FERC approves 2025 IBR rules that make grid support mandatory

FERC’s 2025 approval of inverter-based resource reliability standards turns grid support from best effort to requirement. This playbook shows developers, owners, and grid operators how to comply in 2025 to 2026 and convert upgrades into revenue.

Breaking change: grid support moves from best effort to requirement

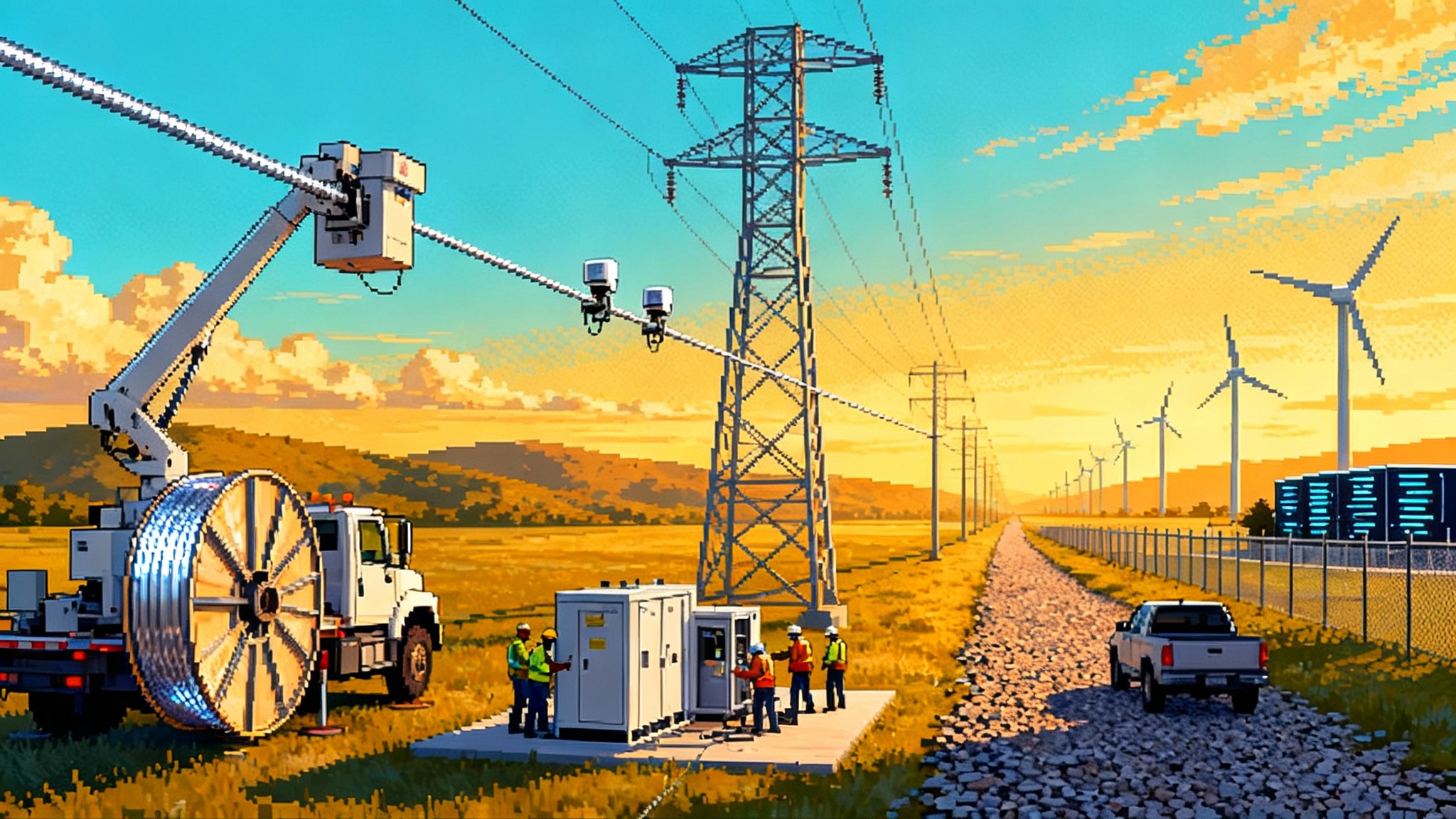

In the summer of 2025, the Federal Energy Regulatory Commission approved a new package of reliability standards for inverter-based resources. That decision turned a long-running concern into a clear rule: if you connect solar, wind, or battery plants to the bulk power system, your inverters must actively support the grid during disturbances and your models must match how the plant behaves in the field. At the same time, the North American Electric Reliability Corporation began pushing for more complete registration of inverter-based sites so that obligations land on the right entities. Together these moves draw a bright line for what it means to be grid ready in 2026. Growing baseline demand from data centers only raises the stakes, as covered in AI becomes the new baseload.

