Inside Citi's 5,000-user pilot for bank‑grade AI agents

Citigroup is running a four to six week pilot of agentic AI for 5,000 employees inside Stylus Workspaces, using models like Gemini and Claude. Here is how the bank is enforcing budgets, human oversight, and audit trails, and the playbook others can reuse.

A regulated giant tests real agents, not just assistants

Citigroup has moved from dabbling in generative AI to testing true multi-step agents inside its walls. The firm is piloting agentic capabilities for 5,000 employees in Stylus Workspaces, evaluating how far AI can carry a task from prompt to completed workflow while staying within strict guardrails. According to a recent Wall Street Journal report on Citi's agents, the pilot will run four to six weeks, uses models such as Gemini and Claude, and is designed around hard cost controls to keep spend predictable. The bank wants to measure productivity impact, adoption patterns, and where agents actually create value, not just novelty.

This is not a toy launch. It is a major regulated institution putting agents into day-to-day work and signaling how bank-grade governance for agents might look. The big questions are the ones every enterprise is now asking. How do you keep costs contained when agents chain tools and run for minutes at a time. How do you ensure humans stay in control when an AI can plan several steps ahead. How do you build an audit trail that an examiner can trust.

From prompts to plans: what changes when AI becomes agentic

Most organizations started with assistants that summarize documents or draft emails. Agents change the shape of work. A request like "research this counterparty, build a risk-aware profile, and prepare a translation for the local team" moves from three or four separate queries to a single instruction that the system decomposes into steps. Planning, tool use, and handoffs between steps happen automatically, bounded by policies. In a bank, that means more than convenience. It means connecting to internal systems, orchestrating workflows that span data sources, and doing so in a way that is observable, reversible, and approvals-aware.

Why does this matter now. Three reasons stand out.

- Cost curves are dropping but are still volatile, so organizations need enforceable budgets.

- Governance expectations for model risk, data protection, and operational resilience already apply, and agents surface new failure modes.

- The productivity upside is only realized when workflows shift, not just outputs. Agents that shave minutes off reading time are useful. Agents that collapse entire processes into one click change headcount plans and service levels.

What we can infer from Citi’s design choices

Citi has not published a detailed control catalog for Stylus Workspaces. Still, the contours are visible. The pilot is time-boxed. The user group is defined. The models are plural, not single-vendor. Cost control is a first-class requirement. Those variables alone tell a governance story.

- Time-boxed pilot. Containing scope allows hard comparisons against baselines and lets control owners refine policies before broad release.

- Multi-model strategy. Swapping models based on task and cost pushes the team to normalize logging, red-teaming, and evaluation across providers. That mirrors the way the enterprise agent stack goes mainstream across providers.

- Cost caps up front. When you ask agents to plan and act, compute becomes a shared resource. Input length caps, step limits, and early stopping are practical guardrails.

Context from Citi’s broader AI program backs this up. In a Citi 2025 AI strategy update, the firm reiterated that it is scaling internal AI tools, training champions across the company, and preparing for agentic capabilities as the next step in its roadmap. In other words, the pilot rides on governance and enablement work that is already in place.

Bank-grade guardrails: what good looks like

Enterprises outside finance can copy a playbook here. The constraints that make sense in a global bank are rarely overkill for other industries. If anything, they future-proof you for audits and incidents.

1) Cost governance that agents cannot ignore

- Token and time budgets per task. Set maximum input size, maximum steps, and maximum wall-clock time. Every task either finishes within budget or the agent degrades gracefully, returns partials, and asks for approval to continue.

- Tiered budgets by risk. Low-impact drafting might allow more generous tokens. High-impact system actions must be smaller, faster, and reviewed.

