Natrium’s 2025 turning point: permits to poured steel

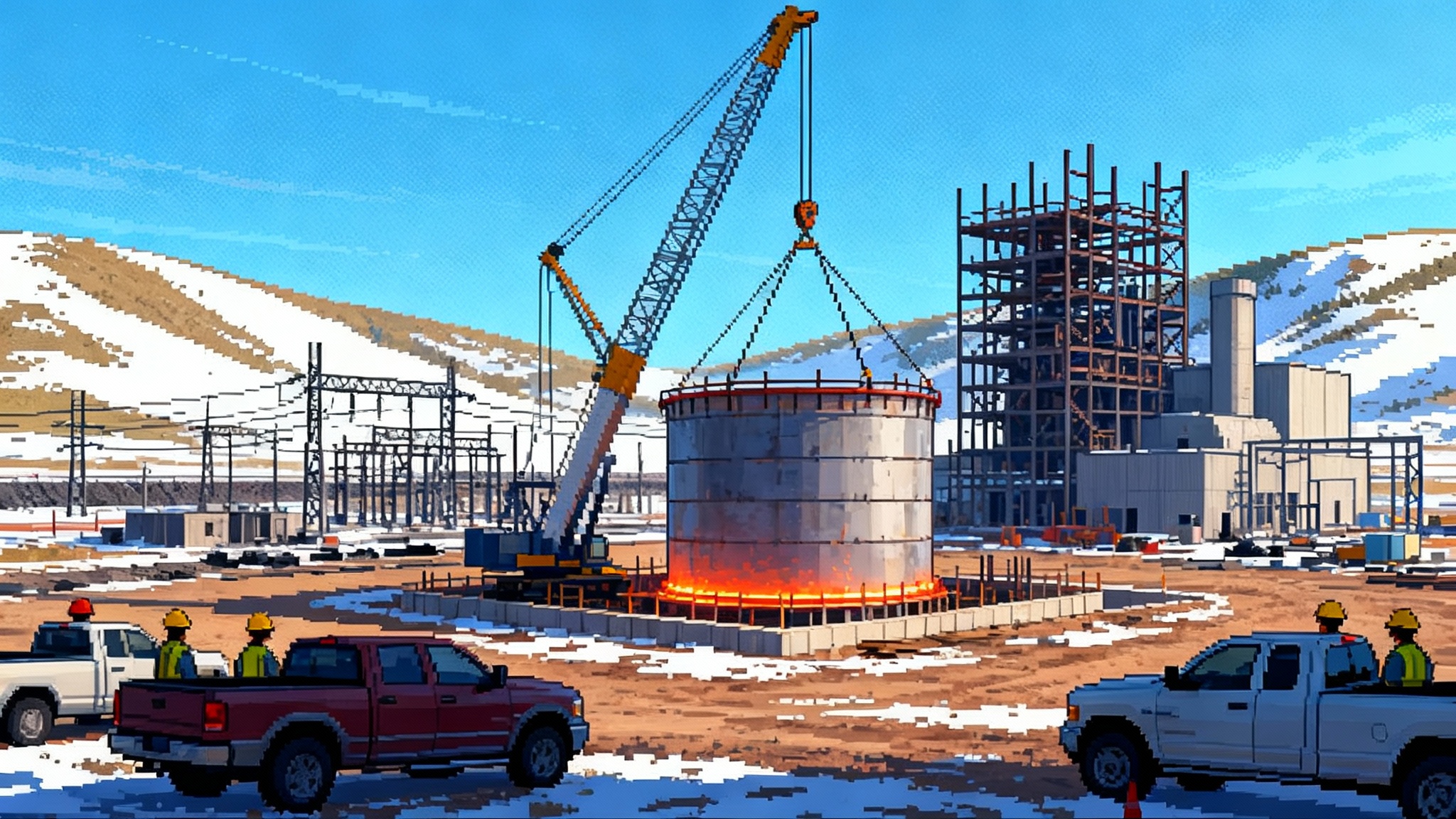

With an accelerated NRC review targeted for December 31, 2025 and Wyoming’s siting permit already in hand, Natrium is crossing from plan to construction. Here is what that inflection means for fuel supply, EPC execution, financing, and data center demand.

