Arbitrum’s $40M DRIP targets leverage loops, not TVL

Arbitrum is turning incentives back on with DRIP, a four-season, 80 million ARB program that pays for borrowing against yield-bearing ETH and stablecoins. Here is how Season One (live since September 3, 2025) works, why it differs from 2021-style liquidity mining, who could benefit, and the KPIs that matter.

What just launched, and why it matters

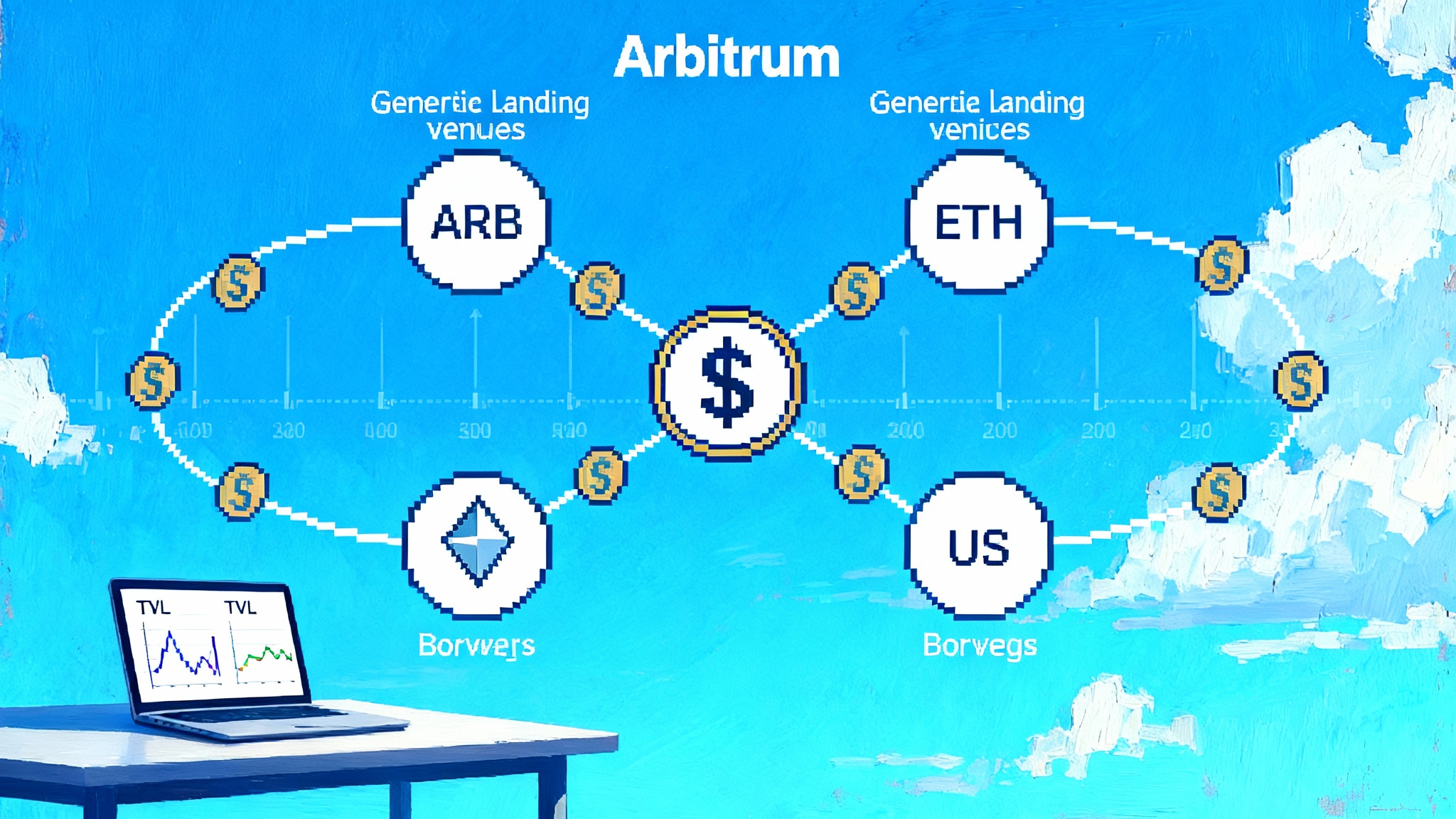

Arbitrum has turned the incentives dial back on, but with a different design goal. The DeFi Renaissance Incentive Program, or DRIP, commits roughly 80 million ARB over four seasons, with Season One live as of September 3, 2025 and budgeted at up to 24 million ARB. Rather than spray emissions across dozens of pools, DRIP targets a single behavior for a full season: leverage looping on lending markets using yield-bearing ETH and stablecoins. Rewards are calculated per two-week epoch and distributed programmatically, with operations managed by Entropy and rewards plumbing powered by Merkl, as outlined in the DRIP program overview on Arbitrum blog.

The intent is straightforward. If you want to grow a DeFi vertical that actually compounds activity, pay for the action that drives it. In Season One, that action is borrowing against productive collateral and looping it back into more of the same. Arbitrum is betting that concentrating emissions on a narrow set of high-impact loops will deepen liquidity, increase organic borrow demand, and convert short-term incentives into longer-lived network effects.

The mechanics in plain English

- Seasons and epochs: Season One runs for about 20 weeks, split into ten two-week epochs. Each epoch has its own allocation per market.

- What earns ARB: The core mechanic is time-weighted average borrows against a curated list of yield-bearing ETH and stable assets on participating markets. In select cases, supplying ETH or USDC can also earn.

- How users loop: A typical stable loop might be deposit a yield-bearing stable, borrow USDC, swap it into more of the yield-bearing stable, then repeat. A typical ETH loop might be deposit an LST or LRT, borrow ETH or a stable, buy more LST or LRT, and loop. Rewards scale with borrow size and duration within the epoch. For context on restaking collateral, see the overview of EigenLayer AVSs debut on Base.

- Where the ARB goes: Allocations are set per market each epoch. DRIP is protocol-agnostic, so emissions can shift toward markets and assets that are driving measurable borrow demand.

