Dynamic Line Ratings Slip Past 2025 as Grid Needs Surge

FERC-approved extensions push dynamic and ambient-adjusted line ratings into 2026 to 2028, leaving billions in congestion and curtailment on the table. Here is what slipped, why it matters, and a practical plan to recover speed.

Breaking: the fastest grid fix is slipping

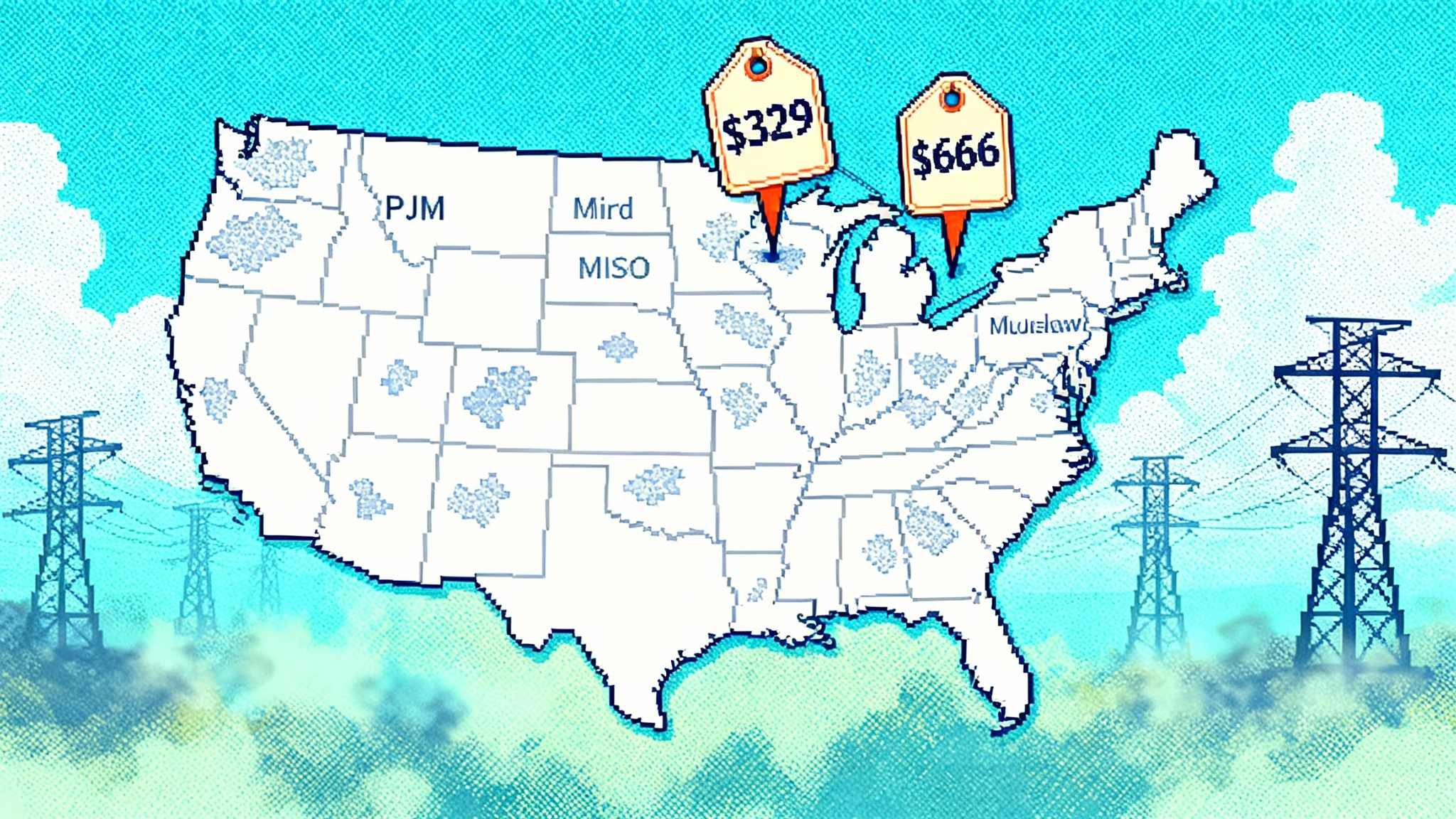

The United States just hit a pothole on the quickest road to more transmission capacity. Dynamic line ratings and the ambient-adjusted ratings that feed them were supposed to be widely in place by mid-2025. Instead, several regional grid operators asked for and received extra time, pushing key milestones into 2026 and even 2028. In public filings this year, federal regulators detailed extensions for the big organized markets: PJM to April 15, 2026, ISO New England to December 15, 2026, Southwest Power Pool to September 1, 2026, California ISO to December 17, 2026, and New York ISO to December 31, 2028. MISO requested a to-be-determined date no later than December 31, 2028, citing industry-wide software delays and vendor constraints, as summarized in a FERC concurrence on requested extensions.

This is a setback at the worst possible time. Load is rising from data centers, industrial reshoring, and electrification. See how these trends accelerate utility spending in AI data centers capex supercycle. New energy projects are waiting in crowded interconnection queues. Building big new lines is essential, but siting and construction take years. Dynamic line ratings are the quick win that makes space on the network in months, not decades. The clock is ticking, and the delays matter.

What dynamic line ratings actually do

Think about driving across a steel bridge on a cool, windy day. The wind cools the metal, so it can safely handle more weight. A power line behaves the same way. When it is cooler and windier, the conductor runs cooler at a given current. That means a higher safe current limit, which is the rating. Static or seasonal ratings assume one set of conditions for a long period. Ambient-adjusted ratings update that limit hourly based on temperature and sun. Dynamic line ratings go further by using sensors and weather models to capture real conditions like wind speed, solar heating, and line sag in near real time.

