Ethereum’s Interop Moment: Intents, EIL, and Uniswap Compact v1

Ethereum’s new Interoperability Layer and Uniswap’s Compact v1 just changed how cross-chain actions feel. This guide breaks down intents, EIL, and reusable locks so wallets, bridges, and apps can deliver one-tap L2 experiences this quarter.

The breakthrough week that made Ethereum feel like one chain again

In the span of a few weeks, two concrete moves reframed how cross layer actions can work on Ethereum. On August 29, the Ethereum Foundation published an update introducing the Ethereum Interoperability Layer, a trustless transport that aims to make cross L2 transactions feel like single chain transactions, along with a suite of intent and messaging standards that help wallets and apps speak a common language across rollups. That update set the blueprint for how execution can move between chains without handing trust to middlemen, and it did it with specifics, not slogans. See the official Ethereum Interoperability Layer update.

Less than a month later, Uniswap Labs released Compact v1, an ownerless contract that lets developers create reusable resource locks and attach programmable commitments to them. In plain terms, Compact v1 gives builders a safe way to put funds on standby and then release them when an agreed action is proven to have occurred, even if that action spanned multiple chains. It is the missing settlement primitive for cross chain intents. Read the overview in the Uniswap Compact v1 launch.

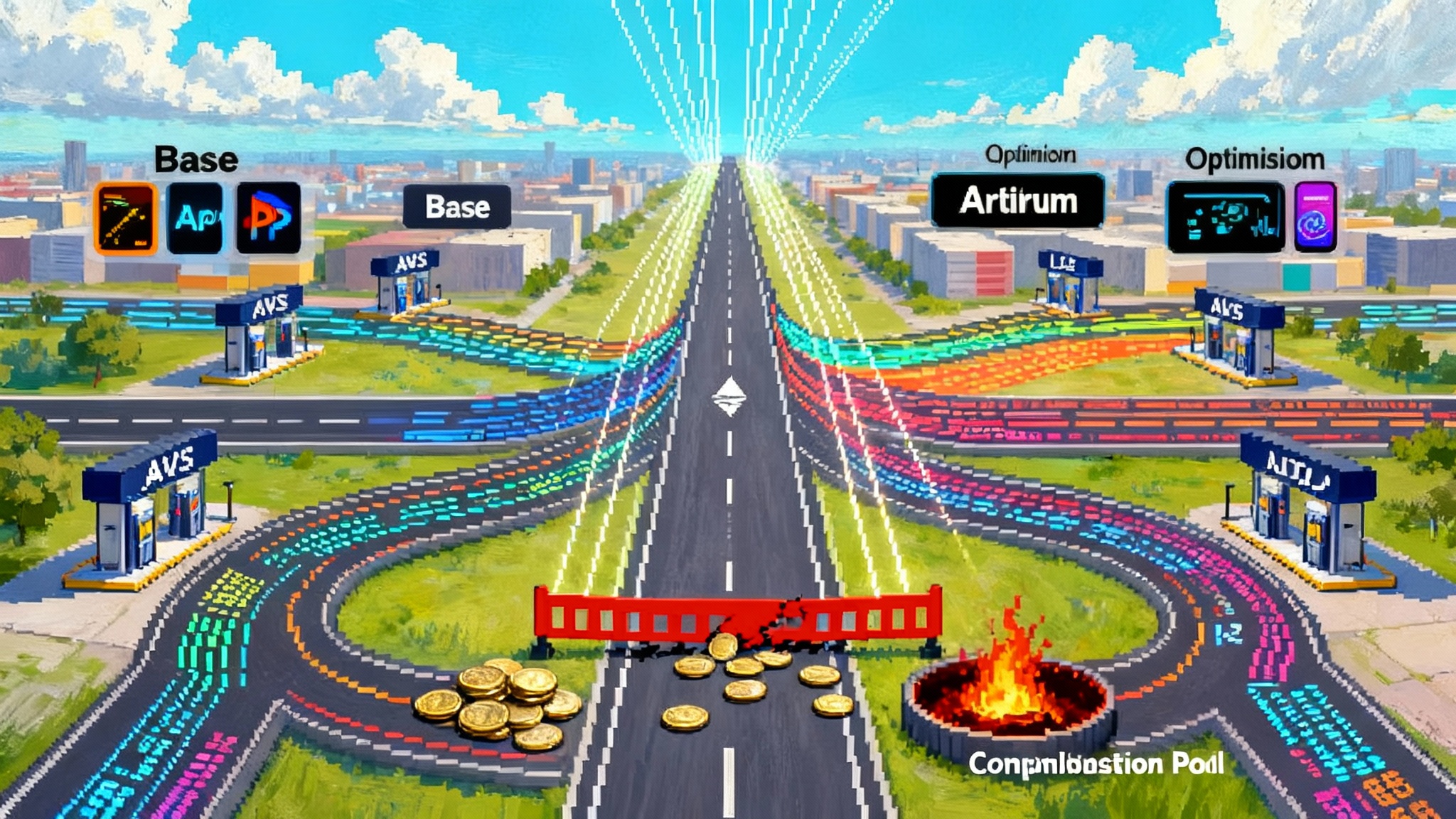

