The GENIUS Act will rewire stablecoins, DeFi, and payments

A builder and investor playbook for the next 6 to 18 months under the new U.S. stablecoin law. Deadlines, winners and losers, DeFi yield shifts, exchange liquidity changes, and a clear U.S. vs MiCA roadmap.

Why the GENIUS Act is a shockwave

On July 18, 2025 the United States enacted the first federal framework for payment stablecoins. The GENIUS Act defines who can issue dollar pegged tokens, what backs them, how they disclose reserves, and which regulators supervise them. It also sets the ground rules for how exchanges, wallets, and custodians can offer stablecoins to U.S. users. If you build or invest anywhere near crypto, this is the rulebook that will set the tempo for liquidity, yields, and on chain payments for years.

Here is the punchline in plain language. Only permitted issuers will be able to mint payment stablecoins for U.S. persons. Issuers must keep 1 to 1 reserves in cash or very short term Treasuries, publish monthly transparency reports, comply with the Bank Secrecy Act, and maintain technical capabilities to comply with lawful orders to freeze or burn tokens. The law carves payment stablecoins out of securities and commodities classifications and routes supervision to banking regulators. It also prohibits issuers from paying interest directly to holders. For the statutory architecture, read the Congress.gov summary of the GENIUS Act.

Taken together, the U.S. is treating payment stablecoins as narrow money instruments with bank grade supervision. That will change who can issue a token, which tokens exchanges can list, where DeFi gets its base yield, and how quickly dollars can move across borders on public rails.

The 6 to 18 month timeline that actually matters

Use these milestones to plan product roadmaps and portfolio risk:

- Now through October 2025: Treasury is running its public comment window on novel AML methods for digital assets. Expect early signals on how aggressively the government wants issuers and platforms to use on chain analytics and AI in monitoring programs.

- By July 18, 2026: Primary federal and state stablecoin regulators must issue implementing rules through notice and comment. Expect several waves of proposals before then. Issuer application templates and examination handbooks will likely drop in this window.

- Earliest effective date in practice: 120 days after final rules. If agencies hit the July 2026 deadline, the law’s core prohibitions on unlicensed issuance could bite as early as November 2026.

- Hard backstop effective date: January 18, 2027. Even if rulemaking slips, the issuer prohibitions switch on at 18 months from enactment.

- July 18, 2028: Digital asset service providers in the U.S. must stop offering stablecoins that are not issued by a permitted U.S. issuer or by a foreign issuer recognized as comparably regulated. This is the cliff for legacy tokens on U.S. venues.

The planning implication is simple. Issuers need to be application ready by mid 2026. Platforms need two migration plans: one for an early effective date if rules arrive on time, and one for the backstop in January 2027.

Likely winners and losers

Who gains market share and who faces headwinds under the new regime:

- Bank affiliated issuers: Clear regulatory runway. Subsidiaries of insured depository institutions will have a straightforward supervisory home. Expect regional banks to partner with fintech operators to combine distribution with compliance scale.

- Federal qualified nonbank issuers: Payments companies and large wallets can qualify as permitted issuers. Expect big consumer brands and retailers with closed loop payment ecosystems to explore private label dollars for rewards and settlement.

- State qualified issuers under 10 billion outstanding: Viable path for focused players and community bank consortiums. Growth will bump them toward federal oversight once they near the threshold, which encourages consolidation or partnerships.

- Legacy offshore or opaque issuers: If a coin cannot qualify as a permitted issuer or as a comparably regulated foreign issuer, U.S. platforms will need to delist it by July 2028. Liquidity will migrate earlier as market makers anticipate the cliff.

- Algorithmic or synthetic dollar tokens: If there is no legally obligated issuer redeeming at par, the instrument may sit outside the payment stablecoin definition. That avoids some constraints but also limits adoption by regulated intermediaries. Treasury and prudential rulemaking could still capture some wrappers through custody and transmission rules.

- Big Tech payment stacks: With clear guardrails, they can experiment with on chain settlement without taking securities risk. Watch for co branded bank partnerships to accelerate.

How regulated stablecoins will reset DeFi yields

Issuers cannot pay interest to token holders. But reserves will sit in Treasury bills and cash. That creates a new baseline dynamic on chain.

