U.S. LNG’s 2025 Reboot: Policy shifts and SPAs fuel Gulf buildout

Washington’s 2025 reset on LNG export approvals and flexible commencement timelines reignited U.S. projects just as new SPAs returned. Here’s who can reach FID, how feedgas and pipelines will adapt, and why methane performance and bunkering will shape margins through 2030.

The pivot that reopened the spigot

Washington’s LNG policy took a sharp turn in 2025, and the market responded. After a year of uncertainty, the Department of Energy restarted export authorizations, reintroduced case-by-case flexibility on commencement deadlines, and approved extensions for stalled projects. Just as important, DOE clarified that it would not stand in the way of LNG bunkering growth at U.S. ports. The signal to developers and offtakers was simple: regulatory headwinds had eased. That was the first spark for a new Gulf Coast buildout, and you could see it in term sheet traffic and EPC bid calendars.

If you want the short version, it is this: DOE resumed LNG export authorizations, rolled back a hard seven-year commencement policy to a more flexible standard, and granted high-profile deadline extensions to keep near-finish projects on track. In the same sweep, DOE clarified that ship-to-ship transfers for LNG marine fuel would not require Natural Gas Act approvals, a boost for bunkering hubs in Texas and Louisiana.

At the same time, new sales and purchase agreements tightened the last gaps in commercialization plans. The headline was September 8, 2025, when NextDecade and ConocoPhillips completed Train 5 marketing at Rio Grande LNG with a 1.0 mtpa Henry Hub indexed SPA, a deal that paved the way for a Train 5 FID by year end. You could almost hear lenders and equity shops revising their pipeline of opportunities. The ConocoPhillips–NextDecade Train 5 SPA is a clear tell that financing can now close.

Who advances by 2030

The U.S. LNG roster is crowded, but the 2025 policy reset and the revival of long-term contracting have separated projects that can credibly deliver by 2030 from those that still face structural hurdles. Here is a field guide based on development maturity, permits, offtake, EPC readiness, and feedgas access.

