AI becomes the new baseload reshaping U.S. power grid

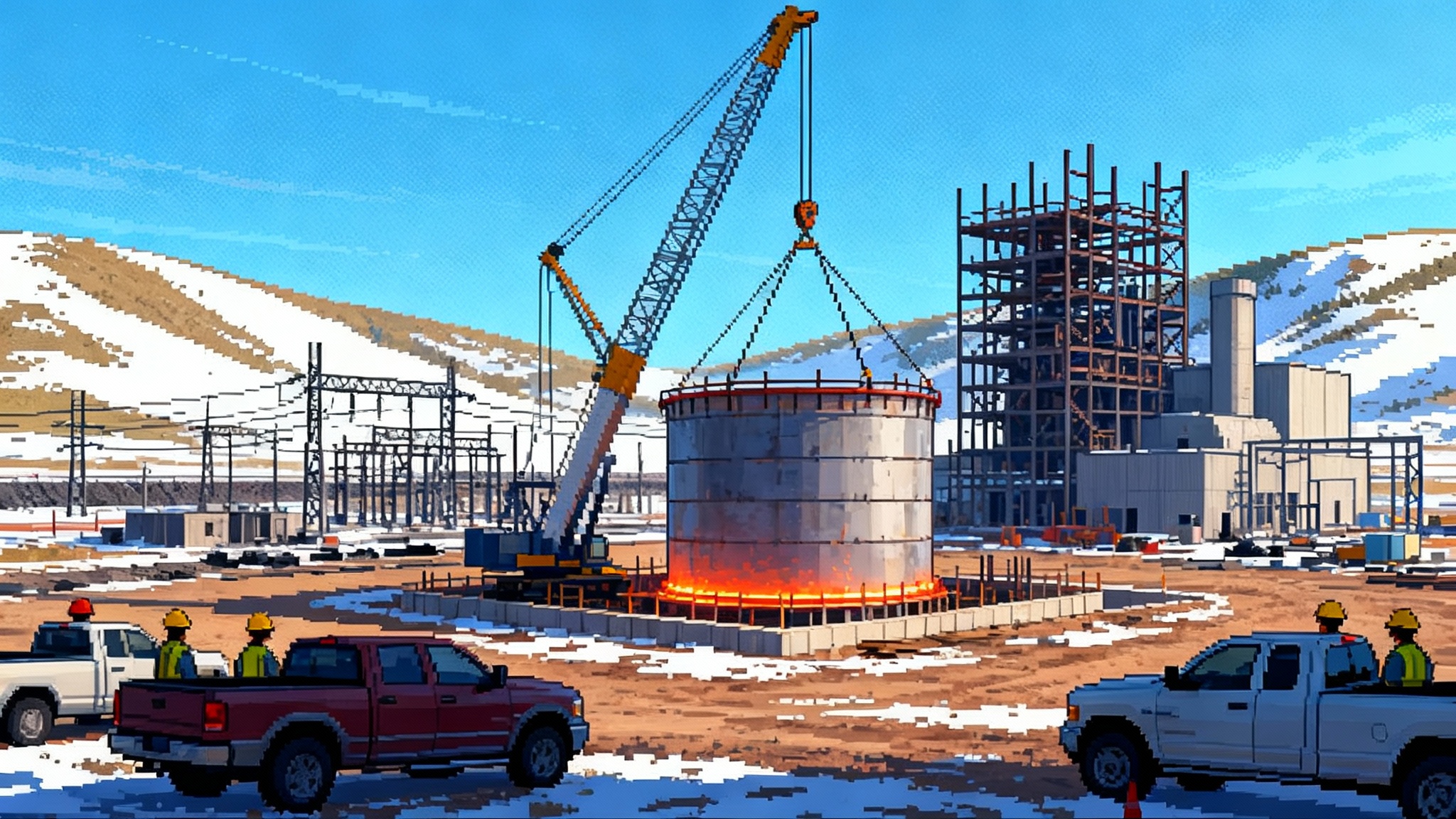

October 2025 delivered a clear signal. Fresh EIA and PJM forecasts point to record, round-the-clock electricity demand as AI data centers shift from edge case to everyday baseload. Utilities are racing to rewrite tariffs, interconnections, and supply strategies to keep up.

