Texas Batteries Overtake California: Prices and Reliability

By mid-September 2025 ERCOT overtook CAISO for the most operating grid-scale batteries in the U.S. This analysis explains why Texas pulled ahead, how storage is reshaping price formation, and what it means for reliability and investors over the next year.

The surprise new leader in grid batteries

By mid-September 2025 the headline was unmistakable. After a record second quarter of additions, ERCOT moved past CAISO to become the U.S. region with the most operating grid-scale batteries. S&P Global’s market tally shows 6.239 GW installed nationwide in Q2 alone, with ERCOT contributing 3.213 GW and lifting its total to roughly 14.2 GW compared with about 12.4 GW in CAISO. U.S. operating storage reached about 38.1 GW by the end of June. Those figures mark a decisive shift in the center of gravity for battery deployment in the United States, and they set the stage for a broader rethinking of price formation and reliability in Texas and beyond. S&P Global’s Q2 storage recap captured both the magnitude and the momentum of the move.

Why Texas pulled ahead

Several ingredients came together in Texas at the same time. None alone would have been enough, but together they created a fast lane for battery developers.

- Scarcity pricing and merchant upside: ERCOT’s energy-only market pays handsomely when reserves tighten. Batteries can buy low and sell high across intraday spreads, but more important, they can monetize scarcity events when real-time prices spike. Even with fewer widespread emergency calls this summer, occasional tight intervals still deliver disproportionate revenue. The prospect of those upside tails continues to draw merchant capital.

- A new ancillary product designed for speed: ERCOT’s ERCOT Contingency Reserve Service, or ECRS, became a dedicated product starting June 10, 2023. ECRS pays for fast contingency response and is well suited to batteries that can move quickly and precisely. For developers it added a second dependable leg to the merchant stool alongside arbitrage. See ERCOT’s market notice confirming the ECRS launch date.

- Faster interconnection timelines: Texas is comparatively streamlined on siting and queue processing. Projects are not layered with multi-agency environmental reviews, and network upgrade cost allocation is clearer up front. That does not mean every node is simple and it does not eliminate transmission constraints, but it lowers non-technical friction and compresses development cycles.

- IRA-enabled economics: The Investment Tax Credit for standalone storage under Section 48 made more of the capital stack financeable. Transferability created a liquid market for tax attributes, which in turn reduced the all-in cost of capital. In merchant-heavy ERCOT, that extra cushion bridges risk for investors who would otherwise balk at pure energy-only volatility.

- A culture of speed: Texas developers and counterparties have grown comfortable with merchant or quasi-merchant structures. They can move from notice to proceed to commissioning quickly, backed by standardized equipment, experienced EPCs, and lender familiarity with two-hour and four-hour lithium iron phosphate builds.

How a larger battery fleet is reshaping ERCOT price formation

The most visible change is the evening shape. Batteries are shifting megawatts from late morning and early afternoon into the early evening hours when net load rises as solar output fades. The effect is a shorter and flatter ramp in many intervals and a cap on some of the once-regular price spikes near sunset.

Under the hood, more batteries change more than just the evening. Several second-order effects are emerging:

- Midday suppression and spread rotation: With more solar and more batteries, midday prices are frequently lower for longer, which can compress the simplest same-day spreads. The profitable windows rotate toward late afternoon into evening and, on some days, into early morning when thermal units cycle or wind output dips.

- Scarcity dilution on the margin: As batteries scale, they increasingly act as a buffer that prevents small disturbances from tipping into scarcity. That trims the frequency of extreme prices, even if the size of any single scarcity event still drives most of a merchant battery’s annual gross margin. Investors should expect a gradual decline in the occurrence of the biggest price hours, offset by more frequent moderate opportunities.

- Ancillary markets rebalance: A bigger battery fleet tends to push down ancillary clearing prices over time as supply deepens. That is healthy for reliability, but it means projects cannot underwrite today’s ECRS or regulation prices indefinitely. Revenue stacks drift toward a more balanced mix of day-ahead ancillary sales and real-time energy arbitrage.

