FERC’s 1920-A hands states the pen on grid planning

FERC’s 1920-A keeps the 2024 transmission rule intact, extends the launch of the first long-term regional planning cycles to as late as mid-2027, and elevates states in scenario design and cost allocation. See what utilities, RTOs, and commissions should do now, how it aligns with DOE’s NIETC process, and what it means for siting and costs.

The short version

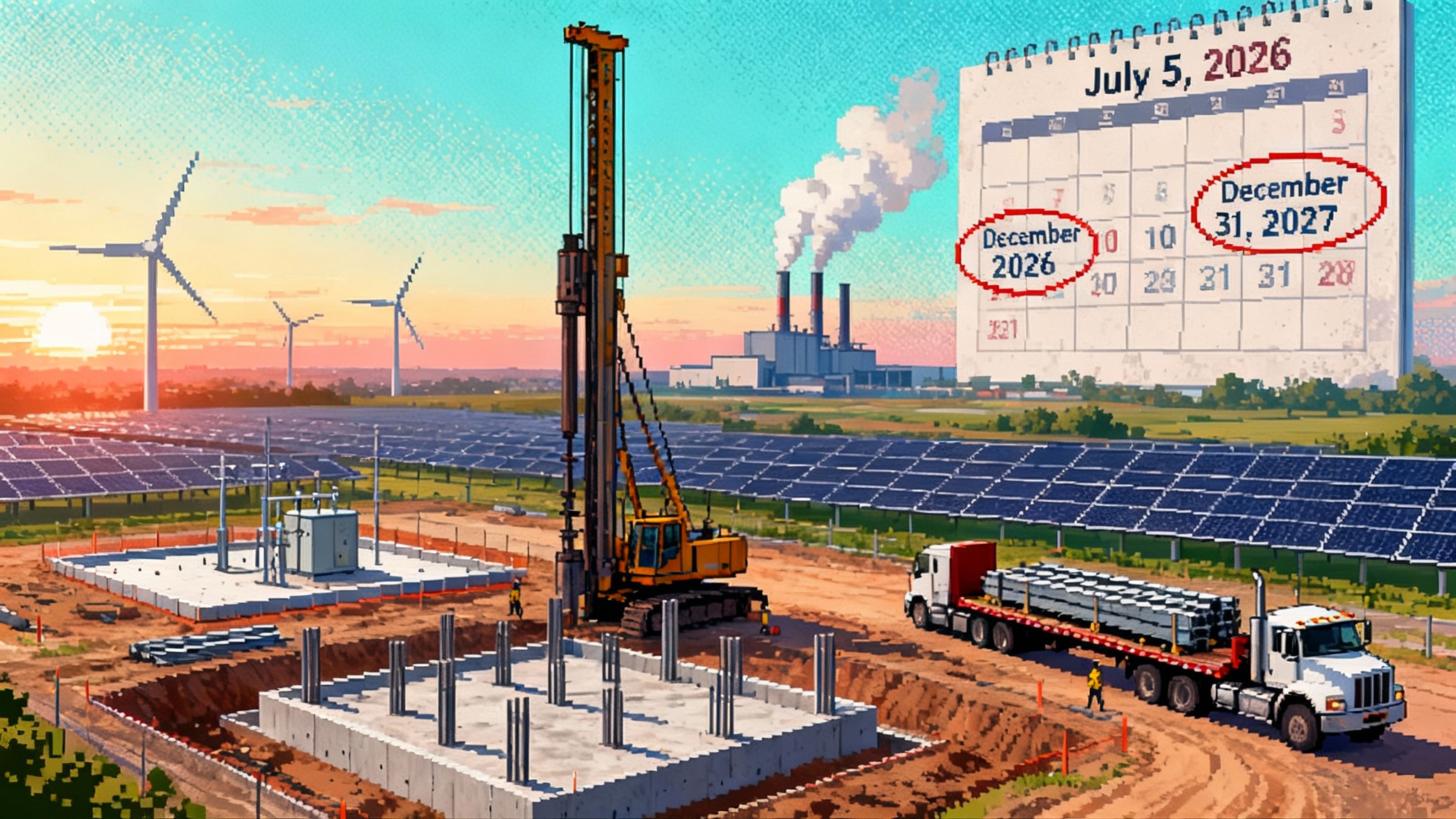

Order No. 1920 reshaped how the United States plans and pays for regional transmission. The rehearing order, Order No. 1920-A, largely affirms those reforms while changing the cadence and elevating state decision makers. Most notably, 1920-A extends the deadline for launching the first long-term regional planning cycle to no later than two years after initial compliance filings are due, and it strengthens state roles in scenario design and cost allocation. In April 2025, a follow-on 1920-B order added clarifications without altering the core. The net effect is clear: regional planning will be longer range, more transparent, and more state shaped, with the first cycles beginning as late as mid-2027. For details, see FERC’s Order 1920-A summary and presentation.

What 1920-A actually changes

The 2024 final rule requires every transmission planning region to run a 20-year horizon, build at least three forward-looking scenarios with sensitivities, evaluate a common set of benefits, and adopt a transparent selection process. 1920-A leaves that architecture in place but:

- Extends timing for the first long-term regional planning cycle. Instead of starting within one year of the initial compliance filings, the first cycle can now start within two years of those filings. For most regions whose first compliance filings are due in mid-2025, that means a latest start in mid-2027.

- Elevates state roles. States must be consulted on how scenarios incorporate state laws, policies, and demand drivers. If states agree on an ex ante cost allocation method or on a State Agreement Process, transmission providers must include it in their compliance filings and FERC can adopt it even if the provider files a different proposal.

- Adds a safety valve for state negotiations. The six-month state engagement period for negotiating ex ante cost allocation or a State Agreement Process can be extended up to six additional months upon state request, with matching extensions to compliance deadlines as needed.

