45V Goes Live: The New Map for Clean Hydrogen Projects in America

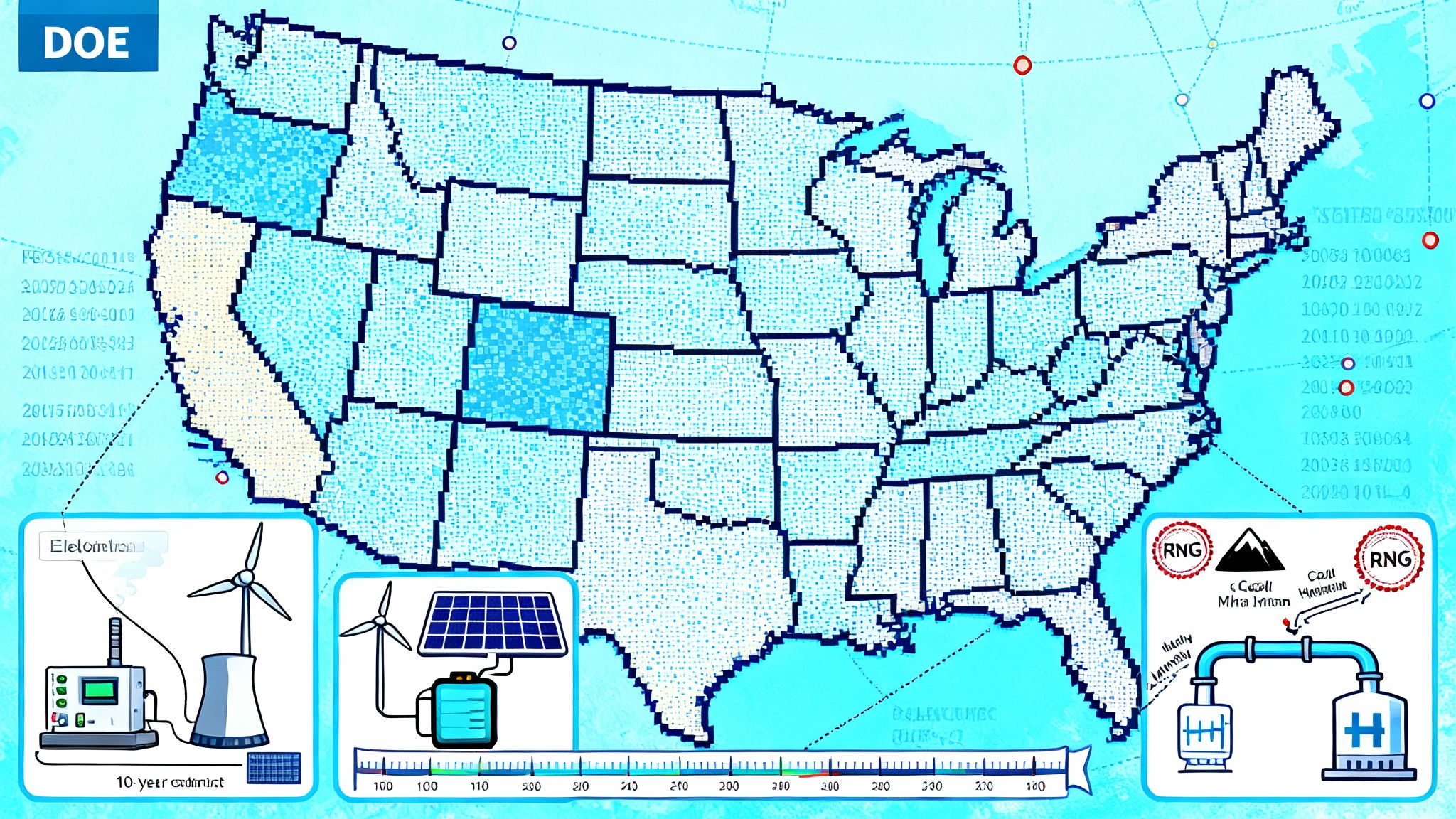

IRS and Treasury s January 2025 decision turned 45V from debate into deal math: annual matching through 2029, hourly by 2030; deliverability by DOE grid regions; new incrementality including at-risk nuclear; and tracked RNG and coal-mine methane starting in 2027. This guide translates rules into siting and contracting moves.

