Pentagon’s Coyote Megadeal Makes Counter-Drone the Default

A multiyear Coyote buy signals the Pentagon’s shift from ad hoc counter-drone kits to a software-driven enterprise baseline. Here is how the stack works, what changes on the ground, and the signals to watch through 2027.

The deal that changed the baseline

On September 29, 2025, the Pentagon awarded roughly 5.04 billion dollars to Raytheon for the Coyote counter-drone ecosystem, an umbrella that includes launchers, interceptors, and Ku-band radars used to find, track, and cue engagements. The contract runs for years and signals a long horizon of production, training, and upgrades rather than a one-off emergency purchase. It is the clearest sign yet that counter-drone is not a boutique add-on. It is becoming the default layer of protection for any unit, base, or convoy that expects to operate under skies full of cheap uncrewed aircraft. The size and timing matter. This is an enterprise buy, not an experiment, and it follows two years of urgent lessons in Ukraine and the Middle East. The Pentagon did not just stock a shelf. It committed to a product line and the software and logistics that keep it current, as covered by Reuters on the $5.04B Coyote award.

Think of the Coyote family as the goalkeeper on a soccer team. Ku-band radars provide the eyes. Command and control decides where the keeper should be standing, and what posture to take. The interceptors, both kinetic and non-kinetic, are the gloves. The new contract buys the whole kit and funds a long season of practice.

From ad hoc buys to an enterprise platform

Since 2018, many counter-drone purchases looked like fire extinguishers bolted onto whatever was already in the building. A base bought a jammer for the gate. A convoy carried a gun truck with special optics. A forward operating location threw together a trailer with a radar and a tablet and hoped the parts spoke to each other. These urgent fixes saved lives, but they did not scale. They were hard to sustain, training pipelines were thin, software updates were sporadic, and every new threat forced another bolt-on.

The new Coyote contract moves the mission from one-off kits to an enterprise platform. Multiyear ordering smooths factory output. A single backbone sensor family and a common effector family reduce the zoo of spares. A repeatable training syllabus makes units interchangeable. Most important, a software-first architecture turns the detect decide defeat sequence into a living system that can be retuned as the threat mutates.

If you are a program manager or a battalion commander, this is the difference between buying a gadget and fielding a capability. You do not just get boxes. You get a release cadence, parts, telemetry, and an onboarding plan for new users and new partners.

The software-defined kill chain

Counter-drone has the same loops as air defense but at a faster tempo and lower altitude. The win goes to whoever closes the loop from detection to effect the quickest while spending the least expensive shot. The Army’s current architecture pairs a mesh of sensors with an open command system and a menu of effectors. The core pieces are:

-

Mesh sensors. Ku-band radio frequency sensors form the backbone and deliver fire-control-quality tracks of low radar cross-section targets. Units augment with passive radio frequency detection, electro-optical and infrared cameras, and sometimes acoustic arrays. In practice, this looks like multiple short-range tripwires, each with a blind spot, stitched together into a coarse but fast picture. The redundancy matters when adversaries fly small quadcopters behind buildings or skim tree lines.

-

Artificial intelligence enabled command and control. Forward Area Air Defense Command and Control, often called FAAD C2, is the battle manager that correlates tracks, decides what matters, and orchestrates the shot. Recent software updates emphasize faster sensor fusion, deconfliction across nearby units, and human-on-the-loop tools that suggest the best effector based on target type, distance, and rules of engagement. When you hear that counter-drone is becoming software defined, this is what it means. The brain gets new tactics and integrations through code, not through a truck swap.

-

Kinetic and non-kinetic effectors. Coyote Block 2 is the go-to kinetic interceptor for small and medium drones that are fast, maneuverable, or flying as part of a coordinated attack. It is rail launched, quick to fire, and optimized for the tight timelines of base defense and convoy protection. Non-kinetic options range from directional jammers that break control links to high power microwaves that fry electronics. Units sequence these effects so that the cheapest shot fires first. If disruption fails or rules of engagement require a hard kill, the Coyote closes the deal. For the directed energy context, see how high power counter-drone weapons are moving into the field and how lasers reset air defense math.

