NIETCs Go Prime Time: Corridors Set 2026-2032 Build

With three federal corridors advancing and backstop siting clarified, transmission finally has a real near-term clock. Here is how DOE and FERC just set up a 2026 to 2032 build window, who stands to benefit first, and where fights will flare.

The breakthrough no one could schedule, now on the calendar

If you build big power lines for a living, your work has always depended on two clocks. The first is physics: loads growing, generators queuing, storms coming. The second is law: rules changing, permits pending, financing expiring. In April 2025, those clocks finally synced. The Department of Energy reopened public comment and moved three National Interest Electric Transmission Corridors into the next phase, and the Federal Energy Regulatory Commission issued a second rehearing on long term planning that strengthens the role of states. Together, those steps take transmission from open-ended hopes to a firm build window that begins to open in 2026 and runs into the early 2030s.

This is not a one-page memo. It is a sequence of decisions that line up authority, money, and process so projects can cross state lines before they age out of relevance. The centerpieces:

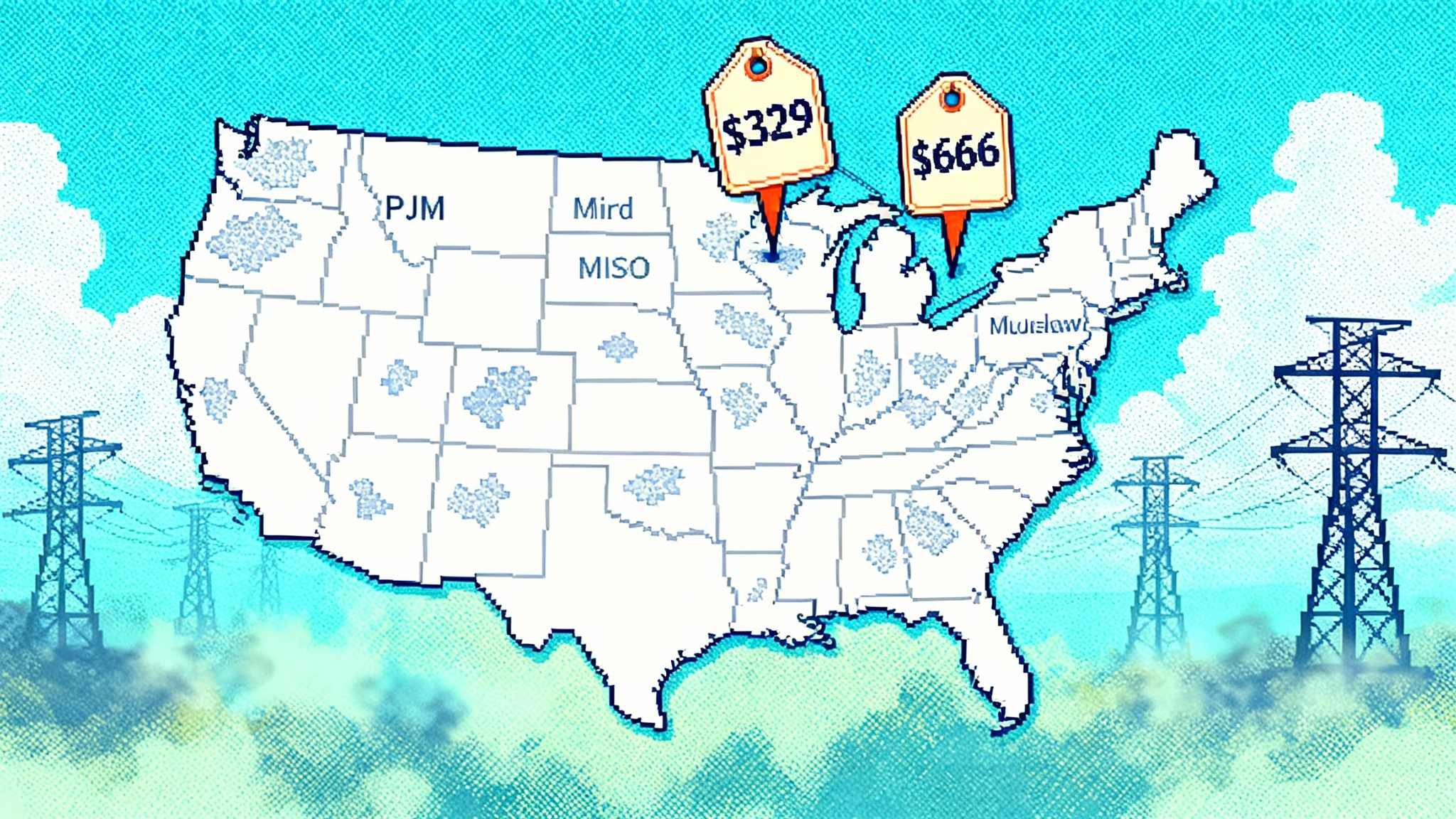

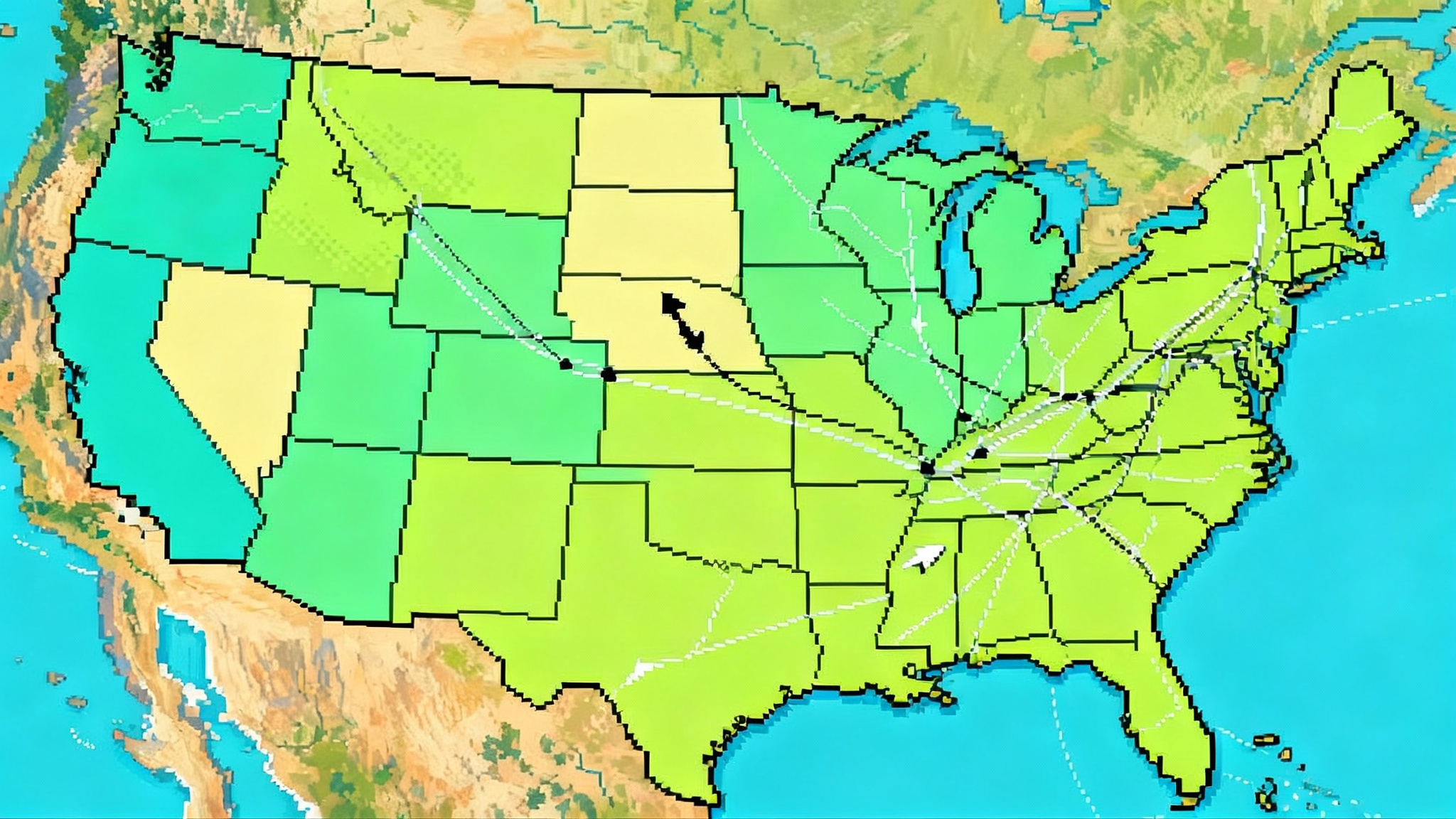

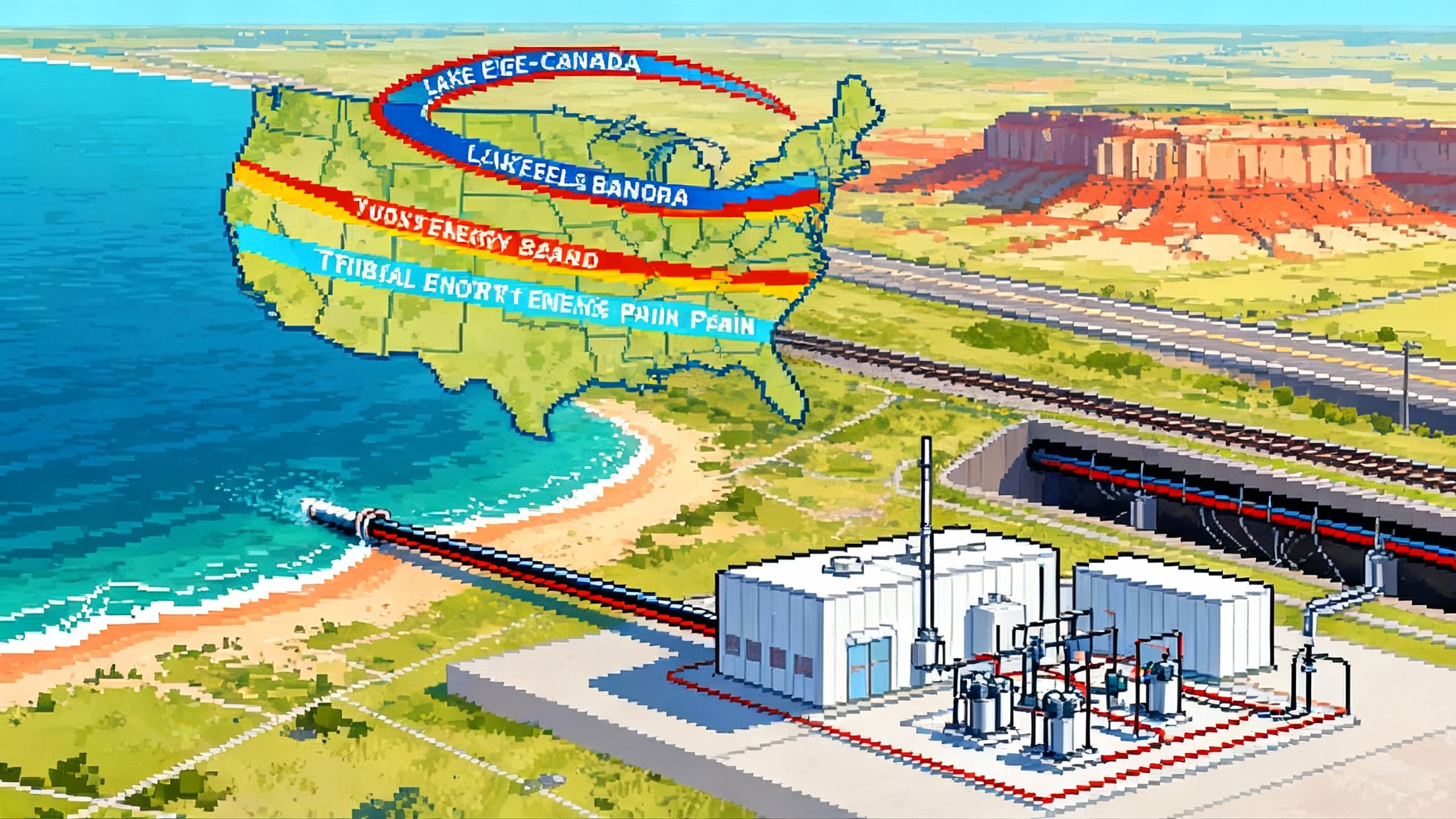

- DOE’s three advancing corridors: Lake Erie to Canada, the Southwestern Grid Connector across Colorado and New Mexico with a slice of western Oklahoma, and a Tribal Energy Access corridor spanning parts of North Dakota, South Dakota, and Nebraska.

- FERC’s Orders 1920, 1920-A, and 1920-B on long term regional planning and cost allocation, which set a 20-year planning horizon and deepen state engagement, plus Order 1977 on backstop siting that defines how federal permitting works inside a designated corridor.

The result is a first credible path to interregional lines that can move bulk power where it is needed most, even when state processes stall.

