FTX Payouts Hit Markets: Liquidity, Flows, and Scenarios

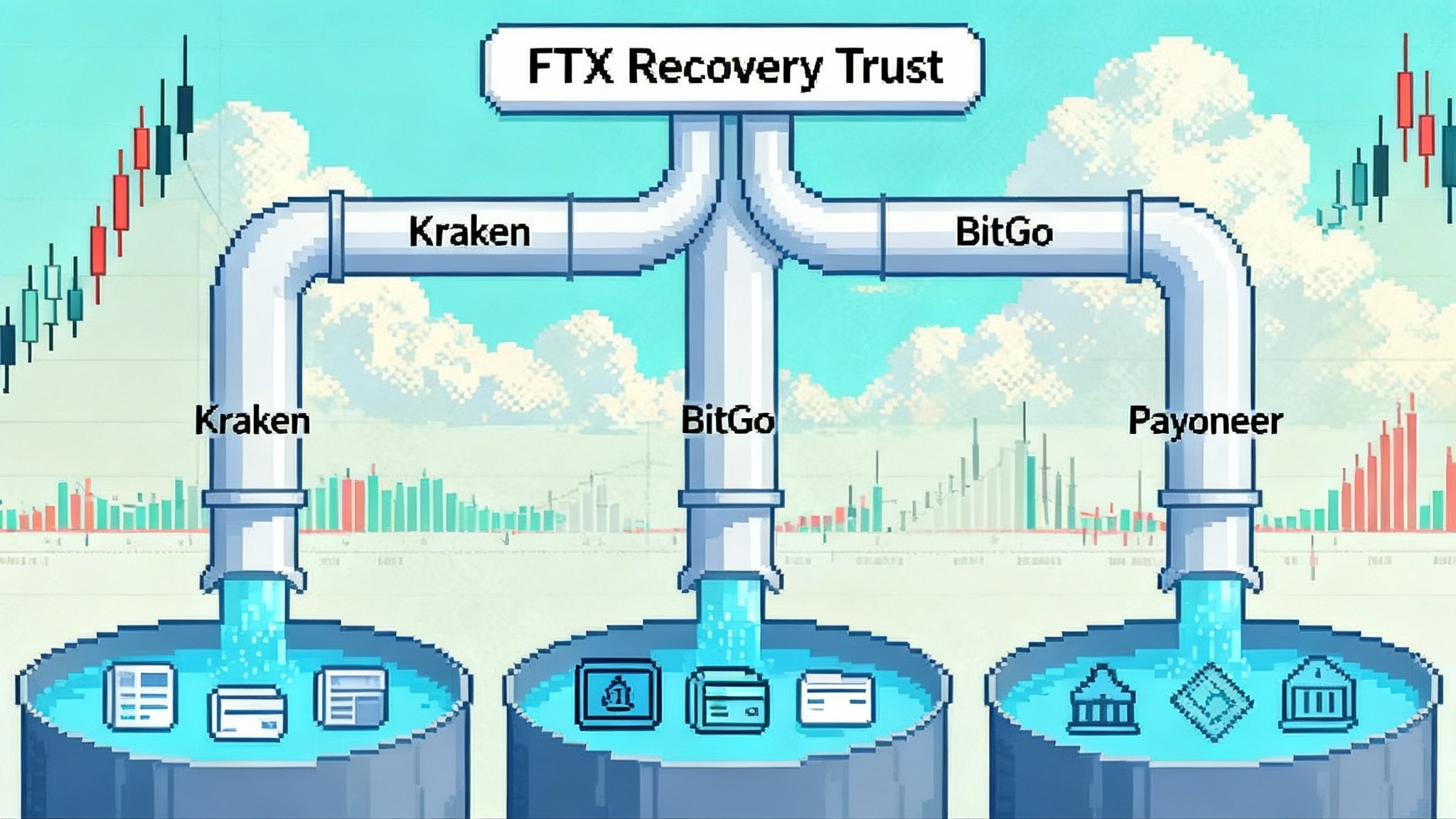

On September 30, the FTX Recovery Trust begins a roughly $1.6 billion distribution to creditors via Kraken, BitGo, and Payoneer. Here is how the cash may route, what to watch in spot and perps, and the scenarios that could shape basis and rotations.

What is happening on September 30 and why it matters

On September 30, the FTX Recovery Trust is scheduled to release about $1.6 billion to eligible creditors, with funds arriving within one to three business days through Kraken, BitGo, or Payoneer. The announcement details allocations by claim class, including an incremental 6 percent for dotcom customer claims and 40 percent for U.S. customer claims, and provides the operational timeline in the FTX third distribution notice.

Why this matters: synchronized cash landings of this size rarely occur in crypto. Even if staggered, a third distribution in under a year is large enough to tilt flows for several sessions. The question is not whether the market will feel it but where it will show up first. Context from earlier estate communications projected high recovery percentages and multiple waves of dollar distributions, as covered in the Reuters plan summary May 2024.

How the money moves: Kraken, BitGo, Payoneer

Think of three rails that begin at the same station and diverge into different liquidity neighborhoods. The distribution currency is cash, not a re-delivery of original tokens, so recipients must choose to re-risk.

