SEC’s new generic rules open floodgates for altcoin ETFs

The SEC's September 18 rule change lets NYSE, Nasdaq, and Cboe use generic listing standards for spot commodity ETPs, cutting timelines to roughly 75 days and paving a lane for Solana and potentially XRP as soon as October. Here is the market-structure playbook.

What changed on September 18

In a vote that will be remembered as a hinge moment for crypto market structure, the Securities and Exchange Commission approved generic listing standards that let NYSE, Nasdaq, and Cboe list commodity-based exchange-traded products that hold spot assets, including digital assets, without a bespoke rule change for each product. Exchanges can now list qualifying products under a preapproved template instead of running the full Section 19(b) gauntlet every time. The agency’s order also reaffirmed investor-protection guardrails around surveillance, disclosure, and ongoing monitoring. You can read the Commission’s announcement under SEC generic listing standards.

If the bitcoin and ether approvals taught issuers anything, it is that the dual-track process was the bottleneck. Every product required 1) an exchange proposal to change its listing rules for that specific product, and 2) an issuer registration process for the shares. By standardizing the listing side, the SEC has removed the most time-consuming and unpredictable half of the workflow.

From 240 days to roughly 75

Under the old path, an exchange’s 19(b) filing triggered deadlines and extensions that could stretch toward eight months, even when the economics were straightforward. Under the new generic standards, the listing decision is rules based. That does not eliminate the issuer’s Securities Act registration step, but it does turn the back-and-forth into a narrower, more predictable review of the prospectus. Market participants expect launches in as little as about seventy-five days from filing, provided the S-1 or S-3 is clean and the product meets the objective criteria in the new standards. See Reuters on 75-day timeline.

Think of it like airports moving from one-off runway approvals for each flight to a standing instrument-flight-rules procedure. Pilots still file flight plans. Towers still monitor traffic. But the route is charted, and flights take off on a schedule.

