45Z Goes Live: A 2025 to 2027 Race to Ultra Low CI Fuels

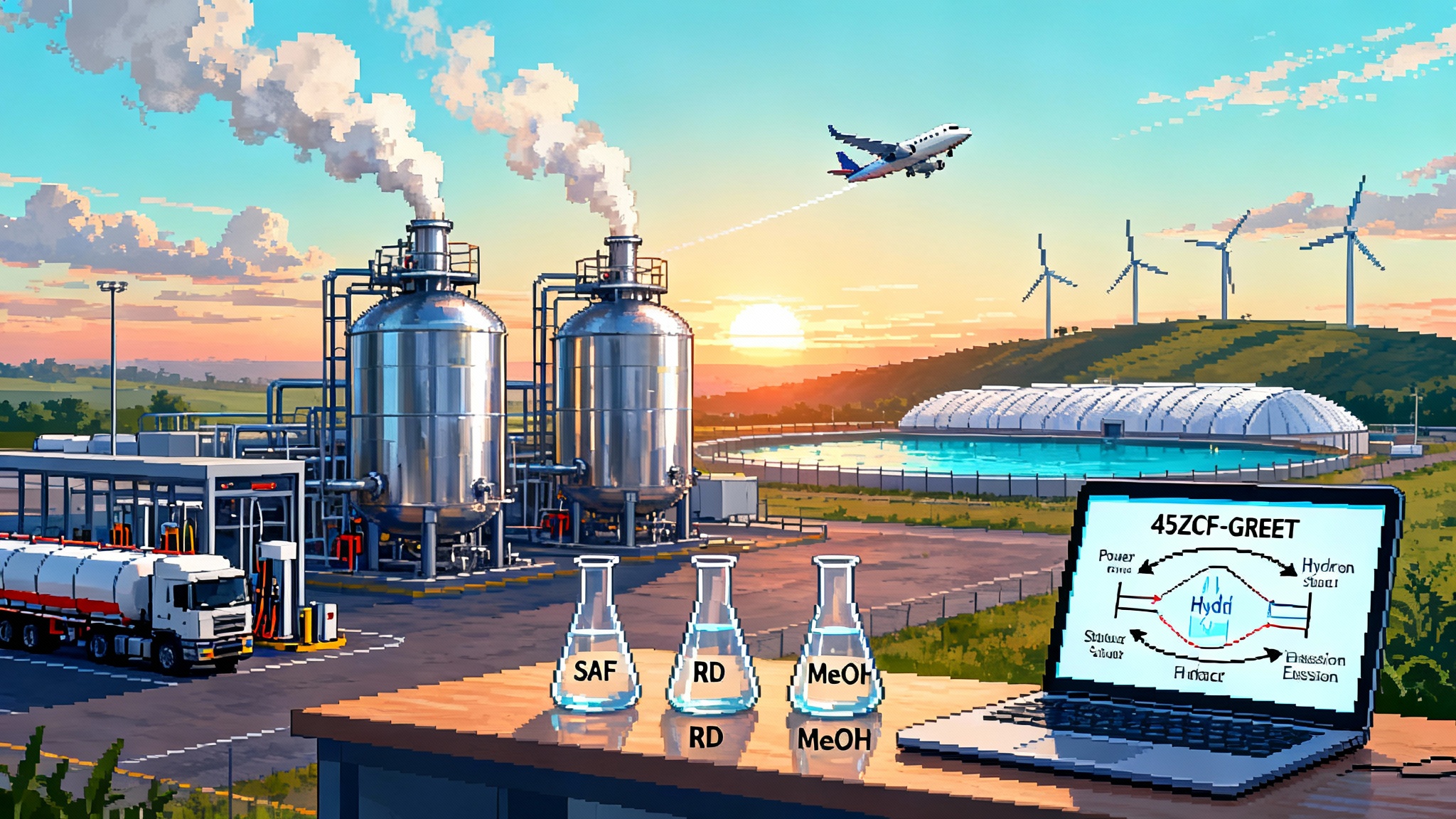

Treasury and the IRS finalized how Section 45Z will work, turning lifecycle carbon intensity into dollars per gallon. Here is how the Clean Fuel Production Credit is already reshaping SAF, renewable diesel, methanol, and RNG-to-hydrogen before it sunsets on December 31, 2027.