The moment advanced nuclear crosses from plan to project

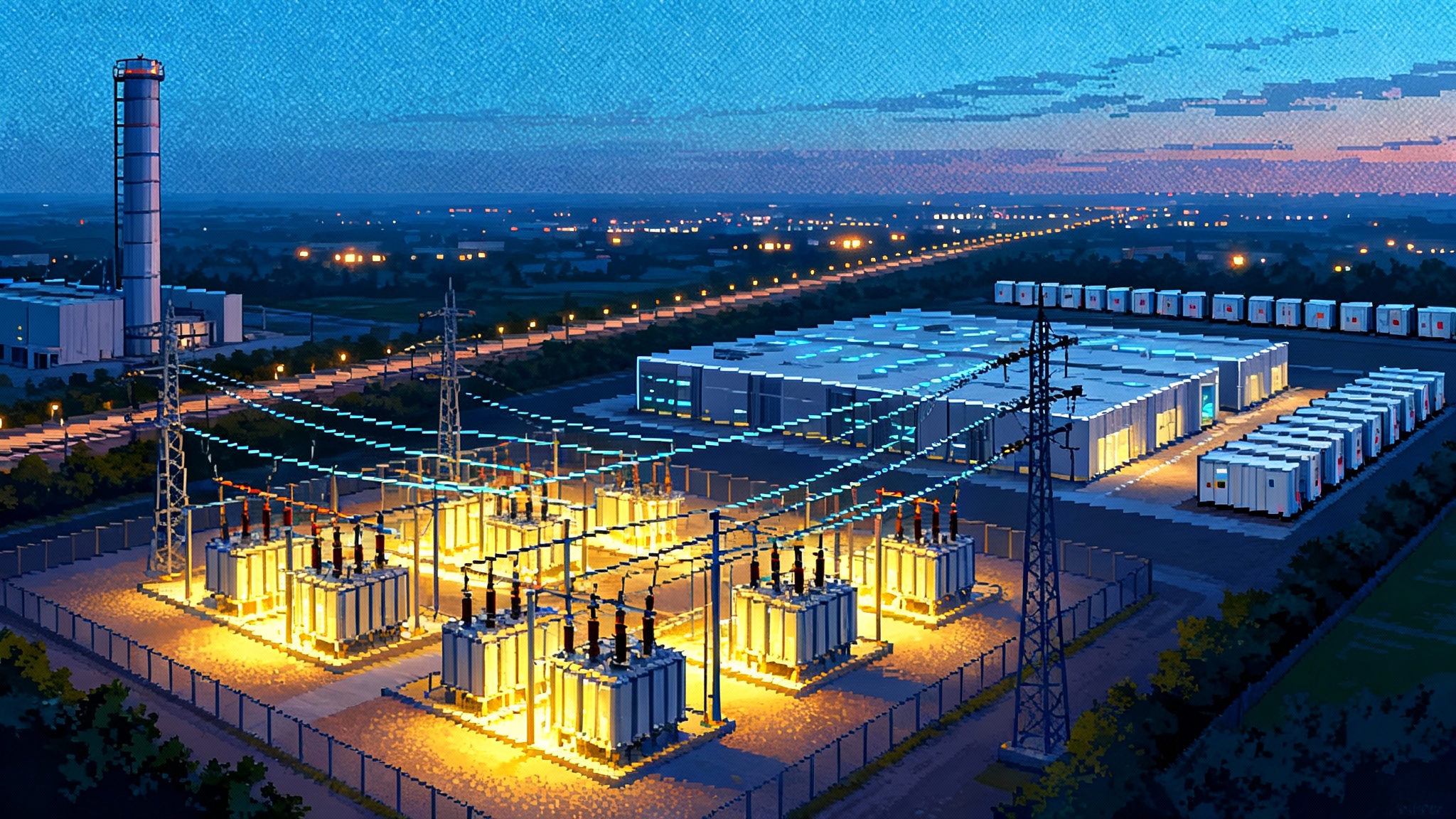

On July 2, 2025, TerraPower said the Nuclear Regulatory Commission would target December 31, 2025 to finish reviewing the construction permit for Kemmerer Unit 1, the first Natrium plant in Wyoming. That review, once slated for 26 months, is now on a 19-month path, pulling a critical decision into this calendar year. NRC review timeline to year-end 2025.

