Treasury's GENIUS Act resets stablecoins and retail payments

Treasury has kicked off rulemaking for the GENIUS Act, outlining licenses, reserves, redemption speed, disclosures, enforcement, and access to Fed settlement. Here is what the next 12 months mean for issuers, exchanges, fintechs, and merchants.

A regime takes shape

A new stablecoin era has begun. In September 2025 the U.S. Treasury opened the first phase of rulemaking under the GENIUS Act, a law aimed at turning dollar‑pegged tokens from a gray‑area product into a supervised part of the payments stack. The opening notices sketch a path that combines bank‑grade supervision with clear rules for nonbank issuers while tying stablecoins into existing rails like FedNow, ACH, RTP, and card networks. For a broader primer on the landscape, see our guide to stablecoin regulation.

This early phase will not answer every question. It does, however, set the contours that matter most for the next year: who can issue, what backs the coins, how fast redemptions must occur, how disclosures will work, when enforcement kicks in, and what it takes to touch a Federal Reserve master account. For issuers, exchanges, fintechs, and merchants, the play now is to align roadmaps to those contours and to prepare for a compliance ramp that is both demanding and highly actionable.

Key takeaways

- Two licensing paths will define market structure and exchange listings.

- Conservative reserves and T+0 retail redemption become table stakes.

- Program oversight and sanctions controls mirror modern payments compliance but with sharper teeth.

- Master account access separates money‑like settlement from trading‑asset latency.

- The first 90 days will sort fast‑track applicants from the rest and shift venue liquidity.

The two licensing paths

Treasury’s blueprint centers on two licensing lanes designed to pull stablecoins inside the perimeter without shutting down innovation.

1) Bank issuer charter

- Audience: insured depository institutions and newly chartered narrow banks.

- Scope: permission to issue dollar‑pegged payment tokens on approved networks, with reserves held on balance sheet and subject to bank capital and liquidity rules.

- Supervision: continuous safety and soundness oversight plus consumer compliance exams.

- Perks: streamlined access to a master account, direct participation in real‑time settlement, and the ability to offer institutional cash accounts that hold tokenized dollars.

2) Federally licensed nonbank issuer

- Audience: purpose‑built stablecoin companies and large fintechs that do not take credit risk.

- Scope: authority to issue tokens redeemable at par, with fully segregated, bankruptcy‑remote reserves held at insured banks and in short‑dated Treasuries.

- Supervision: periodic examinations by a federal team coordinated by Treasury, plus ongoing reporting to a lead prudential supervisor for liquidity and redemption performance.

- Perks: the right to integrate with payment networks through a supervised program bank and a defined process to seek indirect master account access through a settlement partner.

The Act sets a floor, not a ceiling. States can continue to license trust companies, but federal licensure will be the ticket to nationwide issuance and to listing on U.S. exchanges that opt in to the new regime. Expect issuers to choose between a bank wrapper that speeds settlement access, or a nonbank license that keeps the balance sheet light but raises the bar on segregation and transparency.

Reserves, redemption, and disclosures

Reserves are the spine of the regime. The opening proposal signals a conservative mix with little room for interpretation.

- Permitted assets: overnight cash at insured banks, Federal Reserve balances for bank issuers, Treasury bills with maturity of 90 days or less, and reverse repo backed by U.S. government securities. No commercial paper, no corporate deposits above prescribed limits, no tokenized yield products.

- Segregation: nonbank issuers must place reserves in bankruptcy‑remote structures with clearly identified beneficiaries and must appoint an independent trustee.

- Redemption: mandatory T+0 redemption during banking hours for retail amounts and near‑instant redemption for institutional accounts during real‑time windows, subject to fair‑use limits. Any redemption fee must be disclosed and capped.

- Liquidity stress testing: weekly internal tests under prescribed stress scenarios, with results available to supervisors on request.

- Disclosures: daily public reserve snapshots with asset buckets, a weekly statement of outstanding supply and average redemption time, and monthly independent attestations. A full audit of reserve composition and control effectiveness must be published at least annually.

These requirements are stricter than most current practice. They will push issuers to simplify reserve portfolios and to invest in automation for intraday cash management, since the fastest redemption windows will become a key differentiator in merchant and payroll use cases. For merchants planning acceptance, review accepting stablecoins at checkout.

Compliance spine and enforcement powers

Treasury is positioning stablecoins as payment instruments first, not investment products. That means the core compliance spine looks a lot like modern money transmission, but with sharper teeth and closer federal coordination.

- KYC and sanctions: risk‑based onboarding aligned to bank customer due diligence rules, wallet‑level monitoring for sanctioned addresses, and immediate freezing authority for clear sanctions hits.

- Travel rule: required metadata exchange above set thresholds, with a path for privacy‑preserving proofs that attest to required fields without exposing extra personal data.

