SEC’s 2025 ETF overhaul sparks a multi crypto ETF wave

Two SEC moves in July and September 2025 unlocked in kind creations and generic listing standards for crypto ETPs, setting the stage for the first U.S. multi-asset crypto ETF and a new playbook for liquidity, fees, and design.

Breaking: the plumbing changed this fall

For years, crypto exchange traded products in the United States were stuck with cash creations and case by case approvals. The result was slower launches, higher frictions, and limited product designs. That changed in two decisive moves this fall. On July 29, 2025, the Securities and Exchange Commission approved in kind creations and redemptions for crypto ETPs, aligning bitcoin and ether funds with the way most commodity ETPs already work. The key shift is simple. Authorized participants can now deliver or take out the underlying coins instead of wiring cash and waiting for issuers to buy or sell on their behalf. In regulatory terms it sounds dry. In market terms it is a new lane on the highway, and it runs straight into the crypto spot market. See the Commission’s announcement for the full scope of the approval, including related options decisions and exchange applications, in the SEC’s press release titled SEC in kind approval.

In September, the Commission also cleared a path for exchanges to adopt generic listing standards for certain spot commodity ETPs that include crypto assets. That sounds technical, but the effect is concrete. Fewer bespoke filings, shorter timelines, and fewer bottlenecks for issuers that meet the standards. Put together, in kind mechanics plus streamlined listings explained why the next milestone arrived almost immediately.

A first: an SEC approved multi crypto ETF

On September 19, 2025, Grayscale’s CoinDesk Crypto 5 ETF began trading as the first U.S. listed multi asset crypto ETF. It tracks an index of five large and liquid assets and gives investors one ticket to bitcoin, ether, XRP, solana, and cardano. The legal team that guided the uplisting detailed the approval and index design in their note, which confirms the fund’s diversified holdings and quarterly rebalance policy. For background on the milestone and the assets covered, see Davis Polk’s summary, Davis Polk approval note.

For additional context on roadmaps of core constituents, review Post-Pectra Ethereum upgrades and Firedancer aims to uncap Solana blocks.

Why that matters: diversified exposure is the normal entry point for many investors in equities and commodities. Until now, U.S. crypto exposure flowed almost entirely through single coin funds. A basket changes that default. For a typical adviser building an allocation sleeve, one diversified fund simplifies compliance checks, trading, and rebalancing. It also sets a template other issuers can follow, with sector or factor variations coming next.

