Inside Aave V4: a modular hub to unify liquidity this Q4

Aave V4 unifies liquidity into a single hub per chain, shifts balances to ERC-4626 shares, and adds targeted liquidations plus optional reinvestment. Here is the plain-English guide for builders and users ahead of the Q4 2025 launch window.

The big picture: what is changing this quarter

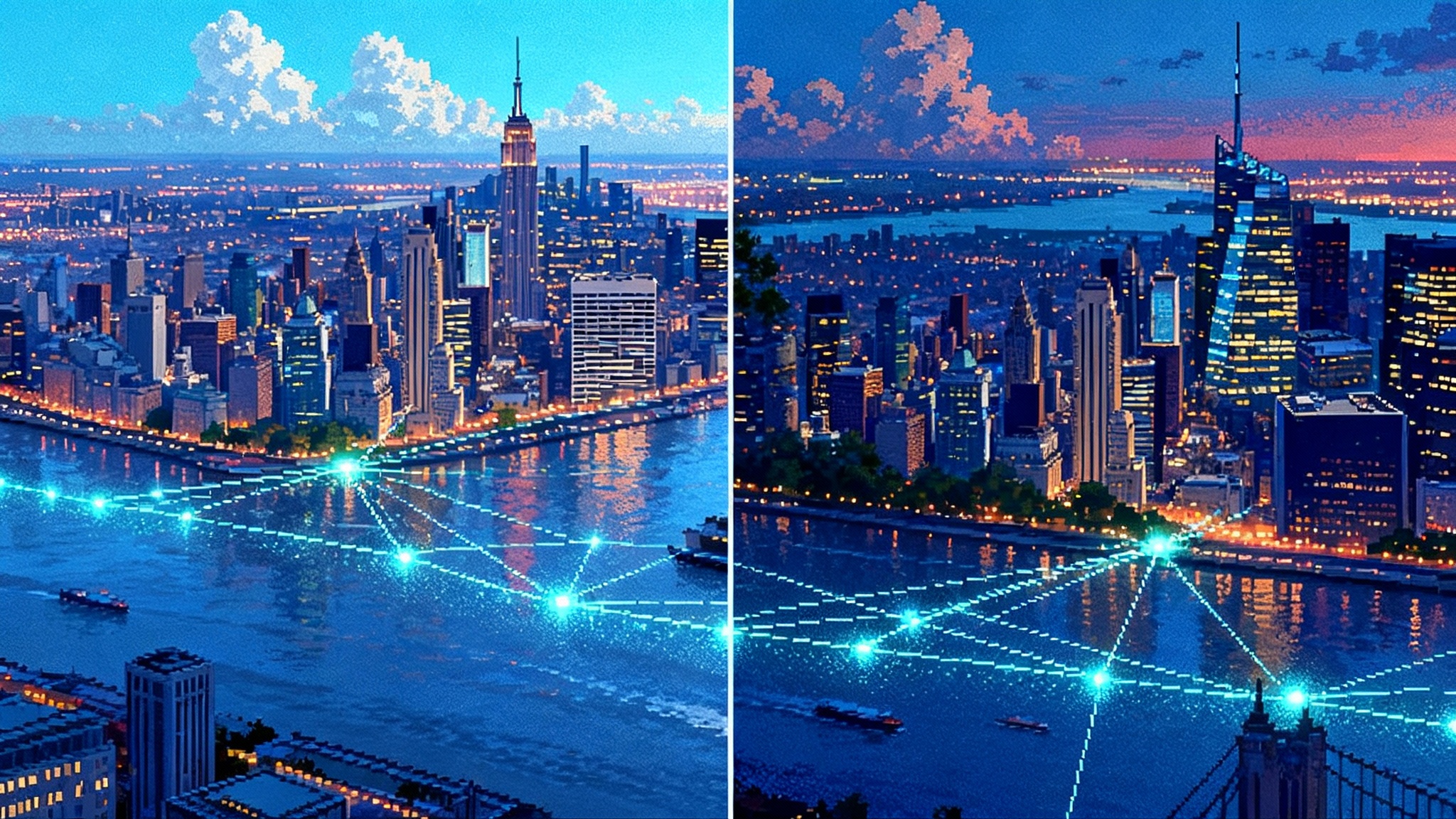

Aave’s next major release replaces separate lending markets with a single Liquidity Hub per network and a gallery of plug-in Spokes that act as specialized entry points. The goal: keep liquidity unified, let markets innovate at the edge, and make risk treatment explicit. For the architecture, read the official Aave V4 architecture overview and the current V4 development update on governance. As of late September 2025, development is described as feature-complete with reviews and a public testnet preceding a Q4 2025 mainnet window.