That federal acceleration meets a state decision already on the books. In January 2025, Wyoming’s Industrial Siting Council granted a permit for the non-nuclear parts of the project. Taken together, those two milestones turn a question that hung over advanced nuclear for a decade into a more practical challenge: not whether Natrium will build, but how well it will build.

This is the inflection point for advanced nuclear in the United States. It is not yet the finish line. It is the moment when financing, fuel, and execution will matter more than concept art and conference decks.

What Natrium actually is, in plain terms

Start with the numbers. Natrium is a 345-megawatt electric sodium-cooled fast reactor. The novel part is what sits next to it: a molten-salt thermal storage system that acts like a giant, high-temperature battery. That tank stores heat from the reactor and then releases it to make extra steam when the grid is short on power. The result is a plant that runs its reactor steadily, yet can raise electrical output to about 500 megawatts for more than five and a half hours.

If that feels abstract, picture a kitchen stove and a kettle. The stove’s burner is the reactor, producing steady heat. The kettle is the salt tank, holding hot water you can pour out fast when guests arrive. The electricity grid is the party. When demand spikes in the evening, Natrium does not ask its burner to run dangerously hot. It pours from the kettle.

This design also separates the “nuclear island” from the “energy island.” Turbines, generators, and those salt tanks live on the energy island outside the nuclear safety boundary. That decoupling matters for two reasons. First, it lets some construction proceed under state jurisdiction while federal nuclear reviews continue. Second, it allows specialized nuclear teams to focus on the reactor while conventional power crews build and operate the balance of plant with familiar equipment and practices.

Why 345 that can surge to 500 matters now

The grid challenge has shifted. Ten years ago the puzzle was how to add more clean energy. Today the puzzle is how to keep clean power steady when both demand and volatility rise at the same time. Solar output can drop quickly in late afternoon. Wind can be calm for hours. Meanwhile, power demand from artificial intelligence and cloud computing is growing in large, flat blocks of 100 to 500 megawatts per site, often with plans to double.

Natrium’s storage-coupled output is sized for this exact problem. A single unit can provide a firm 345 megawatts day after day, then cover the evening peak or a renewable lull with up to 500 megawatts for more than five hours, without racing the reactor up and down. That gives utilities two valuable capabilities in one asset: dependable baseload and fast, dispatchable peaks that behave more like a gas plant, but without the carbon emissions, complementing trends in grid batteries becoming new peakers.

The operational economics follow. When variable renewables are strong, Natrium can store heat and run at its base electrical output, preserving revenue from capacity payments and ancillary services. When the sun goes down or a cloud front pushes solar output lower across a region, it can sell high-value peak energy. Over time, that ability to arbitrage between low and high price periods helps flatten revenue risk compared with a plant that only sells baseload energy.

A design built for coal-to-nuclear site reuse

Kemmerer is not an accident. The site sits beside a coal plant in retirement, with a switchyard, transmission rights of way, rail access, water, and a skilled workforce. Many coal sites across the country share those advantages. The Department of Energy found that a large share of retired and operating coal plant locations could host advanced reactors and that reusing infrastructure can reduce overnight costs by double-digit percentages and preserve hundreds of local jobs. See the government’s summary in the DOE report on coal site conversions.

From 2026 through 2032, that coal-to-nuclear pathway becomes more than a slogan. It becomes a sequence:

- Identify retiring coal plants with existing 230-kilovolt or 345-kilovolt interconnections and water rights. Reuse of transmission and cooling infrastructure saves years.

- Secure state siting, county approvals, and industrial permits for the non-nuclear scope first. That keeps work moving while the federal nuclear review proceeds.