The flag drops on a new fuel economy

On January 10, 2025, the U.S. Treasury and IRS released the long awaited framework for how the Clean Fuel Production Credit under Section 45Z will work. The guidance confirmed what many producers hoped for and feared at the same time. 45Z is simple in idea and unforgiving in execution: the cleaner your fuel’s lifecycle carbon intensity, the more money you earn per gallon. The announcement set off a sprint that will run from January 1, 2025 through December 31, 2027, when the credit expires. It also clarified that certain marine fuels count if they are suitable for use in highway vehicles or aircraft, and it pointed taxpayers to the federal model they must use to calculate emissions. You can read Treasury’s summary of that guidance in this official release: Treasury announces 45Z clean fuels guidance.

Think of 45Z as a speed trap that pays you for braking emissions. Each mile per hour you shave off your fuel’s carbon intensity shows up as cents per gallon in your margin. The result is a very practical incentive that is already rearranging feedstocks, power contracts, and even refinery unit schedules.

How the credit is calculated, in plain English

45Z pays a producer for each qualifying gallon (or gallon equivalent for non-liquids) of transportation fuel sold in a qualifying sale. The credit equals two things multiplied together:

-

An applicable amount per gallon: 20 cents for non-aviation fuels and 35 cents for sustainable aviation fuel. If a facility meets prevailing wage and apprenticeship standards, these base amounts are multiplied by five. That takes the top rate to 1.00 dollar per gallon for non-aviation fuels and 1.75 dollars per gallon for sustainable aviation fuel.

-

An emissions factor that scales from zero to more than one based on lifecycle emissions. The formula compares your fuel’s lifecycle carbon intensity to a statutory baseline of 50 kilograms CO2e per MMBtu. If your fuel’s emissions rate is at or above 50, your emissions factor is zero and you earn nothing. If it is lower, the emissions factor rises proportionally. If your fuel is net negative, the factor can exceed one, which means the credit can be higher than the nominal top rate.

Two more rules matter:

- You must be registered with the IRS as a clean fuel producer when you produce the fuel. The agency’s consolidated 45Z page details registration and claiming mechanics: IRS clean fuel production credit overview.