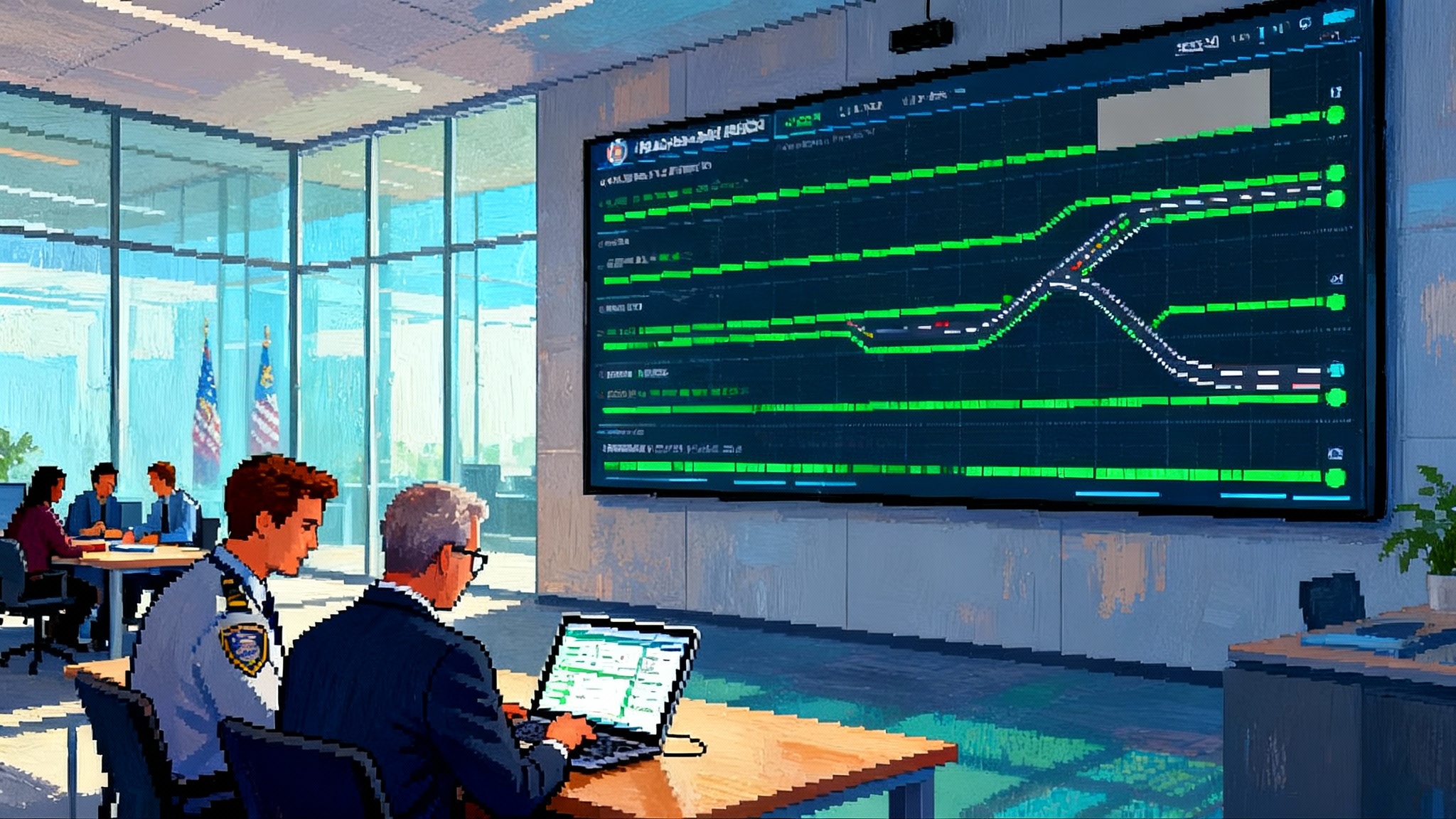

- Real-time budget telemetry. Expose spend per user, per agent, per business unit in dashboards that finance, engineering, and risk can all see. Alert on runaway jobs and retry storms.

2) Human oversight that is visible in the workflow

- Pre-approval for high-impact actions. Any step that changes data in a system of record, touches client information beyond a defined scope, or triggers external communication should require a human click. Make the approval an explicit step, not a chat suggestion.

- Structured reviews, not free-form comments. Use checklists tied to policy. Capture who reviewed, what they approved, and why exceptions were granted.

- Instant pause and rollback. Give operators and reviewers the ability to halt a run and revert the last state change without opening a ticket.

3) Auditability by design, not as an afterthought

- Immutable logs for every step. Record prompts, intermediate plans, tool calls, parameters, and outputs. Hash and time-stamp them. Store hashes in a write-once store so you can prove nothing changed.

- Versioned everything. Tie each run to a specific model version, policy set, tool adapter version, and data snapshot. This is how you reproduce behavior when something looks odd months later.