- Program oversight: if an issuer distributes through exchanges or wallets, the issuer is responsible for program governance, agent audits, and termination rights over noncompliant partners.

- Consumer conduct: clear error‑resolution timelines, standardized disclosures about reserve assets and redemption rights, and plain‑language risk summaries inside host wallets.

- Enforcement: civil money penalties for misstatements or delayed redemptions, mandatory remediation plans, executive accountability through managerial bans, and emergency powers to restrict minting when reserves or operational controls are compromised.

For the first six months regulators will likely favor remediation over punishment for good‑faith actors. After that, the tone will harden. Firms that lag on reporting or that market offshore coins into the U.S. without registration should expect public actions. For operational playbooks, see how FedNow works for settlement.

Master account access and settlement rails

Direct or indirect access to a Federal Reserve master account is the crown jewel. It determines whether a token can settle like money rather than like a trading asset.

- Bank issuers: presumptive eligibility for a master account, subject to the usual risk review and operational testing. These issuers can clear redemptions to deposit accounts in real time during system hours.

- Nonbank issuers: two routes. The first is through a program bank that holds the master account and offers intraday liquidity and settlement windows to the issuer. The second is a narrow‑bank or trust‑bank affiliate that undergoes a more intensive review but can ultimately hold an account and settle directly. Either path requires proof of robust controls, rapid redemption plumbing, and round‑the‑clock incident response.

- Payment rail integration: the rulemaking encourages interoperability with card networks, RTP, and FedNow. That creates a hybrid flow where a tokenized dollar can enter or exit a bank account instantly, with the token ledger and bank ledger staying reconciled through automated sweeps and reports.

This is where network effects will crystallize. Issuers that can offer guaranteed instant redemption to bank accounts will win merchant acceptance faster. Those that cannot will need stronger consumer incentives, such as fee‑free peer‑to‑peer transfers or loyalty features.

