AI Load Rewrites the Grid as Coal Lingers and Gas Surges

AI-driven load and policy shifts are reshaping U.S. power planning through 2030. Federal signals slow coal exits, Texas funds dispatchable capacity, the Southeast resets timelines, and data center PPAs move from virtual to physical with capacity and fuel wraps.

The signals that shifted the outlook

A year ago, the consensus story was simple. Coal would bow out on schedule, renewables and storage would fill the gap, and gas would play a supporting role. That narrative looks different after late September. Federal officials publicly urged utilities to delay coal plant closures to meet surging load from data centers and electrification, a shift in tone that re-centers reliability planning and buying strategies around firm capacity. The message was not subtle. Energy leaders said keeping coal plants available longer is prudent while new firm resources and transmission catch up to demand, a position reported by Reuters on September 25, 2025 as a federal call to delay coal.

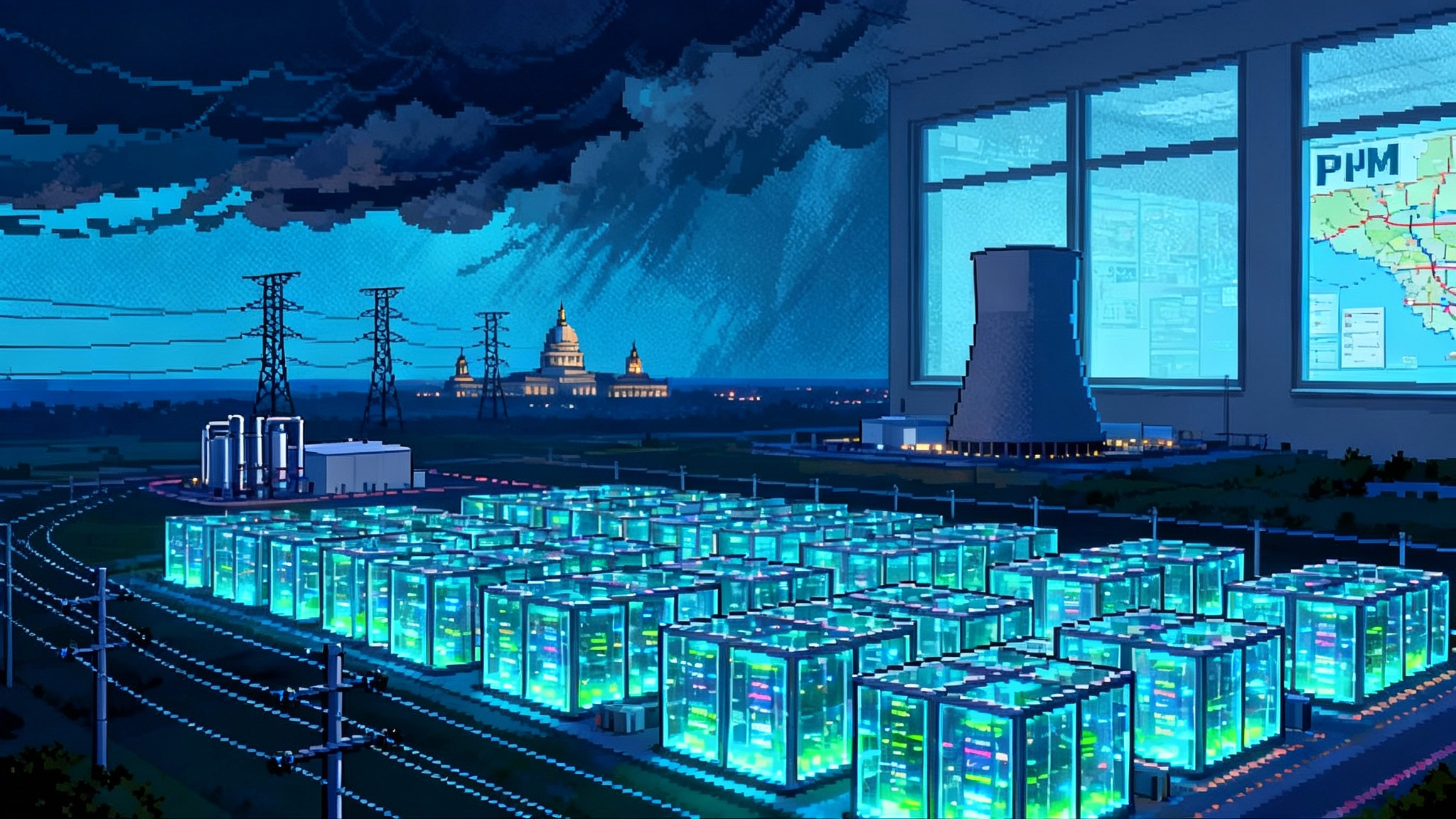

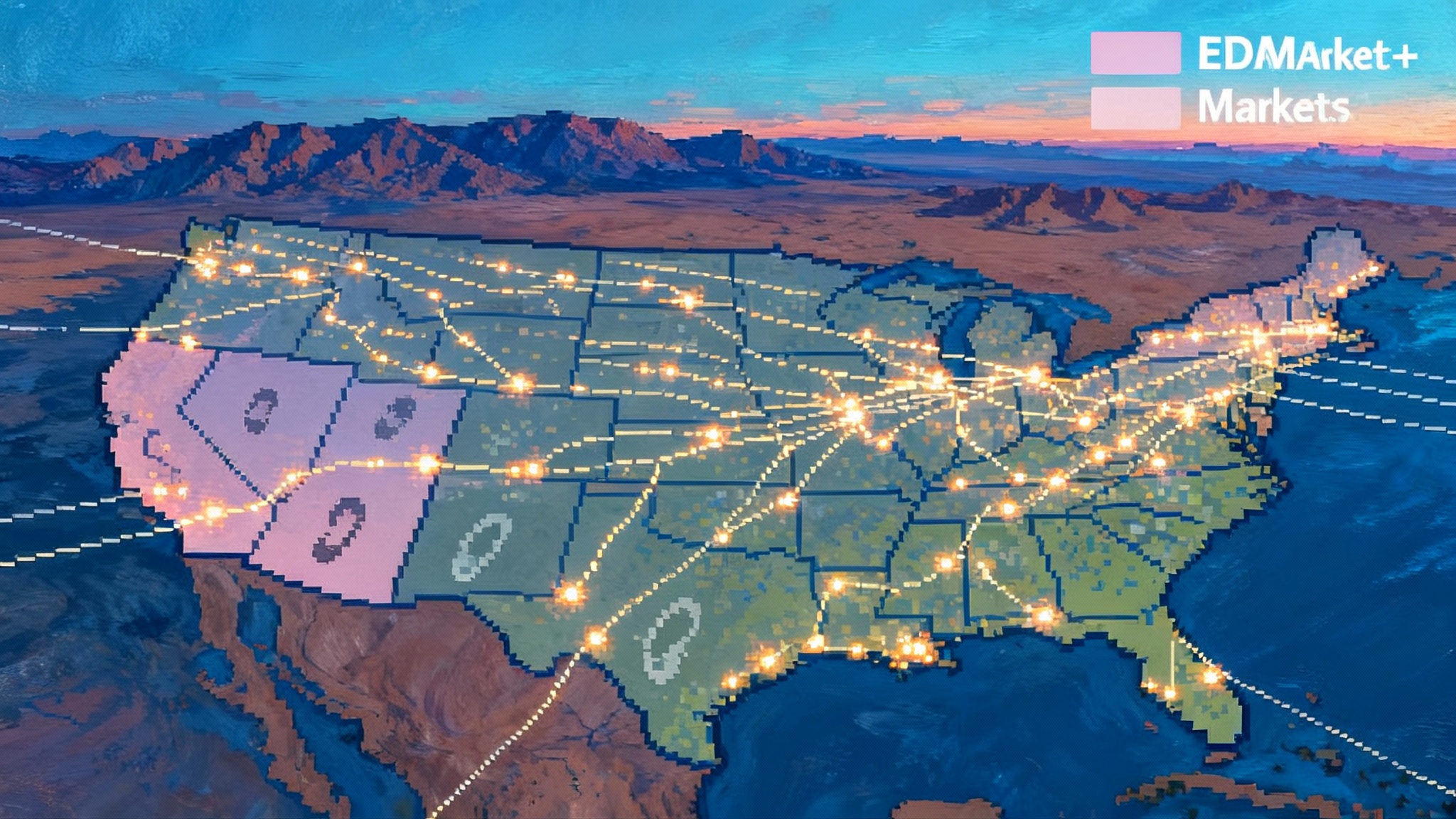

That signal lands in a market already reconfiguring around AI-driven load growth. Utilities and grid operators are revising demand forecasts upward, often compressing a full planning cycle’s growth into a few years. For data center developers, new power deals must weigh capacity accreditation, delivery risk, and carbon intensity under a different set of constraints than those used even six months ago. Expect more interaction with state-led planning under FERC’s recent move that lets states gain grid planning power.

