Saudi Awwal taps Chainlink. GCC banks race past US rails

Saudi Awwal Bank is plugging into Chainlink’s CCIP and CRE to run real onchain finance with audit-ready controls. That unlocks cross-chain DvP, tokenized sukuk servicing, and faster cross-border settlement — and it may let Gulf banks move faster than the United States.

The quiet pivot in Riyadh

Saudi Awwal Bank is not waiting for someone else to define bank‑grade tokenization. The lender says it will use Chainlink’s Cross‑Chain Interoperability Protocol and the Chainlink Runtime Environment to stand up onchain finance in the Kingdom, with an eye to real settlement and asset servicing rather than demos and decks. That single decision signals something bigger across the Gulf. GCC banks are about to build rails that look different from the United States, and they may move faster. SAB will adopt Chainlink CCIP and CRE, and that is the right hook to ask what comes next.

What CCIP and CRE actually do

Think of CCIP as a secure interconnect for value and messages between blockchains. It is not just a bridge to push tokens. It can deliver instructions alongside transfers, enforce rate limits, and connect private bank chains to public networks without leaking control. For banks, that means interbank and cross‑chain settlement becomes programmable. Payment versus payment can run between stablecoin networks or tokenized deposit systems. Delivery versus payment can coordinate a tokenized Treasury purchase against a cash leg on a different chain. The protocol’s defense‑in‑depth design and independent risk monitoring network are built to halt abnormal flows rather than hope someone presses a red button in time.

CRE sits one layer up. It is an execution environment to orchestrate these workflows with audit trails, role‑based access, and connectors to core banking, payment networks, and APIs. Developers write workflows that pull from external systems, compute with consensus, and write onchain with evidence. For a bank, that looks like a place to encode policy and operations. You can require approvals for specific workflows, log every state transition for internal audit, simulate before production, and run the exact same logic across testnets and mainnets. CCIP moves value and messages. CRE choreographs the business logic around them. This complements the institutional direction we outlined in the Nasdaq tokenized shares playbook.

Why GCC banks might leapfrog US incumbents

The Gulf has a few structural advantages for this specific shift. Large banks have centralized decision paths and national programs that reward delivery. Datacenter buildouts and cross‑border corridors are priorities, not side quests. When a bank like SAB can stand up an interoperability layer and a runtime with policy controls, it can test production‑grade flows with a handful of counterparties and scale by mandate once risks are addressed. In the US, similar programs often stall between legal, vendor risk, and coordination across many regulators and internal teams. That slows things down even when the tech is ready. For context on how US policy shapes rails, see our take on U.S. stablecoin politics and the SEC generic ETF rules.

GCC banks also have live use cases that map cleanly to tokenization rails. Sukuk distribution and servicing, export finance, and corporate treasury cash management all involve schedules, predictable events, and recurring reconciliations. Those are perfect for automated workflows with human checkpoints. The region’s cross‑border flows are concentrated across a known set of corridors, which reduces the combinatorial mess of global routing and compliance from day one.

The near‑term playbook: what this enables in 12 months

Here is what CCIP plus CRE can deliver within a year if banks lean in and supervisors set clear guardrails.

- Interbank settlement that spans chains

- Use case: high‑value transfers between banks where the sending bank funds a tokenized deposit on a private ledger and the receiving bank mints a liability on its own network. CCIP carries the message bundle with proofs, CRE enforces per‑transfer limits, approvers, and an automated reconciliation run that writes an immutable receipt.

- Outcome: cut settlement windows from end of day to minutes, reduce manual break handling, and expose a live queue with policy‑defined throttles.

- Cross‑chain DvP for tokenized Treasuries and sukuk

- Use case: the buy‑side holds cash on a permissioned network while a custodian registers a tokenized Treasury on a separate chain. CCIP sends the DvP instruction and sequenced events. CRE coordinates who can instruct, who can pause, and how to log finality proofs.

