Telegram’s TON Wallet Puts Web3 Inside U.S. Chats

Telegram’s July 2025 U.S. roll out of its built‑in TON wallet and its decision to make TON the exclusive chain for Mini Apps compress the Web3 funnel into a single chat. Here is what changed, why it matters, and a builder playbook to ship fast.

The moment Telegram turned chats into a wallet

In July 2025 Telegram switched on its built‑in, self‑custodial wallet for U.S. users and made TON the exclusive blockchain for Mini Apps. Those two choices compress the Web3 funnel that crypto has chased for years. Instead of sending users from social to a website, then to an exchange, then to a wallet, a transaction can now start and finish inside a familiar chat. For the first time at U.S. scale, the default place people coordinate is also the place they hold and spend tokens.

This distribution shift matters because discovery, intent, and payment now coexist in a single surface. Communities already live in Telegram channels. Mini Apps now sit one tap away inside those conversations. The wallet lives there too. When a network controls both the audience and the payment rail, new business models show up fast.

What changed in the product

Telegram’s design work reduces the three main sources of crypto friction.

- In‑chat transfers

- Send and request flows appear natively in a conversation, so money moves follow the same mental model as sending a photo. That keeps users out of the browser and away from copy‑paste addresses.

- Because the wallet is self‑custodial, power users keep keys under their own control. For mainstream users, the default feels like a normal app panel rather than a separate crypto tool.

- One‑tap authentication and connection

- TON Connect gives developers a standard to request permissions, sign messages, and send transactions with clear prompts and app‑level branding. It is the connective tissue that lets a Mini App delegate crypto actions to the Telegram wallet without making the user juggle wallets or QR codes. See the TON Connect overview for capabilities and UX patterns.

- Fiat on‑ramps where the user is

- On‑ramp prompts can appear inline during checkout. That means a user who just discovered a Mini App can buy a few dollars of a stablecoin without leaving the chat context. The wallet can reuse identity where compliance rules allow and can deep link into partner flows when more checks are required.

Put together, these choices drop the time to first successful transaction from hours to minutes. They also turn Telegram’s channel ecosystem into a checkout network. A creator can post, a user taps into a Mini App, and a purchase or tip can happen inside the same session.

Mini Apps as a distribution engine

Mini Apps are lightweight web apps that run inside Telegram with a full‑screen layout, their own navigation, and tight integration points for login and payments. The platform’s primitives are familiar to web developers and do not require learning a new UI toolkit. Telegram documents the container and JavaScript bridge in the Mini Apps developer guide. For builders, the pitch is simple. Bring your app to where your audience already talks.