The model nudges activity where it is most likely to multiply. Borrowing against productive collateral does three things at once. It creates rate competition that tightens spreads for lenders and borrowers, it grows on-chain money markets that backstop other apps, and it concentrates liquidity in assets whose yields are independently maintained.

Why this is not 2021 all over again

The last cycle’s blanket liquidity mining pushed tokens into every venue with a TVL widget. The result was mercenary capital that rotated rapidly and left little behind. DRIP’s design addresses that failure in four ways:

- Single-goal seasons: Each season targets one behavior. That makes success or failure observable and reduces noise from stacked goals.

- Borrow-led incentives: Paying for borrow demand, not just supply or LP shares, forces real risk-taking and price discovery. It is harder to fake useful borrow than to park idle TVL.

- Epoch tuning: Allocations can move every two weeks. Underperforming markets lose emissions quickly rather than being subsidized for months.

- Protocol-agnostic: This is not a grant program for a fixed list of teams. Markets compete for borrow demand, not for committee attention.

Taken together, DRIP is less about inflating aggregate TVL and more about bootstrapping a specific engine of on-chain credit formation.

Where loops are likely to concentrate

Expect activity to cluster around two families of collateral:

- Yield-bearing ETH: LSTs and LRTs such as wstETH, weETH, rsETH, ezETH, and others give loopers a positive carry on the deposited side while they pay a borrow rate on the debt side. If the collateral yield plus ARB rewards outpaces the borrow cost and slippage, loops scale quickly.

- Yield-bearing dollars: Select yield-bearing stables add a similar carry to the dollar leg. Loopers borrow a base stable like USDC and recycle into the yield-bearing version, targeting positive net carry plus ARB.

On the debt side, the mix will swing with rates. If stable borrow rates spike, some loops migrate to ETH borrows. If ETH rates spike, loops rotate back to stable borrows. Pendulum swings like this are healthy in a targeted program because they surface the true marginal use of emissions.

Who stands to win among Aave, Morpho, Fluid, and Euler

All four lending designs can benefit from borrow-led incentives, but for different reasons.