The near-certs

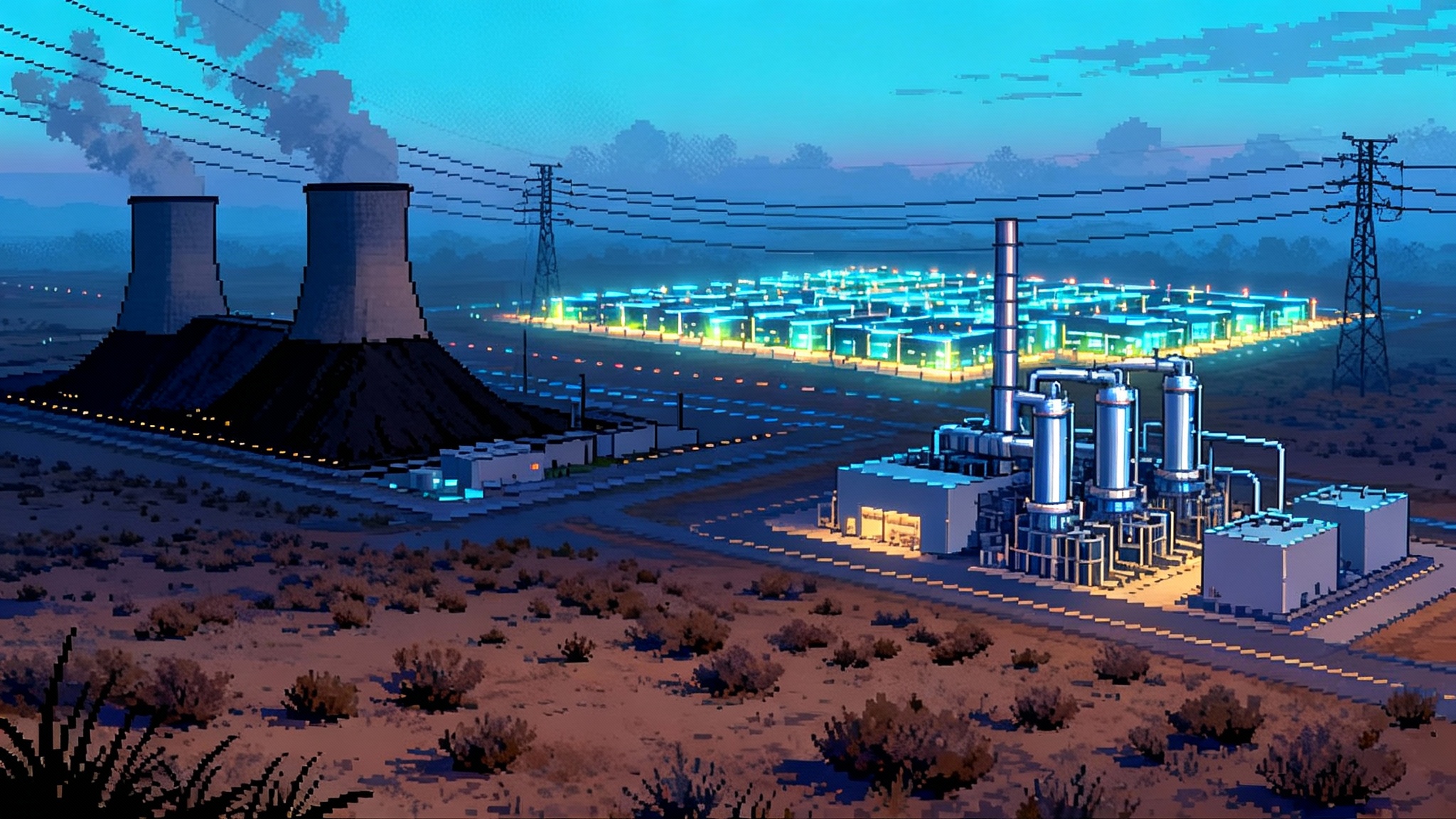

- Corpus Christi Stage 3. Construction is well advanced and a phased ramp is underway. By the late 2020s, Stage 3 should be fully contributing, reinforcing Cheniere’s position as the flexible load balancer of the Gulf.

- Golden Pass. After contractor changes and schedule slippage, DOE granted more time to commence exports, which removed a lingering cloud. With mechanical completion milestones approaching, Golden Pass is positioned to add a multi-bcf per day slug of demand to the Sabine corridor before decade’s end.

- Plaquemines Phase 1 and Phase 2. Venture Global’s build-as-you-go model and the modular approach point to continued ramp through the mid-to-late 2020s. The arbitration baggage with some offtakers still matters, but Phase 1 and 2 are already reshaping Gulf feedgas flows.

- Port Arthur Phase 1. Sempra’s first phase has real heft and strong counterparties. Once pipe tie-ins and power integration settle, this plant becomes a baseload anchor for southeast Texas gas offtake.

Likely movers with 2025–2026 FIDs

- Rio Grande LNG Trains 4 and 5. September’s ConocoPhillips deal filled out Train 5 volume, and management flagged a fourth quarter 2025 FID. Given site work already mobilized for the first three trains and the dedicated Rio Bravo pipeline footprint to Agua Dulce, Trains 4 and 5 have a credible path to first LNG before 2030.

- Commonwealth LNG. DOE issued a final export authorization in late summer 2025 after FERC signoff. The project’s smaller train count, single site, and a more contained capex envelope make it a candidate for a 2026 FID and late-decade start.

- Port Arthur Phase 2. Phase 1 construction and the strong counterparty bench make a second train set a logical follow. The sequence will depend on offtake and an updated EPC price, but the site and interconnects are already advantaged.

Dark horses that need one more break

- Calcasieu Pass 2. DOE granted a conditional export authorization in March 2025, a real positive. The gating items are final permits, contracting clarity post-disputes, and financing. If those align, a late-decade startup remains possible.

- Delfin floating LNG. An extension on the commencement clock helps. The offshore model lowers onshore constraints, but contracting depth and supply chain readiness must firm up.

- Lake Charles LNG. The rescission of strict commencement deadlines took it off life support, and a supportive price deck plus low-carbon upgrades could revive interest. It still needs ironclad offtake and a contemporary EPC.

- Cameron and Sabine incremental expansions. Debottlenecking and small expansions often move faster than newbuild megaprojects. Expect incremental capacity, not headline FIDs, to appear in late-decade forecasts.