How the new mechanics rewire liquidity

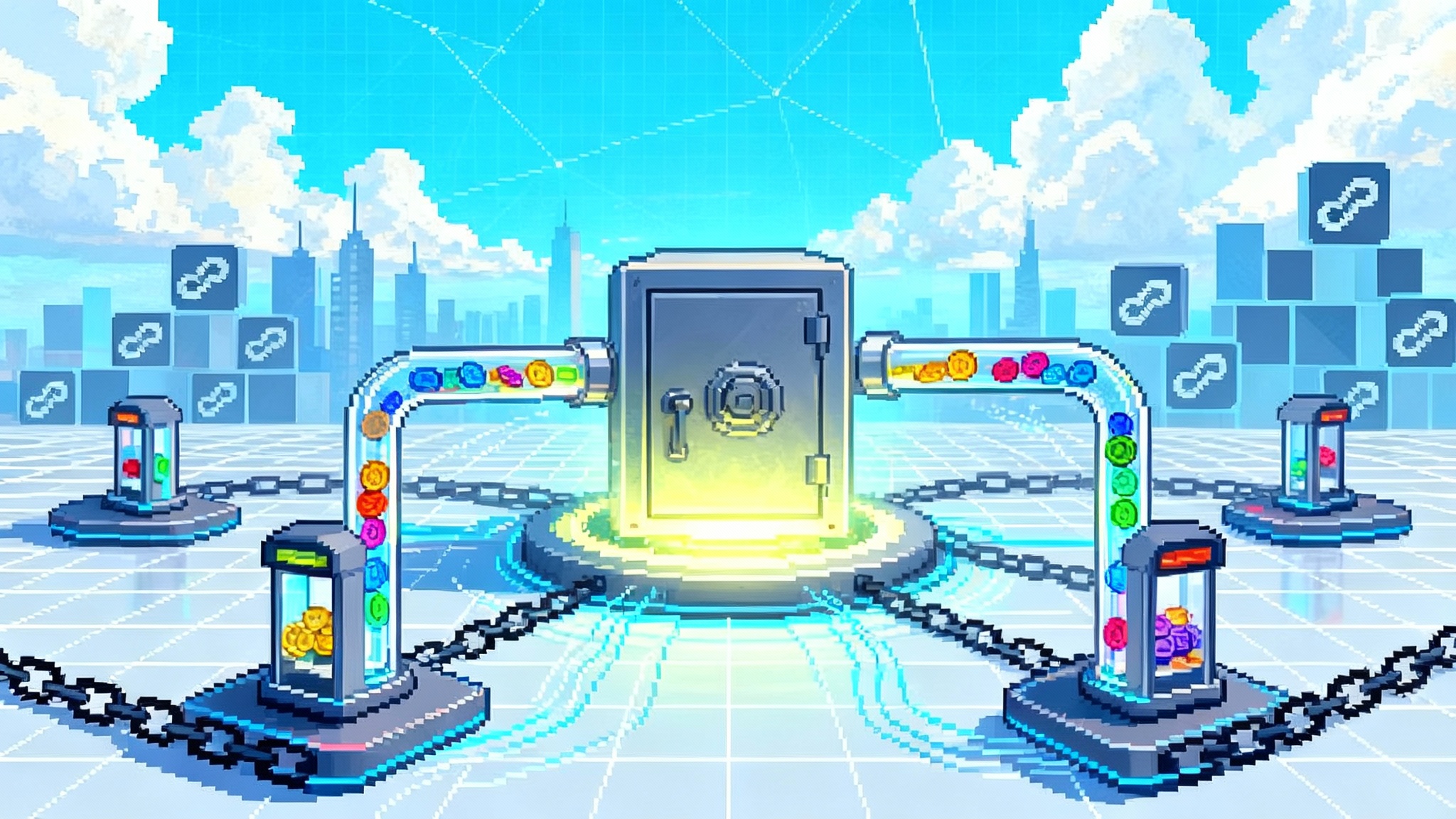

Think of an ETF as a pressure valve between two pools of liquidity. On one side is the ETF’s share market. On the other side is the underlying instrument market. When ETF shares trade at a premium, authorized participants can create new shares by delivering the underlying basket to the fund and selling the new shares to the public. When shares trade at a discount, they can buy shares and redeem them for the underlying coins. That mint and melt cycle keeps the ETF price close to net asset value and moves liquidity pressure back and forth across the valve.

Cash only funnels used to force APs to send dollars, then wait for an issuer or its trading desk to convert those dollars into coins. That delay widened spreads during volatile hours and increased trading costs. In kind lets APs source coins directly, often at better prices, then transfer those coins into the fund’s custodian wallets. In practice, that means:

- Tighter spreads in the ETF’s share market since arbitrage can be executed with fewer steps.

- Lower operating costs for issuers and fewer hidden slippage costs that used to be baked into creation fees.

- Faster risk transfers during volatility since APs are no longer waiting on issuer executions.

