1099-DA arrives: 2025 crypto reporting reset after DeFi repeal

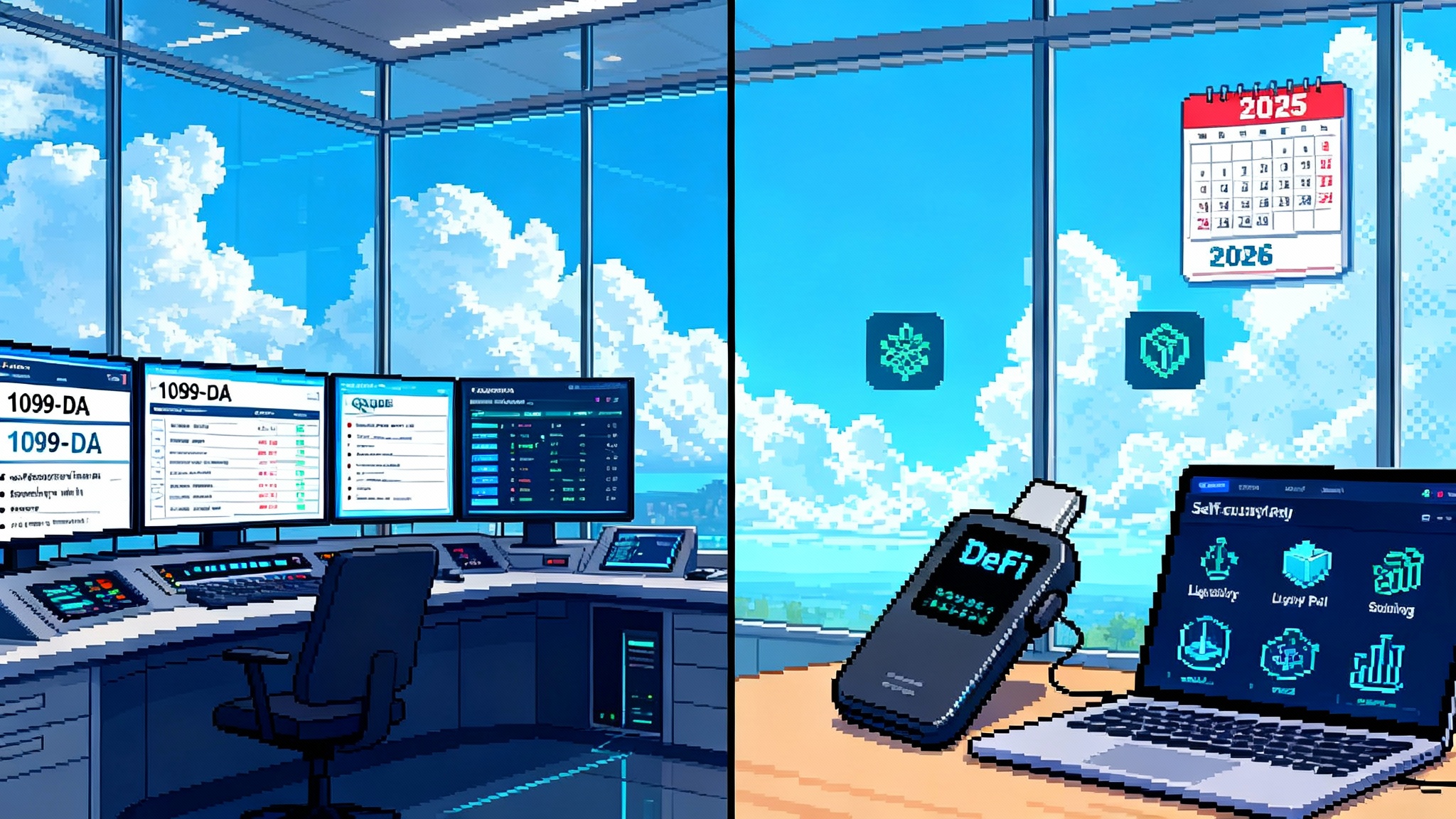

Custodial exchanges, hosted wallets, and payment processors are brokers in 2025. Expect 1099-DA for gross proceeds in early 2026, with basis reporting starting in 2026. DeFi front ends and self-custody remain outside broker rules after Congress repealed the late-2024 DeFi measure.