- Congestion reshapes nodal value: Locational constraints shift the marginal value of storage. Where downline lines are tight, charging may become costly or impossible during certain hours, and discharging can be trapped behind interfaces. Nodal discipline matters more each quarter storage scales. Longer-term transmission plans such as the ERCOT 765 kV buildout could alter these patterns by 2030.

Where congestion and cannibalization risks are building

ERCOT’s congestion map never sits still, but three patterns stand out for storage.

- Houston zone tension: Load growth tied to industrial expansion and data centers is intensifying the need for flexible capacity near the load pocket. Imports into Houston can be constrained in stressed conditions, especially if topology outages bite. Batteries inside the Houston zone can earn strong localized margins in peak periods, but they also face higher siting costs and more competition for suitable interconnection points.

- South zone export limits: The South zone hosts substantial wind and a growing base of solar. Exports northward can congest during high renewable output and mild load. Batteries there can arbitrage locally by charging into curtailment risk and discharging when interfaces relax, yet the very success of storage can cannibalize spreads over time as more units crowd the same hours.

- West zone volatility pockets: The West has long been the land of wind ramps and long interties. New solar has added midday troughs that batteries eagerly fill. The opportunity is real, but so is the risk of being trapped behind constraints. Projects that model only system-wide prices without nodal stress tests will miss the mark on a material share of hours.

Cannibalization is not uniform. It tends to appear first in the easiest hours for arbitrage and the most accessible interconnection locations. The cure is thoughtful siting, slightly differentiated operating strategies, and, in some cases, a shift in battery duration to capture hours that others miss.