In practical terms, V4 brings four shifts for anyone who builds on, borrows from, or supplies to Aave: a hub-and-spoke liquidity model, ERC-4626 share accounting, a health-targeted liquidation engine, and an optional reinvestment module that can put idle liquidity to work when governance enables it.

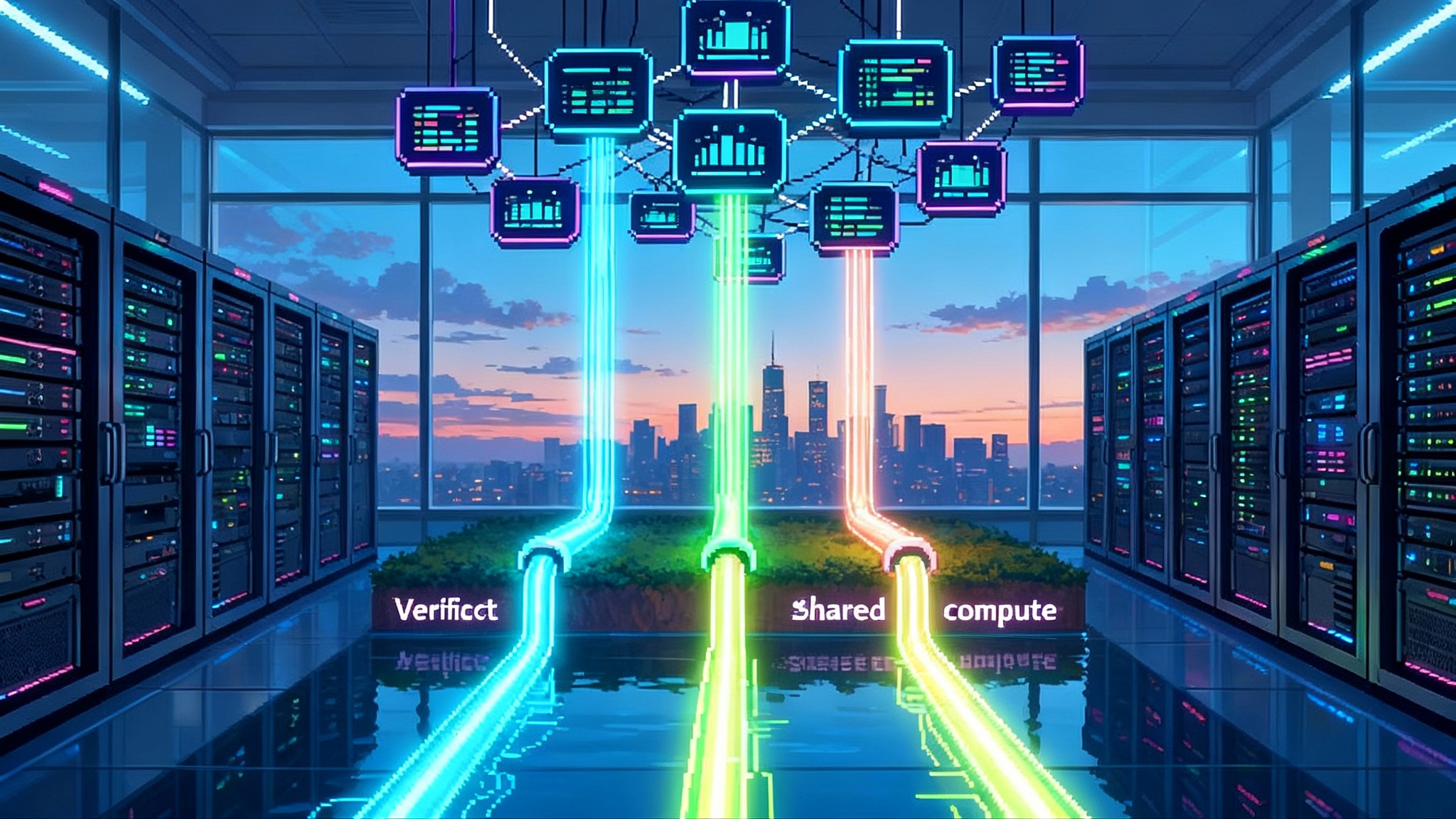

Hub and Spokes in plain English

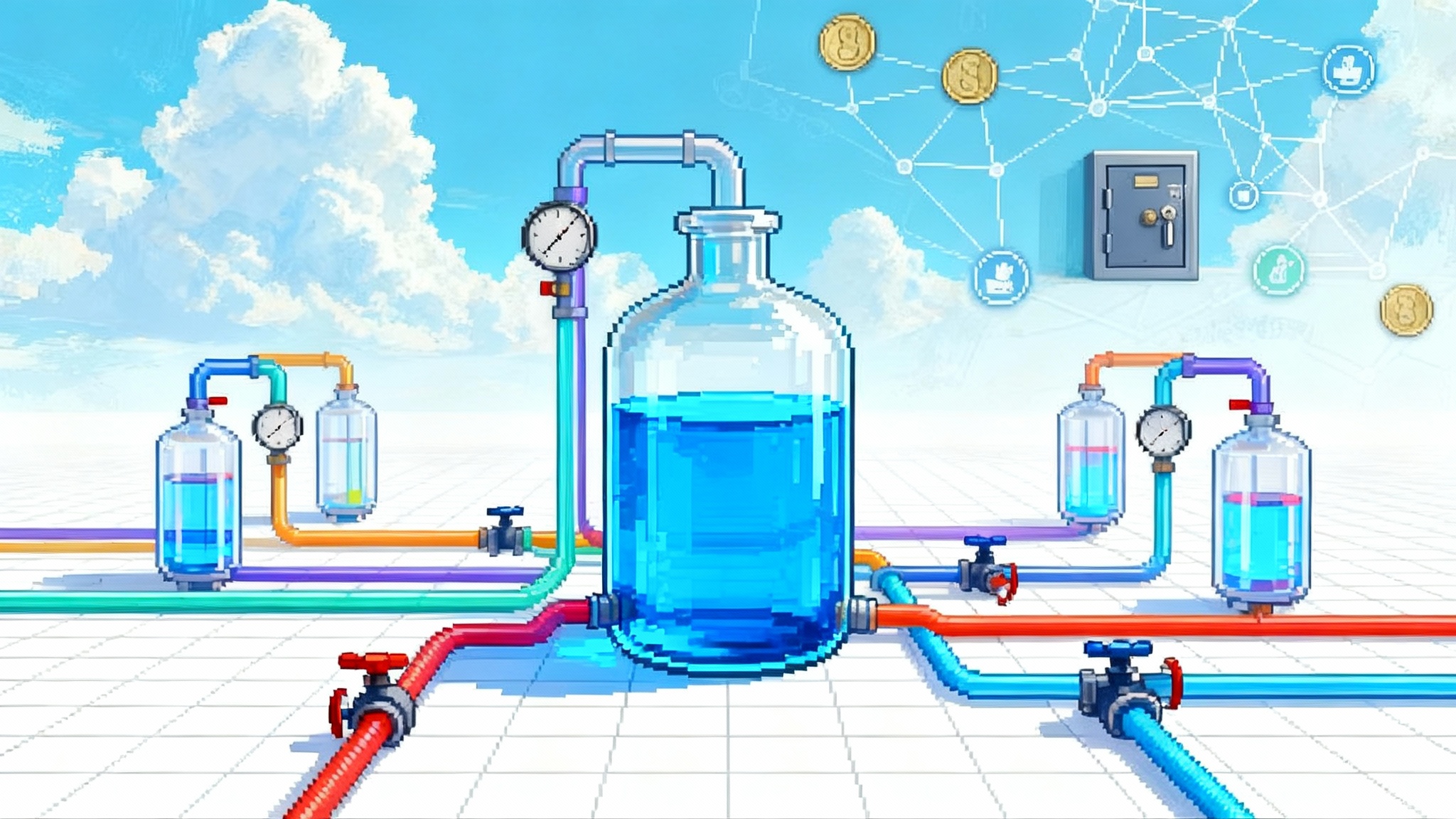

Think of the Liquidity Hub as a central reservoir on each chain. All supplies flow into the reservoir, not into siloed pools. Spokes are smart pipes that connect users and strategies to that reservoir. Each Spoke can set its own rules and risk limits, but it draws from the same shared water. A stablecoin Spoke, a staked Ether Spoke, or a Spoke tailored for newer assets can coexist without bootstrapping separate liquidity. By pooling at the Hub, the protocol can price, meter, and cap how much each Spoke can draw while keeping accounting consistent across the system.