This is the interop moment. Intents describe the outcome a user wants. The Ethereum Interoperability Layer outlines how to execute across layers without trust shortcuts. Compact v1 supplies reusable locks that keep capital safe and ready. Together, they compress the multichain journey into a single, predictable user action. This direction aligns with the broader consolidation we explored in Celo’s L1 to L2 flip and the shift toward permissionless rollups seen in Arbitrum’s BoLD and permissionless L2s.

What is an intent, and why it matters now

Think of an intent as a travel itinerary. You tell a concierge your destination and constraints, not which roads to take. In crypto terms, the user signs a statement like this: swap my 1 ether on Layer 2 A into stablecoins on Layer 2 B, pay no more than a 0.5 percent fee, and deliver within five minutes. Solvers compete to fulfill that intent. They are the drivers picking the route. The user cares about the outcome and the guardrails, not the hop by hop path.

Until now, intents often relied on custom bridges, bespoke relayers, or tightly coupled routers. The result worked, but each project packaged its own definitions, signatures, and settlement patterns. That splintered developer time and user expectations. The standards highlighted alongside the Interoperability Layer push toward shared building blocks. You will hear these names a lot this quarter:

- A common intent interface so wallets and apps can express outcomes in a predictable format.

- Interoperable addresses so the same human readable identifier can point to the right account on different chains.

- Multi call and cross chain calls so a wallet can bundle steps and present a single confirmation to the user.

With these, an intent becomes a portable object. Wallets can render it in a consistent way, solvers can bid to fulfill it, and settlement backends can verify the result against shared rules.