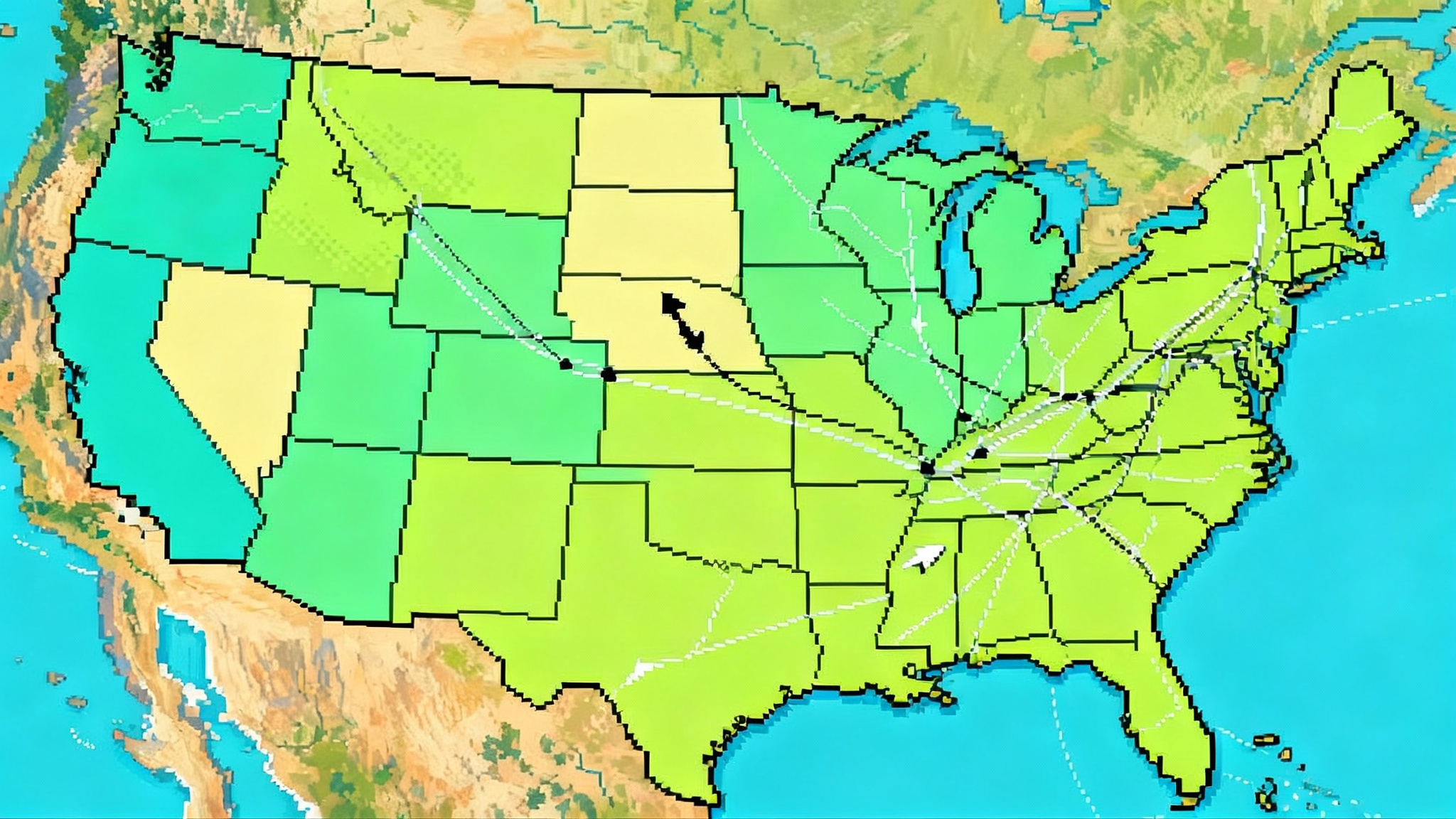

What CAISO and WECC will do next

California is not ceding the field. The state continues to onboard large storage plants tied to its resource adequacy program and to multi-hour evening needs. The fleet plays a foundational role during summer heat waves and dry hydrology periods. Meanwhile, the broader West is accelerating. Arizona and Nevada are adding utility-scale batteries at a rapid clip to firm their surging solar fleets, and interties that move energy across time zones are opening fresh arbitrage patterns. Market integration across the West remains in flux; see our EDAM vs Markets+ overview for how design choices shape storage value.

The practical upshot for the next two quarters is simple. CAISO and WECC will add significant Q3 and Q4 capacity. That will further smooth evening ramps on the West Coast, continue to reduce the frequency of the largest price blowouts, and push developers to refine strategies that rely less on a handful of extreme hours.

The evolving revenue stack in ERCOT

Storage revenue in Texas has already shifted once and will shift again as the fleet grows. A few contours are clear.

- ECRS as a base layer: ECRS offers a reliable booking of capacity sales for qualified batteries. Many projects use ECRS awards in the day-ahead market to lock in a portion of their daily target and then flex into real-time opportunities when spreads open. Over a multi-year horizon, participants should budget for ECRS market clearing prices to drift down as supply scales.

- Arbitrage still matters: Even as ECRS grows, most projects continue to earn a meaningful share of margin by time-shifting energy. The trick is avoiding the herd when spreads are thin. Operators that adapt algorithms to emerging patterns and act nodally rather than system-wide can pick up basis and loss factors that competitors ignore.

- Regulation and FFR: Some assets can qualify for fast regulation products and fast frequency response. Those markets can be bumpy, but in certain nodes and weeks they add meaningful diversification. As battery telemetry and controls improve, expect more assets to toggle between ECRS, regulation, and energy as conditions shift hour by hour.

- Seasonal mix: In hot summers with long afternoons, evening spreads dominate. In shoulder months, morning volatility and wind-driven overnight ramps can surprise to the upside. Winter reliability concerns add occasional scarcity pops on cold mornings. A fleet that can pivot across seasons will outperform.

Development and investment implications

For developers and investors trying to read the next 12 to 24 months, five tactical choices will separate leaders from the pack.