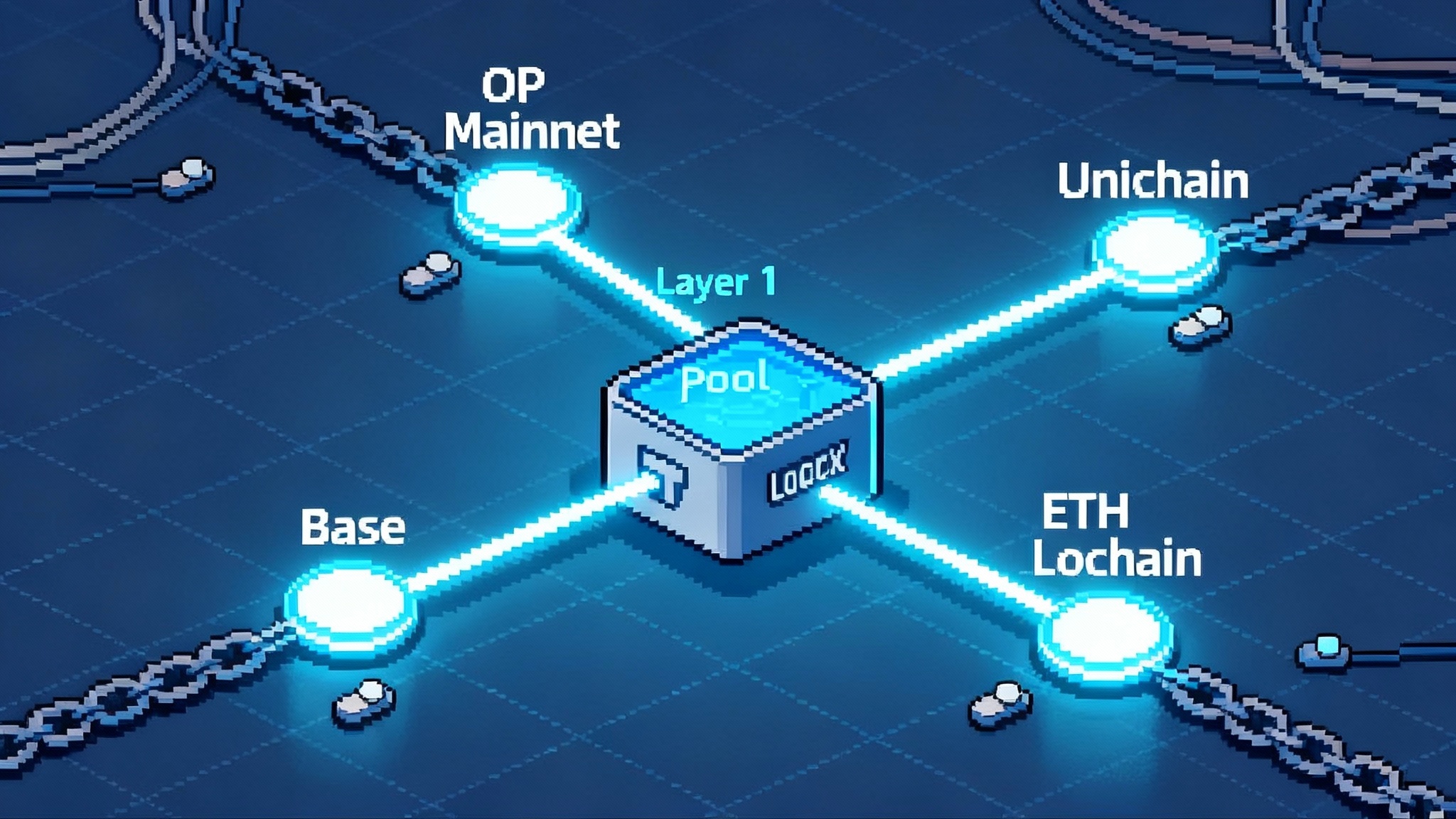

For crypto, the effect is magnified because onchain markets trade continuously and fragmentation is high. APs will route orders across centralized exchanges, bilateral over the counter desks, liquidity networks, and in some cases onchain venues for assets where settlement is operationally feasible. The ETF becomes a bridge that moves order flow into the underlying markets when discounts or premiums appear. Over time, that bridge can deepen order books in the coins that enter ETF baskets because arbitrage traders have a clean exit through the ETF wrapper.

For a parallel in DeFi plumbing, see how protocol design is pursuing similar efficiency in Aave V4 to rewire DeFi liquidity.

Fees and spreads: the coming compression

Expect two forms of fee compression in 2026.

