Texas Goes 765 kV: How ERCOT’s Grid Will Change by 2030

On April 24, 2025, Texas regulators approved new 765 kV import paths into the Permian Basin. Here is what that means for congestion, power prices, oilfield electrification, and the state’s data center buildout through 2030.

The decision that shifts the map

On April 24, 2025, Texas regulators approved the first extra high voltage transmission build in ERCOT history, greenlighting three 765 kV import paths designed to move large volumes of power into the Permian Basin. The commission’s action was formalized as the commission’s second order in Project 55718, which also retired earlier 345 kV alternatives in favor of a higher capacity solution. The choice raises the ceiling on how much energy ERCOT can deliver to West Texas and signals a new era for transmission design in the state.

This is not a cosmetic upgrade. 765 kV lines can move multiple gigawatts on a single corridor with lower losses per megawatt and fewer parallel corridors. For a region as land constrained and contested as the Hill Country and as fast growing as the Permian, those advantages are decisive.

Why 765 kV, and why now

ERCOT’s Far West zone has long been a paradox. It hosts one of the largest concentrations of wind and solar in North America, as well as the country’s most prolific oil and gas basin. For years, sprawling distances, thin transmission, and sharp growth in local demand created chronic congestion and frequent curtailment. As oilfield operators electrify drilling rigs, compressors, produced water systems, and midstream equipment, load ramps in step with commodity cycles rather than slowly and predictably like suburban growth. Add in industrials and the rise of large computing loads seeking inexpensive land and proximity to generation, and the traditional 345 kV buildout no longer keeps pace.

The 765 kV choice addresses three problems at once:

- Capacity at scale: A single corridor can carry the rough equivalent of several 345 kV circuits, which raises west-to-east transfer without crisscrossing the state with parallel lines.

- Lower losses per megawatt: Higher voltage reduces line losses for long hauls, which matters when moving power hundreds of miles.

- Fewer corridors to fight: One bigger corridor, if routed well, can mean fewer eminent domain fights, fewer environmental crossings, and fewer river or road interfaces.