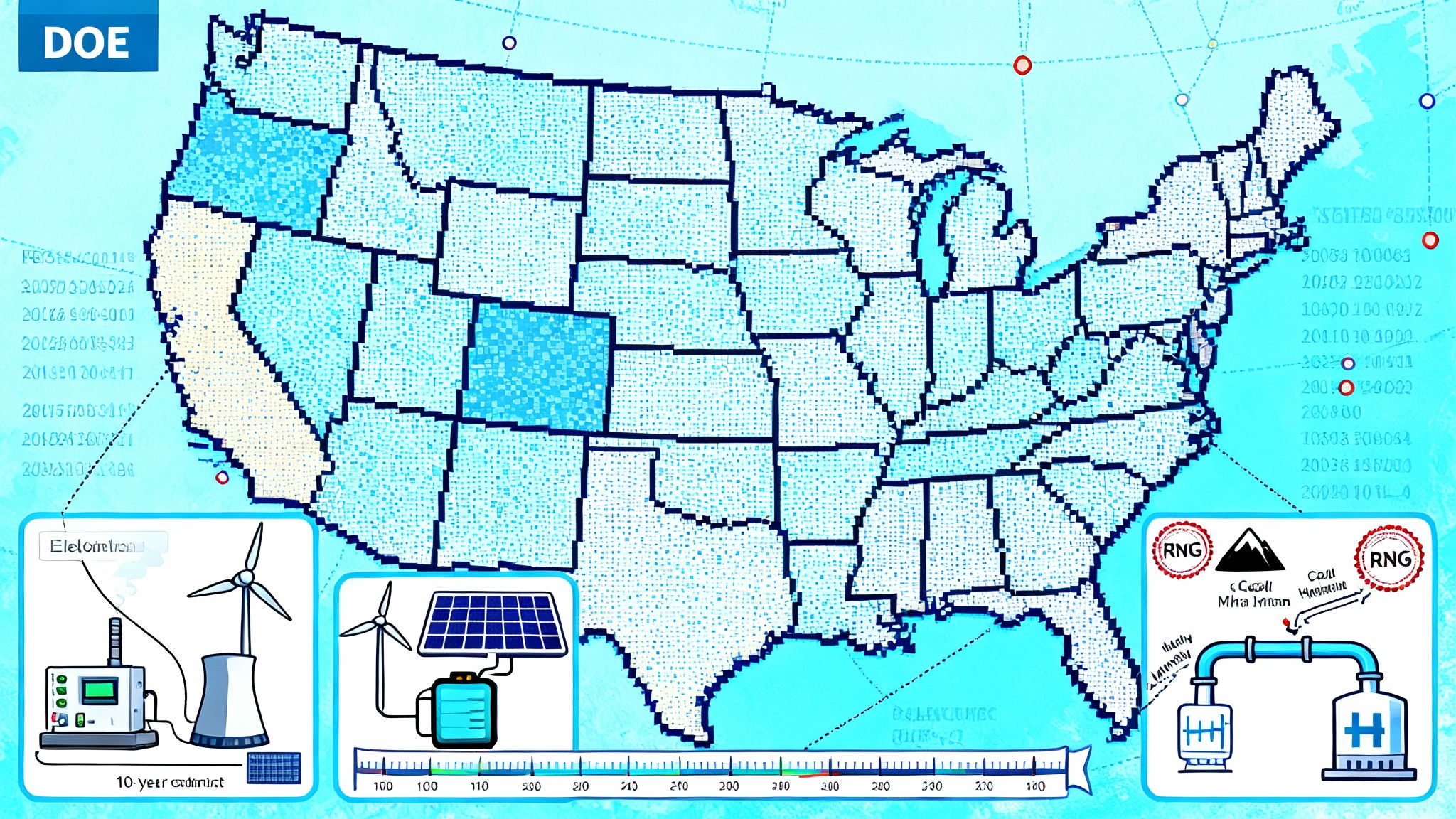

- You must calculate lifecycle emissions using the federal 45ZCF-GREET model for non-aviation fuels, or 45ZCF-GREET or CORSIA methodologies for sustainable aviation fuel. The Department of Energy released 45ZCF-GREET in mid January 2025, along with a user manual.

Quick math to make it real

Ground rules for the examples below: assume prevailing wage and apprenticeship requirements are met unless noted, and that volumes are liquid gallons.

- A renewable diesel pathway at 20 kg CO2e per MMBtu: emissions factor is (50 − 20) ÷ 50 = 0.60. Credit equals 1.00 × 0.60 = 0.60 dollars per gallon.

- A sustainable aviation fuel at 28 kg CO2e per MMBtu: emissions factor is (50 − 28) ÷ 50 = 0.44. Credit equals 1.75 × 0.44 ≈ 0.77 dollars per gallon.

- A methanol pathway at 35 kg CO2e per MMBtu: emissions factor is (50 − 35) ÷ 50 = 0.30. Credit equals 1.00 × 0.30 = 0.30 dollars per gallon when used as a transportation fuel and meeting suitability rules.

- A fuel with slightly negative emissions, say −5 kg CO2e per MMBtu: emissions factor is (50 − (−5)) ÷ 50 = 1.10. Credit equals 1.00 × 1.10 = 1.10 dollars per gallon for non-aviation fuel or 1.75 × 1.10 ≈ 1.93 dollars per gallon for sustainable aviation fuel.

These amounts land straight in the gross margin column, which is why feedstock managers, procurement teams, and CFOs have been sitting together since January.

The sectors most changed by 45Z

Sustainable aviation fuel moves from promise to purchase orders

Before 2025, the blender’s credit under Section 40B helped early deals. 45Z flips the center of gravity to producers. Sustainable aviation fuel, especially alcohol-to-jet and hydroprocessed esters and fatty acids, now earns a per gallon credit that scales with verified lifecycle performance. Airlines still face a cost premium to conventional jet, but the new producer credit narrows that gap and de-risks offtake.

Two practical shifts are happening on the ground:

- Alcohol-to-jet developers are redesigning their electricity strategies. With 45ZCF-GREET in hand, they are taking advantage of an annual matching period for clean power certificates before more granular matching becomes standard for hydrogen under related rules. Their goal is to lower plantwide carbon intensity without overpaying for every hour of the year.

- Hydroprocessing players that were focused on renewable diesel are optimizing cut points and hydrotreating severity to produce more jet range molecules when the emissions math makes the 45Z uplift most valuable. Where sustainable aviation fuel yields are modest, some refineries are blending neat sustainable aviation fuel to meet the suitability test when it will be blended into a commercially fit jet pool.

