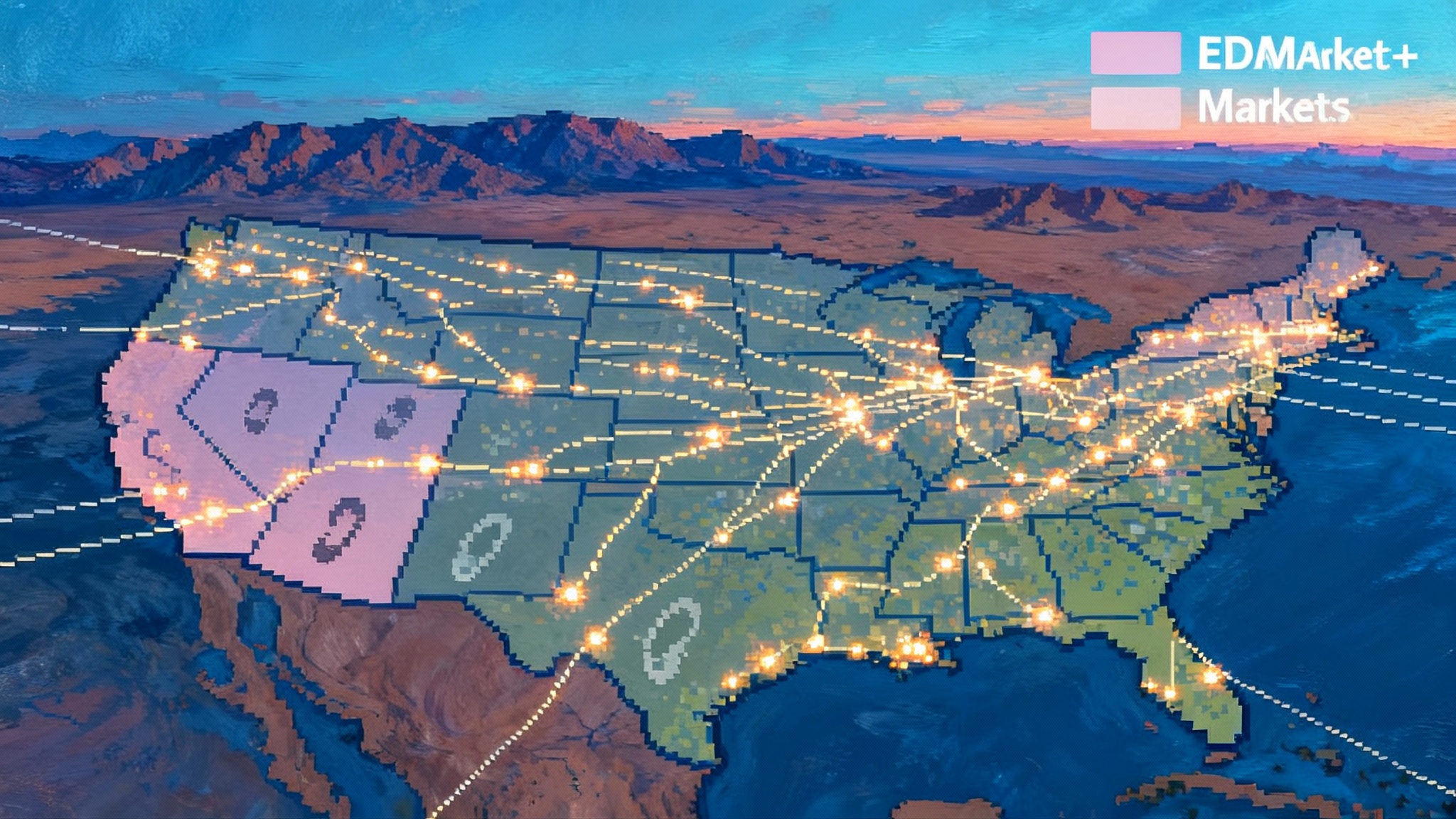

EDAM vs. Markets+: The West’s Two-Market Era Begins

FERC’s 5 approvals turned CAISO’s EDAM and SPP’s Markets+ from concepts into timetables. See the 2026–2027 launch windows, which utilities are lining up where, and how the two-market era could reshape prices, reliability and curtailment across the West.