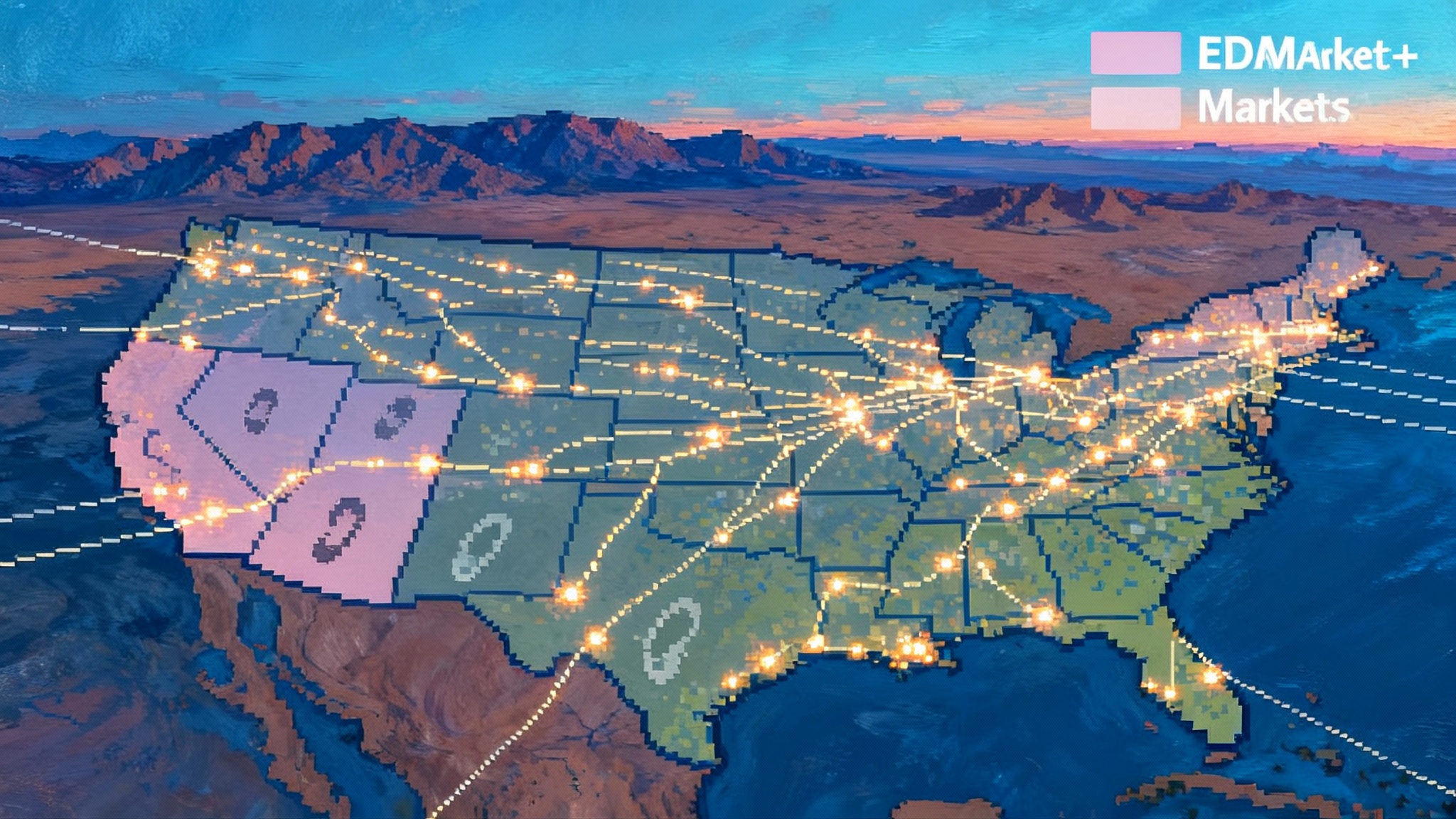

For broader context on how transmission rules are evolving nationally, see how FERC 1920-A resets transmission planning.

Congestion and price formation, before and after

Today’s West Texas market is defined by congestion. When generation in Far West outpaces local load and export capability, nodal prices separate. The result is a wide spread between West Texas hubs and demand centers, with negative prices appearing when renewable output is trapped. Storage responds by charging when congestion is deepest and discharging when the constraint eases, while generators hedge basis risk with congestion revenue rights.

A robust 765 kV backbone changes that calculus:

- West-to-east spreads compress as transfer capability grows. That reduces the frequency and depth of congestion price spikes that have underpinned some merchant strategies.

- Curtailment declines for renewable plants west of the constraint, improving realized prices and capacity factors.

- Storage arbitrage shifts. With fewer hours of extreme separation, storage projects may pivot toward ancillary services, congestion relief closer to urban bottlenecks, or co-location strategies that lean on interconnection value rather than only on price volatility.

- CRR valuations rebalance. Rights tied to the retired bottlenecks become less valuable, while new constraints emerge near interfaces where the 765 kV corridors tie into 345 kV meshes.

None of this eliminates congestion. It relocates and reshapes it. Expect new pinch points where the 765 kV lines step down into existing 345 kV networks, and around urban rings where distribution growth outpaces substation upgrades.

Oilfield electrification meets AI

The near-term anchor for this build is oil and gas. Electrified rigs and compressors swap diesel and field gas for electrons, cutting local emissions and noise while improving reliability. Electrification also enables centralized optimization of power use through flexible load management, which can reduce demand peaks. That said, oilfield demand is lumpy. A surge of drilling can compress substation capacity and trigger localized constraints even as regional transfer headroom improves.

In the same geography, large computing loads are accelerating. Operators want large parcels, access to high-voltage interconnections, favorable tax structures, and the ability to pair with renewables and storage. As AI training campuses transition from tens of megawatts to hundreds, they seek backbone voltage and multiple feeds. As we have covered in AI load rewrites the grid, the shape of demand is changing faster than legacy planning cycles.

For developers, the immediate takeaway is that the market is shifting from scarcity of generation to scarcity of deliverability. Projects that can ride the 765 kV backbone into major load zones will see improved basis and fewer hours of curtailment, especially if they site near new 765/345 kV interconnections. For a governance contrast outside ERCOT, consider data center governance lessons from PJM.

The fights along the right of way

Transmission is ultimately a land use story. A typical 765 kV corridor often requires around 200 feet of right of way, taller structures, and wider spans than 345 kV. That scale can alarm landowners, particularly in the Hill Country, where scenic vistas, tourism, and environmental sensitivities run high. Expect routing cases to feature arguments over river crossings, endangered species habitat, and property devaluation.

The Certificate of Convenience and Necessity process gives landowners standing to contest routes. Utilities will need extensive stakeholder work, early environmental surveys, and routing alternatives that avoid sensitive areas. Compromise routes with more angle structures or longer spans can raise costs and timelines, but they also reduce litigation risk. Because the 765 kV decision reduces the number of corridors required, it can actually simplify siting compared to three or four separate 345 kV lines chasing the same import.

