After the CRA Repeal: How 1099-DA Changes in 2025–26

Congress voided the IRS DeFi broker rule on April 10, 2025 and the IRS followed with June transition relief for Form 1099-DA. Here is what changed and what did not, who is affected, the exact timeline, and what platforms and users should do now.

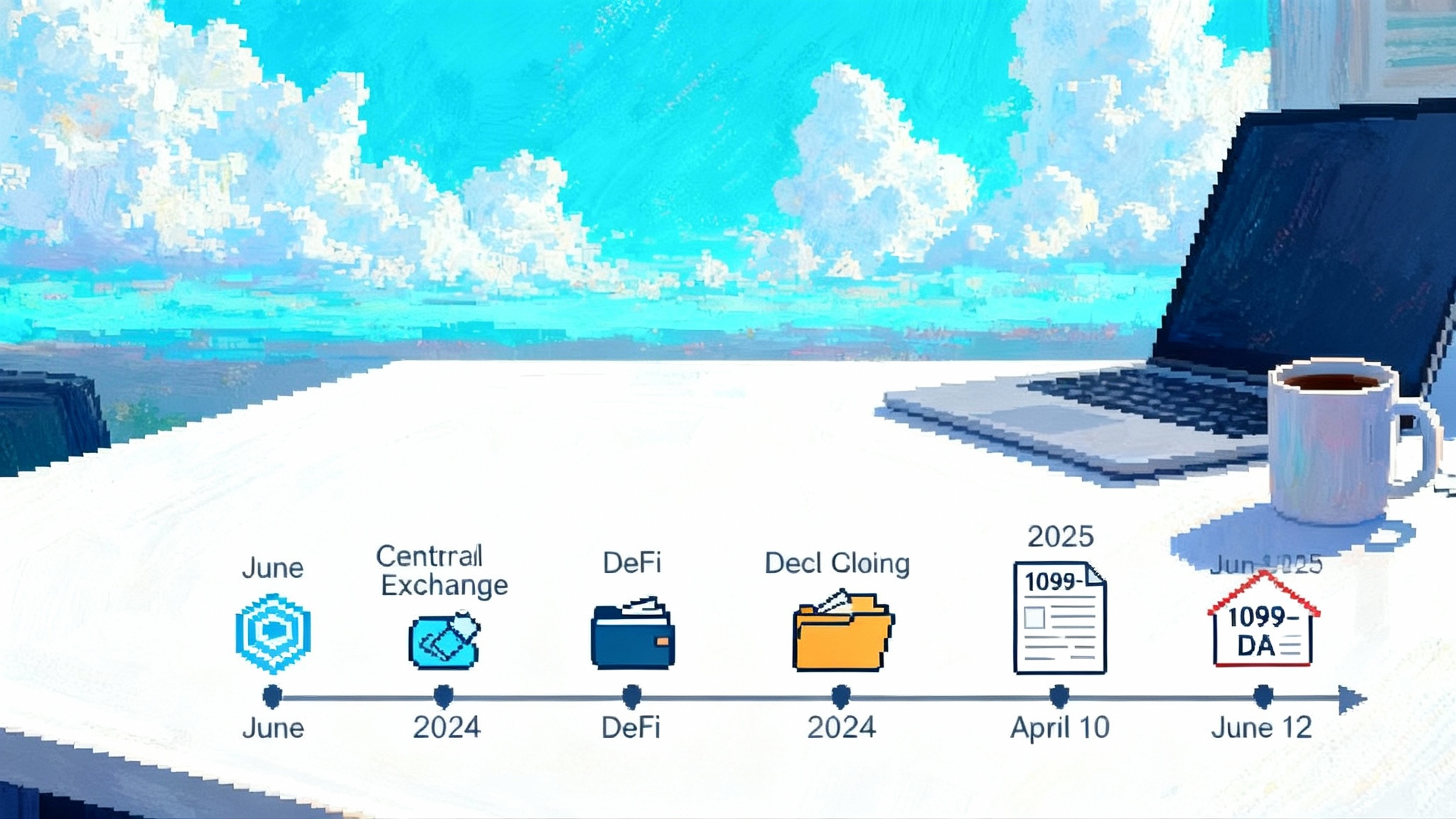

The two dates that reset crypto tax reporting

Two federal actions reshaped digital asset tax reporting for the next two filing seasons. First, Congress used the Congressional Review Act to nullify the IRS rule that would have treated many DeFi front ends as brokers. See H.J.Res. 25 became law on April 10, 2025. Second, on June 12, 2025 the IRS issued additional transition relief for Form 1099-DA, extending parts of the phase in for backup withholding and penalty relief. Review the agency summary at IRS transition relief on June 12, 2025.

If you run a U.S. exchange, wallet, marketplace, payment processor, or real estate closing desk that touches crypto, the headline is simple. Custodial brokers still start 1099-DA gross proceeds reporting for 2025 transactions. Basis reporting phases in for 2026 transactions. Noncustodial and DeFi platforms are temporarily out of scope because the DeFi broker rule was repealed. The IRS is expected to revisit noncustodial activity in a future rulemaking cycle, so teams should build compliance ready architecture now.

What changed and what did not

Here is the short version of a complicated story.

- DeFi front ends and other noncustodial intermediaries: Out of scope for now. The December 2024 DeFi broker rule was repealed, so noncustodial wallets, DEX interfaces, protocol developers, and certain aggregators are not treated as brokers under the disapproved rule.

- Custodial brokers: Still in scope. Final regulations require custodial platforms to report sales and exchanges on Form 1099-DA starting with transactions effected on or after January 1, 2025. That covers centralized exchanges, hosted wallet providers that can take possession, digital asset kiosks, and certain processors of digital asset payments.

- Basis reporting: Phased in. For 2026 transactions, brokers begin reporting adjusted basis and gain or loss on covered transactions. 2025 is gross proceeds only.

