Court Lifts Halt on Revolution Wind, Reprices Offshore Risk

A federal injunction restoring work on Ørsted’s Revolution Wind reshapes legal and financing assumptions for U.S. offshore wind. Here is how the ruling affects political risk, WACC, OREC and PPA clauses, insurance, and lender covenants in 2025–2026.

What just happened and why it matters

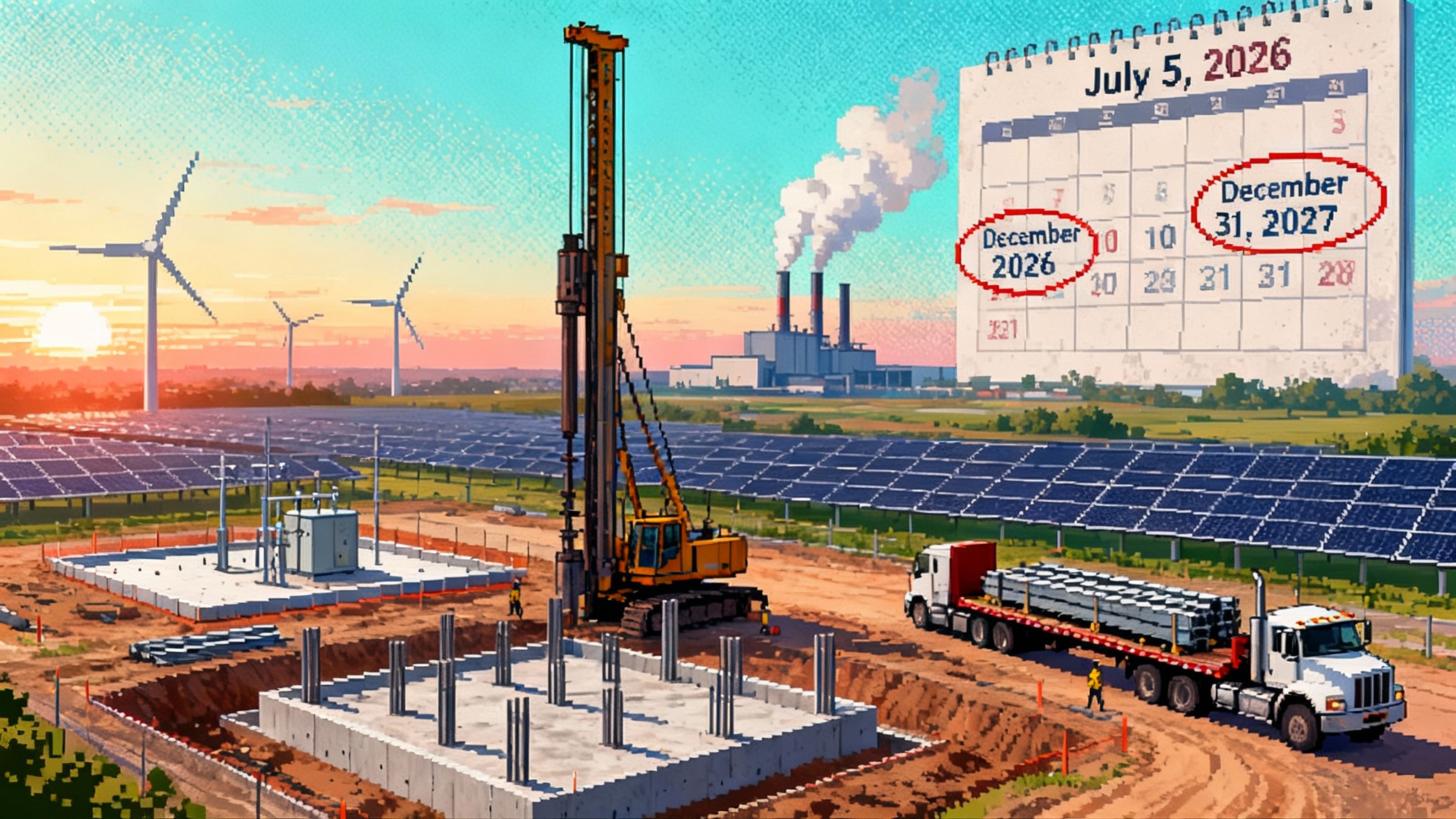

Between September 22 and 24, 2025, a federal judge in Washington, D.C. granted a preliminary injunction that allows Ørsted and its partner to resume construction on the 704 MW Revolution Wind project off Rhode Island and Connecticut. The ruling blocks a BOEM stop work order issued in August and finds the developers likely to succeed on the merits, with irreparable harm if work stayed paused. State officials confirmed that construction could restart immediately. You can read an official summary of the decision in the Connecticut Attorney General’s statement, which quotes the court’s findings and notes that a parallel state suit is still pending Attorney General statement on injunction.

Revolution Wind is reported to be roughly 80 percent complete, with offtake contracted to serve more than 350,000 homes in Rhode Island and Connecticut once commissioned. The project’s restart is not only a construction milestone. It is a legal and financial reset for U.S. offshore wind after a summer of regulatory whiplash.