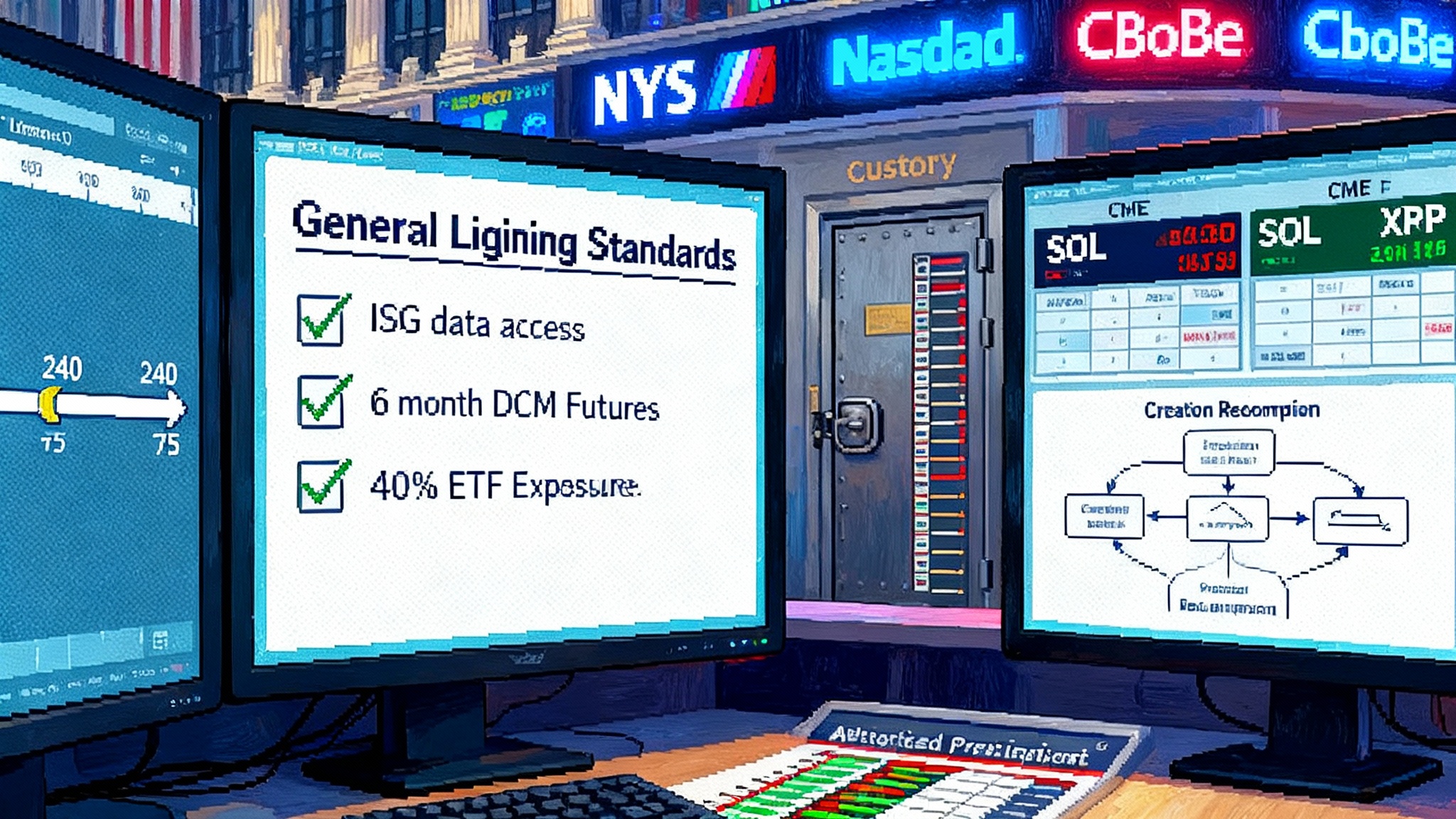

The three gates a coin can pass through

The SEC’s order lays out three ways the underlying commodity qualifies for generic listing:

- It trades on a market that is a member of the Intermarket Surveillance Group, with surveillable data access for the listing exchange.

- It underlies a futures contract that has traded on a designated contract market for at least six months, and the listing exchange has a comprehensive surveillance sharing agreement with that futures venue.

- On an initial basis, an exchange-traded fund listed on a U.S. exchange has at least forty percent of its net asset value exposed to the commodity.

For digital assets, the futures route will do most of the practical heavy lifting in the near term.

Who is first in the queue

- Solana: With Solana futures launched at CME Group in March 2025 and active since then, the six-month threshold is met by mid September, which makes October realistic for a spot Solana ETF, assuming the issuer’s S-1 clears in time and the exchange certifies under the generic standards. For context on Solana’s scaling roadmap, see Firedancer’s roadmap for Solana.

- XRP: XRP futures began trading on U.S. designated contract markets this spring. Counting six months from April places the earliest eligibility window in late October. That makes a late October or November debut plausible if the S-1s are already substantially baked.

- Others: Assets without a six-month futures record on a U.S. designated contract market likely need either a credible Intermarket Surveillance Group pathway or exposure via a listed ETF that already carries at least forty percent in the asset. In practice, that third route will be rare for single-asset spot funds until multi-asset products establish large, stable weightings.

The takeaway is simple: if a coin has a mature, surveilled U.S. futures market, it is now structurally eligible. If it does not, it is waiting for either futures or a surveillance-ready trading venue that meets the rule’s bar.

The S-1 path, simplified but not optional

Generic listing standards do not replace the Securities Act. Issuers of commodity-based trust shares still file Form S-1 or S-3, respond to staff comments, finalize risk disclosures, and coordinate launch logistics. What is different now is the scope and tempo of review. Instead of debating whether the exchange’s rule language meets the Exchange Act for each asset, the staff can focus on the fund’s disclosures, creation and redemption mechanics, valuation policies, conflicts, and operational controls. That is how you get from eight months to something like seventy-five days.

