Sodium Ion’s U.S. Turning Point: Pilots vs. Shutdown

Two headlines define sodium-ion’s U.S. moment: the first grid-scale pilots ship while a flagship factory shuts down. Here is what that split means for 2-6-hour storage, domestic manufacturing, procurement playbooks, and investor signals through 2029.

The week sodium-ion grew up in America

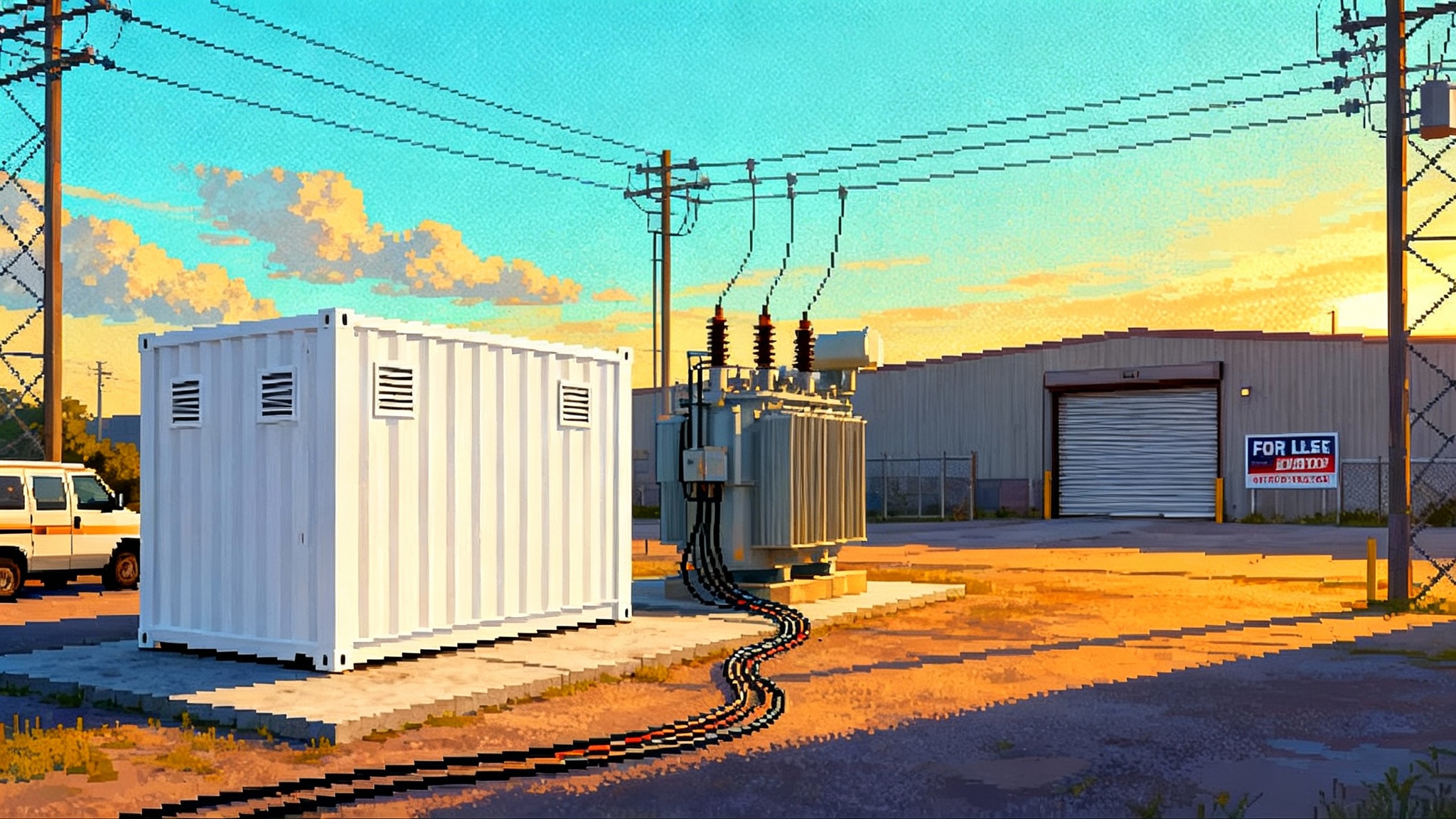

In late summer 2025, sodium-ion stopped being a lab curiosity and became a market story. A young integrator announced it had shipped the first grid-scale sodium-ion storage system to U.S. customers, positioning the chemistry for real-world duty cycles rather than conference slides. The company’s launch went out in a press release that called the system the first of its kind on the U.S. grid and emphasized a passive cooling design aimed at safer, simpler operations. You can read those claims in the company’s announcement: first U.S. grid-scale sodium-ion system.

Then, a few weeks later, the other shoe dropped. Natron Energy, the highest-profile American sodium-ion manufacturer, shut down operations and closed its Michigan plant after struggling to navigate certification delays and a changing funding environment. For an industry that still remembers Aquion’s collapse a decade ago, the juxtaposition was jarring: proof of life on the grid, and a factory going dark.

This is not contradiction so much as a pivot point. Sodium-ion is entering the messy middle of commercialization where pilots meet bankability, and where policy and capital decide which chemistries reach scale.

What sodium-ion is really good at

Think of grid batteries as a fleet of delivery trucks. Some are sports cars built for acceleration. Some are long-haul rigs. Sodium-ion is the sturdy work van: not the fastest, not the flashiest, but dependable, easy to service, and cheap to fuel. For the grid, that translates into a few concrete advantages.

- Materials that are widely available: sodium, aluminum, iron, manganese, and carbon. That lowers supply risk compared with lithium, nickel, and cobalt.

- Pack designs that tolerate a wider temperature range. Many sodium-ion cells can operate with minimal or no active cooling in moderate climates, which simplifies enclosures and reduces auxiliary power.

- Safety profiles that ease siting and insurance. Lower flammability and fewer thermal-runaway pathways mean fewer mechanical systems and lower operating complexity.

