Tokenized Treasuries Hit $7.9B as DeFi Picks T-bills

By October 2025, tokenized Treasury funds reached about $7.9 billion and began displacing idle stablecoin cash as onchain, yield-bearing collateral. Here is how T-bills are becoming DeFi’s base layer and what to expect over the next 6 to 12 months.

The quiet reshaping of DeFi’s balance sheet

The most important DeFi chart this fall is not a token price. It is a market cap line that crept from millions to billions, then paused near the 8 billion mark. As of October 2, 2025, tokenized U.S. Treasury products stood at $7.92 billion, led by BlackRock’s BUIDL at roughly $2.64 billion in market value. That is not a vibe; it is a balance sheet. The onchain dollar is migrating from inert cash to interest‑earning Treasuries, and DeFi is reorganizing around it. RWA.xyz treasury dashboard.

If you spend time inside wallets and trading dashboards, you can feel the shift. Where idle stablecoins once sat as dead cash, today you see shares of tokenized T-bill funds. These tokens clear in minutes, stream or rebase yield to the wallet that holds them, and can be pledged as collateral in both decentralized and centralized venues. That unlocks a simple but powerful loop: hold dollars, earn the policy rate, post the same balance to trade or borrow, and move it again without waiting for a bank wire or a fund transfer window.

Why T-bills fit the chain

Short-term Treasuries carry three traits that make them native to blockchains:

- They are standardized. A 4-week or 13-week bill is the same product no matter who holds it, which maps neatly to fungible tokens.

- They are liquid. Primary and repo markets turn over trillions daily, so token wrappers can scale without distorting the underlying.

- They are close to cash. With minimal credit risk and short duration, they keep price volatility low enough to serve as working capital.

That triad solves longstanding frictions for crypto treasurers and protocols. Stablecoins are great for payments and settlement, but they do not pay you the risk‑free rate. Bank deposits often pay close to zero. Tokenized T-bills bridge both gaps. Mechanically, two designs dominate:

- Rebase tokens that hold a stable price and pay yield by increasing token quantity. BUIDL and Franklin Templeton’s BENJI follow this pattern. Wallet balances tick up daily while the unit price anchors near one dollar.

- Accrual tokens that increase in price as income accumulates. Circle’s USYC is a common example. The token count stays constant; the net asset value inches higher.

For a crypto-native, the difference is like staking on a proof-of-stake chain that either drips new tokens into your wallet or nudges the token’s exchange rate upward. In both cases, the yield now lives directly inside your collateral.

A concrete picture of market leadership

The leaderboard makes the narrative tangible. BlackRock’s BUIDL, tokenized by Securitize, cleared $2.6 billion in early October. Ondo’s OUSG sits in the hundreds of millions and connects T-bill exposure to DeFi rails. Franklin Templeton’s BENJI and Superstate’s USTB provide institutional money fund wrappers for qualified investors. WisdomTree’s WTGXX brings a regulated, token‑represented money market fund that records ownership on public chains. Circle’s USYC offers a programmatic, accrual‑style design that pairs naturally with wallets and settlement flows. These are not press‑release pilots. They are operating funds with subscriptions, redemptions, and daily yield mechanics that can be read from a block explorer.

The headline change in 2025 has been utility. Exchanges and prime brokers in crypto are starting to treat tokenized T-bills as first‑class margin assets. Derivatives venues have added support for BUIDL and similar instruments, allowing traders to earn a government rate while they post collateral. Lenders have begun to accept these tokens for credit lines and structured financing. The effect is cumulative: balances move onchain for yield, then stay put because that same token also works as collateral.

The 6 to 12 month map: from yield to full money markets

The next step is not bigger funds. It is faster plumbing. Over the next year, watch four rails develop in parallel.

1) Intraday onchain repo becomes routine

Repo is where Treasuries become money. Intraday repo on distributed ledgers is already real in traditional finance, and it is scaling. In September, Broadridge reported more than $280 billion in average daily repo transactions in August on its distributed ledger repo platform. That is not a proof of concept. It is throughput. The implication for crypto is direct: once wallets holding tokenized T-bills can access intraday repo against those same positions, collateral becomes truly 24/7 and programmable. That means a market maker can finance inventory at 03:00 UTC, unwind at 06:00, and roll again at 12:00, with smart contracts setting the haircuts, rates, and maturity to the minute. Broadridge repo volumes disclosure.

In crypto terms, think of repo as a flash loan that actually accrues interest and carries custody and legal certainty. The day it becomes a standard leg inside trading and liquidity strategies, the velocity of onchain collateral jumps.

