How 45V Finally Banks: Hourly Match, Storage, and Hubs

Published January 10, 2025, the IRS Section 45V final rule locks in annual matching through 2029, flips to hourly in 2030, permits storage‑backed EACs, and defines deliverability by balancing authority. This builder’s playbook shows how to site, contract, and dispatch financeable hydrogen projects through 2030.

The moment builders were waiting for

On January 10, 2025 the Internal Revenue Service published the final regulations for the Section 45V clean hydrogen production credit. The rule clarifies the three pillar framework for electricity sourcing, extends the transition to hourly matching until 2030, permits storage‑backed Energy Attribute Certificates, and nails down deliverability by balancing authority regions. These are not small edits. Together they convert a fuzzy policy into bankable instructions. Read the details in the Federal Register preamble and rule text, which extend annual matching through 2029 and set the hourly requirement thereafter, allow EACs from storage when registries can verify discharge hour and losses, and tie deliverability to a balancing authority table. See the official summary in the Federal Register rule text and summary.

If you build hydrogen in the United States between 2026 and 2030, this is the playbook. It shows where to site, how to buy power, how to structure offtake and grid revenues, and why flexible electrolyzers are set to become a new class of stabilizing, dispatchable industrial load.

Translate the rule into design constraints

A clean hydrogen project that uses grid electricity has two choices for how to evidence its lifecycle emissions:

- Use the 45VH2 GREET model’s regional average for electricity and live with that number, or

- Use EACs to claim specific generation and meet the three pillars: incrementality, temporal matching, and deliverability.

The final rule changes how those pillars work in practice:

- Temporal matching: annual matching is allowed through December 2029. Hourly matching is required starting January 1, 2030 for hydrogen production represented by EACs.

- Storage counts, with guardrails: an EAC tied to clean electricity that is charged into storage and discharged in the same hour as hydrogen production can satisfy hourly matching once registries implement tracking of discharge time and efficiency losses. Storage must be in the same region as both the generator and the hydrogen plant.