- Kraken: Funds credited to exchange accounts sit next to order books. A portion will withdraw to banks, but a meaningful share is one click from BTC, ETH, SOL, and long-tail pairs. Expect a short, visible impulse in Kraken netflows and a faster price feedback loop because balances are already on-exchange.

- BitGo: Institutional custody with slower, lumpier routing. Recipients often push to OTC desks, prime brokers, or stage assets for later deployment. When flows do move, they tend to arrive in size to centralized exchanges or as block prints via OTC.

- Payoneer: Primarily a fiat off-ramp. Many creditors will direct dollars to bank accounts and expenses, muting near-term on-exchange flows. Some will later move dollars to brokerages or stablecoins, but the first-order effect is less visible on-chain.

Who is likely to do what

The creditor mix is not homogeneous.

- Original retail claimants: Two years removed from the collapse, many will prioritize cash needs. Expect higher cash-out shares, especially through Payoneer. Among retail on Kraken, anticipate a barbell: partial redeploy into majors and favored alts, while others withdraw to bank.

- Distressed claim buyers and funds: A large slice of claims changed hands. Funds that hedged crypto beta while awaiting USD recoveries may unwind those hedges, creating net buying as short basis trades are closed. Some will recycle distributions into liquid majors and basis trades.

- Corporate creditors and counterparties: OTC and custodial routes are common. Activity is scheduled and blocky. These flows often touch derivatives first as a hedge, then trickle into spot or structured products.

For how ETF plumbing can amplify flows around majors and select alts, see our explainer on SEC generic ETF rules.

Market microstructure: where the ripples show up first

- Exchange netflows: Look for a pickup in Kraken net deposits, first in USD or stablecoins, then in spot flows. If BitGo-linked wallets stage to exchanges, expect delayed inflows to multi-venue hot wallets. Payoneer flows are less visible.

- Perpetual funding: If recipients redeploy into longs, funding skews positive on high beta pairs within hours as spot buying leads and perps chase. If fear of sell pressure dominates, funding compresses or dips negative while basis widens from short hedges.

- Basis spreads: CME vs. offshore basis reveals which cohort is in control. A risk-on redeploy tightens basis after an initial pop. A sell-pressure scenario steepens contango briefly as shorts hedge spot inventory or buy protection.

- Altcoin rotations: BTC and ETH usually catch the first bid. If rotation turns risk-on, watch SOL, L2s, liquid staking names, and exchange tokens. Rotations often run 12 to 48 hours behind majors. If recipients lean conservative, alts lag and dominance rises. For a near-term catalyst map, see Solana ETF verdict in October.

- Order book depth and slippage: Kraken top-of-book depth is a live barometer. If depth fills quickly while price grinds higher, it signals TWAP-style accumulation. If depth disappears and price slips on medium clips, that argues for sell-first behavior.

A data-driven playbook to track the flows

You do not need perfect visibility to get good signals. Build a focused dashboard that updates every few hours.

- On-chain labels and staging

- Track labeled clusters for the estate and distribution providers where available. Focus on the secondary hop into exchange clusters or OTC wallets.

- Follow large USDC and USDT movements originating from BitGo custody into exchange hot wallets. Tag recurring sizes and time-of-day patterns.

- Exchange and OTC flow trackers

- Exchange netflow by venue with a special lens on Kraken. Separate stablecoin and USD rails from crypto deposits.

- OTC block prints and implied volumes from market data providers. Look for mismatches between on-exchange volumes and price moves that imply off-venue crosses.

- Perpetuals and basis

- Funding rates across majors and top alts on the big offshore venues. Record snapshots every four hours from T minus 3 days to T plus 5 days.

- Basis spreads: CME front month vs. spot, and offshore quarterly vs. spot. A rush to hedge widens basis. A shift to long spot tightens it.

- Liquidity and execution quality

- Top-of-book and 1 percent depth on key pairs. Note changes around U.S. banking hours and any exchange maintenance windows.

- Slippage on standardized clips. For example, compare price impact of a 1,000 BTC simulated market order versus a 100 BTC clip.

- Stablecoin supply and issuance

- Net issuance and treasury wallet movements for USDT and USDC. Fresh minting into exchanges suggests redeploy. Net redemptions hint at off-ramps. For the regulatory backdrop that can steer issuance, see our new stablecoin playbook.

- Sentiment and positioning

- Open interest changes vs. price and funding. OI up with flat price and rising funding is a classic FOMO signature. OI up with negative funding suggests short hedging into expected sells.

Timeline to watch

Use absolute dates to avoid confusion around bank holidays and settlement windows.

-

T minus 5 to 3 days (September 25 to 27):

- Survey funding and basis baselines. Record Kraken netflows and depth snapshots. Note any estate-related wallet staging that traders might front-run.

- Watch options skew for end-of-month. Elevated put skew can pre-hedge perceived sell pressure.

-

T minus 2 to 1 days (September 28 to 29):

- Expect narrative trading. If social chatter leans sell pressure, perps may pre-position short. Funding volatility increases. Basis can gap as hedges go on.

