FTX’s September Payout: Mapping the Next Crypto Liquidity Wave

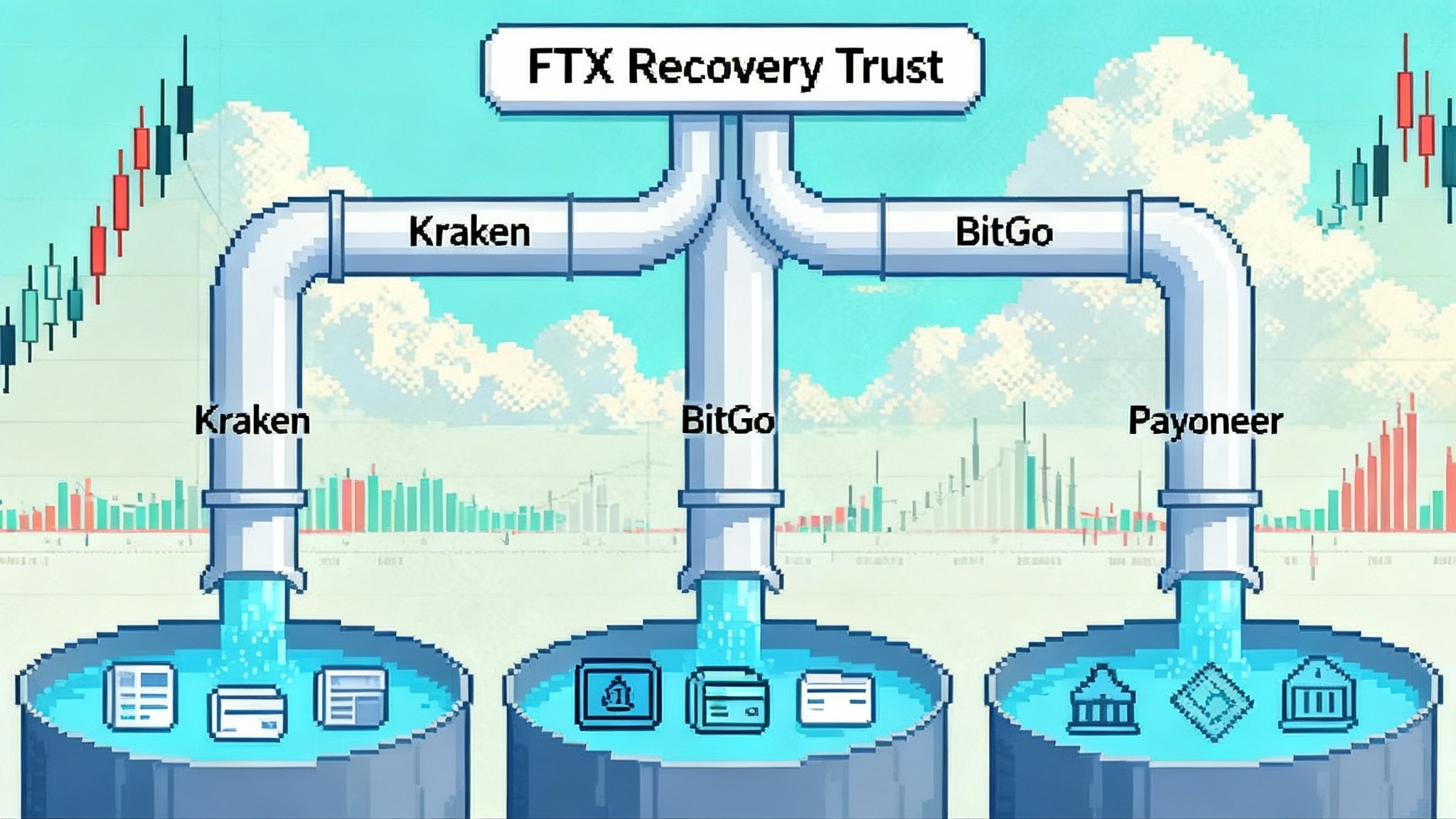

FTX’s third distribution on September 30, 2025 will release about $1.6 billion to creditors. Here is how that cash could travel from BitGo and Kraken into majors, L2s, Solana and TON, and what to watch across spot, perps, bridges, and DeFi yields in the days that follow.