- Energy density that is lower than lithium iron phosphate, but good enough for stationary sites with room to spare. Racks can be larger without killing economics, especially at two to six hours of storage.

These traits align with the grid’s biggest battery jobs through 2029: shifting mid-day solar into evening peaks, damping price spikes, and providing reserve capacity at substations and behind the meter. They also complement the post-IRA sprint to lock wind and solar that is driving more variable generation onto the system.

A tale of two headlines, and what they mean

The pilot shipments matter because utilities have a bias toward proven gear. A unit that passes grid interconnection, runs through a summer peak, and clears a compliance test moves a vendor from slideware to shortlist. Pilots unlock site data: auxiliary loads, cell temperature profiles, inverter harmonics, container HVAC duty cycles, and real degradation under a utility dispatcher’s hand. That data is the on-ramp to framework agreements.

The factory shutdown matters because hardware companies scale through manufacturing readiness, not just chemistry. Production certification, bankable warranties, and line yields are not optional. When a marquee domestic manufacturer cannot bridge a gap between customer interest and certified, insurable shipments, developers take note. The lesson is not that sodium-ion is doomed. It is that capital will flow to companies that can ship fielded, certified, and warrantied product while policy support whipsaws.

The policy whiplash and how to build anyway

On October 2, 2025, the Department of Energy canceled $7.56 billion in awards across clean energy offices, tightening a funding environment that had already grown more selective. The cancellations were part of a broader effort to trim federal support for projects that had been counting on grants and cost share. Read the summary of that decision: DOE cancels $7.56 billion in funding.

Meanwhile, tax law debates in Washington have shortened timelines for several incentives and created uncertainty around future availability and eligibility. Transferability still exists today for many credits, but timelines and terms are in flux. Developers and manufacturers cannot build a business on headlines. Faster interconnection pathways can help de-risk projects, as the interconnection fast-track unclogs queues.

Here is how domestic sodium-ion can still scale from 2026 to 2029.