Let us unpack what changed, why it matters, and how teams can turn mandatory compliance into a competitive edge and a new revenue stack.

First, plain language definitions

- Inverter-based resource (IBR): generation or storage that produces grid-quality alternating current through a power electronic inverter. That includes utility-scale solar photovoltaic plants, modern wind turbines with full converters, and grid-scale batteries.

- FERC: the Federal Energy Regulatory Commission, which approves reliability standards for the bulk electric system and oversees organized power markets.

- NERC: the North American Electric Reliability Corporation, which writes and enforces reliability standards and registers the entities that must comply.

- ISO or RTO: regional grid operators such as CAISO, ERCOT, MISO, PJM, ISO New England, and NYISO. They run markets and manage grid operations.

- Ride through: the ability of a plant to stay connected and controlled during voltage or frequency dips or swells, rather than tripping offline at the first sign of trouble.

What just changed for solar, wind, and batteries

The 2025 decision and the associated NERC implementation guidance tighten three pillars of performance for every utility-scale IBR facility.

- Mandatory ride through and fault response

Plants must remain connected through defined ranges of low and high voltage and frequency excursions. They must provide controlled reactive current and voltage support during faults, rather than disappearing when they are most needed. Think of the grid as a busy highway and your plant as a truck. The old rule tolerated pulling onto the shoulder at the first pothole. The new rule requires you to keep driving your lane, steer with care, and help stabilize traffic.

- Validated, plant-specific models

Developers must submit models that match the actual plant, not just a generic template. After commissioning, the owner must validate those models against measured performance during staged tests and real events. If the model says the plant injects reactive current in 20 milliseconds, the field data must confirm it within agreed tolerances. The message is simple: planning models and dispatch tools can no longer be wishful thinking.

- Disturbance monitoring and event reporting

Plants need high-quality data capture, time synchronization, and retention. When the grid shakes, owners must record it, analyze it, and share results with operators. That includes sequence-of-events logs, high-speed waveform or phasor data, and structured post-event reports that close the loop between models, controls, and measured response.

The 2026 timeline: what to do and when

Every region will publish exact dates, but the shape of the next 18 months is now clear.

-

Registration and applicability in 2025 and early 2026

- Owners should verify whether each plant is registered as a generator owner and generator operator under NERC, and whether the plant controller vendor and the inverter manufacturer are captured as responsible entities for modeling or performance obligations where appropriate.

- Projects near the registration threshold should expect closer scrutiny. If your plant materially affects the bulk system, it will likely be brought into scope.

-

Model submissions and validation through 2026

- New interconnection requests will be held to stricter model packages. Expect to provide both positive sequence models for planning studies and electromagnetic transient models for fault ride-through demonstrations where needed.

- In-service plants will be assigned windows to perform staged tests and validate models. Plan for repeat validations after firmware changes.

-

Disturbance monitoring deployment through 2026

- Grid operators will publish minimum data requirements. Expect phasor measurement unit class time synchronization for the point of interconnection, sub-cycle waveform capture around faults, and a clear process to retrieve data after events.

- Owners must implement data retention policies and a reporting playbook that meets NERC and regional expectations.

-

ISO and RTO alignment in 2026

- Market rules will evolve to reflect performance-based accreditation. Operators will also tighten telemetry, alarm, and model management requirements in their interconnection handbooks.

- Expect prequalification tests for fast frequency response, voltage ride through, and dynamic reactive power. As transmission policy shifts, the Order 1920 transmission reset will shape where and how new capacity connects.

Ride through, explained by a pilot’s checklist

Imagine flying a small plane through a gusty patch. The right response is not to shut off the engine. You keep thrust, adjust pitch, and exit the turbulence with the aircraft intact. Ride through is the grid version of that checklist.