-

Aave: Depth and safety. Aave v3 on Arbitrum brings deep liquidity, mature risk practices, and features like isolation and efficiency modes. Conservative loopers prefer the familiarity and depth, and risk teams can scale caps in step with borrow demand. If DRIP meaningfully compresses Aave’s borrow rates while keeping utilization high, Aave can capture the lion’s share of retail and aggregator flows. A side effect to watch is whether cheaper borrows lift GHO adoption on Arbitrum, since lower wholesale funding often helps a native stable scale. For additional context on the roadmap, see Aave V4’s hub and spoke reset.

-

Morpho: Rate optimization and modular risk. Morpho’s design routes liquidity through isolated vaults governed by risk frameworks that can be tuned per market. That makes it attractive for LST and LRT loops that need custom parameters without touching a shared risk pool. If DRIP drives sustained borrow competition on blue chip collateral, Morpho’s matching can translate those dynamics into better net rates for both sides of the book. Look for Morpho to attract DeFi-native users and integrators that want a programmable credit stack.

-

Fluid: Loop-friendly tooling. Fluid’s product suite emphasizes capital efficiency and programmable collateral and debt, which makes it a natural fit for looping strategies. The protocol has been expanding its Arbitrum footprint and integrations, and DRIP can act as the demand shock that lifts caps and broadens collateral support. The biggest question is execution velocity. If Fluid lists the right yield-bearing assets with sensible limits and oracles, its feature set can convert emissions into sticky borrow demand.

-

Euler: Isolated risk at scale. Euler’s architecture supports isolated markets and granular parameter control, which suits LST and LRT exposures. A key edge is fine-grained risk adjustment as borrow demand rises. If Euler grows the blue chip market on Arbitrum and keeps liquidations orderly during volatility, it can become the venue of choice for power users who prize risk tooling over headline APYs.

Netting it out, Aave is the default winner on depth and distribution, Morpho leads on composable rate optimization, Fluid leans into product-driven loopers, and Euler appeals to risk-sensitive power users. DRIP’s protocol-agnostic design means allocations and user attention can rotate quickly if markets prove better at converting emissions into sustained borrow.

Governance, committees, and accountability

DRIP was approved via the Arbitrum governance process and is operated by a small season selection committee that includes the Arbitrum Foundation, Entropy Advisors, and Offchain Labs. The intent is to keep decisions fast while retaining DAO oversight, as captured in the Finalized DRIP AIP on Arbitrum forum.

Two practical implications follow for participants. First, eligible assets and market weights can change between epochs based on measured outcomes and risk. Second, reporting matters. For a practical approach to turning raw data into decisions, see the timely crypto reporting workflow.

Spillovers to other L2s

A targeted borrow-first program on the largest DeFi L2 will not exist in a vacuum. Three spillovers look likely:

- Competitive responses: Expect other L2s to test copycat seasons that incentivize borrowing against yield-bearing collateral. The shape may vary by stack and ecosystem depth, but the behavior will rhyme.

- Cross-chain liquidity routing: Aggregators and quant funds will route loops to the best net carry after ARB, gas, and slippage. If DRIP compresses net borrow costs enough, Arbitrum could temporarily pull loops away from chains that rely on broad, undifferentiated grants.

- Composability pressure: As loops scale, protocols that touch these positions, from yield routers to perps venues using LST or LRT collateral, will feel demand to optimize for Arbitrum first. That can accelerate integrations and deepen moats.

Systemic risks that grow with stacked leverage

Incentivized loops are powerful and fragile. Here are the main failure modes and how to watch them:

- Liquidation cascades: When many users crowd the same collateral and debt assets, a sharp price move can trigger correlated liquidations. Watch health factor distributions, the share of borrows sitting within narrow liquidation bands, and the concentration of liquidator capacity.

- Oracle risk and basis risk: LSTs and LRTs can diverge from their reference asset. If oracles lag or sample thin markets, loopers can be under-margined. Track oracle sources per market, depth in reference pools, and historical deviations between collateral and spot.

- Depeg and funding stress for stable loops: Yield-bearing stables can face peg stress during market shocks. Monitor intraday peg deviations, on-chain liquidity depth at 50 to 200 bps bands, and borrow rate spikes that erase carry.

- Collateral queue and withdrawal liquidity: Restaking tokens may have withdrawal queues or unlock delays. A surge in redemptions can pressure secondary prices, which bleeds into collateral valuations. Track queue lengths and redemption throughput where applicable.