- Real estate closings using crypto: In scope beginning with closings on or after January 1, 2026. Real estate professionals treated as brokers must report the fair market value of digital assets paid by buyers and received by sellers when crypto is used to close.

- Aggregate and de minimis options: The final rules permit certain aggregate reporting for specific asset categories like stablecoins and NFTs, subject to thresholds and instructions. This is meant to reduce form proliferation for routine small dollar transactions.

- Transition relief: The IRS extended and modified relief so that brokers have more runway to implement backup withholding and to avoid penalties if they make good faith efforts.

What the April 10 repeal legally means

The CRA disapproval means the December 30, 2024 rule that would have treated many DeFi front ends as brokers has no force or effect. CRA also restricts an agency from issuing a new rule that is substantially the same without new statutory authorization. That does not freeze the landscape forever. Treasury and the IRS can still:

- Enforce the 2024 final regulations that apply to custodial brokers.

- Propose a different approach for noncustodial activity that is not substantially the same as the disapproved rule.

- Ask Congress for targeted legislation to address information gaps specific to noncustodial transactions.

For DeFi teams, this buys time but not certainty. Expect a narrower, more technically grounded analysis of who can realistically collect name, address, and TIN and what event should trigger reporting when there is no traditional intermediary. For broader policy context, see our explainer on GENIUS Act stablecoin rulemaking and the Tornado Cash privacy playbook.

The June 12 transition relief for 1099-DA

On June 12, 2025, the IRS issued additional transition relief for brokers subject to 1099-DA. The notice extends relief for backup withholding obligations and modifies penalties in limited circumstances, including a safe harbor when brokers use TIN Matching and when the value of withheld digital assets drops before conversion to cash.

Key takeaways:

- 2025 transactions: Brokers file 1099-DA for gross proceeds and, with good faith effort, may receive penalty relief for filing and furnishing errors. Backup withholding relief applies broadly for 2025.

- 2026 transactions: Basis reporting begins for covered transactions. Relief from backup withholding is extended in specific circumstances, including where TIN Matching confirms a valid TIN.