A new legal baseline for BOEM, at least for now

The injunction does not end the case. It does, however, establish a near term baseline. Courts can and do police abrupt shifts by agencies when those shifts lack a factual record or statutory footing. In practical terms, the order tells developers, lenders, and offtakers that fully permitted projects cannot be paused lightly once capital is sunk and mobilized.

That message lands in a volatile policy backdrop. BOEM’s 2025 actions have included rescinding designated Wind Energy Areas and revisiting the leasing schedule. Those moves widened perceived political risk and complicated forward project pipelines. For context on the scope of the rescission, see BOEM’s stakeholder note on withdrawing Wind Energy Areas BOEM rescinds Wind Energy Areas.

Put together, the court’s check on a stop work order and the agency’s broader retreat create a two sided reality. Near term, judicial review can stabilize in flight projects. Medium term, policy volatility still depresses future lease and development appetite. Investors will price both effects at once. To see how adjacent policy choices are reshaping grid planning, compare this to the FERC 1920-A grid planning shift.

How the ruling reprices political risk and WACC

Political risk had been creeping from background to foreground in offshore wind underwriting. The injunction pushes that premium down for projects that are substantially permitted and constructed, since the probability weighted value of an abrupt halt has dropped. It does not eliminate the premium for earlier stage assets that still face leasing and federal approvals.

Expect the following shifts in the 2025–2026 financing stack:

- Construction debt margins: modest compression for late stage projects. Banks can justify a few basis points of tightening where permits are seasoned, major components are installed, and legal precedent now favors continuity during litigation.

- Tenor and sculpting: greater comfort with standard sculpting to P50 energy curves for near complete projects, while retaining conservative P99 coverage in early operations. Early stage assets will still see shorter average life coverage until federal policy stabilizes.

- Equity IRR hurdles: selective easing where offtake is locked and mechanical completion is within a visible vessel window. Sponsors will still demand a higher hurdle for new greenfield leases given federal leasing uncertainty and the 45Y/48E credit crunch.

- Political risk reserves: more targeted use. Instead of broad contingencies, lenders can dial in reserves to appeal timelines and discrete agency risk points. That lowers carry cost without ignoring tail risk.

The headline signal is not that capital is suddenly cheap. It is that the dispersion in pricing between late stage projects and new greenfield entrants will widen, with the court’s order acting like a credit positive for the former.

OREC and PPA clauses under the microscope

Offtake contracts became a battleground in 2023–2024 when inflation and supply chain shocks collided with fixed pricing. In 2025–2026, the friction moves to political interference risk. Two families of clauses will see upgrades:

- Change in law and political interference

- Define federal administrative actions, including stop work orders, as a qualifying change in law event. Tie relief to a clear mechanic, such as a schedule extension equal to the days of enforced suspension plus remobilization and weather penalty days.

- Add a tariff for documented cost of capital increases caused by an injunction or stop order. This can be a capped percentage adder that sunsets upon final judgment or resolution.

- Create a reopener trigger if an injunction persists beyond a specified long stop threshold. The reopener can allow price true up, reduced volume, or staged COD dates.

- Force majeure and long stop dates

- Clarify that agency ordered halts, national security reviews, and court ordered stays count as force majeure. Exclude developer caused compliance failures to keep incentives aligned.

- Move from a single long stop to a tiered structure. For example, a construction long stop with cure rights, a commissioning long stop that triggers liquidated damages, and an ultimate termination long stop with defined termination payment.

States can embed these protections in OREC orders and PPA templates, reducing litigation over contract interpretation when politics intrudes.

Insurance market response in 2025–2026

Specialty insurers have already repriced offshore wind due to weather and logistics claims. The 2025 legal upset adds a different vector. Expect the following shifts:

- Delay in Start Up, DSU policies to explicitly name government ordered suspensions as covered perils when projects are otherwise compliant. Higher sublimits and longer waiting periods will apply, priced to the appeal window profile.

- Political risk insurance: targeted endorsements rather than stand alone PRI for most projects. Developers will seek endorsements that dovetail with OREC or PPA reopeners to avoid coverage disputes.

- Marine warranty survey scope: expanded to include contingency plans for rapid demobilization and remobilization with documented cost impacts. Underwriters will want to see vessel charter clauses that address sudden pauses.

- Business interruption in early operations: nuanced triggers for partial curtailment caused by government action unrelated to mechanical failure. This becomes a procurement topic for offtakers as well.

The play is to align contract relief, lender consents, and insurance triggers. If one leg is missing, sponsors can be left carrying costs that nobody intended them to absorb.

Lender covenants and credit committee playbooks

Banks and institutional lenders will not rewrite their entire covenant sets. They will insert scalpel level adjustments aimed at political risk and schedule reliability:

- DSCR maintenance and lock up: maintain standard project finance thresholds, but suspend cash sweeps triggered solely by a court or agency ordered halt if the project is otherwise performing. Require escrow of insurance proceeds and OREC true ups to keep the credit protected.

- Milestone and availability tests: add a politics exception that pauses counting of cure periods when an injunction is in place, paired with enhanced reporting and third party verification of remobilization readiness.