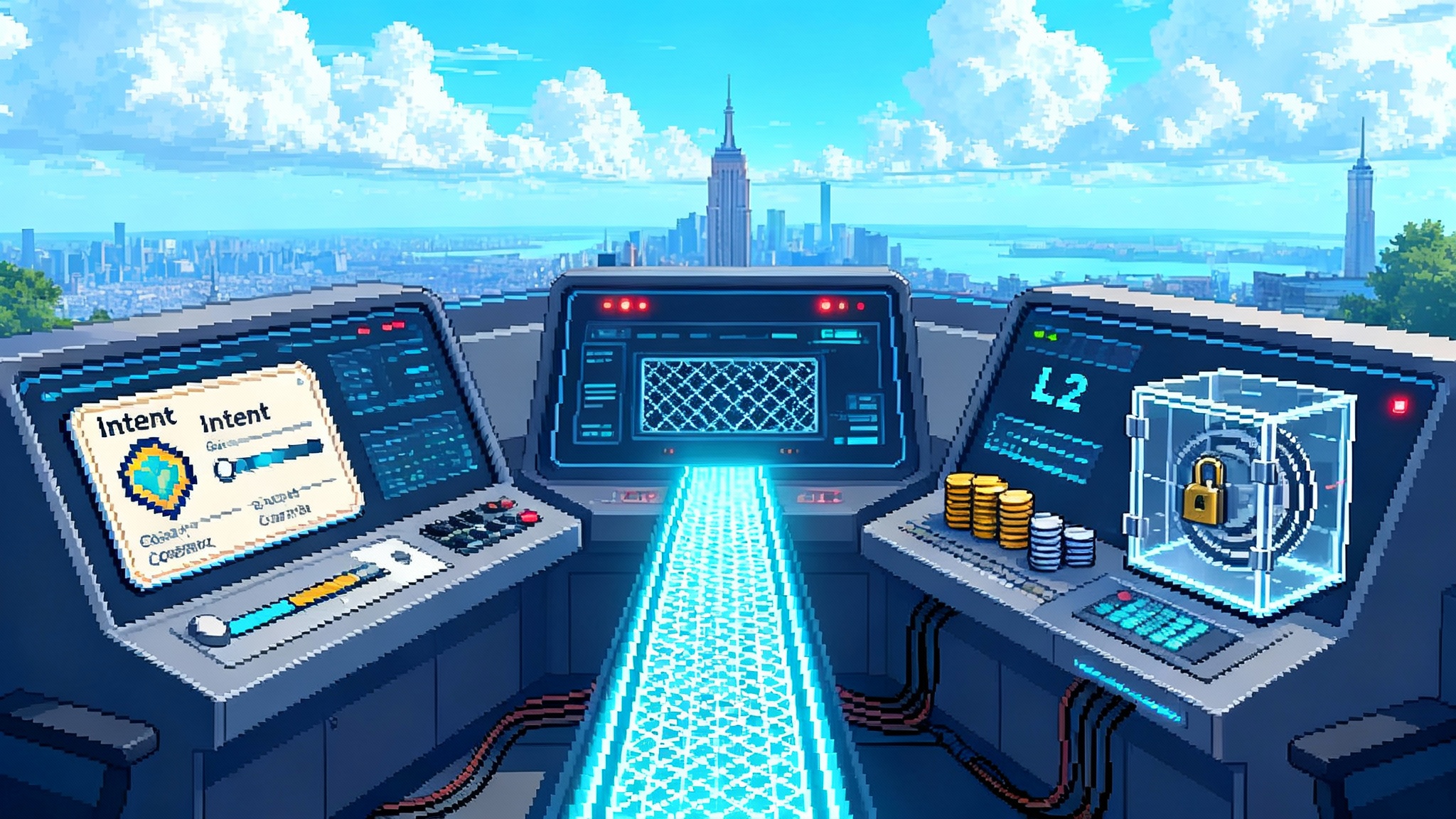

EIL in one paragraph: a transport layer, not a trust trade

The Ethereum Interoperability Layer aims to move from custom relays to a trustless lane for prescriptive execution across rollups. If intents are the declarative layer, EIL is the do layer. It focuses on transaction level execution that preserves Ethereum grade censorship resistance and security. The important shift is conceptual. Rather than hoping that a bridge will behave, execution proofs and settlement assurances flow through Ethereum aligned paths. EIL is being developed by teams that shipped account abstraction at scale, and the update points to a public design document slated for October and more detail at Devconnect. The direction is clear. Users keep control, and cross L2 moves inherit the security model of Ethereum rather than the governance of a single bridge.

This push complements performance work across the ecosystem, including the finality gains covered in Polygon Rio near instant finality.

Compact v1, explained without jargon

Compact v1 introduces reusable resource locks. A lock is a vault that holds assets, represented by a fungible token inside the contract. The lock has four core attributes: the underlying asset, an allocator that authorizes spending, a scope that can be single chain or multichain, and a reset period that enables forced withdrawals if a coordinator goes dark.