- 2027 focus: Additional limited relief and safe harbors apply, including treatment for value volatility when withheld assets are promptly liquidated and accommodations for certain customers not previously classified as U.S. persons.

A clear timeline for 2025 to 2027

- June 28, 2024: Final broker reporting regulations for custodial brokers issued. These require 1099-DA reporting of gross proceeds for 2025 transactions and set the staged rollout for basis reporting beginning in 2026.

- December 30, 2024: A separate final rule aimed at DeFi front ends and other noncustodial intermediaries is published.

- April 10, 2025: CRA disapproval of the DeFi broker rule becomes law. Noncustodial platforms revert to being out of scope under that rule.

- June 12, 2025: IRS issues additional transition relief for 1099-DA, expanding runway for backup withholding and penalty relief.

- 2025 calendar year: Custodial brokers collect data and report gross proceeds on 1099-DA. Users receive 1099-DA in early 2026 for 2025 activity.

- 2026 calendar year: Basis and gain or loss begin to be reported by brokers on covered transactions. Real estate closings that use crypto fall under broker reporting for closings on or after January 1, 2026.

- Through 2027: Selected backup withholding relief and safe harbors apply per IRS notices and instructions.

Who is affected

- Centralized exchanges and brokers that take possession of customer assets.

- Hosted wallet providers that can execute on behalf of customers.

- Payment processors that intermediate crypto payments for goods and services, often called PDAPs in the rules.

- Digital asset kiosks and certain OTC desks when they stand ready to effect sales for customers.

- Real estate closing professionals when crypto is used to close and they are in scope as brokers beginning in 2026.

- Not in scope for now: Noncustodial wallets, DEX front ends that do not take possession, protocol developers, and purely peer to peer interfaces without possession or control of customer assets.

For how market structure changes can cascade into liquidity and product access, see SEC fast-tracks crypto ETFs.

Operational steps for U.S. platforms for the 2026 filing season

2025 activity is reported in early 2026. If you operate a U.S. platform in scope as a broker, you should be doing the following now:

- Program 1099-DA for 2025 gross proceeds

- Map order flows to clearly identify when your platform stands ready to effect sales for a customer and takes possession of assets.

- Implement data extraction for transaction date, asset, quantity, gross proceeds, and counterparty type where relevant.

- Build robust validation and exception handling to achieve good faith compliance and eligibility for penalty relief.

- TIN collection and TIN Matching

- Refresh W-9 collection for U.S. customers and W-8 for non U.S. customers.

- Run TIN Matching to reduce B Notices and to qualify for specific backup withholding relief.

- Withholding playbook

- Document the backup withholding policy, including when not required under transition relief and when liquidation of withheld assets must be immediate. Ensure audit trails.

- Basis and lot tracking for 2026

- Decide the lot identification method your platform will support, and align customer disclosures with the final regulations and instructions.

- Capture transfer in data where feasible. Prepare for partial coverage where users self custody or transfer between platforms.

- Real estate closings readiness

- If you provide closing or escrow services, define your intake workflow for crypto closings, fair market value capture at closing, and reporting roles between agents and processors.

- Communications and support

- Prepare user education that sets expectations about 1099-DA for 2025 activity and basis reporting in 2026. Explain what you will and will not report and how users can reconcile.

What U.S. users should do this tax season

- Expect a new form. If you used a custodial exchange or payment processor in 2025, you should receive Form 1099-DA in early 2026 showing gross proceeds for disposals. Keep it with your tax records.

- Track basis now. Even though basis is not reported for 2025, you must still compute gain or loss on your return. Save trade confirmations, transfer records, and wallet history so that 2026 basis reporting does not surprise you with gaps.

- DeFi activity is still taxable. The CRA repeal does not change your tax obligations. If you swapped on a DEX or earned yield, that is still income when realized under existing law. You just may not receive a 1099 from the interface you used.