- Convert idle or delayed lithium iron phosphate module lines. Many pack-level processes are chemistry agnostic: enclosure assembly, battery management system integration, inverter interconnects. With cell supply from abroad in 2026 and early domestic cells in 2027, integrators can get megawatt-hours out the door while they plan for full vertical integration later.

- Pair state procurement with utility rate base. In vertically integrated states, regulated utilities can approve small initial deployments that get prudence findings, then scale within integrated resource plans. In competitive markets, state energy offices can anchor pilots that retain learning value even without federal cost share.

- Use municipal and cooperative financing. Public power entities can access tax-exempt debt and issue requests for proposals that prioritize safety and total cost of ownership rather than headline cost per kilowatt hour.

- Lean on private credit and insurance. Where the Loan Programs Office would have provided a first-loss backstop, private credit funds will step in if warranties are backed by investment-grade insurance and if independent engineers sign off on performance models.

- Focus on enclosure and integration intellectual property. Even if cells are imported at first, a domestic edge can sit in airflow design, passive thermal management, fire suppression interfaces, rapid isolation features, and software that optimizes auxiliary loads.

Why two to six hours is the sodium-ion lane

Sodium-ion’s lower energy density is not a problem when you have land and a crane. In a suburban substation or a brownfield near a feeder head, container volume is cheap compared with electronics and labor. What matters is the delivered cost of a flexible megawatt, during the four to six hours when the grid needs help. Sodium-ion’s performance sweet spot lines up with the jobs utilities are actually buying in 2026 through 2029:

- Solar shifting: absorb generation from 10 a.m. to 2 p.m., discharge from 5 p.m. to 9 p.m.

- Distribution deferral: hold a feeder under its thermal limit for a summer evening.

- Fast reserve and reliability: ride through contingency events, then recharge overnight.

What wins these jobs is not peak energy density. It is the lifetime cost of delivered, dispatchable capacity. Sodium-ion can pull ahead if it reduces auxiliary loads, extends calendar life without heavy cooling, and keeps insurance and fire safety costs low.

The procurement models utilities will actually use

Utilities do not adopt new chemistries by leaping to thousand-megawatt-hour bets. They standardize risk, then scale. Expect to see five models from 2026 to 2029.

- Pilot tranche with predefined scale-up

- Size: 10 to 50 megawatt hours in year one, with options up to 300 megawatt hours.

- Trigger: pass specified performance tests across a summer and winter season.

- Terms: fixed price with escalation cap, milestone payments tied to site acceptance, step-down warranty deductibles as fleets grow.

- Why it works: creates a runway from learning to volume without another board vote.

- Split-chemistry portfolio buy

- Size: 200 to 800 megawatt hours, mixed sodium-ion and lithium iron phosphate.

- Trigger: portfolio performance obligations at the project level, not the chemistry level.

- Terms: integrator wraps the whole portfolio with a single warranty and performance guarantee; failure in one block can be remedied in another.

- Why it works: spreads risk while benchmarking real-world performance.

- Build-own-operate with capacity payments

- Size: 50 to 300 megawatts with four hours per site.

- Trigger: a capacity contract that pays for availability and call compliance.

- Terms: developer finances and owns the asset; the utility pays a monthly capacity fee and retains dispatch rights within a call window.

- Why it works: keeps chemistry risk with the owner while ensuring reliable service.

- Substation standard module

- Size: 5 to 20 megawatt modules that share a standardized pad design and protection scheme.

- Trigger: utilities approve a repeatable interconnection and protection template.

- Terms: framework pricing, quick-turn procurement, standardized preventive maintenance.

- Why it works: procurement shifts from bespoke projects to product orders.

- Behind-the-meter fleet aggregation

- Size: 50 to 200 megawatt hours deployed across schools, warehouses, data halls, and municipal buildings.

- Trigger: a distribution utility contracts a third party to install, own, and operate sodium-ion units that provide feeder relief and non-wires services.

- Terms: pay-for-performance with locational adders; commercial host gets bill savings and resiliency.

- Why it works: revenue stacking and risk pooling while proving safety in occupied buildings.