The month the load curve changed

October 2025 did not just add another data point to America’s electricity story. It changed the plot. The U.S. Energy Information Administration’s October outlook projected record power consumption in 2025 and again in 2026, pointing to data centers for artificial intelligence as a key driver alongside electrified heating and transport. The numbers are big and, more importantly, persistent, with total demand rising from last year’s record into the 4.2 to 4.3 trillion kilowatt hour range by 2026. That shift is not a spike or a heat wave. It is structural. It is the sound of servers humming day and night. EIA October Short-Term Outlook made it plain.

In the Mid-Atlantic, the picture snapped into even sharper focus. On October 1, PJM, the country’s largest grid operator, published its 2025 long-term load forecast. PJM extended its planning horizon to 20 years and signaled a step-change in peak demand, citing an unprecedented wave of new data centers and industrial loads. By the mid-2030s, PJM expects peak demand to be tens of gigawatts higher than it projected just a year ago. That is the kind of delta you can build entire power plants around. PJM 2025 long-term forecast calls out data center growth explicitly.

This is the month utilities started talking about AI not as a future possibility but as the new baseload.

What does “AI as baseload” actually mean

Baseload used to mean the steady, always-on part of demand that baseload plants like nuclear and coal would serve. The rest of the system ramped up and down around that floor. AI-heavy data centers are becoming a new version of that floor. Think of an airport that suddenly opened three new terminals. Flights do not trickle in only at rush hour. They land all day and night. That is what inference and training look like on the grid.

This matters because the grid is a system built on time and predictability. When demand is 24 hours and load factors are high, the economics and engineering of supply, wires, and tariffs change. Utilities are moving quickly to reflect that reality.

The new playbook for utilities

1) Dedicated high-load tariffs

Utilities in fast-growth regions are carving out special rate classes for very large users, especially data centers. The logic is straightforward. If a customer requires a new substation, hundreds of megawatts of capacity, and dedicated feeders, that customer should carry the cost and the risk. In Virginia, Dominion Energy has formally proposed a separate class for high energy users that includes data centers. The filings emphasize three ideas. First, full cost recovery for the infrastructure built to serve those sites. Second, multi-year commitments so that costs are not stranded if the load underperforms. Third, price signals that reward flexibility and on-site solutions.

A dedicated class does more than allocate costs. It creates a clear contract path for developers and investors. When the tariff spells out the rules for interconnection deposits, capacity reservations, and penalties for curtailment, data center projects can be financed with fewer surprises. Rate design is becoming a tool to both protect existing customers and speed timelines for new ones.