The moment the West picked a lane

For a decade the Western Interconnection debated how to move beyond real-time coordination into regional day-ahead trading. That debate is ending. In 2025 two milestones arrived. First, the Federal Energy Regulatory Commission approved the Southwest Power Pool’s Markets+ tariff on January 16, as confirmed in FERC approval of the Markets+ tariff. Second, on August 29 the California ISO secured an order accepting enhancements to the Extended Day-Ahead Market’s congestion revenue allocation, keeping EDAM on track for 2026 activation, per FERC order on EDAM congestion revenue allocation.

Those approvals unlocked a rush of utility commitments. Arizona’s investor-owned and public power utilities advanced into Markets+. Public power in the Pacific Northwest lined up phase two funding. On the EDAM side, PacifiCorp and Portland General Electric locked in 2026 start dates, with a cohort of public power and municipal entities queued up for 2027, and Imperial Irrigation District aiming for 2028. What had long been a theoretical map is now a calendar.

This is the West’s two-market era. It will not be static or perfectly tidy, but it is arriving fast.

What changed in 2025

- Markets+ moved to implementation. FERC accepted the Markets+ tariff in January. In April, FERC also approved the phase two funding mechanism. SPP confirmed sufficient commitments to begin systems buildout and maintained a 2027 launch target for day-ahead and real-time operations.

- EDAM tightened its design. After earlier FERC actions on the EDAM framework and access charge, the August 29 order accepted CAISO’s congestion revenue allocation enhancements, a key element for how congestion rents flow back to participants. CAISO’s plan points to activation milestones beginning May 2026.

- Commitments snowballed. In the Desert Southwest, APS, SRP, TEP and UniSource declared Markets+ as their path and moved into phase two. In the Pacific Northwest, BPA funded phase two while continuing a parallel evaluation. Chelan, Grant, Tacoma and Powerex joined the Markets+ funding group. In the Mountain West, entities including Tri-State signaled engagement and Xcel Energy Colorado outlined plans to seek approvals.

- EDAM’s queue firmed up. PacifiCorp targets spring 2026. PGE aims for fall 2026. Public power including BANC and LADWP target 2027, along with PNM and Turlock. Imperial Irrigation District is aiming for 2028 while joining CAISO’s real-time market.

Who is aligning where

The map is still fluid, but the contours are clear.

-

Likely EDAM footprint by 2026-2027

- CAISO’s balancing area remains the anchor.

- PacifiCorp, spanning six states, anchors the northern and interior West in 2026.

- Portland General Electric follows in 2026, tightening coordination across Oregon.

- The Balancing Authority of Northern California joins in 2027, bringing SMUD and partners through their JPA.

- LADWP targets 2027, which would put all California balancing authorities into CAISO-operated markets by decade’s end when combined with IID’s 2028 plan.

- PNM targets 2027. Turlock also advances toward a 2027 window.

- NV Energy has signaled intent and could round out a Nevada link if it finalizes its path.

- WAPA’s Sierra Nevada region is pursuing negotiations under the BANC umbrella.

-

Likely Markets+ footprint by 2027

- Arizona pillars: APS, SRP, TEP and UniSource aligning on a common timeline.

- Pacific Northwest cohort: BPA funds phase two while evaluating day-ahead paths; Chelan, Grant and Tacoma participate in the buildout with Powerex engaged.

- Mountain West engagement: Tri-State is among phase two participants. Xcel Energy Colorado has indicated intent to seek approval to move forward.

-

Entities still deciding or hedging

- BPA retains optionality while co-funding Markets+ implementation, signaling that public power wants a viable second market to weigh against EDAM.

- Idaho Power has publicly leaned toward EDAM. Others monitor both markets and the emerging treatment of seams.

No one should mistake this as a forever map. The West will keep edging lines in pencil as governance evolves, seams rules clarify and early operational data arrives.