The day the rules stopped moving

On January 3, 2025, Treasury and the IRS finalized the 45V clean hydrogen credit. The decision turned a shifting policy debate into a working playbook that developers, utilities, and industrial buyers can actually price. The headline shifts are simple to say and powerful in practice: annual time matching for electricity until 2030, then hourly; deliverability based on Department of Energy grid regions; new incrementality pathways that include at-risk nuclear; and a structured way to use tracked renewable natural gas and coal-mine methane starting as early as 2027 when certified book-and-claim systems are available. For wording and scope, see the Treasury’s final 45V rules press release.

This piece translates those rules into siting choices, contract structures, and a market timeline that will define who wins the 2025 to 2029 land-grab for industrial offtake.

45V in one page: the economic levers that matter

Think of 45V as a sliding scale that pays more the cleaner your hydrogen is. The law ties the credit value to lifecycle emissions in kilograms of carbon dioxide equivalent per kilogram of hydrogen. If you hit the lowest carbon intensity tier you can reach the highest credit value, and the tiers step down as emissions rise. The Treasury-approved model to calculate this is DOE’s 45VH2-GREET.

Four policy levers drive your modeled carbon intensity and therefore your 45V dollars per kilogram:

- Temporal matching: Do your clean energy certificates line up with when the electrolyzer runs. Annual matching is allowed through the end of 2029. Hourly matching is required starting January 1, 2030.

- Deliverability: Are the energy attribute certificates from generators located in the same deliverability region as the hydrogen plant, as defined through DOE-derived grid regions and their linked balancing authorities.

- Incrementality: Is the clean electricity additional. The general rule is new supply within a 36-month window, but the final regulations add specific alternatives such as qualifying nuclear, qualifying states, and carbon capture retrofits.

- Methane pathways: For hydrogen produced via methane with carbon capture or using renewable natural gas or coal-mine methane, the rules define how attributes are tracked and when book-and-claim will be allowed.

Each lever has a practical strategy attached to it. The winning projects will stack several of these.

Annual now, hourly later: what the time clock really means

Annual matching through 2029 is a bridge. Under it, an electrolyzer can buy clean energy certificates on an annual basis and match them to total plant consumption for the year. That makes power procurement simpler and allows high utilization while you build an hour-by-hour portfolio. On January 1, 2030, the bridge ends and hourly matching takes over for any electricity you want to count toward clean hydrogen. If you are short even for a few hours, those hours default to the regional grid emissions in the model, which can pull your carbon intensity up and your credit down. For the compliance mechanics, see the IRS summary of final 45V regulations.

The rule of thumb this creates: plan to be at least 90 percent covered on an hourly basis by 2030 with physically deliverable, verifiable clean power. Leave room for a limited fraction of hours to price against the grid default in the model without losing your top credit tier.

Two implementation details matter for developers and buyers:

- Hourly tracking is not a technology you install at the plant. It is a capability that your certificate registry and your counterparties must support, with consistent timestamps and verification.

- The shift to hourly applies regardless of when your plant is placed in service. There is no grandfathering. That levels the playing field but raises the bar for long-term contracting discipline.

Deliverability: the siting grid you actually have to use

Deliverability is not a vague map line. The final rule links generators and hydrogen plants through balancing authorities grouped into DOE-derived regions and codified in a table. In practice, a project in, say, PJM cannot simply claim certificates from a wind farm in the Southwest Power Pool unless it satisfies stringent interregional delivery criteria that registries validate. Developers should work from the balancing authority table first, then the physical interconnection, then any cross-region pathways your registry and contract can truly prove.

Two consequences flow from this:

- Siting near high-quality resources inside your region is worth more than chasing the absolute best wind or solar hours somewhere else you cannot claim.

- Transmission reality matters. Projects inside ERCOT or Western regions that are rich in midday solar or nighttime wind will find more hours to cover at low cost, but they must still clear the deliverability test to count those hours. For the bigger build-out picture, see NIETC corridors and transmission.