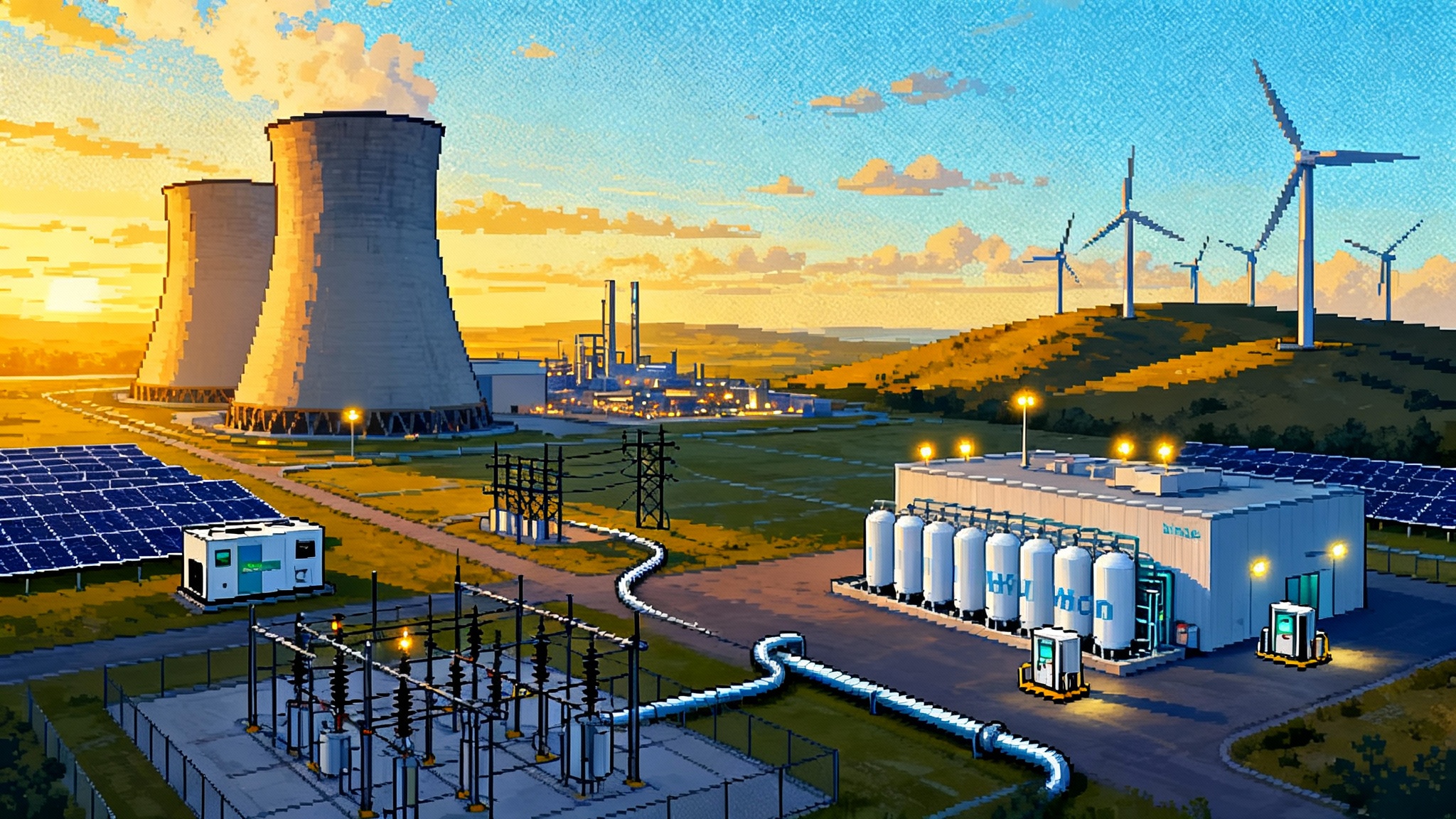

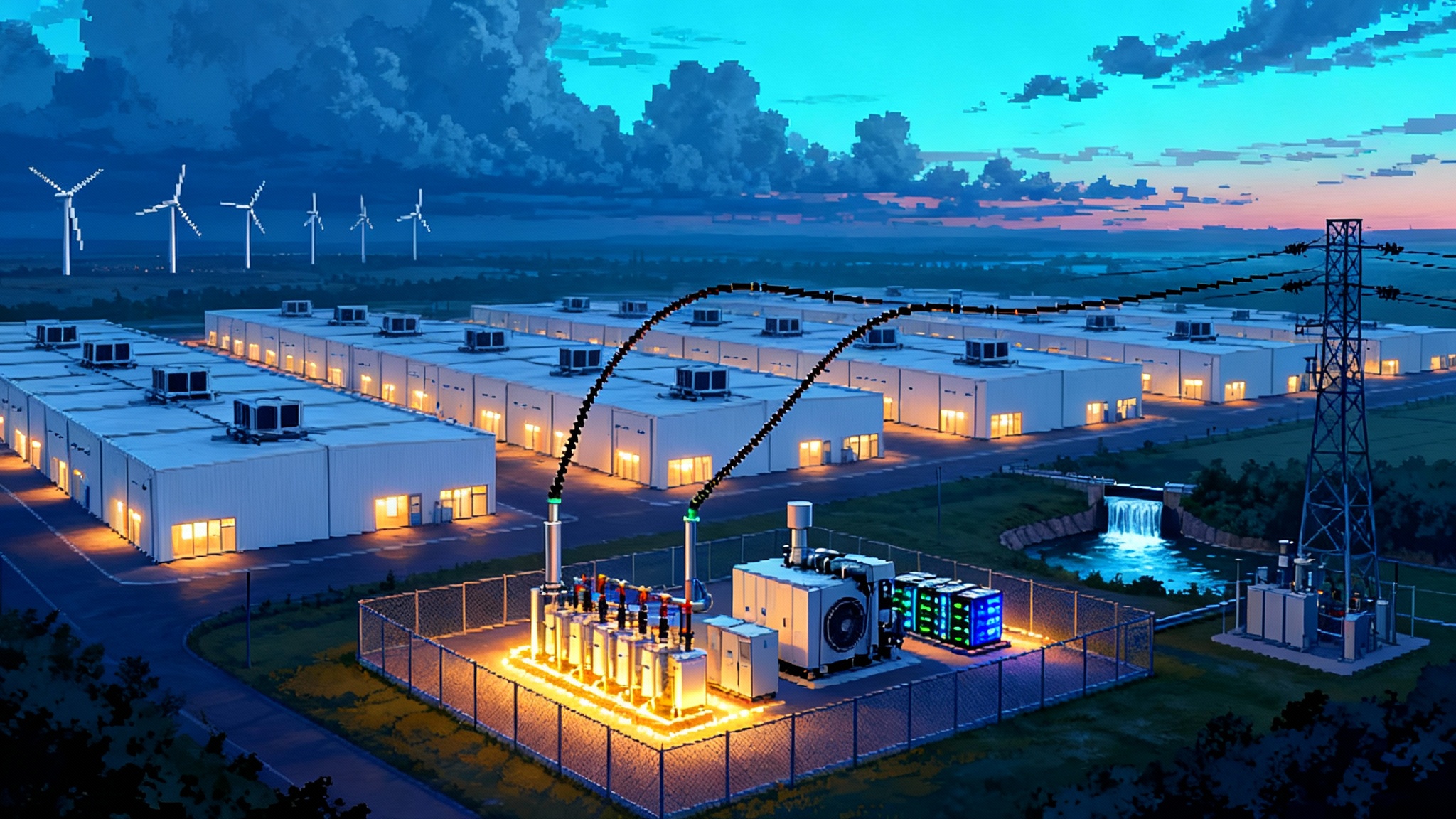

2) On-site firm power pairings

Today’s data centers already rely on uninterruptible power supplies and banks of diesel generators. That model struggles to scale to campuses measured in gigawatts and to public expectations about air quality. The emerging pattern is a hybrid pairing. Fast-starting aeroderivative gas turbines or high-efficiency reciprocating engines provide on-site firm capacity. Batteries handle seconds to hours, cover black starts, provide spinning reserve, and smooth the ride when renewables and market power vary.

Picture a campus as a small town with its own peaker plant and a battery the size of a football field. An aeroderivative turbine is essentially a jet engine on a skid that can reach full output in roughly ten minutes. Couple that with two to four hours of battery storage and a smart controller, and you can ride through grid disturbances, shift consumption away from high-price periods, and even sell ancillary services back to the utility. In some places, engines with selective catalytic reduction will be favored for part-load efficiency. In others, hydrogen-capable turbines will be specified to keep a path to lower carbon fuels open.