What changed in April 2025

Two developments turned “someday” into “soon.” First, FERC issued Order 1920-B on April 11, 2025, a unanimous compromise that keeps the core of long term planning intact while expanding the formal role of state regulators in scenarios and cost allocation, and allowing the state engagement period to run longer when requested. See the agency’s plain-English summary in the FERC Order 1920-B explainer.

Second, DOE advanced three corridors into Phase 3 of its designation process and extended public comment through April 15, 2025. That was not just more time for emails. Phase 3 is where DOE decides the level of environmental review under the National Environmental Policy Act, tailors corridor-specific engagement, and prepares draft designation reports.

Why this pairing matters: planning tells regions what lines they will likely need and who pays for them. Corridors define where federal backstop authority may apply if a state denies or fails to act on a siting application for a year. Put together, they shrink uncertainty on both the what and the where.

Corridors, backstop siting, and the new federal playbook

Here is how the pieces work once DOE designates a corridor:

- A NIETC is not a specific project. It is a geographic area where DOE finds consumers are harmed by inadequate transmission and that new lines would advance national interests such as reliability and cost.

- Inside a designated corridor, a developer that is denied at the state level or stuck for more than a year can apply to FERC for a federal siting permit under the Federal Power Act.

- FERC Order 1977 governs that permit. It requires early engagement plans with landowners, tribes, and communities. It includes a Landowner Bill of Rights and a code of conduct. It clarifies how tribal consent must be addressed when rights of way involve trust or restricted lands.