- Siting with congestion in mind

- Do full nodal modeling, not just hub price backcasts. Stress test against planned outages and typical maintenance seasons, not only peak summer. Incorporate likely queue withdrawals and network upgrades. Longer-term projects should track the ERCOT 765 kV buildout for shifting transfer limits.

- Consider co-optimizing location with potential offtakers. Data centers and industrial loads want resilience close to their facilities. Locational premiums can support tolling or capacity-style payments that de-risk the merchant curve.

- Duration decisions

- Two-hour batteries remain the volume product for ERCOT arbitrage and ECRS. Four-hour builds can earn less per kilowatt in some months but gain resilience against cannibalization by stretching into later hours and covering longer scarcity intervals. Mixed portfolios reduce exposure to a single shape of volatility.

- Interconnection strategy

- Speed still wins. Teams that lock interconnection early and sequence procurement to avoid transformer and inverter bottlenecks will continue to hit commercial operation faster. In Texas, that speed often outperforms attempts to time the market.

- Study transformer bay and switchyard configurations for future uprates. Many sites will pencil as 1.5x expansions if nodal conditions remain constructive.

- Hedging and offtake

- Consider partial tolling structures that sell a slice of capacity into a fixed or indexed arrangement while leaving the rest merchant. Ancillary floors can be valuable during fleet step-changes when clearing prices float down.

- Sharpen congestion and basis hedging. Congestion Revenue Rights and bilateral nodal hedges can stabilize cash flows in nodes with frequent constraints.

- Operations and degradation

- Optimize for lifetime value, not first-year gross margin. Smart state-of-charge management reduces cycle wear while still catching the best hours. As fleets grow, differential battery health will become a competitive edge.

Near-term outlook

For the next six months three dynamics will set the tone in ERCOT.

- More capacity is coming: The queue continues to move and construction crews are busy. Expect additional gigawatts to commission by year end, with a steady cadence into the first half of 2026. That will deepen the pool of batteries bidding into ECRS and regulation and will further tame the most extreme evening spikes in many weeks.