This tackles a chronic issue in decentralized finance. In hubless designs, every new market competes for deposits, so yield spreads and liquidity fracture. With a Hub, deposits reinforce one another. Spokes remain modular and upgradable, so new collateral types or strategies can come online without duplicating the codebase or splitting the pool. For users, this shows up as a single balance that powers multiple experiences plus a unified interface that can display positions across Spokes at the wallet level. For a related look at UX and execution improvements elsewhere in the stack, see our analysis of MEV-aware L2 design.

ERC-4626 made intuitive

Aave V4 moves to ERC-4626-style share accounting across the system. Instead of tokens that rebase, you own a fixed share count, and the Hub tracks a share price that moves with interest and fees. Integrators get predictable rounding rules and cleaner math when composing with vaults, payment rails, or tax software.

Why this matters for builders

- Uniform share semantics reduce custom adapters. Many strategies and wallets already speak ERC-4626, so integrating balances and simulations takes less glue code.

- Share-price growth is easier to reflect in downstream interfaces and reports, and it lines up with vault-based strategies that expect deposits to map to shares.

Why this matters for users

- Your deposit becomes a share count, and value accrues via price per share. Performance is easier to follow and compare.

- Transfers or approvals stop triggering surprise balance updates. What changes is the price per share, not your share count.

A smarter liquidation engine

Liquidations are where safety meets fairness. In V3 and many other protocols, liquidations seize a fixed slice of a borrower’s debt and collateral when accounts fall below required health. V4 replaces that with a health-targeted model. Liquidations repay only what is needed to bring the account back above a governance-defined threshold, then stop. The close factor becomes variable and bounded by risk limits. Incentives are aligned with a dynamic bonus that increases as positions deteriorate via a reverse Dutch auction, while protocol fees adjust to encourage fast action when it matters most.

What this changes in practice

- Smaller, surgical liquidations reduce unnecessary slippage for borrowers while still rewarding liquidators for timely intervention.

- Risk managers get a more precise tool. The engine sizes liquidation amounts to heal, not to harvest.

- The approach should reduce reflexive spirals during volatile markets by avoiding over-liquidation.

The reinvestment module: putting idle float to work

Even efficient pools carry idle cash buffers for withdrawals. V4 exposes an opt-in reinvestment module that can route a portion of that idle liquidity into external, governance-approved strategies. The module is strategy-agnostic by design. It provides the rails and guardrails and leaves the choice of strategies, limits, and risk controls to governance, including the option to keep it disabled. Used carefully, this can lift supplier yields without compromising the withdrawal experience.

Design principles to note

- Strategy-agnostic infrastructure. Aave will not hard-code specific yield paths, inviting competition among strategies and lowering vendor lock-in risk.

- Withdrawal guarantees come first. Governance can cap allocations, set liquidity buffers, and pause or unwind strategies quickly if conditions change.

How V4 could open the door to real-world assets and institutions

Because Spokes encapsulate their own rules, Aave can support categories that previously required bespoke deployments. An RWA Spoke can list tokenized treasury bills with stricter access, custody, or redemption rules while still drawing shared liquidity from the Hub. A Vault Spoke can let a borrower post collateral that remains in a separate smart account, such as a Safe, while risk controls live inside the Spoke. Each of these can be tuned with supply caps and risk configurations, visible in a unified interface, and updated without touching immutable Hub code. For context on the funding landscape that underpins stable liquidity, see our take on the stablecoin market reset.