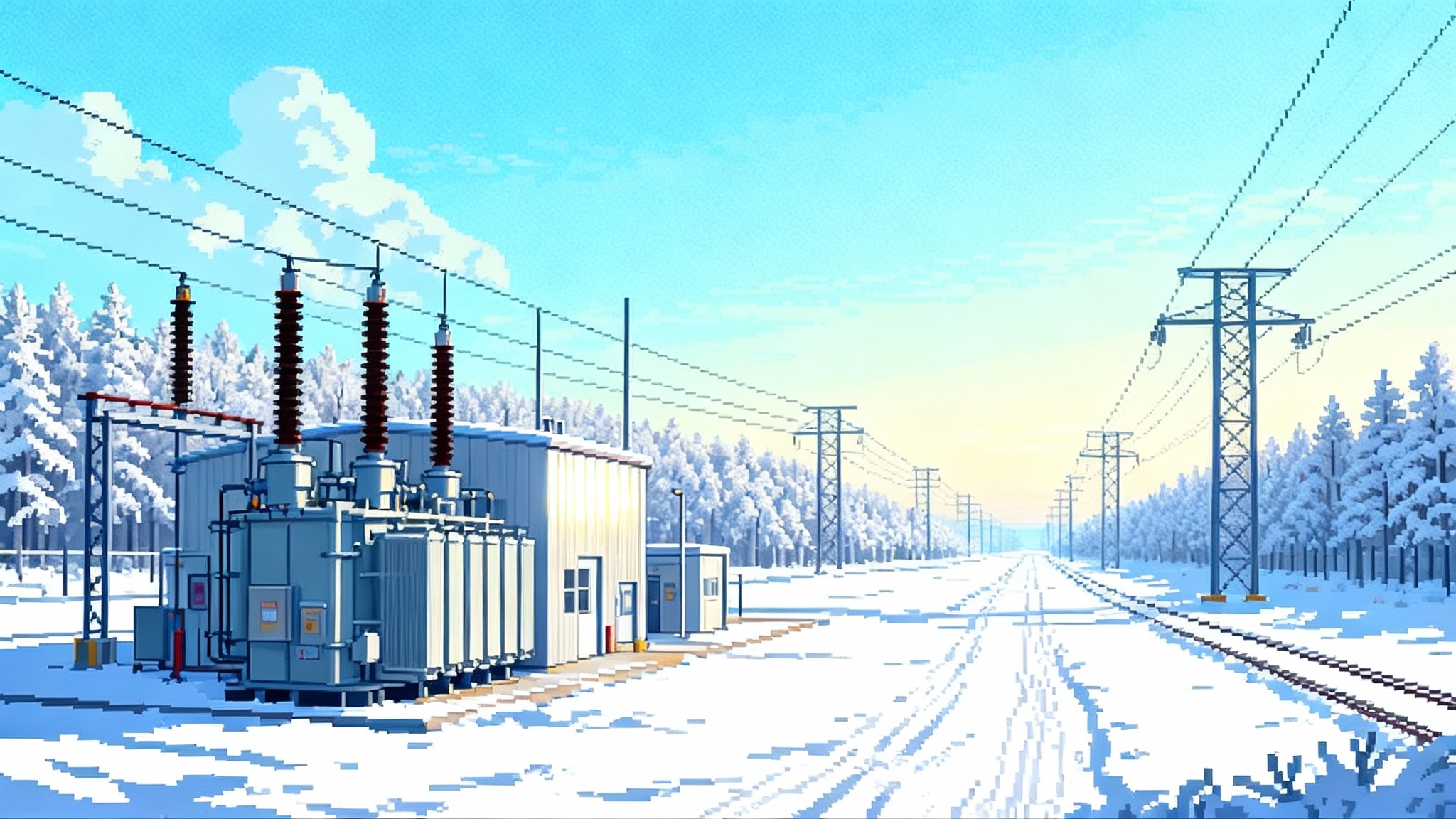

- A FERC permit does not mean construction starts the next day. It triggers a federal environmental review for the project and directs agencies to a coordinated schedule. It also gives developers a clear path to condemn easements as a last resort if negotiations fail, which improves financeability even when never used.

Think of corridor designation as painting a lane on the interstate. State processes still run the on-ramps, local roads still matter, but there is now a federally controlled lane that can keep traffic moving if a ramp gate drops.

Money that actually moves steel

Process alone does not pour foundations. Federal financing tools now line up with the corridor map in ways that matter to underwriting and procurement:

- Transmission Facilitation Program: A $2.5 billion revolving fund for capacity contracts. DOE can serve as an anchor customer, reserving a slice of a line’s capacity and then stepping out once subscription deepens. TFP selections in 2023 and 2024 show how capacity contracts tighten timelines and crowd in private capital.

- Loan Programs Office: Can backstop innovative or reinvestment transmission, especially high voltage direct current. Conditional commitments still depend on rigorous due diligence and can be canceled. Even so, the existence of a federal lender of last resort at scale is a meaningful pressure valve for first-of-a-kind segments or undergrounded stretches.

