SEC fast-tracks spot crypto ETFs with new generic rules

On September 17 and 18, 2025, the SEC approved generic listing standards that let NYSE Arca, Nasdaq, and Cboe list qualifying spot commodity ETPs, including crypto, without individualized 19b-4 orders. Here is what changed, why it matters, and what could list next.

The decision that changes the ETF playbook

On September 17 and 18, 2025, the SEC approved generic listing standards for Commodity-Based Trust Shares across NYSE Arca, Nasdaq, and Cboe. In plain terms, exchanges can now list qualifying spot commodity ETPs, including digital assets, without the slow, case-by-case 19b-4 rule filings that defined the Bitcoin and Ether cycles. The Commission announced the change and simultaneously approved listing and trading for Grayscale’s Digital Large Cap Fund, a multi-asset crypto ETP benchmarked to the CoinDesk 5 Index. It also cleared options on Cboe’s Bitcoin U.S. ETF Indexes, signaling a derivatives buildout alongside cash products. See the SEC’s press release for details in SEC approves generic listing standards.

What actually changed

The core shift is procedural and structural:

- Exchanges now have a generic rule set for listing Commodity-Based Trust Shares. If a product satisfies those conditions, the exchange may list it under Rule 19b-4(e) without first obtaining a Commission approval order. The exchange must post required product information on its website within five business days after trading begins.

- The standards apply to spot commodities generally, not just crypto. Digital assets are explicitly in scope, provided the underlying meets the eligibility tests.

- The SEC also approved index options related to crypto ETF indexes, pointing to a broader options and futures ecosystem around these ETPs.

Eligibility tests at a glance

A crypto asset held by a trust can qualify in one of three ways that give the listing exchange surveillance reach into a regulated venue connected to the asset:

- The asset trades on a market that is a member of the Intermarket Surveillance Group and the listing exchange can obtain information from that market.

- The asset underlies a futures contract that has traded for at least six months on a CFTC-designated contract market, and the listing exchange has a comprehensive surveillance sharing agreement with that DCM.

- On an initial basis only, an ETF with at least 40 percent exposure to the asset already lists and trades on a national securities exchange.

The new fast-track timeline

Before this change, a spot crypto ETF required two parallel approvals: a 19b-4 for the exchange and an effective Securities Act registration for the issuer. The generic standards remove the first bottleneck for qualifying products. Issuers still need an effective registration statement, but the overall timeline drops sharply. Coverage indicates the process now cuts filing-to-launch to 75 days, depending on filing type, staff review, and issuer readiness.

Why 75 days matters

- Predictable capital planning: Issuers can plan seed capital and marketing with clearer dates.

- Competitive dynamics: Asset managers with ready S-1s and operational playbooks can win first-mover flows.

- Lower legal cost per launch: Fewer bespoke exchange filings and comment rounds reduce friction.

Why Grayscale’s multi-asset approval is the template

Grayscale’s Digital Large Cap Fund provides a near-term blueprint for crypto ETP design under the new regime. The fund tracks a five-asset index and is currently anchored by large weights in Bitcoin and Ether, which satisfy the generic standards via CME futures and exchange surveillance arrangements. Using a rules-based, rebalanced index with transparent inclusion screens, pricing sources, and caps gives exchanges and the SEC assurance around methodology, data integrity, and manipulation resistance. The BTC and ETH core also keeps creations and redemptions operationally smooth because APs and market makers can hedge and source inventory efficiently.

Expect more baskets with similar mechanics: top-five or top-ten indexes, factor or momentum tilts that still keep BTC and ETH dominant, or thematic baskets with guardrails that limit smaller components between rebalances.

What could list next

Near-term candidates

- BTC and ETH variants: Equal-weight, risk-parity, or volatility-managed versions; covered-call and income-focused wrappers; duration-managed cash collateral inside trusts.

- Multi-asset indexes: Top-five or top-ten large-cap crypto indexes that maintain a high BTC and ETH core with a controlled sleeve for other majors.

- Single-asset Solana: With CME SOL futures live since March 17, 2025 and beyond the six-month mark, a SOL spot ETP can potentially qualify through the futures pathway if all other conditions are met.

What likely needs more time

- Single-asset XRP: If U.S. listed XRP futures have not yet met the six-month trading requirement on a designated contract market, a spot XRP ETP remains outside the generic fast lane until that criterion is satisfied or another eligibility route is available.

- Long-tail alts: Without regulated futures depth or ISG visibility, these remain out of scope for generic listing and would need bespoke filings.

For broader context on derivatives infrastructure that will influence spreads and hedging, see how a combined venue could shape liquidity in Coinbase and Deribit derivatives hub.

The operational hurdles that still matter

Even with a fast lane, listing is not a free ride. Exchanges and issuers must show they can surveil, price, custody, and keep creations and redemptions orderly. Four friction points dominate.