- Clarifies how benefits and drivers are used. Regions still evaluate a set of benefits for selection and cost allocation, but identification of long-term needs leans on reliability and economic drivers. Corporate commitments are not required inputs to the three required scenarios, though states can ask for additional informational scenarios to inform cost allocation choices.

- Requires more transparency. Transmission providers must post zone-level benefit and cost allocation breakdowns on OASIS or a password-protected stakeholder site. Right-sizing of replacement lines above a voltage threshold must be considered and, if selected, disclosed with costs and benefits.

What changes for each player

Utilities and transmission owners

- Plan to a 20-year horizon with measurable benefits. Planners will need to quantify production cost savings, reliability and resilience benefits, avoided local upgrades, reserve margin impacts, and more, and show zone-by-zone results.

- Prepare to right-size replacements. Asset management programs that would have swapped in-kind conductors or structures now need to test higher-capacity alternatives and bring those into regional benefit-cost evaluation. Incumbent owners retain the right to build selected right-sized replacements, which will attract scrutiny of cost estimates and timing.

- Budget for earlier data and stakeholder work. Posting of assumptions, sensitivities, benefit calculations, and draft cost allocations will happen earlier in cycles and will be challengeable.

RTOs and ISOs

- Run the regional process and file once for everyone. In RTO footprints the RTO files compliance on behalf of member transmission providers, then leads the scenario design, benefit modeling, project evaluation, and selections. Expect more interregional coordination, since 1920-A requires alignment with neighboring regions’ long-term processes.

- Build a durable record for cost allocation. With states now positioned to propose ex ante methods or a State Agreement Process, RTOs will need defensible benefit metrics, clear allocation mechanics, and a public log of state consultations and outcomes.

- Re-time planning calendars. Most RTOs will align long-term cycles with existing regional planning cadences, which often span 18 to 24 months. The two-year start window gives breathing room to integrate new analytics and stakeholder steps.

States and state commissions

- Co-authors, not commenters. States now have defined touchpoints to shape scenario inputs and benefit metrics, and to negotiate how costs are shared. If states reach agreement, their cost allocation method must be filed and can be adopted by FERC.

