Polygon Rio Goes Live: 5,000 TPS and Near Instant Finality

Polygon activated the Rio upgrade on October 8, 2025, refitting Polygon PoS as a payments-first layer 2 with roughly 5,000 TPS, near instant finality, lighter nodes, and fewer reorgs. Here is what changes for wallets, stablecoin issuers, and merchants and how to integrate it this quarter.

Breaking: Rio flips the switch on real onchain payments

Polygon’s Rio upgrade went live on mainnet today, October 8, 2025, and it reads less like a routine hard fork and more like a strategic rebuild for payments. With a target of roughly 5,000 transactions per second (TPS), near instant finality, and lighter nodes, Rio turns the Polygon proof of stake chain into a payments‑first layer 2 network. The headline ideas are simple, and the implications are big: validators elect block producers to make blocks decisively, witnesses let validators verify without lugging around the full state, and the chain removes the practical risk of reorgs. The payoff is faster checkouts, lower operating costs for infrastructure, and more predictable settlement for merchants and fintechs. As Polygon puts it, Polygon's Rio upgrade is live.

If you run a wallet, a stablecoin program, or a checkout stack, Rio is not just an upgrade to observe. It is an integration checklist to start today.

The new engine: Validator‑Elected Block Producers

A key change in Rio is who gets to build blocks, and how. Historically, many validators would take turns producing blocks in short bursts. That creates competition and sometimes short, messy rollbacks when two proposers momentarily disagree, which the industry calls reorganizations or reorgs. Rio replaces this with Validator‑Elected Block Producers, often abbreviated as VEBloP after you spell it out once. For a scaling contrast outside the Polygon ecosystem, see Solana Firedancer scaling plans.

Here is the mechanism in plain terms:

- Validators vote to elect a small pool of block producers. At any given time, exactly one of them is the active producer.

- That producer handles block creation for a longer span, rather than a blink‑and‑you‑miss‑it slot. Because there is only one producer, there is no race and no dueling forks.

- If the producer falters, designated backups step in immediately. Think of it like hot‑standby leaders in a well‑run data center cluster.

This structure does three important things for payments:

- It shortens the path between a submitted transaction and a confirmed block. There is no “who won the race” ambiguity, so you do not wait for multiple confirmations to feel safe.

- It dramatically reduces the chance of a reorg. In payments terms, fewer “sorry, that block was replaced” events mean fewer operational holdbacks and fewer reconciliations.

- It creates room for more throughput by streamlining block propagation. The chain spends less time resolving contention and more time doing useful work.

A predictable question follows: does concentrating block production risk censorship or reduce incentives for the broader validator set? Rio ships with an updated economic model that redistributes fees, including maximal extractable value or MEV, across validators, not just the active producer. That keeps non‑producing validators economically aligned while the protocol separates the act of building blocks from the act of verifying them. The design gives Polygon a faster front end without turning validators into spectators.

Witness‑based stateless validation, explained like you are rebuilding a node on a laptop

If VEBloP is the engine, witness‑based stateless validation is the chassis that makes it light. Running a validator has historically meant holding a huge local copy of the network’s state. That is expensive storage, painful sync times, and high operational cost. Rio introduces an approach where validators can verify blocks using compact cryptographic witnesses that include only the state data needed for the transactions in that block. They do not have to keep the entire state on disk to participate correctly.

A quick metaphor: imagine you are checking a traveler’s documents at the border. You do not need every document they have ever carried. You need the specific proofs relevant to today’s crossing, validated against public rules. Stateless validation works similarly. A block arrives with the minimal proof bundle, and a validator can say yes or no without reconstructing the whole history at home.

For operators, that means:

- Lower storage requirements, often by an order of magnitude compared to keeping full state.

- Faster and less brittle node bootstrapping. You can spin up fresh validators or watchers quickly.

- More competition in node provisioning. Commodity hardware becomes viable, which widens the validator pool and reduces infrastructure concentration.

The technical proposal behind this is public and worth a read: PIP‑72 on stateless verification. The short version is that witnesses, combined with consensus changes, let Polygon both raise throughput and make participation cheaper. That is rare in distributed systems, where speed gains often come with heavier hardware.