Texas puts real money behind firm megawatts

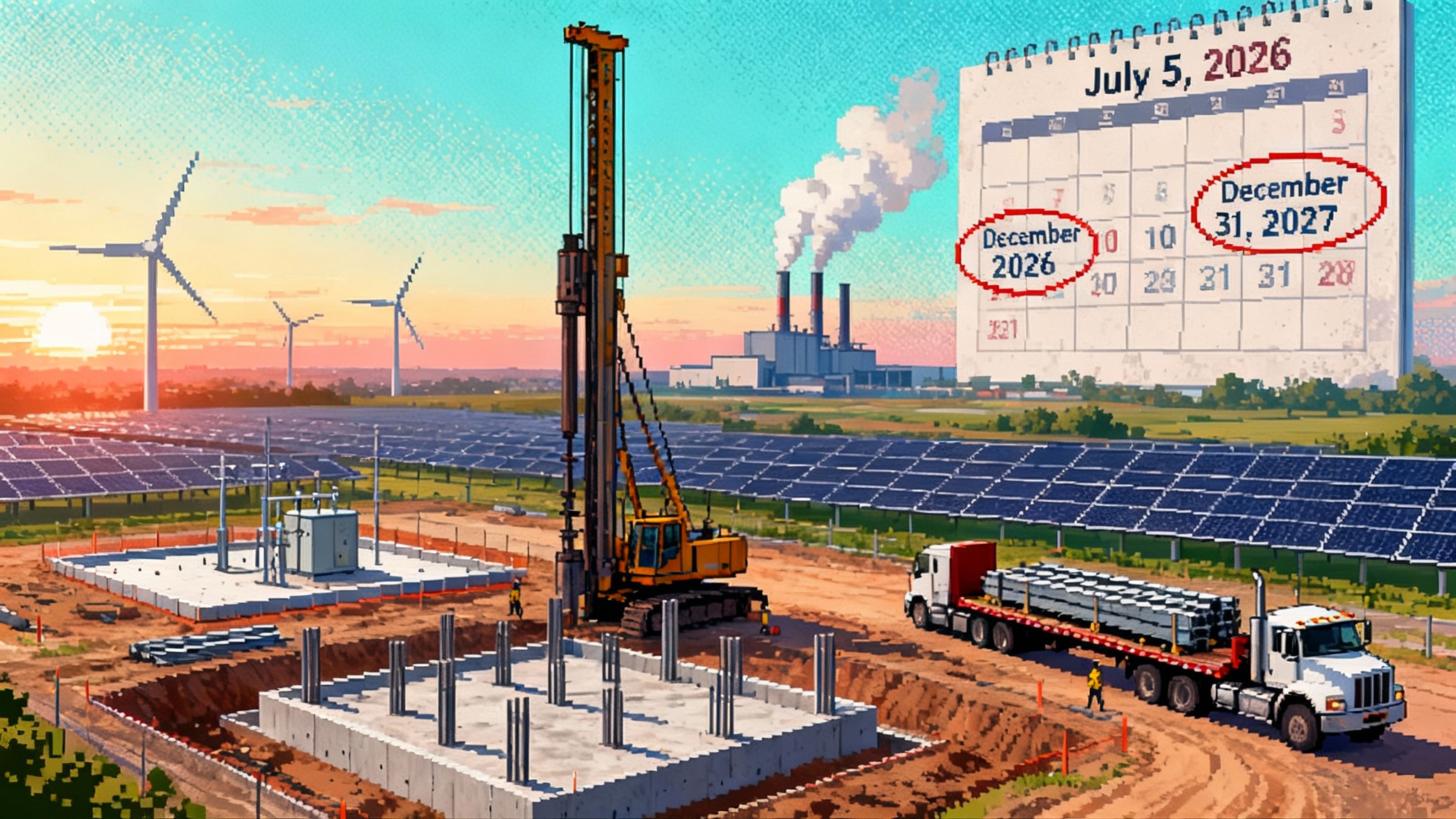

Texas is the most visible case of policy steering capital into dispatchable capacity. The Texas Energy Fund opened in 2025 with low interest loans and completion bonus grants to accelerate new in-ERCOT generation. The Public Utility Commission’s calendar, grant rates, and eligibility rules make one thing clear. Texas is actively buying down the cost of speed to market for gas units that can arrive before 2029, with richer incentives for projects that interconnect by June 1, 2026, as outlined in the Texas Energy Fund guidance.

By mid 2025, the first loan agreements were already moving for simple cycle and combined cycle capacity in key load zones around Houston and the Hill Country. The completion bonus grant program creates a tangible prize for developers who can convert queues into steel, pass performance tests, and show up in the net load shape when ERCOT needs them most. In practice, that package improves bankability, narrows the spread on debt, and helps close technology and schedule risk gaps that stalled some projects during the last rate spike.

The Southeast resets the timeline

North Carolina offers a second anchor for how the policy winds are blowing. Lawmakers rolled back the state’s 70 percent by 2030 power sector target this summer while retaining the 2050 neutrality goal. Regulators had already signaled flexibility on the interim deadline due to reliability and cost, and the legislative change formalized that shift. The implications extend beyond one state. Duke’s Carolinas plan is the benchmark for a region where load growth is running hot, industrial recruitment is strong, and nuclear and gas now sit at the center of near term capacity plans. That makes room for extended coal operations at a subset of units and a faster track for new peakers and repowered sites.

In short, the Southeast is not exiting firm thermal resources on a fixed date. It is managing a glide path with more discretion, more nuclear in the queue, and more gas as the practical bridge for 2026 through 2030.

What this means for coal operations

Extended coal timelines are unlikely to look like a full revival. More plausible is a portfolio of partial years, seasonal availability, and targeted dispatch windows that preserve reserve margins and black-start options without committing to baseload duty. Units with scrubbers, better heat rates, and strong rail or barge logistics will get the longest leases. Plants facing major capital for environmental upgrades or ash management will still retire or convert on schedule.

Expect a rise in seasonal and conditional capacity commitments. Think winter availability with limited energy dispatch, or strategic summer peaking runs during tight reserve periods. That may come with pay-for-performance style incentives tied to forced outage rates. Coal inventories will climb back from lean levels, and rail contracts will regain some of the term that evaporated when retirements looked certain.

