The 2025 Transmission Reset: How Order 1920 Unlocks Capacity

With FERC Order 1920 in force, utilities are fast-tracking reconductoring, dynamic line ratings, and power flow controllers to free gigawatts on existing lines in 2025 to 2026.

Breaking: The grid’s fastest upgrade is already on the towers

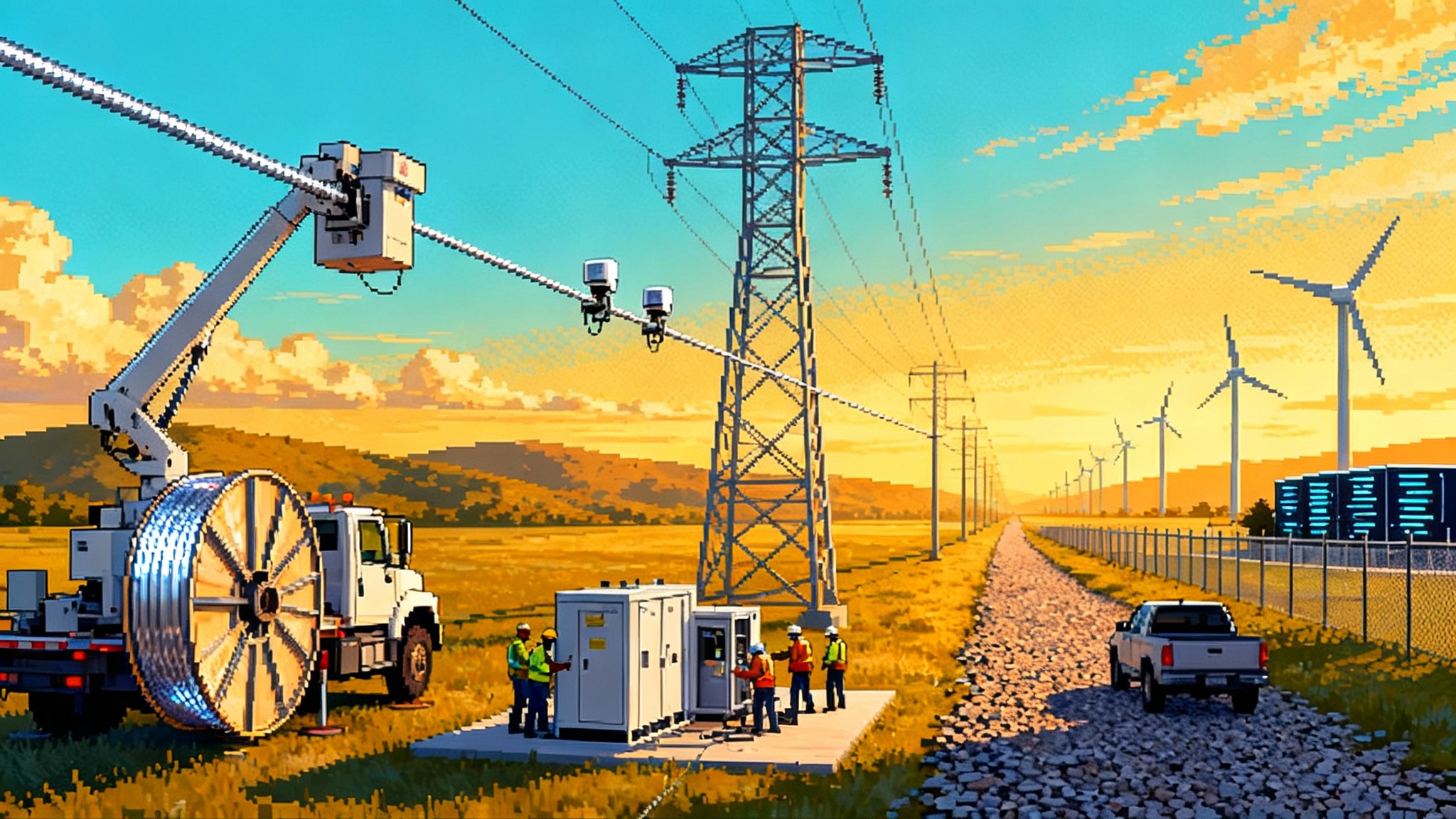

Here is the quiet revolution in U.S. transmission. The fastest way to add bulk power capacity in 2025 is not a new right of way. It is a bag of new conductors on a reel, smart sensors on the span, and modular power electronics in a substation yard. With the Federal Energy Regulatory Commission’s long-term planning rule now live, the near-term playbook is set. Utilities can expand capacity on today’s steel with high-capacity reconductoring, dynamic line ratings, and power flow controllers, while the big multi-state lines advance through longer permitting.