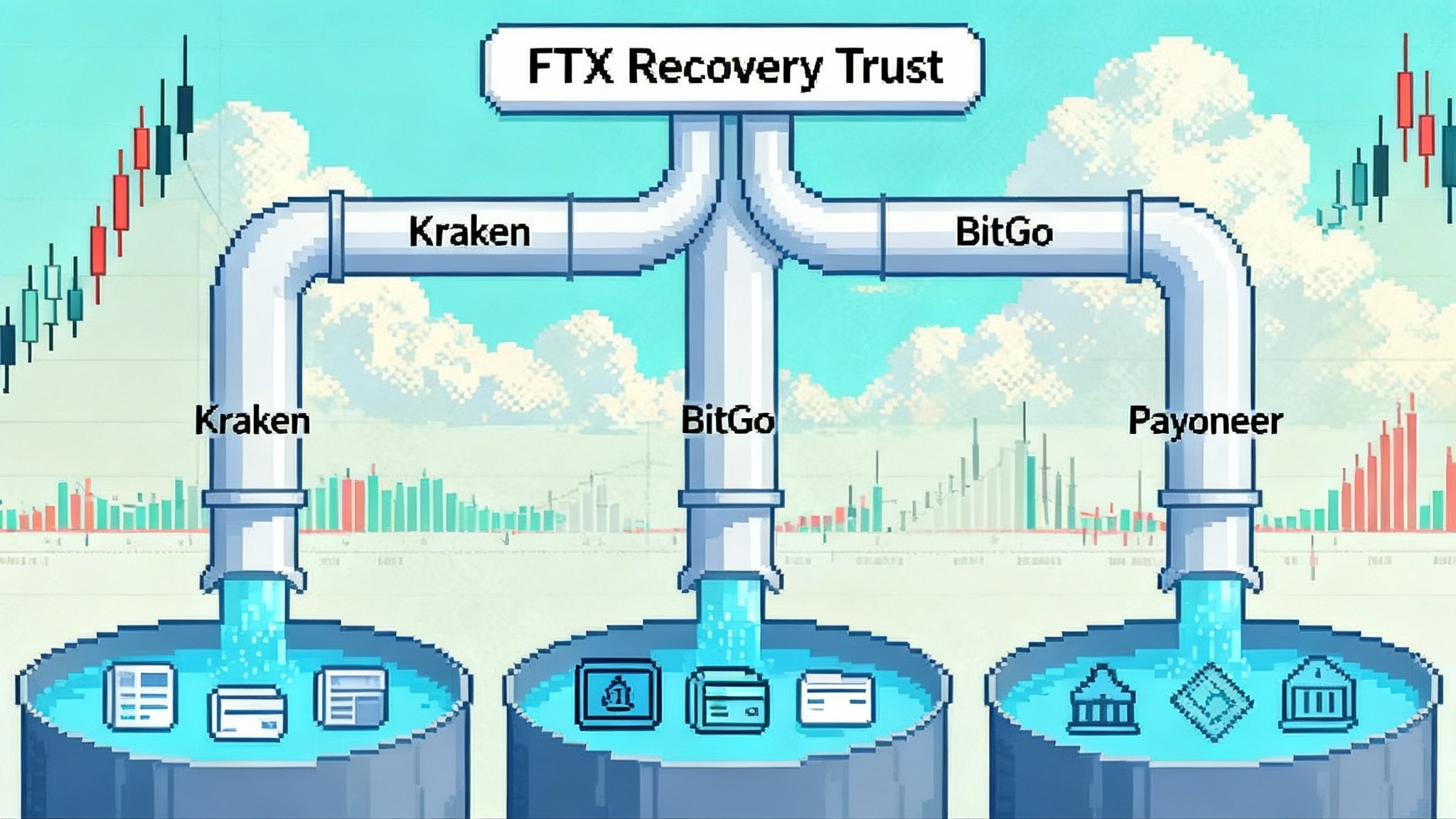

What changes in the first 90 days

- Issuers begin pre‑filings: major issuers file confidential intake forms covering reserve structures, auditors, governance, and network integrations. Treasury triages cases into fast‑track and standard review.

- Exchanges update listings: U.S. venues flag which stablecoins are on a licensure path. Expect liquidity to coalesce around a small set of candidates.

- Banks decide their role: midsize banks announce program partnerships to custodian reserves, while a few larger institutions explore direct issuance pilots.

- Merchant pilots expand: processors quietly enable acceptance for one or two licensed candidates, with refunds and supplier payments as the first live flows.

Six to twelve month scenarios

Scenario 1: Bank‑centric harmonization

Large banks and two or three well capitalized nonbanks secure licenses and master account pathways. Merchant acceptance grows through processors and gateways. On‑chain liquidity concentrates in a handful of regulated tokens. Offshore coins lose market share in U.S. venues. Treasury reports a measurable reduction in redemption frictions and in freeze disputes.

Implications: spreads tighten, token velocity rises, and DeFi pools pivot to approved assets through permissioned wrappers. Cross‑border remittances route through licensed tokens that interoperate with bank accounts at both ends.

Scenario 2: Dual‑track competition

Nonbank issuers execute well and keep pace with banks on redemption speed and uptime. Two networks emerge as preferred rails, one bank issued and one nonbank issued. Exchanges list both. Merchants accept both through a single processor API, and competition focuses on fees, developer tools, and loyalty features.

Implications: consumers benefit from choice, but liquidity is split. Processors and wallets must support multi‑token routing logic. Regulators monitor for operational risks created by cross‑network arbitrage.

Scenario 3: Fragmentation and an enforcement wave

Several midtier issuers stumble on audits and reporting. A high profile freeze incident triggers headlines. Treasury responds with visible enforcement and tighter guidance. A flight to quality squeezes smaller players and slows merchant adoption.

Implications: liquidity shifts abruptly, spreads widen, and offshore coins see a temporary bump in peer‑to‑peer channels until exchanges and processors clamp down.

Winners and losers in the opening year

Winners

- Bank issuers that move first and pair issuance with direct settlement and treasury services for merchants and platforms.

- Nonbank issuers with spotless reserves, real time attestations, and program bank partnerships that offer intraday liquidity.

- Payment processors that add intelligent routing, instant refunds, and chargeback alternatives using token burns and remints.

- Exchanges that standardize wallet screening, publish stablecoin transparency dashboards, and provide simple redemption from exchange balances to bank accounts.

- Merchants that adopt token based supplier payments to cut fees and accelerate reconciliation.

Losers

- Offshore coins that remain outside the U.S. perimeter but continue to seep into U.S. venues. Expect delistings and processor refusals.

- Issuers with yield seeking reserve portfolios or with redemption windows that lag during stress.

- Wallets and neobanks that treat stablecoins as a novelty rather than as a core funding and payouts rail.

Priority playbooks by sector

Issuers

- File a polished intake: include a reserve term sheet, attestation calendar, stress testing playbook, a segregation diagram, and names of independent trustees and auditors. Pre‑answer the operational risk questions that supervisors always ask.

- Operationalize T+0: build automated redemption queues that prioritize age and size, connect to multiple program banks, and pre‑fund intraday buffers for peak hours.

- Prove segregation: move to bankruptcy‑remote structures with beneficiary statements issued to token holders and publish trustee reports.

- Ship the dashboard: daily reserve buckets, a public API for outstanding supply and average redemption time, and an incident log with timestamps and root causes.

- Prepare for exams: stand up a second line of defense for compliance and retain an internal audit firm with crypto and payments expertise.

Exchanges and brokers

- Tier listings: group stablecoins by licensure path and disclosure quality, and show those indicators next to tickers. Make delisting criteria mechanical and predictable.