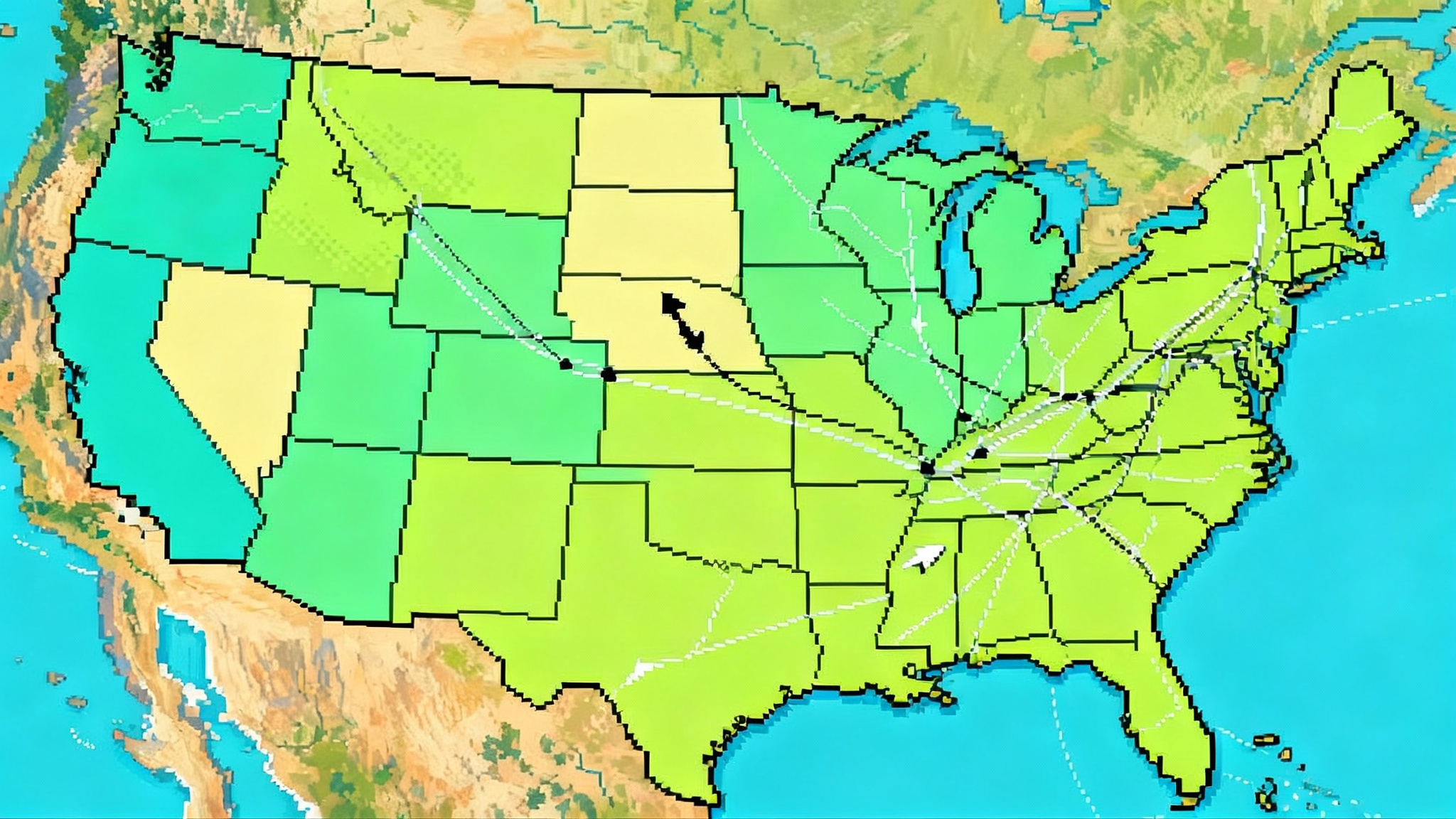

The physics are straightforward. Lines heat up as current flows. Hotter conductors sag more. Operators must keep sag clearances safe and keep conductor temperature within material limits. If you can measure temperature and sag more precisely, and pair that with localized weather, you can raise the rating when conditions allow and lower it when they do not. Studies and field deployments show that dynamic line ratings typically add double-digit percentage capacity, especially on windy days that tend to coincide with high wind generation. The best part is that the steel towers and conductors do not change. The rating changes because the math about heat and wind is more accurate.

Grid-enhancing technologies, explained simply

Dynamic line ratings are part of a broader toolkit called grid-enhancing technologies. Three families matter most for near-term relief:

- Dynamic line ratings and ambient-adjusted ratings: software and sensors that raise or lower line limits with the weather.

- Topology optimization: decision-support software that recommends temporary switching actions at substations to re-route flows around bottlenecks, like a navigation app avoiding traffic jams.

- Modular power flow control: hardware devices that nudge current away from hot spots and toward underused lines, often installed quickly on existing structures.

The Department of Energy has described how these tools can add significant capacity to the existing grid at lower cost and with faster timelines than major reconductoring or new lines, while improving reliability and resilience. The agency’s 2024 Liftoff report on grid solutions framed them as a bridge that frees capacity during the long buildout of new infrastructure.

Why 2025 slipped: software, vendors, and incentives

So why are we not there yet? The filings point to three practical causes, plus one structural problem with utility incentives.