- Tax credits and transferability: Transferability and component bonuses smooth the supply chain for converters, cable, and towers, which mattered in 2024 and will matter more as orders stack up in 2026.

For developers and utilities, the common thread is bankability. Corridors cut the tail risk of endless siting. Capacity contracts improve revenue certainty. Planning orders clarify who pays. Together, they pull build dates forward.

Who is set up to win first

- HVDC specialists. Projects that can cross long distances with minimal losses and precise controllability have a structural edge in interregional service. Expect developers like Invenergy, Grid United, and joint ventures with European capital to move fastest where converter stations can sit near robust substations. Manufacturers of converters and cables, notably Hitachi Energy, Siemens Energy, GE Vernova’s grid unit, and Prysmian for subsea or underground segments, see near-term order books firm up.

- Utility joint ventures. JVs such as BHE U.S. Transmission, Transource Energy, and National Grid’s U.S. ventures can pair regulated balance sheets with merchant-style structures. They already know how to coordinate cost allocation committees and regional planning staff, which lowers friction as Order 1920 compliance rolls through.

- Industrial load aggregators. Data center operators, chip fabs, and advanced manufacturing campuses need firmed megawatts on precise timelines. The most sophisticated buyers will reserve transmission capacity directly or via utility partners, creating bankable anchor subscriptions. For context on how load growth translates into spend, see how AI data centers drive utility capex.

- Cross-border connectors. The Lake Erie corridor aligns with projects that can move power between Ontario and PJM. Underwater or underground HVDC along transportation rights of way will compete well in this alignment because of reduced visual impact and faster permitting under familiar corridors.

Where friction is unavoidable

- State prerogatives. Order 1920-B gives states more influence over planning scenarios and cost allocation timelines. That improves buy-in but also creates a veto window if scenarios undercount local priorities. Developers should budget time for one or two additional iterations of state engagement before cost allocation locks in.

- Landowner consent. The backstop is not a shortcut to skip local concerns. The Landowner Bill of Rights, required engagement plans, and evidence of good-faith negotiation raise the bar on outreach. Undergrounding portions along highways or rail corridors and compensating for perceived loss of future use can defuse hot spots but will add cost and time.

- Tribal sovereignty. Projects intersecting tribal lands or resources will need early, transparent, and adequately funded government-to-government consultation. Order 1977 and its rehearing clarify expectations on consent and right of entry. The practical requirement is capacity building: support for tribal technical staff and independent advisors before routes harden.

- Regional seams. Interregional lines must interconnect with multiple planning entities that use different reliability criteria and benefit metrics. Projects that pre-bake a consistent method to allocate benefits across markets will queue faster. That means adopting the most conservative standard among the affected planners and documenting it from day one.

The emerging map, in plain terms

You can think of three near-term paths where steel could go into the ground first:

- Southwestern Grid Connector corridor: Pairs with known load growth in the Southwest and existing momentum on lines like SunZia, Southline, and new HVDC concepts that stitch New Mexico wind and Arizona load. Co-location along Interstate corridors will be a durable strategy here because of visual and cultural sensitivities across the high desert. For market context on the West’s evolution, see our West's two-market era explainer.

- Lake Erie to Canada corridor: Subsea or underground HVDC can link Ontario’s hydro and nuclear baseload with Midwest and Mid-Atlantic peaks. Cable manufacturing and converter station siting are the gating items, not terrain.

- Tribal Energy Access corridor across the Northern Plains: A set of 345 kilovolt and 500 kilovolt backbones can unlock both export wind and reliability for reservation communities that still depend on fragile radial feeders. Success depends on design that treats tribal participation as co-ownership or revenue sharing, not just one-time easements.

Overlay those with privately led interregional concepts like Grid United’s North Plains Connector between Montana and North Dakota or merchant lines along rail rights of way. The common feature is controllable HVDC that can meter flows between regions without swamping local networks. In parallel, fast-ramping storage is already changing operations, as shown by the Texas battery build reshapes prices.