1) Surveillance and data sharing

- CSSA coverage: For BTC and ETH, exchanges commonly rely on surveillance sharing with CME. For other assets, issuers need a path to a regulated market with reportable, surveillable activity.

- Price integrity: Indexes must use robust reference rates that screen constituent venues, exclude outliers, and withstand exchange outages. Intraday volatility filters and circuit-breaker logic should be documented and tested.

2) Custody and settlement

- Segregation and controls: Cold storage dominance with limited hot exposure, SOC 2 Type II audits, clear key management protocols, disaster recovery, and insurance that is meaningful relative to AUM.

- Settlement reliability: Same-day creation and redemption SLAs that work across multiple on-chain networks and bank rails, with defined fallback processes if a chain experiences congestion or outages.

3) Index construction and rebalances

- Transparent inclusion rules: Free-float adjusted market cap, minimum dollar liquidity and days traded, concentration caps, and clear triggers for eligibility changes.

- Governance and conflicts: Independent index committee minutes, documented error handling, and emergency procedures for forks, halts, or delistings.

4) Market depth and hedging

- Futures and swaps access: APs and market makers hedge creation baskets with listed futures or centrally cleared swaps. Beyond BTC and ETH, hedging tools are thinner, which can widen spreads when the non-core sleeve grows.

- Securities lending and inventory: Borrow supply for altcoins is limited. Issuers that rely on cash creations must model short-cover risk and basis volatility during stress windows.

How market microstructure may shift next

Liquidity migration

- From centralized exchanges to ETFs: For BTC and ETH, more volume migrates to U.S. exchanges through ETF flows as pensions, RIAs, and smaller institutions use brokerage accounts instead of crypto exchange accounts.

- From DeFi to basis trades: Professional flow concentrates in ETF–futures and ETF–index basis rather than perpetual swap venues, especially if options on crypto ETF indexes scale. For how Bitcoin-native rails could interact with this shift, see sBTC listings and BTCFi growth.

AP and market maker behavior in thinner alts

- Hedging gaps: If a diversified basket pushes its non-core sleeve into assets with limited U.S. hedging tools, APs will demand higher creation spreads to compensate for basis risk.

- NAV behavior: Premiums and discounts should remain tight for BTC and ETH single-asset products. Multi-asset baskets may see occasional NAV dislocations around rebalances or during sudden venue outages or regulatory headlines.