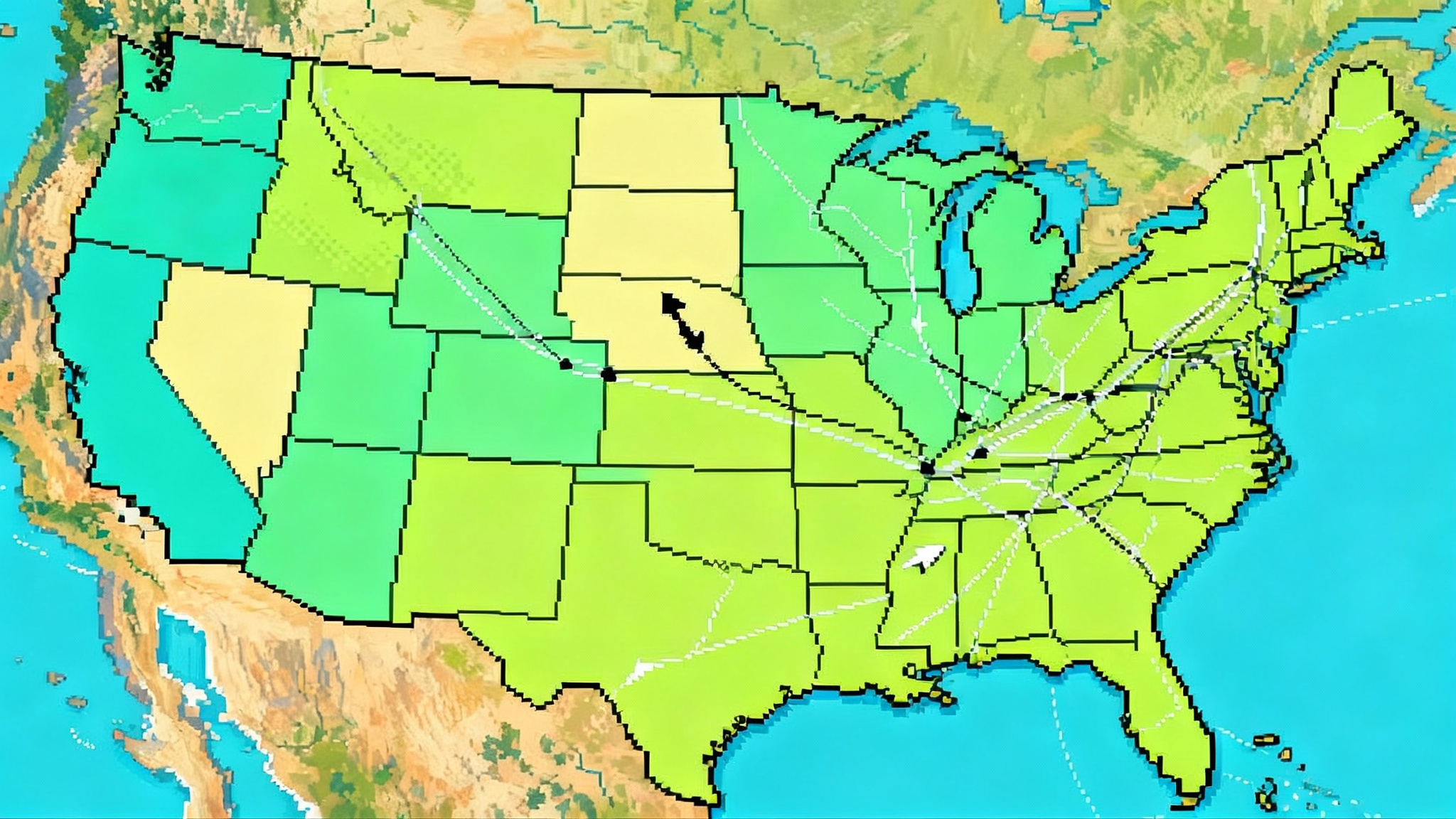

Reliability: the first test will come in summer

Reliability is the main reason to care. Both EDAM and Markets+ move the region from hour-by-hour balancing toward full day-ahead unit commitment across a broader footprint. That matters during heat waves, winter storms and shoulder-season swings, especially as AI load rewrites regional demand.