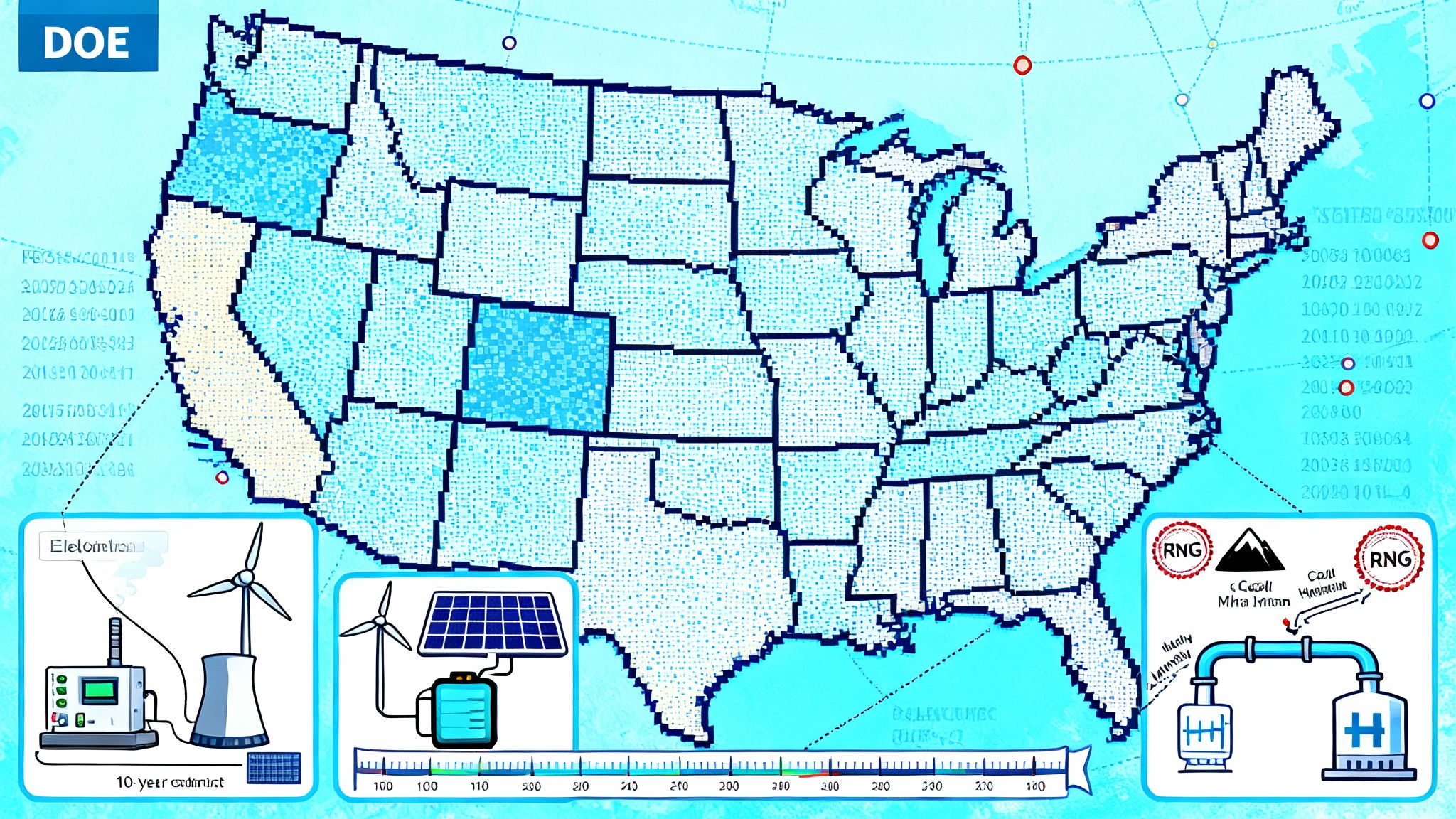

- Deliverability: deliverability is defined by balancing authorities, not simple geography. The rule publishes a balancing authority to region table and sets criteria for limited interregional delivery. For siting context, see how capacity is opening in the Order 1920 transmission reset.

- GREET certainty: developers may elect a beginning of construction safe harbor to lock the version of 45VH2 GREET used to calculate lifecycle emissions for the remainder of the 10 year credit period. That single line reduces underwriting risk and makes term sheets tractable.

- Methane derived pathways: book and claim is permitted for renewable natural gas and coal mine methane using qualified gas EAC registries with strong anti double count controls, temporal rules, and deliverability across defined pipeline regions. Until those registries are qualified, direct physical delivery with documentation is the path.

The Department of the Treasury’s release also points to a forthcoming 45VH2 GREET update and explains scope across electricity, natural gas with carbon capture, renewable natural gas, and fugitive methane pathways. For policy objectives and model notes, see the Treasury final rules overview.

Who wins now

The rule’s specifics create clear engineering and contracting winners.

-

Co located renewables with four to eight hour batteries: a solar or wind site with a battery sized to shape output across the late afternoon and evening can create hourly matched, in region EACs from 2030 forward, with the battery’s discharge timestamp closing most of the gaps. Four hours often covers duck curve ramps; eight hours lets you bridge the evening peak into the night. The economics align with the way grid batteries become peakers.

