SEC fast-tracks crypto ETFs as DOGE and XRP funds debut

A quiet SEC rule change replaces one-off approvals with generic listing standards, shrinking crypto ETF timelines from months to weeks. With DOGE and XRP ETFs trading, we break down what this means for liquidity, custody, surveillance, and the road to broader crypto exposure.

A quiet rule tweak just changed crypto market structure

For years, listing a spot crypto ETF in the United States meant a bespoke, two‑track gauntlet. Exchanges filed a 19b‑4 rule change to permit listing; issuers wrangled with an S‑1 registration. That cadence defined Bitcoin and Ether approvals and set the tone for everything else, as we covered in our Bitcoin ETF primer.

Now the playbook is different. By adopting SEC generic listing standards that cover exchange‑traded products holding spot commodities, including digital assets, the Commission shifted from case‑by‑case approvals to a rules‑based framework. If a proposed fund meets those generic criteria, an exchange can list it without a product‑specific 19b‑4 order.

That is the context for September’s milestone: the first U.S. DOGE and XRP ETFs began trading. The launches confirm the door has opened beyond Bitcoin and Ether and they rewire incentives for issuers, market makers, and builders. For background on how liquidity providers adapt, see understanding ETF market structure. For confirmation of the debuts, see this overview of the first U.S.-listed DOGE ETF, which also notes an XRP fund from the same issuer.

From 240 days to roughly 75: how the calendar actually shrinks

The old path had two gating items that moved independently and often slowly. First, an exchange needed the Commission to approve a proposed rule change that explicitly allowed the listing and trading of a specific spot crypto ETF. Second, the issuer needed the Commission staff to declare the registration effective so the shares could be sold. Either leg could drag the other, which meant even cooperative filings could sit for months.

Under generic listing standards, that first leg is no longer bespoke. The exchange does not need a product‑specific approval if the fund falls within predefined criteria. Those criteria spell out eligible asset types, index or pricing methodology requirements, surveillance‑sharing agreements with regulated counterparties, dissemination of intraday indicative values, and auditor, administrator, and custodian standards. Exchanges already use generic standards for many index equity and commodity ETPs. Extending this architecture to spot digital assets lets crypto products follow the same conveyor belt as commodity funds.

Why does that yield about 75 days? Three reasons:

-

Registration becomes the pacing item. Issuers still file and respond to comments, but the timeline resembles a conventional commodity‑style ETF. With clean disclosures and well‑documented market surveillance and custody, staff review cycles can be planned and resourced. Teams can prepare operationally in parallel instead of waiting on a 19b‑4 order.

-

Surprises move earlier. Generic standards require that key risk mitigants are set before listing. If an issuer cannot meet pricing transparency or surveillance‑sharing criteria, that is discovered quickly. The process stops early rather than drifting.

-

Exchanges can schedule. Once the product ticks every box, listings can be queued like any other ETF, which aligns market‑maker onboarding, create‑redeem plumbing, and data vendor symbology. When calendars are predictable, time to market compresses.

The number is not a hard cap. Some offerings will move faster, others slower. The important shift is that the default outcome is measured in weeks rather than most of a year.

Beyond BTC and ETH: what the new standards actually unlock

Generic standards do not bless every token. They establish rules of the road. In practice, that means:

- Pricing must be tamper resistant. The ETF’s reference rate should pull from multiple high‑quality spot venues with outlier detection, volume weighting, and robust fallback logic.

- Real surveillance must exist. Exchanges need surveillance‑sharing agreements with a regulated market of significant size or a network of venues that together create credible detection of manipulative patterns.

- Custody must be institutional. Qualified custodians, segregation of assets, detailed key management policies, and insurance coverage are expected. Attestations and third‑party audits anchor this. For a deeper dive, see crypto custody best practices.

- Concentration and distribution risks must be disclosed. If a protocol has material token unlock schedules, escrowed supplies, or dominant holders, those dynamics need to be visible in the prospectus and ongoing reports.

Tokens with deep spot liquidity, cleaner ownership distributions, straightforward custody, and observable on‑chain activity patterns move to the front of the line. That helps explain why the first wave beyond BTC and ETH features DOGE and XRP, which each have persistent trading footprints and relatively simple operational models for custodians. Structures can vary by issuer; always check the prospectus to confirm whether a fund holds spot tokens, related ETPs, or a mix.

