U16a lands on the Superchain: safer rollouts, real interop

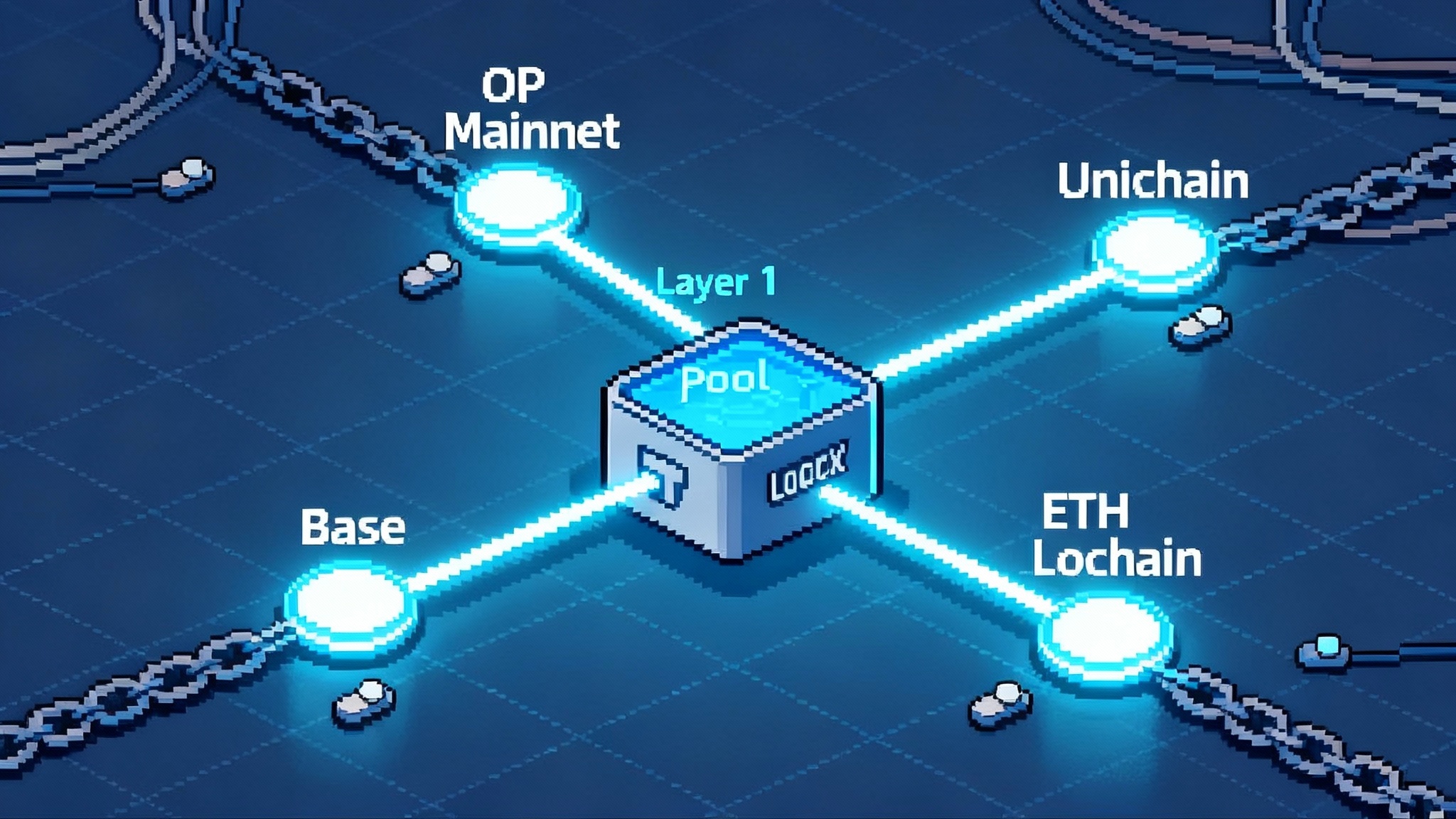

On October 2, 2025, the Optimism Superchain rolled out Upgrade 16a across Base, OP Mainnet, and Unichain. System-level toggles, a safer withdrawal path, and ETH Lockbox readiness push OP Stack chains toward configurable, interoperable Layer 2s.