- Control the pace of negotiations. The initial six-month engagement window can be extended up to six months on request, and the related compliance deadlines move with it.

- Ongoing veto by persuasion. Transmission providers must consult state entities before proposing any later amendments to cost allocation methods and must publicly explain if they diverge from state preferences.

How 1920-A meshes with DOE’s NIETC process

DOE’s National Interest Electric Transmission Corridor designation is a parallel tool, not a substitute for planning. NIETCs identify geographic areas where inadequate transmission harms consumers and unlock certain federal permitting and financing advantages. DOE finalized guidance in 2023, moved three potential corridors into a new engagement phase in December 2024, and is now in Phase 3 with environmental scoping and public engagement. DOE’s schedule points to draft designation reports in 2026, which would frame final designations thereafter. Track progress on DOE’s NIETC designation process.

What this means in practice:

- Planning informs corridors, corridors speed siting. Robust long-term planning records under 1920-A give DOE and developers quantitative evidence of benefits and need, which can strengthen NIETC justifications. In turn, NIETCs can unlock FERC backstop siting authority if state processes fail or deny within an NIETC, shortening the tail for lines that already emerged from regional planning.

- Cost allocation still belongs to the region. NIETC designation does not decide who pays. That remains with 1920-A’s ex ante methods or State Agreement Processes, subject to FERC approval. States that use the engagement windows to settle cost allocation are better positioned to move NIETC-area lines without later fights over the bill.

- Interregional lines get a clearer lane. 1920-A requires neighboring regions to exchange long-term needs and evaluate interregional facilities. If DOE finalizes NIETCs that straddle two regions, those processes can converge on common benefit metrics and timelines.

Siting and permitting impacts

- Backstop siting is now operational. FERC’s 2024 siting rule under Federal Power Act section 216 updated how the Commission would process permits for interstate lines in NIETCs, including a Landowner Bill of Rights and engagement plans for communities and Tribes. If a state withholds action for one year, denies an application, or approves with conditions that defeat a line’s purpose within an NIETC, FERC can step in. 1920-A does not change siting jurisdiction, but it builds the benefit record that a backstop applicant would rely on.

- Right-sizing can move faster. Replacing existing facilities reduces greenfield miles, which often reduces environmental review complexity and local opposition. Expect many first-wave projects in 2026 to be reconductoring, advanced conductors, and right-sized rebuilds at 115 to 345 kV.

Cost allocation in the new regime

- Ex ante methods are the default destination. 1920-A encourages states to agree on a method up front. If they do, the transmission provider must file that method even if it prefers a different one. FERC can adopt the state method if it satisfies cost causation and transparency.

- State Agreement Process remains a safety valve. States can defer agreement until a specific project or portfolio is selected and then negotiate an allocation within six months. If that fails, the pre-filed ex ante regional method governs.

- More sunlight on who pays. Providers must post zone-level benefit metrics and the proposed allocations, with the same calculators applied across portfolios, which will discipline outlier allocations.