- Concentration by venue and strategy: If a single protocol captures most of the loop or a single asset pair dominates, shocks propagate faster. A healthy DRIP season shows diversified borrow demand across venues and assets.

KPIs to watch, and how to compute them

Use this as your dashboard blueprint. All metrics should be filtered to participating markets and the eligible collateral list.

- Borrow growth by market and asset: Daily and weekly change in borrows outstanding, plus percent change since Season One start. Split by ETH-backed and stable-backed loops.

- Utilization and rate spread: Utilization per market, borrow APY minus collateral yield, and the share of time utilization sits above the rate kink. Falling net spread with rising borrows is the sweet spot.

- Net new borrowers and depositors: New addresses per epoch and their 30-day retention. Distinguish first-time Arbitrum users from returning addresses.

- Emissions efficiency: ARB per incremental dollar of borrows sustained for at least seven days. Compute as ARB distributed in epoch t divided by net borrow increase from t to t+1 held above a threshold.

- Revenue lift: Protocol revenue attributed to DRIP markets, measured as incremental interest margin and liquidation fees net of baseline.

- Risk posture: Median and 10th percentile health factor by market, liquidation volume per epoch, number of accounts liquidated, and bad debt if any. A safer season shows stable health factors and low unfilled liquidations even as borrows rise.

- Collateral composition: Share of loops by collateral type. A diversified mix reduces correlated risk.

- Retained TVL and borrows post-epoch: How much activity persists two weeks after an epoch ends or incentives rotate. The goal is non-zero stickiness.

- Cross-protocol overlap: Share of users active on two or more participating markets. High overlap can signal mercenary capital; low overlap suggests distinct user bases discovering their preferred venue.

A dashboard-driven checklist for the next 8 to 12 weeks

Week 0

- Record baselines for borrows, utilization, users, and health factors on all participating markets. Note the Season One start date and current epoch.

- Document eligible assets per market and any caps or oracle configurations that gate growth.

Weeks 1 to 4

- Watch borrow growth on ETH loops first. If ETH borrows climb with flat or falling net spread versus collateral yield, DRIP is doing its job.

- Check for early crowding. If one venue captures more than half of looped borrows, expect rate volatility and sharper liquidation bands. Diversification is healthier.

- Track net new users and 30-day retention. A good signal is new users returning for a second epoch without a cliff in activity.

Weeks 5 to 8

- Evaluate emissions efficiency. Compute ARB per sticky dollar of borrow and compare across markets. Reallocate personal attention toward venues converting emissions into retained users and borrows.

- Stress test the risk posture during a market wobble. Did liquidations clear quickly? Did bad debt remain minimal? Did oracles hold up? Safe answers here are a green light for larger loops.

- Look for integration flywheels. Are perps desks, structured vaults, or intent routers plugging into the winning lending markets? Composability is a leading indicator of stickier demand.

Weeks 9 to 12

- Measure post-epoch retention. As allocations rotate, do borrows hold or decay? High retention suggests product market fit beyond emissions.

- Reassess collateral composition. If one LRT or yield-bearing stable dominates, revisit oracle and liquidity assumptions.

- Decide your stance. For builders, double down on the venues and assets with the best emissions efficiency and retention. For users, scale positions where rate spreads and risk metrics look sustainable into the planned Season One end in January 2026.

What success looks like by the end of Season One

- Borrow growth outpaces raw TVL growth on participating markets, signaling real credit formation rather than idle deposits.

- Net spreads compress but stay positive after accounting for collateral yield and ARB, which suggests rates are converging toward an efficient frontier.

- Liquidations remain orderly and bad debt negligible through at least one volatility event.

- A diversified mix of venues and collateral supports loops, with no single venue utterly dominant.

- A measurable share of borrows persists when epoch weights rotate, pointing to early product market fit.

Bottom line

DRIP is a deliberately narrow experiment that pays for a specific behavior over a sustained window. If it works, Arbitrum will not just add headline TVL. It will deepen the lending rails that other apps build on, and it will do so with cleaner feedback loops than past incentive programs. The next 8 to 12 weeks will show whether leveraged looping can be grown responsibly at L2 scale, and whether paying for borrows is the right primitive to bet on.