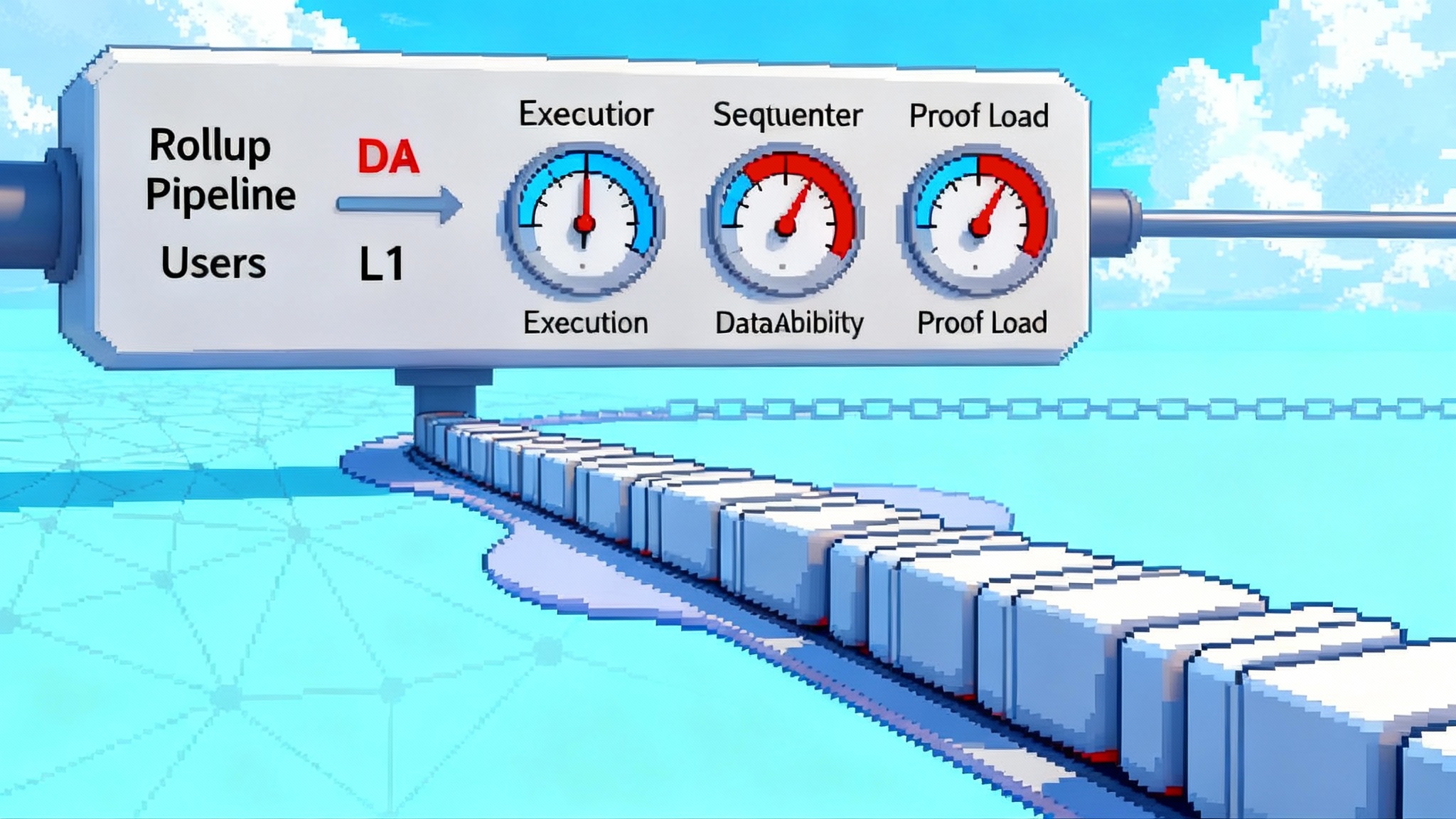

Making TON the exclusive chain simplifies developer decisions and user messaging. It avoids the usual chain‑picker menu and lets the wallet present a single set of fees, token formats, and addresses. The tradeoff is ecosystem dependency. The upside is a consistent payment surface that is easier to support at scale. For context on reliability and decentralization risks across ecosystems, see lessons from decentralizing sequencers lessons.

The stablecoin unlock for P2P

The biggest near‑term impact will likely be peer‑to‑peer payments. Telegram is already a coordination hub for global communities. With a wallet inside the chat and one or more dollar stablecoins on TON, groups get a familiar experience with crypto‑level settlement. Here is what that enables:

- Everyday reimbursements and group expenses. Split a ride, pay for a local event, tip a moderator. The chat you used to plan the thing is now the place you settle up.

- Cross‑border support without card networks. Communities that span countries can move dollars quickly, which matters in places where cards fail or bank wires are slow.

- Creator income in dollars rather than points. A channel owner can accept stablecoin tips and memberships with predictable value. For broader context on issuer strategies, see Tether's USAT stablecoin shift.

If fees and finality remain low, P2P can become the default onboarding path. A friend sending you a few dollars inside a chat beats any first‑run tutorial.

Mini commerce inside Telegram

Once payments are native, Mini Apps become storefronts. Expect three categories to grow fastest:

- Digital goods. Stickers, filters, game items, and access passes fit the low‑friction model. Ownership can be tokenized for portability across experiences.

- Services and bookings. Language tutoring, fitness classes, or local event tickets can run paywalled flows inside a channel community.

- Micro work and rewards. Communities can route bounties, task payouts, or loyalty points through on‑chain primitives, then let users cash out to stablecoins.