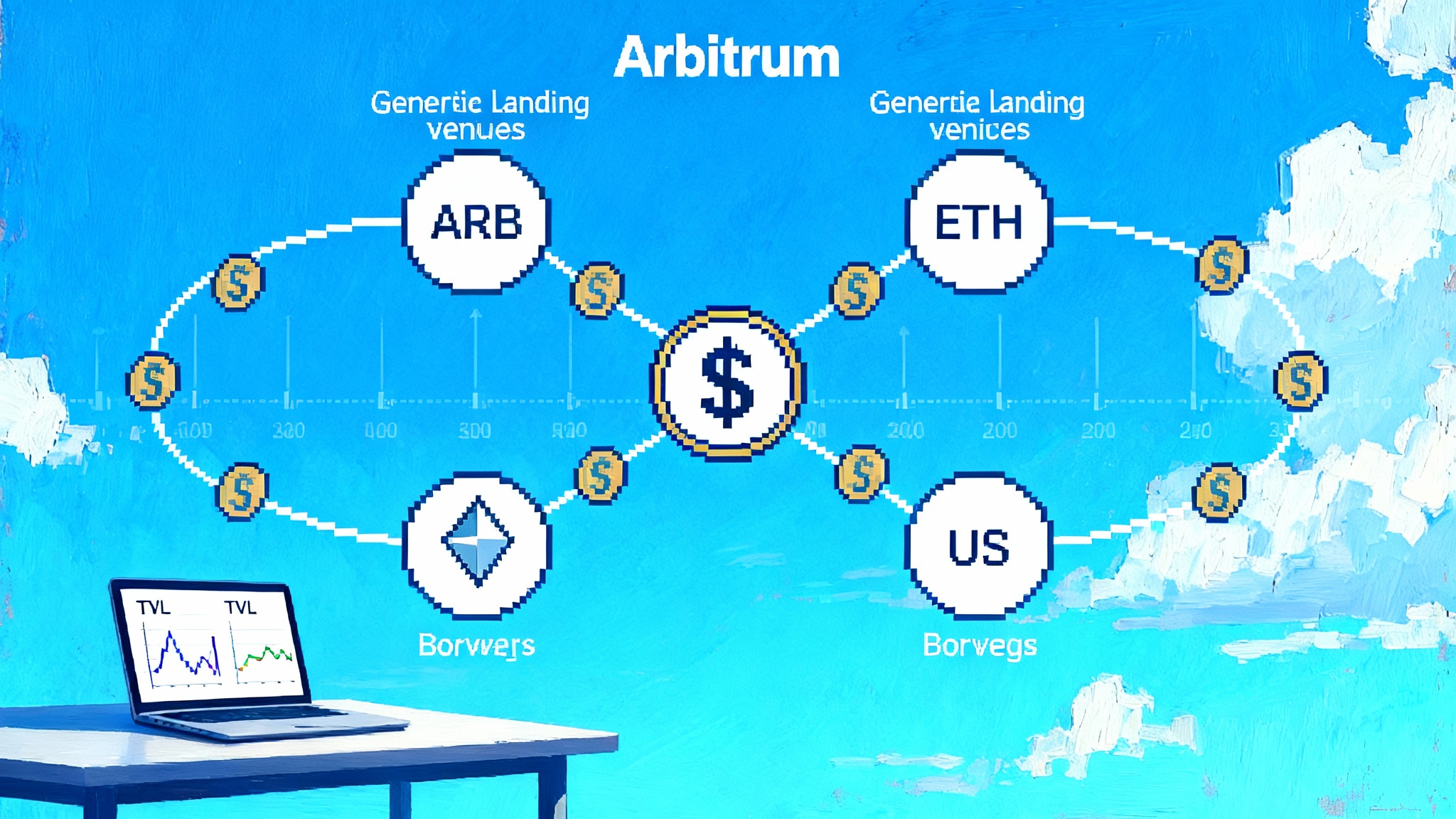

A new pricing layer: base rate plus risk premiums

V4 introduces risk-aware pricing. The Hub sets a base rate that still moves with supply and demand. On top of that, borrowers pay a premium tied to the risk of their collateral set. High quality assets like wrapped Ether or major stablecoins pay close to the base. Assets with thinner liquidity or higher volatility pay more. At the Spoke level, the protocol aggregates user-level premiums into a market-level premium that feeds supplier yields. This aligns incentives and reduces implicit subsidies from blue-chip collateral to riskier tokens.

The other policy upgrade is Dynamic Risk Configuration. When governance changes risk parameters like collateral factors, V4 snapshots those settings under a Risk-Config ID. Existing positions keep their original configuration unless a user takes a risk-increasing action. That makes policy changes more predictable and reduces surprise liquidations when parameters move.