What Order 1920-B and Order 1977 change about timelines

Order 1920-B keeps the 20-year horizon and requires regions to define benefits, run scenario planning, and right-size replacements. It also lets states extend the structured engagement period so cost allocation talks do not time out prematurely. That makes it more likely that selected projects survive rehearings and court tests, which used to be the graveyard for timelines.

Order 1977 lays down a standard federal siting process for interstate lines inside corridors when state processes deny or stall. It requires developers to show detailed engagement, identify affected communities, and produce clear reports on impacts. Most importantly, it tells investors that a denial does not mean a dead end.

Together, these orders turn the 2026 to 2032 period into a plausible build window, not just a plan. Regions will file and implement compliance plans. DOE will run corridor NEPA. Developers that stack anchor subscriptions and early engagement can hit notice to proceed on a first wave of lines toward the back half of the decade.

The milestones to watch through 2026

Here is the short list of dates and decisions that start the clock for real projects:

- Mid 2025: FERC compliance guidance for Order 1920 schedules. Regions begin formal state engagement periods and scenario design with expanded state roles under 1920-B.

- Mid to late 2025: DOE announces the level of NEPA review for each of the three corridors and begins the corresponding analyses and meetings.

- 2026: DOE releases draft NIETC designation reports and any required draft environmental documents for each corridor, with another round of public comment. The phase-gate here is explicit. DOE’s overview sets out the DOE NIETC designation process timeline.

- Late 2026 into 2027: First corridor designations could be finalized. FERC can then process federal siting applications for eligible projects inside the designated boundaries if state processes have denied or stalled.

Watch also for two practical signals. First, procurement. Converter transformer orders with 24 to 36 month lead times will show up in earnings calls for manufacturers before shovels hit ground. Second, right of way aggregation along rail and highway corridors. Public filings for crossing permits are a tell that underground or co-located routes are moving.

How financing and regulatory whiplash can still coexist

It is tempting to see the cancellation of a high profile conditional federal loan as a sign that the federal spigot is closed. That reads the wrong indicator. Conditional commitments are project specific and can be rescinded if conditions are not met or if agency priorities shift. The deeper signal is structural. Corridors and backstop siting survive political cycles because they are embedded in statute and independent commission rules. Meanwhile, the revolving nature of capacity contracts and the continued need from large load additions keep the private debt and equity markets engaged even when one marquee deal falls apart.

For developers, the lesson is to use federal tools to derisk specific gaps, not to assume any one program will carry a project. For utilities, it is to structure joint ventures that can flex between merchant and cost-allocated elements as regional planners finalize benefit methods under Order 1920.

Concrete steps for the next four quarters

- Developers: Lock in converter station sites that sit on strong substations and allow reversible power flows. Build your benefit case with the most conservative reliability and economic metrics used by the affected planning entities. Put two route options on the table that are visibly different, one co-located along a transportation corridor and one conventional overhead, then let early engagement data rule.

- Utilities: Form or join special purpose transmission entities that can sign capacity contracts with DOE, accept cost allocation decisions, and manage merchant exposure. Put state regulators at the center of scenario design now so 1920-B’s extended engagement reduces litigation later, not adds months at the back end.

- Large loads: Aggregate. If five data centers want 2,000 megawatts of firm transfer capability, reserve it together. Anchor tenors can be shorter than the project life if the contract structure includes a resale path and a ramp to cost-allocated service when planners select the facility.

- Tribes and communities: Ask for funded technical assistance and independent legal support at the start of pre-filing. If a project will cross trust lands, set expectations for consent, monitoring, and cultural resource protection in writing before route lock.

The bottom line

For two decades, the United States has talked about interregional transmission in the future tense. With three corridors in Phase 3 and FERC’s planning and backstop rules clarified, the verbs finally change. Designations set the geography. Planning sets the benefits and who pays. Backstop siting sets the fail-safe. If you are building or buying big lines, the opening is 2026 through 2032. The smart move now is to treat that as a deadline, not a hope, and work backward from the milestones that lock it in.