Framed this way, the new contract is less about one missile and more about a factory for decisions. The kill chain is becoming a software product with hardware endpoints, not the other way around. That inversion is what allows the mission to upgrade in months rather than years.

Replicator made counter-drone a headline priority

The award also lands inside a broader shift. In 2024 and 2025 the Department of Defense used the Replicator initiative to accelerate thousands of attritable autonomous systems and the software enablers that let them swarm, sense, and survive in contested environments. Crucially for this story, the first tranche included counter uncrewed aerial systems alongside attack and reconnaissance drones. The Pentagon’s public framing makes clear that C-UAS is not a side project. It is a named pillar of the near-term portfolio. See DoD announces Replicator tranche. For a parallel indicator of acceleration on autonomy, note that uncrewed fighters just flew.

Replicator’s value is less about any single gadget and more about compressing time. It showed the services how to use existing authorities and joint software standards to get capabilities into units in 18 to 24 months. The Coyote buy stands to benefit from that muscle memory. It tells industry to scale production, primes training ranges and simulators, and normalizes the idea that software baselines can change every quarter without breaking the fielded fleet.

The near-term stack you will actually see in the field

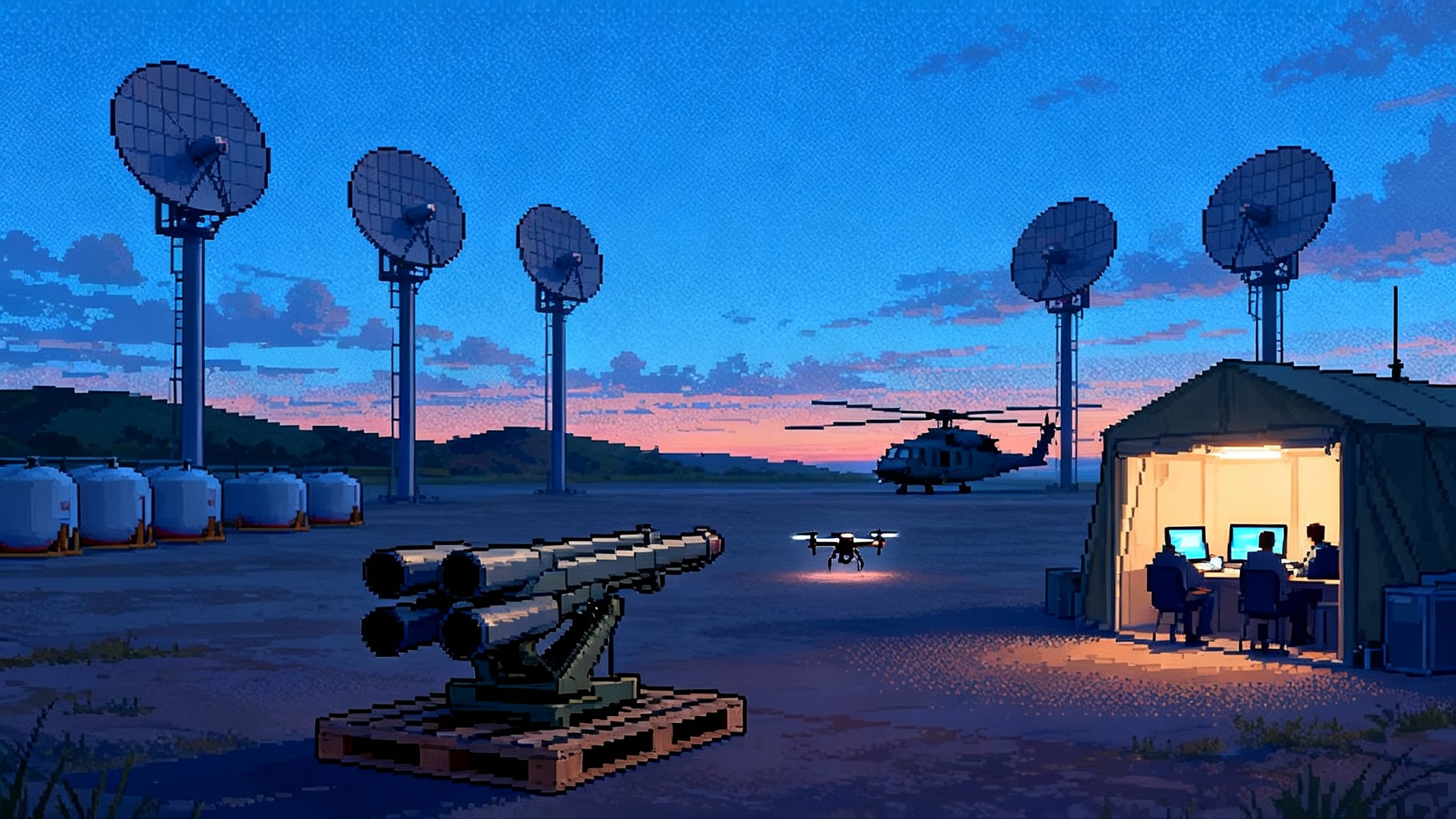

Here is what the 2025 to 2027 counter-drone stack will look like in practice at a typical logistics hub or airfield.

-

Sensors in overlapping rings. Fixed Ku-band radar panels on towers provide 360 degree coverage out to several kilometers. Smaller mobile radars on tripods cover dead ground near buildings and roads. Vehicle-mounted sensors watch approaches to fuel points and ammunition dumps. Passive radio frequency detectors listen for control links and video downlinks to tip the radars before the drone pops into view. Thermal cameras confirm identity without giving away emitter locations.

-

AI-centric command and control at the edge. A ruggedized server in a conex-sized shelter runs the current FAAD C2 baseline with a thin client on tablets. The software fuses tracks, labels likely classes, and suggests a playbook. Operators approve the plan, not each individual click. The system logs everything for training and forensics. When a new sensor shows up on a pallet, the crew adds a software adapter and it joins the party the same day. When the battalion across the fence brings its own radar, both units share tracks with a single button so that no one double shoots.