The punchline for 2030, assuming a base case of timely FIDs in 2025–2026 for the likelier set above, is that the U.S. could add another large tranche of export capacity by decade’s end, enough to keep the Gulf Coast as the marginal price setter for Atlantic Basin LNG in most months.

The feedgas and pipeline puzzle

Every LNG wave redraws the Gulf Coast gas map. The 2025 reboot is no different. Three themes will drive flows and basis through 2030.

-

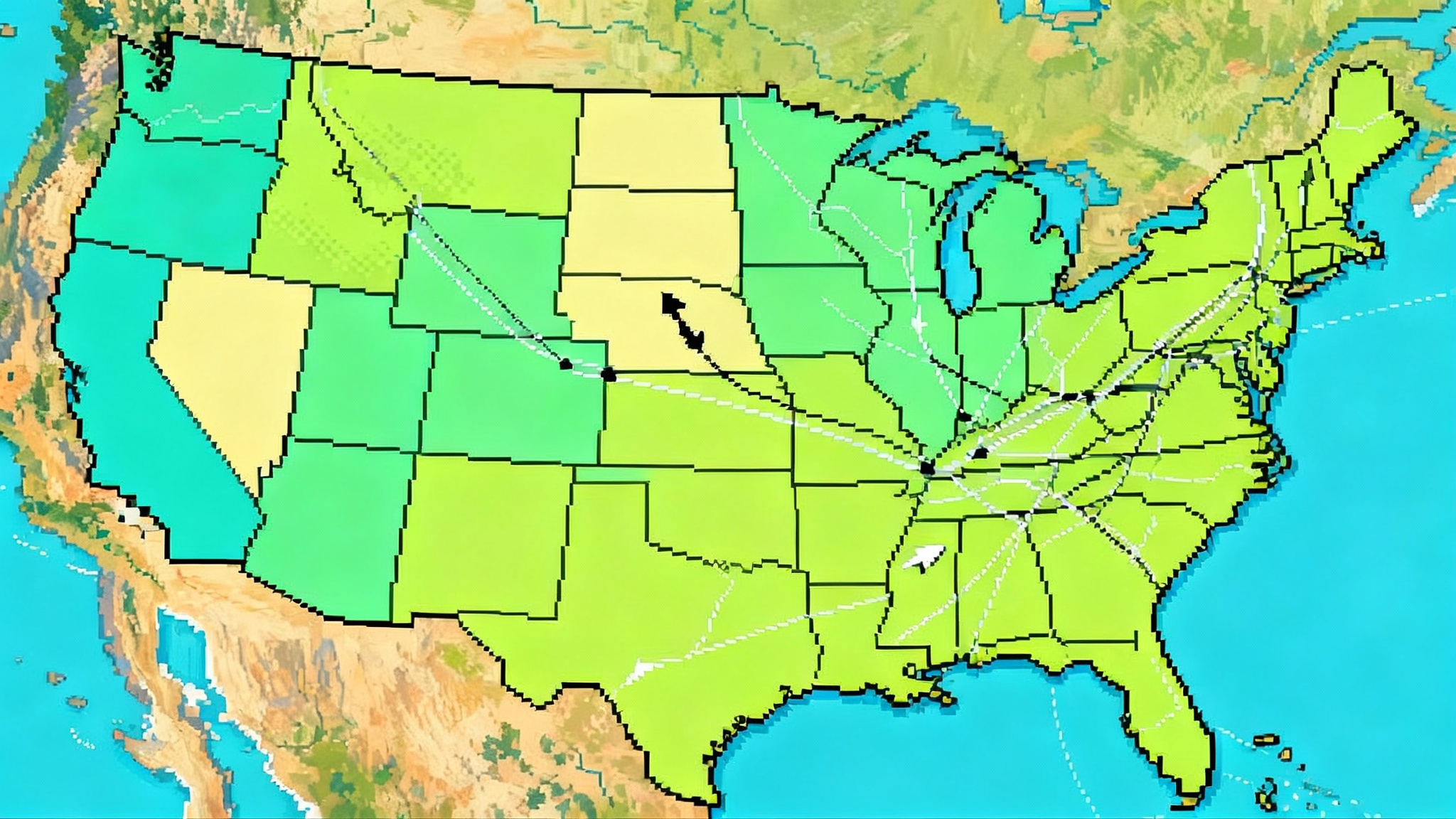

Permian torque, again. Waha has already seen basis pressure improve with new egress, yet the next LNG tranche will test it again. Whistler expansions, Permian Highway debottlenecking, and the startup of new long-haul pipes will help, but intra-Texas congestion from Agua Dulce to Brownsville and from the Permian into the Houston Ship Channel will need more compression and looped segments. Any slippage in pipeline timelines will show up first as a wider Waha discount and a premium at Agua Dulce. Texas’s transmission buildout will matter too; see how ERCOT’s grid will change by 2030.

-

Haynesville to the Calcasieu and Sabine corridors. The Haynesville remains the logical swing basin for Louisiana plants. Gulf Run, Acadian system expansions, and Gillis-anchored enhancements will keep feedgas flowing, but producers have become more cautious on drilling cadence. A stable TTF premium to Henry Hub sustains drilling budgets. If European storage is bloated after mild winters, Haynesville activity could taper and put more pressure on Permian molecules to backfill.

-

The Brownsville buildout. Rio Grande LNG changes South Texas forever. The dedicated Rio Bravo route into the Agua Dulce hub will become a new backbone. Expect associated midstream, including storage and short laterals to power plants, to follow. The region’s industrial load growth, alongside AI load rewrites the grid, is a hidden helper, smoothing daily volatility as LNG trains cycle.

By 2030 the Gulf could be absorbing another double-digit bcf per day of feedgas demand versus early 2025 levels, depending on the pace of FIDs and construction. That kind of pull raises the odds of short, sharp regional basis spikes during outages or heat waves, and it rewards portfolios with interruptible transport optionality and linepack access.

Price exposure and the new SPA math

