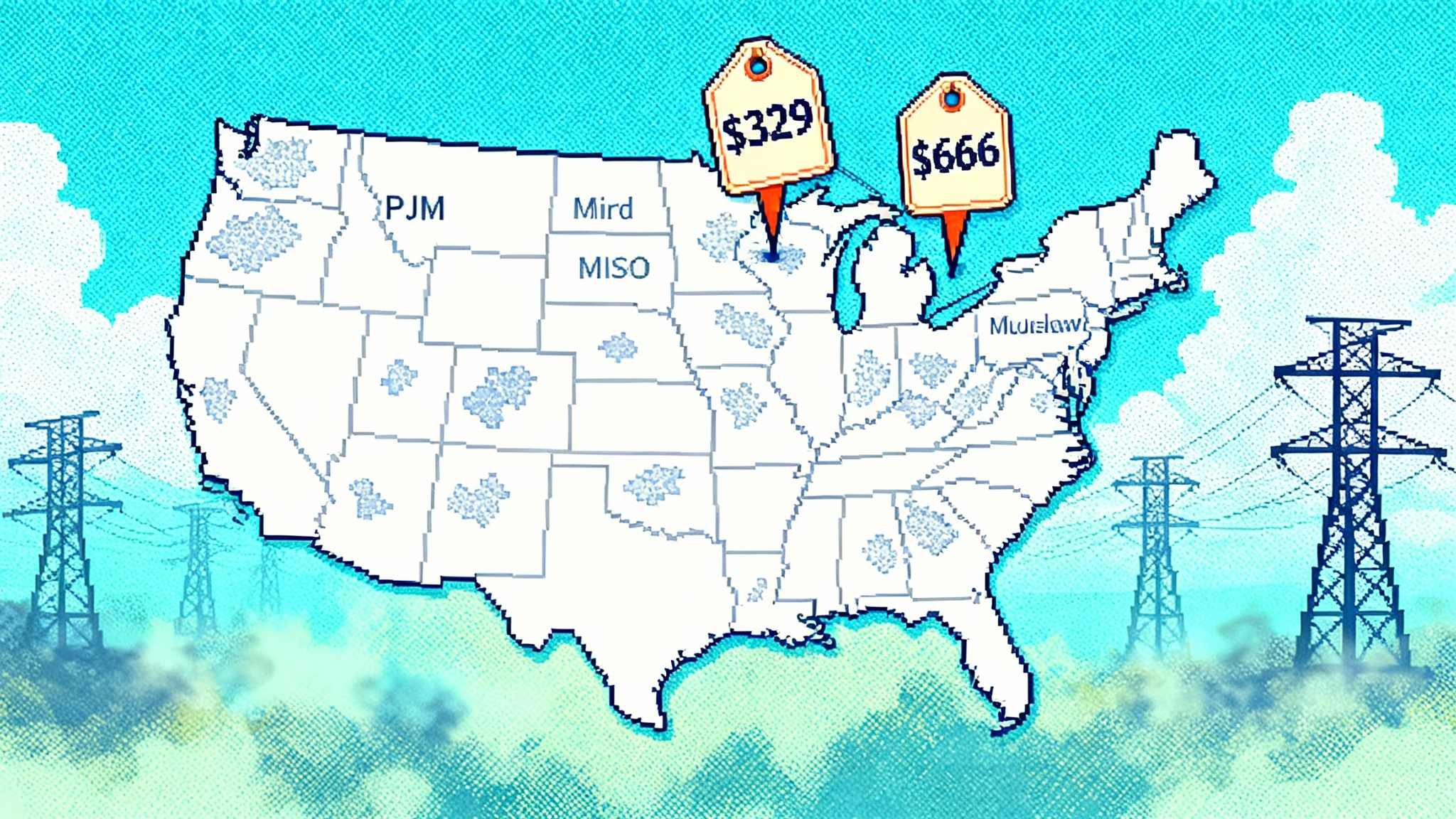

Capacity price shock: PJM hits the cap, MISO's summer soars

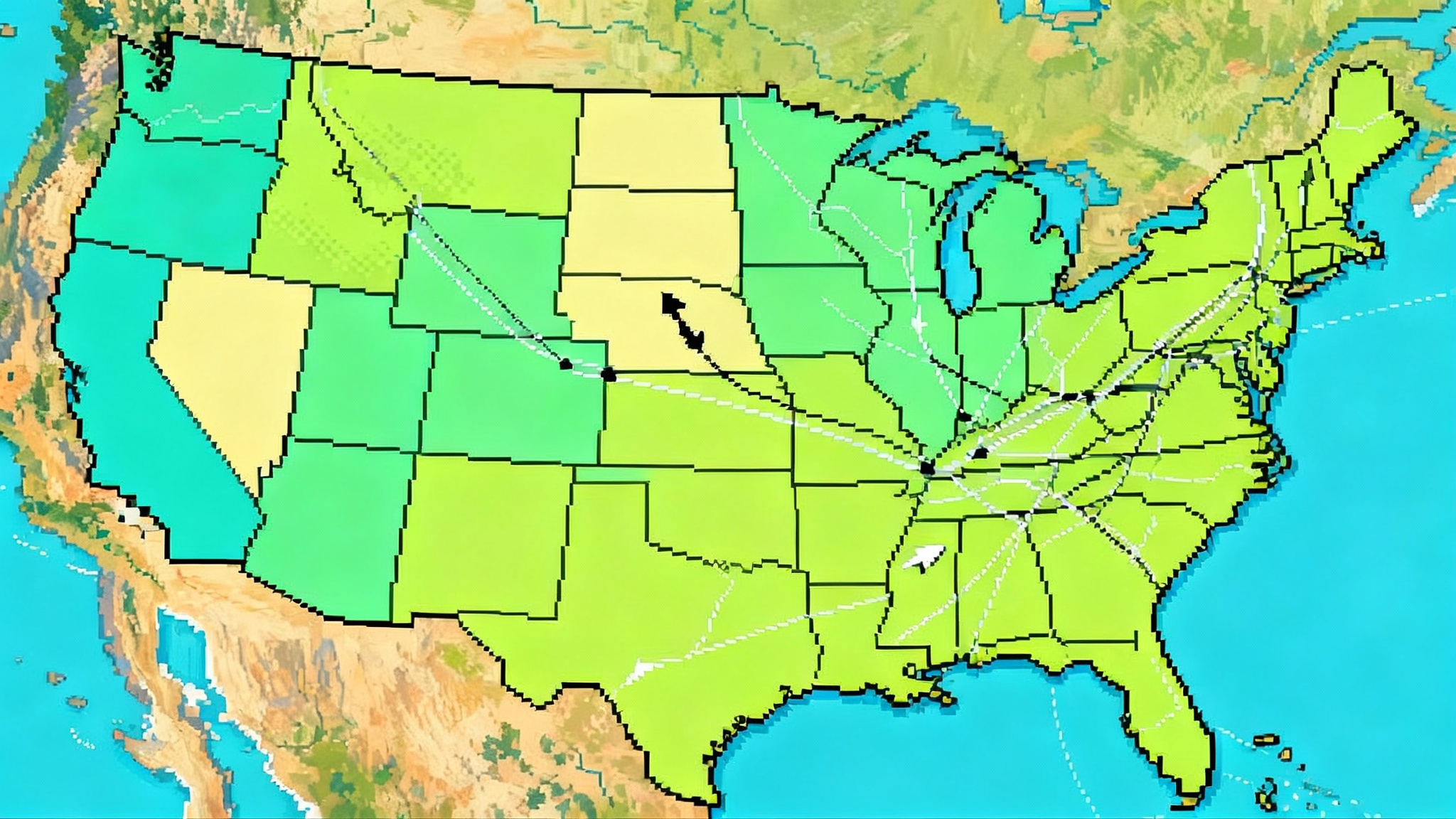

PJM’s 2026-2027 Base Residual Auction cleared at the price cap while MISO’s summer PRA spiked to $666.50 per MW-day. Here is what changed in 2025, where scarcity is tightest, and how developers and large buyers can position for 2026-2030.