Practical implication: the issuers who prewrote their S-1s while the generic standards were pending will have a first-mover advantage. Expect names already active in spot bitcoin and ether to retool faster. The trust wrapper, the service providers, and the mechanics are largely templated.

Custody: who is actually ready for altcoins

Custody will be the gating operational risk for many altcoin funds. Several qualified custodians already support Solana and XRP at institutional scale, with cold storage, insurance, and service-level agreements that are suitable for a public vehicle. The most relevant questions are not just whether a custodian supports a coin, but whether it can support it at ETF scale with:

- Segregated cold storage with provable reserves and real-time reconciliation

- Serviceable settlement windows for daily creations and redemptions

- Robust key management, disaster recovery, and SOC 2 Type II controls

- Network participation policies. For proof-of-stake assets, will the fund or custodian stake, and if not, what is the policy rationale and how is that reflected in tracking error guidance

Issuers that mastered these details for bitcoin learned that crypto custody is closer to running a vault plus a tiny data center than it is to keeping a certificate in a drawer. For altcoins, add protocol-specific quirks such as memo tags, rent balances, fee accounts, and validator interactions. These are solvable, but they require runbooks, not slideware.

Authorized participants and market makers: are they set up for altcoins

On bitcoin and ether, the authorized participant ecosystem now includes Jane Street, Virtu Americas, JPMorgan Securities, Cantor Fitzgerald and others who already proved they can make orderly primary markets. Extending that muscle to Solana or XRP hinges on three topics:

- Sourcing and hedging inventory. The existence of regulated futures, with meaningful open interest and block trade capacity, lets APs and lead market makers balance books intraday and across time zones. That is the biggest reason the futures test matters.

- Cash versus in-kind flows. Most spot crypto ETPs launched with cash creations and redemptions. As custodians, prime brokers, and APs get comfortable with on-chain settlement workflows, in-kind could compress spreads. Near term, assume cash to minimize operational risk at launch.

- Securities lending and borrow. The ability to borrow coin to facilitate redemptions and transitions has been a quiet but critical lubricant for bitcoin ETFs. Building a safe-lend market for altcoins, with strong legal documentation and rehypothecation limits, will improve secondary-market quality and reduce discounts during stress.

Expect the first altcoin funds to rely on a small club of APs who already built out crypto inventory and funding lines. That club will expand as settlement and risk models mature.

Staking yield and tracking error: the thorny design choice

Proof-of-stake assets raise a simple but consequential question: should a spot ETF stake the underlying and pass rewards to shareholders, or should it hold idle coin to avoid any perception of providing a service or bearing validator risk The answer is unsettled. Some issuers have proposed allowing staking for ether and signaled interest for Solana. Others prefer to avoid validator operations at the fund level.

The implications are tangible:

- If a fund does not stake, it will systematically underperform the spot market by the foregone staking reward minus any fees. Investors will see that as tracking error.

- If a fund stakes, it must explain validator selection, slashing risk management, reward accounting, and how it handles locked or illiquid rewards. It must also map staking to the fund’s commodity-based trust status and tax treatment.

A pragmatic near-term pattern is likely: day one without staking, later amendments once the regulator and auditors are comfortable with a narrow, low-risk staking profile. Issuers can mitigate tracking error by explicit language in the prospectus about expected underperformance versus a staked reference index.

Liquidity migration: from offshore perps to onshore ETFs

Spot bitcoin ETFs shifted meaningful flow from offshore perpetual swaps to U.S. brokerages by creating an easy, compliant on-ramp that sits inside existing investment policy statements. Expect a similar pattern for first-wave altcoin funds:

- Portfolio access: registered investment advisers and wealth platforms can add a Solana or XRP sleeve without opening exchange accounts, rewriting custody policies, or taking on wallet risks.

- Basis trades: APs and macro funds will express relative-value views between regulated futures and the spot ETF, deepening liquidity in both. The regulated basis becomes the backbone of price discovery during stress.