What just happened

The OP Superchain executed Upgrade 16a on October 2, 2025, bringing a coordinated protocol update to Base, OP Mainnet, and Unichain. The headline is simple but important. Operators gain system-level feature toggles, the withdrawal flow is revised for safety, and the codebase sheds unused interop-related proving paths while keeping the runway clear for the next phase of cross-rollup interoperability. The official notice lays out the details, including exact chain scope and operator steps, and confirms there was no planned downtime for users upgrading from U16. See the formal summary in the Optimism documentation: Upgrade 16a protocol notice.

The short version for users

- If you are on Base, OP Mainnet, or Unichain, you can keep using apps normally. Gas, balances, and dapp behavior are unchanged.

- Withdrawals you already proved on Layer 1 remain valid if your chain was on the previous U16 release.

- If a chain upgraded from U15 directly to U16a, any pending L1 withdrawal proofs that did not finalize before the upgrade window need to be re-proved. Funds are not at risk, but a second proof transaction must be submitted after the upgrade window.

- Bridges, wallets, and exchanges should update their messaging to reflect the one-time reproving requirement for U15 to U16a transitions.

Think of this as a seatbelt check before a road trip. The car still gets you there, but the straps are adjusted so you are safer on highways that connect more chains.

Why U16a matters under the hood

System-level feature toggles

U16a adds a mechanism that lets chain operators turn specific capabilities on or off without forcing a full network upgrade. The control lives in the SystemConfig contract and is designed for chain-by-chain configuration. This changes the cadence of the Superchain. Instead of flipping many switches at once for everyone, operators can stage features, observe their behavior in production, and then roll forward across the rest of the network when ready.

A concrete example is ETH Lockbox, which consolidates Layer 1 ether liquidity for interoperable withdrawals. Chains already on U16 that adopted ETH Lockbox keep it available, but it is now placed behind a toggle. Chains that skipped from U15 to U16a will not adopt Lockbox until a future upgrade, which reduces complexity during this transition. The toggle model is like enabling modules in a cloud service. You can pilot with one cluster, audit metrics, set alerts, and then expand. For the technical design and invariants see the specification for ETH Lockbox and unified ETH liquidity.

Withdrawal flow changes and temporary reproving

Teams asked for a safer way to stage interop features without changing withdrawal proofs mid-flight. U16a responds by removing interop-specific withdrawal proving paths introduced in U16 that never went live on mainnet. As a result, the production withdrawal path is simpler today, while preserving room to reintroduce interop-aware logic once the rest of the stack hardens.

There is one temporary friction point that is important to call out. If a chain upgraded from U15 directly to U16a, any withdrawals that users had already proven on Layer 1 but that had not yet become executable at the moment of upgrade are invalidated and must be re-proved. This is a one-time housekeeping step that resets proofs to match the simplified code path. Users do not lose funds. They simply submit the proof transaction again and then finalize on the standard schedule.

For chains already on U16, withdrawal proofs remain valid, so users do not see any extra steps.

Development-only feature flags

Engineering teams need to test interop features without exposing production users to experimental code. U16a formalizes this by adding development-only flags that can be enabled in test environments but are blocked in production. That means operators can stand up devnets with interop logic turned on, run full end-to-end scenarios, and gather metrics before scheduling a mainnet release.

This split between production toggles and development flags creates a safer runway. Dev flags encourage faster iteration, while production toggles keep live chains stable.

Immediate impact by audience

Users and dapps

- Normal operation continues. Transactions, gas fees, and app behavior are unchanged.

- Re-proving is sometimes required. If you initiated a withdrawal on a chain that went from U15 to U16a, check your wallet or bridge. If your proof was pending during the upgrade, you will be prompted to re-prove. Expect the same delay window as before once you re-submit.

- No action needed for users on chains that were already on U16.

Wallets and bridges

- Update user messaging to detect the chain’s upgrade path. If the source chain moved U15 to U16a, surface a helpful prompt that a pending L1 proof must be re-submitted and guide the user through the single additional transaction.

- Refresh runbooks for proof monitoring. Mark the upgrade block height and add alerts for proofs created before vs after that height.