-

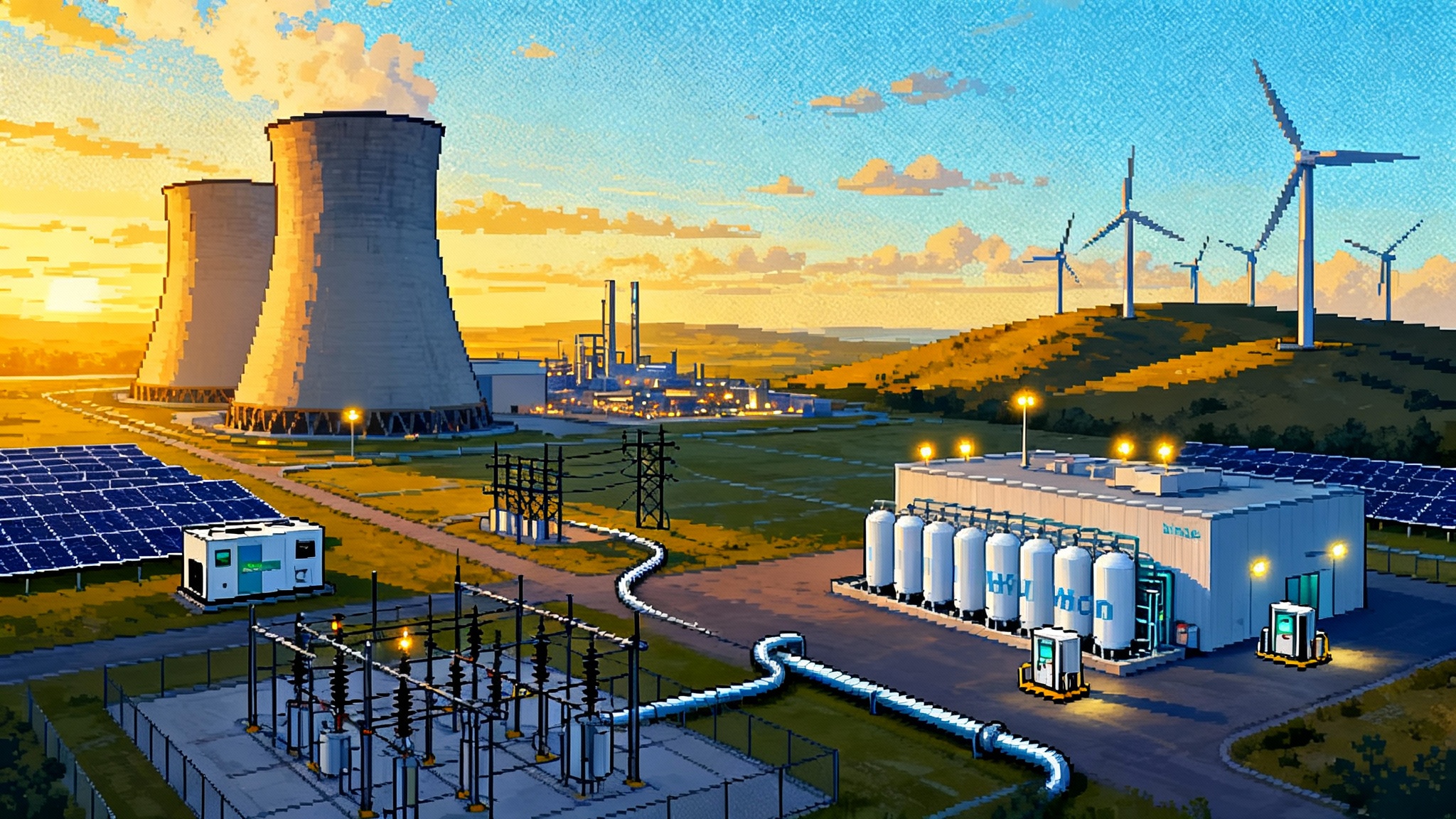

Nuclear paired projects: existing nuclear that meets the qualifying nuclear pathway and signs a 10 year EAC contract can deliver near round the clock low emissions attributes. When paired with electrolyzers that can ramp and a modest battery, you can follow prices at night and offer grid services by turning down during tight afternoons.

-

Hub adjacent siting: DOE hydrogen hub regions usually coincide with infrastructure and large balancing authorities. Siting near a hub cuts hydrogen transport cost, speeds interconnection studies, and improves odds that your generator, storage, and electrolyzer fall in the same defined region for deliverability.

-

Balancing authority aligned EAC contracting: contracts that explicitly reference the balancing authority of the hydrogen plant and the generator, and that provide storage discharge hour attestations from the registry, will clear diligence faster than generic renewable contracts.

Power strategy by 2026 to 2030

You can think of 45V’s electricity pillar as a clock you must align with. The hour from which your EAC comes must be the same hour your electrolyzer runs, starting in 2030. Storage lets you move clean megawatt hours to the right time. That means the design problem is not simply procuring megawatt hours; it is procuring time shaped, region matched, additional megawatt hours.

Two practical patterns emerge:

-

A solar plus storage hybrid sized for at least four hours, ideally six to eight, with a power purchase and EAC contract that gives you rights to the storage discharge hours and the registry’s hourly EACs. Couple that with an electrolyzer that can operate at a 10 to 20 percent turndown, with fast ramping to exploit low price hours, and you can cover most hours in 2030 without buying expensive spot EACs.