Gas buildouts move from optional to essential

On the gas side, the signal is brighter green. Developers see clearer paths to return on capital for simple cycle aeroderivatives, F class peakers, and select H class combined cycles in fast growing load pockets. Incentives in Texas, more flexible planning in the Southeast, and a shift in reliability pricing combine to raise the capacity value of new gas. Add in tighter expectations for flexible ramping and you have a supportive case for quick start turbines and battery hybrids that smooth heat rate penalties during partial load operations.

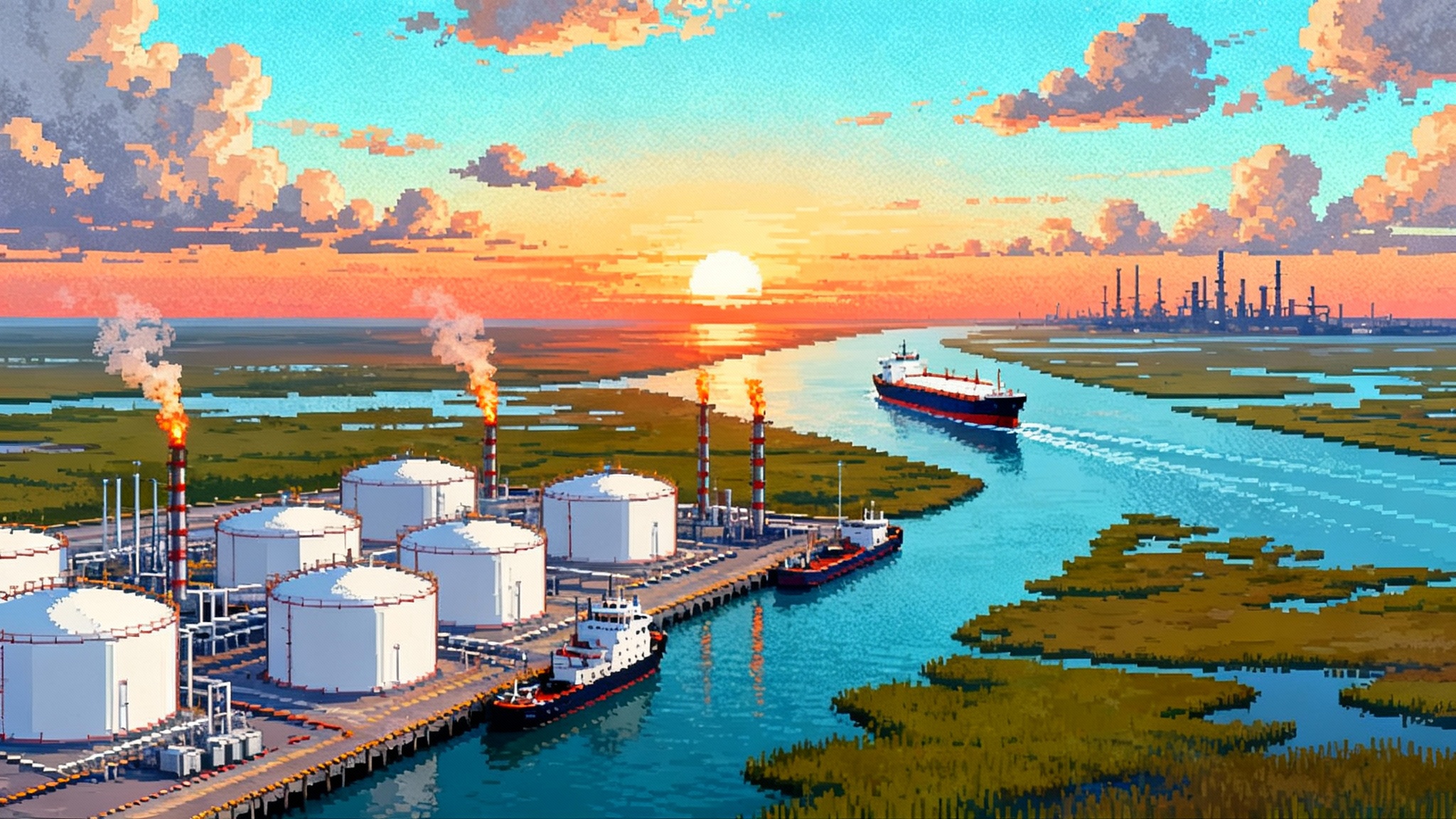

For pipeline and storage, this points to a stronger market for firm transportation and seasonal storage wraps. Data centers tend to be high load factor customers, but peakers are not. That creates a blend of 24x7 burn commitments for combined cycles and peak-oriented call options for simple cycles, all of which need matching transport and inventory strategies. Watch LNG market timing and exports, as discussed in LNG's 2025 reboot and Europe.

Reliability gets repriced through 2030

Utilities are now monetizing reliability more explicitly. Capacity accreditation frameworks are updating, scarcity pricing is more likely to bind, and performance penalties in several markets raise the value of units that start on time and stay on. The swing factor is not just megawatt hours. It is dependable megawatts in the right hour, at the right node, with the right ramp rate.

That re-pricing favors projects that can meet early interconnection dates, carry higher effective load carrying capability, and clear with fewer deliverability conditions. It also raises the bar for standalone renewables to win the same reliability dollar without storage or firming contracts. Expect more hybrid PPAs, tolling arrangements, and resource adequacy contracts that explicitly pay for availability, not only energy.

Emissions accounting gets more complicated, not less

If coal runs longer and gas builds faster, emissions trajectories will not fall in a straight line. The long term destination may still be net zero by mid century in several states. The path in the second half of the 2020s will be bumpier. Corporate buyers that report market based emissions will need to adjust procurement tactics. Annual REC matching will look weaker as a climate story. Hourly matching and 24x7 portfolios will gain weight. Some buyers will add thermal-backed contracts with carbon abatement features, such as hydrogen co-firing eligibility, CCS ready designs, or variable carbon fees tied to delivered MWh emissions.