For all five models, the paperwork looks familiar: UL 9540A testing summaries, NFPA 855 compliance affidavits, independent engineer opinions, and insurance binders that specify site separation and suppression. Buyers will also want evidence of replacement part logistics, not just cell supply. Who stocks spare modules, controllers, and contactors within a four-hour drive of the site? Who trains local electricians? That is often the difference between a successful pilot and a stranded asset. Expect specs to reflect FERC IBR ride-through rules as well.

The investor dashboard: what to watch in 2026-2029

If you are underwriting a sodium-ion platform, skip the hype reel and track five concrete signals.

- Safety and insurability: are premiums and deductibles coming in below lithium iron phosphate of similar scale, or at least not higher? Are underwriters requiring less expensive segregation and ventilation? Are fire marshals signing off faster because the design avoids active cooling and has fewer moving parts?

- Lifecycle cost, proven by data: how many megawatt hours delivered per dollar of all-in cost, including auxiliary loads, scheduled maintenance, and expected module replacements over ten to fifteen years? Pilots should publish auxiliary load profiles, not just round-trip efficiency headlines.

- Supply chain depth: can the integrator qualify two cell vendors, and can those vendors demonstrate two independent cathode sources? Do anode materials use aluminum current collectors rather than copper, and does that reduce both cost and import risk?

- Certification and warranty quality: UL 9540A is table stakes. Underwrite the warranty language. Is cycle life pro-rated in a way that protects the project at real capacity factors? Is there a performance guarantee that integrates augmentation and calls out the testing protocol before and after augmentation?

- Balance sheets and buffers: who stands behind the wrap? If a startup is the face of the product, is there a larger insurer or reinsurer standing behind key obligations? Is there a dedicated reserve for warranty claims funded at financial close?

A final, practical check: backlog versus shipments. A big backlog without certified shipments is a risk flag. A smaller backlog combined with repeat deliveries to the same utility is a green flag.

Scenarios for 2026-2029

- Base case: sodium-ion becomes the default choice for two to four hour distribution-level projects in mild and hot climates where passive or low-complexity cooling works. Market share reaches modest double digits in new U.S. utility procurements by 2029, with most volume still lithium iron phosphate.

- Faster track: if one or two cell makers deliver consistent quality and two U.S. integrators establish reliable service networks, sodium-ion captures a quarter of new two to six hour procurements by 2029. Insurance advantages and simpler operations convince utilities to standardize around a sodium-ion module for substation use.

- Stall: if federal incentives compress further and domestic factories slip while import restrictions tighten, project finance turns conservative. Sodium-ion remains a niche option for public power and campus microgrids, with limited growth until 2030 when new plants come online.

What to do next if you buy, build, or fund storage

- Run a two-season pilot with real dispatch. Require at least 500 cycles or a full summer and winter of utility-directed operations. Publish auxiliary load data and temperature profiles to your own standards.

- Negotiate a warranty you can live with. Insist on a replacement logistics plan, not just a promise. Tie milestone payments to the arrival of spare parts and to the training of your local technicians.

- Pick sites that fit the chemistry. Favor pads with room for larger enclosures and with ventilation and access that suits passive cooling. In cold climates, plan for simple enclosure heating and a conservative degradation model.

- Use portfolio buys to derisk. Pair sodium-ion with lithium iron phosphate or zinc hybrid to keep project-level guarantees while you build comfort.

- Build a second supply path. Qualify a second cell vendor and a second pack integrator early. You will get better pricing and a true hedge.

The bigger picture

The two headlines of late 2025 did not contradict each other. They laid out the path. One showed that sodium-ion can ship and work on American grids. The other reminded everyone that factories do not run on chemistry alone. They run on bankable orders, clear policy, and execution in the dull details: certification dates, insurance binders, replacement parts, and service vans that arrive on time.

If the industry moves those details into muscle memory, sodium-ion will become the grid’s work van from 2026 to 2029. Not the sports car, not the trophy truck. The dependable hauler that shows up every day, costs less to run, and is easy to park at the substation.