Think of it as three tools for the same job. Reconductoring is a thicker hose on the same poles. Dynamic line ratings are a better gauge, telling you in near real time how much water can flow safely. Power flow controllers are the valves that redirect flow to the emptier pipes. Put them together and you get more transfer capability in months to a few years, not a decade.

What Order 1920 changed, and when the clock runs out

FERC Order No. 1920 requires each transmission provider and regional operator to file a standardized, long-term planning process and to give states a formal seat in cost-allocation talks. After rehearing orders, the Commission published a region-by-region schedule that sets two compliance filings, plus a six-month state engagement period. Many regions received extensions. CAISO and PJM now owe initial filings by December 12, 2025, while MISO, SPP, and most of the Southeast file by June 12, 2026. Interregional filings follow months later, and Order 1920-A allows the first long-term planning cycle to start no later than two years after initial filings, rather than one. See the official, region-specific dates on FERC’s 1920 compliance schedule.

Two features of the rule matter most for 2025 to 2026 activity:

- Right-sizing of replacements. When an old line or component is due for replacement, planners must identify whether a bigger, higher capacity version would better serve long-term needs. This is a legal on-ramp for reconductoring with advanced conductors, higher capacity transformers, and related upgrades on the same corridor.

- A structured role for states. The six-month engagement window creates a venue to agree on how to allocate costs before or soon after project selection. That reduces the biggest source of delay after engineering: who pays.

Why reconductoring is breaking loose projects now

If new lines are new freeways, reconductoring is adding more lanes to the roadbed you already own. Advanced conductors pair aluminum strands with a stronger, lower-sag core material. That core can be carbon fiber composite or other high strength materials. The result is higher ampacity without violating ground clearance under hot conditions.

What this looks like in practice:

- A utility can pull out older aluminum conductor steel-reinforced wire and pull in a modern high temperature low sag conductor on the same structures. Foundations remain. Right of way remains. Engineering focuses on stringing plan, tension limits, and hardware compatibility.

- Capacity jumps are typically 50 to 100 percent, sometimes more, depending on span length, weather, and limiting equipment like terminal breakers or transformers.

- Losses fall because the new conductor runs cooler at the same power, which means lower line losses and better economics over the asset life.

Suppliers that matter in 2025 include CTC Global for composite-core conductors, TS Conductor for advanced composite core designs, Prysmian and Southwire for conductor families and accessories, and cable majors like Nexans and LS Cable that strand and supply across North America. Field examples are stacking up. Salt River Project completed an 8.5-mile 230 kilovolt reconductoring in Phoenix to handle data center growth and hit an 80 percent capacity boost ahead of schedule. Montana-Dakota Utilities swapped 11 miles of 230 kilovolt wire to avoid tower modifications and cut costs. California’s current transmission plan even singles out reconductoring projects around San Jose and Oakland as the least-cost way to meet near-term load.

As utilities respond to AI-driven load, strategies like data center rate classes can align demand growth with targeted corridor upgrades.

Dynamic line ratings move from pilot to operations

Static ratings assume summer heat and modest wind. Real weather is rarely average. Dynamic line ratings use sensors and advanced models to update a line’s safe capacity as conditions change. On a windy day a line can safely carry much more because the wind cools the conductor. Hourly updates are the new baseline due to Order 881, and operators are opening their systems to accept dynamic ratings.

Recent signals:

- PJM created procedures and system changes to ingest dynamic line rating data from transmission owners, after years of demonstrations. PPL Electric Utilities already streams ratings for multiple lines in northeastern Pennsylvania, with measured congestion savings.

- NV Energy is installing non-contact sensors on key lines around Reno. Duquesne Light in Pittsburgh is expanding a program that saw up to 25 percent capacity gains on constrained lines.