In regions with no carbon cap, boards will still ask for a credible emissions glide path. That drives interest in diversified portfolios that include long term nuclear offtake, geothermal pilots, long duration storage trials, and hedged thermal firming that can be dialed down as clean firm arrives.

Implications for data center PPAs

Data center developers and hyperscalers now operate inside a tighter reliability regime. The old default, a virtual PPA for a large renewable array plus short term retail supply, will not cover the new risk set. Here are six practical adjustments procurement teams are already exploring, including insights from markets where data centers ignite a governance clash:

-

Move part of the book from virtual to physical. Physical PPAs or tolling agreements with firm delivery reduce basis and shape risk at the node. They also simplify capacity accreditation and can be paired with backup rights at nearby peakers.

-

Add true capacity contracts. A slice of accredited capacity, priced with performance incentives, can backstop outages and reduce the cost of emergency generation when the grid is tight.

-

Hybridize. Solar plus storage lowers shape risk, and storage with four to six hours can cover many daily peaks. Hybrid deals that include a thermal firming strip for seasonal peaks can be cheaper than over-sizing batteries.

-

Buy emissions outcomes, not only megawatts. Hourly clean energy matching, nuclear credits when available, and structured carbon floors tied to contract performance will stand out to audit committees.

-

Secure fuel and transport for tolls. If you toll a gas asset, make sure the contract wraps firm transport, storage swing, and critical infrastructure priority service where available. The value is highest during pipeline constraints and cold snaps.

-

Keep optionality. Shorten some tenors to five to seven years, retain step-in rights for modular nuclear or geothermal, and write sunset provisions that let you shift from gas firming to clean firm without stranded costs.

Fuel supply realities from 2026 to 2030

Gas: The combination of data center growth, industrial load, and new LNG trains sets up a busier pipeline map. Secure firm transportation early in basins with known bottlenecks, and pair it with storage that can swing through shoulder season maintenance. Watch Waha and Houston Ship Channel basis, and verify that any tolling deal uses the same index in both spark spread and fuel pass-through to avoid cross-hedge surprises.