This configuration is not a theoretical whiteboard exercise. Orders for aeroderivatives and large engines are rising in markets with rapid data center growth. Vendors now offer turnkey microgrid packages tailored to campus footprints. Utilities increasingly allow these assets to run in grid-parallel mode under defined rules rather than limiting them to emergency-only. That operational flexibility is crucial to reduce net load without compromising reliability. For deeper context on batteries’ role in peaking duty, see grid batteries as peakers.

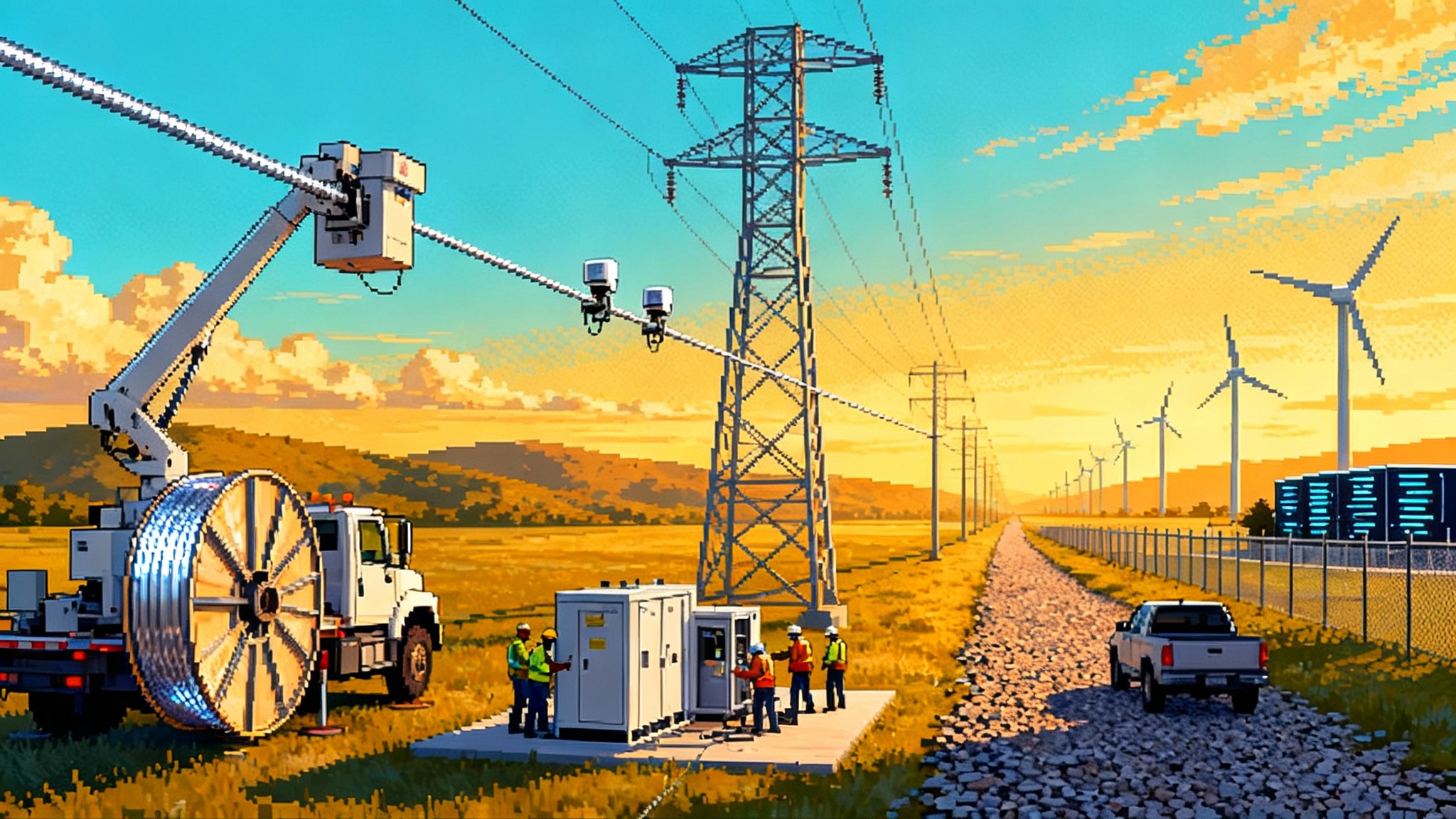

3) Accelerated feeders and interconnections

Transmission queues are long, and patience is short. The fastest way to connect hundreds of megawatts today is often a dedicated high-voltage feeder from a nearby substation with a ring bus and multiple transformers for redundancy. Utilities are standardizing these designs and front-loading engineering so that shovel-ready plans exist before a specific tenant signs. Some are offering cost-plus build programs where the customer posts a larger security deposit early and receives a guaranteed schedule. Others are piloting conditional energization, where a campus can take partial service while upstream reinforcements are still underway.

On the grid operator side, the planning horizon is stretching out to match the rise in long-lead projects. PJM’s extension to a 20-year forecast is as much about transmission as it is about generation. You do not build a 500 kilovolt line for a two-year blip. You build it because the floor is rising. Policy movements like Order 1920 unlocks capacity are pushing transmission planning toward longer-dated needs.

4) 24 by 7 clean energy procurement

The first wave of corporate clean energy was about annual matching. Buy enough wind and solar over a year to equal your consumption. That helped bring costs down and capacity online, but it does not match the hour-by-hour profile of a data center. The second wave aims for 24 by 7 carbon-free electricity. That means combining long-term purchases of wind and solar with hydropower, nuclear, geothermal, storage, and demand flexibility so that each hour has a clean match.

Hyperscalers are now signing multi-technology portfolios with hourly matching requirements, and in some cases they are taking equity stakes in the projects themselves. The priority is shifting from lowest price to highest reliability per unit of carbon avoided. A campus that can ramp compute and battery dispatch to track clean power availability has a lower carbon intensity and a smaller bill for network charges. For the policy mechanics behind hourly matching, see hourly match and storage.