- Build redemption rails: let customers redeem to their bank account the same day, even if they never touched the token on chain. Hold pre‑funded positions with issuers to guarantee speed.

- Screen wallets: adopt risk scoring for deposit addresses and provide wallet risk labels in the UI. Give customers a heads up when withdrawals hit elevated risk.

- Implement the travel rule: embed messaging between exchanges and issuers for transfers above threshold amounts and cache proofs to reduce repeat friction.

Fintechs and wallets

- Choose two issuers: integrate at least two tokens that will pass licensure, and build routing logic that considers fees, acceptance, and redemption speed.

- Embed transparency: show reserve composition inside the wallet and offer a one tap redemption to a bank account. Post an uptime and incident history the way cloud companies do.

- Invest in controls: reuse your bank program standards for agent oversight, complaints handling, and marketing review. Treat stablecoin partners like card program managers.

- Design for refunds and payouts: let merchants and marketplaces refund to the original token, to a bank account, or to a card. Support instant payroll for gig workers and creators.

Retailers and platforms

- Start where it hurts: target refunds, supplier payments, and high dispute categories. Tokens can reduce settlement friction and support instant credit for returns.

- Price the benefits: ask processors for token acceptance pricing with clear interchange alternatives. Compare all‑in costs, not just headline fees.

- Update policies: publish plain language terms about token refunds, price quotes in dollars, and redemption rights if a coin is delisted or paused.

- Train support: equip agents to handle wallet errors, chain congestion, and address hygiene. Provide QR flows that reduce manual address entry.

Knock on effects for DeFi liquidity and cross border transfers

DeFi will feel the shift quickly. Deep pools will migrate to licensed tokens because U.S. exchanges and custodians will prefer them for collateral and settlement. That does not mean DeFi becomes closed. It means the largest pools will split into public permissionless segments and permissioned segments that accept only whitelisted assets.

- Liquidity design: protocols will add guarded pools that admit only licensed tokens, with oracle feeds that reference official reserve disclosures. Incentives will tilt toward those pools because of lower risk weights at custodians.

- Credit primitives: on‑chain credit will lean on tokenized Treasury collateral and overcollateralized loans against licensed stablecoins. Underwriting for uncollateralized credit will move into permissioned enclaves.

- Transparency as a feature: projects that surface redemption time, reserve composition, and freeze policies in their interfaces will gain share with institutions.

Cross‑border payments will see the other big impact. Licensed dollar tokens with clear redemption become compelling for corridors where bank rails are slow and expensive.

- Corporate flows: exporters will hold dollars as tokens overnight and redeem to bank accounts at predictable times. Treasury teams will integrate token sweeps into cash pooling.

- Remittances: licensed issuers will partner with money transfer operators in Latin America, Africa, and Southeast Asia to enable last mile cash out while keeping the first mile supervised in the U.S.

- FX microstructure: spreads may narrow on popular corridors when licensed tokens act as a dollar funding leg. Expect market makers to arbitrage between bank FX and on‑chain pools.

Metrics and milestones to watch

- Licensure pipeline: number of public applications, conditional approvals, and final licenses. Watch for at least one bank issuer and one nonbank issuer to cross the finish line within six to nine months.

- Reserve transparency: how many issuers publish daily reserve snapshots with machine readable APIs. The market will reward data you can automate against.

- Redemption performance: median and 95th percentile redemption times during stress, not just averages in quiet periods.

- Merchant acceptance: announcements from processors and gateways that support token refunds, supplier payments, and payroll at scale.

- Enforcement actions: the first public penalties will set the tone on what Treasury considers material. Expect a focus on misstatements, delayed redemptions, and sanctions failures.

What could still surprise markets

- A major bank enters: if a top five U.S. bank launches or acquires a stablecoin program, merchant adoption could accelerate faster than expected.

- A state charter gains traction: if a state trust company secures indirect master account access quickly, nonbank issuers may keep parity with banks on settlement speed.

- A technical incident: a chain outage or bridge exploit at the wrong moment could prompt stricter operational rules for supported networks.

- Tax clarity: if tax authorities confirm that retail stablecoin payments under modest thresholds face no capital gains, wallet adoption could jump.

The bottom line

The opening phase of Treasury’s GENIUS Act implementation is not the end state. It is the reset that many market participants have been waiting for. The near term winners will be the teams that turn conservative reserve rules and hard redemption promises into a product advantage. The risks will fall on those who hope to skate by with partial transparency or slow operational upgrades.

If you build or rely on dollar stablecoins, the playbook is clear. Align to one of the two licenses, simplify reserves, automate redemption, publish everything that matters, and wire into the payment rails that merchants already trust. Do that in the next six to twelve months and you will be on the right side of the reset.