Coal: Expect more multi-year contracts for Powder River Basin and Illinois Basin supply at moderate volumes that guarantee winter and summer readiness. Railroads will press for volume certainty. Utilities will ask for flexibility clauses that allow partial season deliveries. Ash disposal and wastewater compliance remain the capital swing variables for older units. Those costs will still push marginal units to retire.

OEM order books and the grid supply chain

Gas turbine manufacturers are booking stronger North American pipelines for 2026 to 2028 service. Aeroderivatives offer the fastest schedules for peaking. F class and H class combined cycles still make sense where heat rates and load growth justify longer run hours. Expect transformer lead times to stay a gating item. Heat recovery steam generators and air cooled condensers are also long poles. Owners can cut months by siting at existing brownfields with interconnection and water rights in place, or by repowering gas at coal sites where transmission and cooling already exist.

For original equipment makers, the pivot means more orders for fast start units, more contract structures that reward part load efficiency, and a higher mix of retrofit kits for hydrogen readiness. EPCs with proven schedule control in tight labor markets will price at a premium, and developers will pay it.

Three scenarios for 2026 through 2030

Base case: Coal retirements slow by a third relative to pre 2025 plans. Gas additions rise modestly above current queues where incentives and siting line up. Reserve margins in fast growth pockets remain tight in 2027 and 2028, then widen as new capacity arrives. Emissions intensity drifts down, with occasional reversals when weather or LNG demand spikes gas burn.

Bull gas case: Incentives and fast track siting pull forward several gigawatts of peakers and a handful of combined cycles in ERCOT, the Carolinas, and parts of the Mid Atlantic. Coal stays online seasonally at many dual unit sites. Capacity prices and scarcity adders average higher than the last five year mean. Data center buyers lean into tolling and resource adequacy contracts to secure uptime, and emissions progress relies on more hourly matching and nuclear offtake rather than pure renewable growth.

Slow coal case: Environmental compliance costs and local politics force more coal to retire on the original schedule. Gas still builds, but not fast enough to cover every gap. Scarcity hours increase in 2027 and 2028, followed by a catch up in 2029 as hybrids and fast start units enter. Emissions fall faster than in the other cases, but reliability costs rise and buyers pay more for firming.

Across all three scenarios, one thing is stable. The price of reliability rises and becomes more explicit. Contracts that value availability and start performance will price better than those that only pay for average megawatt hours.

What to watch next year

- The pace of Texas Energy Fund grants and loans that actually reach notice to proceed, not just press releases.

- Final resource plans and approvals in the Carolinas that translate policy into construction schedules.

- Capacity accreditation updates that raise or lower the value of hybrids and long duration storage.

- Pipeline final investment decisions that align with new plants, and the timing of LNG trains that compete for the same molecules.

- Interconnection timelines at brownfield sites versus greenfield locations, which will determine who can credibly commit to 2027 service.

The bottom line for buyers and builders

Federal urging to delay coal retirements, state incentives for dispatchable power, and Southeastern policy flexibility add up to a new planning baseline. Coal will not surge, but it will linger in strategic roles. Gas will build faster where dollars and permits align. Reliability will be priced with more clarity. Emissions will be managed with more sophisticated procurement, not just more volume of the same product.

For data center operators and hyperscalers, the best portfolios will blend physical delivery, accredited capacity, and hourly clean energy, with fuel and transport secured for any thermal tolls. For utilities and IPPs, the winners will be the projects that can show up early, dispatch when needed, and prove it on contract. For OEMs, it will be a cycle built on speed, flexibility, and retrofit readiness, not just nameplate efficiency.

The grid is not turning away from clean energy. It is buying time and optionality while it races to catch up with AI scale demand. The next five years will reward those who can build firm megawatts fast, deliver clean megawatts smart, and stitch both into contracts that survive tight hours without blowing up the carbon ledger.