The short version

2025 is the reset year for U.S. crypto tax reporting. If you run a custodial exchange, a hosted wallet, or a payments platform that touches customer assets, you are now a broker for tax reporting. You must report customer gross proceeds on Form 1099-DA for 2025 transactions, then add basis and gain or loss for covered positions beginning with 2026 sales. Congress repealed the late 2024 DeFi broker measure in April 2025, which keeps decentralized platforms and pure self-custody outside the broker regime for now.

What changed on January 1, 2025

The IRS’s final framework for digital asset brokers took effect for transactions on or after January 1, 2025. In 2025, brokers report gross proceeds only. Beginning with 2026 sales, certain brokers also report cost basis and adjusted gain or loss for covered digital assets. The rules apply first to custodial actors that take possession of customer assets, including centralized exchanges, some hosted wallets, kiosks, and some payment processors. See the final IRS digital asset broker rules.

If you execute sales for customers in 2025, you will furnish Forms 1099-DA to customers in early 2026 and file on the standard information return calendar. Year one includes transitional relief if you make a good faith effort to file and furnish on time, including relief tied to backup withholding in 2025.

2026 is the basis year

Starting with sales on or after January 1, 2026, brokers must compute and report basis and related items for digital assets that qualify as covered securities. For noncovered assets, a broker may check the noncovered box and forgo basis reporting. The framework coordinates multiple broker situations to reduce duplicate reporting. Taxpayers may re-allocate unused basis wallet by wallet as of January 1, 2025, to align records with the new methodology.

What is carved out for now

Until the IRS issues additional guidance, brokers are not required to file 1099-DA for six categories common in DeFi and token infrastructure:

- Wrapping and unwrapping transactions

- Liquidity provider transactions

- Staking transactions

- Lending of digital assets

- Short sales of digital assets

- Notional principal contract transactions

Important note: this exception is about broker reporting, not taxability. Rewards or compensation from these activities can still be taxable to the user. For broader DeFi context, see DeFi after Tornado Cash.

Stablecoins, NFTs, and payment processors

The final rules add de minimis thresholds and an optional aggregate method to reduce noise for certain low-value flows:

- Qualifying stablecoin sales: optional annual threshold of 10,000 dollars per customer, with aggregate reporting above that level.

- Specified NFTs: optional annual threshold of 600 dollars per customer, with aggregate reporting above that level.

- Processors of digital asset payments (PDAPs): 600 dollar annual threshold per customer for PDAP sales, reported on a transactional basis above that level. The PDAP threshold does not stack with the stablecoin or NFT thresholds for the same flows.

For how stablecoin policy is evolving beyond tax reporting, read our look at the stablecoin shockwave and GENIUS Act.