-

A nuclear EAC block that covers 60 to 80 percent of hours, filling gaps with an on site battery charged by surplus nuclear or in region wind. The nuclear block gives your project a stable backbone and hits incrementality via the qualifying nuclear rules.

Both patterns benefit from siting where transmission is not constrained, where interconnection queues are shorter, and where the balancing authority boundaries cover multiple high quality resource options.

A builder’s checklist for siting and contracts

-

Decide your balancing authority first. Map your intended site’s interconnection to its balancing authority. Then shortlist generators and storage in the same authority, or within interregional rules. Your EAC deliverability will live or die on that table.

-

Size storage for the requirement, not for a slogan. Four hours often pencils for solar. If your hydrogen production is price sensitive and your offtake can flex, consider six to eight hours. That extra coverage reduces your need to buy mismatched hours once hourly matching kicks in.

-

Lock in GREET early. Elect the beginning of construction safe harbor to freeze your model assumptions for ten years. This is the difference between a banker worrying about model drift and a banker worrying about execution.

-

Write EAC contracts that mention discharge hour attestations. Your storage backed EACs must show the discharge hour that maps to your electrolyzer’s operation and account for round trip losses. Spell this out in the schedule.

-

Use dual power strategies where possible. A nuclear EAC block with a solar plus storage overlay can minimize uncovered hours and diversify curtailment risk.

-

For methane derived hydrogen, prepare for gas EAC registries. Build relationships with registries and set up metering and data feeds that will pass third party verification. Until book and claim goes live, plan for direct physical delivery with revenue grade meters and matching documentation.

-

Do not ignore water. Hourly matching will push some projects toward night operation. Make sure your water supply contract can flex as your load shape changes.

How to build revenue beyond the 45V credit

A financeable hydrogen project secures predictable revenue, then layers optionality. The stack typically looks like this:

-

45V credit monetization. Transfer the credit at a discount or use a tax equity structure. Your emissions tier drives the per kilogram value. Prevailing wage and apprenticeship compliance unlocks the full amount. Plan for production and verification workflows that minimize delays when filing Form 7210 and related attestations.

-

Industrial offtake. Long term contracts for ammonia, methanol, direct reduced iron, refinery hydrotreating, or materials processing. Index parts of the price to power and feedstock costs. Offer volume flex bands tied to grid conditions to capture ancillary revenues when the grid is tight, while protecting your buyer with make whole clauses or banked deliveries.

-

Grid services from flexible load. A well controlled electrolyzer can respond in seconds to minutes. Enroll with an aggregator for frequency response, spinning reserve, or fast DR programs where allowed. Set safe operating bands for your stacks and deionized water system. Write a control strategy that prioritizes lifetime while capturing high value events.

-

Shape arbitrage with storage. If you co own the battery, you can earn from price spreads while ensuring your own hourly EAC coverage from 2030 onward. If you contract storage, reserve a set of discharge hours in the offtake and pay for additional hours as needed.

-

Carbon offtake or utilization. Where you produce hydrogen with autothermal reforming and capture, sell the carbon or claim a separate sequestration credit if you do not claim 45V for that process. Carefully avoid double counting or disallowed stacking.

-

EAC inventory management. In 2026 to 2029, annual EAC matching is still allowed. Build an inventory and risk policy now. In 2030, pivot to hourly EAC procurement with storage backed certainty to reduce residual risk.

For capital stack ideas, see how sponsors are pairing projects with cheap DOE 1706 loans.

Offtake design that survives hourly matching

Buyers want hydrogen that is affordable, reliable, and demonstrably low carbon. Hourly matching can improve the last part while complicating the first two. Structure your offtake accordingly:

-

Offer three time bands. Night and weekend hours priced lower, shoulder hours at a base, tight afternoon hours at a premium or with volume caps. That mirrors your EAC and grid service economics.

-

Write a proof pack. Give buyers a package that includes your GREET version election, your balancing authority map, and your EAC registry sources. Buyers will not read the whole rule, but they need confidence that your claim will survive an audit.

-

Add a curtailment clause that is tied to system conditions and grid events, not vague force majeure. If you participate in ancillary services, your buyer should know when and how often you may curtail deliveries and what compensation applies.