What is being paid and when

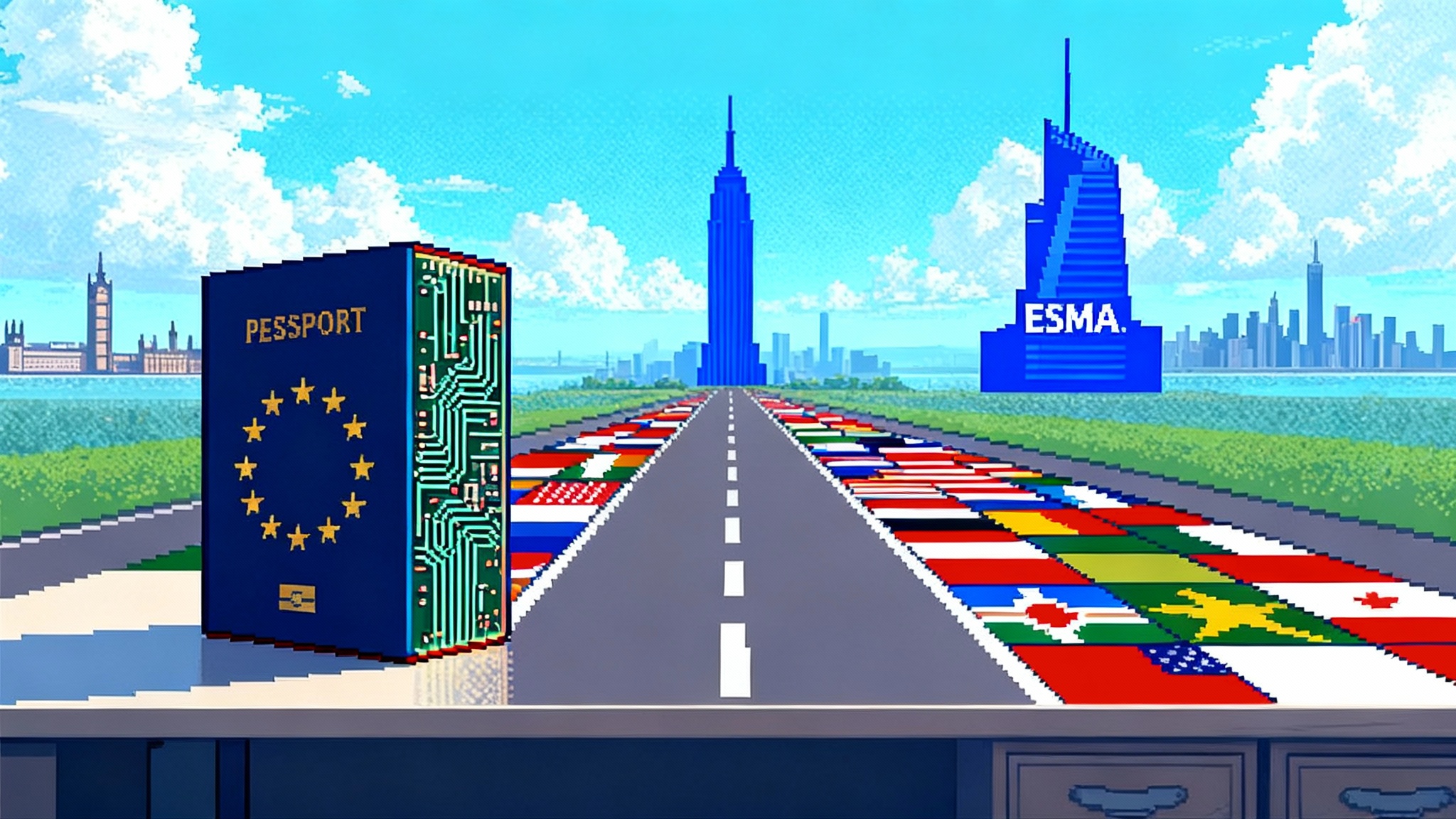

The FTX Recovery Trust has scheduled a third distribution for September 30, 2025 that allocates roughly $1.6 billion to eligible claimants who completed onboarding with BitGo, Kraken, or Payoneer. Payments are expected to reach recipients within 1 to 3 business days, which implies most credits should settle by October 1 to October 3, 2025. See the official details in the FTX Recovery Trust third distribution announcement. For broader context on creditor processes, review our guide to how creditor distributions typically flow.