-

Graduated effects with clear shot doctrine. A drone is detected 5 kilometers out and appears to be a small fixed wing with a modest payload. The system recommends a directional jammer shot first, aimed with radar cues. If telemetry shows the drone is still homing or if the target is a high priority asset, the plan transitions to a Coyote shot with an automated lead solution. A second interceptor is preselected but held. If the first shot breaks the wing and the drone tumbles into a safe area, the software calls off the follow-up missile and logs the save. The crew does not juggle radios. They supervise a script built for speed and economy.

-

A resupply plan that assumes daily use. Because the contract is multiyear, the unit’s monthly allocation of interceptors, spares for radars, and a scheduled software push arrive on a predictable cadence. The radar’s firmware and the C2 software are patched to add new waveforms and new counter-jam techniques learned from other theaters. Training scenarios in the simulator reflect those changes within weeks, not quarters.

This is not a dream board. Units already field many of these pieces. The difference is volume, repeatability, and an expectation that the tech will evolve inside the same shell of hardware.

Why the economics now favor mass fielding

Cost used to be the counter-drone mission’s Achilles’ heel. Why shoot a missile at a 1,000 dollar quadcopter. Two things changed.

First, the adversary’s drones are no longer just hobby craft with a grenade. Small fixed wing aircraft with extended range and operators who know how to mask behind buildings and terrain force faster and more precise shots. They can threaten fuel farms and aircraft tails at standoff. Jamming alone is not enough.

Second, interceptor families like Coyote mix inexpensive bodies with software-guided seekers that do not need to be exquisite to be effective. When a radar and a battle manager do most of the work, the missile can be simpler. Non-kinetic options occupy the low-cost end of the stack and cut down the number of times you need to fire a missile in the first place. The outcome is a portfolio where the average cost per defended hour falls as software improves and shot doctrine gets smarter.

The other lever is training. With a common platform and a predictable pipeline of software builds, units can practice the exact plays they will run on deployment. Simulator time and live fire rehearsals convert inventory into confidence instead of waste.