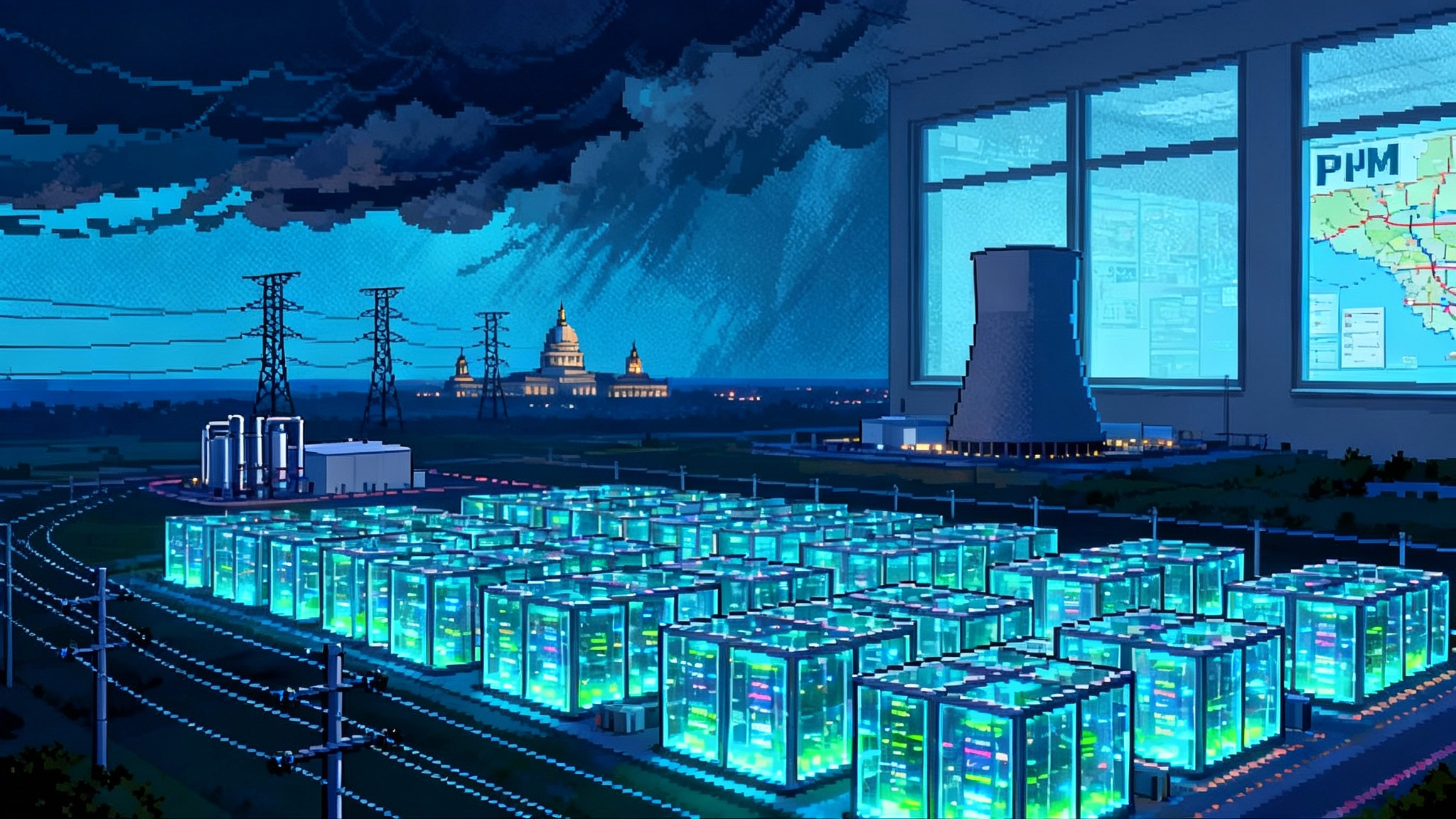

The AI and data center demand surge

Data centers and electrifying industry are no longer distant drivers. From 2024 to 2026, official forecasts show U.S. electricity sales growing near or above two percent per year, a sharp break from the last decade, with ERCOT and PJM as the epicenters. 1920-A does two things that matter over the next two years:

- It buys time to get the long-term machinery right. The new two-year window lets regions stand up credible scenario modeling that reflects hyperscale load siting, power density, backup fuel risks, and winter reliability sensitivities. That is essential for portfolios that will be tested in court. For PJM-specific governance dynamics tied to data center growth, see our analysis of the PJM data center governance clash.

- It pushes near-term solutions. Because big greenfield lines will not be steel in the ground by 2027, early cycles will lean on right-sizing, dynamic line ratings, advanced conductors, power-flow control devices, and targeted 230 to 345 kV reinforcements that can be permitted faster. Forecasting frictions will matter; see EPA data blackout impacts.

Timeline of milestones

- May 13, 2024: FERC approves Order No. 1920, the long-term transmission planning and cost allocation rule.