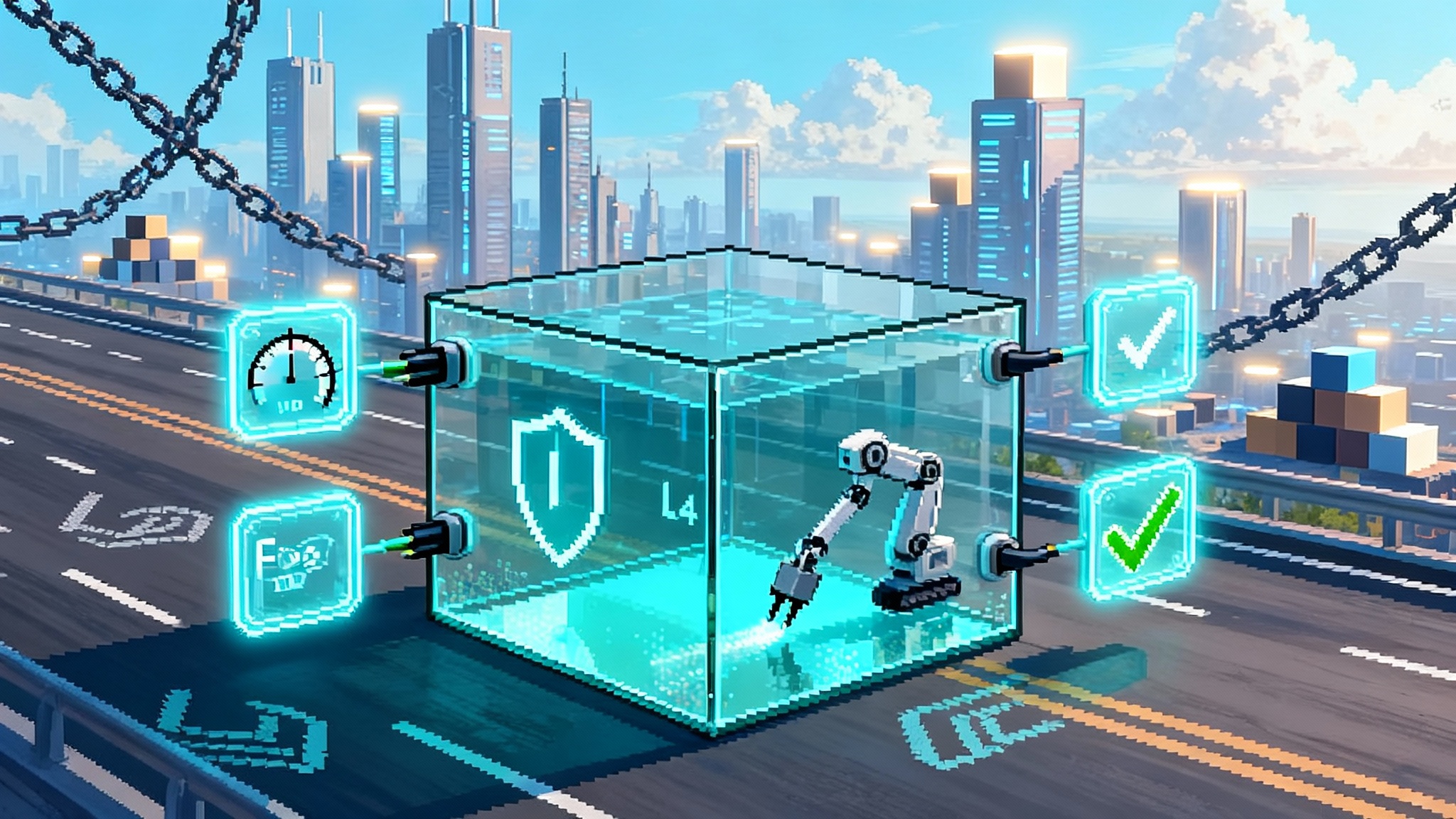

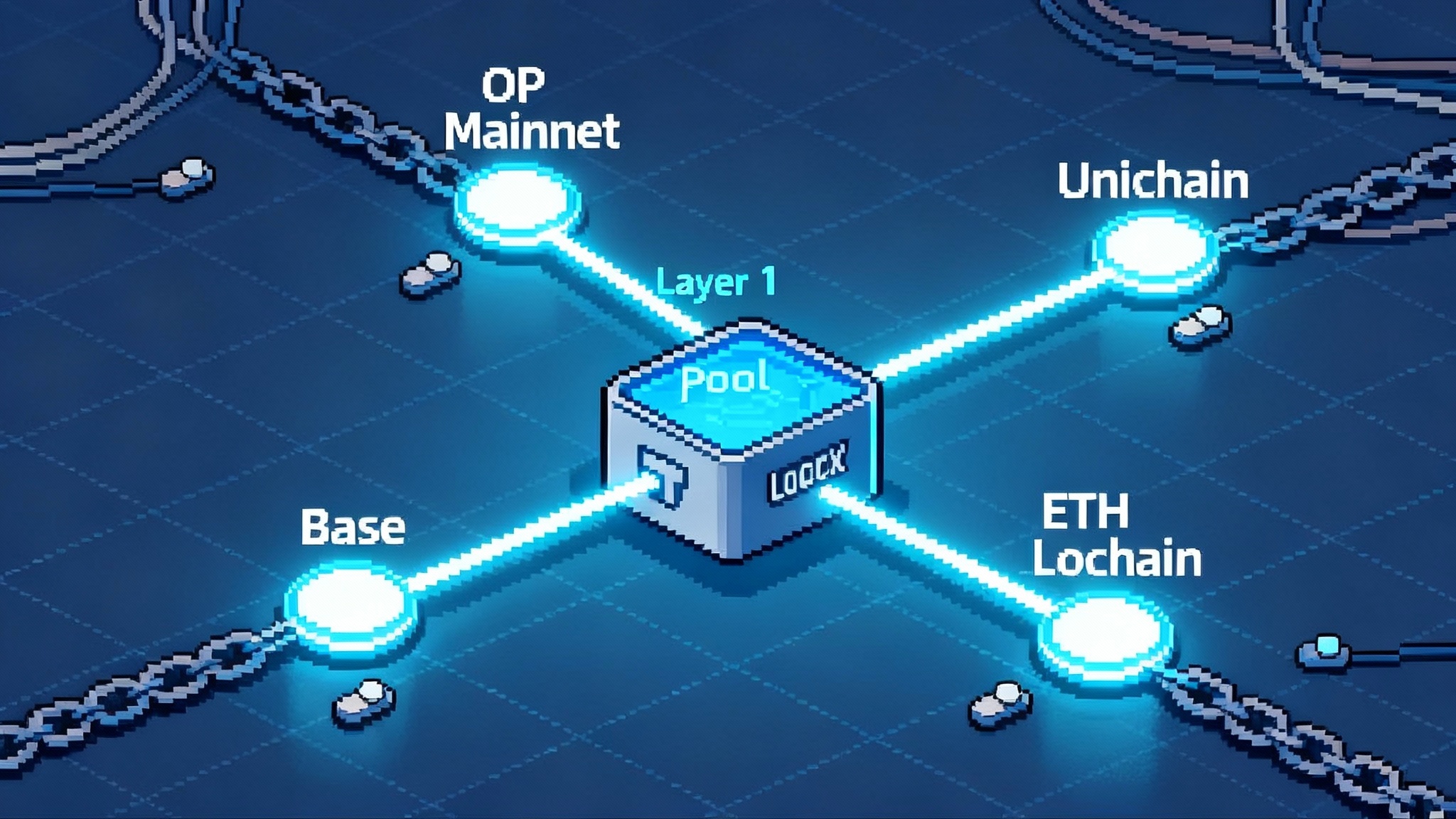

2) Programmable money market funds land on L2s

Money market tokens are already multichain, but the action is shifting to low‑cost, high‑throughput Layer 2 networks. Expect programmable features to move from marketing decks into operations:

- Auto‑sweep: idle stablecoin balances in a smart treasury sweep into a tokenized fund each hour, then return to the wallet before a known liquidity need.

- Real‑time accrual: per‑block calculation of daily dividends or accrual, visible in wallet UIs without refresh.

- Policy hooks: smart contracts that enforce investment policy, for example blocking addresses not on an allowlist or limiting transfers during cutoff windows.

These capabilities intersect with adjacent advances such as Uniswap v4 hooks on L2 and Post-Pectra Ethereum smart accounts, which lower operational friction for programmable funds.

3) Composable KYC perimeters take shape

Institutions cannot post collateral if they cannot clear compliance. The crucial pattern emerging is the reusable, verifiable credential. Instead of doing a new know‑your‑customer and know‑your‑business check for each pool, investors complete identity proofing with a regulated gatekeeper and receive a cryptographic credential. Protocols and funds accept that credential at the smart contract level, so an address can move between a permissioned lending pool, an exchange’s margin system, and a money market fund without re‑onboarding. See our U.S. onchain compliance playbook for the policy backdrop.

We have seen early versions of this with permissioned deployments like Aave Arc, where whitelisters such as Fireblocks enforce entry rules. Securitize handles investor eligibility for BUIDL and other funds across chains. The next step is standardization so those credentials are portable across issuers and venues. The benefit is not only compliance. It is composability. Once a wallet proves it is an eligible counterparty, contracts can automate settlement netting, haircut schedules, and maturity ladders across several protocols at once.

4) DeFi standardizes around Treasury‑backed collateral

Every wave in DeFi has had a base layer collateral. In the early days it was ether posted to borrow stablecoins. Later it was stablecoins that acted as unit of account. The next standard is Treasury‑backed collateral that pays the risk‑free rate by default. This is not about replacing stablecoins. It is about replacing idle stablecoin balances with yield‑bearing instruments and using those as the margin backbone.