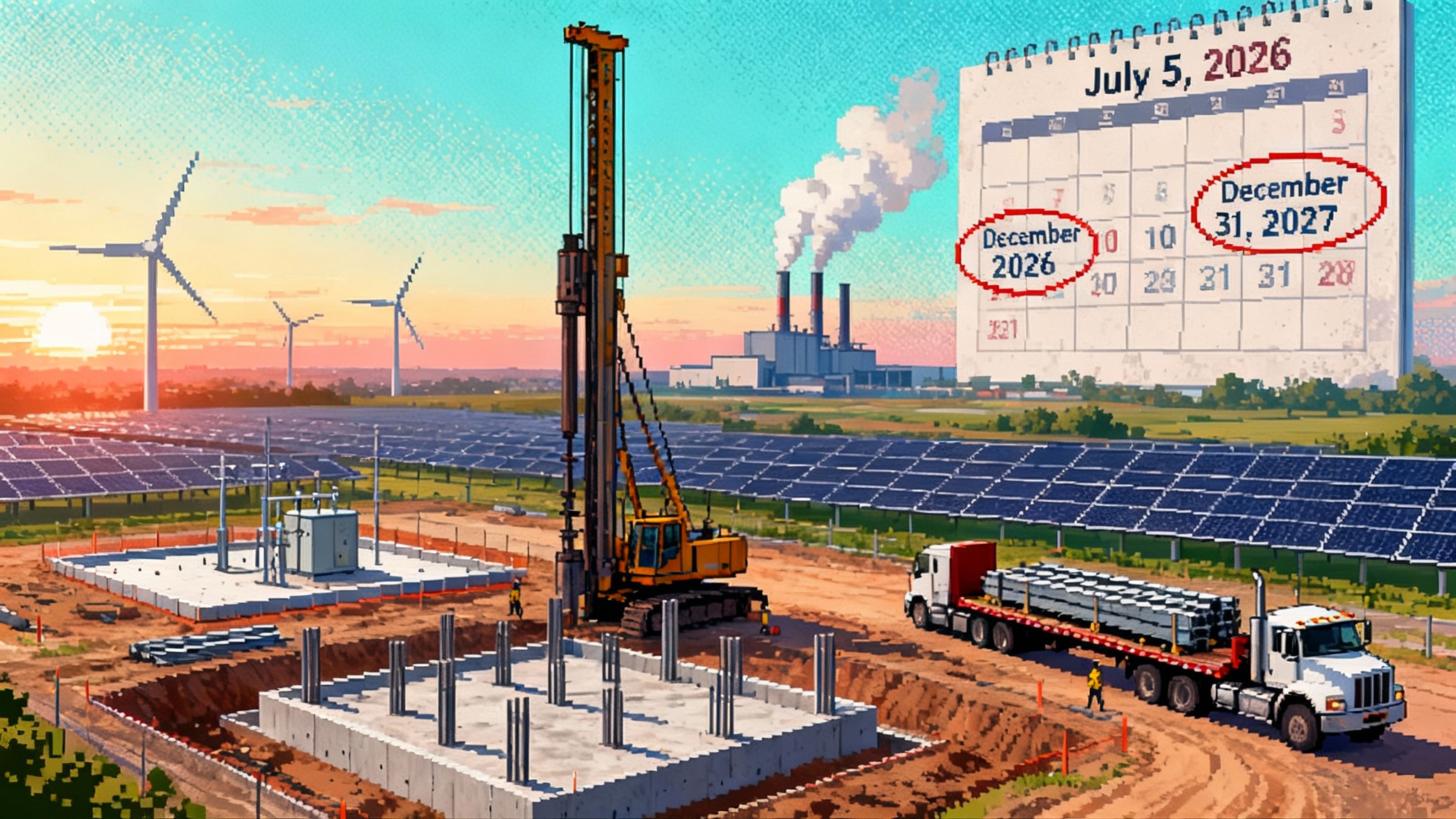

Steel, transformers, and the supply clock

The most fragile piece of the schedule may be the equipment supply chain. Extra high voltage transformers are large, custom, and globally backordered. Lead times for 765 kV autotransformers, shunt reactors, and series compensation components can stretch several years. Manufacturers are expanding, but raw materials, skilled labor, and test bay capacity all constrain throughput.

Hardware choices matter. Design teams will balance compact lattice and tubular structures against constructability and wind performance. Foundation contractors will face tight windows in arid soils that behave very differently from coastal clays. Substation footprints will grow to host 765/345 kV step-downs, series capacitors, and breakers with larger clearance requirements. The earlier the assignments and detailed engineering start, the better the odds of holding a 2030 in-service date.

Who pays, and how bills change

In ERCOT, transmission is a network asset, so costs are broadly socialized across the system. The Permian import paths are not private lines for a handful of customers. They are reliability projects that enhance regional deliverability and statewide resilience. That means transmission cost recovery will largely flow through the standard transmission cost of service mechanisms borne by load.