- If you maintain custom relayers or proof builders, confirm they target the simplified withdrawal path now that interop-specific code is out of production.

- Start planning for ETH Lockbox consistency. If your product abstracts withdrawals across multiple OP Stack chains, normalize how you fetch available liquidity and how you display finality windows once Lockbox is broadly toggled on.

Exchanges and custodians

- Screen deposits and withdrawals around the October 2 window for any chains that skipped U15 to U16a. Where applicable, add a one-time reproving step to support flows that were in flight.

- Validate that your chain indexers still follow the standard message path for L2 to L1 withdrawals and that confirmation logic has not drifted.

- Coordinate with chain teams on scheduled maintenance windows for future feature toggles. The new model allows features to be enabled per chain, so communications should be chain-specific rather than Superchain-wide every time.

Node operators and chain teams

- Execute the documented operator checklist for U16a, including updating fault proof components and verifying the new absolute prestate if you run permissionless fault proofs, as laid out in the official notice linked above.

- If you were on U15, notify users of the one-time proof invalidation well in advance, and consider short banner messages across major dapps during the upgrade.

- Audit your monitoring. Add health checks for SystemConfig toggles, and capture events that will indicate when future features are turned on.

How U16a sets the runway for the next quarter

The road to Stage 2 decentralization

The OP Stack reached Stage 1 decentralization with permissionless fault proofs on OP Mainnet. Stage 2 is the target where protocol governance and operation become more credibly neutral and where user safety no longer relies on centralized fallback powers in normal operation. U16a does not flip the switch to Stage 2 by itself, but it clears the path in three ways:

-

Production toggles reduce blast radius. A Stage 2 system must be resilient to feature rollouts without privileged intervention. Being able to enable features per chain makes incremental deployments possible without cross-network risk.

-

Development flags accelerate hardening. Stage 2 requires proof systems that stand up to adversarial use. Dev-only flags encourage more realistic testing without touching production.

-

Cleaner withdrawal logic makes proofs easier to reason about. By removing unused interop code from the live path and isolating it behind toggles, auditors and researchers can focus on the exact code users rely on today. This reduces uncertainty and helps shorten the path to expanding permissionless features to more chains.

This modular mindset is showing up across crypto. For example, DeFi is moving to componentized architectures, as seen in the Aave V4 modular roadmap.

Multi-proof security

The OP Stack already supports a modular approach to proving, and the community has been exploring additional proof mechanisms that complement the existing Cannon-based proofs. U16a’s separation of development flags from production and the addition of toggles create a framework where new proofs can be trialed on specific chains, with validators and challengers updated in lockstep. Expect to see targeted pilots on smaller chains, followed by measured rollouts to major networks once telemetry is solid.

This matters for security and costs. Different proof systems have different performance envelopes. Some are faster to verify on Layer 1. Others are more efficient to generate on Layer 2. A toggleable, modular stack lets the Superchain pick the right tool for each purpose.

Cross-rollup interoperability and ETH liquidity

Interoperability requires two things to feel seamless to users. Messages have to move safely across chains, and assets, especially ether, must remain practical to withdraw regardless of where users deposit. ETH Lockbox addresses the second requirement by unifying Layer 1 ether liquidity into a single contract that multiple OP Stack chains can share. That way, a withdrawal from Chain A can be funded from the same pool as Chain B, even if deposits flowed unevenly in the other direction. U16a’s toggle system is the operational bridge between today and that future. Chains can join a shared Lockbox when they are ready, while others wait until governance and audits are complete.

Interoperability rollouts on other networks offer useful parallels, such as how routing defaults can shift UX overnight in the case of POL auto-swap and AggLayer.

A concrete checklist teams should follow now

For chain operators

- Confirm your chain’s previous version. If you were on U16, schedule the U16a upgrade and communicate that there is no action for users. If you were on U15, publish a clear timeline for the one-time L1 proof invalidation and reproving requirement.

- Update your fault proof stack. If you run permissionless fault proofs, deploy the new dispute game contracts and verify the absolute prestate referenced in the official notice. Validate your op-challenger configuration against the documented version that matches the new prestate.