- The implicit base rate: Reserves earn T bill yields, but holders do not receive them directly. Expect two responses. First, issuers will compete on zero fees, instant redemption, and transparency rather than advertised APY. Second, protocols will build wrapped structures that route cash into tokenized T bill funds and return yield to depositors in a compliant manner. See our deep dive on DeFi liquidity for design patterns that fit this shift.

- From mercenary to anchored liquidity: Liquidity providers in stablecoin DEX pools historically chased incentive emissions. As regulated stablecoins become the dominant leg in pairs, base yields will converge toward short term rates plus a spread for inventory and peg risk. That compresses the long tail of gimmicky pools and rewards the deepest, safest venues.

- Safer cash like leg for on chain credit: Protocols that collateralize with permitted stablecoins will enjoy lower haircuts and tighter risk parameters. Expect more undercollateralized credit experiments for KYC’d counterparties, built on a stablecoin cash leg plus tokenized T bill collateral.

- Yield stratification: A two tier market will emerge. Tier one holds permitted stablecoins and tokenized government money market assets. Tier two holds everything else. The spread between tiers will reflect regulatory portability more than smart contract risk alone.

Exchange liquidity and market structure

- Base pairs reorganize: U.S. venues will pivot base markets toward permitted stablecoins. Offshore coins will see spreads widen and order books thin as the 2028 deadline approaches. Market makers will gradually shift inventory to avoid last minute migrations.

- Collateral eligibility: Non permitted stablecoins will face limitations in broker dealer and derivatives contexts. That pushes prime brokers and clearing members to standardize on permitted cash collateral for margin.

- Corporate treasury on chain: With clear rules, more U.S. corporates will hold small operational balances in permitted stablecoins for 24 by 7 settlement. Expect treasury portals to integrate with tokenized T bill funds to sweep idle balances daily. For implementation ideas, start with our guide to tokenized Treasuries.

Tokenized Treasuries become the new reference asset

Stablecoin reserves already prime the pump for government money market demand. Under the Act, the combination of 1 to 1 backing, monthly disclosures, and bank grade supervision will push a growing share of on chain savings into short duration Treasuries. Three knock on effects matter:

- The cash ladder comes on chain: Wallets will offer automated allocation between a payments balance in a permitted stablecoin and a yield balance in tokenized T bills. Users will move between the two in one click, with the transfer settled on chain and records suitable for accounting.

- Safer repo and credit primitives: Tokenized T bills will increasingly serve as collateral for on chain repo and credit lines. Risk engines can haircut tokenized bills with observable market prices and daylight redemption mechanics.

- Basis trades tighten: As more participants can hold permitted stablecoins, the basis between cash leg and tokenized T bill funds should compress. Yield will flow to those who provide intraday liquidity and settlement finality, not to opaque maturity transformation.