- Shared commitment and reserves. Broader day-ahead co-optimization lets the market commit the right mix of thermal, hydro and storage earlier. It reduces last-minute starts, improves ramp coverage and enables sharing of operating reserves.

- Diversity and risk pooling. The West’s geography spans coastal wind, desert solar and multi-basin hydro. A day-ahead platform that can pull on that diversity makes it less likely a single weather pattern or outage will force emergency actions.

- Scarcity signals you can plan around. When capacity is tight, nodal prices should reflect it day ahead, giving generators and demand response providers time to line up fuel, staffing and load reductions.

The true reliability measure will be emergency hours avoided. By summer 2026, with PacifiCorp and PGE inside EDAM’s day-ahead engine, the West will begin to see how much risk is reduced simply by scheduling across a bigger footprint. By 2027, an Arizona-centered Markets+ cluster should offer a similar demonstration for the Desert Southwest.

Congestion relief: from redispatch to coordination

Congestion in the West is not just about overloaded lines. It is about the friction created when many balancing authorities optimize inside their boundaries and then try to trade across them. Day-ahead co-optimization lowers that friction.

- Better use of existing paths. A day-ahead market schedules flows with a full network model, pricing and prioritizing transfers across constrained interfaces within a single optimization. That reduces manual redispatch and wheeling workarounds.

- Transparent congestion rents and rights. EDAM’s accepted congestion revenue allocation clarifies how rents flow back to participants. Rights and allocations sharpen planning and hedging for utilities that straddle congested interfaces.

- Fewer surprises across seams. Two different day-ahead markets will still create a seam. Intertie scheduling rules, firm transmission requirements and tagging timelines will matter. But a well-defined seam between two organized markets is often easier to manage than dozens of bilateral schedules converging in the last hour.

Expect early gains on corridors like California to the Northwest and Four Corners into Arizona. The step change comes not from building new lines overnight, but from committing generation with a model that sees regional constraints and opportunities the same way on both sides of the intertie.

Renewable curtailment: shifting from reaction to prevention

Curtailment happens when supply cannot be delivered or absorbed. Both markets should reduce it.

- Day-ahead absorption. Solar-heavy systems can schedule exports day ahead into neighboring load pockets with morning and evening demand shapes, while hydro and storage plan to shift energy into the right hours.

- Hydro flexibility monetized at scale. Northwest hydro can shape to complement desert solar and interior wind. A day-ahead price signal compensates that flexibility, making it routine rather than a special bilateral.

- Storage gets better instructions. Storage needs clear prices in specific hours to operate efficiently. Day-ahead markets provide those instructions a day in advance, then refine them in real time.

If curtailment drops and imports during stressed hours rise without emergency actions, the markets are doing their job.

Price formation: similar engines, different philosophies

Both EDAM and Markets+ will produce locational marginal prices in day-ahead and real-time. The differences are in governance, access charges and the scope of services.

- CAISO EDAM. EDAM extends CAISO’s day-ahead optimization beyond the ISO’s balancing area. Participating entities make transmission available into EDAM and receive credits shaped by the access charge and congestion revenue allocation. The design relies on CAISO’s single-BA engine with joint authority from the Western Energy Markets Governing Body for EDAM and the real-time WEIM tariff elements.

- SPP Markets+. Markets+ is a day-ahead and real-time bundle designed for entities outside SPP’s existing RTO footprint. It uses SPP’s market design and governance model adapted for the West, with stakeholder-led structures and a dedicated market monitor. Participants expect a full commitment and dispatch stack, not just an overlay on an existing BA.

- Scarcity and uplift. Each market has its own scarcity pricing and uplift mechanics. In practice the biggest differences for participants will be in settlement details and the way transmission costs are recovered.

Transmission planning: coordination is the new baseline

Markets do not build lines, but they change the math that justifies them.