- Outcome: secondary settlement that feels T+instant in practice, with clear audit trails. Coupon payments and redemptions schedule as CRE jobs that run on time and broadcast onchain receipts to every required ledger.

- Trade and supply‑chain finance with real data hooks

- Use case: a bank funds invoices or LCs against tokenized collateral where shipping data and IoT attestations arrive via oracles. CCIP moves messages and value to the right chain. CRE enforces rules like concentration limits per buyer, automatic step‑downs on repayment, and trigger‑based pauses if data falls out of tolerance.

- Outcome: less fraud, faster turns, and clearer risk telemetry for credit.

- Corporate treasury and cross‑border cash

- Use case: a corporate maintains tokenized operating balances in the GCC and pays vendors or subsidiaries across regions. CCIP routes funds and instructions across approved networks. CRE provides a single policy surface for sanctions checks, travel rules, and per‑jurisdiction data capture.

- Outcome: cheaper cross‑border and programmable governance. Treasury teams see a single ledger of actions even if the rails are many.

- Tokenized fund distribution with controlled interoperability

- Use case: a bank distributes money‑market‑like products or sukuk funds to qualified investors. Subscriptions happen on one chain, fund tokens live on another. CCIP handles subscriptions and redemptions across networks, while CRE runs NAV updates and Proof of Reserve checks as scheduled tasks, posting verifiable records for compliance.

- Outcome: broader distribution without fragmenting record‑keeping.