Incrementality: the new on-ramps to additional power

The default test for incrementality is new clean generation placed in service no more than 36 months before the hydrogen facility. The final rule adds three practical doors that open projects where new build alone would be too slow or too expensive.

- Qualifying nuclear at risk of retirement. If a reactor meets the rule’s definition of qualifying and either sits behind the meter or is tied to a 10-year binding contract for attributes, up to 200 megawatt hours per operating hour per reactor can count as incremental supply. This helps keep large zero-carbon plants online. For market context, see America’s enrichment comeback.

- Qualifying states. If your project is in a state with a robust greenhouse gas cap paired with a clean electricity standard that drives fossil generators out as renewables rise, Treasury treats in-state clean generation as incremental.

- Carbon capture retrofit rule. If an existing power plant adds carbon capture equipment and brings it into service within the 36-month window before your hydrogen facility, electricity from that plant can count as incremental under the rule.

These three doors change siting math. Co-location next to a qualifying nuclear plant that signs a 10-year attribute contract can cut years off your development calendar. In a qualifying state, pairing with existing wind and solar already under a mandated clean standard can reduce your need to sponsor 100 percent new build on day one. A carbon capture retrofit can provide a controllable backbone resource for your hourly portfolio.

RNG and coal-mine methane: book-and-claim with guardrails

For hydrogen made with methane and carbon capture or with renewable natural gas or coal-mine methane, the final rule creates a parallel attribute system. The design mirrors electricity but respects the physics of pipelines. Three points to know:

- Electronic book-and-claim will be allowed only after the Secretary determines that a registry meets defined requirements, and not before January 1, 2027. Until then, taxpayers must prove physical delivery, such as a direct pipeline tie or another exclusive delivery method.

- Temporal matching for gas attributes is monthly, not hourly. The certificates must show that injection and use occur in the same calendar month.

- Deliverability treats the contiguous United States pipeline network as a single region. Alaska, Hawaii, and territories are separate regions.

If you are planning a 2027 or 2028 startup that relies on landfill gas or coal-mine methane, build optionality into your engineering and contracts now. Have a physical delivery plan you can execute if the registry determination slips, and include a switch clause to move to book-and-claim once a system is certified.

Where projects now pencil: regions and recipes

No two projects are identical, but patterns have emerged from the rule set:

- Pacific Northwest and California. Hydropower, wind, and growing solar portfolios, plus the qualifying state pathway, make Washington and California attractive for early final investment decisions. Hourly coverage is not automatic, yet the resource stack and policy environment favor low-cost certificates before and after 2030.

- Mid-Atlantic and Midwest near merchant nuclear. In PJM and MISO, proximity to qualifying merchant nuclear reactors can unlock firm hourly coverage via behind-the-meter arrangements or 10-year attribute contracts up to the hourly cap. Add daytime solar and nighttime wind for breadth, and shed the remaining uncovered hours to the grid default in the model while staying under the best credit tier.

- Texas and the Plains. ERCOT, SPP, and MISO West offer strong wind and solid solar. The deliverability rule means your electrolyzer should interconnect where those resources can be claimed inside the region. A balanced portfolio that includes storage can push hourly coverage into the 90s by 2030 while keeping power costs competitive. For queue relief trends that affect siting speed, see Interconnection fast-track and AI.

- Gulf Coast blue hydrogen. Existing hydrogen pipelines, reformers, and carbon storage options make blue hydrogen projects feasible. The methane attribute system and carbon capture rules let these plants pursue 45V with clear accounting, as long as capture rates and methane supply emissions are documented in the model and verified.

How to structure PPAs and certificates that survive 2030

Most project value will be created or lost in the paper, not the steel. Good contracts translate the rulebook into bankable certainty. Here is what that looks like.

- Two-phase temporal matching. Write power agreements that explicitly allow annual matching through 2029 and automatically convert to hourly matching for electricity generated on or after January 1, 2030. Include a test for hourly coverage sufficiency and a defined remedy if coverage dips below a threshold, such as a make-good of hourly certificates or a price adjustment tied to modeled carbon intensity.

- Deliverability proof in the exhibit. Reference the balancing authority table that defines your region and require the seller to maintain registry records showing the generator’s interconnection and any qualified interregional delivery pathway. Make it auditable.

