GENIUS Act resets stablecoins: USDC vs Tether’s USAT

With the GENIUS Act now law and Treasury racing into rulemaking, the onchain dollar market is entering a new phase. We map the rule timeline, disclosures, and how USDC and Tether's USAT could reset exchanges, DeFi, and payments from 2025 to 2026.

The new rulebook for onchain dollars

A big reset is underway for digital dollars. On July 18, 2025, the GENIUS Act became U.S. law, creating the first federal framework for payment stablecoins. The law brings stablecoins into a defined perimeter with licensing, supervision, disclosures, redemption requirements, and enforcement. Three dates matter most: the enactment date on July 18, 2025; the rulemaking deadline by July 18, 2026; and the effective date that starts the earlier of 18 months after enactment or 120 days after final rules.

Treasury has already signaled speed. On September 18, 2025, it released an Advance Notice of Proposed Rulemaking to solicit comment on implementation details and compliance tooling. See the department’s call for input in Treasury ANPRM on GENIUS. These dates land on top of the 1099-DA reporting reset in 2025, which will change tax workflows for U.S. platforms.

Timeline and effective dates

- Rules must be finalized within one year of enactment, by July 18, 2026.

- The Act becomes effective the earlier of 120 days after final rules or 18 months after enactment.

- That sets a likely effective window in late 2026, roughly November 2026 to January 2027, depending on when final rules drop.

What changes on the ground

The law creates a category of permitted payment stablecoin issuers that can be either bank affiliated or federally supervised nonbanks. Smaller issuers can operate under a state regime until they cross a size threshold, then must transition to federal oversight. Across the board, issuers must hold one to one reserves in allowed assets like cash and very short U.S. government paper, maintain timely redemption, publish regular reserve disclosures with outside review, and submit to robust supervision. Misrepresenting insurance or guarantees is prohibited, with civil and potentially criminal penalties for violations.

How disclosures and redemption will look

The disclosure regime is built around transparency and speed:

- Reserve transparency: Monthly reserve breakdowns with third party examination and annual financials for the largest issuers.

- Plain language terms: Clear, easily understood redemption commitments at predictable par value.

- Operational resilience: Stronger incident response, wallet management, contingency funding, and auditable freeze and blacklist events.

For DeFi as well as exchanges, faster and more predictable redemptions tighten arbitrage bands and lower spreads.

The quiet fight over interest

Who keeps the yield on reserves is the next competitive front. The law does not mandate passing interest to holders, and direct retail interest could trigger other regulatory regimes. Expect issuers to compete indirectly with lower redemption fees, merchant rebates, partner credits, and programmatic cash back that avoids securities issues. Institutional clients may negotiate bespoke terms via segregated accounts. Protocols may highlight lower net costs if compliant issuers sponsor gas for redemptions or rebate a portion of reserve income to protocol treasuries.

Paths to becoming an issuer

GENIUS opens three main routes:

- Bank route: A subsidiary of an insured depository institution or credit union operates under bank supervision. Pros include payments access and brand trust; cons include heavier governance and exam cycles.

- Federal nonbank route: A purpose built federal license with national preemption of duplicative state licensing. Pros include a tailored charter; cons include demanding program design and ongoing supervision.

- State route with a cap: State level issuers can operate under a threshold if their state regime is substantially similar, with mandatory migration to federal oversight as they scale.

Foreign issuers can serve U.S. persons if they qualify under defined conditions, but intermediaries face new obligations to ensure U.S. users touch permitted coins over time.