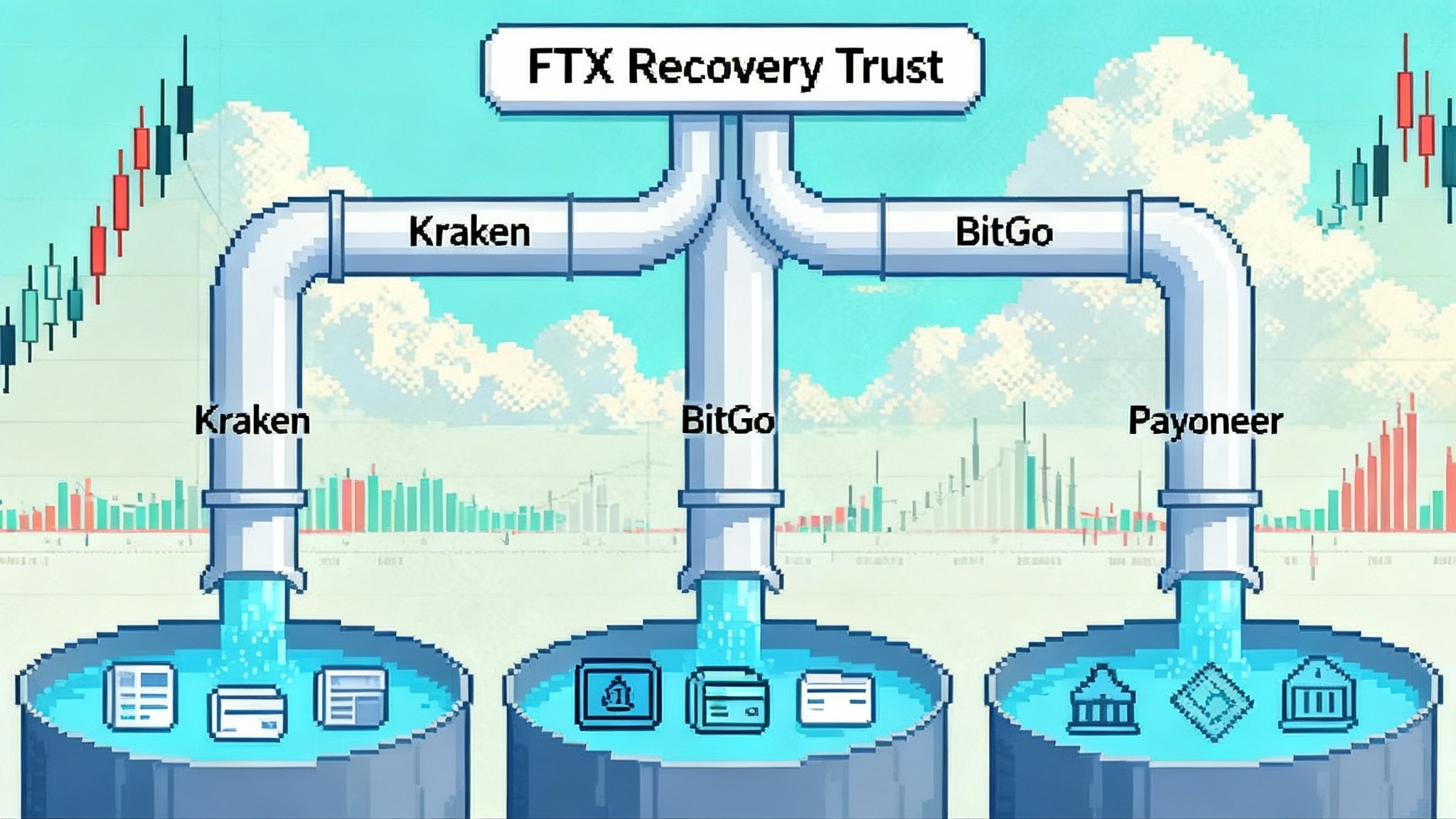

Day one with DOGE and XRP: what changed in the plumbing

The immediate effects of DOGE and XRP ETFs show up in four places: liquidity, market structure, custody, and surveillance.

Liquidity

- Primary market creation becomes a stronger driver of intraday flow. Authorized participants can deliver or receive underlying tokens in exchange for ETF baskets, tying ETF prices to spot. In early sessions, this tends to reduce discounts and premiums since APs step in when spreads widen.