- August 12, 2024: Rule takes effect 60 days after Federal Register publication.

- November 21, 2024: FERC issues Order No. 1920-A on rehearing and clarification, expanding state roles and extending the timeline to start the first long-term regional planning cycle.

- April 11, 2025: FERC issues Order No. 1920-B with additional clarifications for state involvement and filings.

- June 12, 2025: Initial compliance filings due for most regional requirements, with region-specific extensions where granted. Six-month state engagement periods run up to this date and can be extended up to six more months upon state request.

- August 12, 2025: Interregional coordination compliance filings due for most regions, again subject to extensions.

- 2026: DOE anticipates releasing draft NIETC designation reports and related environmental documents for public comment.

- By June 2027: Latest likely date for most regions to start their first long-term regional planning cycle under 1920-A’s two-year window.

Likely litigation flashpoints

- Federal versus state authority. Expect challenges that 1920’s planning and cost allocation intrude on state ratemaking or siting. FERC’s deference to state-negotiated methods under 1920-A is designed to blunt these claims, but debates over how state policies inform scenarios will persist.

- Benefit metrics and cost causation. Parties will test whether portfolios selected on multi-benefit metrics still produce allocations that are roughly commensurate with benefits. Zone-level postings will be fodder for contested cases.

- Right of first refusal for right-sized replacements. The preserved ROFR for selected right-sized projects could draw challenges from non-incumbent developers who argue it is anti-competitive, especially where the rebuild resembles new construction.

- Interregional coordination. If neighboring regions diverge on modeling or selection, cross-boundary projects could be stalled and litigated over inconsistent assumptions.

- NIETC designations and backstop siting. Final corridors will likely face NEPA challenges, and any early use of FERC backstop siting inside NIETCs will be litigated on jurisdictional triggers and the adequacy of need showings. A strong 1920 record will be essential evidence.