Methane derived hydrogen and book and claim

For steam methane reforming or autothermal reforming with carbon capture, or for methane pyrolysis, the rule opens a path to lower lifecycle emissions by sourcing renewable natural gas or coal mine methane through gas EACs. That path is conditional.

-

The certificates must come from a qualified gas registry with unique identifiers, verified production volumes, and anti double counting controls.

-

Temporal matching and deliverability are required, adapted to the gas system. Expect time stamped certificates and geographic rules aligned to pipeline regions in the contiguous United States, with Alaska, Hawaii, and territories treated separately.

-

Until registries meet the rule’s requirements, direct physical delivery with revenue grade meters and clear chain of custody is the compliant option.

This is not a loophole. It is a structured way to channel payments toward waste methane capture and to account for the real emissions of upgrading, compression, and transport.

The equipment choice that makes you dispatchable

Hourly matching favors electrolyzers that can ramp without heavy penalties to lifetime. In simple terms:

-

Proton exchange membrane units ramp fastest and can operate at lower partial loads, which suits grid services and price responsive dispatch.

-

Alkaline units are proven and cost effective, with slower ramp rates, so they work best in a steady block with fewer starts.

-

Solid oxide units thrive on high temperatures and can be efficient when co located with industrial heat, but they require careful thermal management to avoid cycling damage.

Think of a flexible electrolyzer as a shock absorber for the grid. When prices spike or frequency dips, you can step off the accelerator and sell your flexibility. When prices crash or wind is strong at night, you take that energy and turn it into molecules. In a world of hourly matching, that behavior is not a nice to have. It is a design principle.

Do not lose the calendar

A 2025 tax law change shortened the runway for beginning construction of new 45V projects compared with the original Inflation Reduction Act schedule. Many developers now target beginning construction by the end of 2027 to keep eligibility and are designing placed in service plans that work within the new deadlines. Treat those dates as gating items at the front of your critical path. Permits, interconnection, and offtake will not save you if you miss the tax calendar.

Two example buildouts

-

The nuclear backbone. A Mid Atlantic site connects within the balancing authority where a qualifying nuclear plant operates. The project signs a 10 year EAC contract with the plant, adds a 200 megawatt battery that discharges for six hours, and installs 500 megawatts of proton exchange membrane stacks in two phases. In 2026 to 2029 the project uses annual matching while it builds operating discipline and inventory. In 2030 it leans on storage to time shift nuclear overnight into morning and evening hours. Offtake is split between an ammonia plant and a refinery hydrotreating unit, each with flexible bands. The project enrolls for fast frequency response, caps curtailment hours in the offtake, and transfers credits to monetize 45V. The GREET version is locked at beginning of construction, which simplified the credit buyer’s diligence.

-

The hybrid shaper. A Southwest site co locates a 300 megawatt solar plant, a 200 megawatt wind plant, and an eight hour battery with 400 megawatt hours. The storage operator issues hourly discharge attestations through the registry. The electrolyzer operates between 30 and 100 percent of nameplate, chasing a price signal. A steelmaker takes a base load of hydrogen for direct reduced iron, while an e fuel plant buys a night band at a discount. The project earns from price spreads in the battery and from two ancillary products. In 2030 the battery becomes the time machine that keeps the EACs and the stacks in sync.

The takeaway for 2026 to 2030

-

Build where your generator, your storage, and your electrolyzer share a balancing authority. Deliverability is a table problem before it is a transmission problem.

-

Size storage to your hourly gap and contract for its discharge hours. In 2030 your certificate will either say the right hour or it will not.

-

Elect the GREET safe harbor when you begin construction so your emissions math does not drift over ten years.

-

For methane pathways, prepare your verification and registry relationships now. Book and claim will work for projects that respect the rule’s temporal and deliverability rules and can prove chain of custody.

-

Design offtakes that flex in time and write a proof pack that auditors and customers can understand without a PhD.

-

Treat your electrolyzer as a controllable load. The plants that can turn power market chaos into revenue will set the pace.

Hydrogen development is a dance with time. The 2025 rule gives you the choreography, hour by hour, region by region, and even through the battery. Projects that internalize that clock will not just qualify for credits, they will run like resilient infrastructure and earn like modern power plants.