Why “no reorgs” matters at the register

Reorganizations are the blockchain equivalent of a card network reversing a batch after you printed the receipt. They are uncommon on healthy chains, but the risk forces conservative behavior at checkout. Merchants wait for multiple confirmations, wallets show “pending” badges for seconds that feel like minutes, and risk teams build hold periods. Rio’s design aims to remove this category of uncertainty.

With an elected, single block producer and stateless verification, Polygon creates a more deterministic chain. When a block is verified, it stays verified. That gives product teams permission to redesign the payment moment:

- Terminals and wallets can show a clear, single state: submitted, then final. Not four spinning states that make users anxious.

- Refund flows can be explicit instead of opaque, because the original sale is final, recorded, and will not be rewritten by the chain.

- Support teams get fewer tickets that say, “The app shows pending. Did I just pay twice?”

If you manage fraud risk, near instant finality shifts the control surface. Instead of compensating for settlement uncertainty, you focus on pre‑transaction scoring, device risk, and identity. Post‑transaction monitoring becomes cleaner because the ground truth is not moving under your feet.

Stablecoin rails: what changes this week

Polygon has long been a gravity well for stablecoin activity. Rio should increase that pull for three reasons:

- Throughput and finality make stablecoin transfers feel like messages, not money orders. For consumer remittances and peer‑to‑peer transfers, the experience upgrades from “wait and hope” to “send and done.”

- Node cost reductions will trickle down. Payment service providers, market makers, and off‑ramp partners that run their own infrastructure can expand capacity without doubling capital expenditure. Expect tighter spreads and faster quoting in consumer apps that do instant stablecoin swaps.

- Reliability lifts merchant confidence. If you operate a mass‑market checkout with thousands of simultaneous purchases, variance in block times and the tail risk of reorgs create real edge cases. Rio narrows those tails.

If you track the regulatory arc on dollar tokens, see GENIUS Act U.S.-licensed stablecoins race for how policy may shape mainstream adoption.

On issuer side, the immediate homework is operational rather than contractual: ensure allowlists, compliance monitors, and freezing logic have been tested against the Rio chain rules, and coordinate cutovers with exchanges and custody providers that paused or slowed deposits during the hard fork window. The faster these pipes reopen with Rio‑aware assumptions, the faster consumers will feel the upgrade.

Merchant experience: from swipe to settle in seconds

Put yourself in a point‑of‑sale flow on a busy Saturday. Before Rio, a wallet might submit a payment and show a spinner as the app waited for several blocks before feeling confident. With Rio’s one‑producer model and near instant finality:

- The client can optimistically display “finalizing” for a fraction of a second, then switch to “paid” without a second confirmation gate.

- Gas estimation becomes more predictable, because the chain is not juggling multiple competing blocks. That lets providers pre‑quote total cost more accurately.

- Receipts can include a single block identifier as the canonical settlement reference, simplifying reconciliation.

For recurring payments, subscriptions, and metered usage, fewer reorgs mean fewer adjustments. If you are building tap‑to‑pay with account abstraction, Rio’s faster confirmation loop reduces the awkward moment when a user wonders if they should tap again. It is the difference between a friendly beep and an anxious stare at the cashier.