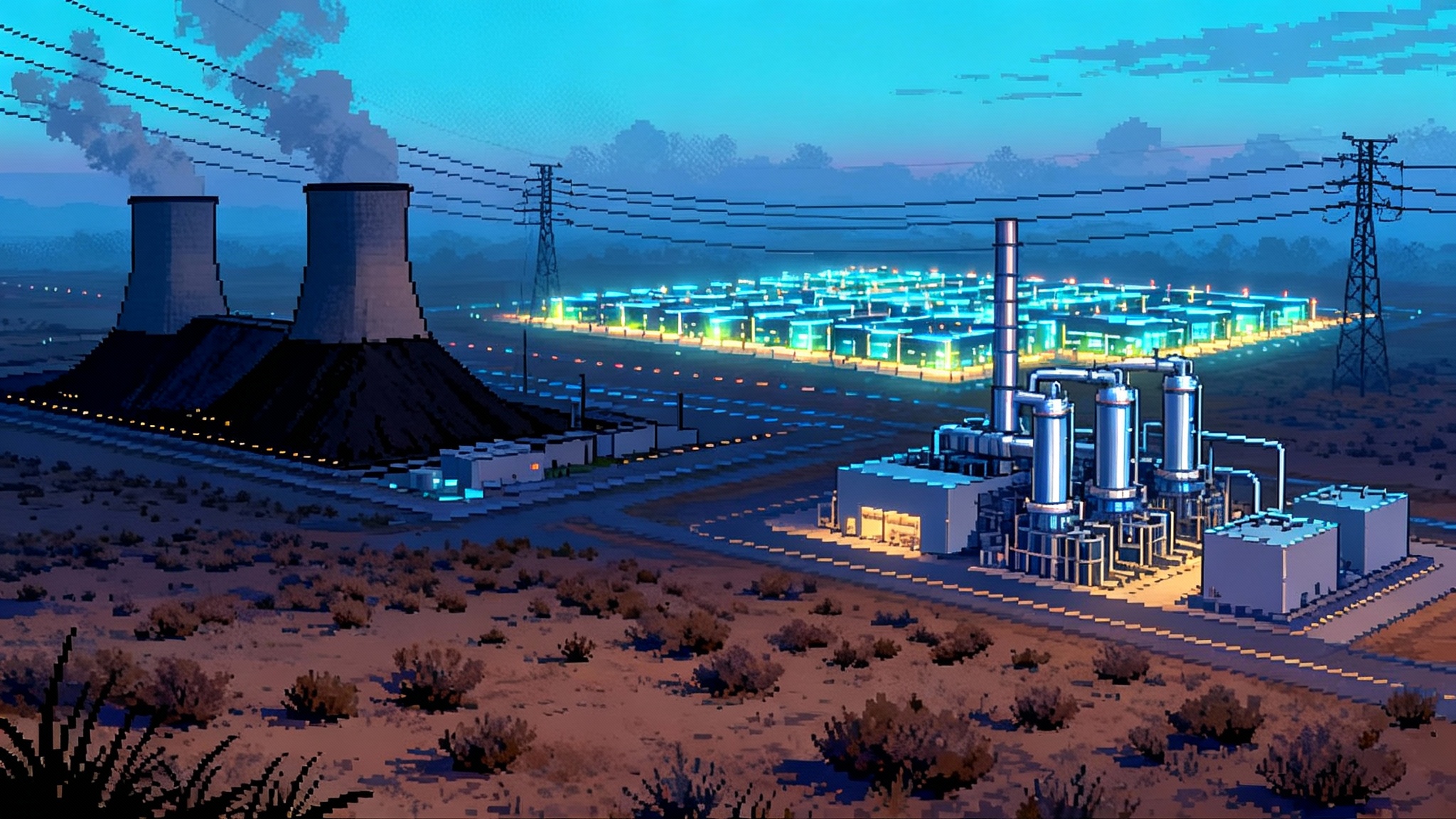

- Data center demand rises: Large load interconnection requests keep climbing. Batteries positioned near those campuses can sell both grid services and behind-the-meter resiliency. For context on how AI-driven demand is changing planning, see AI load rewrites the grid.

- Policy tweaks could re-cut the pie: ERCOT continues to iterate on market design details and telemetry requirements. Small rules changes can shift value between day-ahead and real-time and across ancillary products. Operators that keep their tools and telemetry tight will adapt faster than those that do not.