- Quote quality tightens as lead market makers warehouse risk with more confidence. They have clearer inventory replenishment via creations and better hedging avenues across spot exchanges and regulated derivatives.

- Fragmented crypto venue liquidity begins to centralize in the ETF wrapper during U.S. hours. That can pull some volume from offshore platforms into a regulated, reportable channel, improving the transparency of price discovery that U.S. investors actually experience.

Market structure

- Weekend gaps become a known feature. Underlyings trade continuously; ETFs do not. When big moves occur on Saturday or Sunday, Monday opens feature larger imbalances, wider openings, and more reliance on primary market flows to close the basis.

- Volatility transmission changes. Spikes in retail‑driven token flow can be met by ETF supply through creations, which absorbs shock. The flip side is that heavy redemptions can push tokens into spot markets at size, especially around closing auctions when funds rebalance.

- Options markets will likely develop as open interest grows. Listed options add another layer of hedging and can further improve ETF spreads, but they also add a new channel for leveraged sentiment to feed back into the underlying.

Custody

- Concentration risk becomes measurable. A handful of large custodians now hold significant DOGE and XRP on behalf of funds. This consolidates operational standards and enhances auditability, but it also creates single points of failure that must be managed. Expect more granular disclosures around key storage, deposit and withdrawal limits, and incident response.

- No staking simplifies operations. Neither DOGE nor XRP involves staking rewards or slashing. That removes one complexity that would otherwise create tracking error and governance entanglements between a protocol and a passive fund.

Surveillance and data

- Surveillance sharing moves from theory to practice. Exchanges listing these funds now rely on data pipelines that flag spoofing, wash trading, and cross‑venue manipulation patterns. The intent is not to catch everything in real time, but to create deterrence and post‑trade forensics with teeth.

- Price integrity will be stress tested on event days. XRP can be uniquely sensitive to headline risk related to litigation, settlements, or network‑wide announcements. How the reference rate withstands venue outages or information asymmetry will inform the path for later tokens.

What is likely next in Q4 2025

If September was about proving the machine works beyond BTC and ETH, Q4 is about expanding the roster. Three paths stand out.

- Solana moves to the front

On liquidity depth, developer activity, and institutional mindshare, Solana is a credible next candidate. Custody has matured, reference rates have stabilized, and there is a clear cohort of market makers that can support primary‑market flows at scale. The gating item is meeting every letter of the generic criteria around pricing, surveillance, and operational readiness. If filings are already in the pipe, a late Q4 or early Q1 launch is realistic under a 75‑day rhythm.

- A small basket and index products emerge

Once several single‑asset funds exist, expect issuers to pitch simple baskets that weight by free‑float market cap or liquidity screens. The generic standards can accommodate index‑based products if the methodology is transparent, rebalances are pre‑announced, and the constituents meet the underlying eligibility tests. These vehicles will appeal to wealth platforms that prefer diversified exposure without choosing winners.

- The long tail remains on the shelf

Tokens with complex staking economics, heavy insider unlock schedules, limited U.S. venue depth, or unresolved legal characterizations will face higher friction. Generic standards do not lower that bar; they simply make it clearer. Some projects will pivot to improve disclosures, price transparency, and exchange connectivity. Others will decide that a U.S. ETF is not the right path.

Opportunities and risks through three lenses

For traders

Opportunities

- Better onramps and tighter spreads. ETFs give exposure in brokerage accounts with standardized margin, options overlays, and portfolio reporting. That reduces friction versus setting up multiple spot exchange relationships.

- Cleaner tax and compliance. Funds centralize cost basis tracking and issue familiar tax forms. Advisors can allocate within policy without custom workflows.

- Basis trading and liquidity provision. The ETF creates a robust basis between the wrapper and spot markets. Traders who can deliver or receive underlying can monetize dislocations around opens, closes, and rebalance days.

Risks

- Fees and tracking error matter. A fund that charges 80 to 100 basis points and carries cash balances will lag the underlying in a rising market. Wider premiums or discounts can appear in fast markets, especially outside U.S. hours.

- Weekend gap risk. Tokens move when the ETF is closed. That creates jump risk at Monday’s open and can trigger stop‑outs or forced de‑risking.

- Venue dependency. If the reference rate relies on a small set of spot venues and one has an outage, pricing and arbitrage can wobble. The ETF structure helps, but it cannot cancel microstructure shocks.