- Cleaner pricing: benchmark providers and exchanges will harmonize reference rates around surveillable venues. That lowers the noise in net asset value calculations and reduces the incentive to game offshore prints into U.S. closes.

The short version: onshore, surveilled liquidity crowds out shadow liquidity when you make the onshore route faster and safer. For how payments rails are converging with regulated crypto access, see our look at the stablecoin payouts shift.

How protocols can get ETF ready

For token foundations and ecosystems that want to graduate into the ETF lane, there is a clear checklist. None of this guarantees an ETF, but it makes the conversation credible:

- Futures first. Work with a designated contract market to list a cash-settled future based on a high-integrity reference rate. Support market makers with seed liquidity and block-sized appetite to build open interest above cosmetic levels.

- Reference data. Sponsor robust, publicly documented reference rates with clear constituent venues, error handling, and outlier protection. Daily calculation and transparent governance are mandatory.

- Surveillance plumbing. Facilitate exchange access to time-stamped trade and order book data for constituent venues. If a venue is not an Intermarket Surveillance Group member, close the gap with bilateral surveillance sharing agreements where possible.

- Disclosures that read like a 10-K. Publish versioned, machine-readable documents covering token supply, unlock schedules, insider holdings, validator concentration, treasury policies, and protocol upgrade processes. Add a playbook for incident response, including how you handle forks or chain halts.

- Custody ergonomics. Work with custodians to document safe operational flows for deposits, withdrawals, fee accounts, and any chain idiosyncrasies. Reduce operational surprises by funding a test environment and paying for audits.

- Staking policy hygiene. If the asset is proof of stake, define what ETF-safe staking looks like. That might mean whitelisting institutional validators with posted slashing insurance and transparency on client concentration. Make it easy to opt out without harming network liveness.

Protocols that treat this like a productization of their market structure will be ready when issuers come calling. For allocators thinking about downstream onchain execution, see our overview of the Aave V4 liquidity stack.

What to watch in October

- Filing cadence: look for updated S-1s and redlines from issuers with futures-qualified assets. If filings go quiet for two or three weeks, it likely means staff comments are in progress and nothing is leaking.

- Exchange notices: once launches are imminent, exchanges will post the required notices and trading symbols. For generically listed products, that can happen close to go live.

- AP rosters: expect a similar cast to bitcoin and ether at first. If you see a second-tier broker-dealer added as an AP, it is a sign that the operational burden is dropping.

- Staking language: the first wave may carry placeholder language that keeps the door open to staking later. That is the tell for where the conversation is headed.

Why this accelerates crypto’s integration with traditional finance

This is not just a speed story. It is a standardization story. By turning the exchange side into a checklist, the SEC has stitched digital assets into the same plumbing that carries gold, oil, and broad equity baskets. The practical effects compound:

- Compliance becomes procedural. Investment committees can approve a Solana sleeve with the same rubric they used for bitcoin. That unlocks capital that was structurally sidelined by process friction.

- Risk management gets more precise. When hedging lives on regulated futures and price discovery anchors on surveillable data, model risk drops. That lets allocators size positions more confidently.

- Costs move down and to the right. Tighter spreads, better tracking, and reusable fund templates push total cost of ownership lower, which draws in passive and multi-asset allocators who were waiting for the fee stack to normalize.

If you are slightly accelerationist about financial innovation, this is the kind of change that matters more than a price chart. It migrates crypto exposure into the regulated rails where large pools of capital already flow, and it rewards good market hygiene.

The bottom line

September’s generic standards turned a bespoke approval saga into a rules-based listing lane. With six months of futures as the practical gate, Solana is teed up for October and XRP is in the same quarter’s zip code if paperwork keeps pace. The rest of the market has a roadmap: get a surveilled futures market, publish enterprise-grade disclosures, make custody and staking boring, and the exchange can flip the switch.

That is how you ignite fourth quarter flows. Not with slogans, but with standards that make crypto exposure a matter of routine.