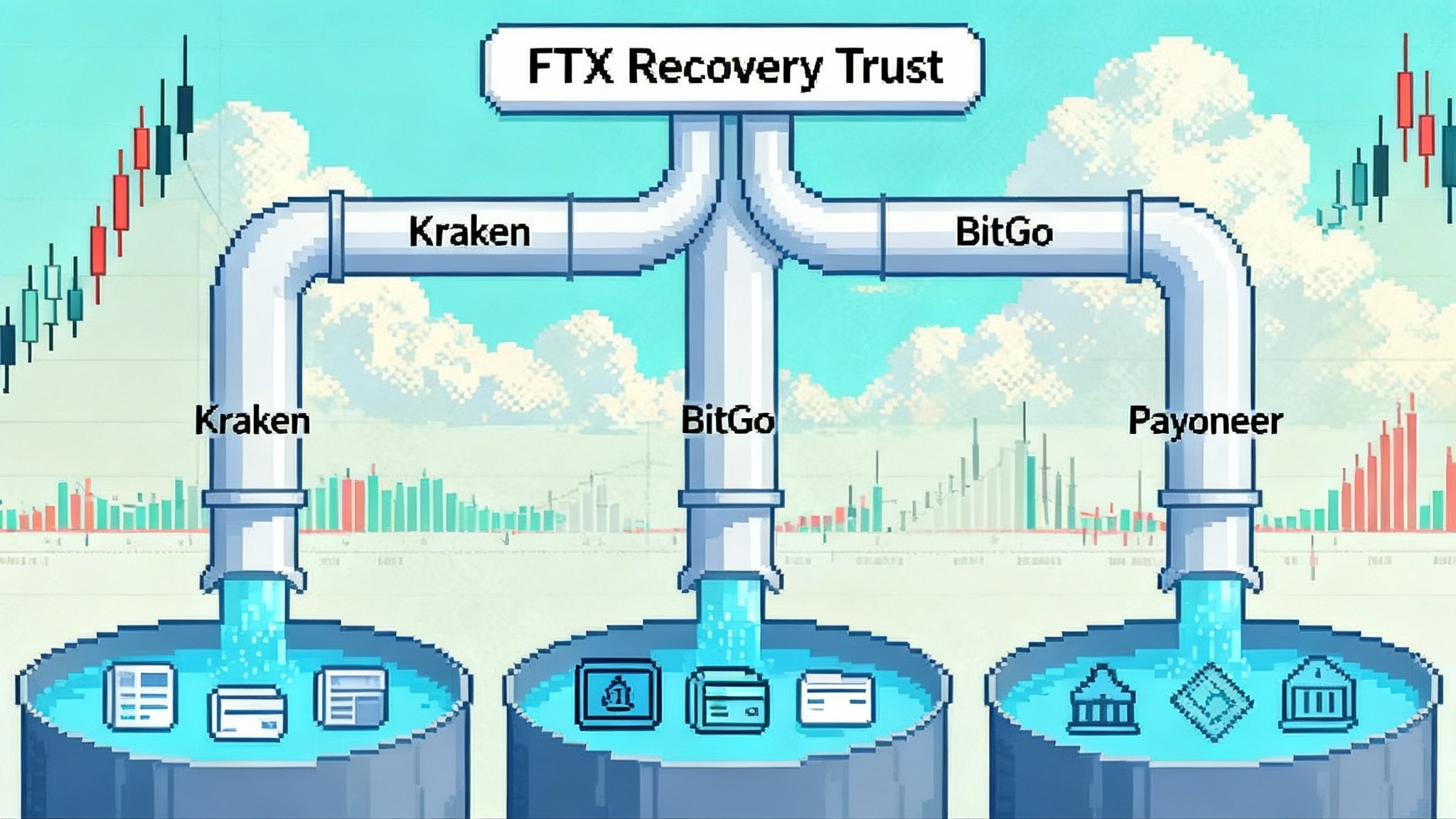

The April repeal that reshaped the map for DeFi

A late 2024 measure would have pulled some decentralized and non-custodial actors into the broker net by treating certain front ends and service providers as brokers. Congress nullified that rule under the Congressional Review Act. See how the Congress repealed the DeFi broker rule. In practical terms, decentralized exchanges and pure self-custody remain outside section 6045 broker reporting absent new legislation. This repeal does not change your obligation to report taxable income from DEX activity.

What this means for each business model

Centralized exchanges

- 2025 scope: report gross proceeds for customer sales executed on or after January 1, 2025. Furnish 1099-DA to U.S. customers in early 2026.

- 2026 basis: stand up covered security tracking and basis computation for sales on or after January 1, 2026. Plan for wallet-by-wallet specific ID and FIFO logic, transfer statements, and multiple-broker coordination.

- TIN and withholding: tighten W-9 collection, implement IRS TIN matching, and design fallbacks for non-matching cases as backup withholding relief phases out.

Operationally, reconcile inbound transfers to your cost basis engine, identify prior holding periods where possible, and produce customer-friendly tax lots. Clean ingestion of transfer statements will be critical.

Hosted wallets

If your hosted wallet effects a customer’s sale or exchange, you are a broker. If you only store assets without effecting dispositions, you may not trigger reporting. In practice, many consumer wallets have integrated swap or sell features through partners. Clarify which entity is the reporting broker, who controls KYC, and how transfer statements will pass cost data between the wallet and the execution venue.

Processors of digital asset payments

If you process merchant payments in digital assets and stand ready to convert a user’s coins to settle a purchase, you likely fall into the PDAP bucket. You will not report if a customer’s PDAP sales stay under 600 dollars for the year. Above that level, PDAP sales are reported transaction by transaction. For qualifying stablecoins used at checkout, the optional aggregate method can reduce the volume of forms. Avoid double-applying thresholds across categories.