- Tenor alignment. Set your core electricity and certificate contracts at 10 to 12 years to match the credit period and the nuclear pathway’s 10-year requirement for contracts. If you rely on the nuclear on-ramp, build the 200 megawatt hour per operating hour limit directly into the schedule so it cannot be overdrawn.

- Portfolio, not a single plant. Hourly scarcity is a portfolio problem. Combine midday solar, evening wind, and a controllable resource such as a qualifying nuclear block, carbon-captured generator, or storage. Use a master firming and shaping agreement to allocate which resource covers which hour in the registry and to avoid double claiming.

- Gas attribute options. If your design includes renewable natural gas or coal-mine methane, add a pre-2030 physical delivery fallback and a 2027 or later switch option to book-and-claim. Specify monthly timestamping and contiguous United States deliverability for attributes, as required by the rule.

- Verification baked in. Appoint an independent verifier in the contract set and require registry-level data sharing. Put verification deadlines on the same calendar as your tax filing to avoid timing issues.

What industrial buyers should do in the 2025 to 2029 window

If you buy hydrogen, derivatives like ammonia or methanol, or plan to offtake captured carbon intensity, the next four years are your opportunity to lock in the most favorable pricing you will see this decade. Here is a buyer’s checklist.

- Move now on annual-matched supply. Under annual matching through 2029, suppliers can run electrolyzers at higher utilization with cheaper certificates. You capture that margin in your offtake price if you contract early.

- Contract for hourly conversion. Demand step-down pricing or credits if your supplier misses a contracted hourly coverage level after 2030. Make the carbon intensity target and the 45V tier an explicit part of the contract price adjustment.

- Use qualification as a sorting tool. Prioritize projects with clear deliverability within a region, with at least two complementary resource types and, where relevant, a qualifying nuclear contract block.

- Ask for a proof-of-hour plan. Hourly matching is a data exercise. Require a readiness plan that lists the registry, the timestamping method, the balancing authorities involved, and the process to cure gaps.

Timeline: what happens when

- 2025. Final rules are live. Developers firm sites, secure interconnections, and negotiate PPAs and gas attribute contracts with annual matching flexibility. DOE updates to 45VH2-GREET provide the modeling basis for credit calculations.

- 2026 to 2028. Sweet spot for final investment decisions. Long-lead equipment orders land. In qualifying states and near nuclear or carbon capture retrofits, projects with portfolio PPAs stand out. RNG and coal-mine methane users line up physical delivery pathways while book-and-claim systems mature.

- 2027. Earliest possible start for book-and-claim of gas attributes once a registry is certified. Until then, physical delivery proof is required.

- 2029. The last full year when annual matching can cover electricity for 45V purposes. Developers lock in hourly certificates and storage or firm resources for 2030.

- 2030. Hourly matching is required for electricity. Projects without an hourly plan see carbon intensity rise in uncovered hours and credit value fall. Buyers who wrote hourly protections into contracts keep their price certainty.

What this means for electrolyzer siting and plant design

- Co-location matters. Being next to your anchor resource reduces basis risk, simplifies deliverability, and can unlock behind-the-meter nuclear eligibility.

- Flexible equipment wins. Choose electrolyzers that can ramp without large efficiency penalties, so you can chase low-emission hours when hourly matching begins.

- Build around verification. Instrumentation, data retention, and registry integration are not afterthoughts. They are core to monetizing 45V.

The bottom line

Treasury’s final 45V rules did not pick technologies. They picked rules of the road. Those rules favor developers who can prove when and where their clean power flows, and buyers who can translate that into carbon-intensity guarantees and price protection. Between now and the end of 2029, annual matching provides an on-ramp to scale projects and sign offtake. After that, hourly scarcity will separate portfolios with true 24-hour coverage from those that only looked clean on paper.

The winners will treat 45V like a clock and a map. The clock says get to hourly by 2030 with a high-coverage plan. The map says build where deliverable clean megawatt hours are thick on the ground, and use the new nuclear and carbon capture pathways where they make sense. Do those two things, and 45V becomes not just a policy, but a durable advantage.