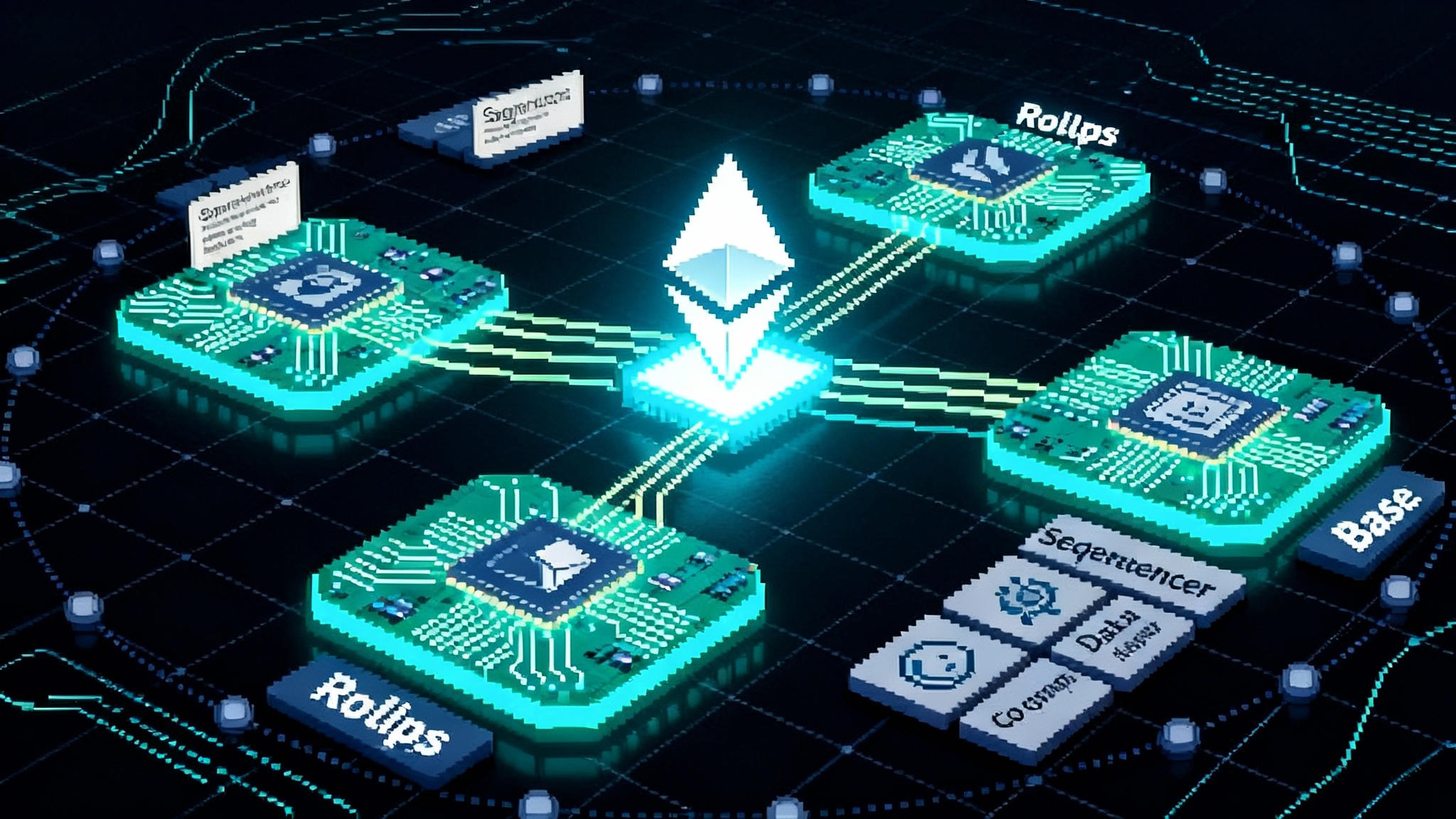

AggLayer next: the cross‑chain dividend for payments

Rio lands on the proof of stake chain, but it is aligned with Polygon’s AggLayer strategy. The AggLayer is a cross‑chain settlement fabric that aims to unify liquidity and users across many chains into a single experience. For a payments operator, here is what that could mean as it matures:

- Accept on one chain, settle where it fits. A merchant could take a payment on Polygon PoS and settle treasury on a specialized chain connected through AggLayer without building bespoke bridges.

- Native over wrapped assets. The AggLayer vision is to make assets feel native across connected chains. That removes the mental tax of wrapped tickers from checkout screens and accounting systems.

- Global routing with local latency. As more chains plug into AggLayer’s shared security and proofs, payments can move to where liquidity is deepest or fees are lowest while keeping a single user experience.

If you care about the direction of sequencing and proofs across rollups, see permissionless L2 sequencing trends.