-

Trading frictions fall. With in kind, the extra layer of issuer execution costs fades. That shows up as tighter bid ask spreads and smaller premiums and discounts. If a single coin ETF was showing a 20 to 40 basis point round trip in normal hours during cash only days, the same fund could stabilize in the low teens once APs internalize more of the workflow and compete the basket sourcing across venues. The effect may be larger during opening and closing rotations when most volume concentrates.

-

Sponsor fees face competitive pressure. Basket funds expand the addressable market and trigger price wars. Single coin fees compressed as issuers competed for flows. The same dynamic will play out across diversified funds, with scale advantages for sponsors that can secure low custody tiers, automate transfers, and line up multiple APs. The first wave of diversified products likely prices in the 20 to 45 basis point range, then grinds lower if assets scale and operational risks prove manageable.

One wild card is staking economics. Some coins in diversified baskets support staking or similar protocol rewards. Whether those rewards are captured, paid through to the fund, or used to offset fees depends on the fund structure, exchange listings, custodian capabilities, and tax treatment. Issuers that can clearly disclose and operationalize fair reward handling will have an advantage in fee discussions, since a portion of protocol rewards can subsidize the fund’s net expense ratio.

Why diversified crypto ETFs unlock flows beyond bitcoin and ether

Asset allocation teams prefer building blocks that spread risk. A basket reduces the selection burden for non specialist investors and simplifies policy approvals for retirement platforms and broker dealer home offices. Consider a portfolio committee that wants a 2 percent crypto allocation inside a model. Choosing a single coin exposes them to concentration headlines and idiosyncratic risk. Choosing a diversified fund that covers most of the large cap crypto set spreads regulatory and technical risk while retaining beta exposure. That is often the difference between a maybe and an approval.

Index based baskets also create predictable, rules driven rebalances. That is attractive to institutions that want a scheduled cadence for due diligence and trading. If the index uses liquidity screens, free float adjustments, and safeguards around events like network halts, those features become selling points for platforms that moved slowly with single coin products. The result is not a flood into every asset overnight. It is a steady redirection of incremental dollars away from bitcoin only and ether only funds into baskets that hit an allocation checkbox with one trade.

The second order effect is deeper. Once diversified funds are the default, issuers can launch sector funds that mirror familiar equity categories. A smart contracts leaders basket, a payments focused basket, or a high throughput infrastructure basket are obvious examples. Those products reinforce the flow shift because they let investors place views without picking individual tokens or navigating specialist exchanges.

Arbitrage, APs, and onchain depth

Arbitrage in diversified funds will create new demand for underlying coin liquidity in specific sizes and time windows. That is good for healthy markets, but it changes who participates and where. Three mechanics to watch:

-

Creation basket sourcing. APs will negotiate with multiple liquidity providers for full baskets at once. That encourages cross coin inventory warehousing and tighter cross spreads. Market makers that can price the full set of tokens in the basket, deliver them to the custodian, and hedge residual risk will win.

-

Onchain transfer rails. As custodians and issuers streamline inbound and outbound transfers, the time between negotiating a basket and posting it to a cold or warm wallet shrinks. That reduces tracking error, which increases the confidence of arbitrage desks to lean harder into mispricings.

-

Rebalance turnover. Index rebalances in a diversified fund produce predictable order flow in the underlying coins. That can deepen order books around rebalance dates and attract statistical arbitrage strategies that pair ETF flows with onchain and centralized exchange depth.

The net effect is a sturdier bridge between traditional finance rails and crypto venues. Healthy arbitrage tightens spreads and improves price discovery. In crypto, where liquidity often sits in pockets, that bridge helps connect the pockets.

The new risks that matter

Progress in plumbing does not eliminate risk. It changes the risk map. The important ones are operational and design based.

-

Custody concentration. A small number of custodians hold the keys for most ETPs. That boosts standardization and auditability, but it creates a tail risk if any provider faces an outage or a key management incident. Investors should read the fund’s custody disclosures, look for redundant providers or sub custodian arrangements, and scan incident response language. Issuers that maintain multiple approved wallets and tested failover procedures deserve a premium.