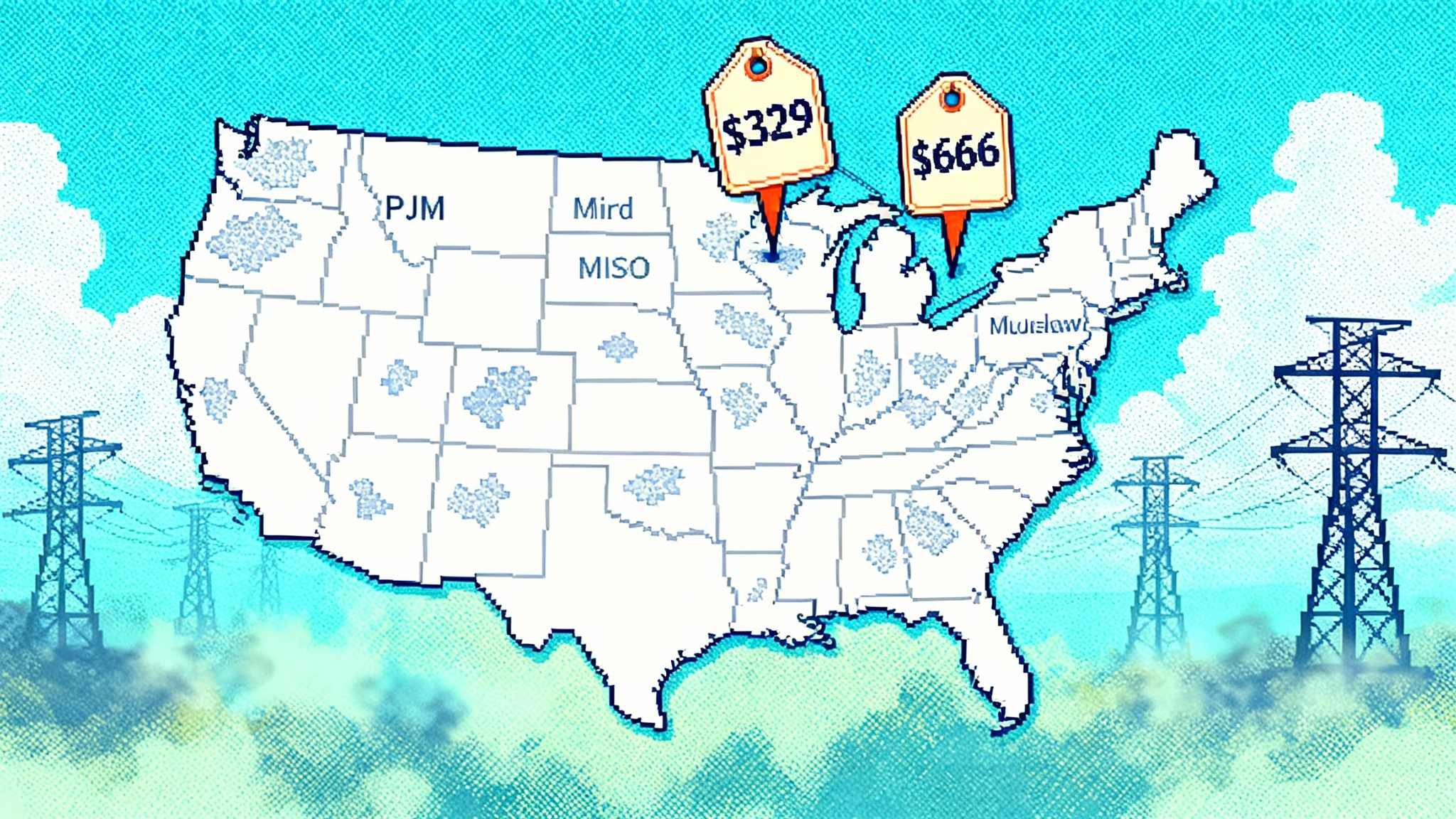

What other ISOs can learn from Texas

- Build the right products: ECRS demonstrated that a well-designed ancillary product tailored to fast resources can unlock private capital for reliability. Markets that add a clear, dispatchable, and measurable service open the door for storage without writing a blank check.

- Speed matters: Interconnection timelines are not just a developer headache. They are a reliability variable. Faster, clearer processes bring flexible capacity online when it is needed, not two or three summers later.

- Embrace merchant signals alongside planning: Resource adequacy programs can coexist with merchant opportunity. In fact, letting storage respond to granular real-time price signals helps align operation with system need hour by hour.

- Plan for congestion: Transmission investment and queue management must be synchronized with storage siting. Otherwise cannibalization and trapped value show up fast and slow the very buildout needed for reliability.

The bottom line

Texas took the lead in operating grid batteries because it married merchant upside, a storage-friendly ancillary product, the economics of the IRA, and a culture of fast interconnection. A larger fleet is already smoothing evening ramps, trimming the frequency of the worst price spikes, and improving reliability. It is also shifting value from a few spectacular scarcity hours toward a steadier mix of day-ahead ancillary capacity and nodal energy arbitrage.

Cannibalization and congestion risks are real, especially in the Houston and South zones, but they are manageable for teams that treat nodal location as a first-class decision and operate with precision. As CAISO and the rest of WECC add significant Q3 and Q4 capacity, the gap could narrow again, but the strategic lessons from Texas will travel well. Build products that batteries excel at, clear the interconnection runway, and let price signals do the rest.