The headline numbers and why they matter

On July 22, 2025, PJM’s 2026-2027 Base Residual Auction cleared at $329.17 per MW-day across the entire RTO. The price hit the cap and did so uniformly, a signal that supply tightness is no longer isolated to a handful of pockets but has become system wide. PJM also secured more than 134 GW of unforced capacity, enough to meet peak load plus reserve margin but with very little slack. See the official figures in PJM’s July 22 auction result.

Six weeks earlier, on April 28, 2025, MISO published its 2025-2026 Planning Resource Auction results. The new reliability-based demand curve and a tighter summer balance pushed the Summer clearing price to $666.50 per MW-day across the footprint. The other seasons cleared far lower, but the summer price sets the tone for developers and large buyers planning build and contracting strategies around peak risk. See the seasonal prices in MISO’s April 28 PRA results.

These two datapoints are not isolated blips. They are a combined message from the country’s two largest centrally dispatched regions that reliability risk is rising faster than supply additions can catch up, and that the market is now paying for it.

What changed between 2024 and mid-2025

Three forces converged.

-

Demand growth from large loads. Data center development has accelerated to a pace the Mid-Atlantic and Midwest have not seen in decades. Northern Virginia’s cluster has led the way for years, but new campuses are now landing across Maryland, Pennsylvania, Ohio, Illinois, and Indiana. These are not incremental retail customers; single sites can require the output of a mid sized power plant with high load factors that concentrate during summer afternoons and early evenings. For context on how digital demand is reshaping the system, see how AI load rewrites the grid.

-

Tighter reserves and retirements. Coal exits, delayed gas projects, and slower transmission build have closed the gap between accredited capacity and target reserves. In PJM’s 2025-2026 auction, zonal prices in BGE and Dominion already exceeded the RTO average, a warning that local deliverability constraints were binding. By 2026-2027, the whole RTO effectively converged at the cap.

-

Accreditation and market design reforms. MISO’s switch to a reliability-based demand curve began pricing capacity risk more steeply as the system approaches minimum requirements. PJM continues to refine accreditation for variable and limited-duration resources, emphasizing performance during the highest-risk hours. Across both markets, those adjustments have lifted capacity prices toward the hours and seasons that matter most.

None of these factors is transitory. Demand growth from new digital, manufacturing, and electrification loads has multi-year momentum. Permitting and interconnection timelines for new generators and lines are measured in years, not months. And accreditation methodologies will continue to reward resources that reliably show up during the scarcest hours, not merely nameplate ratings.

Where scarcity is tight: BGE and Dominion

Even though the 2026-2027 PJM auction cleared uniformly, the system level price masks locational stress that still clusters in Baltimore Gas and Electric and Dominion. Here is why those pockets remain critical:

-

Load growth has been concentrated. Northern Virginia’s data center cluster continues to expand and is mirrored by projects spilling into Maryland and the broader Mid-Atlantic. The load profile is flatter than traditional commercial load and pushes local wires and transformers hard, especially on hot, humid days.

-

Deliverability limits are binding. Transmission transfer capability into these LDAs is constrained by both line capacity and substation upgrades. When local load grows faster than import capability, the market must clear more capacity locally or lift the price to pull in new supply.

-

Siting and interconnection are slow. Even when developers have projects ready, local permitting, community acceptance, and substation work can stretch timelines beyond a single capacity delivery year. That keeps existing resources valuable and pushes buyers to seek near term solutions like demand response and distributed generation.

Bottom line: expect continued volatility in BGE and Dominion capacity adders and ancillary charges even if the headline RTO number looks stable.

