Unichain’s 200ms Flashblocks rewrite DeFi’s MEV playbook

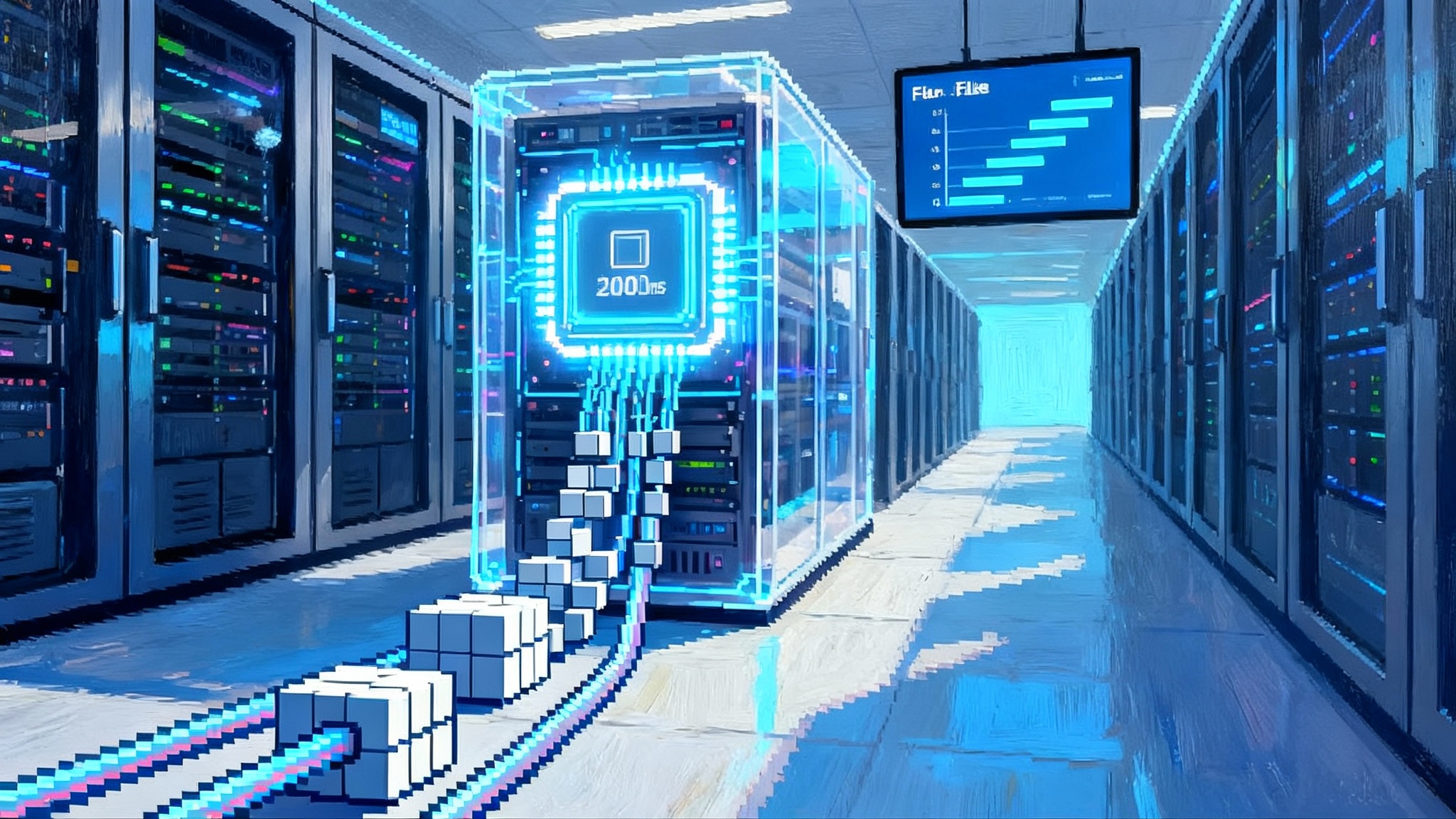

Uniswap’s Unichain has switched on 200 ms Flashblocks. By pairing fee-first ordering inside a trusted execution environment with an encrypted mempool, it promises near‑instant preconfirmations, less extractive MEV, and a cleaner trading experience. Here is what changes for traders, LPs, and builders.

The big idea: faster blocks, provable ordering, less extractive MEV

Unichain now streams preconfirmations every 200 milliseconds and enforces fee-first transaction ordering inside a trusted execution environment. The core details are in the Uniswap announcements for Unichain 200 ms sub-blocks and fee-first ordering inside TEEs. The headline: sub-second latency plus verifiable ordering and private orderflow.

What Flashblocks actually do, in plain English

- Sub-blocks every 200 ms. You no longer wait a full second for a block to form. The system streams incremental commitments that show where your transaction sits and signals acceptance almost instantly.