The 2025 signing season revealed where the market wants to be on risk. Most new U.S. SPAs still clear on Henry Hub plus a liquefaction fee for FOB cargoes, with tolling structures preserving optimization upside for the buyer. Some hybrid indexation appears in portfolios that want a mix of Hub and global markers, but Henry Hub remains the core for Gulf plants.

That puts the focus on spreads to TTF and JKM. When TTF is volatile and storage trajectories are uncertain, the premium to Hub funds newbuild economics, shipping, and margins. When TTF softens and the Atlantic Basin is long, U.S. LNG margin compresses and offtakers lean harder on shipping optimization, Panama or Cape routing choices, and floating storage to smooth deliveries.

The other leg of price exposure is policy driven. The end of rigid commencement deadlines reduces the chance that authorizations time out during construction, which lowers completion risk. Extensions for projects that have broken ground, like Golden Pass, reduce the need to carry a risk premium for administrative delay. That matters for both debt pricing and the liquefaction fee negotiated in late-stage SPAs.

Shipping and bunkering: a quiet structural shift

The same 2025 DOE actions carried a sleeper change for the marine side. By clarifying that DOE will not use Natural Gas Act authority to police ship-to-ship transfers for LNG used as marine fuel, the agency encouraged growth in LNG bunkering networks from Galveston Bay to the lower Mississippi. That change intersects neatly with the steady rise in dual-fuel tonnage across container, car carrier, and tanker fleets.

For U.S. exporters and traders, more LNG bunkering has two effects. First, it adds a localized offtake sink that can absorb marginal molecules during Gulf weather disruptions. Second, it supports a deeper small-scale logistics ecosystem along the coast that, over time, can reduce boil-off losses and help time cargoes around canal constraints.

As Gulf ports certify more bunkering barges and standardize procedures, expect a modest but durable uplift in local LNG demand that is less correlated with European power market swings. That can slightly smooth cash flows for tollers and plant operators.

Methane performance will set a new premium

Europe’s methane strategy is no longer a talking point; it is a procurement screen. Importers will need to report and, eventually, manage the methane intensity of their portfolios. That pushes LNG sellers toward verifiable monitoring, reporting, and verification across the chain, from gathering and processing to liquefaction and shipping.