- Real estate with crypto. If you plan to buy or sell property with crypto in 2026, expect the closing to include information reporting and identity collection similar to other brokered transactions.

- Watch for backup withholding. If you do not provide a valid TIN, your platform may withhold a percentage of gross proceeds once relief phases out. Avoid surprises by furnishing a valid TIN and keeping your taxpayer status up to date.

Scenarios for the next rulemaking cycle

The agency has several options that do not recreate the disapproved DeFi rule.

- Narrow broker triggers for noncustodial contexts. Future proposals could focus on operators that both route orders and intermediate settlement with some possession or control. This would sidestep interfaces that only publish code or UI without touching funds.

- Transaction type focus. Rules could target specific events where a noncustodial actor actually effects a sale for a customer, for example through a hosted smart contract wallet with delegated control or a cross chain bridge that custodies interim assets.

- Third party attestation. The government could pilot voluntary data exchange or attestations that help taxpayers populate returns without imposing name and TIN collection on noncustodial software.

- Congressional action. Lawmakers could clarify broker scope for digital assets and direct the IRS to build a new regime tailored to on chain realities.

Market and builder implications

Compliance architecture for wallets and aggregators

With DeFi out of scope for now, teams have a window to design architectures that can support reporting if it returns in tailored form.

- Keep user keys client side. Favor designs where you never take possession of assets or the ability to move funds. That reduces broker risk today and tomorrow.

- Separate UI from execution. If your interface merely constructs transactions that users sign and broadcast, document that clearly. If you introduce relayers, paymasters, or smart wallets with upgrade authority, analyze whether you have crossed into possession or control.

- Build data portability. Offer exportable, standardized activity files that customers can plug into tax software. If the rules expand, these schemas become the backbone for compliant 1099 workflows without retrofitting your core.

- Prepare optional consent based reporting. Some users will want you to help them generate return ready data. Offer opt in reporting or read only integrations with tax vendors without collecting identity data platform wide.

Privacy preserving tax tools

The post repeal environment invites real innovation around tax with privacy.

- Client side computation. Compute gains and losses in the wallet using indexed market data, then produce a signed report that users can share without exposing full history.

- Zero knowledge attestations. Explore proofs that show a correct gain total or bracket without revealing addresses or counterparties. Pair this with auditor keys for dispute resolution.

- Selective disclosure. Use encrypted activity bundles where users can reveal only the portions a preparer needs. This reduces over sharing and aligns with the principle of data minimization.

- Stablecoin and NFT aggregation. Design tooling that can use the aggregation allowances in the rules to produce concise summaries that still reconcile to on chain activity. For payments design angles, see GENIUS Act stablecoin rulemaking.

Where teams domicile and raise capital

The repeal reduces near term regulatory risk for noncustodial builders and may pull some projects back to the United States. Capital allocators will still underwrite rulemaking risk, but the path looks more incremental and less existential.

- For U.S. teams, the opportunity is to show regulators what workable noncustodial reporting might look like through voluntary standards and privacy tech. This can build credibility and reduce the chance of blunt rules.

- For global teams, the U.S. remains attractive for enterprise partnerships that want clear tax reporting at the custodial layer. The 1099-DA framework provides that clarity for 2025 and 2026 while leaving room for DeFi to evolve.

Bottom line

- April 10, 2025 ended the DeFi broker rule under the CRA, so noncustodial interfaces are temporarily out of scope. Custodial brokers remain obligated to report, starting with gross proceeds for 2025 transactions and basis for many 2026 transactions.

- June 12, 2025 IRS guidance extended transition relief and clarified backup withholding and penalty relief contours.

- Exchanges, hosted wallets, PDAPs, kiosks, and real estate closers should finalize 1099-DA builds for 2025 and be ready for basis in 2026. Users should organize records now, expect a new form in early 2026, and remember DeFi activity remains taxable even without a 1099.

- The next rulemaking cycle will likely be narrower and more technical. Builders should use this window to harden compliance ready designs and privacy preserving tax tooling that can scale if rules expand later.