On top of a lock, a sponsor creates a compact. Picture it as an escrow instruction that says under what evidence the locked funds can be claimed. An arbiter checks that evidence and submits a claim. The allocator ensures the claim cannot double spend. Sponsors can reuse the same lock for many compacts, which makes capital efficient because funds do not need to be redeposited for each cross chain action.

From a product standpoint, Compact v1 gives Ethereum a credible way to say yes to asynchronous settlement without trusting a single relayer. Capital sits in one canonical place, allocations are tracked precisely, nonces prevent replay, and reset periods give sponsors a way out if a party misbehaves. It is a clean separation of concerns. Locks hold funds. Compacts define conditions. Allocators prevent race conditions. Arbiters attest that conditions were met. The design is ownerless, which means no single team can veto integrations or change rules at will.

How intents, EIL, and Compact snap together

- Intents describe what the user wants and set clear constraints. This is the user experience layer. It belongs in wallets and apps.

- EIL supplies a transport lane that makes the execution step feel like a normal transaction, even when it spans chains. This is the protocol lane.

- Compact v1 supplies settlement objects that can be reused, audited, and reasoned about. This is the capital lane.

A concrete flow looks like this:

-

A user in a wallet says swap 1 ether on Scroll into 3 stablecoins on Base, all in one action, with a max fee and a deadline.

-

The wallet packages that as a standard intent. Solvers bid. The winning solver promises price and time.

-

The solver uses EIL aligned messaging to orchestrate the calls. The solver pre commits settlement by referencing a Compact lock funded by a sponsor. That lock’s allocator caps how much can move and where.

-

Once the arbiter verifies that the promised outcome landed on Base, it submits a claim against the compact. Funds move from the lock to the claimant, and the lock is ready for the next compact.

To the user, this is one tap and one receipt. Under the hood, capital, messages, and proofs moved across chains while risk remained bounded by an allocator and a reset period.

What changes for wallets

Wallets become intent originators by default, not just transaction signers. Three concrete shifts follow:

- Single confirmation flows. With multi call and interoperable message standards, wallets present one confirmation with clear outcomes and slippage bounds. No more approve here, bridge there, swap over there.

- New signing surfaces. Intents should be human readable. Wallets will need templates for common outcomes, plus a way to display allocator limits and arbiter roles when a compact is involved.

- Background gas and fees. In a cross L2 flow, users should see total cost, not a stack of little charges. Wallets can negotiate solver quotes that include gas, execution risk, and settlement fees, then present a single number.

Action for wallet teams this quarter: ship a minimal intent composer, render standard fields consistently, and incorporate compact awareness. If a solver references a lock, show the scope, the reset period, and who allocates. Treat these like safety rails, not trivia.

What changes for bridges and routers

Bridges move from being the primary product to being a piece of infrastructure. The winners will measure themselves by reliability, proof quality, and capital efficiency, not by brand impressions on an app screen.

- Message over brand. If EIL style execution dominates, the bridge that carries the message matters less than whether the message arrives with the right proofs. Expect more standardized interfaces and fewer custom SDKs.

- Liquidity becomes sponsored. With reusable locks, professional sponsors can underwrite settlement for many apps at once, and allocators can meter risk. That is a very different capital model than isolated fast bridges with stranded liquidity.

- Time to certainty becomes a product metric. Bridges that can provide strong confirmation quickly become preferred backends for solver networks. Expect public dashboards that report time to first fill, reorg sensitivity, and failure recovery.

Action for bridge and router teams: expose allocator friendly risk limits, publish proof characteristics clearly, and make it simple for solver networks to integrate you as one of several interchangeable backends.

What changes for users

Most users will not think about any of this. They will notice that cross chain actions now look and feel like a single transaction.

- Fewer prompts, more clarity. One confirmation shows what you get, when, and the total cost. If a compact is in play, the wallet can show which lock backs the promise and how much headroom remains.