Renewable diesel rethinks its feedstock stack

Renewable diesel producers have been living in a world of state Low Carbon Fuel Standards, Renewable Identification Numbers, and the now expired federal biodiesel credits. 45Z adds a national signal that rewards low carbon intensity pathways regardless of geography. The effect is immediate:

- Used cooking oil and tallow keep their premium if they deliver better lifecycle scores under 45ZCF-GREET, but supply is tight. Producers are experimenting with sorghum oil, canola, and cover crop oils where agronomic practices lower on farm emissions.

- Grid strategies matter more. If you can cut the power draw from fossil heavy grids during hydrogen production and hydrotreating, the lifecycle math quickly adds 10 to 20 cents per gallon of credit.

Methanol has a new path to relevance

Methanol is not just a marine story anymore. Treasury’s guidance clarifies that methanol can be eligible if it is suitable for use as a fuel in highway vehicles or aircraft, or when blended into a fuel that is. That opens the door to on road applications and to e-fuel intermediates that route through methanol. Producers using clean hydrogen and captured carbon dioxide to make e-methanol can chase very low carbon intensities. If they crack net negative territory by diverting methane emissions or capturing process CO2 with secure storage, their emissions factor can exceed one, which boosts credits above the nominal top rate.

RNG to hydrogen becomes a serious bridge technology

Renewable natural gas has always been an attractive molecule for niche fleets and pipeline programs. Under 45Z, it becomes a lever in two places. First, compressed or liquefied renewable natural gas itself can qualify when suitable for use as transportation fuel on a gasoline gallon equivalent basis. Second, renewable natural gas can be reformed to produce hydrogen that is then used in refining, methanol synthesis, or e-fuel routes. The lifecycle math can be favorable because you are substituting a high emissions input with a lower or even negative emissions one.

What producers are doing right now

The common thread in 2025 is speed. With only three credited years, teams are prioritizing moves that pull carbon intensity down quickly and verifiably.

- Feedstock swaps and logistics arbitrage: Refineries and stand alone biorefineries are moving the lowest carbon intensity feedstocks to the assets that can monetize 45Z the most. That may mean routing the cleanest tallow to the site with the largest hydrotreating train that meets prevailing wage and apprenticeship standards.

- Grid tied carbon intensity strategies: Producers are signing power purchase agreements and certificate contracts that line up clean electricity with production schedules. Where on site electrification of process heat or hydrogen electrolysis is viable, they are co locating to make the electricity accounting straightforward. For large site builds, the DOE 1706 loan program can reduce capital cost.

- Co processing with guardrails: Some crude refineries will increase co processing of biogenic oils in hydroprocessing units. 45Z’s draft guidance draws a bright line between true production and mere blending. The project teams that win will document which steps transform feedstock into qualified fuel, track volumes at those steps, and avoid counting minimal processing.

- Hydrogen housekeeping: Whether hydrogen is purchased or made on site, the 45Z playbook now includes cutting emissions from that hydrogen. That can mean switching to renewable natural gas feedstock, capturing carbon from steam methane reformers, or buying clean power for electrolyzers where practical.

How 45V hydrogen rules change the 45Z game

45V, the clean hydrogen production credit, landed its final rules on January 3, 2025. Those rules clarify how electrolytic, natural gas with carbon capture, renewable natural gas, and coal mine methane pathways can qualify based on lifecycle emissions. They also codify the three pillars for using energy attribute certificates. Annual matching is allowed during a transition, with hourly matching required beginning in 2030. Deliverability and new build criteria are specified, and there is a roadmap for book and claim systems for renewable natural gas starting in 2027 once a qualifying registry exists.

What does that mean for 45Z fuels that depend on hydrogen?

- A refinery that lowers the carbon intensity of its hydrogen with renewable natural gas or with electrolysis powered by verified clean electricity will lower the fuel plant’s lifecycle emissions under 45ZCF-GREET. That raises the emissions factor and the 45Z credit per gallon.

- E methanol or other e fuels that rely on hydrogen see a double benefit. 45V reduces the cost of clean hydrogen itself, and 45Z pays you more per gallon because your downstream fuel is cleaner. The combination can flip project economics from red to black if power procurement and carbon accounting are done carefully.

- For developers counting on grid power, the 2030 shift to hourly matching under 45V is a planning anchor. New projects will favor co locating with dedicated renewables or nuclear, or siting in regions with strong deliverability rules. See the Order 1920 transmission reset for how capacity can be unlocked.

SAF, renewable diesel, methanol, and RNG to hydrogen: playbooks and pitfalls

Here is what the most effective 45Z strategies look like, by fuel family.