For users, the difference is that shopping becomes conversational. You discover a Mini App in a channel, try it with a demo flow, and confirm payment without hopping apps. For merchants, the funnel compresses. Discovery, consideration, and purchase happen in one place, which tends to lift conversion and average order value.

What this means for developers

- Discovery. Your best acquisition channel is the audience you already have. Launch in your own channel, partner with other channels, and use deep links that open your Mini App to a specific state. The old App Store Top Charts game matters less when your store is a chat.

- Monetization. Mix recurring memberships, one‑time unlocks, and usage‑based fees. Because the wallet is self‑custodial, you can support token‑gated features without custodial risk. You can also experiment with referral payouts that settle instantly to partners.

- Custody models. Default to self custody through the Telegram wallet for simplicity. Add optional custodial accounts for users who need recovery or card refunds. Be explicit about what lives on chain and what lives in your database. Offer export tools so advanced users can take assets to other TON wallets.

- Identity and risk. Reuse Telegram identity signals for account creation, then layer your own risk models. Ask for additional checks only when users cross specific thresholds.

What this means for brands

- Direct channel commerce. Treat a Telegram channel like an owned storefront. Post drops, run live shopping, and let a Mini App be the checkout counter.

- Loyalty that travels. Use tokens to represent tiers and benefits that work across partners. Because ownership is on chain, a fan can bring their status into new experiences without API integrations.

- Attribution you can verify. On‑chain transfers and signed app calls make it easier to measure contribution by creators and affiliates.

What this means for exchanges and wallets

- New on‑ramp edge. Exchanges and licensed wallets can power fiat entry inside Telegram flows. The wallet’s prompts can route users into partner KYC only when needed.

- Off‑ramp and settlement. Payouts to bank accounts or cards can be positioned after the on‑chain purchase. That timing keeps on‑chain settlement fast while still meeting user expectations for cash out.

- Listings and liquidity. If Mini Apps drive volume in specific tokens, exchanges will chase listings to serve that demand. Liquidity on TON matters because the wallet is native. Bridges become part of the critical path. For the broader exchange playbook in the U.S., see the onshore crypto perps push.

The risks and their blast radius

- App store policy dependency. Telegram’s distribution still rides on Apple and Google policies. If Apple shifts rules on crypto wallets or in‑app payments, Telegram may need to gate or remove features on iOS. Builders should keep a web fallback and design critical flows to survive policy toggles.

- U.S. compliance. Know Your Customer and Anti‑Money Laundering rules apply once users cross certain limits or use off‑ramps. The Travel Rule may trigger for larger transfers or when specific counterparties are involved. Plan for sanctions screening and suspicious activity reporting if you custody funds. Even with self‑custody defaults, your Mini App can be the compliance point if you intermediate value.

- Censorship and relay controls. Telegram operates the client and the distribution. If a jurisdiction demands takedowns or feature limits, Mini Apps and wallet calls can be blocked or geofenced. Build with graceful degradation. Host core logic outside the app when possible so you can continue basic service via the web.