Rio’s role here is to serve as a fast, reliable front door. For cross‑border payments and remittance corridors, you can imagine incoming flows landing on Polygon PoS at retail speed, then settling across connected chains for treasury, hedging, or yield operations.

What fintechs should do in Q4 to ship real onchain payments

If you want to go live this quarter, treat Rio as a practical checklist.

- Update infrastructure and monitors

- Confirm your node provider or internal nodes are on Rio‑compatible clients. Validate that witness data is available and logged for audit.

- Raise your alerting on block production handoffs. The active producer will rotate; watch for anomalies rather than assuming a single proposer pattern.

- Instrument end‑to‑end latency. Track mempool to final block timing and alert on tails. This is your new service‑level objective.

- Revise finality assumptions in product

- Drop the old multi‑confirmation counters in consumer interfaces. Replace with a single finality indicator tied to Rio’s semantics.

- Update merchant dashboards to reconcile on a single block reference. Remove retry prompts that were designed to handle reorgs.

- Reprice and repackage fees

- Use the throughput headroom to reexamine your per‑transaction markup and batch size. For small tickets, shaving seconds matters more than shaving a fraction of a cent.

- If you rebate gas, reconfirm your hedging and pre‑funding strategy now that gas variance should compress.

- Strengthen fraud and compliance logic

- Shift rules from confirmation depth to behavioral signals. With near instant finality, you can make earlier, firmer decisions.

- Test issuer controls, blacklist hooks, and recovery flows under Rio traffic patterns. Timeouts and retries will look different now.

- Build an AggLayer‑ready plan

- Map which assets and partner chains your customers need next. Identify when it is worth settling across chains versus staying put on Polygon PoS.

- Prepare for native asset handling across chains instead of maintaining wrapped asset mappings. That means accounting, treasury policies, and risk books should be updated in advance.

- Coordinate the ecosystem cutover

- Exchanges often pause deposits during hard forks. Confirm deposit windows are reopened and that your risk limits reflect Rio’s finality properties.

- If you custody funds, verify your custodians have run Rio playbooks, including stateless verification checks.

- Run a Q4 go‑live drill

- Pick one corridor or merchant category, simulate peak traffic, measure decline rates, and track refund latency. Hand those numbers to sales and support so the story is real, not theoretical.

What could go wrong, and how the design addresses it

- Concentration risk in producer elections. Any system that elects a small set of producers must manage capture risk. Rio mitigates this with frequent rotation, backup producers that take over automatically, and a rewards model that keeps the wider validator set motivated to verify and challenge. Your part as an operator is to monitor producer churn and include it in your risk dashboards.

- Witness availability. Stateless verification relies on witnesses arriving with blocks. If witnesses are delayed or malformed, validation could stall. This is why your infrastructure checklist should include explicit logging and alerting for witness integrity, not just block headers.

- Application‑level assumptions. Teams sometimes bake in “wait N blocks” logic deep in their systems. If you do not unwind those assumptions, you will not realize the user experience gains. Audit your services for these legacy patterns.

- Data availability and cross‑chain semantics. As AggLayer grows, the temptation is to assume every asset is available everywhere instantly. Treat the first phase as settlement‑first, then expand to real‑time flows as proofs and liquidity guarantees mature.

The bigger picture: Polygon as a payments‑first layer 2

Rio is not a promise of someday. It is a live change to how the network runs blocks and how validators do their jobs. By pairing a decisive block production model with stateless verification, Polygon reduces technical friction that has quietly limited onchain payments for years. There is no magic. There is a set of engineering choices that make money movement fast, predictable, and cheap while keeping the door open for broad participation.

For merchants and fintechs, that is the unlock. You can design a checkout that feels like a card swipe but settles like a cash transaction. You can scale volume without turning your infrastructure budget into a science project. You can plan for a multi‑chain future with AggLayer without building a tower of bespoke bridges.

The switch flipped today. The rest is execution. The teams that ship pilots in Q4, measure real‑world conversion, and reprice their unit economics will define what payments on public rails look like in 2026. Everyone else will be catching up.