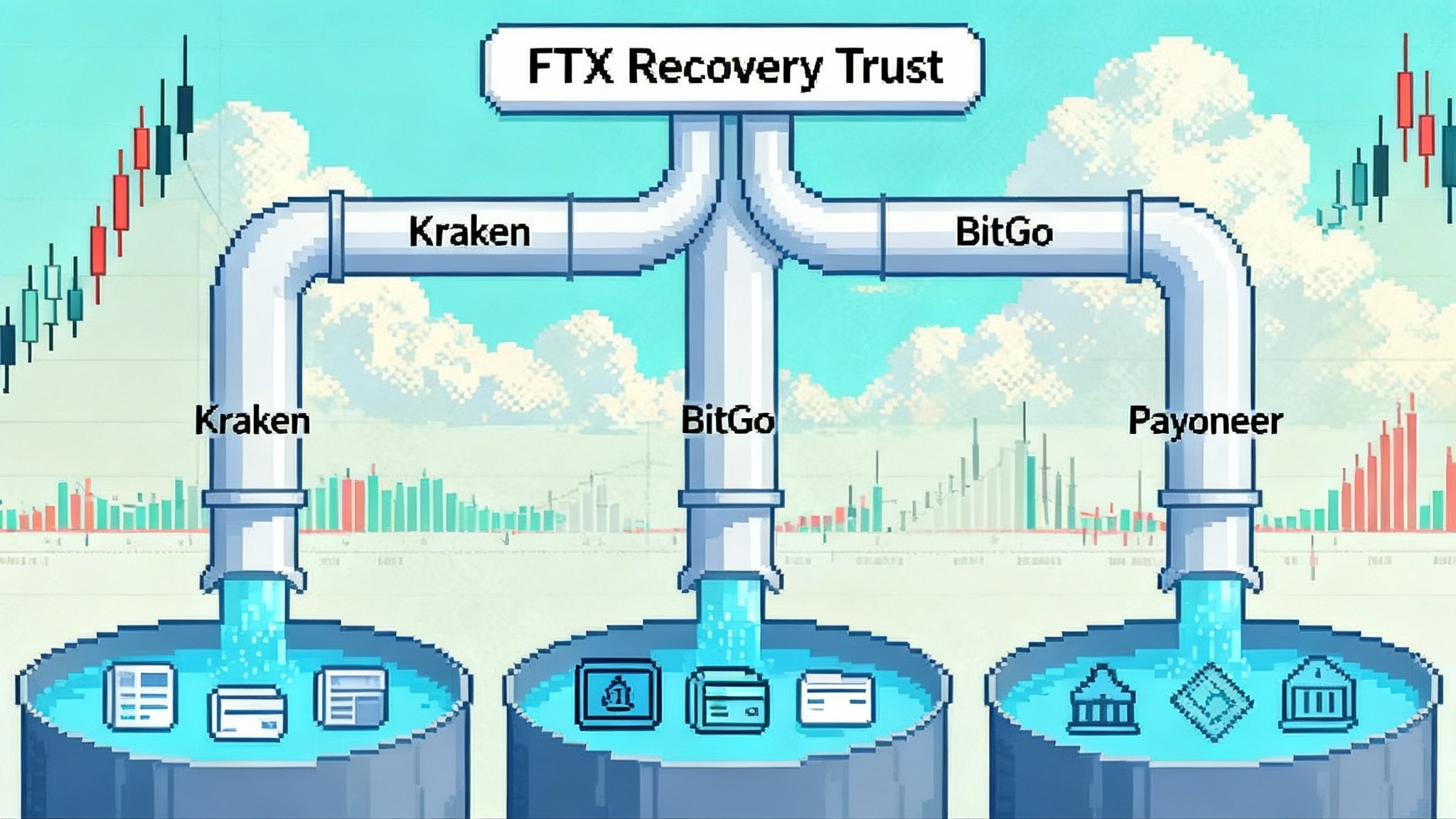

Why recent Chainlink assurances matter to banks

Banks do not adopt new infrastructure on faith. They buy controls and assurances. Chainlink’s ISO 27001 certification and SOC 2 Type 1 attestation, which cover CCIP and core oracle services, move this conversation from promise to audit. Those reports validate the existence and design of security controls across operations, development, and infrastructure. They also give vendor risk teams a shared language to work with. For a bank that wants to run regulated flows on CCIP and orchestrate them in CRE, these third‑party reviews are not nice to have. They are the price of entry. See the official note on Chainlink ISO 27001 and SOC 2 certifications.

Add the protocol‑level safeguards. CCIP uses independent risk monitoring to detect anomalies and apply an emergency stop. Rate limits and allowlists exist at the token pool and route level. Messages include metadata that policy engines can parse before execution. CRE, as the orchestrator, provides identity, role separation, and observability. That combination lets a bank prove to its supervisors that it can halt, roll forward, or reconcile with evidence if something goes wrong.

A reference architecture for SAB and peers

Picture a bank‑grade layout that teams can build now:

- Trusted perimeter: HSM‑backed keys, secure enclaves for workflow secrets, and a reviewed change‑management path for new connectors or policies.

- CRE orchestration: workflows as code, with human approvals on sensitive actions, separation between development, staging, and production, and an immutable log that internal audit can sample.

- CCIP connectivity: approved routes between specific chains, token pools with explicit rate limits, and policy checks on every incoming message before acting.

- Asset services: modules for coupon schedules, redemptions, consent management, and corporate actions. These jobs run on time, emit receipts, and checkpoint state onchain.

- Offchain systems: adapters for core banking, payment rails, and risk engines. CRE handles retries and backpressure so an outage does not create silent failures.

The point is not to replace everything at once. It is to plug this into one or two products where the bank controls both sides of the flow or can coordinate with a friendly counterparty. That puts risk inside a small box while delivering real wins for operations and clients.

How this could outpace the US

US banks are building too, but their adoption curve is shaped by cross‑institution coordination and regulatory ambiguity. The GCC can pick a limited set of corridors, establish policy gates, and move to production step by step. Once a bank proves cross‑chain DvP for a tokenized Treasury and cash on separate ledgers, the same pattern applies to sukuk coupons, custody transfers, and even syndicated loan allocations. The region’s supervisors can align on data capture and pause rights early. With that, every new bank joining the network benefits from the same playbook.