USDC vs USAT: the rivalry that will reset liquidity

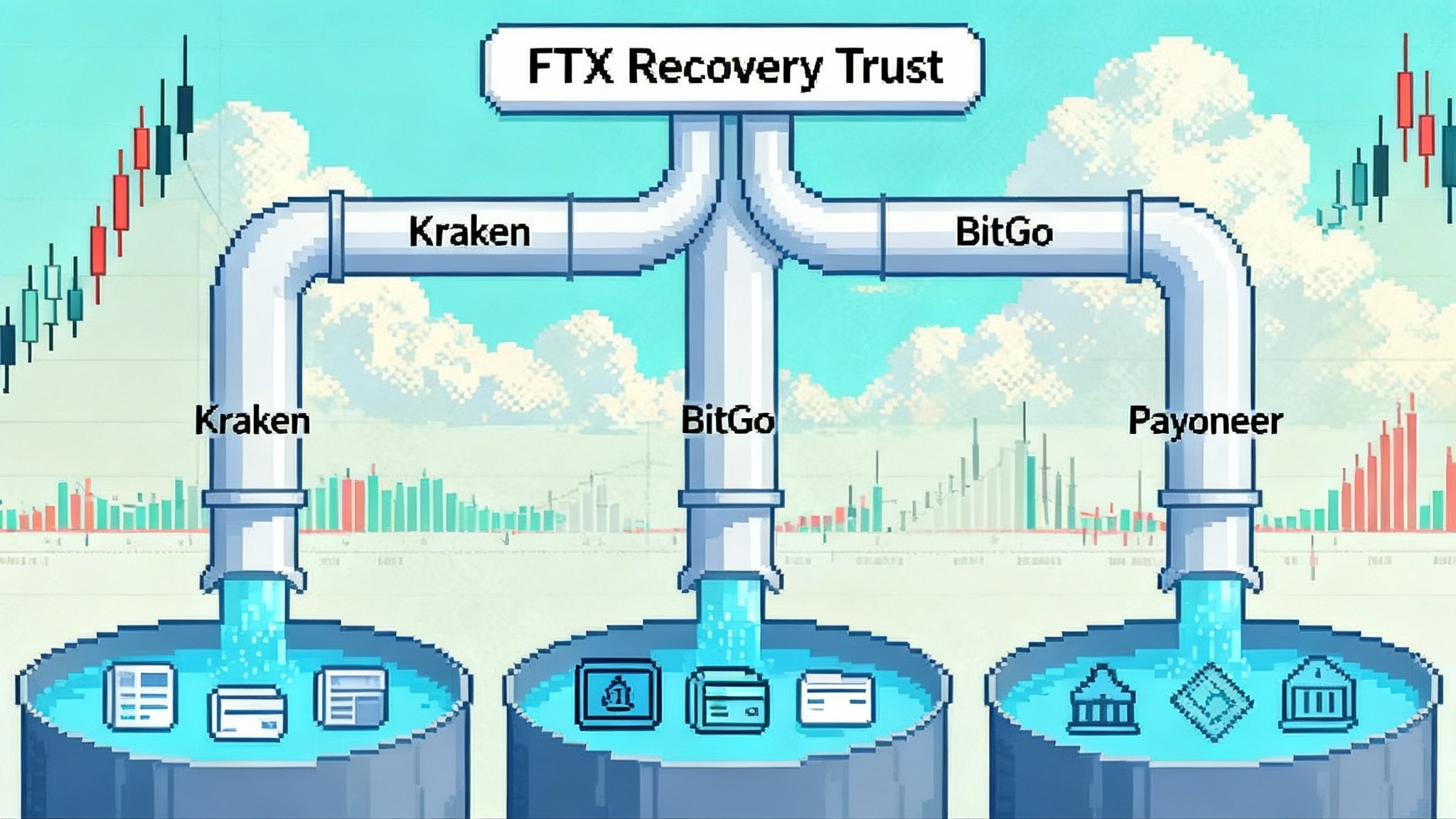

Circle’s USDC is the incumbent in the compliant corner, with extensive disclosures and deep distribution across U.S. exchanges, fintechs, and DeFi. Tether, issuer of USDT, is entering the U.S. ring with a domestically compliant dollar. On September 12, 2025, Tether said it will launch USAT for U.S. residents, with a federally regulated bank partner issuing the token and a large broker dealer managing reserves. See reporting in Reuters on Tether's USAT launch.

USAT is not a replacement for USDT. Think of it as a parallel product tuned for GENIUS compliance, with domestic issuance, U.S. supervisors in the loop, and a distribution strategy focused on onshore exchanges, U.S. fintechs, and dollar payments.

Centralized exchanges

- Listings and routing: U.S. exchanges will prioritize permitted dollars for default quote pairs. Expect USDC and USAT to be top tier, with some venues keeping USDT for non U.S. customers behind geofences.

- Fee wars: Exchanges may waive maker or taker fees on USAT pairs to seed depth, with Circle and partners countering for USDC pairs. The result is deeper books and tighter spreads.

- Treasury desks: Clean reserves and fast redemption will push exchanges to sweep onchain balances into cash or T bills more frequently, rewarding issuers that offer instant mint burn APIs and intraday settlement windows.

DeFi liquidity

- Pool migrations: Blue chip pools and money markets on Ethereum, Solana, and L2s will list USAT alongside USDC. With strong incentives, 10 to 20 percent of stablecoin TVL could rotate toward USAT by mid 2026, mainly from USDT and smaller tokens.

- Risk curves: Protocols that haircut USDT collateral today will offer USAT terms on par with USDC once disclosures and redemption service levels prove out, lifting borrow capacity and lowering funding costs.

- Compliance aware DeFi: Expect wallet overlays that check issuer freeze lists and sanctions screens, with machine readable event feeds. For context on liability contours, see developer liability after Tornado Cash.