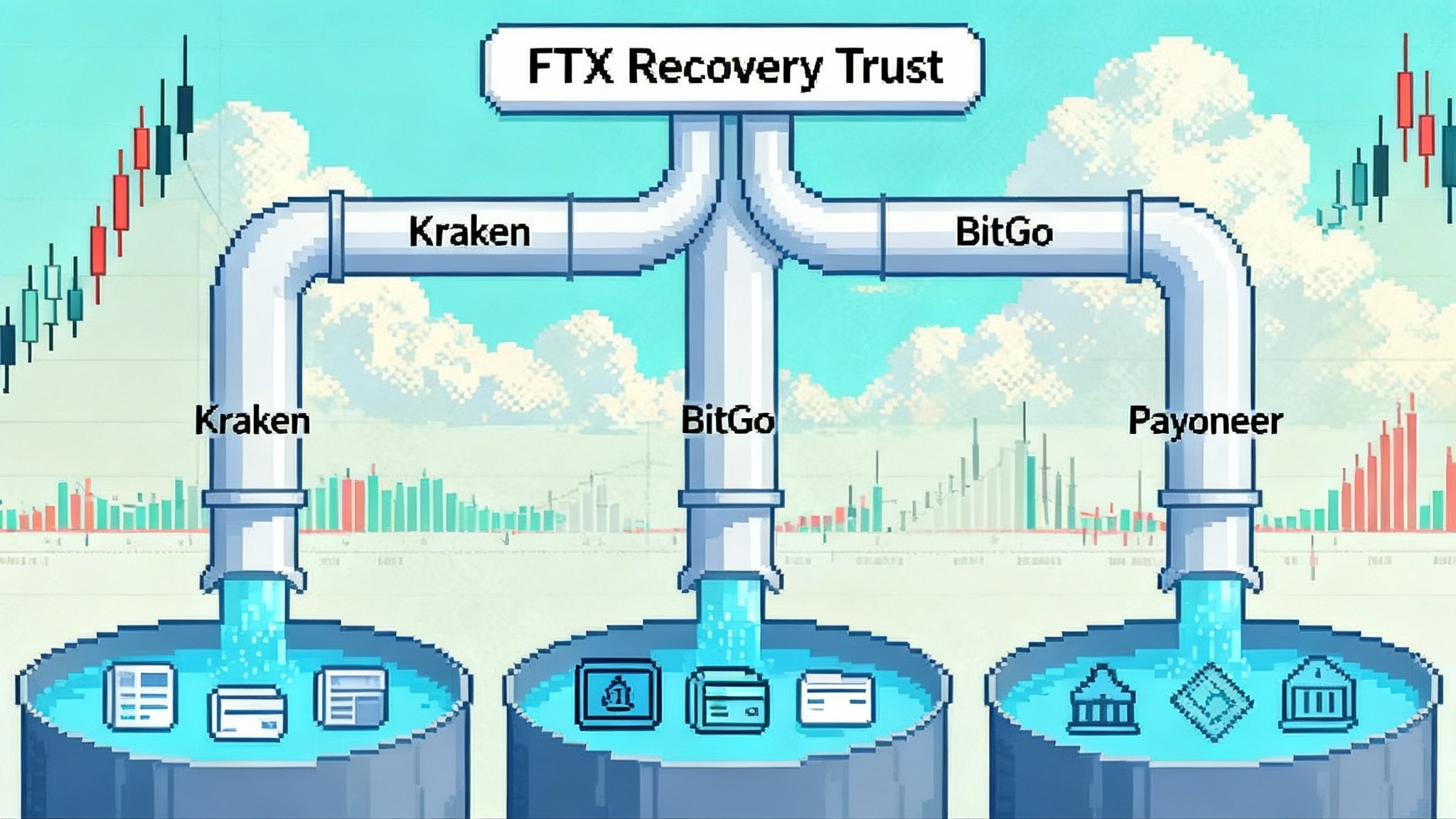

Cross border rails and on and off ramps

The Act allows foreign issuers to serve U.S. users if Treasury deems their regimes comparable. That opens a channel for high quality non U.S. issuers to interoperate with American platforms without full re incorporation. It also creates clear incentives for partners in Latin America, Africa, and Asia to route dollar flows through permitted coins for faster settlement and better bank connectivity. Expect:

- Improved banking access: U.S. banks will be more comfortable offering accounts and payment services to compliant issuers and to platforms that restrict themselves to permitted coins.

- Cheaper corridors: Merchant acquirers and payroll platforms will leverage stablecoin rails for weekend settlement, then sweep balances back to bank accounts at the start of business. The ability to freeze or comply with lawful orders lowers perceived sanctions risk for banks.

- More selective listings offshore: Even non U.S. exchanges will court U.S. market makers and institutional flow by prioritizing permitted coins and comparably regulated foreign coins.

U.S. GENIUS vs MiCA: what really differs

Builders working across the Atlantic need to internalize the practical contrasts.

- Issuer categories: The U.S. permits bank subsidiaries, federal qualified nonbanks, and state qualified issuers below a size threshold. The EU splits tokens into e money tokens and asset referenced tokens, with e money tokens tied one to one to a single official currency and issued by credit institutions or electronic money institutions.

- Interest to holders: The U.S. bars issuers from paying interest on payment stablecoins. MiCA goes further by prohibiting interest both for issuers and for crypto asset service providers on e money tokens, and it applies a similar prohibition to asset referenced tokens. See the MiCA consolidated text.

- Usage caps: MiCA can force an issuer of an asset referenced token used widely as a means of exchange to halt issuance if daily transactions and value exceed set thresholds within a currency area. The U.S. has no comparable usage cap but relies on prudential supervision and disclosure.

- Securities treatment: GENIUS clarifies that payment stablecoins under the framework are not securities. Under MiCA, qualifying tokens live outside MiFID securities but inside a bespoke regime with its own white papers, governance, and custody rules.

