Palisades Leads America’s Nuclear Restart From Shutdown to Grid

In July 2025 regulators opened the gate for Palisades, the first U.S. commercial reactor moving from retirement back to operation. This roadmap shows how NRC approvals, DOE financing, and a contract-led model can be replicated at other brownfield sites.

Breaking news and a first for U.S. nuclear

In July 2025 the Nuclear Regulatory Commission approved a suite of actions that returned the Palisades Nuclear Plant’s operating basis and allowed Holtec to begin fuel load preparations. It is the first time a U.S. commercial reactor that had shut down moved back toward operations. The decision restored emergency and security plans, technical specifications, and transferred operating authority to Palisades Energy LLC. The agency made clear that additional steps were still required before startup, but the milestone opened the gate to restart. NRC approvals in July 2025.

Less than a month later, the Department of Energy approved another loan disbursement to Holtec under its previously closed 1.52 billion dollar loan guarantee, signaling that the federal financing spigot is flowing as work advances. The August disbursement, one in a series since financial close in 2024, helped fund component repairs, staffing, and site readiness on the path to reconnecting an 800 megawatt reactor to Michigan’s grid. DOE’s August loan disbursement.

Together these two actions did more than nudge one plant across a regulatory threshold. They created a working playbook for reviving retired reactors when the math beats new construction on cost and time.

Why restarts can outcompete new builds

Think of a brownfield restart like renovating a sturdy brick school with new HVAC and safety systems, not erecting a new campus from scratch. The foundation is there. So are the water intake, cooling infrastructure, switchyard, transmission interconnect, foundations, fuel handling systems, training facilities, office space, and a community that has lived with the plant for decades. That head start shows up in both time and dollars.

- Time to grid: A restart reuses a cleared and licensed site. Palisades’ path from shutdown in May 2022 to targeted restart by late 2025 compresses what would otherwise be a decade-plus sequence for a greenfield gigawatt reactor. Much of that schedule advantage comes from sidestepping site selection, environmental reviews on a greenfield location, land acquisition, major civil works, and new high-voltage interconnection.

- Capital intensity: Publicly announced federal loan support of up to 1.52 billion dollars and state appropriations have covered a large share of restart capital. That implies all-in costs in the low single digit billions for roughly 800 megawatts. New gigawatt-scale plants have recently required many times that per megawatt, in part because first-of-a-kind civil works, craft labor peaks, supply chain learning curves, and interest during construction add up quickly.

- Execution risk: A restart faces real technical challenges, but they are bounded. Equipment is known. The failure and maintenance history is logged. Procurement focuses on specific replacements and upgrades rather than a full plant build. That lowers the surface area for delays.

None of this makes restarts cheap or easy. They must clear the same safety bar and still require thousands of tasks. The point is comparative: if you need clean, firm power on the grid within a few years, reviving a proven machine can compete head to head with new build schedules and risk profiles.

The Palisades repair and licensing milestones, explained simply

If you have ever restored a classic car, you will recognize the steps. You do not just drop in a new engine and drive away. You rebuild the brakes, test the fuel lines, and update the seat belts to modern standards. Palisades followed an equivalent sequence under NRC oversight.

- License basis restoration: The NRC reinstated the plant’s prior operating documents and plans, including the Emergency Plan and Emergency Action Levels, and transferred authority to Palisades Energy LLC. That move reestablished the regulatory scaffolding for operations.

- Steam generator repairs: Inspections identified tube indications that required repair. Holtec pursued a licensed repair method known as sleeving, using high corrosion-resistant alloy sleeves to reinforce affected tubes and return heat transfer capacity. That is like relining worn brake cylinders rather than replacing the entire assembly.

- Emergency preparedness: Federal and state agencies conducted and graded emergency response exercises with county partners. The outcome revalidated offsite plans and siren-to-shelter communication pathways. You can think of this as retesting the car’s airbags and emergency flashers after a long layup.