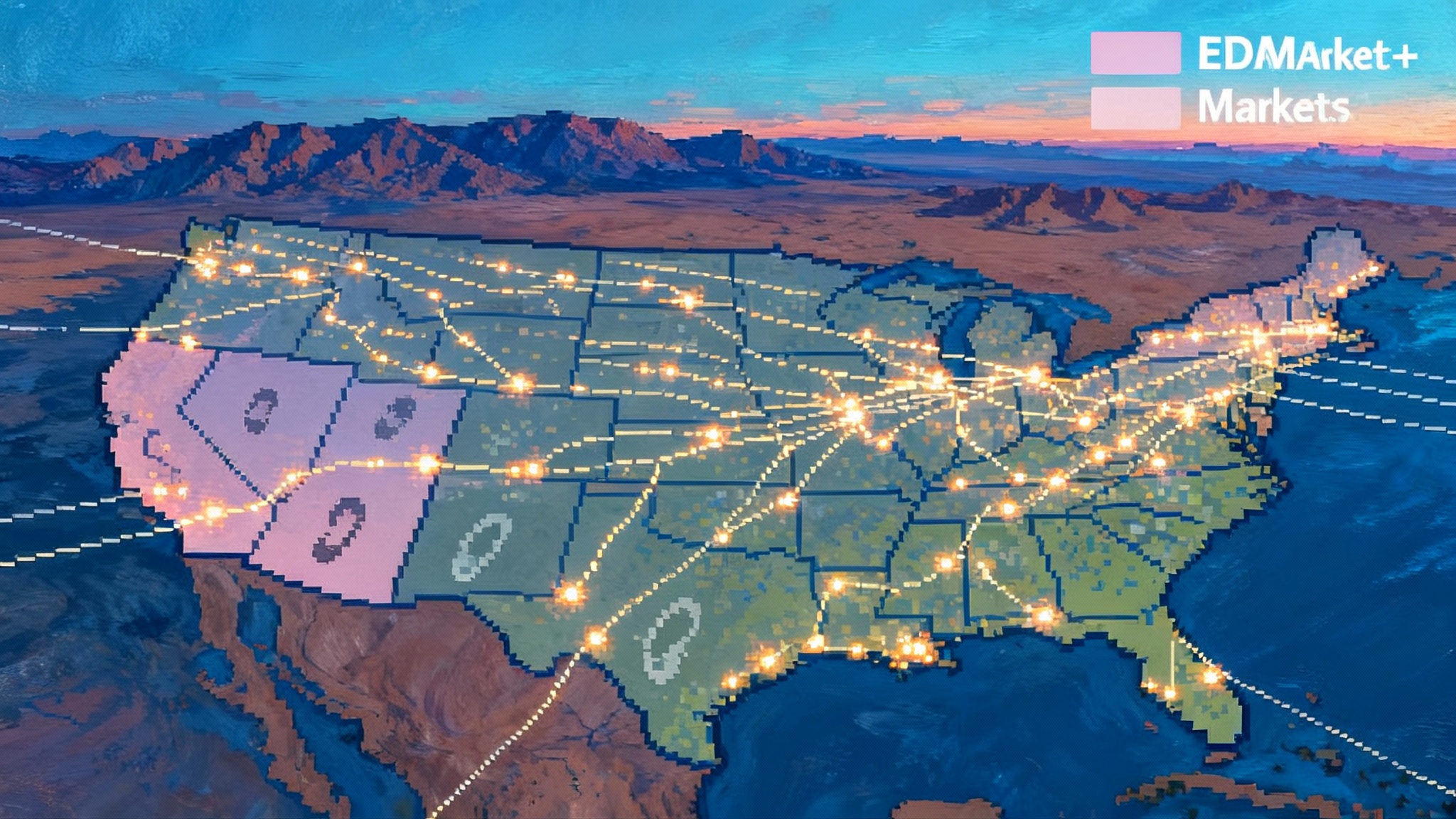

Who stands to gain, region by region

- PJM and the Mid-Atlantic. Northern Virginia and Ohio Valley data center pull, plus aging 500 kV backbones, make PJM a prime beneficiary. Early wins likely include right-sizing and reconductoring on 230 to 500 kV lines, plus targeted new 500 kV ties that move surplus generation and support winter reliability.

- ERCOT. Outside FERC’s planning rule but central to demand growth. Expect a rapid build of 345 kV reinforcements and voltage support, with lessons from 1920’s benefit accounting informing Texas debates even if not required.

- MISO and SPP. Massive wind, new solar, and growing industrial loads point to long-haul 345 to 765 kV backbones and MISO-SPP interregional ties.

- Southeast non-RTO regions. SERTP utilities can use the engagement window to craft ex ante methods that fit multi-state footprints while preparing portfolios heavy on right-sizing and advanced conductors.

- The West. CAISO and neighboring non-RTO utilities need high-capacity paths for offshore wind, desert solar, and growing data center clusters in Arizona and Utah. Market design will matter; see the West day-ahead market showdown. Early projects will emphasize reconductoring and targeted 500 kV upgrades.

- New England and New York. Offshore wind integration and winter reliability make right-sizing and HVDC on existing routes attractive. States already active in transmission funding have a clear path to State Agreement Processes that tailor cost splits to public policy goals.

What to do now

- Utilities and RTOs. Lock in modeling platforms, benefit calculators, and data governance that will survive a hearing. Pre-brief state staff on scenario and benefit design choices. Identify a first tranche of right-sized replacements and advanced conductor candidates for 2026 to 2028 in-service dates.

- States. Decide early whether to aim for an ex ante method or rely on State Agreement Processes. Use the extended engagement window strategically, but set decision thresholds and dispute resolution up front.

- Developers and large loads. Map projects against potential NIETCs and existing rights of way. Position near right-size candidates and interregional seams, where benefit metrics are strongest and siting is quicker. Document reliability and economic benefits in the same language regions will use for 1920 filings.

The next two years are the runway. With 1920-A, states have the pen, regions have time to stand up robust long-term planning, and DOE’s corridor process is advancing. The players who invest now in shared facts and workable cost splits will move projects from plan to permit the fastest.