If the US wants to catch up, the unlock is not only more pilots. It is shared standards for interoperability controls, test plans that map to examiner expectations, and a short list of approved message routes that can scale. The tech is ready. The governance is the bottleneck.

Metrics that will tell us if this is real

Over the next four quarters, watch for:

- Production announcements that name specific counterparties, assets, and chains.

- First live DvP between banks in the region where cash and asset live on different ledgers, with finality times published.

- Tokenized sukuk servicing at scale, including coupon schedules that run without manual intervention and publish receipts to multiple chains.

- Cross‑border payment corridors that report cost per transaction and failure rates versus legacy.

- Supervisor guidance that formalizes pause rights, data retention, and node placement in the region.

If two or three of these land, the leapfrog claim moves from narrative to evidence.

The real risks and how to manage them

Vendor lock‑in

- Risk: building deep into a single interoperability stack can trap a bank. If fees, support, or control terms change, switching can be costly.

- Mitigation: treat CCIP as a pluggable component. Keep workflow logic in CRE or your own orchestration, and abstract message routing behind a bank‑owned interface. Maintain an exit plan that covers key rotation, route retirement, and data export. Use contract patterns that let you redeploy pools or adapters to an alternative route if needed.

Data residency and sovereignty

- Risk: data might cross borders or sit on nodes outside approved regions. Certain metadata could be personal or sensitive.

- Mitigation: push only what is required onchain. Keep PII out of messages, use tokenization or hashing for references, and enforce region‑pinned node sets where possible. Document node locations and failover plans. For audit data, store primary logs within the jurisdiction and anchor integrity proofs onchain.

Supervisory oversight

- Risk: regulators need visibility, pause rights, and predictable change windows. Without that, they will limit scope or require slow, manual processes.

- Mitigation: define a supervisory interface. Expose a dashboard with live metrics, queue state, and emergency controls with proper governance. Commit to change windows and preapproved test plans. Provide read‑only access to onchain receipts and offchain logs that tie to specific workflows.

Operational failure modes

- Risk: key compromise, misconfigured rate limits, chain reorgs, or downstream system outages can create funds at risk or reconciliation nightmares.

- Mitigation: HSMs and quorum approvals for key use, automated drift detection for config, and staged rollouts. Build circuit breakers that trip on anomalies. For reorgs, wait for policy‑defined finality and use CRE to reconcile if a message is rolled back. Test disaster recovery with real cutovers, not tabletop.

Ecosystem concentration

- Risk: too much volume on a small set of chains or a single oracle provider raises systemic risk.

- Mitigation: diversify routes where it matters, use separate pools for different asset classes, and cap exposure per network. Simulate failure of a route and prove that critical services can continue or wind down safely.

A pragmatic path forward for banks

- Pick one product where you control both legs or can co‑design with a partner. Tokenized Treasuries for corporate clients or a sukuk program with a friendly custodian are good starts.

- Stand up CRE workflows and get vendor risk done early using standardized assurance reports. Map controls to your policies so internal audit can test them.

- Configure CCIP routes with rate limits and allowlists. Keep routes narrow at first and expand only when monitors are boring.

- Publish receipts onchain for every action and maintain an external verifier that can recompute expected state. That simplifies reconciliation and supervision.

- Share metrics and playbooks with peers. Interoperability gains value as others adopt similar patterns.

Bottom line

SAB’s move is not a press‑release‑only moment. CCIP gives banks controlled reach across chains. CRE gives them a place to encode policy and operations with proofs. In the Gulf, where corridor‑level coordination is possible and product scopes are clear, that combination can move from pilot to production quickly. Over the next year, expect real DvP, tokenized sukuk servicing, and cross‑border payment flows to turn on. The risk is not that banks build onchain finance. It is that some banks do it with intention and controls while others wait and watch. The GCC looks ready to run.