- Open phase and grid protection checks: The plant closed out actions related to detecting open phase electrical conditions on the offsite power system to ensure plant safety systems do not see misleading voltages during external faults. These protections complement evolving inverter-based resource ride-through requirements, as discussed in FERC 2025 IBR rules.

- Fuel load authorization: With prerequisite amendments in hand, the team prepared to bring new fuel onsite and into the reactor vessel. Fuel load itself is an orchestrated, camera-monitored evolution that triggers a cascade of pre-startup testing.

- Restart test program: Following fuel load, operators complete low-power physics testing, systems operability checks, and gradual power ascension with hold points. Third-party oversight and NRC resident inspectors verify each step. Only then does the generator synchronize and send power to the grid.

None of those steps are optional. Each has an engineering purpose and a regulatory gate, and failure to complete them in order would delay restart. The notable change in 2025 was the pace at which those gates started to open after years of groundwork.

Show me the money: merchant vs regulated paths, and why Palisades chose contracts

There are two basic revenue models for big nuclear plants in the United States:

- Regulated utility rate base: A vertically integrated utility builds or acquires the asset, regulators approve costs, and the utility recovers capital plus an allowed return from customers over time. The benefit is stable cost recovery and financing. The tradeoff is regulatory scrutiny and, often, longer approval cycles.

- Merchant with contracts: The plant sells into wholesale markets, often with long-term power purchase agreements or contracts for differences that stabilize cash flows. The benefit is speed and the ability to match a plant with an anchor customer. The tradeoff is market exposure if contracts roll off, and higher financing costs unless public programs mitigate them.

Palisades followed the second path. Long-term contracts with cooperatives serve as the anchor offtake, supplemented by participation in the MISO market. That model pairs well with federal loan support, which reduces financing cost and aligns repayment with contracted revenues. The approach is modular: sign enough contracted load to underwrite restart, then add customers or hedges as confidence grows. It also gives buyers leverage. Companies and coops that want clean, firm power at scale can procure it directly rather than waiting for a regulated utility to build new capacity.

States can play a decisive role either way. Michigan’s appropriations and public support reduced restart uncertainty and sent a signal to investors, while federal agencies provided financing and emergency planning validation. Other states can replicate that mix through site-specific grants, zero emission credit programs, and property tax agreements that stabilize community services during the transition back to operations.

The replication playbook for Three Mile Island and Duane Arnold

The interest is not confined to one shore of Lake Michigan. Two prominent candidates illustrate how Palisades can be replicated with local variation.

Three Mile Island Unit 1, Pennsylvania

- Commercial anchor: Corporate clean power demand is the accelerant. A long-term contract with a hyperscale data center or a consortium of industrial buyers can underwrite restart economics. Contracts can include time-of-delivery value, flexible baseload commitments, and price collars that align incentives. See how AI data centers ignite capex.

- Regulatory path: Like Palisades, the sequence is to restore the operating basis, secure license amendments tied to equipment upgrades, and conduct graded emergency exercises with state and county partners. Pennsylvania’s deep nuclear workforce and transmission footprint around the Susquehanna and Susquehanna-PJM corridors simplify staffing and interconnection.

- Equipment focus: Expect major inspection campaigns on steam generators, reactor coolant pumps, and protective relays, plus digital control upgrades in the turbine building. A targeted set of replacements can modernize the plant without changing its core design.

- State role: Pennsylvania can revive or tailor nuclear attributes within its clean energy policies, support local tax base stability agreements, and align workforce training through community colleges near the site.

Duane Arnold, Iowa

- Interconnection first: Keeping or restoring queue position is the difference between years and months. Securing Federal Energy Regulatory Commission approvals to consolidate interconnection rights and avoid a fresh multi-year queue is a keystone move. Regional work to speed studies mirrors the interconnection fast-track arrives.

- Cooling and balance-of-plant: Since parts of the site were dismantled, restart requires new transformers, rebuilt cooling towers, and facilities upgrades. This is a heavier lift than Palisades, but still faster than a greenfield plant because the nuclear island and switchyard footprints remain.