How much could reach crypto rails

Not all $1.6 billion will immediately buy tokens. A practical split:

- Fiat-first creditors: withdraw through Payoneer or leave USD on Kraken to de-risk. A conservative 35 to 50 percent could remain in cash or money markets.

- Crypto-convenience creditors: those using BitGo or Kraken for direct asset access. A middle 30 to 45 percent may buy majors first, then rotate.

- Claim traders and funds: many already monetized prior distributions. About 15 to 25 percent may redeem to cash and wait for dislocations.

Blending those ranges, immediate inflows to crypto rails could land near 35 to 55 percent, or roughly $560 million to $880 million in the first 3 to 7 business days after September 30. The rest may trickle in as sentiment and narratives develop. For a primer on flow patterns, see understanding crypto liquidity cycles.

The likely flow path

- Distribution providers to centralized exchanges

- BitGo credits Go Accounts and in some jurisdictions USDC or USD, then recipients route to trading venues.

- Kraken balances sit one click from spot and perps, so depth can improve quickly with spillover via arbitrage.

- Payoneer users may wire into exchanges or fintechs before buying.

- Majors soak first flows

- Bitcoin and Ether are the default initial buys due to depth and low cognitive load.

- Basis and funding often react before spot trends fully develop, especially during the first 24 to 72 hours.

- Rotation to high beta

- When majors feel firm, flows rotate to top L1s and L2s. Solana often leads high beta, followed by Base, Arbitrum, and Optimism.

- TON has become a separate retail funnel. Telegram-native trading can accelerate memecoin cycles when new money arrives.

- Memecoins and microcaps last

- After majors and tier-one alts move, risk chases volatility. Cycles are shorter, so risk controls matter.

Market microstructure to prep for

- Spot liquidity: expect temporarily thicker books on Kraken and cross-venue arbitrage. Depth improves first, spreads tighten next, realized volatility may compress before rotation re-widens spreads.

- Perps and basis: spot buying hedged with perps compresses basis. Watch funding flip from negative to flat to positive across BTC and ETH, then a delayed echo in SOL and other majors.

- Exchange volumes: Kraken should show the earliest spike given its distribution role, followed by Binance, Coinbase, and Bybit through hedging and retail spillover.

- Stablecoin dynamics: while much of the distribution is fiat or USD balances, USDC and USDT transfers can surge if recipients bridge to L2s and Solana.

- DeFi yields: lending APYs can pop as stablecoins are deployed. LP fees on majors rise during the first 48 hours as volumes spike, with a second wave on L2s as users chase incentives. See our on-chain metrics playbook for validation tools.

On-chain metrics and labels to watch

-

CEX netflows and hot wallets

- Kraken deposit and hot wallet clusters on Ethereum and Bitcoin for step-ups in inflows that precede spot volume bursts.

- BitGo-labeled addresses moving USDC or USD outward from custody toward exchanges.

-

Stablecoin routing

- Large USDC and USDT transfers into exchange clusters on Ethereum and Tron.

- High-frequency transfer spikes are more telling than net mint or burn events this round.

-

Bridges and L2 gateways

- Canonical bridges for Arbitrum, Base, Optimism, and Polygon PoS for upticks in USDC and ETH within 24 to 72 hours after settlement.

- Wormhole routes into Solana and direct SOL withdrawals to fresh wallets.

-

TON rails

- TON bridge and exchange inflow labels for rising small to mid-sized deposits that signal Telegram-native momentum.

-

DEX and AMM activity

- Uniswap v3, Jupiter, Base-native DEXs, and Arbitrum perps AMMs for multi-hour fee and TVL surges.

-

Derivatives breadth

- Rising open interest on BTC, ETH, and SOL with flat or modestly positive funding is healthier than OI growth with rapidly spiking funding.

Flow timeline you can operationalize

- T0 to T+1 business day after September 30: Kraken spot depth improves, perps basis compresses, BitGo to CEX USDC transfers tick up. Price moves may be modest while spreads tighten.

- T+2 to T+3 business days: rotation starts. Solana and high beta majors catch stronger bids. Bridge volumes to Base and Arbitrum increase. Funding turns positive and open interest rises.

- T+4 to T+7 business days: memecoins on Solana and Base heat up if majors hold gains. DEX volumes and LP fees rise, borrow rates increase in stablecoin lending pools.