- Check stablecoin treasuries. A surprise wave of mints into Kraken could foreshadow redeploy.

-

Distribution day (September 30):

- Monitor Kraken USD and stablecoin balance changes intraday. Depth on BTC and ETH often tightens first. If you see immediate positive funding with price strength, rotation risk-on is in play.

- If funding compresses while spot volumes rise on the sell side, the scenario tilts to sell pressure. Track the first two hours of New York trading closely.

-

T plus 1 to 3 days (October 1 to 3):

- BitGo-related flows are more likely here. Look for blocky exchange inflows and short-lived price dislocations around those prints.

- Alt rotations, if they come, typically light up during this window. Watch SOL, liquid staking tokens, and exchange tokens for relative strength vs. BTC.

-

T plus 4 to 7 days (October 4 to 7):

- If redeploy dominated, funding normalizes but open interest remains elevated. Basis tightens. If sell pressure dominated, expect a mean reversion bounce once forced hedges unwind.

- Cross-check stablecoin redemptions. Elevated redemptions through T plus 5 suggest continued cash-out via fiat rails.

Scenario testing: what the tape could look like

Below are stylized paths, not predictions. The point is to know what to measure and when to change your mind.

- Sell-pressure shock

- Setup: A majority of recipients choose cash-out. Kraken sees early withdrawals and net selling from balances credited on day one. BitGo recipients route dollars off-exchange or hedge via short perps while executing OTC.

- Tape: Spot volumes rise with down-to-sideways price. Funding falls or flips negative on majors. Basis widens as hedges stack. Order book depth thins into sells. Stablecoin redemptions increase.

- Rotation: BTC dominance rises. Alts lag materially. High beta pairs show sharper drawdowns with weak bounces.

- What changes your mind: Funding stays positive despite weak price, and depth refills quickly. That points to buyers absorbing supply.

- Risk-on rotation

- Setup: Funds and claim buyers unwind hedges and redeploy into liquid majors and a basket of high beta names. Kraken balances turn into immediate spot buying. OTC desks print blocks that recycle into perps to maintain delta.

- Tape: Price up with moderate funding increase and tighter basis after a brief pop. Depth improves even as price rises. Exchange netflows are positive for 24 to 48 hours.

- Rotation: BTC and ETH lead, then SOL and L2s, then a selective alt season. Exchange tokens and liquid staking names see follow-through.

- What changes your mind: Funding spikes without spot follow-through and basis widens. That implies speculative longs without real cash backing.

- Mixed churn

- Setup: Retail cashes out, funds redeploy, corporates hedge. The net effect is noisy with offsetting flows.

- Tape: Funding whipsaws intraday. Basis pops and compresses quickly. Price ranges with higher realized volatility. Depth alternates between thin and thick as cohorts trade at different times.

- Rotation: Factor dispersion is high. Sectors rotate rapidly with no sustained leadership. Microcaps get ignored.

- What changes your mind: A decisive break in basis and a persistent funding skew in one direction.

Practical checklist for the desk

-

Before September 28:

- Prepare a lightweight dashboard: Kraken netflows, multi-venue funding, CME vs. spot basis, BTC and ETH depth, USDC and USDT treasury flows.

- Predefine thresholds that trigger action. Example: plus 400 million dollars net inflow to Kraken over 48 hours, or funding above 30 bps annualized on BTC for four consecutive prints.

-

September 30 morning New York:

- Watch the first hour after U.S. banking opens. That is when fiat availability and exchange activity often converge.

- If price rises with improving depth and neutral funding, lean toward risk-on rotation. If price stalls with negative funding and wider basis, lean toward sell-pressure shock.

-

October 1 to 3:

- Shift focus to BitGo-linked movements. Expect blockiness. Adjust execution to avoid crossing thin books during those bursts.

- Track alt relative strength vs. BTC on a 4-hour lookback to spot early rotations.

-

October 4 to 7:

- Reassess positioning as funding normalizes. If OI remains high and basis tight, risk has been added. If OI fades and basis stays wide, hedges remain and further chop is likely.

Risk management notes

- Liquidity is path dependent. A 1.6 billion dollar headline does not equal 1.6 billion dollars of immediate spot supply or demand. Routing choices and settlement windows matter.

- Beware of narrative reflexivity. If everyone expects sell pressure, the early trade can be to lean long as shorts crowd in. The reverse is true if rotation is the dominant expectation.

- Trust the tape. If your dashboard disagrees with the timeline above, follow the data rather than the story.

What comes after this tranche

The trust has indicated that subsequent record and payment dates will be announced in due course. Earlier communications established the pattern of multiple staged distributions as assets are monetized and claims become allowed. Treat each event like a scheduled macro print for crypto liquidity, especially given how ETF and stablecoin rails can transmit flows into majors and selective alts.

Bottom line

The late September payout is large enough to move microstructure for a few days. The rails channel behavior in predictable ways: Kraken flows fast, BitGo flows in blocks, Payoneer flows mostly off-exchange. The deciding factor is claimant intent and hedge unwinds. Build a dashboard, commit to thresholds, watch the tape, and be ready to switch scenarios quickly.