-

Sustainable aviation fuel

- Short term: secure low carbon intensity feedstocks, dial in power contracts, and target pathways that are already in the emissions rate table so you avoid waiting for a provisional emissions rate.

- Medium term: design in flexibility to shift product slate between jet and diesel as market signals move. Track every kilogram of hydrogen and kilowatt hour through the system boundary that 45ZCF-GREET uses.

- Pitfalls: overpaying for certificates that you cannot count under the model, or assuming blending creates production. It does not.

-

Renewable diesel

- Short term: optimize hydrotreating severity and cut points around lifecycle yields, not just volume yields. Lock in biogenic feedstocks with strong traceability.

- Medium term: add carbon capture to hydrogen units or move to renewable natural gas based hydrogen. Electrify pumps and heaters where practical.

- Pitfalls: treating 45Z as just another LCFS layer. The federal model has its own rules, and marginal mistakes on electricity sourcing or feedstock logistics are the fastest way to lose 10 to 20 cents per gallon of value.

-

Methanol

- Short term: document suitability for use in transportation and align end use markets accordingly. Where feasible, combine biogenic carbon dioxide with clean hydrogen to push lifecycle emissions as low as possible.

- Medium term: integrate with e fuel chains for aviation and on road applications. The lower the hydrogen’s emissions, the stronger the 45Z credit per gallon of downstream fuel.

- Pitfalls: assuming marine only sales will qualify without meeting the suitability standard.

-

RNG to hydrogen

- Short term: secure verifiable renewable natural gas supply from landfills, wastewater, or agriculture. Prioritize sources with clear counterfactual emissions so the model recognizes the avoided methane.

- Medium term: invest in measurement and registry systems that will meet the book and claim requirements expected to come online in 2027.

- Pitfalls: relying on pipeline certificates that are not accepted by the relevant model version or that lack the data granularity Treasury and DOE expect.

Milestones to watch between now and 2027

- Provisional emissions rate process: The IRS has signaled a process for pathways not in the table. Project plans that rely on a provisional emissions rate should assume delays and design contingency pathways that use existing model entries.

- DOE model updates: Expect periodic updates to the 45ZCF-GREET user manual and to the hydrogen model that informs 45V calculations. Producers can usually lock in the model version by construction date for hydrogen projects, so check your dates and keep records.

- Registration and compliance: The IRS 45Z page centralizes registration and future filing instructions. Keep an eye on frequently asked questions and on examples that clarify who counts as the producer inside complex supply chains.

- Capital timing: With the credit expiring on December 31, 2027, schedule matters. Investments that require new permits or long lead equipment will need fast track procurement and construction strategies. Where on site power is part of the plan, consider grid batteries as peakers to hedge price and availability risks.

- Policy risk: There is active debate in Congress about extensions or modifications to 45Z. Build resilience into your plan so that your project returns make sense even if the policy landscape shifts.

A checklist you can use this week

- Map your lifecycle boundary. Draw the exact system 45ZCF-GREET measures. List every input that drives carbon intensity: electricity by meter, hydrogen by source, thermal energy by fuel, feedstock by origin and logistics.

- Price the abatement curve in dollars per ton and in cents per gallon. Target measures that deliver less than 200 dollars per ton abatement cost first. Many electricity and hydrogen switches fall under this line.

- Rewrite purchase agreements. Add data and verification clauses so vendors provide what you need for model inputs and for IRS substantiation.

- Decide on power strategy. If you can self build or co locate, do it. If not, structure certificates that align with model rules, the grid region you are in, and expected updates.

- Build a claim file as you go. Document eligibility, facility qualification, registration, fuel measurements, and your emissions calculations. The paper trail is part of the project.

The bottom line

45Z turns carbon intensity into hard cash for three short years. That has already set off a scramble in aviation fuels, renewable diesel, methanol, and hydrogen supply chains built on renewable natural gas. The winners are not the companies with the glossiest brochures. They are the ones that can measure, verify, and reduce lifecycle emissions in weeks, not years. Treasury and the IRS have given producers a clear scoreboard. Now it is a race to find every ton of emissions inside the system boundary and convert it to cents per gallon before the clock hits 2027.

The takeaway is simple. If you make molecules for transportation, 45Z is the most immediate lever you have to improve margins and move real tons. Do the math, lock in clean inputs, and build the record. When policy pays you for performance, performance is the strategy.