-

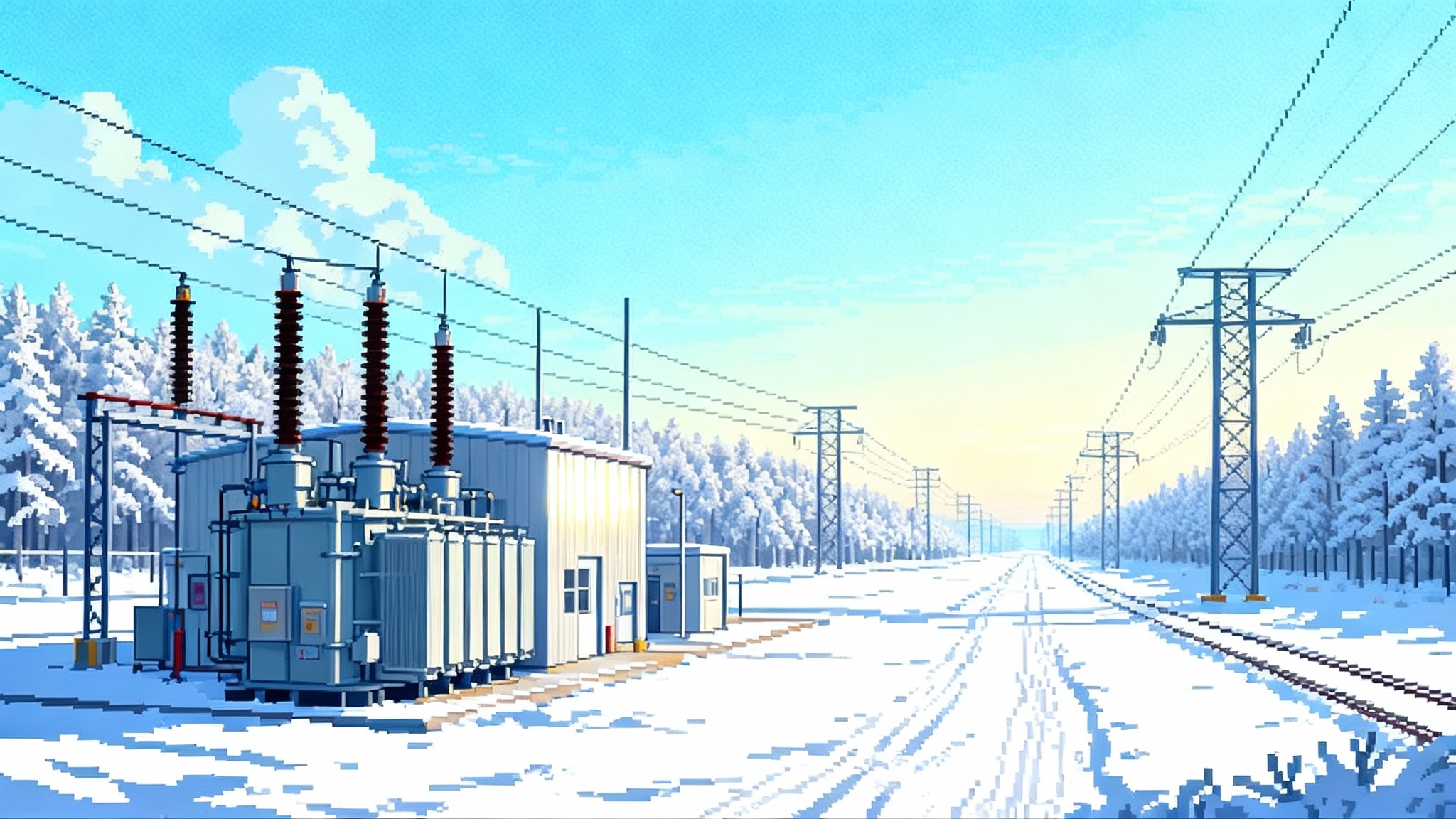

Market and operations software are the bottleneck. Ambient-adjusted and dynamic ratings must be integrated inside energy management systems, state estimator pipelines, contingency analysis, and market engines for day-ahead and real-time security-constrained dispatch. Those engines were built around fixed ratings. Hourly updates across thousands of elements change the shape of feasible dispatch every hour. That requires stable interfaces, new data models, and rigorous testing under N-1 security. Operators cannot flip that switch without confidence that alarms, contingencies, and market outcomes remain stable.

-

Vendor capacity is tight. The same small set of software providers and sensor manufacturers are serving dozens of transmission owners and multiple regional operators at once. Integration teams for market engines and energy management systems are finite. Lead times for qualified sag temperature sensors, weather stations, and communications gear are not trivial, especially when cybersecurity hardening, field acceptance tests, and redundancy are included. Even when a vendor has a working product, getting it through an operator’s full production test cycle takes months.

-

Interoperability and data hygiene slow things down. Ratings are not just numbers. Each one must be tied to a specific network element in the telemetry model. Field assets must have correct identifiers, physical attributes, and locations. Weather feeds must be accurate and cover the right spans. For dynamic ratings, the chain from sensor to control room must be robust and auditable, with fallback logic if data goes missing. Cleaning and reconciling these models across owners and operators is painstaking work.

-

Incentives are misaligned. Utilities earn regulated returns primarily on capital assets in the rate base. Software and small devices look like expenses that are hard to capitalize. Benefits from better ratings show up as reduced congestion payments and improved dispatch, which accrue to market participants and customers. That creates a split incentive. Owners carry the implementation burden and cyber risk, while many of the benefits flow to others. Without explicit performance-based rewards tied to congestion reduction, reliability metrics, or interconnection throughput, executives have little reason to prioritize a complex change in operations.