- T+14 onward: follow-through depends on macro and broader narratives. If majors stall, rotation usually unwinds first in memecoins, then tier-one alts.

A playbook for traders

- Prepare inventory and routes

- Pre-fund CEX and L2 accounts with stablecoins to avoid bridge bottlenecks.

- Map two or three venues per asset for slippage control. Use smart routes or split orders.

- Read the tape in this order

- Kraken spot depth and top-of-book spreads for BTC and ETH during US hours.

- USDC and USDT transfer spikes into exchange labels within 24 to 48 hours after settlement.

- BTC and ETH perps funding flips from negative to flat to positive, confirmed by open interest growth.

- Position with scenarios

- Base case: spot-led move in majors, basis compresses, then rotation into SOL and L2s. Lean long majors early with defined risk, rotate part of gains into high beta with staggered entries.

- Overheat case: funding spikes faster than OI. Fade stretched perps with small hedges or reduce risk and wait for pullbacks.

- Risk-off case: creditors sell into strength or macro shocks hit. Use TWAP exits and avoid illiquid tails. Keep dry powder for post-liquidation wicks.

- Risk controls

- Pre-define stops and invalidate quickly when funding overheats.

- Ladder exits ahead of obvious resistance. Do not chase late memecoin legs without a hard stop and size cap.

- Treat basis and cross-venue spread dislocations as reversible trades when direction is noisy.

A playbook for projects and protocols

- Centralized exchanges

- Coordinate with market makers to thicken books during the first 72 hours after inflows start. Align listings and campaigns with real deposit behavior.

- Consider low-friction fiat to stable promotions for newly credited users and reinforce security messaging to reduce phishing risk.

- L2s and appchains

- Pre-announce limited-time LP fee boosts or staking multipliers that begin 48 hours after settlement windows. Stagger incentives to avoid day-one mercenary flows.

- Surface easy on-ramps from Kraken and BitGo to your L2 through clear guides and prebuilt routes.

- DeFi protocols

- Lending: set caps and tune interest rate models for step-function increases in supply. Calibrate reserve factors to avoid runaway APY spikes.

- DEXs and perps AMMs: deepen top pairs and consider temporary fee tiers to balance volume with LP returns. Monitor impermanent loss and hedge inventories where possible.

- Risk management: validate oracle feeds and liquidation bots before volumes pick up. Stress-test keepers and RPC endpoints.

- Communications and safety

- Expect phishing waves around settlement windows. Publish safety checklists and coordinate verified channel warnings with distribution partners and exchanges.

How to validate that flows are real

- If the September 30 distribution is live, you should first see increased balances and activity at Kraken and BitGo, followed by recognizable USDC and USDT transfers into exchange deposit clusters.

- Funding and basis should corroborate spot depth improvements. If not, flows may still be parking in fiat or stables.

- Bridge inflows to Base and Arbitrum, plus SOL withdrawals from CEXs, confirm rotation. Rising DEX volumes and LP fees indicate on-chain engagement rather than simple CEX cycling.

Practical notes on distribution mechanics

Distribution partners shape the rails and latency. BitGo’s process includes Go Accounts and optional USDC rails in certain jurisdictions, which shortens the path to on-chain activity for some creditors while others remain in fiat first. Review specifics in the BitGo guide to FTX distributions.

What could go wrong

- Macro shock: a risk-off turn can keep creditors in cash or prompt selling into thin books.

- Overcrowding: everyone rotating the same way can create slippage and fast round trips. Use smaller sizes on tails and accept partial fills.

- Infrastructure strain: bridges and RPC endpoints can slow during bursts. Maintain backup routes and endpoint lists.

- Phishing: distribution windows attract impostors. Never connect wallets from unsolicited links and always verify domains.

Final checklist

- Before September 30: fund accounts on two CEXs and one L2, predefine majors and high beta watchlists, set alerts for exchange inflows, bridges, and perps funding.

- T+1 to T+3 business days: focus on majors and basis. If spot holds and funding behaves, scale into SOL and top L2 names.

- T+4 to T+7 business days: if DEX fees and L2 bridge volumes remain elevated, rotate selectively into momentum leaders and manage position size.

- Ongoing: take profits on spikes, recycle into safer carry, avoid illiquid tails when momentum fades.

The September distribution concentrates new buying power in a defined window. Prepare routes, watch the right labels, and let the tape confirm when cash becomes risk.