When the base layer pays you, the rest of the stack re‑prices. Protocol interest rate models should reference a Treasury‑linked floor. Haircuts on tokenized T-bills will converge toward traditional money market practice, with higher haircuts when duration extends or liquidity thins. Liquidation bots will adapt to new mechanics like rebase increments and timed dividend cutoffs. The outcome is a more cash‑efficient DeFi stack, where the opportunity cost of posting collateral drops toward zero.

Knock‑on effects you will actually notice

The thesis that the dollar’s capital markets are moving onchain sounds abstract until you follow the impacts through specific businesses.

-

Exchanges: Margin systems add tokenized money funds as approved collateral types, with real‑time haircuts that account for fund liquidity and cutoff times. Payout engines pass through daily dividends or accruals, turning margin accounts into tiny prime brokerage accounts that earn interest while idle. Risk teams begin monitoring fund‑level disclosures in addition to token transfers.

-

Lenders: Borrowers can finance inventory with T-bill tokens, lowering their blended cost of capital. Credit committees adopt policies that mirror traditional repo and money fund guidelines. Expect lenders to ask for permissioned pools that only accept investors with reusable credentials and restrict the sale or rehypothecation of collateral by policy.

-

Stablecoin issuers: Reserve design shifts from bank deposits plus offchain funds to tokenized fund units held in segregated wallets with programmable restrictions. Issuers gain intraday liquidity by repoing against their reserve holdings, and can automate distribution of reserve income to tokenholders or partners subject to licensing. Attestations will start to reference onchain fund positions directly rather than static PDFs, which shortens the information loop for regulators and users.

-

Market data: Dashboards begin to look like money market terminals. You will see time‑weighted average price of tokenized funds, cutoff calendars, and a live view of repo rates available against specific tokens.

The frictions to solve

This migration will not be a straight line. Three practical hurdles matter over the next year.

-

Redemption mechanics: Tokenized funds still live inside legacy cutoffs. If a fund has a 4 p.m. Eastern subscription window and a T+1 settlement convention, protocols must hold buffer liquidity or model cutoff risk. Expect more funds to add intraday subscription cycles and round‑the‑clock transfer windows to support collateral use.

-

Cross‑chain risk: These tokens exist on several chains. Bridges and messaging layers add operational and security risk. The safest early deployments will restrict accepted chains and use native rather than wrapped representations, even if that limits composability at first.

-

Legal clarity on reuse: Posting fund shares as collateral introduces questions about segregation, beneficial ownership, and rights during liquidation. Expect issuers to ship specific transfer‑restricted share classes designed for rehypothecation or margin use, along with standardized legal agreements that map cleanly into smart contract logic.

What to watch from now to next summer

If you are a treasurer, trader, or builder, here is a simple checklist for the coming 6 to 12 months:

- Total market cap and share by issuer on tokenized T-bill dashboards. If the market crosses 10 billion with concentration dropping, second‑order effects accelerate.

- Exchange collateral lists. When two or three more major venues add Treasury‑backed tokens with competitive haircuts, the flywheel turns faster.

- Repo throughput on institutional DLT platforms and early pilots that connect onchain funds to intraday financing. Once those rails expose programmatic interfaces, crypto desks will automate them.

- Layer 2 adoption by money market fund tokens. Watch for auto‑sweep features and per‑block accrual that make these tokens truly programmable.

- Adoption of verifiable credentials. A visible, reusable KYC credential accepted by multiple funds, lenders, and exchanges is the threshold for institutional scale.

How to act on this shift

- If you run a trading business, map your margin stack so that base collateral earns the risk‑free rate. Begin with a conservative tokenized T-bill allocation and negotiate haircuts and eligibility with venues you already use.

- If you operate a protocol treasury, replace idle stablecoin balances with short‑duration tokenized T-bills inside policy controls. Model cutoff and redemption risk. Do not wait for perfect standards; start with a small, well‑documented pilot.

- If you issue or manage a stablecoin, prototype reserve sub‑accounts that hold tokenized fund shares with programmable restrictions. Build reporting hooks that export state to your attestations with block‑level proofs.

The bottom line

DeFi is standardizing around collateral that pays interest and settles at internet speed. The dollar’s core instruments are moving onchain, and that is changing incentives from the base layer up. The winners will be the teams that treat tokenized Treasuries not as a headline but as the new default, then wire their products into intraday financing, Layer 2 programmability, and reusable compliance rails. When the base collateral is a Treasury, everything else in the stack gets cheaper, faster, and clearer. That is how a quiet line on a dashboard becomes the backbone of the onchain dollar.