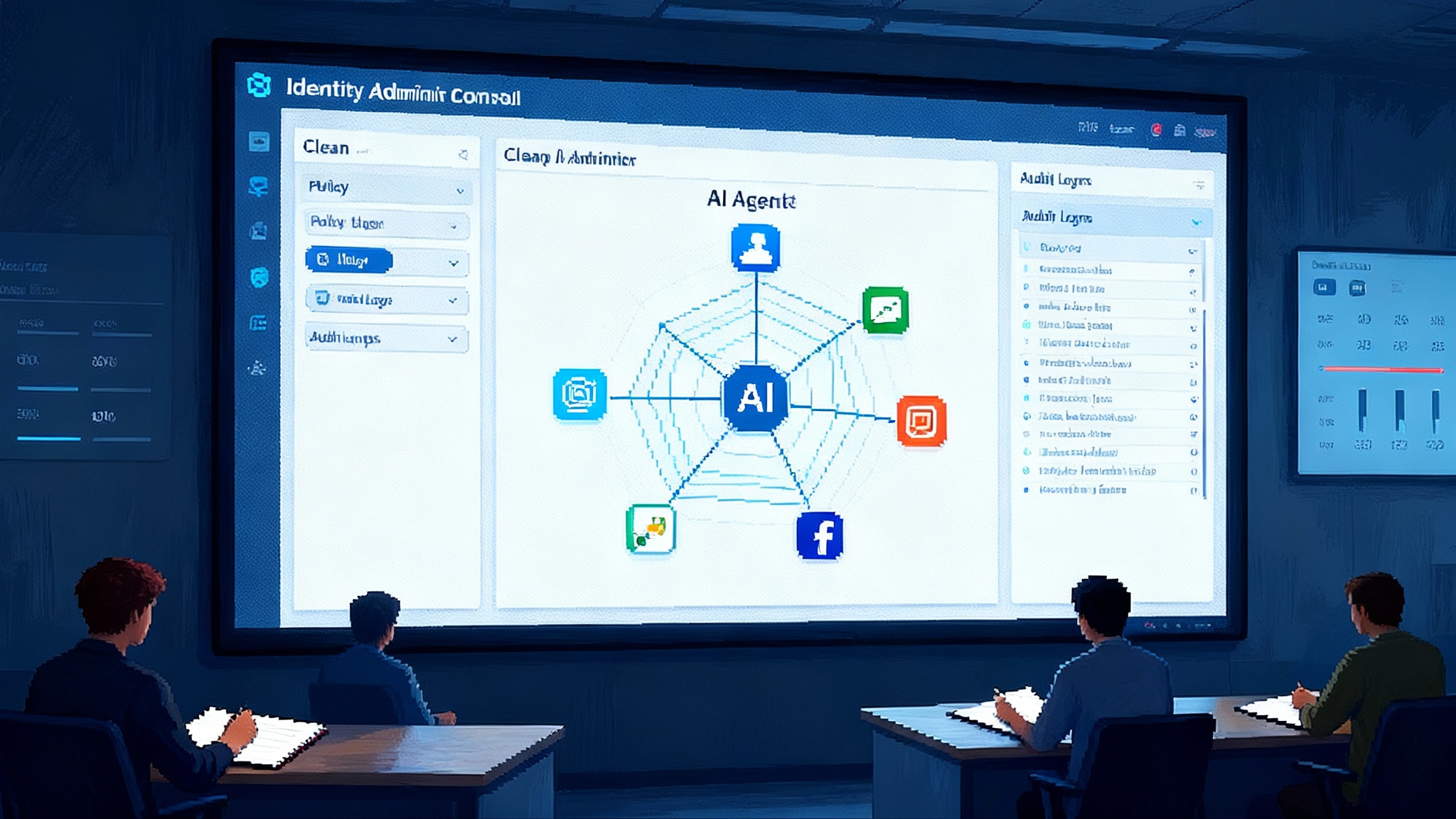

- Traceable identity. The agent itself needs an identity separate from end users. Every call to an internal system should carry both identities, so you can attribute who asked and which agent acted. This echoes the view that identity is the control plane.

4) Safety nets for content and decisions

- Deterministic wrappers around risky tools. When the agent calls a system that can make changes, interpose a validation layer that enforces schemas, units, and policy rules. Reject ambiguous instructions outright.

- Multi-agent cross-checks for critical tasks. Use a second agent as a verifier for calculations, reconciliations, or sanctions logic, and escalate to a human if checks disagree.

Measuring ROI where it actually matters

Citi has been explicit that the pilot is meant to answer whether the juice is worth the squeeze. That is the right framing. Enterprises should borrow a similar scoreboard.

Baseline first. Before pilots begin, capture the current cost and time of the target workflows.

- Elapsed time per task and per case. Not just keystrokes saved, but calendar time from request to done.

- Human hours and grade mix. Minutes by role for each step. A shift from specialized roles to generalists can be as valuable as raw time savings.

- Rework rate and defect rate. How often work loops back for fixes and why.

- Queue age and backlog volatility. How many items wait more than a threshold and how that fluctuates.

Now run the pilot with clean attribution.

- Uplift in throughput at the same quality. If output volume rises without extra rework, the agent is doing real work.

- Cost per completed workflow. Combine model usage, tool execution, and human oversight minutes into one unit cost.

- Variance and tail events. Averages are comforting, but the tails kill budgets. Track the 95th percentile of task cost and time.