- Priority ordering inside a TEE. Transactions are sorted by priority fee using a fixed, public ruleset enforced in hardware. The design aims to prove the builder followed those rules.

- Private encrypted mempool. Orderflow is encrypted before it reaches the builder, reducing predatory strategies like sandwiching and minimizing information leakage.

- Revert protection. Apps that opt in can filter likely-to-fail transactions before execution, cutting wasted gas and freeing blockspace for real price discovery.

- Attestations on deck. Public attestation endpoints are expected to let anyone verify that blocks were built by a specific measured image running the promised rules.

Why sub-second confirmations change the MEV game

MEV spans timing, information, and priority. Flashblocks pressure each piece:

- Timing MEV. With only 200 ms between preconfirmations, fewer latency rounds fit, pushing searchers toward colocated, integrated strategies and away from slow public races.

- Information MEV. Encrypting mempool data curtails copycats and front-running based on publicly visible intent.

- Priority MEV. If you want different ordering, you pay more. That nudges value toward explicit fee markets that are easier to reason about and audit.

Net effect: MEV consolidates into lanes that either improve prices while winning on fees and speed, or share value back through protocol-aligned designs.

LP returns and the LVR angle

Liquidity providers suffer when prices move before they can rebalance. Flashblocks help at the margin:

- Faster feedback. Near-instant preconfirmations let active LPs and vaults update ranges or hedges sooner.

- Fewer failed probes. Revert protection removes spammy, reverting transactions, improving the signal-to-noise ratio of actual trades.

- Cleaner orderflow. An encrypted mempool lowers toxic fill frequency, reducing adverse selection risk for passive capital.

This does not guarantee higher LP returns. Inventory risk, fee tiers, pool design, and broader market structure still dominate outcomes.

Trader UX: what changes on screen

- Instant reassurance. Preconfirmations replace anxious multi-second pending states.

- Fewer failed charges. Once revert protection is widely adopted, user balances should see fewer failed debits.

- More predictable slippage. Fee-based ordering and private flow reduce surprise price jumps between click and inclusion.

- Minimal integration friction. Flashblocks ride standard JSON-RPC, so most wallets and apps need only small updates.

The trade-offs: trust, centralization, censorship risk

- TEE trust and attestations. You trust the enclave by verifying identity and code measurements. Public, reproducible images and stable attestation endpoints are essential.

- Builder centralization. A single TEE builder is a concentration of influence. Long term, multiple attested builders or rotations reduce single-operator risk.

- Censorship risk. Any choke point can censor. Encrypting flow and enforcing transparent priority ordering helps, but permissionless submission paths and independent watchers matter.

- Hardware risk. TEEs can be vulnerable. Fast image rotation, visible attestations, and clear incident response are required.

For a policy perspective on developer obligations when systems centralize choke points, see our take on developer liability after Tornado Cash.

How Unichain’s approach compares to other L2s

- Most L2s. Single sequencers, 1 to 2 second blocks, soft ordering norms, and public mempools by default. Some private relays exist, but few pair sub-second confirmations with attestable fee-first ordering.

- zk-rollups. Strong proofs of execution, yet similar pre-block ordering and mempool challenges unless they add encrypted orderflow and provable builder rules.

- Decentralized sequencing. Improves neutrality, but often trades off latency and does not alone solve orderflow privacy or provide attestable ordering.

What to watch next

- Attestation APIs and audits. Public endpoints that expose enclave measurements, signed outputs, and exact code hashes per block will let independent teams verify enforcement.

- Economic checks and incentives. A credible validator and watcher ecosystem can pressure-test the builder and accelerate economic finality.

- Ecosystem uptake. The benefits compound as aggregators, perps venues, lenders, and vaults react at sub-second speed. Watch how liquidity cycles compare with episodes like FTX payouts hit markets.

- Rule evolution. Priority-by-fee is simple. Over time, programmable ordering hooks or MEV-sharing could split backrun value with users and LPs, so long as rules remain provable.

Regulatory structure also shapes market plumbing. For broader context on standardized, rule-driven markets, see SEC generic crypto ETF rules.

Practical takeaways

- For traders. Set sane max priority fees, expect near-instant preconfirmations, and remember fast inclusion does not eliminate price risk.

- For LPs. Tune update cadence and hedging logic to react to preconfirmations, not just full blocks. Track how revert protection changes gas dynamics in your pools.

- For builders. Surface preconfirmation state in your UI, integrate via your RPC provider, and prepare to validate attestations as they become public. Consider user-aligned MEV capture now that ordering rules are enforceable.

The bottom line

Flashblocks turn latency and fairness into verifiable mechanics. With 200 ms sub-blocks, fee-based ordering enforced in hardware, an encrypted mempool, and revert protection, Unichain sets a new baseline for DeFi speed and integrity. The economics will evolve as searchers adapt, but the direction is clear: less hidden extraction, more explicit competition, and a better experience for normal users.