- Great River Energy in Minnesota launched one of the largest sensor-based deployments to date, moving from static seasonal ratings to fully dynamic ratings on dozens of spans.

Vendors to know include LineVision and Lindsey Systems for non-contact monitoring, and Heimdall Power and Ampacimon for sensor-based ratings and software. The utility action item is practical. Pick three to five congested lines, install sensors by the next high-heat season, and adjust operator training so ratings updates flow into dispatch and outage planning. The payback comes from congestion relief and fewer renewable curtailments, which also improves the economics of grid batteries as peakers.

Power flow controllers are the grid’s lane shifters

Where reconductoring adds capacity and dynamic ratings reveal it, power flow controllers direct it. These are modular power electronics that increase or decrease the effective impedance of a line so that megawatts take a different path. Place them on a line that is chronically overloaded, or on a parallel line that is underutilized, and you balance the corridor.

In 2025, deployments are moving beyond pilots. Georgia Power set its first large installation of modular series controllers on two 230 kilovolt circuits to handle fast-rising load in the Atlanta area. On the West side of the Rockies, the Avista and Idaho Power partnership is pairing series controllers with a rebuilt 230 kilovolt line to boost an interregional tie. Expect more announcements because these devices can be installed in months with a smaller outage footprint than a rebuild.

Companies to watch: Smart Wires for modular series devices, GE Vernova and Hitachi Energy for system-level Flexible Alternating Current Transmission Systems, and Siemens Energy for related devices that can be paired with series controllers and phase shifters.

The early RFPs to watch in 2025 and 2026

Competitive windows and targeted procurements are already opening. A few examples that hint at the pipeline ahead:

- MISO’s January 31, 2025 competitive RFP for the Reid EHV to state line 345 kilovolt project attracted multiple bids and produced a selection by summer. It is the first award from the Tranche 2.1 portfolio approved in late 2024. MISO has signaled more competitive windows through 2026 as it sequences Long Range Transmission Planning with reliability needs.

- CAISO’s 2024 to 2025 plan, approved in May 2025, explicitly recommends multiple reconductoring projects in the Bay Area and calls out grid-enhancing technologies as cost-effective alternatives for select constraints. The full plan details are public in the CAISO 2024 to 2025 transmission plan.

- SPP refreshed its Qualified RFP Participant list in 2025, a precursor to more competitive solicitations in 2026. Given strong wind development and new data center load in its East region, look for right-sized replacements and corridor upgrades to feature.

- PJM used a summer 2025 window to solicit competitive solutions for specific violations in its Regional Transmission Expansion Plan. As PJM finalizes its Order 1920 filing by December 12, 2025, expect a 2026 window that explicitly references right-sizing of replacements and grid-enhancing technologies.

What to read between the lines: early RFPs will rarely say reconductoring in the title. Look for phrases like rebuild on existing structures, right-sized replacement, or congestion relief on corridor X. Those are the telltales.

Who is positioned to benefit

- Advanced conductor makers. CTC Global’s composite-core ACCC family, TS Conductor’s composite core portfolio, and high temperature low sag conductors from Southwire, Prysmian, Nexans, and LS Cable are the immediate beneficiaries of right-sizing provisions. These firms have U.S. plants or are adding capacity to serve accelerated schedules.

- Grid-enhancing technology vendors. LineVision, Heimdall Power, Ampacimon, and Lindsey Systems are turning pilots into fleet programs. OATI and other software providers are integrating ambient-adjusted and dynamic ratings into energy management and market systems.

- Power electronics. Smart Wires’ modular series controllers are making their way into utility standards, while GE Vernova, Hitachi Energy, and Siemens Energy are pitching packages that pair series controllers, phase shifters, and shunt devices to lift transfer limits.

- Developers with a reconductoring muscle. Engineering, procurement, and construction firms that have mastered hot work, stringing plans, and outage choreography on live corridors will win. Think Quanta Services affiliates, MYR Group, and regional specialists that can minimize outage days per mile.

Low-cost public financing can further compress project timelines and costs. Expect more activity where cheap DOE 1706 loans intersect with right-sized replacements and grid-enhancing technologies.