- Better congestion data. Transparent rents and modeled flows create a shared picture of where upgrades pay for themselves, dovetailing with FERC’s 1920-A planning rule.

- Regional planning hooks. SPP’s parallel RTO expansion into the Western Interconnection, slated to bring new western members into full RTO services starting in April 2026, gives the Mountain West a more integrated planning home. EDAM keeps California and neighbors coordinated on day-ahead flows and elevates intertie upgrades as shared priorities.

- Queue discipline. With more predictable congestion and clearer price signals, interconnection studies have a firmer basis for deliverability assumptions. Developers can site projects where day-ahead markets show persistent value, similar to how Texas goes 765 kV by 2030 reframes corridor economics in ERCOT.

Expect an iterative cycle. Market data informs quick-hit upgrades and reconductoring in the near term, then frames multi-year backbone proposals that cross multiple jurisdictions.

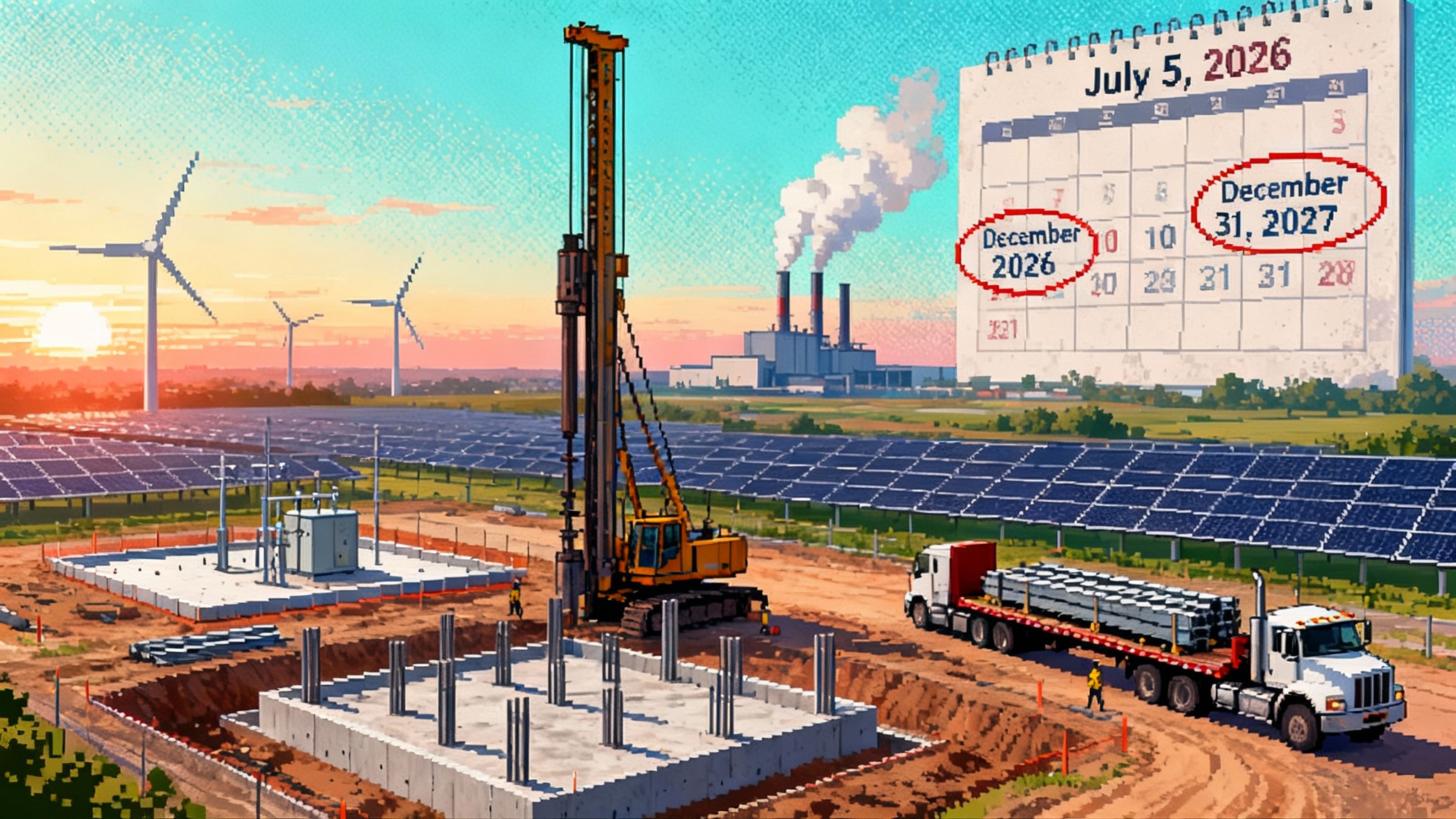

The 2026-2027 timeline at a glance

-

2026

- EDAM hits activation milestones beginning May 1, with PacifiCorp targeting spring participation and PGE targeting fall. Early lessons will center on multi-state flows and hydro coordination.

- SPP’s western RTO expansion begins operations in April, relevant for entities that may treat Markets+ as a stepping stone to full RTO services or pair Markets+ with RTO membership on the eastern side of their systems.

-

2027

- EDAM expands with BANC, LADWP, PNM and Turlock. That puts most of California and portions of the interior West on a common day-ahead platform.

- Markets+ launches with Arizona utilities and a Northwest cohort of public power and marketers, plus Mountain West participants that complete approvals.

-

2028

- Imperial Irrigation District targets EDAM participation, closing a long-standing gap among California balancing authorities.

Dates may shift at the margins as software, modeling and regulatory approvals progress. The direction of travel is set.

Seams and governance: where the hard work remains

Two markets create a seam. That seam can be a friction point or a managed frontier.

- Scheduling and priority rules. How firm transmission and wheel-through priority apply between EDAM and Markets+ will influence real transfer volumes. Expect detailed protocols and joint testing as go-lives approach.

- Joint operations during stress. The first major heat wave after both markets are live will prompt call-downs and dynamic transfers. Operators will need playbooks that minimize conflicting instructions.