- Stage construction so the energy island leads. Salt tanks, turbines, and cooling systems can be fabricated and erected with conventional crews while the nuclear island waits for the construction permit.

- Retrain coal plant operators for thermal operations on the energy island and instrument and control work. The skill overlap is real.

The result is not just a cheaper project. It is a faster one, because the path through local land use, water, interconnection, and workforce has already been walked.

Data centers and Natrium, explained without buzzwords

Data centers are simple in one way and hard in another. They draw lots of power at a steady rate, and if that supply blinks, equipment trips and services fail. At the same time, the largest campuses now plan for 300 to 1,000 megawatts per location, often in areas already dealing with transmission constraints. For how utilities are adapting, see data center rate classes for AI.

For that profile, a storage-coupled reactor is attractive for three concrete reasons:

- Shapeable power on a single point of interconnection. A 345 megawatt baseload with 500 megawatt peaks can cover a campus’s daily ramp without adding a separate battery farm.

- Fewer land and siting conflicts. A single plant provides both energy and long-duration storage. That consolidates land use and reduces the number of new lines and permits.

- Contract simplicity. A buyer can sign a long-term offtake that combines a firm block of power with a call option for shaped peaks, priced upfront. That is easier to finance than a patchwork of hourly market purchases and stand-alone storage leases.

This is where rule details matter. Some buyers want behind-the-meter supply. Others need conventional grid delivery with clear metering and market settlement. Natrium works in either construct, but the development team, the utility, and the buyer need to lock down the transmission configuration early. The least glamorous drawings in the plan set, the single-line diagrams, will decide whether this kind of deal glides through approval or bogs down for a year.

The three real bottlenecks to watch

The big risks are no longer primarily scientific. They are industrial and financial. Three stand out.

1) Fuel: high-assay, low-enriched uranium

Most advanced reactors require high-assay, low-enriched uranium, often called HALEU, enriched between 5 percent and 20 percent. In 2025, domestic production has begun, but at initial scale measured around a metric ton per year. The first wave of projects will need dozens of tons over the late 2020s and early 2030s. That gap must be closed.

Natrium’s fuel story has three pieces that must all work at once: enrichment to produce HALEU, deconversion into the right chemical form, and fabrication of metallic fuel suitable for a sodium-cooled fast reactor. The United States is standing up each piece, but synchronized schedules are the hard part. The worst case is not that fuel does not exist. It is that it shows up six months late, which can cascade through a first-of-a-kind project’s critical path.

What to do now

- Developers should sign multiyear take-or-pay contracts that give enrichers the confidence to order centrifuges and give fabricators the confidence to hire and train. Include delivery windows with liquidated damages on both sides.

- Utilities and data center buyers should decide early whether they are comfortable taking some fuel delivery risk in exchange for price certainty. Big balance sheets can unlock capacity that smaller developers cannot.

- States can de-risk the middle mile. A targeted grant or loan for deconversion equipment is smaller than a reactor subsidy but removes a fragile link that every project depends on.

2) EPC execution: first-of-a-kind discipline

TerraPower selected Bechtel as its engineering, procurement, and construction partner. That brings deep nuclear credentials and a workforce that knows heavy industrial work. Even so, first-of-a-kind projects struggle when design maturity lags procurement, when suppliers lack nuclear quality programs, or when workfronts stall because two trades need the same footprint.

Where Natrium has an advantage is the split between the nuclear and energy islands. Turbines, generators, condensers, and the salt tanks are complex but conventional, with suppliers that have built similar equipment for concentrating solar plants and thermal power stations. The sodium systems and safety-related components demand nuclear pedigree and extensive testing, which TerraPower has been staging with dedicated facilities.

What to do now

- Freeze drawings before buying steel. The schedule gained by early procurement can be lost twice over if changes hit the field. A clean model and stable equipment lists save months.

- Overinvest in mockups. Full-scale fit-ups of critical welds and modular assemblies reveal a thousand paper-cut problems on the ground, not on the critical path.