What shows up on bills is not only the capital cost of new lines, but the avoided costs they enable. Less curtailment improves the effective output of existing wind and solar, which moderates energy prices during high output periods. Reduced congestion lowers the volatility that can punish consumers during tight hours. For large industrials, the tradeoff is clearer deliverability for high-density loads and potentially fewer behind-the-meter backup systems, at the expense of a higher postage-stamp transmission charge.

The Texas Energy Fund, friend or foil

The Texas Energy Fund is the parallel track. It was approved by voters to finance dispatchable generation and resiliency programs with low-interest loans and grants overseen by the commission. Early rounds focus on adding firm capacity and strengthening systems across and beyond ERCOT. The program’s structure is detailed on the commission’s Texas Energy Fund page. While the fund does not directly pay for these 765 kV lines, it influences timelines in two ways.

First, by accelerating gas-fired projects and other dispatchable resources, the fund reduces the risk that new load in West Texas creates reliability shortfalls before the backbone is ready. A more robust fleet can backstop the grid if transmission slips.

Second, by signaling state support and offering financing certainty to generation, the fund shapes where new plants get sited. If developers choose sites near new 765/345 kV nodes, they amplify the value of the backbone and shorten the time from steel in the ground to meaningful congestion relief.

Assignments and execution risk

The commission has already identified utilities to own and build segments of the import paths. That shared assignment can de-risk execution by matching each segment to utilities with local experience, existing rights of way, and compatible standards. It also introduces coordination complexity, since the success of the whole depends on synchronous schedules, aligned outage plans, and harmonized procurement. Joint design reviews, integrated construction sequencing, and common testing protocols will matter as much as any individual contract.

A practical milestone stack looks like this:

- Finalize preliminary routes and environmental constraints, then file CCN applications with robust alternatives.

- Order long-lead equipment early, including 765 kV transformers, breakers, and reactors, and secure manufacturing slots with schedule incentives.

- Sequence substation builds so that step-downs are operational before line energization, and plan system cutovers to avoid prolonged outages of existing 345 kV meshes.

- Stage construction by terrain and season, with separate crews focused on foundations, structures, and stringing to compress schedule without compromising safety.

What this means for market participants

- Developers: Basis spreads will likely moderate on the west-to-east path over time. Projects that assumed persistent deep curtailment or congestion in their economics should stress-test merchant revenue.

- Retail and large C&I buyers: Expect improved access to West Texas renewable output and a clearer path to deliverable long-term contracts that balance price with deliverability. Co-location at new nodes may offer interconnection advantages.

- Storage: Arbitrage windows tied to West Texas export constraints compress, but value grows at new interfaces and near urban rings. Duration choices may tilt toward 2 to 4 hours for congestion relief and ancillary services unless developers target local resilience.

- Oil and gas operators: Electrification becomes more bankable as interconnection queues and voltage headroom improve at new nodes. Some operators will still choose private microgrids for resiliency, but the backbone expands options.

- Communities and landowners: Engagement will determine whether routing gets resolved early or drifts into protracted litigation. One big corridor can be less disruptive than several smaller ones, but only if stakeholders shape the route.

Timelines, with eyes on 2030

Even with momentum, 765 kV is a marathon. CCN cases can run more than a year, especially with contested routes. Construction for hundreds of miles of line and multiple substations often takes two to three years after approvals, and that assumes supply chains hold and weather cooperates. The step that is least visible but most critical is procurement. Long-lead orders need to land well before final route determinations so that manufacturers can hit their factory slots once CCNs clear. Utilities that move early on engineering, environmental surveys, and joint standards will be the ones that keep 2030 viable.

If schedules slip, watch for interim mitigations. Utilities can add series compensation to existing 345 kV corridors, deploy mobile transformers and reactors, and stage incremental substation work to eke out transfer. Those measures will not replace a 765 kV path, but they can bridge a season or two of peak demand.

The bottom line

Texas did not just approve another set of wires. It chose a different scale for its backbone. The 765 kV import paths into the Permian will change how power flows, how projects get built, and how prices form across the state. The build will be hard, from rights of way to transformers, but the payoff is real. A stronger spine means more deliverability for oilfield loads, more room for renewables to produce when the sun is high and the wind is up, and a better shot at serving the data economy without sacrificing reliability elsewhere.

If the state keeps assignments tight, orders long-lead equipment early, and pairs the backbone with well-sited dispatchable additions, 2030 can be a milestone rather than a mirage. That is what 765 kV buys Texas, not just more steel in the sky, but more room to grow.