- Long stop dates and termination mechanics: allow extension upon court injunction up to a defined outside date tied to vessel availability windows. Include an accelerated case plan if an appellate stay is issued.

- Material adverse effect definition: carve out temporary injunctions or policy shifts that do not change core permits, then add a snap back if an appeal results in a merits loss or permit revocation.

- Information covenants: require notice within 24 hours of any federal action affecting construction or operation, plus a monthly legal status certificate during active litigation.

Expect more frequent use of side letters to clarify how insurance proceeds, OREC reopeners, and reserve releases interact during a legal pause.

For states, a de risking playbook

State energy offices, public utility commissions, and procurement authorities can reduce future blowups without overpaying:

- Standardize change in law language that covers federal stop orders, court injunctions, and similar events. Provide automatic schedule relief and narrowly tailored price adjustments tied to observable financing costs.

- Build an appeals timeline annex into OREC and PPA awards. Define how milestones, credit support, and long stop dates flex if an appeal or stay is filed.

- Use staged OREC pricing. A base price at COD plus a small, temporary legal risk adder that burns off once all appeals or investigations close.

- Pre coordinate with state attorneys general. Commit to rapid intervention in federal cases that implicate state ratepayer interests. This cuts response time when days equal millions, and aligns with the broader states versus PJM governance clash.

- Expand green bank and infrastructure bank tools. Offer standby liquidity to cover DSU deductibles or working capital during court ordered pauses, repaid from insurance or reopener proceeds.

- Require vessel and logistics resilience plans in bids. Make bidders show charter flexibility, alternative port options, and detailed demobilization and remobilization cost curves.

These steps lower the state’s risk premium without writing blank checks. They also make solicitations more bankable in a world where policy volatility is a known variable.

For developers and sponsors, what to do now

Sponsors should operationalize the new baseline while appeals continue:

- Lock in critical vessel windows. If the project depends on a narrow installation season, secure extension options and step down rates that survive pauses, with pre agreed remobilization fees.

- Recut contingency and reserve strategy. Shrink generic contingencies and add a litigation reserve sized to appeal durations. Pair this with an insurer endorsed DSU structure.

- Update lender and rating agency cases. Run cases that include 30, 60, and 120 day court pauses with layered weather delays, then show covenant headroom and liquidity sources under each.

- Tighten governmental relations and defense coordination. Pre brief DOD and Coast Guard on navigation, radar and training impacts. Create an interagency fact pack that can be dropped into court declarations within hours if needed.

- Align offtake reopeners with insurance. Make sure DSU triggers and PPA or OREC reopeners point to the same calendar days and cost definitions to prevent gaps.

- Refresh community and labor MOUs. Pauses hurt workers first. Agreements that prioritize remobilization, apprenticeship continuity, and wage protection will matter to courts judging public interest.

For lenders and investors, underwriting in two lanes

Credit committees can improve speed and discipline by splitting the market into two lanes:

- Lane A: late stage or partially built projects with seasoned permits. Apply marginally lower political risk premiums, offer standard tenors, and emphasize operational readiness audits.

- Lane B: early stage or pre lease projects. Impose higher equity cushions, shorter tenors, and tighter milestones. Anchor valuations on conservative assumptions for federal leasing and environmental review timing.

In both lanes, put a premium on sponsors that can demonstrate vessel flexibility, insurance integration, and state support mechanisms baked into contracts.

What to watch over the next 90 days

- Appeal posture. The federal government can appeal a preliminary injunction and may seek a stay pending appeal. A stay would re elevate risk, so watch for any emergency motions and the briefing schedule.

- BOEM’s internal review. The agency has said it will continue its investigation. If that process develops a factual record, it could influence both the litigation and future project conditions.

- Commissioning schedule. The project’s ability to hit near term installation windows will determine whether cost overruns are reclaimed through reopeners or absorbed by equity.

- Rate and regulatory approvals. Any price reopeners in OREC or PPA structures will require commission approvals. Early and transparent filings will help keep investor confidence intact.

- Supply chain ripple effects. Turbine, cable, and vessel providers need visibility to plan 2026 work. Clear signals from states and sponsors will reduce knock on delays across the Atlantic supply chain.

The bottom line

The court’s injunction restoring work on Revolution Wind does more than restart a single project. It sketches a playbook for how legal checks can stabilize late stage builds even when federal policy is in flux. Capital will respond in kind. WACC should ease for projects that are already in the water, while greenfield works will still pay a premium until BOEM’s forward program regains predictability.

For states, the path forward is to standardize political risk mechanics in ORECs and PPAs, coordinate legal strategy with AGs, and deploy targeted liquidity backstops. For sponsors, it is to hard wire vessel flexibility, insurance triggers, and lender consents so that a legal pause does not become a financial crisis. For lenders, it is to underwrite in two lanes, protect the downside with covenant clarity, and recognize when courts have meaningfully reduced the odds of catastrophic interruption.

Appeals and investigations may continue, and new policy turns are possible. Yet this ruling signals that fully permitted, substantially built offshore wind projects are not easily derailed. In a crowded risk universe, that clarity is exactly what long horizon capital needs to get comfortable again.