The cost of delay: congestion, curtailment, and stranded projects

The price tag for slipping past 2025 shows up in three places.

-

Congestion costs stay elevated. When a line binds at a lower static rating than conditions would allow, the market must curtail cheaper generation upstream and dispatch more expensive local generation. The spread between those resources is paid as congestion rent. MISO’s market monitor estimated roughly five hundred million dollars of added costs during 2023 to 2024 from the absence of ambient and emergency ratings. That is a conservative signal of how much headroom we are not using during high-wind or cool periods, especially in shoulder seasons. The same dynamic plays out in PJM, SPP, and NYISO during windy or cool hours. For context on recent scarcity and pricing dynamics, see capacity price shock in PJM and MISO.

-

Renewable curtailment increases. Wind and solar output often peaks when weather would support higher ratings. Without dynamic limits, operators curtail clean generation. Those lost megawatt-hours are not just environmental losses, they also erode revenue for projects and dampen merchant financing for new builds. When curtailment becomes a persistent feature of a region, developers shift pipelines elsewhere.

-

Interconnection queues bog down. Network upgrade costs and timelines are sensitive to which constraints bind in the studies. Dynamic line ratings, topology optimization, and modular flow devices defuse some constraints quickly. Without them, more clusters face large network upgrades or re-studies, which lengthens queues and raises developer attrition. Near-term federal siting efforts like NIETC corridors set for 2026 to 2032 can help, but software-driven relief is still the fastest lever.

What slips to 2026 to 2030 if nothing changes

If the current path holds, hourly ambient ratings will roll into production across the big markets through 2026. Full dynamic line ratings will proceed more slowly, especially in complex corridors with multiple owners. Some operators will scale topology optimization and limited modular flow devices on congested interfaces, but adoption will be uneven.

The risk is that load growth outpaces these gains. Data center clusters will continue to appear where power and land are available. Electrification of industrial heat and fleet charging will add new peaks. If operators slip further, curtailment and congestion will become structural features in parts of the Midwest and East, and more developers will pivot to regions with clearer timelines or to behind-the-meter arrangements with private wires. Customers will pay more for the same electrons.

An acceleration plan for 2026 to 2030

A faster path is still within reach. It does not require a new act of Congress. It requires prioritization, better targeting, and incentives that reward measured outcomes. Here is a concrete plan that would move the needle.

1) Declare 15 to 20 targeted dynamic line rating corridors per region

- How to choose: pick interfaces that appear in both operations and interconnection studies, that show high curtailment of low-cost generation, and that already have telemetry coverage and communications. Favor spans with high wind exposure where ratings are most elastic.

- What to do: instrument those lines with a mix of weather stations, sag temperature sensors, and digital twins; define fallback rules; and bring hourly ratings into contingency analysis and market models first, then add sensor-driven dynamic ratings where the benefit-cost is strongest. Start with shoulders and nights when solar heating is lowest and risk is reduced.

- Who executes: transmission owners with designated corridor teams, in coordination with the regional operator. Vendors include LineVision, Ampacimon, Lindsey, Heimdall Power, and Neara, but the critical path is integration with the operator’s software and procedures.

- How to measure: publish a monthly scorecard with congestion savings, curtailment avoided, emergency rating usage, and hours of high rating utilization.

2) Stand up always-on topology optimization in the control room

- How to choose: target the same corridors and the top ten binding constraints in each region. Treat this as a decision-support tool that suggests switching actions with pre-cleared contingencies and limits.

- What to do: integrate software that can search feasible configurations in seconds, propose reconfigurations that preserve security, and log every recommendation and action. Create a playbook of approved reconfigurations and update it quarterly as network conditions change.

- Who executes: regional operators, with transmission owner sign-off, using commercial tools or homegrown modules. Operators should run supervised pilots, then graduate to 24x7 advisory mode with operator acceptance training.

- How to measure: report megawatt-hours of congestion relief and the percentage of time the tool provided actionable recommendations.