What this means for user experience

Aave is building a new interface in parallel with V4 that shows a unified, wallet-level view across Hubs and Spokes. Instead of flipping across markets, you see all positions, risk settings, and rate curves in one place. Multicall support lets common flows such as supply and set-as-collateral execute in one transaction, saving clicks and gas. Position Managers can automate routine actions with explicit user approvals. These improvements echo broader UX gains across the stack, similar in spirit to the throughput and coordination advances we covered in MEV-aware L2 design.

For a primary view of the changing mechanics, see the official V4 development update on governance.

Builder’s checklist for V4

Integration changes

- Update balance logic to ERC-4626 semantics. Treat deposits and withdrawals as share mints and burns, and read value via share price rather than balance deltas. Validate rounding behavior at boundary conditions and test swaps of small amounts and dust levels.

- Move from market-specific adapters to Hub-aware integrations. Your app connects to a Spoke for user actions but reads liquidity, rates, and caps from the Hub. Abstract these calls so you can add new Spokes without refactoring.

- Support the new multicall flow. Batch supply, collateral toggle, and borrow into a single transaction where it improves user experience.

- If you operate automations, implement Position Manager flows with explicit user approvals, and surface the on-behalf-of address in logs and alerts.

Risk modeling

- Incorporate risk premiums in simulations and user quotes. Show users their expected premium and the Spoke-level average so they understand how collateral quality affects borrowing costs.

- Model health-targeted liquidations. Adjust liquidation risk metrics from fixed close factors to variable, threshold-seeking amounts, and stress test reverse Dutch auction dynamics under price gaps and oracle delays.

- Adopt Dynamic Risk Configuration. Snapshot the Risk-Config ID in your position records and display it in the interface so users know which policy regime applies. Set alerts for when an action would migrate a position to a newer, stricter configuration.

Migration prep

- Inventory all V3 market assumptions in your code and documentation. Map each to the V4 equivalent. Identify dependencies that assume rebasing balances or fixed close factors and queue changes.

- Pre-provision test data. When the public testnet opens, replicate your top user flows with real end-to-end scripts. Capture gas, latencies, and error envelopes.

- Plan user messaging. Explain ERC-4626 share behavior, risk premiums, and new liquidation logic with one screen of copy and a link to deeper docs. Post a clear rollout path for when your app flips V3 to V4 defaults.

Optional reinvestment module

- If you are a strategy provider, prepare an ERC-4626-compatible vault with a narrow mandate and strong liquidity. Expect governance to start with low caps and strict pause controls. Design for fast withdrawals and clear mark-to-market accounting.

User playbook before the rollout

Where yields may shift

- Suppliers of blue-chip collateral could see steadier yields as riskier collateral pays an explicit premium that flows into Spoke-level averages. That reduces cross-subsidies and ties yield to the risk you are indirectly underwriting. For broader payments context and how flows may evolve, see USDC refunds and Arc update.

- If governance enables reinvestment, part of the idle pool float may earn additional yield. Expect conservative caps at first. If enabled, watch the chosen strategies and the liquidity buffer size.

Where borrowing costs may change

- Borrowers with mixed or lower quality collateral will likely pay more than the base rate. Improve your collateral mix to reduce your personal risk premium. The interface is expected to display these curves directly.

How liquidation risk changes

- Health-targeted liquidations should be less disruptive. Still, volatile assets can move fast. Use Position Managers or automations to maintain a safety buffer, and set alerts on your Risk-Config ID in case an action would move you to a stricter regime.

What to watch in the interface

- Look for your wallet-level dashboard that aggregates positions across Spokes, a clear display of your user risk premium, and direct views into each Spoke’s caps and parameters. That transparency is part of the design.

The road to Q4

As of late September 2025, Aave reports V4 as feature-complete, with a public codebase release and testnet next, plus a new interface preview. Industry commentary points to a Q4 mainnet window, which aligns with the cadence of code finalization and audits. Plan migration and user education in October, test in November, and be ready to opt in when your preferred Spokes and assets are live.

A builder’s and user’s moment

The promise of decentralized finance is not more markets. It is better ones. Aave V4’s hub-and-spoke design treats liquidity as a shared resource rather than a prize to be divided. ERC-4626 turns balances into shares with predictable economics. A liquidation engine that aims for health rather than blunt cuts reinforces user trust. An optional reinvestment module offers a path to higher efficiency without forcing the issue. If you build, update your assumptions now and get your test plans ready. If you use Aave, clean up your collateral mix, set alerts, and watch the early Spokes.