- Governance keeps evolving. EDAM’s governance has shifted to give the Western Energy Markets Governing Body primary authority over relevant tariff sections once non-ISO participation passes a threshold. Markets+ launched phase two governance in 2025 with a dedicated market monitor and stakeholder committees.

What it means for participants

-

Utilities and load-serving entities

- Choose your path with a seams strategy. If neighbors concentrate in one market, alignment can simplify operations. If your portfolio straddles the seam, negotiate firm transmission and craft hedges that span both markets.

- Focus on day-ahead flexibility. Storage, hydro shaping and fast-start thermal units gain value under co-optimization. Contract for it and price it explicitly.

- Track curtailment and import dependence. Regulators will ask how market participation reduces emergency actions and lowers customer costs.

-

Generators and marketers

- Build congestion views that extend beyond your BA. Nodal prices and congestion rents will create new trade lanes and bottlenecks. Use day-ahead CRR or TCR products where available to hedge.

- Prepare for design nuance. Uplift rules, shortage pricing and credit requirements differ. Set up settlement and risk systems that can handle both designs if you trade across the seam.

-

Regulators and consumer advocates

- Demand measurement and transparency. Set expectations for quarterly reporting on reliability events avoided, curtailment reduced and customer savings.

- Plan for iterative improvement. Market designs will need tuning as participation expands. Insist on clear stakeholder processes and independent market monitoring.

The bottom line

The West is not choosing one market. It is choosing two. EDAM and Markets+ are real schedules with real money behind them. By 2026 EDAM will be committing generation across much of California, Oregon and the interior West. By 2027 the Desert Southwest and a slice of the Northwest will test a different model under Markets+. The experiment is not about ideology. It is about which designs produce fewer emergencies, fewer curtailments and better prices for customers.

If you are a utility leader or trader, the next fifteen months are your runway. Lock down intertie rights. Align contracts with day-ahead price signals. Prepare to measure what matters. The West’s two-market era is beginning, and the first grades will arrive as early as next summer.