3) Deploy modular power flow control where software alone cannot carry the load

- How to choose: look for persistent bottlenecks that appear even after dynamic ratings and topology fixes, especially where a parallel path is underused. Interfaces with a few key lines are good candidates.

- What to do: install modular devices on lattice towers or in substations to steer current. These can be placed in months and reconfigured as network conditions change. Pair with topology optimization so software and hardware complement each other.

- Who executes: transmission owners, coordinated through the regional planning process. Vendors include Smart Wires and other providers of power flow control.

- How to measure: report changes in flows on targeted interfaces and how often devices are retuned.

4) Put performance-based rates on congestion and interconnection throughput

- What to change: regulators can authorize incentive mechanisms that pay utilities and operators for reducing congestion costs against a baseline, for cutting curtailment hours, and for increasing the number of projects reaching interconnection milestones. This aligns revenue with outcomes rather than asset count.

- How to structure: set a transparent baseline from historical congestion by constraint and season. Share savings between customers and the utility. Cap upside and downside to keep risk reasonable. Include clawbacks if reliability violations increase.

- Why it works: executives respond to incentives they can control. When the prize is tied to measurable relief, software and small devices become business priorities rather than science projects.

5) Fast-track approvals for grid-enhancing technologies

- What to streamline: create a short docket template for dynamic ratings, topology optimization, and modular flow control. Approve corridor-level programs rather than single-asset pilots. Allow portfolio procurement so owners can sequence sensors, software, and devices without serial cases.

- How to guardrail: require cyber and safety certifications, standardized operating procedures, and a public measurement plan. Time-limit the fast track to five years with a renewal based on measured benefits.

Who wins first, and where the risk sits

-

Developers: projects near targeted dynamic rating corridors and in regions adopting topology optimization should see fewer hours of curtailment and lower network upgrade costs. That improves the finance case. Developers should prioritize interconnection sites proximate to those corridors and should engage operators on corridor selection.

-

Traders: congestion strategy shifts when ratings go hourly. Traders who build weather-aware models of line ratings and incorporate emergency rating usage will be better positioned. Liquidity may improve on constraints that move from permanently binding to occasionally binding.

-

Original equipment manufacturers and software vendors: sensor providers, weather modelers, power flow control manufacturers, and market software integrators are obvious winners. The near-term pinch point is integration talent inside operators. Vendors that arrive with pre-tested adapters for state estimation, contingency analysis, and market engines will advance fastest.

-

The risk if operators slip again: curtailment becomes structural, queues stretch, and regions with tight margins during 2027 to 2029 see more scarcity pricing. Data center siting will migrate to regions that move faster or to private wires that bypass organized markets. The public narrative will shift from building a smarter grid to paying more for the same service.

What readers can do now

-

If you are at a utility or regional operator: volunteer a corridor where your models show the biggest swing between static and ambient ratings, and propose a joint corridor team with your operator. Bring interconnection and operations planners to the same table. Budget two releases, first hourly ambient ratings in contingency and markets, then sensor-driven dynamic ratings on the highest value spans.

-

If you are a regulator: pilot a congestion savings sharing mechanism on one interface, and demand a monthly scorecard with measured benefits. Commit to a six-month fast track for grid-enhancing portfolios that meet standard safety and cyber criteria.

-

If you are a developer: pivot projects toward nodes near likely corridors. In stakeholder venues, push for topology optimization and modular flow control in study assumptions, not as afterthoughts.

-

If you are an investor: ask vendors about integration backlogs, not just sensor performance. Favor companies with proven adaptors into market and operations software, and those with training and change-management offerings for control room staff.

The bottom line

The grid is a physical network with digital constraints. Static ratings were a placeholder, useful when telemetry was limited and computing was scarce. We live in a different world. We can measure, model, and operate lines in step with the weather. The filings this year tell a plain story. Operators still need more time to make hourly and dynamic ratings part of routine operations. That is understandable, but it is not sustainable.

The fastest path forward is to narrow the ambition to the corridors that matter, run software in the loop every hour, drop in modular hardware where needed, and pay for results. If we act with that focus, the period from 2026 to 2030 can be remembered as the moment the grid learned to breathe with the wind and the weather. If we do not, congestion and curtailment will keep climbing, and so will the bill.