- Offtake strategy: A blended offtake with a data center anchor, rural cooperatives, and municipal buyers can diversify risk. Contracts should match the restart schedule with milestone-driven payment structures, allowing sellers to hedge construction risk and buyers to secure price certainty.

- State support: Iowa can stack incentives around manufacturing growth near the site, training grants, and transitional tax arrangements that ramp as generation returns.

For both sites the financing stack is familiar: a mix of loan guarantees or direct loans, customer pre-commitments, and possibly state-backed credit enhancements that lower the cost of capital. The technical work is site specific, but the governance and financial architecture are portable.

The 2030s upside: restarts paired with small modular reactors at brownfield sites

Once a brownfield plant is back, the site can do more than just return its legacy megawatts. It can host a new phase of capacity growth. Small modular reactors, if licensed and delivered at scale, unlock three compounding advantages at these sites:

- Shared infrastructure: New units can plug into existing transmission, roads, security, training, and water systems. That efficiency shaves both years and millions of dollars per megawatt.

- Community license to operate: Communities that have lived with a plant for decades have already answered many social questions about land use and benefits. That makes public engagement clearer and reduces siting friction.

- System design flexibility: Co-located SMRs can be phased. A site can add 300 megawatts, learn, then add another 300. This laddered approach reduces peak financing needs and smooths craft labor demand.

Palisades is the earliest testbed for this pairing. Holtec has signaled intent to deploy small modular reactors at the site after the legacy reactor returns. Whether those units come from Holtec or others, the big picture is the same. The 2030s could see clusters of brownfield nuclear campuses that combine a recommissioned legacy unit with one or two modular additions. Each campus would deliver one to two gigawatts of clean, firm power with far less siting risk than greenfield alternatives.

The near-term constraint is straightforward: small modular reactor designs must complete federal licensing and reach repeatable factory production. The brownfield advantage remains compelling even if the first wave of units is not perfect on cost. The site and grid savings are hard to match anywhere else.

Practical next steps for stakeholders

- Governors and legislators: Identify brownfield nuclear sites with intact switchyards and water rights. Create a state restart package that includes workforce training funds, tax base stabilization agreements with local governments, and streamlined state-level permits for repairs and testing.

- Grid operators: Reserve or restore interconnection rights for qualified restart candidates under clear criteria. Publish a restart fast lane that defines studies, protection upgrades, and timelines for resynchronization.

- Corporate buyers and coops: Aggregate demand. Form buyer clubs that commit to 10 to 20 year contracts with milestone pricing that funds restart in stages. Keep contract terms simple enough for financing but specific on delivery risk and remedies.

- Plant owners: Start with a disciplined condition assessment. Sequence license actions so that emergency planning, security, and technical specifications are restored before major procurement. Communicate realistic schedules and hold points to earn regulator confidence.

- Federal agencies: Keep the loan disbursements tied to technical progress. Expand support for life extension investments that extend operating licenses beyond the current expiry dates once restart is proven.