Interoperability is the magnet for allies

Allies watch two things when they pick a counter-drone system. They want something that is proven at scale and they want it to speak the same command and control language as the United States and neighboring forces. The Coyote plus Ku-band radar backbone clears both bars.

A second magnet is upgrade tempo. Partners do not want to discover that their variant is stuck on last year’s software while the mainline moves ahead. A multiyear enterprise buy that publishes a common baseline and a schedule signals that allies who join will get the same updates on roughly the same days.

Expect front line North Atlantic Treaty Organization states and key partners in the Middle East and Indo Pacific to align with this stack through 2027. Some will adopt the full sensor-to-interceptor package. Others will pick the command and control piece first, then layer in local sensors and effectors. The point is not identical hardware. It is a shared kill chain and shared tactics that let units cover each other and avoid blue on blue interference in crowded airspace.

What changes on the ground starting this winter

-

Base defense becomes default. Any forward operating site with fuel, ammunition, or aircraft will plan around a counter-drone ring, the same way we treat perimeter security or fire suppression. That means civil engineering for power and network drop points, hardstands for towers, and clear fields of view baked into site plans.

-

Procurement gets faster and more boring. Instead of emergency buys with bespoke integration, units will draw from an approved menu with known adapters and support plans. The artistry shifts from wiring to employment.

-

Software releases drive tactics. Commanders will start to plan exercises and live fires around quarterly software drops the way naval officers plan around maintenance availabilities. Expect more table-top drills where leaders practice approving engagement playbooks rather than single shots.

-

Training spreads beyond specialist teams. Because the stack is more repeatable, commanders can move operators between sites and keep performance steady. Certification becomes part of routine rotations, not a one-off predeployment cram.

Risks to manage on the way to 2027

Three challenges will define whether counter-drone truly becomes the default.

-

Electronic warfare fratricide. Jammers and other non-kinetic effects can blind friendly sensors and disrupt friendly links. Units will need clear playbooks for when to jam and when to hold fire to preserve the radar picture or to protect higher-priority communications. The answer again is software and training. If the battle manager knows who is transmitting what and when, it can schedule and prioritize emissions.

-

Magazine depth. Even with smarter shot doctrine, units can go winchester during a multi-axis attack. Commanders should pre-plan resupply triggers, collocate non-kinetic systems near their most likely engagement zones, and coordinate with neighboring units to share tracks and effects.

-

Industrial capacity. The contract is big enough to justify second sources for several subcomponents and to fund line expansions. Watch for announcements about additional suppliers for seekers, propulsion, and radar modules. The health of that bench will decide whether fielded units see steady deliveries or hiccups in 2026 and 2027.

Signals to watch

For readers who track programs for a living, here are concrete indicators that the shift is real.

-

Quarterly software notes that add new sensor integrations and tweak engagement recommendations based on field telemetry.

-

A steady beat of deliveries where units report the same baseline hardware across theaters.

-

Training curricula that migrate from vendor classrooms to unit-owned simulators with shared scenarios and after-action reviews that feed back into code.

-

Public exercises where multiple allies share tracks and deconflict effects in real time, especially in Eastern Europe and the Indo Pacific.

-

Procurement language that moves away from one-off installations and toward site packages that include power, hardstands, backhaul, and redundancy by default.

The bottom line

The late September award did more than buy missiles and radars. It bought a rhythm. Paired with Replicator’s habit of moving faster and integrating software from the start, the Coyote ecosystem turns counter-drone from a scramble into a standard. The near-term stack is clear. Mesh sensors feed an AI-enabled commander that selects non-kinetic or kinetic effects to achieve a safe, cheap kill. The contracts run long enough to scale production and to train the force that will use it.

That is how counter-drone becomes the new default. Not with a single breakthrough, but with a deliberately boring pipeline that gets better every quarter. If industry can keep deliveries predictable, if software teams keep pushing practical updates, and if commanders measure success by defended hours rather than flashy intercept videos, then by 2027 every critical site from ammo dump to airfield will treat this kill chain as ordinary infrastructure. That is the quiet victory that matters.