Why this pivot is happening now

Two things changed in 2025. First, the demand signal became undeniable. EIA’s October report explicitly connects rising commercial sales to data centers and projects record consumption through 2026. Second, the biggest grid operator in the country upgraded its forecast and planning horizon, putting numbers on what many developers were sensing. Once planners treat AI load as a baseline rather than a pilot, the way they evaluate capacity margins, transmission, and resource adequacy changes.

There is also a policy undertone. Regulators have become more vocal about insulating residential customers from costs created by specific large users. Dedicated tariffs and cost-causation principles are the instruments. At the same time, federal rules are encouraging longer-term transmission planning, which fits the new demand profile.

What it means for emissions

Short term, the outlook is mixed. EIA expects higher total generation in 2025 and 2026, with renewables growing but not always aligned with demand in every hour. Natural gas remains the marginal workhorse in many regions. Coal generation sees a brief uptick in 2025 before falling again as more solar and storage arrive. In that context, on-site gas plus batteries can reduce dependence on diesel and avoid some grid peaks, but it is not zero carbon.

From 2026 to 2030, the emissions trajectory depends on two practical decisions. First, whether data centers procure firm clean energy, not just annual green attributes. That pushes the mix toward uprated nuclear, refurbished hydropower, long-duration storage, and geothermal, which together can cover night hours and winter weeks. Second, whether new tariffs actively reward flexibility. If large loads shift training jobs to clean hours and use batteries to avoid peak gas-fired generation, emissions fall faster even before the supply stack transforms.

A realistic expectation is that net emissions associated with data center growth will go through a plateau phase during 2026 and 2027, then begin to decline more sharply as a wave of clean capacity with firm characteristics connects. The timing will vary by region. PJM’s footprint, with access to nuclear and hydro alongside new solar, can move faster than regions that rely almost exclusively on wind and solar without firm complements.