- Approval friction. Count approvals per workflow and measure how long they take. High friction means you either need better policies or agents that produce higher confidence outputs.

Translate to a CFO-ready view.

- Payback period. Pilot-level math is fine. Take the delta in monthly operating expense for the workflow, account for incremental platform and enablement costs, and estimate time to break even.

- Sensitivity to model price cuts. Show the same curves with current, minus 25 percent, and minus 50 percent model prices. Leadership will want to see how quickly ROI improves as prices fall.

- Headcount redeployment rather than reduction. Map hours saved to a backlog you already have. This reframes gains from hypothetical to concrete.

A pragmatic compliance playbook any enterprise can adopt now

You do not need a bank charter to benefit from bank-grade thinking. Use this playbook to stand up an agent pilot that will hold up under scrutiny.

- Define the scope like a change request. Owners, systems touched, data classes, and clear success criteria. Put the pilot in your change calendar.

- Risk-tier your agents. Drafting and research agents are low risk. Anything that updates records or touches third-party systems is medium or high risk. Tie review and logging depth to the tier. For regulated baselines, look to FedRAMP High model failover patterns.

- Establish a minimum viable control set. Cost budgets, human approvals for high-impact steps, immutable logs, version pinning, operator kill switch. Write these as policy, not just guidance.

- Stand up an evaluation harness. Run a fixed battery of test tasks weekly. Look for drift, cost spikes, and behavior changes after model updates.

- Prepare incident response. Treat strange outputs or unauthorized actions as incidents. Assign severity levels, define containment steps, and rehearse the rollback.

- Decide data boundaries early. Clarify what data can leave the tenant, whether you use isolated inference, and how prompts are scrubbed. Document the decision.

- Build the change story for auditors. Keep a short dossier that lists purpose, controls, owners, metrics, and exceptions. Update it as you iterate.

Patterns from the pilot that others can reuse

Even without a detailed public manual from Citi, several patterns are already visible and widely applicable.

- Start with internal, multi-source research tasks. These show value quickly and exercise search, retrieval, and synthesis without writing to systems of record.

- Integrate with existing ticketing and approval flows. Placing approvals in tools people already use cuts friction and improves evidence quality.

- Treat models like interchangeable parts. Use adapters and contracts so you can change providers without upending logging or controls. This aligns with the enterprise agent stack goes mainstream.

- Build a neutral data layer between agents and systems. A well-governed API layer lets you constrain what an agent can do, enrich calls with policy context, and log uniformly.

What this signals about the near future of agent governance

A bank piloting agents in production workflows is a milestone. It suggests three near-term shifts in how enterprises will run AI programs.

- Governance will move from slideware to code. Cost caps, approvals, and audit trails will be machine-enforced policies, not guidelines. Success will depend on getting policies into the runtime path.

- Identity will extend to nonhuman actors. Every agent will need a first-class identity that can be provisioned, scoped, and monitored. Agent actions will carry dual attribution, both user and agent. This reinforces that identity is the control plane.

- ROI will be measured at the workflow level. Tool demos will give way to program reviews built around stable metrics, like cost per case or time to resolution.

Common pitfalls and how to avoid them

- Letting agents roam into undefined systems. Solve this with a thin control plane that brokers all access and enforces scopes.

- Treating human-in-the-loop as a checkbox. If reviewers do not have clear criteria or cannot pause a run, oversight is theater. Make reviews actionable.

- Overfitting to one model’s quirks. If you handcraft prompts and tools for a single provider, you will struggle to switch later. Prefer contracts and test suites that travel.

- Ignoring the tails. Average costs look fine until a handful of long-running tasks blow the budget. Monitor p95 and p99 from day one.

A 30-60-90 day roadmap to copy

- Days 1 to 30. Pick two workflows, one research, one structured drafting. Write the control policy. Implement budgets, approvals, and logging. Capture baselines. Train reviewers.

- Days 31 to 60. Run the pilot. Hold weekly reviews with risk, engineering, and operations. Triage incidents and exceptions. Publish dashboards.

- Days 61 to 90. Decide scale up or shut down. If you scale, invest in the neutral data layer and identity plumbing. If you pause, roll findings into a stronger second attempt with tighter scope or clearer success metrics.

The upshot for leaders

If you lead technology, risk, or a business line, Citi’s pilot is a useful north star. It shows that agentic AI can be brought into a regulated workflow without breaking cost discipline or oversight. It also shows that success depends on details that never make keynote slides. Budgets enforced in code. Approvals embedded in the run. Logs that survive audit.

You do not need to wait for the perfect policy memo to get started. Choose a bounded workflow, implement the guardrails above, and measure what matters. The organizations that build these muscles now will be ready when agents become not just a helpful colleague, but a standard part of how work gets done.