What this means for reliability and decarbonization

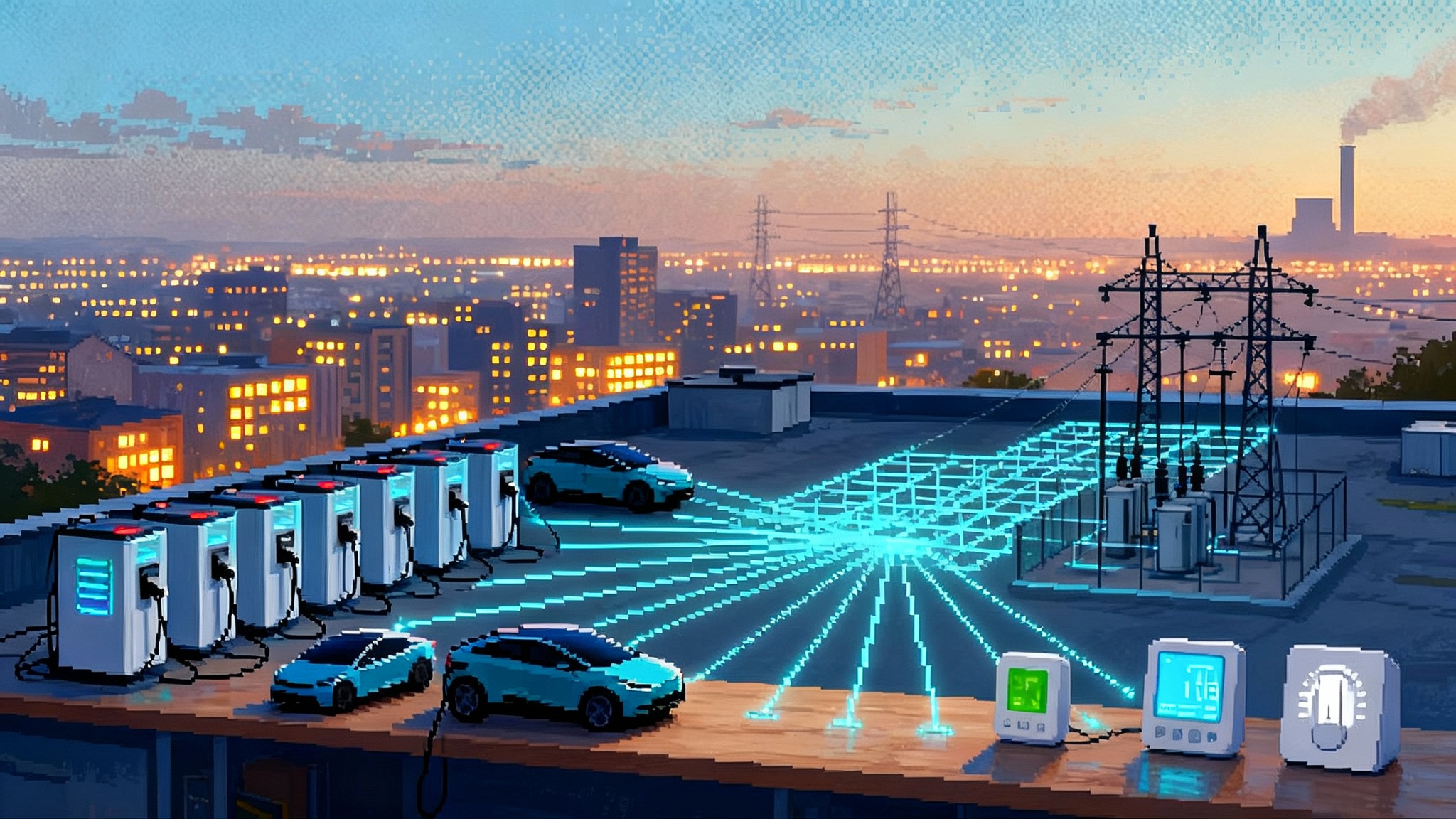

Grid planners project that demand will climb through the 2030s as industry reshapes supply chains, vehicles electrify, and data centers multiply. Those loads require 24 hours a day power that wind, solar, and batteries cannot fully cover alone. Returning proven nuclear megawatts is like putting a trusted veteran back on the roster in time for the playoffs. It steadies the team.

Palisades is now the case study that replaces speculation with a sequence. A retired plant can restore its license basis, repair prioritized systems, requalify its workforce, and return to service on a schedule that looks more like a major overhaul than a new build. The financing is replicable. The offtake structures are already in the market. The public benefit is tangible: faster decarbonization and tighter reliability at a time when both have become binding constraints.

The next two years will determine how quickly the playbook scales. If Palisades synchronizes on time and performs well, Three Mile Island and Duane Arnold can follow with confidence. By the early 2030s, pairing restarts with modular additions at the same sites can turn brownfield nuclear campuses into the fastest, most scalable lever for clean, firm power in the country.

The headline is simple. July’s regulatory green light and August’s financing signal did not just rescue a plant on Lake Michigan. They opened a path to bring back a fleet of retired reactors and to build on them. That is how America can add clean megawatts at the speed the grid now demands.