The practical takeaway is that continuous monitoring at key assets, higher frequency leak detection and repair, and third-party certification will move from pilot projects to contract conditions. Upstream producers that can document methane intensity below one percent with credible audits will command a small premium, or at minimum avoid a discount, when marketing feedgas into LNG trains with European exposure. Midstream operators that install continuous sensors at compressor stations and implement rapid response protocols can protect delivered intensity metrics. For policy context, see what changes after methane fee repeal.

For LNG sellers, it is not just about compliance. The methane profile becomes part of credit as well. Lenders are already asking how methane costs would flow through if an importing region adds fees or carbon border adjustments to methane emissions. Contracts that share methane compliance costs or that set performance thresholds with step-downs in liquefaction fees may clear more quickly. Expect a visible bifurcation by 2027 between portfolios that carry full MRV and those still promising future upgrades.

Hurricanes and credit will reprice risk

The Gulf’s storm seasons do not care about offtake calendars. Each additional coastal plant increases the concentration of interruption risk. That shows up as a seasonal premium in Atlantic Basin spreads and, for sellers, in higher insurance and contingency planning costs.

Projects that can demonstrate hardened electrical systems, redundant power, and improved drainage earn better credit terms. Offtakers increasingly ask for more granular availability guarantees, stricter liquidated damages for prolonged commissioning periods, and stronger step-in rights if EPC contractors stumble. The post-2022 experience with long commissioning windows has reset how buyers price the first eighteen months after mechanical completion.

On the financing side, higher interest rates have raised the carrying cost of long build cycles. The 2025 policy reset helps by reducing the chance that a permit clock becomes a financing cliff, but lenders still want to see fixed-price EPC scope with clear contingency buffers. That tends to favor phased, repeatable designs over first-of-a-kind concepts.

Three scenarios for 2026–2030

- Base case. FIDs land for Rio Grande 4 and 5, Commonwealth, and Port Arthur Phase 2 by mid 2026. Calcasieu Pass 2 and one floating project slip to later in the decade. U.S. capacity expands steadily, adding another large tranche before 2030. Feedgas demand rises sharply in South Texas and southwest Louisiana, tightening Agua Dulce and Gillis balances during heat waves and maintenance. Henry Hub plus liquefaction fees remain the dominant SPA structure, with modest methane performance clauses becoming standard.

- Upside. A supportive TTF premium, smooth EPC execution, and swift pipeline expansions bring two more projects forward, one in Louisiana and one in Texas. LNG bunkering demand grows faster than expected at Gulf ports, providing a small local baseload. A handful of European buyers pay a clear premium for certified low-methane LNG, and U.S. sellers with credible MRV capture it.

- Stress. A weak Asia winter, high European storage, and a string of Gulf storms flatten spreads. One large project faces EPC delays that push out commencement, and a smaller project misses its revised timeline. Haynesville drilling slows and basis blows out at Waha during summer power demand. In this case, buyers push for more flexible take-in windows and favor shorter term deals, and some developers defer FIDs to protect balance sheets.

Across these scenarios, the constant is that the 2025 policy changes removed a set of administrative risks and shifted attention back to commercial fundamentals, construction execution, and basin-to-plant logistics.

What to watch next

- FIDs and offtake. A fourth quarter 2025 decision on Rio Grande Train 5 will be the bellwether for late-decade South Texas. Watch for whether Train 4 follows quickly. Keep an eye on Commonwealth’s contracting cadence and any fresh announcements from Port Arthur Phase 2.

- Pipeline open seasons. New compression and looping into Brownsville and across the Calcasieu hub will tell you whether the midstream is staying ahead of the trains. Pay attention to storage expansions that pair with LNG load swings.

- Bunkering buildout. U.S. Coast Guard approvals for new LNG bunkering barges and the first regular service into Houston and Galveston will mark whether the DOE clarification translates into real tonnage.

- Methane rules and certification. Track how European implementing acts translate to procurement language, and which sellers standardize third-party certification tied to contractual thresholds.

- Storm hardening and insurance. Expect more disclosure on resiliency upgrades in EPC packages and new benchmarks for availability in the first two years post-startup.

The 2025 reboot did not solve every problem, but it made the next wave of U.S. LNG possible again. With policy risk pared back, the winners through 2030 will be the projects that lock in credible offtake, secure reliable feedgas, and prove their build schedules in the field. The Gulf Coast is ready for another round, and this time the market will reward execution more than headlines.