-

Index construction. A diversified fund is only as good as its rules. How are constituents screened for liquidity and free float? How is decentralized exchange volume treated? What happens when a network halts, a bridge is exploited, or an asset faces a temporary trading ban at major venues? Transparent methodology with event rules reduces surprises. Pay attention to how the index treats concentrated ownership, large unlock schedules, or foundation controlled treasuries.

-

Staking and protocol rewards. If a component coin offers staking, does the fund stake, delegate, or forgo rewards? If it stakes, who controls validators? How are slashing risks governed? How are rewards taxed and distributed? Consistent policies matter because staking economics can alter a fund’s effective fee and can change behavior during network stress.

-

Options and leverage exposure. As listed options expand on spot crypto ETPs, new strategies will layer into flows. That increases liquidity but also changes intraday dynamics, especially around strikes that anchor large positions. Funds will need to manage creation and redemption surges near options expirations.

-

Regulatory drift. Generic listing standards and in kind permissions lower friction, but they can be adjusted. Funds that rely on narrow interpretations of commodity status or custody exemptions could face rule tweaks. Methodologies that require a coin to be listed at several major exchanges, or to meet specific surveillance sharing thresholds, can conflict with fast moving regulatory events.

Practical signals to watch next

Investors and builders can track specific, concrete signals rather than waiting for slogans.

-

Options markets. Watch for the growth of listed options on spot crypto ETPs and any changes to position limits. Healthy options depth tightens ETF spreads and helps risk managers stay invested through volatility. Note how options volume concentrates by tenor and whether skew stabilizes as more market makers quote.

-

Index methodology updates. If an index provider revises liquidity screens, free float thresholds, or event rules, expect flows around the next rebalance. Read the public methodology supplements. Shifts that add or remove staking eligible assets will have fee and reward implications.

-

Altcoin eligibility at exchanges. Exchanges will publicize which assets meet their own listing criteria and surveillance sharing requirements. Assets that clear those bars become candidates for diversified funds under the new standards. Track which coins achieve multi exchange spot depth with consistent closing auctions and high quality price feeds.

-

Creation basket logistics. The number of authorized participants, their identity, and the minimum creation unit size all influence spreads. More APs and smaller creation units usually mean tighter spreads and less inventory risk.

-

Custody enhancements. Look for issuers adding second custodian relationships, faster transfer windows, and standardized onchain transaction reporting. Better custody plumbing lowers operational risk and encourages APs to lean into in kind flows.

-

Staking disclosures. Funds that can clearly disclose staking policies, validator selection, slashing protections, and reward accounting will differentiate on net costs and governance quality.

Product design in 2026: from baskets to a shelf

The first diversified fund is a starting gun, not a finish line. Three design directions are likely.

-

Core beta baskets. Expect more multi coin funds that target a percentage of total market capitalization with liquidity screens. These will serve as the default building blocks in model portfolios and retirement plan menus where crypto is permitted.

-

Sector and theme baskets. Issuers will package smart contract platforms, scaling networks, and payment focused assets into separate sleeves. If options develop on those baskets, the feedback loop will deepen liquidity further by letting institutions express views without single asset risk.

-

Reward aware structures. Where policy permits, funds will explore staking or protocol reward capture with conservative guardrails. Expect pilots that cap staked balances, use third party validators with strict service level agreements, and pass most rewards through to shareholders after risk adjusted fees. Clear disclosures and conservative design will matter more than clever engineering.

Alongside baskets, single asset funds will not disappear. They will sharpen their edge with lower fees, deeper options markets, and specialist use cases like collateral and balance sheet hedging. But the center of gravity for new investors is shifting to diversified exposures that do more with one trade.

The bottom line

The fall of 2025 changed the ETF rulebook for crypto. In kind creations lowered the friction in the pipes. Generic standards shortened the distance from idea to listing. A first multi asset crypto ETF showed how quickly product design can evolve once the pipes are open. The next year will be about execution. Watch the options tape, the index updates, the custody playbooks, and the eligibility lists. The winners will be the issuers and APs that treat crypto like any other modern market structure problem. Build reliable rails, minimize frictions, disclose clearly, and let the order flow do the rest.