How this helps interconnection queues finally move

Order 2023 restructured generator interconnection, and by late 2025 the first transition cycles in PJM are largely through study, with the second and final cycle expected to wrap in 2026. MISO is launching its own expedited interconnection channel for near-term projects that can be built within three to six years. That progress is necessary but not sufficient. A big share of withdrawals in recent years occurred when deliverability studies found that network upgrades were too slow or too expensive.

This is where 1920 meets 2023. Reconductoring, dynamic ratings, and power flow controllers can be scoped and executed as network upgrades that unlock interconnection clusters at a fraction of the cost of a new line. If a region can add 500 to 1,500 megawatts of transfer capability on a congested seam in 18 to 36 months, the next interconnection study can assign lower upgrade costs and shorter in-service dates. That makes projects stick. Expect to see merchant developers also propose corridor upgrades that pair with their generator clusters.

What utilities and ISOs must file by 2025 to 2026

Here is the checklist that will show up in every compliance plan:

- Scenario planning. A minimum set of long-term scenarios that include load growth from data centers and electrification, extreme weather stressors, and generator retirements. The planning horizon extends 20 years with periodic refreshes.

- Benefit metrics. A common set of benefits that quantify congestion relief, reliability, fuel savings, avoided load shed, and reduced curtailment. Many regions will start with seven benefits and propose additions tailored to local conditions.

- Right-sizing procedures. Triggers and decision rules for when equipment replacement is upsized. This includes a short list of advanced conductor families, transformer classes, and substation arrangements that qualify.

- Transparent local planning. A schedule of meetings and data releases so stakeholders can see local projects that could be right-sized into regional solutions.

- State engagement process. A formal six-month window for states to negotiate a cost allocation method for selected regional facilities, plus a state agreement process if states want to partner on individual projects.

- First cycle start date. A proposed start date for the first long-term regional transmission planning cycle no later than two years after initial compliance filings, per Order 1920-A.

Utilities should also show how their Order 881 work on ratings feeds into the markets and operations platform, so dynamic line ratings and ambient-adjusted ratings actually change dispatch and outage planning, not just data screens.

Practical playbook for 2025

- Identify the five most congested corridors in your territory where structures are sound. Pre-engineer reconductoring options, including terminal equipment upgrades. Keep a stock of compatible hardware to shorten lead times.

- Run a dynamic line rating pilot on two of those corridors this winter, then move to operational use by summer. Train operators on how ratings vary during storms and heat waves, and adjust safety margins accordingly.

- Scope two to three modular series controller sites that would redirect 100 to 300 megawatts of flow away from overloaded lines. Pre-approve civil and pad designs so devices can be installed in a single outage season.

- For interconnection, re-rank upgrade options under a right-sizing lens. If a reconductoring and controller combination can deliver the same deliverability as a new build at half the cost, document the trade-offs clearly and propose it in the next queue study.

- Work with your state energy office during the engagement period. If states have clarity on who pays and why by summer 2026, projects selected in the first long-term cycle can proceed without relitigating cost allocation.

Risks and reality checks

- Lead times. Advanced conductor and hardware lead times have come down, but schedule risk persists for insulators, deadends, and specialized clamps. Early bulk orders and framework agreements help.

- Outage windows. Reconductoring without long outages takes choreography. Fly-by reconductoring robots are tempting, but most capacity gains still require full pulls and planned outages.

- Systems integration. Dynamic line ratings must feed dispatch and energy management systems. If your market or control center cannot accept hourly ratings, benefits drop to paper savings.

- Permitting. Right-sizing avoids new right of way, but structure changes and substation work still trigger permits. Early coordination with local authorities keeps the schedule intact.

The bottom line

Order 1920 has forced a new discipline into long-term planning. In 2025 that discipline is already yielding near-term construction and operations choices that add real capacity on a fast clock. The smart utilities will pair reconductoring with dynamic ratings and power flow controllers, then use that added headroom to carry interconnection clusters over the line. Regulators have set the timeline. Investors are adding factory capacity. And RTOs are opening competitive windows that explicitly reward right-sized replacement. The next two years will not erase decades of underbuild, but they can buy precious gigawatts while the long corridors make their way through the map. That is the breakthrough hiding in plain sight on today’s towers.

For official timelines and filings, monitor the FERC 1920 compliance schedule, and watch how recommendations in the CAISO 2024 to 2025 transmission plan convert to shovel-ready work.