- Frequency ride through: staying online across a defined frequency range and providing primary frequency response when the system dips or surges.

- Voltage ride through: remaining connected during low-voltage faults and feeding reactive current that helps prop up voltage at the point of interconnection.

- Active power recovery: ramping back to pre-fault output in a controlled way rather than slamming power and causing secondary oscillations.

For owners, the implication is direct. Trip settings, plant controller logic, and inverter firmware must work as a coherent system. A single misaligned protection threshold can undo an otherwise sound design.

Validated models: making the digital twin honest

Model validation is where many projects will earn or lose time. The grid needs confidence that what is in the study case behaves like what is in the field. That means:

- Use the right level of detail. Planning needs reduced-order models that are numerically stable. Fault studies or weak-grid interconnections may require electromagnetic transient models.

- Test, estimate, and tune. Perform baseline tests after commissioning to estimate control gains, current limits, and delay times. Use those values in the model rather than vendor marketing numbers.

- Keep a change log. Every firmware update to inverter units or the plant controller can change dynamic behavior. Treat it like an aircraft maintenance record and update the model and documentation after each change.

- Prove it with data. Select a handful of events and show overlays of measured response and model response, including time alignment. If the model deviates, adjust parameters and repeat until it matches within tolerance.

Vendors matter here. Inverter manufacturers such as Power Electronics, Sungrow, SMA, and GE Vernova, and plant controller vendors that integrate the fleet must provide model blocks and support parameter estimation. Owners who negotiate for stronger model support in procurement will finish validation faster and with fewer surprises.

Disturbance monitoring and event analytics: from burden to advantage

The new standards make disturbance monitoring a must-have. Done well, it also becomes a superpower.

-

Instrumentation

- Time synchronization: install a disciplined clock with satellite time and holdover. Misaligned clocks ruin event analysis.

- Point of interconnection metering: capture three-phase voltage and current waveforms at high resolution and retain pre-fault and post-fault windows.

- Plant controller logs: enable high-frequency logging of setpoints, limits, and state machine transitions.

- Inverter fleet sampling: configure a subset of inverters for detailed diagnostics so you can see inside the plant during an event.

-

Data pipeline

- Stream event data into your historian with accurate timestamps and a common naming scheme. Many owners already run enterprise historians. Extend them with disturbance channels and add short-term hot storage for sub-second data.

- Build an event trigger that listens for protection operations or voltage dips and automatically harvests the right files from meters and inverters. Lessons from AAR, DLR and grid tech apply here for telemetry quality and real-time operations.

-

Analytics

- Automatic overlays compare measured response to model response for each event and flag parameter drift.

- Fleet-wide views detect which inverters underperformed, which strings clipped too long, or which collector feeders saw the worst voltage swings.

- Root cause libraries help engineers classify events quickly and generate structured, auditable reports for operators and NERC compliance.

This is also where new service businesses will grow. Expect more offerings from established grid software providers and from storage integrators who bundle analytics with performance guarantees.

Grid-forming controls: the capability moat

Most inverters in the field are grid-following. They synchronize to the grid voltage and inject current. Grid-forming controls go a step further. They establish a voltage waveform and can share load with other resources through virtual inertia and droop response. In practical terms, grid-forming controls:

- Improve fault ride through on weak grids by holding voltage when the system sags.

- Enable black start and islanded operation in some configurations.

- Provide faster and more stable recovery from faults and frequency dips.

The key for owners is that grid forming is often a control mode delivered in firmware and plant controller logic. That makes it upgradeable. Storage integrators and inverter vendors increasingly offer grid-forming modes, and some utilities now require or strongly prefer them on feeders with high penetration of inverter-based resources.

Owners who budget for firmware modernization and plant controller upgrades will not only clear compliance. They will have plants that can qualify for more grid support services and that suffer fewer nuisance trips.