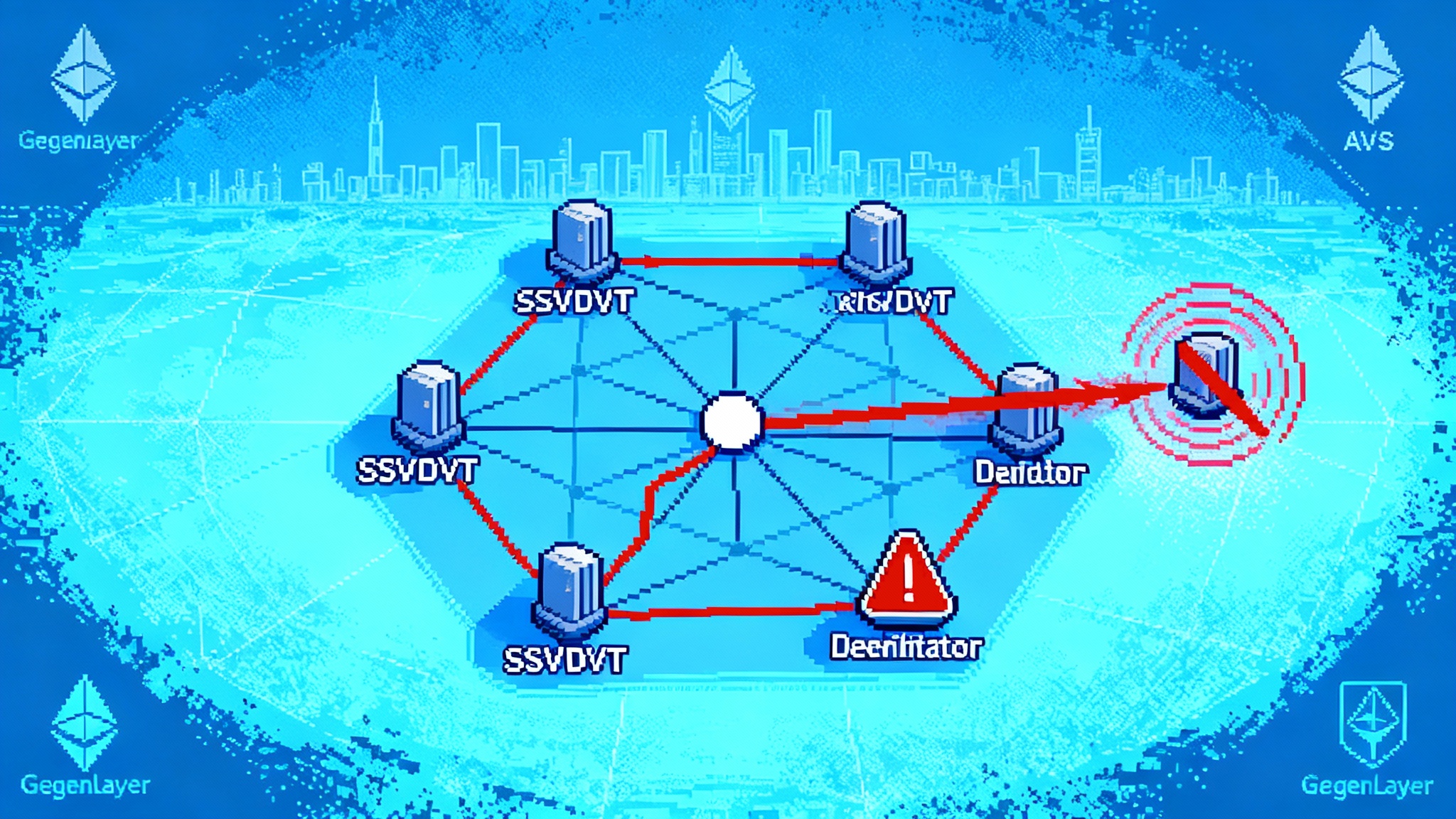

- Validator and ecosystem concentration. Making TON the exclusive chain increases dependency on one set of validators, bridges, and service providers. If validator sets are small or concentrated, censorship risk and outage risk go up. Monitor the share of stake by top validators and the diversity of infrastructure.

- Bridge security. Many assets that users expect will arrive as wrapped or bridged tokens. Bridges are a high‑value target and a common failure point. Prefer native tokens on TON for core payments. When you must bridge, choose providers with formal audits, public bug bounties, and clear incident response plans. Consider circuit breakers that pause risky paths.

- User protection and scams. Inline wallet prompts can increase impulse transactions. Phishing via lookalike bots will rise. Use signed, verified bot names, teach users to expect the wallet’s native confirmation screens, and add delay and review steps for high‑risk transfers.

How incumbents could respond

- Coinbase. Coinbase can lean into its wallet and smart wallet stack to offer easy sign‑in, on‑ramps, and gas sponsorship across multiple chains. It may build deeper social features around payments and launch developer programs that compete with Mini Apps on reach and funding.

- Cash App and peer apps. Cash App, Venmo, and PayPal can add stablecoin send in chat threads and enhance cross‑border routes. They already have distribution and KYC. If they add developer surfaces for mini commerce, they defend time spent and payments volume.

- Asia’s super apps. WeChat, LINE, and Kakao have proven playbooks. If they add self‑custodial options or token rails, they can copy the model with stronger local compliance. That competition will pressure Telegram to keep fees low and developer incentives high.