- Tie payment to milestones that matter. Fabrication complete, factory acceptance test passed, module delivered, module set. Progress payments against those markers keep cash flowing when work is real.

3) Financing: from demonstration to a repeatable product

The Kemmerer project benefits from a cost-share partnership with the Department of Energy’s Advanced Reactor Demonstration Program, authorized up to several billion dollars for the first plant and supporting facilities. That helps absorb first-of-a-kind costs that later units will not carry. But scaling from one site to many requires a financeable product in two different markets: regulated utility rate base and long-term corporate offtake. For policy levers that can reduce capital costs, see DOE 1706 loans and financing.

In a regulated state, the utility can put a Natrium unit in rate base if regulators judge it prudent. That demands a transparent budget, a schedule with verifiable hold points, and a clear plan for replacement power if anything slips. In a merchant market, developers will need 15 to 25-year offtakes with creditworthy buyers. The most financeable structure is a blend: a fixed payment for a firm block of power, a variable payment for shaped peaks from the salt tanks, and indexed adjustments tied to inflation and specific input costs.

Tax credits also matter, but treat them as the icing, not the cake. Technology-neutral production and investment credits established in 2025 help, and siting at coal plant communities can unlock location-based bonuses, but credits cannot paper over an incomplete contract stack or an unproven supply chain.

What to do now

- Ask buyers to commit to shape, not just volume. A contract that values the 500 megawatt peak explicitly justifies the storage tanks and the additional turbines. Without that, the project leaves money on the table.

- Use transferability and direct pay options where available to reduce the cost of capital. Even a small reduction in the weighted average cost of capital moves billions over the life of a fleet.

- Engage state economic development teams early. Training centers, supplier grants, and streamlined local permits are small line items that make big schedule differences.

What to watch between now and the end of 2026

- Federal permit finish. The construction permit review is targeted to complete by December 31, 2025. Watch for issuance of the final safety evaluation and environmental impact statement, then the permit itself.

- Energy island milestones. Foundation pours for the salt tanks and turbine hall, followed by tank fabrication and placement, will be the visible proof that the decoupling strategy works.

- Nuclear island long-lead items. Reactor vessel and heat exchanger awards, and the start of fabrication in qualified shops, are the schedule spine for the nuclear scope.

- Fuel contracting. Expect a sequence of agreements for enrichment, deconversion, and fuel fabrication with delivery windows that line up with initial core load and first reloads. The timing of those signatures will signal real confidence in first power dates.

- Offtake clarity. Additional announcements that pair Natrium units with specific loads, including data center campuses and retiring coal plant replacements, will differentiate a pipeline from a one-off.

A short explainer on safety, because it always comes up

Sodium-cooled fast reactors operate at low pressure and high temperature. That removes the pressure-vessel stress that dominates the design of light-water reactors. Natrium’s pool-type layout keeps key systems submerged in a large body of sodium that can absorb heat. The plant’s passive features allow decay heat removal through air, without active pumps. Finally, by removing sodium from any direct contact with water and placing the salt storage and steam systems on a separate island, the design eliminates a class of sodium-water interactions that were a headache in older fast reactor concepts.

The storage system uses nitrate salts that have long industrial pedigrees. Think of it as borrowing proven materials from concentrating solar plants, adapted to the temperature range and interfaces that a fast reactor provides. The novelty is in the integration and the scale, not in inventing new chemistry from scratch.

The bottom line

In 2025, advanced nuclear crossed a threshold in Wyoming. A faster federal review and a state siting permit have moved Natrium from regulatory theory to on-the-ground sequencing. The technology bet, a steady reactor feeding a thermal battery, matches exactly the shape of today’s grid problems: evening peaks, renewable variability, and round-the-clock digital loads.

What happens next will not hinge on a single announcement. It will come down to the discipline of first-of-a-kind execution, the realism of fuel contracts, and the maturity of long-term offtake deals that value peak power as well as steady power. If those three pieces stay aligned, 2025 will be remembered as the year advanced nuclear finally shifted from promises to poured steel, and as the first step in a decade when coal plant sites find a second life lighting data halls and towns alike.