Turning compliance into revenue

Once plants can ride through, are modeled accurately, and can prove performance with data, new market doors open. Examples include:

-

Primary frequency response and fast frequency response

Battery plants with precise controls can deliver very fast power changes. Solar and wind can contribute when headroom is reserved. Some regions pay for this capability through dedicated products or performance adders. -

Dynamic reactive power and voltage support

Plants that sustain reactive support through faults and manage voltage ramps can earn compensation under voltage support tariffs or through must-offer ancillary service products. -

Ramp products and contingency reserves

Well-controlled batteries and hybrid solar plus storage plants can bid into spinning and non-spinning reserves with confidence. Accurate models and validated performance simplify accreditation and reduce testing repeats. -

Inertia-like response

Grid-forming controls that provide fast active power injections during frequency decline can qualify for new products that recognize inertia substitution. Where not yet explicitly compensated, the capability still reduces curtailments and exceptions by making the plant a preferred neighbor on weak grid lines.

The playbook is to pair compliance upgrades with market qualification. Plan tests that the ISO already accepts for product qualification. Package your disturbance monitoring, model validation results, and plant controller settings in a standardized dossier so market evaluators can approve faster.

Cost, risk, and return: how to build the case

Rather than chase exact prices that vary by vendor and region, structure the business case around four buckets.

-

Compliance capital

Disturbance recorders, time synchronization, communications upgrades, and selective inverter diagnostics. -

Firmware and controls

Inverter firmware updates, plant controller enhancements, and retuning services. Include lab time for controller-in-the-loop tests when grids are weak. -

Testing and modeling

On-site staged tests, parameter estimation, and third-party model validation. Include budget for a second round after a major firmware change. -

Operations and analytics

Historian extensions, event automation, analytics subscriptions, and internal training so engineers can interpret results.

On the benefit side, quantify avoided losses from nuisance trips, reduced curtailment risk on weak lines, and new ancillary service revenue. Many owners find that one or two market products combined with fewer unplanned outages cover the compliance investment in a few years.

A two-year action plan for owners and developers

0 to 90 days

- Run a gap assessment across settings, models, firmware, and monitoring. Document what you have and what is missing for each plant.

- Confirm NERC registration status for each facility and whether third parties need to be identified in compliance roles.

- Engage inverter and plant controller vendors to secure supported firmware paths to grid forming or at least enhanced grid-following modes.

3 to 9 months

- Procure and install disturbance monitoring, time synchronization, and data pipeline upgrades at the point of interconnection and plant controller.

- Stage a pilot validation on one plant to learn the test choreography and report templates. Use those templates for the fleet.

- Align with your ISO on testing windows and telemetry formats to avoid rework.

9 to 18 months

- Execute model validation fleet-wide, beginning with weak-grid or high-risk plants. Update models and submit evidence packages.

- Complete firmware and controller upgrades and redo key tests to prove improved ride through.

- Prequalify for at least one market product that your plant can reliably deliver.

Ongoing

- Treat firmware as a program, not a project. Maintain a version roadmap and a change control process that triggers model updates.

- Automate event analytics and hold monthly performance reviews that include vendors.

- Keep a fleet book that tracks which plants can serve which market products and refresh it after every upgrade.

What ISOs and utilities should do next

- Publish clear test protocols and model acceptance criteria that match the new standards and avoid duplicative testing.

- Provide secure data exchange paths so owners can deliver disturbance data quickly without ad hoc file transfers.

- Establish feedback loops. After a significant event, convene owners and vendors for a short, structured review that drives parameter fixes within weeks, not months.

- Recognize and reward proven performance through accreditation methods that value fast, accurate response and verified ride through.

Common traps and how to avoid them

- Misaligned protection settings between collector feeders, inverters, and the point-of-interconnection relay that cause unnecessary trips during shallow voltage dips.

- Plant controller limits that throttle reactive current just when fault response is needed most.

- Firmware updates pushed to a subset of inverters without updating the plant controller, resulting in uneven behavior and oscillations.

- Time synchronization drift that turns good data into unusable data. Invest in better clocks and monitor them.

- Models that pass a desktop check but fail against real events because parameters were never estimated from data. Always tune from measurement.

The bottom line

The 2025 IBR rules close the chapter on voluntary grid support. Through 2026 the focus shifts to execution. Owners who treat ride through, validated models, and disturbance monitoring as a single program will clear compliance, earn trust with grid operators, and unlock new revenue. Grid-forming controls and well-managed firmware turn plants into stabilizing anchors rather than fair-weather neighbors. The grid will be stronger for it, and the best-run fleets will be more profitable. Compliance is no longer a cost center. It is a feature that wins interconnections, market access, and lasting advantage.