What it means for prices

For households and small businesses, the primary risk is not the wholesale energy price. It is the network cost of adding substations, feeders, and transmission. Dedicated rate classes and upfront contributions from large users are designed to keep those costs out of general rates. Expect to see more utilities require security deposits and long-term commitments for capacity reservations, and more regulators scrutinize the cost allocation of big interconnections.

For data centers, the old calculus of simply chasing the cheapest megawatt hour is over. Tariffs will increasingly charge for peak draw and unpredictability, not just volume. That makes on-site assets, demand flexibility, and location strategy part of the power price. Sites that can take service near existing high-voltage infrastructure and co-optimize with local utilities will have a structural cost advantage.

How the financing stack is changing

Between 2026 and 2030, expect three models to dominate project finance for power serving data centers.

-

Tolling agreements for on-site firm assets. The developer finances aeroderivative turbines or engines plus batteries against a long-term capacity payment from the data center, with shared rights to provide grid services. Think of it as a mini utility inside the fence. It is financeable because the counterparty is strong and the asset has multiple revenue streams.

-

24 by 7 clean energy portfolios with hourly contracts. Instead of a single wind farm, buyers sign a portfolio of wind, solar, storage, and firm clean resources with explicit hourly performance targets. Banks underwrite against the contract’s penalty structure and the credit of the buyer, not pure merchant exposure.

-

Utility cost-of-service with dedicated riders. Where utilities build the substation and feeders, they recover through a rider applied only to the high-load class. The customer posts a large deposit and commits for many years, reducing the risk of stranded costs. That predictability brings the utility’s cost of capital to the project’s benefit.

A fourth niche will grow as well. Data center developers will acquire brownfield generation sites or interconnection rights to jump the queue. That can unlock power quickly but requires careful environmental and community work.

Concrete moves for each player

-

Utilities

- Publish transparent high-load tariffs with clear capacity reservation fees, performance penalties, and options for on-site asset coordination. Build standard designs for 230 kilovolt and 500 kilovolt feeders with modular ring buses to cut months from schedules.

- Offer demand flexibility programs that pay for shifting training loads. Treat data centers as grid resources, not just grid users.

-

Regulators

- Require that large new loads take service under dedicated classes that include long-term commitments and fair exit provisions. Pair that with fast-track approvals for standard substation packages and for on-site firming that meets air quality limits.

- Encourage 24 by 7 procurement by allowing tariff credits or reduced network charges when buyers demonstrably lower hourly emissions and peak contributions.

-

Data center operators

- Design power portfolios, not just power purchases. Combine on-site firming with storage and 24 by 7 contracts to cap risk on both price and carbon. Shift flexible workloads to clean hours and publish hourly performance so that partners can plan around you.

- Choose sites with dual benefits. Proximity to robust substations and access to firm clean energy sources like hydropower or nuclear uprates will outperform the cheapest wholesale node on a flat map.

-

Developers and investors

- Focus on hybrid projects where batteries stack multiple services and where firm capacity has both a data center toll and a path to grid revenues. Simple merchant bets will struggle in congested pockets. Portfolios with hourly targets and firming will clear investment committees faster.

-

Communities

- Negotiate for infrastructure that leaves a legacy. Ask for substation capacity that can serve future local growth, and for on-site assets that can provide emergency support to public services during outages.

The bottom line

This fall’s forecasts confirmed what the construction cranes already hinted at. AI workloads are not a passing surge. They are a new baseline. Utilities are responding with new tariffs, new on-site configurations, faster interconnections, and more precise clean energy buying. The near-term result is more firm capacity and more wires, with careful guardrails to protect other customers. The medium-term payoff, if buyers and utilities follow through, is a grid that is cleaner by the hour and stronger by design.

The grid is being rewired around continuous demand. The smartest players will treat that not as a constraint, but as a design brief, and build power portfolios that run as predictably as the code they serve.