Payments and fintech rails

- Merchant acquiring: Payment companies will prefer coins with clear redemption rights, transparent reserves, and reliable compliance APIs. USDC has a head start, but comparable USAT APIs and settlement guarantees will attract enterprise pilots.

- Neobanks and apps: U.S. consumer apps will standardize around one or two coins. If USAT delivers lower fees, higher uptime, or marketing support, it can win shelf space.

- Cross border corridors: USDT remains dominant in many remittance lanes, but U.S. licensed MSBs will route U.S. originated flows through permitted dollars to simplify audits and correspondent relationships, nudging volume onshore.

What this means for Treasury markets

If GENIUS accelerates stablecoin growth, reserves will lean on short dated U.S. government debt, creating steady incremental demand for bills and repo. That could smooth funding markets and give Treasury another durable buyer base. As stablecoin float grows, watch bill yields, the overnight reverse repo facility, and money market fund flows. A stronger base of bill demand could compress yields at the very short end and shift issuance mix.

Banks may feel deposit pressure if balances drift into onchain dollars, raising funding costs at the margin. The Act’s emphasis on bank affiliated options and tight supervision is designed to keep linkages to traditional finance safe.

Offshore to onshore migration

Over the next four quarters, onshore exchanges, broker dealers, and fintechs will prefer coins that fit squarely within the new perimeter. Offshore coins will not disappear, but U.S. volumes and liquidity will increasingly settle in permitted dollars.

For Tether, that suggests a two track approach: keep USDT as the global offshore rail while USAT serves U.S. platforms, fintechs, and institutions. For Circle, the play is to consolidate its lead with API reliability, chain parity, and deeper merchant and bank partnerships. Market structure shifts may rhyme with the SEC's generic ETF rules moment that broadened access on the securities side.

What builders should change now

- Compliance endpoints: Consume issuer feeds for freeze lists, sanctioned addresses, redemption windows, reserve attestations, and incident notices. Surface events to users and risk engines in real time.

- Identity layers: Build optional identity that can step up when needed. Support verifiable credentials, travel rule payloads, and sanctions screens at send time, with standardized schemas and audit trails.

- Redemption UX: Offer one click redemption to bank rails or money funds with clear fees and timing. If you custody, test intraday liquidity for large redemptions.

- Multi chain support: Treat chains as interchangeable transport. Normalize deposit flows and failure handling. Be ready to reroute traffic to higher uptime networks if issuers or regulators prefer certain chains.

- Fee and yield strategy: Model scenarios where issuers share less spread or regulators cap fee types. Explore merchant rebates, volume discounts, and network sponsored gas to keep economics attractive without paying explicit retail yield.

- Transparency surface: Provide a single screen showing coin, issuer, reserve composition, last attestation date, and redemption policy.

- Permitted coin routing: Automatically route U.S. users to permitted stablecoins and geofence others, with auditable logic.

A practical timeline for Q4 2025 through 2026

- Q4 2025: Treasury refines questions and drafts proposals. Issuers publish deeper reserve breakdowns and operational service levels. Tether rolls out USAT pilots with U.S. exchanges and payment partners. USDC counters with integrations and liquidity incentives.

- H1 2026: Agencies release proposed rules for comment. Exchanges make permitted dollars primary quote assets for U.S. order books. DeFi lists USAT pairs and aligns risk parameters with USDC. Merchants pilot refunds and payouts in both USDC and USAT.

- H2 2026: Final rules approach. Issuers lock redemption processes, standardize compliance APIs, and finalize incident response. Wallets ship identity and compliance upgrades. Liquidity splits stabilize, with USDT dominant offshore and USDC and USAT competing onshore.

What to watch next

- Treasury’s timeline: The speed of final rules will determine whether the effective date lands in late 2026 or early 2027.

- Reserve disclosures: Consistency and attestation quality will decide which coins earn blue chip status in DeFi collateral and money markets.

- Exchange policy shifts: When a major U.S. exchange makes USAT a default quote pair alongside USDC, liquidity migration will accelerate.

- Payments traction: The first Fortune 500 treasury team to run large scale refunds or supplier payouts in a permitted stablecoin will trigger fast follower behavior.

Bottom line

GENIUS pulls stablecoins into a predictable framework and gives U.S. agencies a clear mandate to move. USDC starts with a compliance brand and embedded distribution. USAT brings scale, market muscle, and a fresh regulatory wrapper. Expect tighter spreads, deeper books, and more reliable redemption across exchanges, DeFi, and payments. For builders, ship the compliance plumbing, tune routing for permitted coins, and design for redemption first. The onchain dollar is graduating from experiment to infrastructure, and the next year will set the defaults others follow.