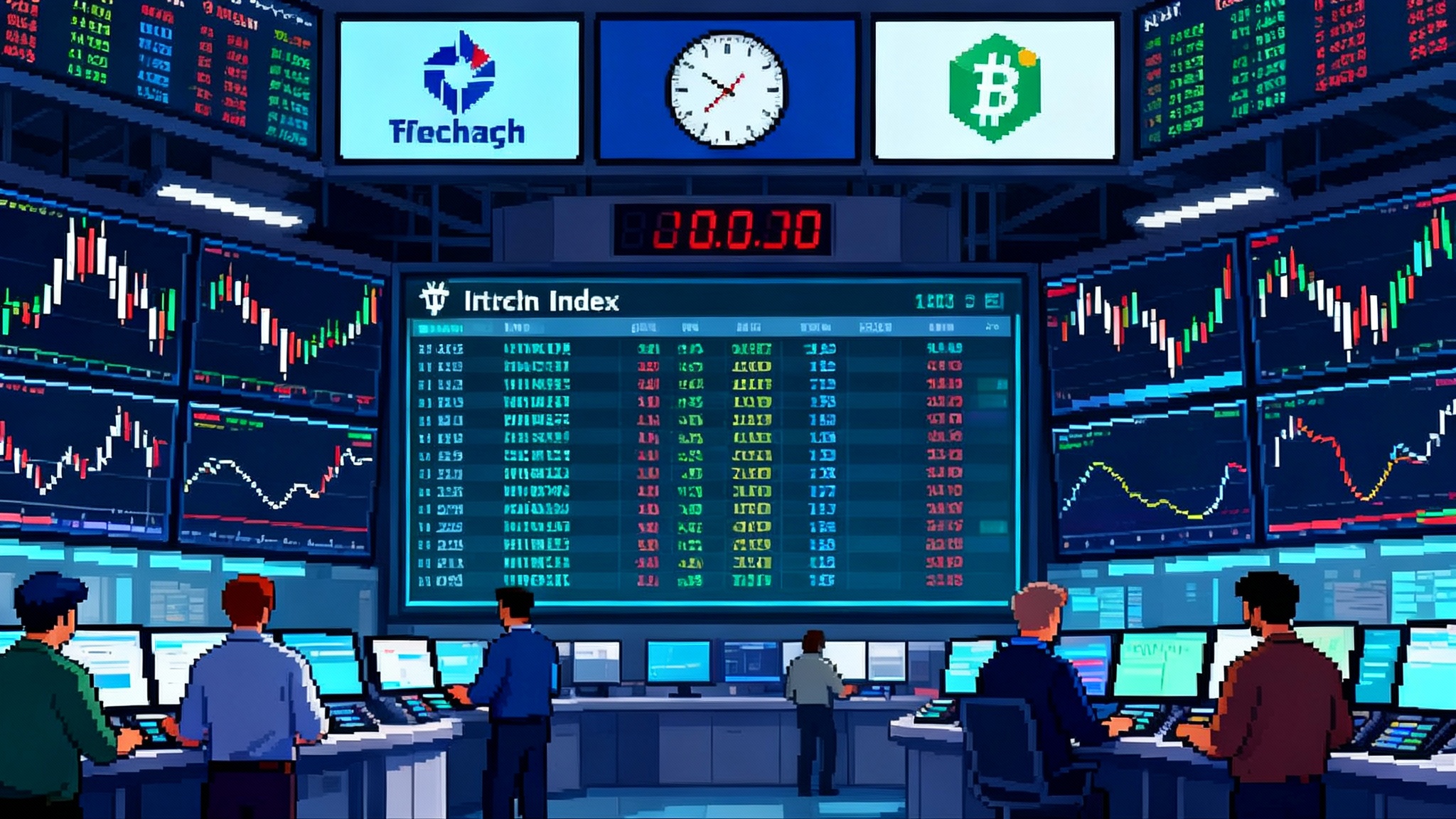

Derivatives flywheel

- Index options and futures: The Commission’s same-day options approvals on crypto ETF indexes point to listed options growth and, eventually, cash-settled index futures. That deepens hedging capacity, tightening ETP spreads. For an industry snapshot of the derivatives center of gravity, see Coinbase and Deribit derivatives hub.

Practical mapping of the pipeline

Realistic near-term launches

- BTC and ETH adjacent: Low-volatility, covered-call, and target-volatility series that reuse existing custody and surveillance plumbing.

- Index baskets with a dominant BTC and ETH core: Large-cap and factor-tilt funds that allocate a modest sleeve to majors like SOL or ADA subject to index screens and rebalance buffers.

Medium-term if futures develop

- Single-asset XRP: Feasible once a U.S. DCM lists cash-settled XRP futures that trade for at least six months with credible participation.

- Sector-specific ETPs: If several alts gain DCM futures, expect smart-contract, payments, and DePIN baskets anchored by BTC and ETH.

Readiness checklist for issuers and token teams

Issuers

- Registration calendar discipline: Prepare S-1 drafts early, pre-clear key disclosures, and plan a fast iteration path on staff comments. Align marketing, seed, and ticker readiness to an achievable effective date window.

- Creation and redemption playbooks: Offer both in-kind and cash creations where possible. Document a contingency for cash-only periods if altcoin sourcing becomes difficult, with clear communication to APs.

- Index and pricing governance: Adopt a rules-based index with a published methodology, emergency procedures, error handling, and oversight minutes. Use multi-venue reference rates with robust outlier and dependency checks.

- Custody SLAs and attestations: Negotiate concrete SLAs for settlement windows, withdrawal limits, and cutoffs. Publish SOC 2 Type II and penetration test attestations on a predictable cadence and disclose insurance coverage clearly.

- Risk and surveillance: Show how exchange surveillance, CSSAs, and third-party monitoring will detect spoofing, wash trades, and outlier prints that could impact NAV or intraday indicative values. For disclosure touchpoints that intersect with investor tax reporting, see 1099-DA changes in 2025–26.

Token teams and foundations

- Data transparency: Provide stable, queryable endpoints for circulating supply, unlock schedules, governance changes, and validator concentration. Make exchange listings, liquidity, and on-chain metrics easily auditable by indexers.

- Eligibility by design: Engage with index providers on inclusion criteria. Avoid mechanics that create sudden float shocks near rebalances. Implement staking or inflation changes with long lead times and clear communication.

- Custody readiness: Work with qualified custodians to ensure token-specific functionality can be disabled or gated for institutional mandates. Ensure tokens are supported by multiple systemic custodians to avoid single points of failure.

- Futures market development: If your asset aims for a single-asset ETP, collaborate with DCMs, FCMs, and market makers to seed a compliant, cash-settled futures market and sustain it for at least six months.

- Surveillance cooperation: Facilitate data sharing with surveillance vendors and DCMs. Encourage top spot venues for your asset to join or interoperate with surveillance frameworks that exchanges can rely on.

The bottom line

The SEC’s generic listing standards turn crypto ETP approvals from bespoke art into engineering. Products that anchor surveillance to regulated markets and run clean operational stacks now have a clearer, faster path to market. In the near term, expect a wave of BTC and ETH variants and diversified baskets with those assets as the core. The next leap, into additional single-asset altcoin ETPs, will depend on building real U.S. futures markets and surveillance reach.