Anatomy of the price jump

Think of the capacity price as a function of three variables: how much accredited capacity you have, how high your reliability target is, and how steeply the curve pays as you approach that target. In 2025, all three moved in a bullish direction across PJM and MISO.

-

Accredited capacity fell for some fleets. Variable renewables and limited-duration storage often receive less than 100 percent accreditation. Coal and gas units with maintenance backlogs or deratings can also lose UCAP. The accounting is tighter and the peak hours are later in the day, so every percentage point matters.

-

The requirement rose. Weather-normalized peak forecasts have climbed, and target reserve margins have not softened. PJM’s and MISO’s planning assumptions now reflect more frequent high-stress conditions.

-

The curve got steeper in MISO. The reliability-based demand curve explicitly pays more as you get close to shortfall conditions, which is exactly what happened for Summer 2025.

When you combine a higher requirement with a slightly smaller pile of accredited MWs and a more scarcity-sensitive curve, the market does exactly what it is designed to do: it pays up.

Implications for 2026-2030 build decisions

The numbers now justify decisions that were marginal in 2023.

-

Simple-cycle gas peakers. At roughly $700 to $1,100 per kW installed for modern aeroderivative or frame CTs, a capacity payment around $120 per kW-year in PJM can support a material slice of fixed costs before a single MWh is sold. In MISO, the annualized equivalent implied by Summer 2025 pricing is even more compelling. Risks remain. Fuel supply and pipeline interconnects are not trivial in congested corridors, siting timelines can be long, and air permits are getting tighter. Yet for developers with pipeline-ready sites or brownfield upgrades, these auctions are the green light to move.

-

Grid batteries. Four-hour lithium projects are now clearing in both markets with rising accredited contributions during the peak net load window. Capacity revenues can cover a meaningful fraction of fixed costs when stacked with energy arbitrage and ancillary services. The catch is accreditation risk. If peak risk shifts deeper into the evening, some projects may require longer duration or hybridization with on-site thermal or demand response to preserve capacity value. Interconnection speed and queue position will separate winners from followers. Policy shifts affecting solar-paired storage also matter; note how June 2025 tariffs reset solar.

-

Demand response and load flexibility. These auctions reward fast, verifiable reductions during a handful of tight hours. Modern DR portfolios built around commercial HVAC, cold storage, data center backup systems, and industrial processes are now competitive with peakers on a risk-adjusted basis. In BGE and Dominion, building owners and campuses that can deliver firm DR will find a seller’s market in bilateral capacity contracts.

-

Uprates and life extensions. Existing nuclear and gas fleets can monetize incremental UCAP via maintenance, winterization, and minor uprates. In a $120 per kW-year environment, a one or two percent accreditation gain is real money.

-

Hybrid siting near load. Storage-plus-solar on constrained substations in BGE and Dominion can capture both capacity and local value streams if they relieve distribution bottlenecks. Expect more private-wire and behind-the-meter configurations to emerge where interconnection timelines are longest.

Near term bill impacts

Capacity is only one piece of a retail bill, but it is a volatile one. For large commercial buyers in PJM, the math is straightforward. A site with a 10 MW capacity tag will owe on the order of $1.2 million per year in capacity charges at $329.17 per MW-day, before any zonal adders. Improve your peak shaving and that bill falls immediately. Fail to manage your tag and it climbs just as fast.

For residential customers on default service, pass-through mechanics vary by state and utility. Expect modest to meaningful upward pressure in 2026 and 2027 as supply portfolios roll and new capacity vintages feed into retail rates. In BGE and Dominion, the impact will be more noticeable because local charges ride on top of the RTO number. Households will not see a line labeled capacity, but they will feel it in the supply component of the bill and, in some cases, in riders that recover capacity and transmission costs.

MISO’s Summer 2025 price spike will be most visible to customers with short positions or contracts that index to PRA outcomes. Many utilities self-supply and hedge, which dampens the pass-through. But for competitive retail service and community choice aggregations that rely on index products, the summer step-up will show through in 2025 and again in 2026 if the system remains tight.

