian long‑term buyers, and portfolio players diversifies credit and reduces concentration risk. Government linked buyers can unlock ECA support that cheapens debt.

- Cost controls. Lump sum EPC with proven contractors, early procurement of cryogenic equipment, and redundancy planning for power and water reduce the risk of cost overruns. Schedule buffers around hurricane season please credit committees.

- Sustainability scaffolding. Demonstrable methane tracking, carbon intensity targets per cargo, and optional carbon capture at the terminal can widen the pool of lenders and buyers willing to sign long tenor paper in Europe.

Expect more project financings that include sustainability‑linked covenants and pricing ratchets tied to methane performance. Expect sponsors to place some volumes into corporate offtake with integrated power and gas retailers who can pass LNG costs into regulated tariffs or hedged generation portfolios.

How Europe’s 2027 goal redirects offtake

As EU policy tightens on Russian LNG, buyers will reshuffle their long‑term books. Here is what that means in practice:

- Replacement need. Even if total EU gas demand trends lower, the quality of supply matters. Removing Russian LNG from the marginal stack creates room for Atlantic Basin volumes during winter and for storage injection seasons.

- Timing. Many new U.S. trains target first cargo between 2027 and 2029. That lines up with the EU’s policy horizon and with the need to replace expiring medium term deals signed in the scramble of 2022 and 2023.

- Location advantage. U.S. cargoes into Northwest Europe are fast and flexible. When Iberian terminals are full or when French nuclear runs high, cargoes can divert to the UK or Benelux with limited extra steaming.

- Portfolio fit. European buyers want optionality to redirect volumes into Asia or Latin America when winters are mild. FOB U.S. contracts deliver that optionality better than fixed DES commitments.

This pivot does not mean Europe will absorb all new U.S. capacity. Asia remains the long‑run demand anchor. But European policy creates a dependable floor of offtake that helps marginal Gulf Coast projects clear FID over the next 12 to 18 months.

What to watch next

- DOE processing cadence. How many authorizations are issued each quarter and how the agency applies its refreshed public interest test to different project profiles.

- FID wave timing. Look for sponsor announcements that pair long‑term SPAs covering at least 70 to 85 percent of nameplate with signed EPC and financial close. Those are the telltale signs of a real go decision.

- EU policy implementation. National measures that restrict transshipment services, new reporting on cargo origin, and methane import standards will determine how fast Russian LNG volumes decline.

- Shipping markets. Newbuild slots for 2028 and 2029 delivery and two to three year charter rates will tell you whether DES premiums rise or fall.

- U.S. gas infrastructure. Pipeline expansions from Haynesville and Permian into the Gulf, plus storage injections along the coast, will determine feed gas reliability for the second wave.

The bottom line

DOE’s 2025 restart does not guarantee smooth sailing, but it removes the single biggest procedural overhang for U.S. LNG. At the same time, Europe’s pivot away from Russian LNG is creating a predictable lane for U.S. cargoes to fill winter peaks and replace suspect molecules by the 2027 policy horizon. The combination aligns policy timing with project timing. If sponsors keep contracts bankable, ships booked, and environmental performance credible, the second wave of Gulf Coast LNG will move from paperwork to piling rigs and then to first cargoes just as Europe needs them most.

![Why Your UI Shows [object Object] and How to Fix It Fast](https://fvnmlvqcgqaarpyajaoh.supabase.co/storage/v1/object/public/images/1758580185084-c5pj4s.png)