- DeFi touchpoints: The U.S. framework explicitly targets intermediaries that hold customer assets or act on their behalf. Immutable, self custodial software interfaces are not treated as digital asset service providers. MiCA regulates crypto asset service providers broadly and requires authorization for custody, trading, and exchange services; code alone without a service provider remains outside scope but gray areas persist where teams run front ends and operations. For product planning across regions, use our MiCA vs U.S. crypto rules primer.

- Cross border access: GENIUS creates a comparability path for foreign issuers to access U.S. platforms. MiCA enables EU passporting once an issuer is authorized, but stablecoin usage caps and euro area monetary concerns can limit non euro tokens in payments.

A practical checklist to capture growth

For wallets

- Map supported stablecoins into three buckets: permitted U.S. issuers, likely permitted foreign issuers, everything else. Start steering new users to bucket one with clear disclosures.

- Build a two balance UX: one payment balance in a permitted stablecoin, one savings balance in tokenized T bill products. Automate daily sweeps with user consent and clear tax and statement exports.

- Add real time reserve signals: Ingest issuer disclosures and attestations programmatically. Flag anomalies in the UI and pause inbound transfers if an issuer goes offside.

- Implement freeze messaging and routing: If an issuer freezes a token by legal order, show users the status and a guided path to support. Publish a transparency report on how freezes are surfaced.

For exchanges and brokerages

- Create a permitted only market tier: Quote all majors against at least one permitted stablecoin. Begin quietly tightening tick sizes and incentives on legacy pairs to nudge migration.

- Prepare collateral policy changes: By early 2027 assume only permitted stablecoins will qualify as cash collateral for margin. Simulate impacts on liquidation waterfalls and risk limits.

- Build comparability logic: If Treasury designates specific foreign regimes as comparable, enable listings with geofencing and disclosure presets. Keep a playbook ready for rapid listing once designations land.

- Treasury integration: Offer corporate customers automated sweeps between spot stablecoin balances and short duration government money market funds or tokenized T bill vehicles with proper disclosures.

For DeFi protocols

- Add issuer aware risk parameters: Treat permitted stablecoins as a separate asset class with lower haircuts and deeper oracle coverage. Distinguish by issuer, not just by ticker.

- Prepare for whitelist bridges: If you interact with custodial bridges, design opt in allowlists and sanctions checks without collecting unnecessary user data. Document how immutable contracts meet the law’s intermediary definitions.

- Yield design: Expect lower nominal yields on stablecoin pools. Focus on strategies that monetize order flow, payment routing, and intraday liquidity rather than promising headline APY.

- Composability with tokenized T bills: Treat these as the new base layer for conservative strategies. Build native redemption paths and settlement guarantees into contracts.

For issuers and treasurers

- Application readiness by mid 2026: Have compliance manuals, reserve policies, custodian agreements, and technology controls audit ready. Expect a 120 day decision clock after submission once rules finalize.

- Reserve operations: Lock in short duration Treasury access through multiple counterparties to avoid concentration risk. Automate public reserve reports and provide machine readable feeds.

- Incident response: Build the legal, compliance, and engineering hooks to freeze, seize, or burn on lawful order. Publish a playbook that balances user transparency and legal obligations.

- Communications: Shift marketing away from yield. Compete on redemption speed, uptime, and transparency. Educate users on how savings products are separate from the stablecoin itself.

What to build next

- A permitted cash rail for everything: Payroll, receivables, and B2B settlement that moves nights and weekends and reconciles into ERP systems without manual work.

- Wallets that feel like bank accounts: Instant funding with permitted stablecoins, automatic sweep to a tokenized T bill sleeve, and one tap back to payments at checkout.

- Prime services built on public rails: Collateralized credit, repo, and custody that marry the speed of on chain settlement with bank grade supervision and reporting.

- Tax and accounting infrastructure: Tools that classify permitted stablecoins as cash equivalents for policy compliant treatment and reconcile tokenized T bill sweeps.

The bottom line for the next 6 to 18 months is clarity. The GENIUS Act turns the stablecoin category from a regulatory gray zone into a supervised cash instrument with bank style rules. That will compress risk premia, reward transparent issuers, and pull liquidity into the cleanest pools. If you align product design to that reality now, you will be on the right side of the migration when the effective date arrives.