State and federal responses to watch

-

Interconnection reforms. PJM and MISO are working through backlog-clearing reforms aligned with federal guidance. Cluster studies, tighter readiness milestones, and penalties for speculative positions should accelerate projects that can actually reach COD. The immediate effect is to prioritize shovel-ready sites.

-

Siting modernization. States are updating siting laws for both generation and high-capacity data centers. Expect clearer standards for noise, water, and backup generation at data centers and more predictable timelines for peakers and batteries that locate on or near existing substations.

-

Targeted transmission. Long-haul lines will take years, but targeted 230 kV and 500 kV upgrades into BGE and Dominion can unlock import capability and reduce local scarcity. Reconductoring, dynamic line rating, and transformer additions are the near term tools. Where new corridors are unavoidable, public private partnerships and federal backstops will get more attention. For the shifting rules of the road, see how FERC 1920-A shifts planning.

-

Reliability incentives. MISO’s new demand curve is already signaling summer risk. PJM continues to refine performance-based constructs that pay resources for showing up during the worst hours. Expect smaller, more frequent scarcity events to have outsize revenue impact.

-

Load management standards. Several states are moving to standardize building peak reduction through smart thermostats, real time pricing pilots, and demand response integration in default service. This is the fastest path to flattening the last few net load hours that drive most of the capacity cost.

What buyers and developers should do now

-

Plan for two years of elevated prices. Even if new builds start in 2026, meaningful relief across the RTO footprints is unlikely before late decade. Budget for capacity charges to remain high and volatile.

-

Get serious about capacity tags. In PJM, peak load contribution drives most of the dollar outcome. Verify your tag calculations, test your operational playbook for peak days, and align incentives between facilities and procurement teams so that peak shaving happens when it matters.

-

Lock interconnection and permits. If you have a site in BGE or Dominion, ring fence it. Secure queue position, finish studies, and get permits in hand. Capacity at the cap will not last forever; the window to bank premium value is 2026-2028.

-

Think portfolio, not project. For batteries, the best outcomes stack capacity with ancillary services and well-structured energy offtake. For peakers, fuel assurance and black start contracts can add resilience and revenue. For DR, invest in telemetry and M&V so that every event counts.

-

Hedge seasonality. In MISO, the summer premium is the whole story. Align contracts to cover summer risk explicitly, then buy the shoulder seasons opportunistically.

The 2026-2030 map

-

PJM. Expect a build wave of fast-start gas and 4 to 6 hour storage near load, especially in Maryland and Virginia. Nuclear uprates and lifetime investment will pencil for several plants. Solar will keep growing but with a stronger emphasis on pairing and deliverability, not standalone acreage. Targeted transmission upgrades will selectively cool the hottest pockets, but only after 2027.

-

MISO. Summer scarcity will drive peakers and batteries in urban and industrial load centers from Minnesota to Michigan and down through Illinois and Indiana. Seasonal accreditation makes resource mix more nuanced; developers who shape output to summer evenings will win more value. Expect competitive bilaterals for Summer 2026 and 2027 as buyers seek certainty.

-

Cross market developers. If you can recycle a late stage site that stalled in 2022, dust it off. This price environment supports final investment decisions with fewer contingencies. But take accreditation risk seriously and model downside cases where prices fall back toward long run equilibrium by 2029 as new capacity arrives.

The takeaway

Capacity markets are doing exactly what they were designed to do. When risk rises, they pay more to keep the lights on. PJM’s $329.17 per MW-day RTO-wide result and MISO’s $666.50 summer clearing price are not a glitch. They are a clear call for new, reliable megawatts and for smarter, more flexible demand. If you build, build near load and build fast. If you buy, manage your peaks and hedge your summers. Either way, the next few years will reward those who plan for scarcity rather than hope it fades.