- Simulate the upgrade transaction ahead of time. Use a dry run to confirm the expected changes to SystemConfig, feature toggles, and any registry references. Record transaction hashes in an internal runbook.

- Add telemetry for feature toggles. Capture on-chain events that indicate a toggle change and wire them into alerting. This becomes critical when interop features are staged on your chain.

- Rehearse a rollback plan. Even with toggles, you should know how to pause or revert a feature in case of bugs. Document who can execute the operation, the expected user impact, and the communication template.

For wallets and bridges

- Detect the chain’s upgrade path and show precise guidance. If the source chain upgraded U15 to U16a, display a banner for pending withdrawals that explains the reproving step, why it is needed, and how to complete it. Include a link to retry the proof transaction in a single click.

- Refresh withdrawal tracking. Separate monitoring for proof creation, challenge windows, and finalization by block height relative to the upgrade. This avoids mixing pre-upgrade events with post-upgrade logic.

- Normalize Lockbox handling in your code. Abstract the L1 liquidity source so your user interface can show consistent withdrawal estimates whether a chain uses Lockbox or its portal balance.

- Test your flows on devnets with interop flags. Use the development-only flags to validate cross-chain messaging before features hit production.

For exchanges and custodians

- Adjust customer support scripts to address the one-time reproving requirement for chains that moved U15 to U16a. Provide a short explanation and expected timing for the extra transaction.

- Validate deposit and withdrawal indexers. Confirm that your parsers still track standard L2 to L1 messages and that nothing relies on interop-specific code paths that are no longer active.

- Segment chain policies. With toggles, features will land at different times on different OP Stack chains. Maintain per-chain settings for withdrawal delay assumptions and maintenance notices.

For dapps, analytics, and infra providers

- Update dashboards to show feature status per chain. At a minimum, track whether ETH Lockbox is active and whether dev-only interop flags are visible on public testnets.

- If your app uses cross-chain messages, begin testing on devnets that enable interop flags. Capture end-to-end timings and prepare to adjust retry logic when production toggles land.

- If you rely on event streams for withdrawal proofs, make sure your consumers handle the case where a pre-upgrade proof is invalidated and re-submitted by the user.

What to watch over the next 90 days

- Lockbox activation patterns. Which chains opt in first, and how much ether liquidity moves into the shared pool. This signal tells you when cross-chain withdrawal experience will smooth out for most users.

- Proof system pilots. Expect early experiments that trial additional proving mechanisms on smaller OP Stack chains. Watch for announcements tied to dev flags graduating to production toggles.

- Governance and audits. Feature toggles make it easier to ship safely, but they also demand precise governance. Track proposals that specify who can flip a toggle and under what conditions, as well as audit reports that greenlight enabling features on major chains.

- Exchange integration timelines. As reproving settles and toggles roll out, exchanges will tune their SLAs for withdrawals and deposits for each chain. That is a leading indicator of user experience stabilizing for retail.

- Performance engineering elsewhere. High-throughput networks are preparing for bigger blocks and tighter latencies, as seen in Firedancer’s scaling push.

Risks and how they are being managed

- Operational drift across chains. Toggles can lead to different capabilities being live on different chains. The mitigation is clear documentation, a shared registry of toggle states, and per-chain user messaging.

- User confusion during reproving. This is short-lived, but it needs crisp user interfaces and simple language. Wallets and bridges can eliminate most friction by detecting the condition and presenting a one-click re-proof flow.

- Over-reliance on dev flags. It is tempting to leave features in development mode too long. Operators should set target dates to graduate features to production toggles, with checkpoints for audits and test coverage.

The bottom line

U16a is not a flashy feature release. It is the kind of careful protocol work that unlocks the next wave. By adding system-level toggles, cleaning up the live withdrawal path, and pushing interop logic behind safe gates, the Superchain becomes easier to operate and safer to evolve. Users get continuity today. Builders get a controlled runway to ship real interop and stronger proofs tomorrow. Over the next quarter, expect selective Lockbox activation, targeted proof pilots, and a steady march toward Stage 2 decentralization.

For operator specifics and exact scope, see the Optimism documentation linked above in Upgrade 16a protocol notice.