For issuers

Opportunities

- AUM race with clear rules. Generic listing standards convert product development into operations and distribution. The fastest to meet the template and secure market‑maker support can gather assets.

- Fee competition at scale. As more products list, fee wars will compress expense ratios, which in turn expands the addressable market of fee‑sensitive advisors and model portfolios.

- Index inclusion potential. Once a critical mass of single‑asset funds is live, index providers can design rule‑based crypto baskets for traditional platforms. That opens doors to model portfolios, multi‑asset funds of funds, and target‑risk solutions.

Risks

- Memecoinization pressure. If retail flows chase the latest narrative, issuers face pressure to list increasingly speculative tokens. That raises reputational and regulatory risk, especially if liquidity is shallow or ownership is concentrated.

- Operational single points of failure. Overreliance on one custodian, one pricing agent, or one surveillance partner magnifies tail risks. Redundancy and clear escalation playbooks are no longer optional.

- Litigation and disclosure creep. As products proliferate, plaintiffs will test prospectus language after any drawdown tied to protocol events. Plain‑English risk sections and ongoing updates are essential.

For web3 builders

Opportunities

- Broader onramps without wallet friction. ETFs bring new holders who would never self‑custody. That grows the pie of users who can later explore wallets and protocols at their own pace.

- More predictable demand. Index inclusion and model portfolios create steady, rules‑based flows that can support ecosystem funding and validator economics where relevant.

- Data feedback loops. ETF reporting on holdings, flows, and costs adds structured signals that developers can use to refine protocol incentives and dashboards.

Risks

- Governance decoupling. ETF shareholders do not generally vote on protocol matters. If ETF ownership becomes dominant, token holder governance may not reflect the economic base of holders.

- Flow‑driven volatility. Large creations and redemptions can amplify short‑term moves, especially around rebalances or quarter ends. Protocols may see healthy fundamentals overshadowed by wrapper mechanics.

- Builder incentives vs product shelf. If wealth platforms focus on a small set of ETF‑eligible tokens, smaller projects could struggle to attract attention and capital.

What to watch in the next 90 days

- The size of the authorized participant club. More APs usually mean tighter spreads and more resilient primary markets.

- Custody concentration metrics. The percentage of circulating supply held by ETF custodians will become a new line item for watchdogs and risk managers.

- Options market development. Listed options on DOGE and XRP ETFs will deepen liquidity and provide new hedging tools, but they also invite leverage.

- Fee compression. Expect at least one issuer to cut below the early cohort to gain share. Watch how quickly others match.

- Index announcements. A major index provider previewing a free‑float weighted multi‑asset crypto index would be a tell that multi‑token ETFs are on deck.

Practical playbooks

For active traders

- Treat ETFs as liquidity hubs during U.S. hours. Use them to hedge or enter positions while managing weekend risk on the underlying.

- Track the creation basket costs. If custody or transfer fees climb for a token, the basis may widen intraday.

- Watch options open interest and skew. These shape intraday flows and can hint at pressure into closes.

For issuers and market makers

- Build redundancy across pricing agents and data vendors. Failover plans reduce headline risk on volatile days.

- Publish transparent creation sizes and cut‑off times. Predictability invites more APs and lowers spreads.

- Invest in education. Plain‑English materials on how creations, redemptions, and surveillance work will preempt confusion when volatility hits.

For developers and ecosystem teams

- Instrument the impact. Track ETF holdings relative to free float, and monitor address concentration and exchange balances.

- Plan for investor education. Build pathways from passive exposure to on‑chain participation without forcing it.

- Engage with index providers. If your token is a candidate on liquidity and transparency, make the data easy to digest.

The bottom line

Generic listing standards are the missing bridge between one‑off approvals and a scalable crypto ETF market. By moving the gating to well‑defined criteria, the SEC has made timelines more predictable and opened a path beyond BTC and ETH. The debut of DOGE and XRP funds shows the machine works. Liquidity is centralizing in regulated wrappers during U.S. hours, surveillance is moving from paper to practice, and custody standards are converging. The next quarter will test whether this model can absorb more assets without losing investor protections. If the industry leans into transparency, redundancy, and education, the winners will be investors who want simple access, issuers who execute with discipline, and builders who can welcome new holders without compromising the values that made these networks worth owning in the first place.