U.S. traders and investors

- Expect a 1099-DA in early 2026 for any 2025 sales executed on custodial platforms.

- Basis reporting on forms expands for 2026 sales, but you remain responsible for accurate basis records now. Use the wallet-by-wallet approach from January 1, 2025.

- If you use DeFi, your wrapping, LP, and staking flows are not broker reported for now, yet rewards can be taxable. Keep your own ledger for on-chain activity.

A practical prep checklist

For centralized exchanges and custodial brokers

- Map in-scope products, including spot, convert, P2P desks that take possession, and white-label flows where you are the effecting broker.

- Lock a data model that supports transaction-level proceeds for 2025 and cost basis for 2026 covered securities, including fees and adjustments.

- Implement transfer statements that capture units, dates, and any basis metadata for assets moving into custody.

- Build the TIN pipeline. Collect W-9s, enable IRS TIN matching, and coordinate backup withholding logic for when relief ends.

- Decide on optional methods for stablecoins and NFTs. Document and communicate your approach.

- Prepare for January recipient statements, March IRS filing, and standard correction workflows.

For hosted wallets

- Clarify the broker of record in integrated swap flows and confirm data and 1099 responsibilities in your agreements.

- If you effect sales, mirror the exchange checklist, including transfer statements and basis handling.

For PDAPs

- Identify PDAP sales and separate them from exchange sales. Apply the 600 dollar PDAP threshold correctly and avoid double thresholds with stablecoins and NFTs.

- Consider the stablecoin aggregate option for qualifying stablecoins used at checkout.

- Coordinate merchant and buyer records so customer-level totals are accurate.

For U.S. traders

- Consolidate 2025 records now. Pull export files from each platform, tag self-custody addresses and DEX activity, and adopt wallet-by-wallet basis.

- Track transfers. When you move coins into a custodial platform, keep the acquisition history so your gain or loss is correct when you sell.

- Do not wait for forms. A 1099-DA is a starting point. You must still report all taxable events, including on-chain trades and rewards that do not generate a 1099-DA.

Market structure in 2025 to 2026

Two forces pull in opposite directions. Custodial brokers now have standardized reporting, which reduces tax-prep friction for mainstream users and may pull more retail trading and small business treasury activity into custodial venues. DeFi and self-custody remain outside the broker perimeter, which appeals to sophisticated users who prize sovereignty. For broader market shifts, see our crypto ETF playbook reset.

Expected shifts:

- Retail gravitates to custodial rails. Banked users who want clean paperwork will value accurate 1099-DA and cost basis, which should deepen fiat pairs and improve off-chain liquidity around filing season.

- DeFi retains strategy and tooling. With wrapping, LPing, and staking carved out of broker reporting for now, liquidity programs and yield strategies can continue without 1099 friction.

- Stablecoin commerce gets a clearer lane. The stablecoin aggregate method and PDAP threshold reduce noise for everyday spending, while taxable obligations remain with the user.

- Basis portability becomes a differentiator. Platforms that ingest and propagate transfer statements cleanly will win high-value users who move between wallets, CeFi, and DeFi.

Timelines to keep on your desk

- January 1, 2025: custodial brokers start reporting gross proceeds for sales executed on or after this date under the IRS framework noted above.

- Early 2026: first 1099-DA statements arrive for 2025 transactions.

- January 1, 2026: basis reporting begins for covered securities. Real estate reporters start reporting fair market value of digital assets used in closings on or after this date.

- April 10, 2025: Congress’s repeal left decentralized and non-custodial actors outside the broker regime unless new legislation is enacted.

Bottom line

For custodial platforms, 2025 is the year to get your pipes right. Treat gross proceeds reporting as your minimum viable product and use the relief window to nail TIN matching, transfer statements, and a basis engine that can scale in 2026. For payment processors, tune thresholds and aggregation choices so customers get useful forms without drowning in small-dollar noise. For traders, expect a 1099-DA next winter and build the habit of keeping wallet-level basis and transfer records. The DeFi repeal changes the competitive map but not your obligation to report income.