Builder playbook: launch a Mini App that converts

- Nail the use case and the first 30 seconds

- Write the 10‑second pitch you will pin in your channel. Design your landing screen to show a demo state without requiring funds. Let users click around before asking them to connect the wallet.

- Set up the bot and web app shell

- Create a Telegram bot, host a secure web app, and integrate the Mini App JavaScript bridge. Follow the container rules from the official docs linked above. Make sure deep links open to a context‑specific route so creators can point users to the exact screen that matters.

- Integrate TON Connect

- Use TON Connect to request account addresses, sign messages, and send transactions. Map scopes to clear user intents. Show what you will do before you request permissions. Log every on‑chain call with a human‑readable description. The TON Connect overview is your source of truth for capabilities and UX.

- Choose your payment rails

- Pure self custody. Let users pay directly from the Telegram wallet with TON or a supported stablecoin. This keeps you out of the flow of funds but limits refund and chargeback tools.

- Hybrid custody. Use a regulated partner to hold balances for certain flows like subscriptions or deposits. This enables card‑like refunds and dispute management but adds compliance scope and partner risk.

- Stars and off‑chain credits. If you already monetize with off‑chain credits for microtransactions, use them for sub‑dollar actions and settle periodically on chain for withdrawals and ownership.

- Compliance checklist for U.S. users

- Publish clear terms, support, and refund policies. Screen for sanctions at onboarding and before payouts. Gate thresholds that trigger enhanced checks. Keep audit logs for all wallet interactions. If you ever take custody, consult counsel on money transmission.

- Growth and retention loops

- Pair launches with channel collaborations. Offer referral codes that unlock a small credit or discount after the first successful on‑chain payment. Use giveaways that require a wallet connection to enter, but let users see the prize pool first. Pin videos that show the payment flow.

- Risk, support, and ops

- Add a prominent verification badge and a short explainer on how to confirm the real bot name. Build a blocked‑words list for chat commands to catch common scam prompts. Implement transfer limits and a second confirmation for large payments.

Payments flow patterns to copy

- One‑tap tip. The user taps Tip, signs a transfer to the creator address, and gets a visual confirmation in chat. No app switching, no extra forms.

- Token‑gated access. The Mini App checks ownership of a pass token in the user’s wallet. If present, it unlocks premium features instantly. If absent, it offers to mint or buy the pass with a single on‑chain purchase.

- Cart with on‑ramp. The user adds items, sees an estimated stablecoin total, and is offered an on‑ramp if the wallet balance is low. After KYC if required, funds land and the transaction submits without leaving the app.

Metrics to track through Q4 2025

- Wallet conversion. Users who open your Mini App and connect the wallet within the same session.

- Time to first successful transfer. Median time from first open to first on‑chain action.

- On‑ramp completion rate. Users who start and finish a fiat purchase when prompted.

- Stablecoin share. Percent of total transactions denominated in stablecoins vs TON or other tokens.

- Payment success rate. Submitted transactions that finalize without user retry.

- Average fee per transaction. Track both base chain fees and bridge or partner fees.

- D1, D7, D30 retention by cohort. Break out users who received tokens from a friend vs those who funded via on‑ramp.

- ARPPU and paywall conversion. Average revenue per paying user and conversion from first visit to first purchase.

- Refund and dispute rate. Keep it low by setting clear expectations and offering self‑serve fixes.

- Creator and channel partner ROI. Measure revenue per thousand impressions and per unique click from partner posts.

What to watch next

- App store policy updates that affect crypto wallets and web app containers. A change in iOS review guidance can affect distribution overnight.

- Stablecoin issuer support on TON. The more native options exist, the more resilient your payments mix becomes.

- Validator decentralization and network reliability. Track outages, validator churn, and concentration.

- Bridge security posture and incident response. Favor providers with strong security practices and published remediation playbooks.

- Exchange integrations and off‑ramp coverage by region. The easier it is to cash out, the more mainstream the funnel feels.

If you design for the first 30 seconds, integrate TON Connect cleanly, and pick payment rails that match your risk posture, Telegram’s July 2025 shift can be your fastest route to product‑market fit. Chats are where communities decide to act. Now they are also where money moves.