- Better price integrity. Solvers compete on a clear intent, not on hidden routes. That helps align incentives around best execution rather than routing kickbacks.

- Safer by default. Allocator caps and reset periods reduce blast radius if a component fails. If a coordinator stalls, sponsors can force withdraw, then reassign.

Who captures the UX edge as chain abstraction goes mainstream

- Wallets that speak intents. The first wallets to ship clean intent composers, explain settlement roles, and negotiate good solver integrations will feel a league ahead. Expect a short list of leaders to emerge based on speed, readability, and refund policies.

- Solver networks that prove consistent fills. The platforms that aggregate capital, manage rebalancing costs, and post transparent reliability metrics will become default choices for wallets and apps. They will look more like internet service providers than trading desks.

- L2s that lean into EIL. The rollups that wire interop standards into their tooling, publish good developer docs, and support reference implementations will see their apps become the easiest to use across the ecosystem.

- Protocol teams that adopt Compact v1. Builders that shift to reusable locks will ship cross chain features faster because they do not need fresh custody code every time. Expect early integrations from established routers and middleware providers that already serve many apps.

Risks and design tradeoffs you should actually care about

No system is free of tradeoffs. Here are the practical ones to watch and what to do about them.

- Allocator failure. If an allocator goes offline, claims stop. Mitigate by setting realistic reset periods and using well monitored allocator implementations with fallbacks. Sponsors should practice forced withdrawals in staging.

- Arbiter errors. Arbiters verify that conditions were met. A bad arbiter can approve a claim too early or reject a valid one. Separate arbiter roles from allocators, publish arbiter logic, and require on chain evidence where possible.

- Capital contention. Reusable locks improve efficiency, but they can also become hot spots. Sponsors should limit per intent allocations and use tags to scope locks to the minimum necessary domain.

- Economic fairness. Solver auctions must be designed to prevent last look advantages and censorship by gatekeepers. Use open bidding windows, publish fill criteria, and rotate participants.

- Implementation bugs. Both EIL aligned components and Compact v1 integrations will benefit from audits and public testnets. Uniswap Labs noted multiple independent reviews and a bug bounty in its launch. Teams integrating these pieces should budget time for their own audits as well.

What to build this quarter

If you are a wallet, a bridge, or an app that wants to feel like one chain, here is a concrete plan for the next eight weeks.

- Ship a minimum viable intent flow. Support a small set of outcomes like swap, bridge and swap, repay, or provide liquidity. Keep the interface consistency and let users pin defaults.

- Add compact awareness. When a solver references a lock, display allocator, scope, and reset period. Warn users if a claim window is about to expire or if the lock’s remaining allocation is low.

- Integrate at least two solver networks. Give users redundancy. Measure fill speed, slippage, and failure recovery, then pick a default that you can justify publicly.

- Start treating bridges as interchangeable. Abstract your bridge interface behind a capability layer that speaks in messages and proofs. Publish a health score across backends and rotate when conditions change.

- Instrument everything. Track time to first confirmation, time to finality, and refund rates. Use these metrics to choose defaults and to explain behavior to users.

How we will know chain abstraction went mainstream

It will not be when someone declares victory in a blog post. It will be when a new user downloads a wallet, swaps across two rollups on day one, and never once asks which bridge they used. It will be when wallets market total cost and reliability, not brand names of backends. It will be when a team can launch a cross chain feature with a small patch rather than a quarter of integration work.

The late August protocol update brought a credible plan for trustless transport and shared standards. The late September release of Compact v1 provided the reusable settlement primitive. Together, they let builders treat Ethereum as one logical computer again. The payoff is practical. Fewer prompts, lower cognitive load, and execution that just works.

We do not need new buzzwords. We need shipping code and simple choices that respect user attention. That is what this interop moment is about. It is a handshake between intents, a transport lane that does not ask for trust it cannot guarantee, and a settlement object that can be reused until the next upgrade. The next wave of user growth will not notice the machinery. They will just notice that Ethereum feels whole again.